As filed with the Securities and Exchange Commission on September 16, 2015

Registration No. 333-205666

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

NOVOGEN LIMITED ACN 063 259 754

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| New South Wales, Australia |

|

2834 |

|

Not Applicable |

| (State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

Level 1, 16-20 Edgeworth David Avenue

Hornsby, New South Wales 2077

Australia

(61-2)

9472-4104

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Novogen North America, Inc.

110 Loomis Court

Ithaca,

NY 14850-8929

(607) 539-4002

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

| Michael Ryan, Esq.

Addisons Level 12, 60

Carrington Street Sydney, New South Wales 2000

Australia |

|

John F.F. Watkins, Esq.

Reitler Kailas & Rosenblatt LLC

885 Third Avenue 20th Floor New York, NY 10022 |

Approximate date of commencement of proposed sale to the public: From time to time after effectiveness of this registration statement (except as

otherwise described herein).

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,

please check the following box. ¨

If any of the securities being registered on this Form are

to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or

additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of each class of

Securities to be Registered |

|

Amount

to be

Registered(1) |

|

Proposed

Maximum Offering

Price

Per Share |

|

Proposed

Maximum Aggregate

Offering Price |

|

Amount of

Registration Fee |

| Ordinary Shares |

|

77,625,000(1) |

|

$0.161(2) |

|

$12,497,625(2) |

|

$1,452.22 |

| |

| (1) |

Consists of ordinary shares issuable upon exercise of options issued by Novogen Limited to the selling shareholders described in the prospectus. These ordinary shares may be represented by American Depository Shares, or

ADSs. The ADSs issuable upon deposit of the ordinary shares registered hereby have been registered under a separate registration statement on Form F-6 (Registration No. 333-128681). Each ADS represents twenty five ordinary shares.

|

| (2) |

Pursuant to Rule 457(c) of the Securities Act of 1933, the maximum aggregate offering price of shares being registered for resale by the selling shareholder was calculated on the basis of high and low sales prices of

the Novogen Limited ordinary shares represented by ADSs as reported on Nasdaq Capital Market on June 30, 2015. |

| (3) |

Previously paid based on 77,625,000 ordinary shares originally contemplated for registration as reflected in the original Form F-3 Registration Statement filed on

July 15, 2015. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its

effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until

the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may

not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where

the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 16, 2015

Preliminary Prospectus

Up to 3,105,000 American Depositary Shares representing Ordinary Shares

Novogen Limited

This prospectus relates to the proposed resale by the selling shareholders named in the section “Selling Shareholders”

(collectively with any of their respective transferees or other successors-in-interest, the “Selling Shareholders”) of up to 3,105,000 American Depositary Shares, or ADSs”, representing 77,625,000 ordinary shares

(“ordinary shares”) of Novogen Limited (the “Company”). Each ADS represents twenty-five ordinary shares.

The ordinary shares underlying the ADSs are being registered pursuant to the requirements of a placement confirmation letter dated

April 20, 2015, between our Company and the Selling Shareholders to permit the Selling Shareholder to sell ADSs representing the ordinary shares from time to time in the public market (the “Placement Letter”).

We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of ADSs.

The ADSs covered by this prospectus may be offered or sold from time to time directly to purchasers or through agents, underwriters, brokers

or dealers at prevailing market or privately negotiated prices and on other terms to be determined at the time of sale. See “Plan Of Distribution.”

The ADSs are traded on the Nasdaq Capital Market, or Nasdaq, and our ordinary shares are listed on the Australian Stock Exchange, or ASX,

under the symbol “NRT”. On September 11, 2015, the closing price of the ADSs on Nasdaq was $2.52 per share and the closing price of our ordinary shares on the ASX was A$0.15 per share.

An investment in these securities involves risks. Please carefully consider the “Risk Factors”

beginning on page 3 of this prospectus, in Item 3.D of our Annual Report on Form 20-F for the fiscal year ended June 30, 2014 and other documents incorporated by reference in this prospectus, and in any applicable prospectus supplement,

for a discussion of the factors you should consider carefully before deciding to purchase these securities.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is September 16, 2015.

You should rely only on the information contained in or incorporated by reference into this

prospectus and any applicable prospectus supplement. Neither we nor the Selling Shareholders have authorized anyone to provide you with information different from that contained in this prospectus. The Selling Shareholders are not offering to sell

or soliciting offers to buy any security other than the ADSs and ordinary shares offered by this prospectus. In addition, the Selling Shareholders are not offering to sell or soliciting offers to buy any securities to or from any person in any

jurisdiction where it is unlawful to make this offer to or solicit an offer from a person in that jurisdiction. The information contained in this prospectus is accurate as of the date on the front of this prospectus only, regardless of the time of

delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus is part of a registration statement on Form F-3 that we filed with the U.S. Securities and Exchange Commission, or the SEC.

This prospectus does not contain all of the information set forth in the registration statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. Accordingly, you should refer to the registration statement

and its exhibits for further information. Copies of the registration statement and its exhibits are on file with the SEC.

TABLE OF CONTENTS

IMPORTANT INFORMATION ABOUT THIS PROSPECTUS

Before you invest in our securities, you should carefully read this prospectus and any prospectus supplement together with the additional

information described in the sections entitled “Risk Factors,” “Where You Can Find Additional Information About Us” and “Incorporation of Certain Information by Reference” in this prospectus.

In this prospectus, unless otherwise indicated or the context otherwise requires:

| |

• |

|

the terms “we,” “us”, “our,” “the Company,” “our Company,” “Novogen,” or “NVGN” refer to Novogen Limited, an Australian company and its consolidated

subsidiaries; |

| |

• |

|

“Our shares,” “ordinary shares” and similar expressions refer to our Ordinary Shares; |

| |

• |

|

“ADSs” refers to American depositary shares, each of which represents twenty-five ordinary shares, and “ADRs” refers to the American depositary receipts that may evidence the ADSs; |

| |

• |

|

“US$,” “dollars” or “U.S. dollars” refers to the legal currency of the United States, unless otherwise indicated. |

i

This prospectus is part of a registration statement on Form F-3 that we filed with the SEC

utilizing a shelf registration process permitted under the Securities Act of 1933, as amended, or the Securities Act. By using a shelf registration statement, we or any selling security holder may sell any of our securities from time to time and in

one or more offerings. Each time we or any selling security holder sell securities, we may provide a supplement to this prospectus that contains specific information about the securities being offered and the specific terms of that offering. The

supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the prospectus supplement.

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and matters discussed in this prospectus, the documents incorporated by reference, any related prospectus and any related

free writing prospectus constitute “forward-looking statements” within the meaning of, and intended to qualify for safe harbor from liability established by the Securities Act, the Securities Exchange Act of 1934, as amended, or the

Exchange Act, and the Private Securities Litigation Act of 1995. Forward-looking statements are statements that are not historical facts and may contain estimates, assumptions, projections, belief, expectations, future plans and strategies,

anticipated events and/or trends. Statements related to our future financial condition, results of operations and expected market growth are examples of forward-looking statements. Such forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause our actual results, performance, or future results to differ materially from historical results or any future results, performance or achievements expressed, suggested or implied by such

forward-looking statements. In some instances, you can identify these forward-looking statements by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,”

“plan,” “potential,” “will,” “should,” “would,” or similar expressions, including their negatives. These forward-looking statements include, without limitation, statements relating to our

expectations and beliefs regarding:

| |

• |

|

fluctuations in the market price of our securities; |

| |

• |

|

the possibility that our securities could be delisted from Nasdaq or the ASX; |

| |

• |

|

potential dilution to the holders of our securities as a result of future issuances of our securities; |

| |

• |

|

fluctuations in our results of operations; |

| |

• |

|

the accuracy of our financial forecasts in our drug development activity as well as in our medical device activity and the uncertainty regarding the adequacy of our liquidity to pursue our complete business objectives;

|

| |

• |

|

the timing and cost of the in-licensing, partnering and acquisition of new product opportunities; |

| |

• |

|

the timing of expenses associated with product development and manufacturing of the proprietary drug candidates; |

| |

• |

|

the costs involved in prosecuting and enforcing patent claims and other intellectual property rights; and |

| |

• |

|

other risks and uncertainties described in this prospectus. |

The risks included in this

section are not exhaustive. You should carefully consider the section entitled “Risk Factors” in this prospectus and reports filed with or furnished to the SEC, which include additional factors that could impact our business and financial

performance, before making any investment decision with respect to our securities. If any of these trends, risks or uncertainties actually occurs or continues, our business, financial condition and results of operations could be adversely affected,

the trading prices of our securities could decline and you could lose all or part of your investment.

Forward-looking statements

contained in this prospectus and documents incorporated by reference into this prospectus are based on our current plans, estimates and projections. Therefore, you should not place any reliance on any forward-looking statement as a prediction of

future results. Forward-looking statements made in this prospectus and the documents incorporated by reference are made as of the date of the respective documents. We undertake no obligation, and specifically decline any obligation, except as

required by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

PROSPECTUS SUMMARY

This summary provides a brief overview of the key aspects of Novogen Limited and certain material terms of the securities that may be

offered that are known as of the date of this prospectus. For a more complete understanding of the terms of a particular sale of offered securities, and before making your investment decision, you should carefully read:

| |

• |

|

this prospectus, including the materials incorporated herein by reference and the risk factors commencing on page 2 of this prospectus, which explains the general terms of the securities that may be offered;

|

| |

• |

|

the accompanying prospectus supplement for such issuance, which explains the specific terms of the securities being offered and which may update or change information in this prospectus; and |

| |

• |

|

the documents referred to in “Where You Can Find Additional Information” for information about us, including our financial statements. |

Our Company

We are

a pharmaceutical drug development company, with two main drug technology platforms: super-benzopyrans (SBPs) and anti-tropomyosins (ATMs). SBP compounds have the potential to kill the hierarchy of cancer cells that constitute a tumor, potentially

including the tumor-initiator cells. The ATM compounds target the microfilament cytoskeleton of a cancer cell. In vitro studies have shown that cancer cells treated with both the ATM compounds and standard of care anti-microtubule drugs, undergo

enhanced cancer cell death compared with the effect achieved with the respective monotherapy controls. Researchers have also observed this enhanced anti-cancer effect in in vivo studies (see below), ovarian cancer, colorectal cancer, prostate

cancer, neural cancers (glioblastoma, neuroblastoma in children), gastric cancer, pancreatic cancer, sarcomas and melanoma are the potential clinical indications being pursued, with the ultimate objective of employing both technologies as a unified

approach to therapy.

In November 2013, we formed a joint-venture company, CanTx Inc., with Yale University. The purpose of the joint

venture is to pool the resources of both parties in order to develop drugs for the treatment of ovarian cancer. Under a license agreement from Novogen, CanTx can access our patent portfolio of SBP drugs in order to identify a lead candidate compound

which leads to the development of a product for the treatment of intra-abdominal cancers, with a particular focus on ovarian cancer. A license agreement between Yale and CanTx provides CanTx access to certain Yale cell culture technology, animal

models, facilities, and resources. Arising from these studies, CanTx has identified a candidate drug product, Cantrixil. Cantrixil modulates the JNK and PKC pathways in cancer cells and induces caspase-mediated cell death. Cantrixil has been

designed to be injected into the peritoneal cavity with the aim of treating cancer initiating cells, the cells primarily responsible for cancer recurrence post chemotherapy. On April 20, 2015, we announced the results of pre-clinical studies

showing that Cantrixil was active in a stringent rodent model of human ovarian cancer. Pending successful completion of our formal toxicology program, an initial first in human Phase I clinical study is planned to be conducted in Australia

assessing the safety and tolerability of Cantrixil in patients with abdominal cancers with a bias toward patients with late-stage ovarian cancer in patients that no longer respond to standard of care therapy during 2016. We are planning to extend

this trial into US trial sites once we have received IND status for Cantrixil from the FDA. The FDA recently granted Cantrixil Orphan Drug status.

1

The Company’s second drug technology platform is called the anti-tropomyosin (ATM)

drug platform. The ATM’s are a class of small molecules designed to target a protein component of the actin microfilaments, tropomyosin Tpm3.1 which, as confirmed by in vitro studies, is essential for tumor cell survival. Inhibition of

Tpm3.1 function impacts the structural integrity of the cancer cell cytoskeleton causing the cancer cell to die. In addition to being an effective anti-cancer agent as a solo agent, these ATM compounds are also novel because they enhance the

anti-cancer activity of one of the most widely used classes of chemotherapy drugs - the anti-microtubule drugs.

In November 2014 we

announced that we had identified our lead ATM drug candidate, Anisina. Anisina was identified using Novogen’s proprietary VAL-ID - Versatile Approach to Library-based Iterative Design – medicinal chemistry program. This

strategy is based around the design, synthesis and evaluation of targeted small-molecule libraries and has proven to be a rapid and robust method of identifying lead compounds. Using a series of cell based triage screens, Anisina was selected

based on; i) its ability to bind to and inhibit the function of the target protein, Tpm3.1, ii) its effectiveness against a panel of both adult and pediatric tumor cell lines and iii) its ability to enhance the sensitivity of adult and pediatric

cancer cell lines to the standard of care microtubule targeting agents such as the taxanes and vinca alkaloids.

Preclinical in

vivo studies are underway to validate the effectiveness of Anisina in animal models of adult and paediatric (neuroblastoma) cancers both on its own and in combination with standard of care microtubule inhibitors. Importantly, a proof of

concept study done as part of the Children’s Oncology Drug Alliance (CODA) has confirmed that Anisina is not only effective on its own in reducing tumor growth in, but also enhances the sensitivity of the tumor to microtubule targeting

compounds in an animal model of neuroblastoma. The data from this study was presented at the Eighth Annual Cancer Molecular Therapeutics Research Association (CMTRA) meeting in the USA on July 13th of this year.

We are now focused on optimising the Anisina formulation and mode of delivery. Recent studies in a rodent model of cancer (announced

on the 24th of June 2015) have demonstrated that Anisina delivered in a cyclodextrin formulation is effective in reducing tumor growth, and was well tolerated when dosed orally (daily) or

intravenously (twice weekly). These studies clear the way to now initiate IND enabling studies with the view of taking Anisina through to the clinic as an IV delivered drug in combination with taxanes or vinca alkaloids. Pending the outcome

of our Anisina toxicology program, our first in man studies, are predicted to start during 2016.

We recently announced that pre-clinical

in vitro studies conducted on our other lead SBP drug candidate, TRXE-009, affects the viability of cancer cells by increasing rates of cell death (via caspase-mediated apoptosis) and reducing proliferation. This was observed in cancer cells

representative of glioblastoma, melanoma and prostate cancer. We have also demonstrated tumor growth inhibition in several animal models (flank models of melanoma, prostate and GBM) (see below). These findings combine with other recently announced

pre-clinical in vitro studies showing that TRXE-009 is highly cytotoxic to chemo-resistant pediatric brain cancers including Diffuse Intrinsic Pontine Glioma (DIPG). Through our collaboration with a local pediatric medical oncologist, the

Company has confirmed that Trilexium is highly active against patient derived explants of Diffuse Intrinsic Pontine Glioma (DIPG) in pre-clinical studies. DIPG is an aggressive but rare brain tumor primarily affecting children. Novogen has

identified a drug formulation that in animals is able to deliver Trilexium to brain tissue and researchers will soon commence a proof-of-concept pre-clinical study in an orthotropic model of DIPG. Once this proof-of-concept study is completed, the

Company plans to commence the required safety evaluation program. By targeting DIPG, the Company anticipates that this strategy may provide a fast-to-market opportunity and is also planning to file for an Orphan Drug Designation status with the FDA.

At this stage, first-in-human trials are targeted to commence by 2017.

Novogen has also recognised the potential depth of both the SBP

and ATM technology platforms which secures exceptional future growth opportunities, provides back-ups for our existing lead compounds and opens up new avenues for future discovery with a focus on Oncology. Our actions have also strengthened our

existing patent protection. In light of Novogen’s commitment to progressing at least two of its lead drug candidates into the clinic and focus on oncology-centric drug discovery, we have decided to pursue a patent protection approach for our

degenerative and regenerative medicine program known as Jacob’s Hope. This program will now take a lower profile while we focus on the nearer term core opportunities.

2

THE OFFERING AND PLACEMENT OF ORDINARY SHARES AND OPTIONS

We are registering for resale 77,625,000 ordinary shares, comprised of ordinary shares issuable upon exercise of (i) 51,750,000

options at the initial exercise price of A$0.30 per ordinary share that expire on December 30, 2015 (“Short-term Options”) and (ii) 25,875,000 options at the initial exercise price of A$0.40 per ordinary share that expire

on June 30, 2020 (“Long-term Options”; we refer in this Prospectus to the Short-term Options and the Long-terms Options collectively as the “Placement Options”), issued by our Company in a private placement

(the “Placement”) pursuant to a placement confirmation letter dated April 20, 2015 (the “Placement Letter”) between our Company and certain investors named in the section “Selling Stockholders”

(collectively, the “Selling Shareholders”), which may be represented by ADSs. In the Placement, our Company issued and sold to the Selling Shareholders an aggregate of 51,750,000 ordinary shares and 77,625,000 Placement Options. The

securities were issued without registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”), pursuant to the exemption from registration under the Securities Act for transactions not involving any public

offering. We received gross proceeds of approximately A$15.5 million from the Placement, which we are using for, among other purposes, further development of pharmaceutical drug products and general corporate purposes to support further development

of our Company.

RISK FACTORS

Before you invest in the ADSs you should understand the high degree of risk involved. You should carefully consider the risks described below

and other information in this report, including our financial statements and related notes included elsewhere in this report, before you decide to purchase the ADSs. If any of the following risks actually occur, our business, financial condition and

operating results could be adversely affected. As a result, the trading price of the ADSs could decline and you could lose part or all of your investment.

3

Risks Related to Our Business

We are currently exploring the development of anti-cancer drugs based on two unproven drug technology platforms – no assurance can be given that

either of these platforms will prove successful.

We are committed to the identification of lead candidate anti-cancer drugs from

the two drug technology platforms, super-benzopyrans (SBPs) and anti-tropomyosins (ATMs). Although early pre-clinical studies have confirmed the utility of either drug technology platform in the generation of compounds with novel and potent

cytotoxicity against various human cancer cell lines in vitro, there are significant risks and uncertainties in translating those early laboratory results into drugs that will have meaningful clinical application and meet the stringent

requirements of regulatory authorities such as the United States Food and Drug Administration, that review Investigational New Drug (IND) Applications to enable the conduct of first-in-man clinical trials. The Company plans to obtain the appropriate

approvals to enable the trials.

Factors that may have a negative impact on early drug candidate selection include:

| |

• |

|

unacceptably high toxicity; |

| |

• |

|

Poor efficacy in in vivo models; |

| |

• |

|

unacceptably short drug half-life; |

| |

• |

|

inability to deliver the drug in a practical manner; and |

| |

• |

|

insurmountable difficulties in large-scale manufacture. |

Our ability to continue as a going concern is

dependent on a continuing positive news flow from our pre-clinical R&D programs, and our ability to raise capital to support those programs.

As a result of the placement and the rights offer completed by the Company on June 2, 2015, we have raised approximately A$33.2 million

which, together with the Company’s existing cash resources, will enable the Company to proceed with its proposed R&D programs over the next 2 years. However, in the longer run, we will need substantial additional funds to maintain our

planned level of R&D.

The factors that will determine the actual amount of additional capital required may include the

following:

| |

• |

|

the rate of success and the length of time it takes to identify lead candidate compounds in both the super-benzopyran (SBP) and anti-tropomyosin (ATM) drug technologies; |

| |

• |

|

the length of time and amount of work required to bring any lead candidate compounds through their pre-clinical programs |

| |

• |

|

the need to employ additional staff or contractors to meet the needs of the R&D programs. |

If we are unable to obtain additional funds on favorable terms or at all, we may be required to cease or reduce our operations. Also, if we

raise more funds by selling additional securities, the ownership interests of holders of our securities will be diluted.

We are at an early stage

of drug development and are in the process of applying for patents over composition and matter and use for both of our drug technology platforms. There is no certainty that patent protection will be granted.

Our patent portfolio is in a development stage. It comprises a certain number of provisional patents that have been lodged and others that

are in the process of being lodged. The patents usually have worldwide coverage, with a particular focus on USA, EU, Asia and Australia. While our patent strategy is closely supervised by experienced patent attorneys and every effort made to ensure

the likely success of achieving approval of patent claims in all major territories, there is no guarantee that any or all territories will grant such claims.

4

Negative global economic conditions may pose challenges to our business strategy, the success of which

relies on our continued ability to access capital from the markets or collaborators.

Negative conditions in the global economy,

including credit markets and the financial services industry, have generally made equity and debt financing more difficult to obtain, and may negatively impact our ability to complete financing transactions. The duration and severity of these

conditions is uncertain, as is the extent to which they may adversely affect our business and the business of current and prospective vendors and collaborators. If negative global economic conditions persist or worsen, we may not be able to secure

additional funding to sustain our operations or to find suitable collaborators to advance our internal programs, even if positive results are achieved from research and development efforts.

We have a history of incurring losses and expect to continue to incur losses.

We have not yet generated any income from our activities. We have had a history of incurring losses and are likely to continue to incur

operating losses in the near future, until such time as any possible commercial breakthrough occurs.

Final approval by regulatory authorities of

our drug candidates for commercial use may be delayed, limited or prevented, any of which would adversely affect our ability to generate operating revenues.

We will not generate any operating revenue until we, or our subsidiaries, successfully commercialize one or more of our drug candidates.

Currently, our drug candidates are at an early stage of development, and each will need to successfully proceed through a number of steps in order to obtain regulatory approval before potential commercialization.

For example, any of the following factors may serve to delay, limit or prevent final approval by regulatory authorities of our drug

candidates for commercial use:

| |

• |

|

we have identified two lead drug-candidates, Cantrixil and Anisina that are progressing through a safety evaluation program, and are in the process of identifying a number of other lead candidate compounds. All are in

the early stages of development, and we will need to conduct significant pre-clinical and clinical testing to demonstrate the safety and the efficacy of these drug candidates before applications for marketing can be filed with the FDA, or with the

regulatory authorities of other countries; |

| |

• |

|

data obtained from pre-clinical and clinical studies can be interpreted in different ways, which could delay, limit or prevent regulatory approval; |

| |

• |

|

development and testing of product formulation, including identification of suitable excipients, or chemical additives intended to facilitate delivery of our drug candidates; |

| |

• |

|

it may take us many years to complete the testing of our drug candidates, and failure can occur at any stage of this process; and |

| |

• |

|

negative or inconclusive results or adverse medical events during a clinical trial could cause us to delay or terminate our development efforts. |

The successful development of any of these drug candidates is uncertain and, accordingly, we may never commercialize any of these drug

candidates or generate revenue.

Even if we receive regulatory approval to commercialize our drug candidates, the ability to generate revenues from

any resulting products will be subject to a variety of risks, many of which are outside of our control.

Even if our drug

candidates obtain regulatory approval, resulting products may not gain market acceptance among physicians, patients, healthcare payers or the medical community. We believe that the degree of market acceptance and our ability to generate revenues

from such products will depend on a number of factors, including, but not limited to:

| |

• |

|

timing of market introduction of our drugs and competitive drugs; |

| |

• |

|

actual and perceived efficacy and safety of our drug candidates; |

| |

• |

|

prevalence and severity of any side effects; |

| |

• |

|

potential or perceived advantages or disadvantages over alternative treatments; |

| |

• |

|

strength of sales, marketing and distribution support; |

5

| |

• |

|

price of future products, both in absolute terms and relative to alternative treatments; |

| |

• |

|

the effect of current and future healthcare laws on our drug candidates; and |

| |

• |

|

availability of coverage and reimbursement from government and other third-party payers. |

If

any of our drugs are approved and fail to achieve market acceptance, we may not be able to generate significant revenue to achieve or sustain profitability.

We may not be able to establish the contractual arrangements necessary to develop, market and distribute the product candidates.

A key part of our business plan is to establish contractual relationships with strategic partners. We must successfully contract with third

parties to package, market and distribute our product candidates.

Potential partners may be discouraged by our limited operating

history.

There is no assurance that we will be able to negotiate commercially acceptable licensing or other agreements for the future

exploitation of our drug product candidates including continued clinical development, manufacture or marketing. If we are not able to successfully contract for these services, or if arrangements for these services are terminated, we may have to

delay the commercialization program which will adversely affect our ability to generate operating revenues.

Our commercial opportunity will be

reduced or eliminated if competitors develop and market products that are more effective, have fewer side effects or are less expensive than our drug candidates.

The development of drug candidates is highly competitive. A number of other companies have products or drug candidates in various stages of

pre-clinical or clinical development that are intended for the same therapeutic indications for which our drug candidates are being developed. Some of these potential competing drugs are further advanced in development than our drug candidates and

may be commercialized sooner. Even if we are successful in developing effective drugs, our compounds may not compete successfully with products produced by our competitors.

Our competitors include pharmaceutical companies and biotechnology companies, as well as universities and public and private research

institutions. In addition, companies active in different but related fields represent substantial competition. Many of our competitors developing oncology drugs have significantly greater capital resources, larger number of research and development

staff and facilities and greater experience in drug development, regulation, manufacturing and marketing. These organizations also compete with us and our service providers to recruit qualified personnel and to attract partners for joint ventures

and to license technologies. As a result, our competitors may be able to more easily develop technologies and products that would render our technologies or our drug candidates obsolete or non-competitive.

We rely on third parties to conduct our pre-clinical studies. If those parties do not successfully carry out their contractual duties or meet expected

deadlines, our drug candidates may not advance in a timely manner or at all.

In the course of discovery, pre-clinical

testing and clinical trials, we rely on third parties, including laboratories, investigators, contract research organizations, or CROs (Clinical Research Organisation) and manufacturers, to perform critical services. For example, we rely on third

parties to conduct all of our pre-clinical studies. These third parties may not be available when we need them or, if they are available, may not comply with all regulatory and contractual requirements or may not otherwise perform their services in

a timely or acceptable manner, and we may need to enter into new arrangements with alternative third parties and the studies may be extended, delayed or terminated. These independent third parties may also have relationships with other commercial

entities, some of which may compete with us. As a result of our dependence on third parties, we may face delays or failures outside of our direct control. These risks also apply to the development activities of collaborators, and we do not control

their research and development, clinical trial or regulatory activities.

We have no direct control over the cost of manufacturing our drug

candidates. Increases in the cost of manufacturing our drug candidates would increase the costs of conducting clinical trials and could adversely affect future profitability.

We do not intend to manufacture the drug product candidates in-house, and we will rely on third parties for drug supplies both for clinical

trials and for commercial quantities in the future. We have taken the strategic decision not to manufacture active pharmaceutical ingredients (‘API’) for the drug candidates, as these can be more economically supplied by third parties with

particular expertise in this area. We plan to manufacture product and test it to FDA requirements. We have identified contract facilities that are registered with the FDA, have a track record of large scale API manufacture, and have already invested

in capital and equipment. We have no direct control over the cost of manufacturing our product candidates. If the cost of manufacturing increases, or if the cost of the materials used increases, these costs will be passed on, making the cost of

conducting clinical trials more expensive. Increases in manufacturing costs could adversely affect our future profitability if we were unable to pass all of the increased costs along to our customers.

6

We may face a risk of product liability claims and may not be able to obtain adequate insurance.

Our business exposes us to the risk of product liability claims. This risk is inherent in the manufacturing, testing and

marketing of human therapeutic products. We have product liability insurance. The coverage is subject to deductibles and coverage limitations. We are in the process of identifying lead candidate compounds. When identified, and INDs are obtained,

they will be taken into the clinic. We may not be able to obtain or maintain adequate protection against potential liabilities, or claims may exceed the insurance limits. If we cannot or do not sufficiently insure against potential product liability

claims, we may be exposed to significant liabilities, which may materially and adversely affect our business development and commercialization efforts.

If we are unable to adequately protect our intellectual property, third parties may be able to use our technology, which could adversely affect our

ability to compete in the market.

Our commercial success will depend in part on our ability and the ability of our licensors to

obtain and maintain patent protection on our drug products and technologies and successfully defend these patents and technologies against third-party challenges. As part of our business strategy, our policy is to actively file patent applications

in the US and internationally to cover methods of use, new chemical compounds, pharmaceutical compositions and dosing of the compounds and composition and improvements in each of these. Because of the extensive time required for development, testing

and regulatory review of a potential product, it is possible that before we commercialize any of our products, any related patent may expire or remain in force for only a short period following commercialization, thus reducing any advantage of the

patent.

The patent positions of pharmaceutical and biotechnology companies can be highly uncertain and involve complex legal and factual

questions. No consistent policy regarding the breadth of claims allowed in biotechnology patents has emerged to date. Accordingly, the patents we use may not be sufficiently broad to prevent others from practicing our technologies or from developing

competing products. Furthermore, others may independently develop similar or alternative technologies or design around our patented technologies. The patents we use may be challenged or invalidated or may fail to provide us with any competitive

advantage.

Generally, patent applications in the US are maintained in secrecy for a period of at least 18 months. Since publication of

discoveries in the scientific or patent literature often lag behind actual discoveries, we are not certain that we were the first to make the inventions covered by each of our pending patent applications or that we were the first to file those

patent applications. We cannot predict the breadth of claims allowed in biotechnology and pharmaceutical patents, or their enforceability. Third parties or competitors may challenge or circumvent our patents or patent applications, if issued. If our

competitors prepare and file patent applications in the US that claim compounds or technology also claimed by us, we may be required to challenge competing patent rights, which could result in substantial cost, even if the eventual outcome is

favorable to us. While we have the right to defend patent rights related to the licensed drug candidates and technologies, we are not obligated to do so. In the event that we decide to defend our licensed patent rights, we will be obligated to

cover all of the expenses associated with that effort.

We also rely on trade secrets to protect technology where we believe patent

protection is not appropriate or obtainable. Trade secrets are difficult to protect. While we require our employees, collaborators and consultants to enter into confidentiality agreements, this may not be sufficient to protect our trade secrets or

other proprietary information adequately. In addition, we share ownership and publication rights to data relating to some of our drug candidates and technologies with our research collaborators and scientific advisors. If we cannot maintain the

confidentiality of this information, our ability to protect our proprietary information will be at risk.

7

Litigation or third-party claims of intellectual property infringement could require us to spend

substantial time, money and other resources defending such claims and adversely affect our ability to develop and commercialize our products.

Third parties may assert that we are using their proprietary technology without authorization. In addition, third parties may have or obtain

patents in the future and claim that our products infringe their patents. If we are required to defend against patent suits brought by third parties, or if we sue third parties to protect our patent rights, we may be required to pay substantial

litigation costs, and our management’s attention may be diverted from operating our business. In addition, any legal action against our licensors or us that seeks damages or an injunction of our commercial activities relating to the affected

products could subject us to monetary liability and require our licensors or us to obtain a license to continue to use the affected technologies. We cannot predict whether our licensors or we would prevail in any of these types of actions or that

any required license would be made available on commercially acceptable terms, if at all. In addition, any legal action against us that seeks damages or an injunction relating to the affected activities could subject us to monetary liability and/or

require us to discontinue the affected technologies or obtain a license to continue use thereof.

In addition, there can be no assurance

that our patents or patent applications or those licensed to us will not become involved in opposition or revocation proceedings instituted by third parties. If such proceedings were initiated against one or more of our patents, or those licensed to

us, the defense of such rights could involve substantial costs and the outcome could not be predicted.

Competitors or potential

competitors may have filed applications for, may have been granted patents for, or may obtain additional patents and proprietary rights that may relate to compounds or technologies competitive with ours. If patents are granted to other parties that

contain claims having a scope that is interpreted to cover any of our products (including the manufacture thereof), there can be no assurance that we will be able to obtain licenses to such patents at reasonable cost, if at all, or be able to

develop or obtain alternative technology.

Risks Related to the ADSs

The trading price of our ordinary shares and ADSs is highly volatile. Your investment could decline in value and we may incur significant costs from

class action litigation and our securities may be delisted from Nasdaq.

The trading price of our ordinary shares and ADSs is

highly volatile in response to various factors, many of which are beyond our control, including:

| |

• |

|

announcements of technological innovations by us and our competitors; |

| |

• |

|

new products introduced or announced by us or our competitors; |

| |

• |

|

changes in financial estimates by securities analysts; |

| |

• |

|

actual or anticipated variations in operating results; |

| |

• |

|

expiration or termination of licenses, research contracts or other collaboration agreements; |

| |

• |

|

conditions or trends in the regulatory climate in the biotechnology, pharmaceutical and genomics industries; |

| |

• |

|

changes in the market values of similar companies; |

| |

• |

|

the liquidity of any market for our securities; and |

| |

• |

|

additional sales by us of our shares. |

In addition, equity markets in general and the market

for biotechnology and life sciences companies in particular, have experienced substantial price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of the companies traded in those markets. Further

changes in economic conditions in Australia, the United States, Europe, or globally, could impact our ability to raise funding. Adverse economic changes are outside our control and may result in material adverse effects on our business or results of

operations. These broad market and industry factors may materially affect the market price of our ordinary shares and ADSs regardless of our development and operating performance. In the past, following periods of volatility in the market price of a

company’s securities, securities class action litigation has often been instituted against that company. Such litigation, if instituted against us, could cause us to incur substantial costs and divert management’s attention and resources.

The market price of the ADSs remains below US$5.00 per share. As such, under stock exchange rules, our stockholders will not be able to

use such ADSs as collateral for borrowing in margin accounts. This inability to use ADSs as collateral may depress demand as certain institutional investors are restricted from investing in securities priced below US$5.00 and may lead to sales of

such ADSs creating downward pressure on and increased volatility in the market price of our ordinary shares and ADSs.

8

In addition, under Nasdaq rules, companies listed on the Nasdaq Capital Market are required to

maintain a share price of at least US$1.00 per share and if the share price declines below US$1.00 for a period of 30 consecutive business days, then the listed company would have 180 days to regain compliance with the US$1.00 per share minimum. In

the event that our share price for an ADS declines below US$1.00, we may be required to take action, such as a reverse stock split, in order to comply with the Nasdaq rules that may be in effect at the time.

The ADSs are traded in small volumes, limiting your ability to sell your ADSs that represent ordinary shares at a desirable price, if at all.

The trading volume of the ADSs has historically been low. Even if the trading volume of the ADSs increases, we can give no

assurance that it will be maintained or will result in a desirable stock price. As a result of this low trading volume, it may be difficult to identify buyers to whom you can sell your ADSs in desirable volume and you may be unable to sell your ADSs

at an established market price, at a price that is favorable to you, or at all. A low volume market also limits your ability to sell large blocks of the ADSs at a desirable or stable price at any one time. You should be prepared to own the ADSs

indefinitely.

Our stock price can be volatile, which increases the risk of litigation and may result in a significant decline in the value of your

investment.

The trading price of the ADSs representing our ordinary shares is likely to be highly volatile and subject to wide

fluctuations in price in response to various factors, many of which are beyond our control. These factors include:

| |

• |

|

developments concerning our drug candidates or medical devices; |

| |

• |

|

announcements of technological innovations by us or our competitors; |

| |

• |

|

introductions or announcements of new products by us or our competitors; |

| |

• |

|

developments in the markets of the field of activities and changes in customer attributes; |

| |

• |

|

announcements by us of significant acquisitions, in/out license transactions, strategic partnerships, joint ventures or capital commitments; |

| |

• |

|

changes in financial estimates by securities analysts; |

| |

• |

|

actual or anticipated variations in interim operating results and near-term working capital as well as failure to raise required funds for the continued development and operations of the Company; |

| |

• |

|

expiration or termination of licenses, patents, research contracts or other collaboration agreements; |

| |

• |

|

conditions or trends in the regulatory climate and the biotechnology and pharmaceutical industries; |

| |

• |

|

failure to obtain orphan drug designation status for the relevant drug candidates in the relevant regions; |

| |

• |

|

increase in costs and lengthy timing of the clinical trials according to regulatory requirements; |

| |

• |

|

failure to increase awareness to our non-medicinal non-invasive therapy and its benefits; |

| |

• |

|

changes in reimbursement policy by governments or insurers in markets we operate or may operate in the future; |

| |

• |

|

any changes in the regulatory environment relating to our products may impact our ability to market and sell our products; |

| |

• |

|

failure to obtain or renew the required licenses for the marketing and sale of our products (once developed) in the main markets in which those products are to be sold; |

| |

• |

|

changes in the market valuations of similar companies; and |

| |

• |

|

additions or departures of key personnel. |

In addition, equity markets in general, and the

market for biotechnology and life sciences companies in particular, have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies traded in those markets. These

broad market and industry factors may materially affect the market price of the ADSs, regardless of our development and operating performance. In the past, following periods of volatility in the market price of a company’s securities,

securities class-action litigation has often been instituted against that company. Such litigation, if instituted against us, could cause us to incur substantial costs to defend such claims and divert management’s attention and resources even

if we prevail in the litigation, all of which could seriously harm our business.

9

Future issuances or sales of ADSs could depress the market for the ADSs.

Future issuances of a substantial number of ADSs, or the perception by the market that those issuances could occur, could cause the market

price of our ordinary shares or the ADSs to decline or could make it more difficult for us to raise funds through the sale of equity in the future. Also, if we make one or more significant acquisitions in which the consideration includes ordinary

shares or other securities, your portion of shareholders’ equity in us may be significantly diluted.

ADS holders are not shareholders and do

not have shareholder rights.

The Bank of New York Mellon, as depositary, delivers the ADSs. ADS holders will not be treated as

shareholders and do not have the rights of shareholders. The depositary will be the holder of the shares underlying the ADSs. Holders of ADSs will have ADS holder rights. A deposit agreement among us, the depositary and ADS holders, and the

beneficial owners of ADSs, sets out ADS holder rights as well as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs. Our shareholders have shareholder rights prescribed by Australian law. Australian

law and our Constitution, govern such shareholder rights. ADS holders do not have the same voting rights as our shareholders. Shareholders are entitled to our notices of general meetings and to attend and vote at our general meetings of

shareholders. At a general meeting, every shareholder present (in person or by proxy, attorney or representative) and entitled to vote has one vote on a show of hands. Every shareholder present (in person or by proxy, attorney or representative) and

entitled to vote has one vote per fully paid ordinary share on a poll. This is subject to any other rights or restrictions which may be attached to any shares. ADS holders may instruct the depositary to vote the ordinary shares underlying their

ADSs. If we do not ask the depositary to ask for their instructions, ADS holders will not receive our notices of general meeting and may not find out about it in time to give voting instructions. ADS holders will not be entitled to attend and vote

at a general meeting unless they surrender ADSs and withdraw the ordinary shares. ADS holders may not know about the meeting enough in advance to withdraw the ordinary shares. If we ask for ADS holders’ instructions, the depositary will notify

ADS holders of the upcoming vote and arrange to deliver our voting materials and form of notice to them. The depositary will try, as far as is practical, subject to the provisions of the deposit agreement, to vote the shares as ADS holders instruct.

The depositary will not vote or attempt to exercise the right to vote other than in accordance with the instructions of ADS holders. We cannot assure ADS holders that they will receive the voting materials in time to ensure that they can instruct

the depositary to vote their shares.

ADS holders do not have the same rights to receive dividends or other distributions as our

shareholders. Subject to any special rights or restrictions attached to a share, the directors may determine that a dividend will be payable on a share and fix the amount, the time for payment and the method for payment (although we have never

declared or paid any cash dividends on our ordinary stock and we do not anticipate paying any cash dividends in the foreseeable future). Dividends and other distributions payable to our shareholders with respect to our ordinary shares generally will

be payable directly to them. Any dividends or distributions payable with respect to ordinary shares represented by ADSs will be paid to the depositary, which has agreed to pay to ADS holders the cash dividends or other distributions it or the

custodian receives on shares or other deposited securities, after deducting its fees and expenses. ADS holders will receive these distributions in proportion to the number of shares their ADSs represent. In addition, there may be certain

circumstances in which the depositary may not pay to the ADS holders amounts distributed by us as a dividend or distribution.

If we fail to

maintain an effective system of internal controls over financial reporting, we may not be able to accurately report our financial results or prevent fraud.

We are subject to reporting obligations under U.S. securities laws. The SEC, as required by Section 404 of the Sarbanes-Oxley Act of

2002, or the Sarbanes-Oxley Act, adopted rules requiring most public companies to include a management report on such company’s internal controls over financial reporting in its annual report, which contains management’s assessment of the

effectiveness of the Company’s internal controls over financial reporting. Our management may conclude that our internal controls over our financial reporting are not effective.

If we fail to maintain the adequacy of our internal controls, we may not be able to conclude that we have effective internal control over

financial reporting. Moreover, effective internal control over financial reporting is necessary for us to produce reliable financial reports and is important to help prevent fraud. As a result, our failure to maintain effective internal control over

financial reporting could result in the loss of investor confidence in the reliability of our financial statements, which in turn could harm our business and negatively impact the trading price of the ADSs. Furthermore, we have incurred and expect

to continue to incur considerable costs and devote significant management time and efforts and other resources to comply with Section 404 of the Sarbanes-Oxley Act.

10

Compliance with rules and regulations applicable to companies publicly listed in the United States is

costly and complex and any failure by us to comply with these requirements on an ongoing basis could negatively affect investor confidence in us and cause the market price of the ADSs to decrease.

In addition to Section 404, the Sarbanes-Oxley Act also mandates, among other things, that companies adopt corporate governance

measures, imposes comprehensive reporting and disclosure requirements, sets strict independence and financial expertise standards for audit committee members, and imposes civil and criminal penalties for companies, their chief executive officers,

chief financial officers and directors for securities law violations. Our current and future compliance efforts will continue to require significant management attention. In addition, our board members, chief executive officer and chief financial

officer could face an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty attracting and retaining qualified board members and executive officers to fill critical positions

within our Company. Any failure by us to comply with these requirements on an ongoing basis could negatively affect investor confidence in us, cause the market price of the ADSs to decrease or even result in the delisting of the ADSs from NASDAQ.

Because we are not organized under U.S. law, we are subject to certain less detailed disclosure requirements under U.S. federal securities

laws.

We are a “foreign private issuer,” as defined in the SEC’s regulations, and consequently we are not

subject to all of the same disclosure requirements applicable to domestic (U.S.) companies. We prepare annual financial statements in accordance with International Financial Reporting Standards. We are exempt from the SEC’s proxy rules, and our

annual reports contain less detailed disclosure than reports of domestic issuers regarding such matters as management, executive compensation and outstanding options, beneficial ownership of our securities and certain related party transactions.

Also, our officers, directors and beneficial owners of more than 10% of our equity securities are exempt from the reporting requirements and short-swing profit recovery provisions of Section 16 of the Exchange Act. We are also generally exempt

from most of the governance rules applicable to companies listed on NASDAQ. These limits on available information about our Company and exemptions from many governance rules applicable to U.S. domestic issuers may adversely affect the market prices

for our securities.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or

bringing original actions in Australia based on United States or other foreign laws against us or our management named in the annual report.

We are incorporated in Australia and conduct most of our operations in Australia. Most of our assets are located in Australia. In addition,

many of our directors and senior executive officers reside within Australia and some or all of the assets of those persons are located outside of the United States. As a result, it may not be possible to effect service of process within the United

States or elsewhere outside Australia upon our directors and senior executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. Even if you are successful in bringing an

action of this kind, the laws of Australia may render you unable to enforce a judgment against our assets or the assets of our directors and officers.

Australia has no statutory reciprocal enforcement arrangements in place with the US. Therefore, to enforce a US judgment in Australia, the

common law prerequisites to the recognition and enforcement of an overseas’ judgment must be met.

The common law prerequisites are

that the foreign Court must have exercised a jurisdiction which the Australian Courts recognise, the judgment is final and conclusive, the parties to the judgment and in the application to register the judgment are identical and the judgment is for

a fixed, or readily calculable debt.

The debtor can apply to have the enforcement of a judgment refused on grounds such as for public

policy reasons, because judgment was obtained by fraud, because the foreign Court failed to act in accordance with natural justice or to apply the appropriate law, or the party seeking the enforcement is stopped from doing so.

11

You may not be able to participate in rights offerings and may experience dilution of your holdings as a

result.

We may from time to time distribute rights to our shareholders, including rights to acquire our securities. Under the

deposit agreement for the ADSs, the depositary will not offer those rights to ADS holders unless both the rights and the underlying securities to be distributed to ADS holders are either registered under the Securities Act or are exempt from

registration under the Securities Act with respect to all holders of ADSs. We are under no obligation to file a registration statement with respect to any such rights or underlying securities or to endeavor to cause such a registration statement to

be declared effective. In addition, we may not be able to take advantage of any exemptions from registration under the Securities Act. Accordingly, holders of ADSs may be unable to participate in our rights offerings and may experience dilution in

their holdings as a result.

You may be subject to limitations on transfer of your ADSs.

Your ADSs are transferable on the books of the depositary. However, the depositary may close its transfer books at any time or from time to

time when it deems expedient in connection with the performance of its duties. In addition, the depositary may refuse to deliver, transfer or register transfers of ADSs generally when our books or the books of the depositary are closed, or at any

time if we or the depositary deem it advisable to do so because of any requirement of law or of any government or governmental body, or under any provision of the deposit agreement, or for any other reason.

CAPITALIZATION AND INDEBTEDNESS

The table below sets forth our capitalization as of July 31, 2015.

|

|

|

|

|

| |

|

As of

July 31,

2015 |

|

| |

|

(In A$, except

number of shares) |

|

| Ordinary Shares issued and outstanding (1) |

|

|

424,117,465 |

|

| Borrowings |

|

$ |

0 |

|

| Contributed Equity |

|

$ |

190,555,804 |

|

| Reserves |

|

$ |

2,566,053 |

|

| Accumulated losses |

|

($ |

148,696,769 |

) |

| Non-controlling interest |

|

|

(318,573 |

) |

| Total shareholders’ equity |

|

$ |

44,105,615 |

|

| (1) |

Excludes 178,924,987 ordinary shares issuable upon the exercise of 178,924,987 options, having exercise prices ranging from A$0.1250 to A$0.40 per ordinary share and having a weighted average exercise price of

A$0.3278 per ordinary share. |

12

MARKET FOR OUR ORDINARY SHARES

Australian Securities Exchange

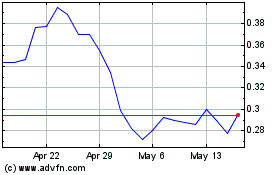

Our

ordinary shares are traded on the ASX. The following table sets forth, for the periods indicated, the high and low market quotations for our ordinary shares, as quoted on the ASX.

|

|

|

|

|

|

|

|

|

| |

|

Per Ordinary Share

(A$) |

|

| |

|

High |

|

|

Low |

|

| Fiscal Year Ended June 30, |

|

|

|

|

|

|

|

|

| 2010 |

|

|

0.89 |

|

|

|

0.17 |

|

| 2011 |

|

|

0.46 |

|

|

|

0.10 |

|

| 2012 |

|

|

0.25 |

|

|

|

0.08 |

|

| 2013 |

|

|

0.47 |

|

|

|

0.06 |

|

| 2014 |

|

|

0.40 |

|

|

|

0.15 |

|

| 2015 |

|

|

0.45 |

|

|

|

0.08 |

|

|

|

|

| Fiscal Year Ended June 30, 2013: |

|

|

|

|

|

|

|

|

| First Quarter |

|

|

0.10 |

|

|

|

0.07 |

|

| Second Quarter |

|

|

0.20 |

|

|

|

0.06 |

|

| Third Quarter |

|

|

0.47 |

|

|

|

0.07 |

|

| Fourth Quarter |

|

|

0.37 |

|

|

|

0.16 |

|

|

|

|

| Fiscal Year Ended June 30, 2014: |

|

|

|

|

|

|

|

|

| First Quarter |

|

|

0.21 |

|

|

|

0.16 |

|

| Second Quarter |

|

|

0.40 |

|

|

|

0.17 |

|

| Third Quarter |

|

|

0.23 |

|

|

|

0.18 |

|

| Fourth Quarter |

|

|

0.18 |

|

|

|

0.15 |

|

|

|

|

| Fiscal Year Ended June 30, 2015: |

|

|

|

|

|

|

|

|

| First Quarter |

|

|

0.16 |

|

|

|

0.12 |

|

| Second Quarter |

|

|

0.16 |

|

|

|

0.08 |

|

| Third Quarter |

|

|

0.24 |

|

|

|

0.10 |

|

| Fourth Quarter |

|

|

0.45 |

|

|

|

0.20 |

|

|

|

|

| Fiscal Year Ended June 30, 2016: |

|

|

|

|

|

|

|

|

| First Quarter (through to September 11, 2015) |

|

|

0.27 |

|

|

|

0.13 |

|

|

|

|

| Month Ended: |

|

|

|

|

|

|

|

|

| July 2014 |

|

|

0.16 |

|

|

|

0.12 |

|

| August 2014 |

|

|

0.15 |

|

|

|

0.13 |

|

| September 2014 |

|

|

0.16 |

|

|

|

0.13 |

|

| October 2014 |

|

|

0.14 |

|

|

|

0.12 |

|

| November 2014 |

|

|

0.12 |

|

|

|

0.08 |

|

| December 2014 |

|

|

0.16 |

|

|

|

0.08 |

|

| January 2015 |

|

|

0.11 |

|

|

|

0.09 |

|

| February 2015 |

|

|

0.17 |

|

|

|

0.12 |

|

| March 2015 |

|

|

0.24 |

|

|

|

0.13 |

|

| April 2015 |

|

|

0.45 |

|

|

|

0.21 |

|

| May 2015 |

|

|

0.38 |

|

|

|

0.28 |

|

| June 2015 |

|

|

0.30 |

|

|

|

0.23 |

|

| July 2015 |

|

|

0.27 |

|

|

|

0.20 |

|

| August 2015 |

|

|

0.21 |

|

|

|

0.15 |

|

| September 2015 (through to September 11, 2015) |

|

|

0.15 |

|

|

|

0.13 |

|

13

NASDAQ Capital Market

The ADSs are traded on the NASDAQ Capital Market under the symbol “NVGN.” The following table sets forth, for the periods

indicated, the high ask and low bid prices of the ADSs on the NASDAQ Capital Market:

|

|

|

|

|

|

|

|

|

| |

|

Per ADS (US$)* |

|

| |

|

High |

|

|

Low |

|

| Fiscal Year Ended June 30, |

|

|

|

|

|

|

|

|

| 2010 |

|

|

26.20 |

|

|

|

2.85 |

|

| 2011 |

|

|

14.85 |

|

|

|

2.05 |

|

| 2012 |

|

|

8.25 |

|

|

|

1.95 |

|

| 2013 |

|

|

10.49 |

|

|

|

0.76 |

|

| 2014 |

|

|

6.84 |

|

|

|

3.42 |

|

| 2015 |

|

|

5.20 |

|

|

|

2.50 |

|

|

|

|

| Fiscal Year Ended June 30, 2013: |

|

|

|

|

|

|

|

|

| First Quarter |

|

|

2.44 |

|

|

|

1.81 |

|

| Second Quarter |

|

|

6.14 |

|

|

|

0.76 |

|

| Third Quarter |

|

|

10.49 |

|

|

|

1.75 |

|

| Fourth Quarter |

|

|

6.92 |

|

|

|

3.57 |

|

|

|

|

| Fiscal Year Ended June 30, 2014: |

|

|

|

|

|

|

|

|

| First Quarter |

|

|

5.18 |

|

|

|

3.50 |

|

| Second Quarter |

|

|

6.84 |

|

|

|

3.73 |

|

| Third Quarter |

|

|

5.70 |

|

|

|

3.85 |

|

| Fourth Quarter |

|

|

4.16 |

|

|

|

3.42 |

|

|

|

|

| Fiscal Year Ended June 30, 2015: |

|

|

|

|

|

|

|

|

| First Quarter |

|

|

3.62 |

|

|

|

2.74 |

|

| Second Quarter |

|

|

5.38 |

|

|

|

1.64 |

|

| Third Quarter |

|

|

4.33 |

|

|

|

2.09 |

|

| Fourth Quarter |

|

|

9.50 |

|

|

|

3.41 |

|

|

|

|

| Fiscal Year Ended June 30, 2016: |

|

|

|

|

|

|

|

|

| First Quarter (through to September 11, 2015) |

|

|

5.20 |

|

|

|

2.50 |

|

|

|

|

| Month Ended: |

|

|

|

|

|

|

|

|

| July 2014 |

|

|

3.23 |

|

|

|

3.09 |

|

| August 2014 |

|

|

3.60 |

|

|

|

2.72 |

|

| September 2014 |

|

|

3.46 |

|

|

|

2.70 |

|

| October 2014 |

|

|

3.05 |

|

|

|

2.76 |

|

| November 2014 |

|

|

2.98 |

|

|

|

1.65 |

|

| December 2014 |

|

|

5.38 |

|

|

|

1.64 |

|

| January 2015 |

|

|

2.65 |

|

|

|

2.09 |

|

| February 2015 |

|

|

4.07 |

|

|

|

2.52 |

|

| March 2015 |

|

|

4.33 |

|

|

|

2.50 |

|

| April 2015 |

|

|

9.50 |

|

|

|

4.05 |

|

| May 2015 |

|

|

7.66 |

|

|

|

5.50 |

|

| June 2015 |

|

|

5.82 |

|

|

|

3.86 |

|

| July 2015 |

|

|

5.20 |

|

|

|

3.41 |

|

| August 2015 |

|

|

3.49 |

|

|

|

2.50 |

|

| September 2015 (Through to September 11, 2015) |

|

|

2.58 |

|

|

|

2.70 |

|

| * |

Note that we effected a change to the ADS ratio on January 3, 2012. The ratio changed from each ADS representing 5 ordinary shares to each ADS representing 25 ordinary shares. All of the ADR prices presented above