Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 17 2022 - 3:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2022

Commission File Number: 001-41444

Intelligent

Living Application Group Inc.

Unit 2, 5/F, Block A, Profit Industrial Building

1-15 Kwai Fung Crescent, Kwai Chung

New Territories, Hong Kong

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F

¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

INFORMATION CONTAINED IN THIS FORM 6-K

REPORT

Entry into a Material Definitive Agreement

On

October 12, 2022 (the “Effective Date”), Hing Fat Industrial Limited (“Hing Fat”), a wholly owned subsidiary

of Intelligent Living Application Group Inc. (the “Company”) and Dongguan Xingfa Hardware Products Co., Ltd.,

a wholly owned subsidiary of Hing Fat (“Buyer”) entered into an Asset Purchase Agreement (the “Agreement”)

with Hu Xiongjie, a citizen of Singapore (the “Seller”), pursuant to which the Seller agreed to sell to the Buyer an

electroplating production line, including but not limited to equipment, machinery, tanks, fixtures, flowlines, improvements and mixed

property located in Dongguan City, Guangdong, China (the “Asset”) for an aggregate purchase price (the “Purchase

Price”) of $4,500,000 in cash. The Seller’s clientele details, books, accounting records and liabilities are excluded

from this transaction.

Pursuant to the Agreement, Buyer shall pay a refundable

deposit of $2,000,000 on Effective Date and Buyer shall check operational conditions and access the value of the Asset at current market

rate within ten (10) days of the Effective Date, and if Buyer accepts the Purchase Price, an intermediate payment of $1,000,000 shall

be then paid. Upon closing, Buyer shall pay Seller an additional amount of $1,000,000. A residual of $500,000 shall be held by the Buyer

for one (1) year from closing date as quality guarantee for possible tax liabilities, defects or required repair(s) of the Asset. The

balance of Purchase Price shall be paid after deduction of costs of repairment related to unidentified defects or problems with the Asset

at transfer date.

The Agreement is filed as Exhibits 10.1 to this

Current Report on Form 6-K. The foregoing summary of the terms of the Agreement is subject to, and qualified in its entirety by, the Asset

Purchase Agreement, which is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

Intelligent Living Application Group Inc. |

| |

|

| Date: October 17, 2022 |

By: |

/s/ Bong Lau |

| |

Name: |

Bong Lau |

| |

Title: |

Chief Executive Officer |

Exhibit Index

Intelligent Living Appli... (NASDAQ:ILAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

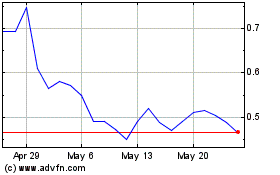

Intelligent Living Appli... (NASDAQ:ILAG)

Historical Stock Chart

From Dec 2023 to Dec 2024