Golden Entertainment, Inc. (NASDAQ: GDEN) (“Golden

Entertainment” or the “Company”) today reported financial results

for the second quarter ended June 30, 2024. The Company reported

second quarter revenue of $167.3 million, net income of $0.6

million and Adjusted EBITDA of $41.2 million. In addition, on

August 6, 2024, the Company’s Board of Directors authorized the

Company’s third recurring quarterly cash dividend of $0.25 per

share of the Company’s outstanding common stock payable on October

2, 2024 to shareholders of record as of September 17, 2024.

Blake Sartini, Chairman and Chief Executive Officer of Golden,

commented, “In the second quarter, we continued to strengthen our

balance sheet by fully repaying our outstanding bonds in April and

reducing our interest rate on our term loan in May. We also

aggressively returned capital to shareholders through our recurring

dividend and repurchasing nearly one million shares. Our healthy

operating cash flow and strong balance sheet will continue to

provide us with strategic and financial flexibility while we return

capital to shareholders throughout the year.”

On April 15, 2024, the Company redeemed and repaid in full all

of its senior unsecured notes in the amount of $287.0 million,

consisting of $276.5 million in principal and $10.5 million in

accrued and unpaid interest. On May 29, 2024, the Company repriced

its $396 million term loan, which reduced the annual interest rate

on the term loan by 60 basis points.

The Company also paid its first and second quarterly cash

dividends in the amount of $7.2 million and $7.1 million on April

4, 2024 and July 2, 2024, respectively. In addition, the Company

repurchased 989,117 shares of its common stock during the quarter

at an average price of $29.85 per share for total amount of $29.5

million. As of June 30, 2024, the Company had $61.4 million of

availability remaining under its share repurchase

authorization.

Consolidated Results

The Company reported second quarter of 2024 revenues of $167.3

million and Adjusted EBITDA of $41.2 million as compared to

revenues of $286.7 million and Adjusted EBITDA of $58.4 million for

the second quarter of 2023. The declines in revenues and Adjusted

EBITDA over the prior year period were primarily related to the

exclusion of the results for the Company’s Rocky Gap Casino Resort

and distributed gaming operations in Montana and Nevada that were

sold on July 25, 2023, September 13, 2023 and January 10, 2024,

respectively. Net income for the second quarter of 2024 was $0.6

million, or $0.02 per fully diluted share, as compared to $12.3

million, or $0.40 per fully diluted share, for the second quarter

of 2023.

Debt and Liquidity

As of June 30, 2024, the Company’s total principal amount of

debt outstanding was $400.7 million, consisting primarily of $396.0

million in outstanding term loan borrowings.

As of June 30, 2024, the Company had cash and cash equivalents

of $88.6 million. There continues to be no outstanding borrowings

under the Company’s $240 million revolving credit facility.

Investor Conference Call and

Webcast

The Company will host a webcast and conference call today,

August 8, 2024 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time),

to discuss the 2024 second quarter results. The conference call may

be accessed live over the phone by dialing (800) 717-1738 or for

international callers by dialing (646) 307-1865. A replay will be

available beginning at 8:00 p.m. Eastern Time today and may be

accessed by dialing (844) 512-2921 or (412) 317-6671 for

international callers; the passcode is 1170998. The replay will be

available until August 14, 2024. The call will also be webcast live

through the “Investors” section of the Company’s website,

www.goldenent.com. A replay of the audio webcast will also be

archived on the Company’s website, www.goldenent.com.

Forward-Looking

Statements

This press release contains forward-looking statements regarding

future events and the Company’s future results that are subject to

the safe harbors created under the Securities Act of 1933 and the

Securities Exchange Act of 1934. Forward-looking statements can

generally be identified by the use of words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “plan,” “project,” “potential,” “seek,” “should,”

“think,” “will,” “would” and similar expressions, or they may use

future dates. In addition, forward-looking statements in this press

release include, without limitation statements regarding: the

Company’s strategies, objectives, business opportunities and plans;

anticipated future growth and trends in the Company’s business or

key markets; the payment of recurring quarterly cash dividends;

projections of future financial condition, operating results or

other financial items; and other characterizations of future events

or circumstances as well as other statements that are not

statements of historical fact. Forward-looking statements are based

on the Company’s current expectations and assumptions regarding its

business, the economy and other future conditions. These

forward-looking statements are subject to assumptions, risks and

uncertainties that may change at any time, and readers are

therefore cautioned that actual results could differ materially

from those expressed in any forward-looking statements. Factors

that could cause the actual results to differ materially include:

changes in national, regional and local economic and market

conditions; legislative and regulatory matters (including the cost

of compliance or failure to comply with applicable laws and

regulations); increases in gaming taxes and fees in the

jurisdictions in which the Company operates; litigation; increased

competition; reliance on key personnel (including our Chief

Executive Officer, President and Chief Financial Officer, and Chief

Operating Officer); the Company’s ability to comply with covenants

in its debt instruments; terrorist incidents; natural disasters;

severe weather conditions (including weather or road conditions

that limit access to the Company’s properties); the effects of

environmental and structural building conditions; the effects of

disruptions to the Company’s information technology and other

systems and infrastructure; factors affecting the gaming,

entertainment and hospitality industries generally; and other risks

and uncertainties discussed in the Company’s filings with the SEC,

including the “Risk Factors” sections of the Company’s most recent

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The

Company undertakes no obligation to update any forward-looking

statements as a result of new information, future developments or

otherwise. All forward-looking statements in this press release are

qualified in their entirety by this cautionary statement.

Non-GAAP Financial

Measures

To supplement the Company’s consolidated financial statements

presented in accordance with United States generally accepted

accounting principles (“GAAP”), the Company uses Adjusted EBITDA

because it is the primary metric used by its chief operating

decision makers and investors in measuring both the Company’s past

and future expectations of performance. Adjusted EBITDA provides

useful information to the users of the Company’s financial

statements by excluding specific expenses and gains that the

Company believes are not indicative of its core operating results.

Further, the Company’s annual performance plan used to determine

compensation for its executive officers and employees is tied to

the Adjusted EBITDA metric. It is also a measure of operating

performance widely used in the gaming industry.

The presentation of this additional information is not meant to

be considered in isolation or as a substitute for measures of

financial performance prepared in accordance with GAAP. In

addition, other companies in gaming industry may calculate Adjusted

EBITDA differently than the Company does.

The Company defines “Adjusted EBITDA” as earnings before

depreciation and amortization, non-cash lease expense, share-based

compensation expense, gain or loss on disposal of assets and

business, loss on debt extinguishment and modification, preopening

and related expenses, transaction costs, interest and other

non-operating income (expense), income taxes, and other non-cash

charges that are deemed to be not indicative of the Company’s core

operating results, calculated before corporate overhead (which is

not allocated to each reportable segment).

About Golden

Entertainment

Golden Entertainment owns and operates a diversified

entertainment platform, consisting of a portfolio of gaming and

hospitality assets that focus on casino and branded tavern

operations. Golden Entertainment owns eight casinos and 71 gaming

taverns in Nevada, operating over 5,500 slots, nearly 100 table

games, and over 6,000 hotel rooms. For more information, visit

www.goldenent.com.

Golden Entertainment,

Inc.

Consolidated Statements of

Operations

(Unaudited, in thousands, except

per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenues

Gaming

$

78,247

$

182,355

$

165,196

$

370,442

Food and beverage

43,113

46,534

86,774

92,805

Rooms

31,422

30,918

60,822

61,495

Other

14,552

26,874

28,589

39,990

Total revenues

167,334

286,681

341,381

564,732

Expenses

Gaming

20,764

105,380

47,655

212,306

Food and beverage

34,300

33,645

68,476

67,667

Rooms

16,452

15,359

32,686

30,140

Other

2,784

7,905

6,864

11,735

Selling, general and administrative

56,087

67,093

116,074

129,129

Depreciation and amortization

22,616

21,454

44,736

44,962

(Gain) loss on disposal of assets

—

(34

)

14

(120

)

Loss (gain) on sale of business

792

—

(68,944

)

—

Preopening expenses

4

141

143

525

Total expenses

153,799

250,943

247,704

496,344

Operating income

13,535

35,738

93,677

68,388

Non-operating expense

Interest expense, net

(8,610

)

(18,803

)

(19,296

)

(37,039

)

Loss on debt extinguishment and

modification

(4,446

)

(405

)

(4,446

)

(405

)

Total non-operating expense,

net

(13,056

)

(19,208

)

(23,742

)

(37,444

)

Income before income tax benefit

(provision)

479

16,530

69,935

30,944

Income tax benefit (provision)

144

(4,248

)

(27,349

)

(7,032

)

Net income

$

623

$

12,282

$

42,586

$

23,912

Weighted-average common shares

outstanding

Basic

28,798

28,845

28,761

28,578

Diluted

30,234

30,717

30,482

30,831

Net income per share

Basic

$

0.02

$

0.43

$

1.48

$

0.84

Diluted

$

0.02

$

0.40

$

1.40

$

0.78

Golden Entertainment,

Inc.

Reconciliation of Adjusted

EBITDA

(Unaudited, in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenues

Nevada Casino Resorts (1)

$

101,093

$

102,562

$

202,105

$

202,738

Nevada Locals Casinos (2)

37,866

39,829

76,857

81,067

Nevada Taverns (3)

28,152

27,319

55,959

54,912

Corporate and other

223

8,282

441

8,797

Total Revenues - Continuing

Operations

167,334

177,992

335,362

347,514

Distributed Gaming (4)

—

89,084

6,019

179,485

Maryland Casino Resort (5)

—

19,605

—

37,733

Total Revenues - Divested

Operations

—

108,689

6,019

217,218

Total Revenues

$

167,334

$

286,681

$

341,381

$

564,732

Adjusted EBITDA

Nevada Casino Resorts (1)

$

27,392

$

28,044

$

54,283

$

59,755

Nevada Locals Casinos (2)

16,928

19,471

34,464

39,631

Nevada Taverns (3)

7,791

8,450

15,352

16,988

Corporate and other

(10,919

)

(13,403

)

(22,399

)

(26,557

)

Total Adjusted EBITDA - Continuing

Operations

41,192

42,562

81,700

89,817

Distributed Gaming (4)

—

9,950

484

19,734

Maryland Casino Resort (5)

—

5,898

—

11,026

Total Adjusted EBITDA - Divested

Operations

—

15,848

484

30,760

Total Adjusted EBITDA

41,192

58,410

82,184

120,577

Adjustments

Depreciation and amortization

(22,616

)

(21,454

)

(44,736

)

(44,962

)

Non-cash lease benefit (expense)

148

9

233

(24

)

Share-based compensation

(2,450

)

(3,288

)

(5,719

)

(7,181

)

Gain (loss) on disposal of assets

—

34

(14

)

120

(Loss) gain on sale of business

(792

)

—

68,944

—

Loss on debt extinguishment and

modification

(4,446

)

(405

)

(4,446

)

(405

)

Preopening and related expenses (6)

(4

)

(141

)

(143

)

(525

)

Transaction costs

(337

)

(170

)

(2,275

)

(277

)

Other, net

(1,606

)

2,338

(4,797

)

660

Interest expense, net

(8,610

)

(18,803

)

(19,296

)

(37,039

)

Income tax benefit (provision)

144

(4,248

)

(27,349

)

(7,032

)

Net income

$

623

$

12,282

$

42,586

$

23,912

(1)

Comprised of The STRAT Hotel, Casino &

Tower, Aquarius Casino Resort and Edgewater Casino Resort.

(2)

Comprised of Arizona Charlie’s Boulder,

Arizona Charlie’s Decatur, Gold Town Casino, Lakeside Casino &

RV Park and Pahrump Nugget Hotel Casino.

(3)

Comprised of the operations of the

Company’s branded tavern locations.

(4)

Comprised of distributed gaming operations

in Montana (for the three and six months ended June 30, 2023 only)

and Nevada. On September 13, 2023, the Company completed the sale

of its distributed gaming operations in Montana. On January 10,

2024, the Company completed the sale of its distributed gaming

operations in Nevada.

(5)

Comprised of the operations of the Rocky

Gap Casino Resort, which was sold on July 25, 2023.

(6)

Preopening and related expenses consist of

labor, food, utilities, training, initial licensing, rent and

organizational costs incurred in connection with the opening of

branded tavern and food and beverage and other venues within the

casino locations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808506393/en/

Investor Relations Charles

H. Protell President and Chief Financial Officer (702) 893-7777

James Adams Vice President of Corporate Finance (702) 495-4470

james.adams@goldenent.com

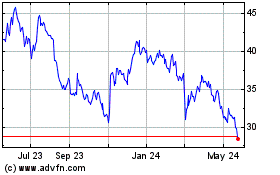

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Nov 2023 to Nov 2024