SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under

the Securities Exchange Act of 1934

LiqTech

International, Inc. (Name of Issuer)

Common

Stock, $0.001 par value

(Title

of Class of Securities)

Bleichroeder

LP

1345

Avenue of the Americas, 47th Floor,

New

York, New York 10105

(212)

698-3101

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

November

12, 2024

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box: [X]

Note: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See Rule 240.13d-7 for other parties to whom copies are to be

sent.

* The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP

No. 53632A201 |

|

Page 2 of 8 Pages |

| 1 |

NAME OF REPORTING PERSON

Bleichroeder LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (a) [_]

(b) [_]

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [_]

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

| |

7 |

SOLE VOTING POWER

3,182,239 |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

8 |

SHARED VOTING POWER

0 |

| |

9 |

SOLE DISPOSITIVE POWER

3,182,239 |

| |

10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,182,239 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS) [_]

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.7% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IA |

| |

|

|

|

|

|

| CUSIP

No. 53632A201 |

|

Page 3 of 8 Pages |

| 1 |

NAME OF REPORTING PERSON

Bleichroeder Holdings LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (a) [_]

(b) [_]

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [_]

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

| |

7 |

SOLE VOTING POWER

3,182,239 |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

8 |

SHARED VOTING POWER

0 |

| |

9 |

SOLE DISPOSITIVE POWER

3,182,239 |

| |

10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,182,239 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS) [_]

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.7% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

HC |

| |

|

|

|

|

|

Item 1. Security and the Issuer

This Schedule 13D relates to the Common Stock, $0.001 par value

(the “Shares”), of LiqTech International, Inc., a Nevada corporation (the “Issuer”), and is being

filed pursuant to Rule 13d-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The address

of the Issuer’s principal executive offices is Industriparken 22C, DK 2750 Ballerup, Denmark.

Item 2. Identity and Background

(a)

This Schedule 13D is being filed on behalf of Bleichroeder LP (“Bleichroeder”),

with respect to Shares beneficially owned by it. The general partner of Bleichroeder is Bleichroeder Holdings LLC (the “General

Partner”).

The foregoing persons are hereinafter sometimes referred to

as the Reporting Persons. Any disclosures herein with respect to persons other than the Reporting Persons are made on information believed

to be accurate after making inquiry to the appropriate party. Bleichroeder is the investment manager or adviser to funds and/or managed

accounts and may be deemed to have beneficial ownership over the Shares directly owned by the funds and managed accounts by virtue of

the authority granted to it to vote and to dispose of the securities held by them.

(b) The address of the principal business and principal office

of the Reporting Person and the General Partner is 1345 Avenue of the Americas, 47th Floor, New York, NY 10105.

(c) The principal business of Bleichroeder is to serve as an

investment manager or adviser to various investment partnerships and managed accounts. The principal business of the General Partner is

to serve as General Partner of Bleichroeder.

(d) During the last five (5) years, none of the Reporting Persons

has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five (5) years, neither Bleichroeder nor

the General Partner has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result

of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Bleichroeder is a limited partnership organized under the

laws of the State of Delaware. The General Partner is a limited liability company organized under the laws of the State of Delaware.

Item 3. Source and Amount of Funds or Other Consideration.

Accounts and funds managed by the Reporting Persons hold 3,182,239

Shares, which were acquired pursuant to open market purchases and private purchases.

On June 22, 2022, the Issuer issued and sold senior promissory

notes in an aggregate principal amount of $6.0 million (the “Notes”) to certain funds managed by the Reporting Persons

and issued warrants to purchase 531,250 shares of common stock of the Issuer (the “2022 Warrants”) to funds managed

by the Reporting Persons pursuant to a note and warrant purchase agreement entered into with the Purchasers. Concurrently, the Issuer

entered into a registration rights agreement (the “2022 Registration Rights Agreement”) with such funds providing,

among other things, resale registration rights with respect to the Shares issuable upon conversion of the 2022 Warrants.

On October 13, 2023, the Issuer and the funds managed by the

Reporting Persons agreed to extend the maturity date of the Notes from June 20, 2024, to January 1, 2026 (the “Extension”).

As consideration for the Extension, the Issuer issued to the funds additional warrants to purchase an aggregate of 531,250 shares of Common

Stock at an exercise price of $5.20 per share (the “2023 Warrants”) and agreed that the resale registration rights

set forth in the 2022 Registration Rights Agreement would be applicable to the Shares issuable upon conversion of the 2023 Warrants.

On September

27, 2024, the Issuer entered into a securities purchase agreement (the “2024 Securities Purchase Agreement”) with certain

investors, including certain managed account and funds managed by the Reporting Persons, pursuant to which the Issuer agreed to issue

and sell Shares, pre-funded warrants and warrants to such investors, including the issuance of an aggregate of (i) 2,605,129 Shares,

(ii) 344,871 pre-funded warrants and (iii) 2,950,000 warrants to managed accounts and funds managed by the Reporting Persons. Concurrently,

the Issuer entered into a registration rights agreement (the “2024 Registration Rights Agreement”) with the investors

party to the 2024 Securities Purchase Agreement requiring the Issuer to file a registration statement with the Securities and Exchange

Commission (the “SEC”) within 60 days of the Issuer’s receipt of the investors’ demand that the Issuer

file a registration statement to register for resale the Shares and the Shares underlying the pre-funded warrants and warrants, in each

case, issued pursuant to the 2024 Securities Purchase Agreement.

The 3,182,239 Shares beneficially owned by the Reporting Persons

were acquired at an aggregate cost of $15,316,427.99.

| Item 4. | Purpose of Transaction. |

Bleichroeder acquired beneficial ownership of the 3,182,239

Shares for investment purposes.

Bleichroeder intends to evaluate on an ongoing basis its investment

in the Issuer and its options with respect to such investment. In connection with such evaluation, Bleichroeder may meet with members

of the Board and/or senior management of the Issuer, or communicate publicly or privately with other stockholders, knowledgeable industry

or market observers or other third parties with respect to its investment. As part of such evaluation and any such discussions, Bleichroeder

may make recommendations, suggestions or proposals to the Issuer that may relate to or result in one or more of the matters specified

in clauses (a) through (j) of Item 4 of Schedule 13D, including, but not limited to, changes in the strategic direction and future plans

of the Issuer as a means of enhancing shareholder value.

Depending on various factors, including the Issuer’s

financial position, prospects and strategic direction, the outcome of the matters referenced above, other developments concerning the

Issuer, actions taken by the Issuer’s board of directors, price levels of the Shares, other investment opportunities available to

the Reporting Persons, conditions in the securities markets and general economic and industry conditions, the Reporting Persons may in

the future take such actions with respect to their investments in the Issuer as they deem appropriate, including, without limitation,

making or causing further acquisitions of securities of the Issuer, including Shares, from time to time, and disposing of, or cause to

be disposed, any or all of the securities of the Issuer, including Shares, beneficially held by Bleichroeder at any time.

Item 5. Interest in Securities of the Issuer.

(a) As of the

date of this Schedule 13D, the Reporting Persons beneficially own 3,182,239Shares, representing 33.7% of the outstanding Shares.

The Reporting Persons also beneficially own warrants

representing the right to acquire up to an aggregate of 6,832,379 Shares, however the exercise of such warrants are subject to a beneficial

ownership limitation of 9.99% of the number of Shares outstanding immediately after giving effect to the issuance of the Shares issuable

upon exercise of such warrants. If there was no [9.99% limit on the exercise of the warrants, the Reporting Persons would be deemed to

be the beneficial owners of 10,014,618 Shares (including 6,832,379 Shares that would be issuable upon exercise of the warrants held by

the Reporting Persons), representing 61.5% of the outstanding Shares.

The percentages used herein are based upon the 9,449,401Shares

reported to be outstanding as of November 14, 2024by the Issuer in its Quarterly Report on Form 10-Q filed with the Securities and Exchange

Commission on November 14, 2024.

(b) The

Reporting Persons have sole voting and dispositive power over 3,182,239 Shares.

(c) Except

as set forth in Item 3, the Reporting Persons have not effected any transaction in the Shares during the past sixty days.

(d) No

person other than the Reporting Persons and the managed accounts or funds which hold the Shares is known to have the right to receive,

or the power to direct the receipt of dividends from, or proceeds from the sale of, the Shares.

(e) Not

applicable.

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

The disclosure under Item 3, Item 4 and Item 5 is incorporated

herein by reference.

The summaries contained herein of the 2022 Registration Rights

Agreement and 2024 Registration Rights Agreement, as applicable, are not intended to be complete and are qualified in their entirety by

reference to the full text of the 2022 Registration Rights Agreement or 2024 Registration Rights Agreement, as applicable, copies of which

are filed as Exhibits hereto and which are incorporated herein by reference.

Other than as described herein, there are no contracts, arrangements,

understandings or relationships (legal or otherwise) between the Reporting Persons and any other person with respect to the securities

of the Issuer.

Item 7. Material to be filed as Exhibits.

| Exhibit 1 |

Registration Rights Agreement, dated June 22, 2022, among the Issuer, 21 April Fund, Ltd. and 21 April Fund, LP. (Incorporated by reference to Exhibit 10.3 to the Issuer’s Current Report on Form 8-K filed on June 24, 2022.) |

| |

|

| Exhibit 2 |

Registration Rights Agreement, dated September 27, 2024, among the Issuer and the parties thereto (Incorporated by reference to Exhibit 10.2 to the Issuer’s Current Report on Form 8-K filed on September 27, 2024.) |

| |

|

| Exhibit 3 |

Joint Filing Agreement, dated November 19, 2024, by and between Bleichroeder LP and Bleichroeder Holdings LLC. |

| |

|

SIGNATURE

After reasonable inquiry and to the best of each of the undersigned’s

knowledge and belief, each of the undersigned, severally and not jointly, certifies that the information set forth in this statement is

true, complete and correct.

| Dated: November 19, 2024 |

BLEICHROEDER LP |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Michael M. Kellen |

|

| |

|

Name: Michael M. Kellen |

|

| |

|

Title: Chairman and CO-CEO |

|

| |

|

|

| |

|

|

| |

BLEICHROEDER HOLDINGS LLC |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Michael M. Kellen |

|

|

|

| |

|

Name: Michael M. Kellen |

|

|

|

| |

|

Title: Chairman and CO-CEO |

|

|

|

EXHIBIT 3

JOINT FILING AGREEMENT

THIS JOINT FILING AGREEMENT is entered into as of November

19, 2024, by and among the parties hereto. The undersigned hereby agree that the Statement on Schedule 13D with respect to the Common

Stock, $0.001 par value, of LiqTech International, Inc., a Nevada corporation, and any amendment thereafter signed by each of the undersigned

shall be (unless otherwise determined by the undersigned) filed on behalf of each of the undersigned pursuant to and in accordance with

the provisions of Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended.

| Dated: November 19, 2024 |

BLEICHROEDER LP |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Michael M. Kellen |

|

| |

|

Name: Michael M. Kellen |

|

| |

|

Title: Chairman and CO-CEO |

|

| |

|

|

| |

|

|

| |

BLEICHROEDER HOLDINGS LLC |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Michael M. Kellen |

|

|

|

| |

|

Name: Michael M. Kellen |

|

|

|

| |

|

Title: Chairman and CO-CEO |

|

|

|

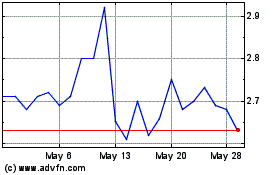

LiqTech (NASDAQ:LIQT)

Historical Stock Chart

From Dec 2024 to Jan 2025

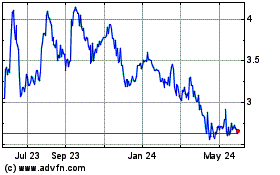

LiqTech (NASDAQ:LIQT)

Historical Stock Chart

From Jan 2024 to Jan 2025