0001285550FALSE00012855502024-08-262024-08-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 26, 2024

_________________________________________

CLEARPOINT NEURO, INC.

(Exact name of registrant as specified in its charter)

_________________________________________

| | | | | | | | |

Delaware | 001-34822 | 58-2394628 |

(State or other jurisdiction of incorporation) | (Commission

File Number) | (I.R.S. Employer Identification Number) |

120 S. Sierra Ave., Suite 100

Solana Beach, CA 92075

(Address of principal executive offices, zip code)

(888) 287-9109

(Registrant’s telephone number, including area code)

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | CLPT | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. Regulation FD Disclosure.

On August 26, 2024, ClearPoint Neuro, Inc. (the “Company”) issued a press release announcing its prepayment of certain convertible notes issued by the Company. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in Item 7.01 of this Form 8-K, as well as Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act of 1934, as amended, (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act, of 1933, as amended (the “Securities Act”), or the Exchange Act, expect as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description of Exhibit |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: August 26, 2024 | CLEARPOINT NEURO, INC. |

| | |

| By: | /s/ Danilo D’Alessandro |

| | Danilo D’Alessandro |

| | Chief Financial Officer |

ClearPoint Neuro Announces Early Repayment of $10 Million Note

SOLANA BEACH, CA, August 26, 2024 – ClearPoint Neuro, Inc. (Nasdaq: CLPT) (the “Company”), a global device, cell, and gene therapy-enabling company offering precise navigation to the brain and spine, today announced that on August 23, 2024, it provided for the full early repayment of the principal amount and interest on a $10 million convertible note held by PTC Therapeutics Inc., which would have matured in January 2025 according to its terms. The convertible note was issued by the Company pursuant to a financing transaction which was completed in January 2020.

“PTC has been and continues to be a strong partner of ClearPoint Neuro. The early repayment of our convertible note shows how both companies continue to work together to find a desired outcome,” commented Joe Burnett, President and CEO at ClearPoint Neuro. “This early repayment underlines the confidence we continue to have in our business, and it accomplishes the very important financial and strategic goal of removing all debt from our balance sheet in a way that avoids additional dilution. PTC still maintains the full support of ClearPoint Neuro for the Biologics License Application submission to FDA for Upstaza™ (eladocagene exuparvovec), an investigational treatment for AADC Deficiency currently under priority review by the agency, and we are excited to continue to work with PTC.”

About ClearPoint Neuro

ClearPoint Neuro is a device, cell, and gene therapy-enabling company offering precise navigation to the brain and spine. The Company uniquely provides both established clinical products as well as preclinical development services for controlled drug and device delivery. The Company’s flagship product, the ClearPoint Neuro Navigation System, has FDA clearance and is CE-marked. ClearPoint Neuro is engaged with healthcare and research centers in North America, Europe, Asia, and South America. The Company is also partnered with the most innovative pharmaceutical/biotech companies, academic centers, and contract research organizations, providing solutions for direct CNS delivery of therapeutics in preclinical studies and clinical trials worldwide. To date, thousands of procedures have been performed and supported by the Company’s field-based clinical specialist team, which offers support and services to our customers and partners worldwide. For more information, please visit www.clearpointneuro.com.

Forward-Looking Statements

This press release may contain forward-looking statements within the context of the federal securities laws, which may include the Company’s expectations for the future performance, revenues, and operating expenses, and the adequacy of cash and cash equivalent balances to support operations and meet future obligations. These forward-looking statements are based on management’s current expectations and are subject to the risks inherent in the business, which may cause the Company's actual results to differ materially from those expressed in or implied by forward-looking statements. Particular uncertainties and risks include those relating to: global and political instability, supply chain disruptions, labor shortages, and macroeconomic and inflationary conditions; future revenue from sales of the Company’s products and services; the Company’s ability to market, commercialize and achieve broader market acceptance for new products and services offered by the Company;

the ability of our biologics and drug delivery partners to achieve commercial success, including their use of the Company’s products and services in their delivery of therapies; the Company’s expectations, projections and estimates regarding expenses, future revenue, capital requirements, and the availability of and the need for additional financing; the Company’s ability to obtain additional funding to support its research and development programs; the ability of the Company to manage the growth of its business; the Company’s ability to attract and retain its key employees; and risks inherent in the research, development, and regulatory approval of new products. More detailed information on these and additional factors that could affect the Company’s actual results are described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and the Company’s Quarterly Report on Form 10-Q for the three months ended June 30, 2024, both of which have been filed with the Securities and Exchange Commission. The Company does not assume any obligation to update these forward-looking statements.

Contact:

Media Contact:

Jacqueline Keller, Vice President of Marketing

(888) 287-9109 ext. 4

info@clearpointneuro.com

Investor Relations:

Danilo D’Alessandro, Chief Financial Officer

(888) 287-9109 ext. 3

ir@clearpointneuro.com

v3.24.2.u1

Cover

|

Aug. 26, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 26, 2024

|

| Entity Registrant Name |

CLEARPOINT NEURO, INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34822

|

| Entity Tax Identification Number |

58-2394628

|

| Entity Address, Address Line One |

120 S. Sierra Ave., Suite 100

|

| Entity Address, City or Town |

Solana Beach

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92075

|

| City Area Code |

(888)

|

| Local Phone Number |

287-9109

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

CLPT

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001285550

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

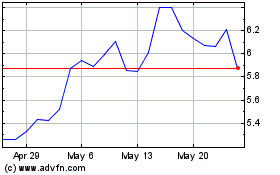

ClearPoint Neuro (NASDAQ:CLPT)

Historical Stock Chart

From Sep 2024 to Oct 2024

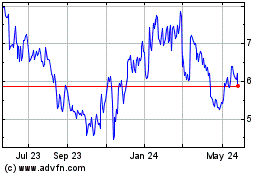

ClearPoint Neuro (NASDAQ:CLPT)

Historical Stock Chart

From Oct 2023 to Oct 2024