Q3 2023 total revenue of $48.6 million

Recorded net loss of $21.8 million; delivered

positive adjusted EBITDA of $4.0 million for Q3 2023

5G Fixed Wireless Access (FWA) revenue

represented 23.0% of total revenue and grew 29.0%

year-over-year

Inseego Corp. (Nasdaq: INSG) (the “Company”), a leader in 5G

edge cloud solutions, today reported its results for the third

quarter of 2023 ending September 30, 2023. The Company reported

third quarter total revenue of $48.6 million, GAAP operating loss

of $18.4 million, GAAP net loss of $21.8 million, GAAP net loss of

$0.19 per share, adjusted EBITDA of $4.0 million, and non-GAAP net

loss of $0.16 per share. Cash and cash equivalents at quarter end

was $18.9 million.

“We remain focused on maintaining profitability as we transition

from 4G to 5G. While supply chain challenges are impacting our

business in the near term, we are well positioned to capitalize on

the newly developing 5G FWA market,” said Ashish Sharma, CEO of

Inseego. “During the last year, our enterprise and SMB customer

base has grown by almost 56,000 customers, all driven by our 5G FWA

and cloud portfolio. While the FWA market is taking a bit of time

to develop, we remain focused on driving success with the early

customer base we have established.”

Recent Business

Highlights

– Total revenue for Q3 2023 was $48.6 million

– 5G revenue accounted for 54.0% of Q3 2023 total revenue – Cloud

software revenue was 30.0% of Q3 2023 revenue – 5G FWA revenue grew

29.0% YoY driven by over 56,000 new enterprise and SMB customers

signed up during the last year – GAAP margin was 3.9%; Non-GAAP

gross margin increased year-over-year from 26.4% to 33.0% as the

revenue mix continued to shift to higher-margin products –

Operating expenses dropped to lowest in over two years – Delivered

3rd straight quarter of positive cash flow and adjusted EBITDA –

Steven Gatoff joined as Chief Financial Officer in September –

Philip Brace joined our Board of Directors in September – Steve

Harmon joined as Chief Revenue Officer in October

“We continue to optimize and align our spend with near-term

customer demand and our revenue trajectory,” said Steven Gatoff,

Chief Financial Officer of Inseego. “We’re focused on managing the

decline of legacy 4G revenue as we look to drive growth in 5G. In

the current quarter, we see our recent cost savings actions helping

to alleviate some of the revenue pressures and we are focused on

delivering profitability as we manage through the transition."

Q4 2023 Guidance

– 4G mobile hotspot revenue to decline as the

product category goes end-of-life – Total revenue is anticipated to

be in the range of $40.0 million to $42.0 million for Q4 2023 –

Adjusted EBITDA for Q4 2023 expected to be in the range of positive

$1.5 million to $2.0 million

Conference Call Information

Inseego will host a conference call and live webcast today at

5:00 p.m. ET. A Q&A session will be held live directly after

the prepared remarks. To access the conference call:

- Online, visit

https://investor.inseego.com/events-presentations

- Phone-only participants can pre-register by navigating to

https://dpregister.com/sreg/10183330/faad83f75e

- Those without internet access or unable to pre-register may

dial in by calling:

- In the United States, call 1-844-282-4463

- International parties can access the call at

1-412-317-5613

An audio replay of the conference call will be available one

hour after the call through November 16, 2023. To hear the replay,

parties in the United States may call 1-877-344-7529 and enter

access code 3005255 followed by the # key. International parties

may call 1-412-317-0088. In addition, the Inseego Corp. press

release will be accessible from the Company's website before the

conference call begins.

About Inseego Corp.

Inseego Corp. (Nasdaq: INSG) is the industry leader in 5G

Enterprise cloud WAN solutions with millions of end customers and

thousands of enterprise and SMB customers on its 4G, 5G and cloud

platforms. Inseego’s 5G Edge Cloud combines the industry’s best 5G

technology, rich cloud networking features and intelligent edge

applications. Inseego powers new business experiences by connecting

distributed sites and workforces, securing enterprise data and

improving business outcomes with intelligent operational

visibility---all over a 5G network. For more information on

Inseego, visit www.inseego.com #Putting5GtoWork

©2023. Inseego Corp. All rights reserved. The Inseego name and

logo are registered trademarks of Inseego Corp. Other company,

product or service names mentioned herein are the trademarks of

their respective owners.

Cautionary Note Regarding Forward-Looking Statements

Some of the information presented in this news release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. In this context,

forward-looking statements often address expected future business

and financial performance and often contain words such as “may,”

“estimate,” “anticipate,” “believe,” “expect,” “intend,” “plan,”

“project,” “will” and similar words and phrases indicating future

results. The information presented in this news release related to

our future business outlook, the future demand for our products,

and other statements that are not purely historical facts are

forward-looking. These forward-looking statements are based on

management’s current expectations, assumptions, estimates, and

projections. They are subject to significant risks and

uncertainties that could cause results to differ materially from

those anticipated in such forward-looking statements. We,

therefore, cannot guarantee future results, performance, or

achievements. Actual results could differ materially from our

expectations.

Factors that could cause actual results to differ materially

from the Company’s expectations include: (1) the future demand for

wireless broadband access to data and asset management software and

services and our ability to accurately forecast; (2) the growth of

wireless wide-area networking and asset management software and

services; (3) customer and end-user acceptance of the Company’s

current product and service offerings and market demand for the

Company’s anticipated new product and service offerings; (4)

dependence on a small number of customers for a significant portion

of the Company’s revenues and accounts receivable; (5) increased

competition and pricing pressure from participants in the markets

in which the Company is engaged; (6) dependence on third-party

manufacturers and key component suppliers worldwide; (7) the impact

that new or adjusted tariffs may have on the cost of components or

our products, and our ability to sell products internationally; (8)

the impact of fluctuations of foreign currency exchange rates; (9)

the impact of supply chain challenges on our ability to source

components and manufacture our products; (10) unexpected

liabilities or expenses; (11) the Company’s ability to introduce

new products and services in a timely manner, including the ability

to develop and launch 5G products at the speed and functionality

required by our customers; (12) litigation, regulatory and IP

developments related to our products or components of our products;

(13) the Company’s ability to raise additional financing when the

Company requires capital for operations or to satisfy corporate

obligations; (14) the Company’s plans and expectations relating to

acquisitions, divestitures, strategic relationships, international

expansion, software and hardware developments, personnel matters,

and cost containment initiatives, including restructuring

activities and the timing of their implementations; (15) the global

semiconductor shortage and any related price increases or supply

chain disruptions, (16) the potential impact of COVID-19 or other

global public health emergencies on the business, (17) the impact

of high rates of inflation and rising interest rates, and (18) the

impact of geopolitical instability on our business.

These factors, as well as other factors set forth as risk

factors or otherwise described in the reports filed by the Company

with the SEC (available at www.sec.gov), could cause results to

differ materially from those expressed in the Company’s

forward-looking statements. The Company assumes no obligation to

update publicly any forward-looking statements, even if new

information becomes available or other events occur in the future,

except as otherwise required under applicable law and our ongoing

reporting obligations under the Securities Exchange Act of 1934, as

amended.

Non-GAAP Financial Measures

Inseego Corp. has provided financial information in this press

release that has not been prepared in accordance with GAAP.

Adjusted EBITDA, non-GAAP net loss, non-GAAP net loss per share and

non-GAAP operating costs and expenses, for example, exclude

preferred stock dividends, share-based compensation expense,

amortization of intangible assets purchased through acquisitions,

amortization of discount and issuance costs related to our 2025

Notes and revolving credit facility, fair value adjustments on

derivative instruments, a one-time prior period adjustment related

to unamortized debt discount and loss on debt extinguishment

pertaining to our 2025 Notes, and other non-recurring expenses.

Adjusted EBITDA excludes interest, taxes, depreciation,

amortization (unrelated to acquisitions and the 2025 Notes),

impairment of capitalized software, impairment of long-lived

assets, and foreign exchange gains and losses.

Adjusted EBITDA, non-GAAP net loss, non-GAAP net loss per share

and non-GAAP operating costs and expenses are supplemental measures

of our performance that are not required by, or presented in

accordance with, GAAP. These non-GAAP financial measures have

limitations as an analytical tool. They are not intended to be used

in isolation or as a substitute for operating expenses, net loss,

net loss per share or any other performance measure determined in

accordance with GAAP. We present these non-GAAP financial measures

because we consider them to be an important supplemental

performance measure.

We use these non-GAAP financial measures to make operational

decisions, evaluate our performance, prepare forecasts and

determine compensation. Further, management and investors benefit

from referring to these non-GAAP financial measures in assessing

our performance when planning, forecasting and analyzing future

periods. Share-based compensation expenses are expected to vary

depending on the number of new incentive award grants issued to

both current and new employees, the number of such grants forfeited

by former employees, and changes in our stock price, stock market

volatility, expected option term and risk-free interest rates, all

of which are difficult to estimate. In calculating non-GAAP

financial measures, we exclude certain non-cash and one-time items

to facilitate comparability of our operating performance on a

period-to-period basis because such expenses are not, in our view,

related to our ongoing operational performance. We use this view of

our operating performance to compare it with the business plan and

individual operating budgets and in the allocation of

resources.

We believe that these non-GAAP financial measures are helpful to

investors in providing greater transparency to the information used

by management in its operational decision-making. The Company

believes that using these non-GAAP financial measures also

facilitates comparing our underlying operating performance with

other companies in our industry, which use similar non-GAAP

financial measures to supplement their GAAP results.

In the future, we expect to continue to incur expenses similar

to the non-GAAP adjustments described above, and the exclusion of

these items in the presentation of our non-GAAP financial measures

should not be construed as an inference that these costs are

unusual, infrequent, or non-recurring. Investors and potential

investors are cautioned that material limitations are associated

with using non-GAAP financial measures as an analytical tool. The

limitations of relying on non-GAAP financial measures include, but

are not limited to, the fact that other companies, including other

companies in our industry, may calculate non-GAAP financial

measures differently than we do, limiting their usefulness as a

comparative tool.

Investors and potential investors are encouraged to review the

reconciliation of our non-GAAP financial measures in this press

release with our GAAP financial results.

INSEEGO CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share and

per share data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Net revenues:

IoT & Mobile Solutions

$

41,357

$

62,633

$

131,367

$

172,129

Enterprise SaaS Solutions

7,226

6,534

21,567

20,279

Total net revenues

48,583

69,167

152,934

192,408

Cost of net revenues:

IoT & Mobile Solutions

43,560

48,209

105,011

131,805

Enterprise SaaS Solutions

3,128

3,002

8,945

9,505

Total cost of net revenues

46,688

51,211

113,956

141,310

Gross profit

1,895

17,956

38,978

51,098

Operating costs and expenses:

Research and development

8,951

15,417

27,127

47,597

Sales and marketing

5,355

8,295

17,975

25,789

General and administrative

4,906

5,720

16,703

20,101

Amortization of purchased intangible

assets

424

433

1,277

1,319

Write-down of capitalized software

611

—

1,115

—

Total operating costs and expenses

20,247

29,865

64,197

94,806

Operating loss

(18,352

)

(11,909

)

(25,219

)

(43,708

)

Other (expense) income:

Loss on debt conversion and

extinguishment, net

—

—

—

(450

)

Interest expense, net

(2,891

)

(2,034

)

(6,902

)

(6,621

)

Other (expense) income, net

(578

)

(1,758

)

875

(3,145

)

Total other expense

(3,469

)

(3,792

)

(6,027

)

(10,216

)

Loss before income taxes

(21,821

)

(15,701

)

(31,246

)

(53,924

)

Income tax (benefit) provision

(16

)

42

600

(582

)

Net loss

(21,805

)

(15,743

)

(31,846

)

(53,342

)

Series E preferred stock dividends

(756

)

(691

)

(2,218

)

(2,029

)

Net loss attributable to common

stockholders

$

(22,561

)

$

(16,434

)

$

(34,064

)

$

(55,371

)

Per share data:

Net loss per common share:

Basic and diluted

$

(0.19

)

$

(0.15

)

$

(0.30

)

$

(0.52

)

Weighted-average shares used in

computation of net loss per common share:

Basic and diluted

116,967,545

107,747,468

112,247,219

106,977,201

INSEEGO CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except par value

and share data)

(Unaudited)

September 30,

2023

December 31,

2022

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

18,946

$

7,143

Accounts receivable, net of provision for

credit losses of $1,101 and $541, respectively

17,435

25,259

Inventories

21,916

37,976

Prepaid expenses and other

5,562

7,978

Total current assets

63,859

78,356

Property, plant and equipment, net of

accumulated depreciation of $28,240 and $26,049, respectively

3,597

5,390

Rental assets, net of accumulated

depreciation of $5,037 and $5,484, respectively

5,037

4,816

Intangible assets, net of accumulated

amortization of $42,138 and $31,629, respectively

35,057

41,383

Goodwill

21,922

21,922

Right-of-use assets

5,819

6,662

Other assets

1,464

488

Total assets

$

136,755

$

159,017

LIABILITIES AND STOCKHOLDERS’

DEFICIT

Current liabilities:

Accounts payable

$

30,980

$

29,018

Accrued expenses and other current

liabilities

28,917

27,945

Total current liabilities

59,897

56,963

Long-term liabilities:

2025 Notes, net

159,541

158,427

Revolving credit facility, net

—

6,919

Deferred tax liabilities, net

278

323

Other long-term liabilities

7,822

6,503

Total liabilities

227,538

229,135

Commitments and contingencies

Stockholders’ deficit:

Preferred stock, par value $0.001;

2,000,000 shares authorized:

Series E Preferred stock, par value

$0.001; 39,500 shares designated, 25,000 shares issued and

outstanding, liquidation preference of $1,000 per share (plus any

accrued but unpaid dividends)

—

—

Common stock, par value $0.001;

150,000,000 shares authorized, 117,024,709 and 108,468,150 shares

issued and outstanding, respectively

117

108

Additional paid-in capital

808,203

793,855

Accumulated other comprehensive loss

(7,288

)

(6,329

)

Accumulated deficit

(891,815

)

(857,752

)

Total stockholders’ deficit

(90,783

)

(70,118

)

Total liabilities and stockholders’

deficit

$

136,755

$

159,017

INSEEGO CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Cash flows from operating activities:

Net loss

$

(21,805

)

$

(15,743

)

$

(31,846

)

$

(53,342

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

5,451

6,981

16,270

20,936

Provision for credit losses

368

44

612

29

Write-down of capitalized software

611

—

1,115

—

Provision for excess and obsolete

inventory

6,701

434

7,011

1,330

Share-based compensation expense

2,267

2,406

6,030

15,892

Amortization of debt discount and debt

issuance costs

1,071

450

2,048

2,472

Fair value adjustment on derivative

instrument

—

—

—

(902

)

Loss on debt conversion and

extinguishment, net

—

—

—

450

Deferred income taxes

82

(127

)

177

(223

)

Right-of-use assets

223

(13

)

437

1,057

Changes in assets and liabilities:

Accounts receivable

7,470

(5,800

)

7,703

(561

)

Inventories

1,512

4,222

7,685

(5,926

)

Prepaid expenses and other assets

1,009

(377

)

1,479

2,723

Accounts payable

(3,944

)

(7,341

)

1,162

(13,548

)

Accrued expenses, income taxes, and

other

8,945

8,016

2,561

6,276

Operating lease liabilities

(239

)

(257

)

(41

)

(1,366

)

Net cash provided by (used in) operating

activities

9,722

(7,105

)

22,403

(24,703

)

Cash flows from investing activities:

Purchases of property, plant and

equipment

(242

)

(144

)

(403

)

(1,203

)

Additions to capitalized software

development costs

(1,673

)

(3,020

)

(6,114

)

(9,242

)

Net cash used in investing activities

(1,915

)

(3,164

)

(6,517

)

(10,445

)

Cash flows from financing activities:

Net borrowing (repayment) of bank and

overdraft facilities

—

(317

)

79

(458

)

Principal payments under finance lease

obligations

—

—

—

(62

)

Proceeds from a public offering

—

—

6,057

—

Principal payments on financed assets

—

(337

)

(360

)

(1,567

)

Borrowings on revolving credit

facility

—

—

Borrowings (Repayments) on revolving

credit facility

(3,253

)

4,500

(7,851

)

4,500

Payment of debt issuance costs on

revolving credit facility

(1,126

)

(1,126

)

Proceeds from stock option exercises and

employee stock purchase plan, net of taxes paid on vested

restricted stock units

2

80

49

196

Net cash (used in) provided by financing

activities

(3,251

)

2,800

(2,026

)

1,483

Effect of exchange rates on cash

(775

)

1,172

(2,057

)

1,916

Net increase (decrease) in cash, cash

equivalents and restricted cash

3,781

(6,297

)

11,803

(31,749

)

Cash, cash equivalents and restricted

cash, beginning of period

15,165

24,360

7,143

49,812

Cash, cash equivalents and restricted

cash, end of period

$

18,946

$

18,063

$

18,946

$

18,063

INSEEGO CORP.

Reconciliation of GAAP Net

Loss Attributable to Common Shareholders to Non-GAAP Net

Loss

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

September 30, 2023

Nine Months Ended

September 30, 2023

Net Loss

Net Loss Per Share

Net Loss

Net Loss Per Share

GAAP net loss attributable to common

shareholders

$

(22,561

)

$

(0.19

)

$

(34,064

)

$

(0.30

)

Adjustments:

Preferred stock dividends(a)

756

0.01

2,218

0.02

Share-based compensation expense

2,267.4

0.02

6,030

0.05

Purchased intangibles amortization

424

—

1,277

0.01

Debt discount and issuance costs

amortization(b)

881

0.01

1,819

0.02

Non-GAAP net loss

$

(18,233

)

$

(0.16

)

$

(22,720

)

$

(0.20

)

Note: Amounts may not foot due to rounding.

(a)

Includes accrued dividends on Series E

Preferred Stock.

(b)

Includes the debt discount and issuance

costs amortization related to the 2025 Notes, and the issuance

costs related to the revolving credit facility.

See “Non-GAAP Financial Measures”

for information regarding our use of Non-GAAP financial

measures.

INSEEGO CORP.

Reconciliation of GAAP

Operating Costs and Expenses to Non-GAAP Operating Costs and

Expenses

Three Months Ended September 30,

2023

(In thousands)

(Unaudited)

GAAP

Share-based compensation

expense

Purchased intangibles

amortization

Non-GAAP

Cost of net revenues

$

46,688

$

251

$

—

$

46,437

Operating costs and expenses:

Research and development

8,951

599

—

8,352

Sales and marketing

5,355

373

—

4,982

General and administrative

4,906

1,044

—

3,862

Amortization of purchased intangible

assets

424

—

424

—

Write-down of purchased intangible

assets

611

—

—

611

Total operating costs and expenses

$

20,247

$

2,016

$

424

$

17,807

Total

$

2,266

$

424

See “Non-GAAP Financial Measures”

for information regarding our use of Non-GAAP financial

measures.

INSEEGO CORP.

Reconciliation of GAAP

Operating Costs and Expenses to Non-GAAP Operating Costs and

Expenses

Nine Months Ended September 30,

2023

(In thousands)

(Unaudited)

GAAP

Share-based compensation

expense

Purchased intangibles

amortization

Non-GAAP

Cost of net revenues

$

113,956

$

657

$

—

$

113,299

Operating costs and expenses:

Research and development

27,127

1,291

—

25,836

Sales and marketing

17,975

1,093

—

16,882

General and administrative

16,703

2,989

—

13,714

Amortization of purchased intangible

assets

1,277

—

1,277

—

Write-down of purchased intangible

assets

1,115

—

—

1,115

Total operating costs and expenses

$

64,197

$

5,373

$

1,277

$

57,547

Total

$

6,030

$

1,277

See “Non-GAAP Financial Measures”

for information regarding our use of Non-GAAP financial

measures.

INSEEGO CORP.

Reconciliation of GAAP Net

Loss Attributable to Common Shareholders to Adjusted EBITDA

(In thousands)

(Unaudited)

Three Months Ended

September 30, 2023

Nine Months Ended September

30, 2023

GAAP net loss attributable to common

shareholders

(22,561

)

$

(34,064

)

Preferred stock dividends(a)

756

2,218

Income tax provision (benefit)

(16

)

600

Depreciation and amortization

5,451

16,270

Share-based compensation expense

2,267

6,030

Write-down of capitalized software

611

1,115

Right-of-use asset impairment

469

Interest expense, net(b)

2,891

6,902

Inventory adjustment - E&O and

contract manufacturer liability

13,058

13,058

Write-off of capitalized inventory order

fees

924

924

Other(c)

578

(875

)

Adjusted EBITDA

$

3,959

$

12,647

(a)

Includes accrued dividends on Series E

Preferred Stock.

(b)

Includes the debt discount and issuance

costs amortization related to the 2025 Notes, and the issuance

costs related to the revolving credit facility.

(c)

Primarily relates to foreign exchange

gains and losses.

See “Non-GAAP Financial Measures”

for information regarding our use of Non-GAAP financial

measures.

INSEEGO CORP.

Quarterly Net Revenues by

Product Grouping

(In thousands)

(Unaudited)

Three Months Ended

September 30, 2023

June 30, 2023

March 31, 2023

December 31, 2022

September 30, 2022

IoT & Mobile Solutions

$

41,357

$

46,383

$

43,627

$

46,272

$

62,633

Enterprise SaaS Solutions

7,226

7,174

7,167

6,643

6,534

Total net revenues

$

48,583

$

53,557

$

50,794

$

52,915

$

69,167

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102546798/en/

Investor Relations Contact: IR@inseego.com

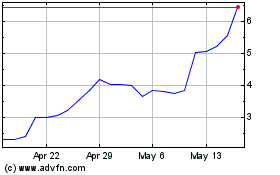

Inseego (NASDAQ:INSG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Inseego (NASDAQ:INSG)

Historical Stock Chart

From Feb 2024 to Feb 2025