Materialise NV (NASDAQ:MTLS), a leading provider of additive

manufacturing software and of sophisticated 3D printing services,

today announced its financial results for the second quarter ended

June 30, 2017.

Highlights – Second Quarter 2017

- Total revenue increased 21.8% from the

second quarter of 2016 to 33,612 kEUR, with increases in all

three business segments.

- Adjusted EBITDA increased 164% from

1,034 kEUR for the second quarter of 2016 to

2,732 kEUR.

- Total deferred revenue from annual

software sales and maintenance contracts amounted to

17,206 kEUR at the end of the second quarter of 2017 compared

16,799 kEUR at the end of the fourth quarter of 2016.

Executive Chairman Peter Leys commented, “Materialise turned in

another sound quarter, delivering strong revenue growth in all our

segments, particularly Manufacturing, where, driven by a surge in

end part manufacturing, revenue rose 32.5%. Reflecting the pick-up

in the demand environment for 3D printing this year, revenue from

our Software segment increased 19.0%, while Medical rose almost 10%

on the strength of solid software revenues. Despite start-up

activities associated with the opening of our new manufacturing

facilities in Leuven and Poland, our Adjusted EBITDA margin more

than doubled. We look forward to completing the facilities’

start-up process during the third quarter and to gradually

realizing scale effects and efficiency gains thereafter.”

Second Quarter 2017 Results

Total revenue for the second quarter of 2017 increased 21.8% to

33,612 kEUR compared to 27,597 kEUR for the second

quarter of 2016, with gains in all three of our segments,

particularly Materialise Manufacturing. Adjusted EBITDA increased

to 2,732 kEUR from 1,034 kEUR as a result of the

combination of continued revenue growth (21.8%) and a significantly

lower increase in operational expenses (9.0%) as compared to the

second quarter of 2016. The Adjusted EBITDA margin (Adjusted EBITDA

divided by total revenue) in the second quarter of 2017 was 8.1%

compared to 3.7% for the second quarter of 2016.

Revenue from our Materialise Software segment, which offers a

proprietary software backbone that enables and enhances the

functionality of 3D printers and 3D printing operations worldwide,

increased 19.0% to 8,305 kEUR for the second quarter of 2017

from 6,981 kEUR for the same quarter last year. Recurrent

revenues from annual and renewed licenses and maintenance fees grew

25.2% from the same period in the prior year. Segment EBITDA rose

to 2,952 kEUR from 1,602 kEUR while the segment EBITDA

margin was 35.5% compared to 22.9% for the prior-year period.

Revenue from our Materialise Medical segment, which offers a

unique platform consisting of medical planning and design software,

clinical engineering services and patient specific devices,

increased 9.7% to 10,646 kEUR for the second quarter of 2017

compared to 9,706 kEUR for the same period in 2016. Compared

to the same quarter in 2016, revenue from our medical software grew

15.5%, and revenue from medical devices and services grew 6.6%.

Segment EBITDA was 758 kEUR compared to 14 kEUR while the

segment EBITDA margin increased to 7.1% from 0.1% for the second

quarter of 2016.

Revenue from our Materialise Manufacturing segment, which offers

an integrated suite of 3D printing and engineering services to

industrial and commercial customers, increased 32.5% to

14,455 kEUR for the second quarter of 2017 from

10,907 kEUR for the second quarter of 2016. End part

manufacturing revenues increased 89.7% compared to the same quarter

in 2016. Segment EBITDA rose to 1,241 kEUR from 430 kEUR

while the segment EBITDA margin increased to 8.6% from 3.9% for the

same quarter in 2016.

Gross profit was 19,388 kEUR, or 57.7% of total revenue,

for the second quarter of 2017 compared to 16,253 kEUR, or

58.9% of total revenue, for the second quarter of 2016.

Research and development (“R&D”), sales and marketing

(“S&M”) and general and administrative (“G&A”) expenses

increased, in the aggregate, 9.0% to 20,911 kEUR for the

second quarter of 2017 from 19,182 kEUR for the second quarter

of 2016. R&D expenses increased from 4,760 kEUR to

5,131 kEUR while S&M expenses increased from

9,533 kEUR to 10,009 kEUR. G&A expenses increased

from 4,889 kEUR to 5,771 kEUR.

Net other operating income decreased by 550 kEUR to

1,228 kEUR compared to 1,778 kEUR for the second quarter

of 2016. Net other operating income consists primarily of

withholding tax exemptions for qualifying researchers, development

grants, partial funding of R&D projects and currency exchange

results on purchase and sales transactions.

Operating loss improved to (295) kEUR from

(1,151) kEUR for the same period prior year. This improvement

was the result of a combination of an increase in gross profit of

19.3% and an increase of only 9.0% in R&D, S&M and G&A

expenses, partially offset by a slight decrease of 550 kEUR of

net other operating income compared to the same quarter in

2016.

Net financial result was (427) kEUR compared to

207 kEUR for the prior-year period, reflecting variances in

the currency exchange rates, primarily on the portion of the

company’s IPO proceeds held in U.S. dollars versus the euro.

Net loss for the second quarter of 2017 was (955) kEUR

compared to net loss of (436) kEUR for the same period in

2016. The 2016 period contained income tax income of 639 kEUR

primarily from deferred taxes compared to an expense of

(191) kEUR in the 2017 period. This variance of

(830) kEUR in income tax and the decrease in the net financial

result of 634 kEUR, which were offset in part by a decrease of

89 kEUR in the share in the loss of a joint venture and the

improvement of the operating loss by 856 kEUR, explain the

increase of the net loss by (519) kEUR for the second quarter of

2017. Total comprehensive loss for the second quarter of 2017,

which includes exchange differences on translation of foreign

operations, was (1,403) kEUR compared to (911) kEUR for

the same period in 2016.

At June 30, 2017, we had cash and equivalents of

53,832 kEUR compared to 55,912 kEUR at December 31, 2016.

Cash flow from operating activities in the first six months of 2017

was 5,188 kEUR compared to 5,781 kEUR for the same period

in 2016, mainly due to working capital evolution.

Net shareholders’ equity at June 30, 2017 was 77,419 kEUR

compared to 79,033 kEUR at December 31, 2016.

2017 Guidance

In its year-end 2016 and first-quarter 2017 earnings

announcements, Materialise stated that it expects to report

consolidated revenue between 128,000 - 134,000 kEUR and Adjusted

EBITDA between 10,500 – 13,500 kEUR in 2017. Based on the company’s

first-half 2017 results, management now expects revenue and

Adjusted EBITDA to be at the high end of these ranges. Management

continues to expect the amount of deferred revenue generated in

2017 from annual licenses and maintenance to increase by an amount

between 4,000 - 5,000 kEUR as compared to 2016.

Non-IFRS Measures

Materialise uses EBITDA and Adjusted EBITDA as supplemental

financial measures of its financial performance. EBITDA is

calculated as net profit plus income taxes, financial expenses

(less financial income), shares of loss in a joint venture and

depreciation and amortization. Adjusted EBITDA is determined by

adding non-cash stock-based compensation expenses to EBITDA.

Management believes these non-IFRS measures to be important

measures as they exclude the effects of items which primarily

reflect the impact of long-term investment and financing decisions,

rather than the performance of the company's day-to-day operations.

As compared to net profit, these measures are limited in that they

do not reflect the periodic costs of certain capitalized tangible

and intangible assets used in generating revenues in the company's

business, or the charges associated with impairments. Management

evaluates such items through other financial measures such as

capital expenditures and cash flow provided by operating

activities. The company believes that these measurements are useful

to measure a company's ability to grow or as a valuation

measurement. The company's calculation of EBITDA and Adjusted

EBITDA may not be comparable to similarly titled measures reported

by other companies. EBITDA and Adjusted EBITDA should not be

considered as alternatives to net profit or any other performance

measure derived in accordance with IFRS. The company's presentation

of EBITDA and Adjusted EBITDA should not be construed to imply that

its future results will be unaffected by unusual or non-recurring

items.

Exchange Rate

This press release contains translations of certain euro amounts

into U.S. dollars at specified rates solely for the convenience of

readers. Unless otherwise noted, all translations from euros to

U.S. dollars in this press release were made at a rate of EUR 1.00

to USD 1.1412, the reference rate of the European Central Bank on

June 30, 2017.

Conference Call and Webcast

Materialise will hold a conference call and simultaneous webcast

to discuss its financial results for the second quarter of 2017

today, August 8, 2017, at 8:30 a.m. ET/14:30 CET. Company

participants on the call will include Wilfried Vancraen, Founder

and Chief Executive Officer; Peter Leys, Executive Chairman; and

Johan Albrecht, Chief Financial Officer. A question-and-answer

session will follow management’s remarks.

To access the conference call, please dial 844-469-2530 (U.S.)

or 765-507-2679 (international), passcode #45016167. The conference

call will also be broadcast live over the Internet with an

accompanying slide presentation, which can be accessed on the

company’s website at http://investors.materialise.com.

A webcast of the conference call and slide presentation will be

archived on the company's website for one year.

About Materialise

Materialise incorporates more than 25 years of 3D printing

experience into a range of software solutions and 3D printing

services, which Materialise seeks to form the backbone of the 3D

printing industry. Materialise’s open and flexible solutions enable

players in a wide variety of industries, including healthcare,

automotive, aerospace, art and design, and consumer goods, to build

innovative 3D printing applications that aim to make the world a

better and healthier place. Headquartered in Belgium, with branches

worldwide, Materialise combines one of the largest groups of

software developers in the industry with one of the largest 3D

printing facilities in the world. For additional information,

please visit: www.materialise.com.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our intentions, beliefs,

assumptions, projections, outlook, analyses or current

expectations, plans, objectives, strategies and prospects, both

financial and business, including statements concerning, among

other things, current estimates of fiscal 2017 revenues, deferred

revenue from annual licenses and maintenance and Adjusted EBITDA,

completion of start-up activities associated with our new

manufacturing facilities, results of operations, cash needs,

capital expenditures, expenses, financial condition, liquidity,

prospects, growth and strategies, and the trends and competition

that may affect the markets, industry or us. Such statements are

subject to known and unknown uncertainties and risks. When used in

this press release, the words “estimate,” “expect,” “anticipate,”

“project,” “plan,” “intend,” “believe,” “forecast,” “will,” “may,”

“could,” “might,” “aim,” “should,” and variations of such words or

similar expressions are intended to identify forward-looking

statements. These forward-looking statements are based upon the

expectations of management under current assumptions at the time of

this press release. These expectations, beliefs and projections are

expressed in good faith and the company believes there is a

reasonable basis for them. However, the company cannot offer any

assurance that our expectations, beliefs and projections will

actually be achieved. By their nature, forward-looking statements

involve risks and uncertainties because they relate to events,

competitive dynamics and industry change, and depend on economic

circumstances that may or may not occur in the future or may occur

on longer or shorter timelines than anticipated. We caution you

that forward-looking statements are not guarantees of future

performance and involve known and unknown risks, uncertainties and

other factors that are in some cases beyond our control. All of the

forward-looking statements are subject to risks and uncertainties

that may cause the company's actual results to differ materially

from our expectations, including risk factors described in the

company's annual report on Form 20-F filed with the U.S. Securities

and Exchange Commission on May 1, 2017. There are a number of risks

and uncertainties that could cause the company's actual results to

differ materially from the forward-looking statements contained in

this press release.

The company is providing this information as of the date of this

press release and does not undertake any obligation to update any

forward-looking statements contained in this press release as a

result of new information, future events or otherwise, unless it

has obligations under the federal securities laws to update and

disclose material developments related to previously disclosed

information.

Consolidated income statement

(Unaudited)

For the six

For the three months

months ended 30

ended 30 June

June (in thousands, except per share amounts)

2017

2017 2016 2017

2016 U.S.$ € € € €

Revenue 38,358 33,612 27,597 65,533 54,264 Cost of sales (16,232)

(14,224) (11,344) (27,668) (22,049)

Gross profit

22,126 19,388 16,253 37,865

32,215 Gross profit as % of revenue 57.7% 57.7% 58.9% 57.8%

59.4% Research and development expenses (5,855) (5,131)

(4,760) (9,723) (9,132) Sales and marketing expenses (11,422)

(10,009) (9,533) (19,617) (18,348) General and administrative

expenses (6,586) (5,771) (4,889) (11,150) (9,939) Net other

operating income (expenses) 1,401 1,228 1,778 2,246 3,064

Operating (loss) profit (336) (295)

(1,151) (379) (2,140) Financial

expenses (1,503) (1,317) (609) (2,236) (1,506) Financial income

1,016 890 816 1,667 979 Share in loss of joint venture (48) (42)

(131) (431) (299)

(Loss) profit before taxes (871)

(764) (1,075) (1,379) (2,966)

Income taxes (218) (191) 639 (392) (621)

Net (loss) profit of

the period (1,089) (955) (436)

(1,771) (3,587) Net (loss) profit attributable to:

The owners of the parent (1,089) (955) (436) (1,771) (3,587)

Non-controlling interest − − − − −

Earnings per share

attributable to ordinary owners of the parent Basic (0.02)

(0.02) (0.01) (0.04) (0.08) Diluted (0.02) (0.02) (0.01) (0.04)

(0.08) Weighted average basic shares outstanding 47,325

47,325 47,325 47,325 47,325 Weighted average diluted shares

outstanding 47,325 47,325 47,325 47,325 47,325

Consolidated statements of

comprehensive income (Unaudited)

For the six

For the three months

months ended 30 ended 30 June June (in

thousands)

2017 2017 2016

2017 2016 U.S.$ € €

€ € Net profit (loss) for the period

(1,089) (955) (436) (1,771)

(3,587) Other comprehensive income Exchange difference on

translation of foreign operations (511) (448)

(475) (326)

(1,439) Other comprehensive income (loss), net of taxes (511) (448)

(475) (326) (1,439)

Total comprehensive income (loss) for the

year, net of taxes (1,600) (1,403) (911)

(2,097) (5,026) Total comprehensive income (loss)

attributable to: The owners of the parent (1,600) (1,403) (911)

(2,097) (5,026) Non-controlling interest − − − − −

Consolidated statement of financial

position (Unaudited)

As of June 30

As of December 31

(in thousands)

2017 2016 € €

Assets

Non-current assets

Goodwill 8,771 8,860 Intangible assets 9,385 9,765 Property, plant

& equipment 58,327 45,063 Investments in joint ventures 69 −

Deferred tax assets 246 336 Other non-current assets 2,485 2,154

Total non-current assets 79,283 66,178

Current assets

Inventories 8,356 7,870 Trade receivables 29,383 27,479 Held to

maturity investments − − Other current assets 6,121 4,481 Cash and

cash equivalents 53,832 55,912

Total current assets

97,692 95,742 Total assets 176,975

161,920 As of June 30

As of December 31

(in thousands)

2017 2016 € € Equity

and liabilities Equity Share capital 2,729 2,729 Share

premium 79,497 79,019 Consolidated reserves (3,369) (1,603) Other

comprehensive income (1,438) (1,112)

Equity attributable to the

owners of the parent 77,419 79,033 Non-controlling interest − −

Total equity 77,419 79,033

Non-current liabilities

Loans & borrowings 40,146 28,267 Deferred tax liabilities 1,078

1,325 Deferred income 2,869 3,588 Other non-current liabilities

2,122 1,873

Total non-current liabilities 46,215

35,053

Current liabilities

Loans & borrowings 6,587 5,539 Trade payables 16,009 13,400 Tax

payables 748 926 Deferred income 20,164 17,822 Other current

liabilities 9,833 10,147

Total current liabilities

53,341 47,834 Total equity and liabilities

176,975 161,920

Consolidated statement of cash flows

(Unaudited)

For the six months ended June 30 (in

thousands)

2017 2016 € €

Operating activities Net (loss) profit of the period (1,771)

(3,587) Non-cash and operational adjustments Depreciation of

property, plant & equipment 3,954 3,012 Amortization of

intangible assets 1,269 938 Share-based payment expense 700 360

Loss (gain) on disposal of property, plant & equipment 28 (62)

Fair value contingent liabilities − 54 Movement in provisions 14 −

Movement reserve for bad debt 139 111 Financial income (318) (87)

Financial expense 585 483 Impact of foreign currencies 302 131

Share in loss of a joint venture (equity method) 431 299 Deferred

tax expense (income) (150) (159) Income taxes 542 781 Other (58)

(40)

Working capital adjustment & income tax paid

Increase in trade receivables and other receivables (3,580) 1,654

Decrease (increase) in inventories (509) (5) Increase in trade

payables and other payables 4,207 2,442 Income tax paid (597) (544)

Net cash flow from operating activities 5,188

5,781 For the six months ended June

30 (in thousands)

2017 2016 €

€ Investing activities Purchase of property, plant

& equipment (15,770) (5,831) Purchase of intangible assets

(1,027) (526) Proceeds from the sale of property, plant &

equipment (net) 104 708 Proceeds from the sale of intangible assets

(net) − 19 Acquisition of subsidiary − − Investments in

joint-ventures (500) − Interest received 241 6

Net cash flow used in investing

activities

(16,952) (5,624)

Financing activities

Proceeds from loans & borrowings 14,203 2,812 Repayment of

loans & borrowings (1,634) (1,346) Repayment of finance leases

(1,405) (843) Interest paid (302) (328) Other financial income

(expense) (154) (32)

Net cash flow from (used in) financing

activities 10,708 263 Net increase of

cash & cash equivalents (1,056) 420 Cash

& cash equivalents at beginning of the year 55,912 50,726

Exchange rate differences on cash & cash equivalents (1,024)

158

Cash & cash equivalents at end of the year

53,832 51,304

Reconciliation of Net Profit (Loss) to

EBITDA and Adjusted EBITDA (Unaudited)

For the three For the six months ended

30 months ended 30 June June (in

thousands)

2017 2016 2017

2016 € € € € Net

profit (loss) for the period (955) (436)

(1,771) (3,587) Income taxes 191 (639) 392 621

Finance expenses 1,317 609 2,236 1,506 Finance income (890) (816)

(1,667) (979) Share in loss of joint venture 42 131 431 299

Depreciation and amortization 2,656 2,040 5,224 3,950

EBITDA 2,361 889 4,845 1,810

Non-cash stock-based compensation expense (1) 371 145 700

359

ADJUSTED EBITDA 2,732 1,034

5,545 2,169

(1) Non-cash stock-based compensation expenses represent the

cost of equity-settled and cash-settled share-based payments to

employees.

Segment P&L (Unaudited)

(in thousands)

MaterialiseSoftware

MaterialiseMedical

MaterialiseManufact-uring Total

segments Unallocated Consoli-dated

€ € € € € € For

the six months ended June 30, 2017 Revenues 16,880 20,578

27,862 65,320 213 65,533 Segment EBITDA 5,945 1,072 2,563 9,580

(4,735) 4,845

Segment EBITDA %

35.2% 5.2% 9.2% 14.7% 7.4%

For the six months ended June

30, 2016 Revenues 14,412 18,312 21,513 54,237 27 54,264 Segment

EBITDA 4,367 (516) 687 4,538 (2,728) 1,810

Segment EBITDA %

30.3% -2.8% 3.2% 8.4% 3.3%

(in thousands)

MaterialiseSoftware

MaterialiseMedical

MaterialiseManufact-uring Total

segments Unallocated Consoli-dated

€ € € € € € For

the three months ended June 30, 2017 Revenues 8,305 10,646

14,455 33,406 206 33,612 Segment EBITDA 2,952 758 1,241 4,951

(2,590) 2,361

Segment EBITDA %

35.5% 7.1% 8.6% 14.8% 7.0%

For the three months ended

June 30, 2016 Revenues 6,981 9,706 10,907 27,594 3 27,597

Segment EBITDA 1,602 14 430 2,046 (1,157) 889

Segment EBITDA %

22.9% 0.1% 3.9% 7.4% 3.2%

Reconciliation of Net Profit (Loss) to

Segment EBITDA (Unaudited)

For the three months For the six months

ended 30 June ended 30 June (in thousands)

2017 2016 2017 2016

€ € € € Net profit (loss) for

the period (955) (436) (1,771)

(3,587) Income taxes 191 (639) 392 621 Finance cost 1,317

609 2,236 1,506 Finance income (890) (816) (1,667) (979) Share in

loss of joint venture 42 131 431 299

Operating profit

(295) (1,151) (379) (2,140)

Depreciation and amortization 2,656 2,040 5,224 3,950 Corporate

research and development 516 392 1,025 959 Corporate headquarter

costs 2,464 1,801 4,537 3,539 Other operating income (expense)

(390) (1,036) (827) (1,770)

Segment EBITDA

4,951 2,046 9,580 4,538

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170808005171/en/

Investors:LHAHarriet Fried/Jody

Burfening212-838-3777hfried@lhai.com

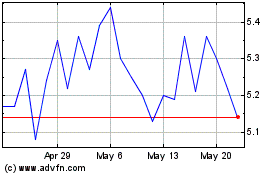

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Oct 2024 to Oct 2024

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Oct 2023 to Oct 2024