Capital Southwest Announces New $150 MM Secured Credit Facility

March 20 2024 - 3:01PM

Capital Southwest Corporation (“Capital Southwest” or “we”")

(Nasdaq: CSWC), an internally managed business development company

focused on providing flexible financing solutions to support the

acquisition and growth of middle market businesses, announced today

that its wholly owned subsidiary, Capital Southwest SPV LLC (the

“SPV”), entered into a senior secured revolving credit facility

(the “SPV Facility”) with Deutsche Bank AG, New York Branch. The

SPV Facility provides for $150 million of initial commitments with

(i) an increase to $200 million of total commitments on the earlier

of (a) June 20, 2024 or (b) the date requested by the Company, in

its sole discretion, and (ii) an accordion feature that allows

increases up to $400 million of total commitments from new and

existing lenders on the same terms and conditions as the existing

commitments. Advances under the SPV Facility bear interest at

three-month Term SOFR plus an applicable margin of 2.50% during the

revolving period ending on March 20, 2027. The SPV’s obligations to

the lenders are secured by a first lien interest in all of the

SPV’s assets but are non-recourse to Capital Southwest. The SPV

Facility matures on March 20, 2029.

Michael Sarner, Chief Financial Officer,

commented, “We are pleased to continue our long-standing

relationship with Deutsche Bank through the creation of a new SPV

Facility. The SPV Facility further diversifies our sources of

capital and provides significant funding flexibility as we continue

to grow our balance sheet. We expect to continue to grow total

commitments under this Credit Facility in lockstep with our asset

growth.”

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is

a Dallas, Texas-based, internally managed business development

company with approximately $1.4 billion in investments at fair

value as of December 31, 2023. Capital Southwest is a middle market

lending firm focused on supporting the acquisition and growth of

middle market businesses with $5 million to $35 million investments

across the capital structure, including first lien, second lien and

non-control equity co-investments. As a public company with a

permanent capital base, Capital Southwest has the flexibility to be

creative in its financing solutions and to invest to support the

growth of its portfolio companies over long periods of time.

Forward-Looking Statements

This press release contains historical

information and forward-looking statements with respect to the

business and investments of Capital Southwest, including, but not

limited to, the statements about Capital Southwest’s ability to

grow total commitments under the SPV and to grow Capital

Southwest’s assets in the future. Forward-looking statements are

statements that are not historical statements and can often be

identified by words such as "will," "believe," "expect" and similar

expressions and variations or negatives of these words. These

statements are based on management's current expectations,

assumptions and beliefs. They are not guarantees of future results

and are subject to numerous risks, uncertainties and assumptions

that could cause actual results to differ materially from those

expressed in any forward-looking statement. These risks include

risks related to: changes in the markets in which Capital Southwest

invests; changes in the financial, capital, and lending markets;

changes in the interest rate environment and its impact on Capital

Southwest’s business and its portfolio companies; regulatory

changes; tax treatment; Capital Southwest’s ability to operate its

wholly owned subsidiary, Capital Southwest SBIC I, LP, as a small

business investment company; an economic downturn and its impact on

the ability of Capital Southwest’s portfolio companies to operate

and the investment opportunities available to Capital Southwest;

the impact of supply chain constraints and labor shortages on

Capital Southwest’s portfolio companies; and the elevated levels of

inflation and its impact on Capital Southwest’s portfolio companies

and the industries in which Capital Southwest invests.

Readers should not place undue reliance on any

forward-looking statements and are encouraged to review Capital

Southwest's Annual Report on Form 10-K for the year ended March 31,

2023 and any subsequent filings, including the “Risk Factors”

sections therein, with the Securities and Exchange Commission for a

more complete discussion of the risks and other factors that could

affect any forward-looking statements. Except as required by the

federal securities laws, Capital Southwest does not undertake any

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

changing circumstances or any other reason after the date of this

press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial Officer214-884-3829

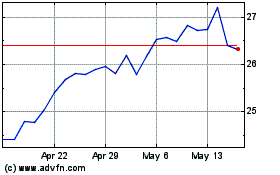

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Nov 2024 to Dec 2024

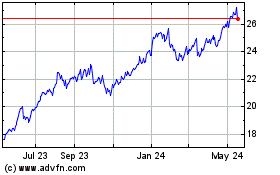

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Dec 2023 to Dec 2024