SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 Under

the Securities Exchange Act of 1934

For the month of August 2023

Commission File Number: 001-37829

NISUN INTERNATIONAL ENTERPRISE

DEVELOPMENT GROUP CO., LTD

(Registrant’s name)

21F, 55 Loushanguan Rd

Changning District

Shanghai 200336

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.:

Form 20-F ☒ Form 40-F

☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

NISUN INTERNATIONAL ENTERPRISE DEVELOPMENT GROUP CO., LTD |

| |

|

|

| Date: August 8, 2023 |

By: |

/s/ Xiaoyun Huang |

| |

Name: |

Xiaoyun Huang |

| |

Title: |

Chief Executive Officer

(Principal Executive Officer) and Duly

Authorized

Officer |

Exhibit 99.1

Nisun International Reports Financial Results

for Fiscal Year 2022

SHANGHAI, China, August 8, 2023 /PRNewswire/

-- Nisun International Enterprise Development Group Co., Ltd (“Nisun” or the “Company”) (Nasdaq: NISN), a provider

of innovative comprehensive solutions through an integration of technology, industry, and finance, today announced its financial results

for the fiscal year ended December 31, 2022.

Mr.

Xiaoyun Huang, Chief Executive Officer of Nisun, commented, “We are pleased to end fiscal year 2022 with solid financial performance,

despite the uncertain market conditions during this period. Our total revenue reached $234.2 million in fiscal year 2022, representing

an increase of 46% from fiscal year 2021, demonstrating our strong capabilities to execute strategic initiatives successfully. In fiscal

year 2022, we have been committed to scaling our supply chain trading business, particularly agricultural supply chain operations. While

acknowledging the challenges in our existing business, we have been actively seeking qualified partners for new business opportunities.

As mentioned in our recent press releases, many of our new business partnerships established beyond their infancy, we expect to distinguish

ourselves from other industry participants by prioritizing the expansion of our business, providing quality supply chain services to

our clients and improving our brand awareness. In the second half of 2023 and beyond, we will continue to deepen the comprehensive coverage

and dynamic cycle of the agricultural supply chain to support China’s grand strategy of rural revitalization. We will also continue

to focus on enhancing our operating efficiency, aiming to sustain our long-term competitiveness in the market and creating long-term

value for our shareholders.”

Financial Results for the Fiscal Year Ended

December 31, 2022

All comparisons made on a year-over-year (“yoy”)

basis.

Revenue

| ● | Total

revenue increased by 46% to $234.2 million from $160.2 million in fiscal year 2021, primarily

with increases in revenue from supply chain trading sales. The increase in total revenues

was primarily due to the Company’s ability to expand its business, attract higher quality

customers, and achieve a higher customer retention. |

| ● | Revenue

from Supply Chain Trading Business increased by 110% to $143.4 million from $68.1 million

in fiscal year 2021, primarily due to the Company’s expansion of its supply chain trading

business in various industries such as the agricultural industry and retail industry. |

| ● | Revenue

from Financing Services slightly decreased by 1% to $90.8 million from $92.1 million

in the prior year period. |

| ● | Revenues

generated from the Small and Medium Enterprise (SME) financing solutions business increased

modestly to $87.3 million from $87.1 million in the prior year period. |

| ● | Revenue

generated from supply chain financing solutions decreased by 28% to $3.5 million from $4.9

million in the prior year period, primarily due to the reason that the Company shifted the

focus of business development from the supply chain financing solutions to supply chain trading. |

| | |

For the Year ended December 31, | | |

Changes | |

| | |

2022 | | |

% | | |

2021 | | |

% | | |

($) | | |

(%) | |

| Revenue from Supply

Chain Trading Business | |

$ | 143,361,714 | | |

| 61 | % | |

$ | 68,132,237 | | |

| 43 | % | |

$ | 75,229,477 | | |

| 110 | % |

| Revenue from financing services: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| SME financing solutions | |

| 87,269,959 | | |

| 37 | % | |

| 87,133,963 | | |

| 54 | % | |

| 135,996 | | |

| 0 | % |

| Supply chain financing solutions | |

| 3,542,592 | | |

| 2 | % | |

| 4,930,289 | | |

| 3 | % | |

| (1,387,697 | ) | |

| (28 | )% |

| Other financing solutions | |

| - | | |

| 0 | % | |

| 3,222 | | |

| 0 | % | |

| (3,222 | ) | |

| (100 | )% |

| Total revenue from financing

service | |

| 90,812,551 | | |

| 39 | % | |

| 92,067,474 | | |

| 57 | % | |

| (1,254,923 | ) | |

| (1 | )% |

| Total revenue | |

$ | 234,174,265 | | |

| 100 | % | |

$ | 160,199,711 | | |

| 100 | % | |

$ | 73,974,554 | | |

| 46 | % |

Cost of revenue

Cost of revenue was $197.1 million, compared

to $106.2 million in the prior year period, representing an increase of 86%. The increase was primarily attributable to increases in

cost of revenue from supply chain trading business.

Gross Profit

Gross profit decreased by 31% to $37.0 million,

from $54.0 million in the prior year period. The decrease was primarily due to the significant increase in the costs of third-party channels

for SME financing solution services, adjusted by an increase in the gross profit of the Company’s supply chain trading business

by 393%, which increase was primarily a result of the Company’s ability to expand its business, attract higher quality customers,

and achieve higher customer retention. Gross margin was 15.8% and 33.7% for the fiscal year ended December 31, 2022 and 2021, respectively.

Operating Expenses

Total operating expenses increased by 22% to

$19.3 million from $15.9 million in the prior year period. The increase was primarily attributable to increases in bad debt expenses,

offset by the decrease in selling expenses, general and administrative expenses and research and development (“R&D”)

expenses.

| ● | Selling

expenses decreased by 15% to $2.0 million from $2.3 million in the prior year period. The

decrease in selling expenses was mainly due to the Company’s building up its network

in supply chain trading business in various industries and cutting its marketing expenses. |

| ● | General

and administrative expenses decreased by 3% to $11.3 million from $11.6 million in the prior

year period. The decrease in general and administrative expenses was mainly because the Company

paid a one-time agreement cancellation fee of $2.5 million in 2021, adjusted by the impairment

loss on goodwill incurred in 2022 and increased expenses on business expansion. |

| ● | R&D

expenses was $1.6 million, unchanged from fiscal year 2021. |

| ● | Bad

debts expenses were $4.5 million, as compared to $0.3 million in the prior year period. The

bad debts expenses incurred in 2022 were primarily because certain suppliers were not be

able to fulfill their contractual obligations due to the COVID outbreaks in 2022. |

Other Income (Expense),

net

The Company had a net other income of $4.8 million,

compared to $2.6 million in the prior year period. The increase was due to an increase in investment income from the short-term investments

and investment in limited partnership.

Net Income

In fiscal year 2022,

the Company achieved a net income of $17.8 million, compared to $30.5 million in the prior year. The decrease was primarily due to the

significant increase in the costs of third-party channels.

Net Income per

Share

Net income per share

was $4.42 in fiscal year 2022, compared to $14.13 in the prior year period. The weighted average number of shares was 3,986,359 and 2,150,683

in the fiscal year ended December 31, 2022 and 2021, respectively.

Financial Condition and Cash Flow

As of December 31, 2022, the Company had cash,

cash equivalents and restricted cash of $67.3 million, compared to $91.6 million as of December 31, 2021.

In the fiscal year ended December 31, 2022, net

cash used in operating activities was approximately $29.0 million, net cash provided by investing activities was $17.8 million, and net

cash used in financing activities was $8.3 million.

In the fiscal year ended December 31, 2021, net

cash provided by operating activities was approximately $23.9 million, net cash used in investing activities was $25.3 million, and net

cash provided by financing activities was $70.5 million.

About Nisun International Enterprise Development

Group Co., Ltd

Nisun International Enterprise Development Group

Co., Ltd (NASDAQ: NISN) is a technology-driven, integrated supply chain solutions provider focused on transforming the corporate finance

industry. Leveraging its rich industry experience, Nisun is dedicated to providing professional supply chain solutions to Chinese and

foreign enterprises and financial institutions. Through its subsidiaries, Nisun provides users with professional solutions for technology

supply chain management, technology asset routing, and digital transformation of tech and finance institutions, enabling the industry

to strengthen and grow. At the same time, Nisun continues to deepen the field of industry segmentation through industrial and financial

integration, by cultivating/creating an ecosystem of openness and empowerment. Nisun has built a linked platform that incorporates supply

chain, banking, securities, trust, insurance, funds, state-owned enterprises, among other businesses. Focusing on industry-finance linkages,

Nisun aims to serve the upstream and downstream of the industrial supply chain while also assisting with supply-side sub-sector reform.

For more information, please visit http://ir.nisun-international.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains information about

Nisun’s view of its future expectations, plans and prospects that constitute forward-looking statements. Actual results may differ

materially from historical results or those indicated by these forward-looking statements as a result of a variety of factors including,

but not limited to, risks and uncertainties associated with its ability to raise additional funding, its ability to maintain and grow

its business, variability of operating results, its ability to maintain and enhance its brand, its development and introduction of new

products and services, the successful integration of acquired companies, technologies and assets into its portfolio of products and services,

marketing and other business development initiatives, competition in the industry, general government regulation, economic conditions,

dependence on key personnel, the ability to attract, hire and retain personnel who possess the technical skills and experience necessary

to meet the requirements of its clients, and its ability to protect its intellectual property. Nisun encourages you to review other factors

that may affect its future results in Nisun’s registration statement and in its other filings with the Securities and Exchange

Commission. Nisun assumes no obligation to update or revise its forward-looking statements as a result of new information, future events

or otherwise, except as expressly required by applicable law.

Contacts:

Nisun International Enterprise Development

Group Co., Ltd

Investor Relations

Tel: +86 (21) 2357-0055

Email: ir@cnisun.com

Ascent Investor Relations LLC

Tina Xiao

Email: tina.xiao@ascent-ir.com

Tel: +1 (917) 609-0333

NISUN INTERNATIONAL ENTERPRISE DEVELOPMENT

GROUP CO., LTD AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(EXPRESSED IN US DOLLARS)

| | |

December 31,

2022 | | |

December 31,

2021 | |

| ASSETS | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

$ | 63,901,329 | | |

$ | 91,447,620 | |

| Restricted cash | |

| 3,417,244 | | |

| 179,421 | |

| Short-term investments | |

| 11,700,400 | | |

| 40,666,617 | |

| Accounts receivable, net | |

| 18,931,346 | | |

| 18,516,150 | |

| Advance to suppliers, net | |

| 46,968,549 | | |

| 9,213,279 | |

| Receivables from supply chain solutions | |

| 43,475,981 | | |

| 59,792,613 | |

| Inventories | |

| 31,609,877 | | |

| 3,979,653 | |

| Prepaid expenses and other current assets | |

| 10,890,083 | | |

| 4,002,675 | |

| TOTAL CURRENT ASSETS | |

| 230,894,809 | | |

| 227,798,028 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | |

| Property and equipment, net | |

| 719,574 | | |

| 464,156 | |

| Intangible assets, net | |

| 1,795,234 | | |

| 2,850,853 | |

| Right-of-use assets, net | |

| 3,349,432 | | |

| 479,473 | |

| Equity investments | |

| 373,292 | | |

| 404,022 | |

| Investment in limited partnership | |

| 14,913,539 | | |

| 16,207,152 | |

| Goodwill | |

| 23,814,005 | | |

| 25,774,402 | |

| Deferred tax assets, net | |

| 310,577 | | |

| - | |

| Long term investment | |

| 7,249,319 | | |

| - | |

| TOTAL NON-CURRENT ASSETS | |

| 52,524,972 | | |

| 46,180,058 | |

| TOTAL ASSETS | |

$ | 283,419,781 | | |

$ | 273,978,086 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

$ | 40,925,155 | | |

$ | 34,997,401 | |

| Short-term bank loans | |

| 434,959 | | |

| 784,609 | |

| Accrued expenses and other current liabilities | |

| 6,090,582 | | |

| 3,575,836 | |

| Operating lease liabilities - current | |

| 1,008,766 | | |

| 337,698 | |

| Payables to supply chain solutions | |

| 9,122,978 | | |

| 25,922,931 | |

| Advances from customers | |

| 21,827,387 | | |

| 3,429,103 | |

| Taxes payable | |

| 2,748,474 | | |

| 8,851,898 | |

| Loan from related party | |

| 8,028,965 | | |

| 10,528,965 | |

| Due to related parties - current | |

| 282,724 | | |

| 295,336 | |

| TOTAL CURRENT LIABILITIES | |

| 90,469,990 | | |

| 88,723,777 | |

| | |

| | | |

| | |

| Operating lease liabilities – non-current | |

| 2,425,597 | | |

| 148,988 | |

| Deferred tax liabilities | |

| 727,326 | | |

| 504,033 | |

| TOTAL LIABILITIES | |

| 93,622,913 | | |

| 89,376,798 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY*: | |

| | | |

| | |

| Class A common stock, $0.01 par value, 30,000,000 and 4,000,000 shares authorized, 4,006,263 and 3,981,263 shares issued, and 3,944,075 and 3,981,263 shares outstanding as of December 31, 2022 and 2021, respectively | |

| 40,063 | | |

| 39,813 | |

| Class B common stock, $0.01 par value, 1,000,000 shares authorized, no shares issued and outstanding as of December 31, 2022 and 2021 | |

| - | | |

| - | |

| Treasury shares | |

| (355,844 | ) | |

| - | |

| Additional paid-in capital | |

| 130,503,387 | | |

| 130,318,637 | |

| Retained earnings | |

| 53,214,304 | | |

| 37,819,226 | |

| Statutory reserves | |

| 9,167,845 | | |

| 6,942,111 | |

| Unearned compensation | |

| - | | |

| (125,630 | ) |

| Accumulated other comprehensive income | |

| (6,937,950 | ) | |

| 5,632,199 | |

| COMMON SHAREHOLDERS’ EQUITY | |

| 185,631,805 | | |

| 180,626,356 | |

| Non-controlling interests | |

| 4,165,063 | | |

| 3,974,932 | |

| TOTAL SHAREHOLDERS’ EQUITY | |

| 189,796,868 | | |

| 184,601,288 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 283,419,781 | | |

$ | 273,978,086 | |

| * | The

financial statements give retroactive effect to the May 18, 2023 one-for-ten reverse share split. |

NISUN INTERNATIONAL ENTERPRISE DEVELOPMENT

GROUP CO., LTD AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME (LOSS)

(EXPRESSED IN US DOLLARS)

| | |

For the Year Ended December 31, | |

| | |

2022 | | |

2021 | | |

2020 | |

| REVENUES: | |

| | |

| | |

| |

| Revenue generated from services: | |

| | |

| | |

| |

| Small and Medium Enterprise financing solutions | |

$ | 87,269,959 | | |

$ | 87,133,963 | | |

$ | 40,779,794 | |

| Supply Chain financing solutions | |

| 3,542,592 | | |

| 4,930,289 | | |

| 1,369,859 | |

| Other financing solutions | |

| - | | |

| 3,222 | | |

| 40,538 | |

| Total revenue generated from services | |

| 90,812,551 | | |

| 92,067,474 | | |

| 42,190,191 | |

| Revenue generated from sales: | |

| | | |

| | | |

| | |

| Supply chain trading business | |

| 143,361,714 | | |

| 68,132,237 | | |

| - | |

| Total revenues | |

| 234,174,265 | | |

| 160,199,711 | | |

| 42,190,191 | |

| | |

| | | |

| | | |

| | |

| COST OF REVENUE: | |

| | | |

| | | |

| | |

| Cost of revenue - services | |

| (55,472,076 | ) | |

| (37,989,001 | ) | |

| (19,740,267 | ) |

| Cost of revenue - sales | |

| (140,880,063 | ) | |

| (67,628,806 | ) | |

| - | |

| Business and sales related taxes | |

| (772,830 | ) | |

| (533,760 | ) | |

| (233,389 | ) |

| GROSS PROFIT | |

| 37,049,296 | | |

| 54,048,144 | | |

| 22,216,535 | |

| | |

| | | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | |

| Selling expenses | |

| 1,977,617 | | |

| 2,323,403 | | |

| 3,181,810 | |

| General and administrative expenses | |

| 11,288,871 | | |

| 11,641,567 | | |

| 8,188,736 | |

| Research and development expenses | |

| 1,563,718 | | |

| 1,599,728 | | |

| 817,770 | |

| Bad debt expense | |

| 4,509,634 | | |

| 294,536 | | |

| - | |

| Total operating expenses | |

| 19,339,840 | | |

| 15,859,234 | | |

| 12,188,316 | |

| INCOME FROM OPERATIONS | |

| 17,709,456 | | |

| 38,188,910 | | |

| 10,028,219 | |

| | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | | |

| | |

| Interest and investment income | |

| 2,790,768 | | |

| 2,122,903 | | |

| 585,177 | |

| Other income (expense), net | |

| 2,021,688 | | |

| 464,210 | | |

| 244,274 | |

| Total other income, net | |

| 4,812,456 | | |

| 2,587,113 | | |

| 829,451 | |

| | |

| | | |

| | | |

| | |

| INCOME BEFORE PROVISION FOR INCOME TAXES | |

| 22,521,912 | | |

| 40,776,023 | | |

| 10,857,670 | |

| | |

| | | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| 4,741,854 | | |

| 10,269,501 | | |

| 941,064 | |

| NET INCOME FROM CONTINUING OPERATIONS | |

| 17,780,058 | | |

| 30,506,522 | | |

| 9,916,606 | |

| | |

| | | |

| | | |

| | |

| DISCONTINUED OPERATIONS: | |

| | | |

| | | |

| | |

| (Loss) from discontinued operations, net of tax | |

| - | | |

| - | | |

| (23,107,066 | ) |

| Net gain on sale of discontinued operations, net of tax | |

| - | | |

| - | | |

| 136,050 | |

| NET (LOSS) FROM DISCONTINUED OPERATIONS, NET OF TAX | |

| - | | |

| - | | |

| (22,971,016 | ) |

| NET INCOME (LOSS) | |

| 17,780,058 | | |

| 30,506,522 | | |

| (13,054,410 | ) |

| Net (income) attributable to non-controlling interests | |

| (159,246 | ) | |

| (126,161 | ) | |

| (37,380 | ) |

| NET INCOME (LOSS) - Nisun International’s shareholders | |

$ | 17,620,812 | | |

$ | 30,380,361 | | |

$ | (13,091,790 | ) |

| | |

| | | |

| | | |

| | |

| OTHER COMPREHENSIVE INCOME (LOSS) | |

| | | |

| | | |

| | |

| Foreign currency translation (loss) income | |

| (12,576,380 | ) | |

| 2,039,011 | | |

| 5,507,420 | |

| COMPREHENSIVE INCOME (LOSS) | |

| 5,044,432 | | |

| 32,419,372 | | |

| (7,584,370 | ) |

| Comprehensive loss attributable to non-controlling interests | |

| 6,231 | | |

| 2,051 | | |

| 2,172 | |

| COMPREHENSIVE INCOME (LOSS) | |

$ | 5,050,663 | | |

$ | 32,421,423 | | |

$ | (7,582,198 | ) |

| | |

| | | |

| | | |

| | |

| BASIC AND DILUTED EARNINGS (LOSS) PER COMMON SHARE: | |

| | | |

| | | |

| | |

| Income from continuing operations | |

$ | 4.42 | | |

$ | 14.13 | | |

$ | 5.32 | |

| Income (loss) from discontinued operations | |

| - | | |

| - | | |

| (12.36 | ) |

| NET EARNINGS (LOSS) PER COMMON SHARE | |

$ | 4.42 | | |

$ | 14.13 | | |

$ | (7.04 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding-basic and diluted* | |

| 3,986,359 | | |

| 2,150,683 | | |

| 1,858,767 | |

| * | The

financial statements give retroactive effect to the May 18, 2023 one-for-ten reverse share split. |

NISUN INTERNATIONAL ENTERPRISE DEVELOPMENT

GROUP CO., LTD AND SUBSIDIARIES

CONDENSED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2022, 2021

AND 2020

(EXPRESSED IN US DOLLARS)

| | |

2022 | | |

2021 | | |

2020 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| | |

| |

| Net income (loss) | |

$ | 17,780,058 | | |

$ | 30,506,522 | | |

$ | (13,054,410 | ) |

| Net (loss) from discontinued operations | |

| - | | |

| - | | |

| (22,971,016 | ) |

| Net income from continuing operations | |

| 17,780,058 | | |

| 30,506,522 | | |

| 9,916,606 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 2,113,732 | | |

| 2,180,038 | | |

| 1,686,518 | |

| Stock-based compensation | |

| 125,630 | | |

| 498,825 | | |

| 1,097,415 | |

| Shares issued for compensation | |

| 185,000 | | |

| 71,175 | | |

| - | |

| Bad debt expense | |

| 4,509,634 | | |

| 294,536 | | |

| - | |

| Impairment of goodwill | |

| 777,329 | | |

| - | | |

| - | |

| Loss on disposition of property and equipment | |

| 1,385 | | |

| 190,301 | | |

| 42,534 | |

| (Income) from investments | |

| (541,578 | ) | |

| (808,464 | ) | |

| (169,720 | ) |

| Deferred tax (benefit) expense | |

| 271,907 | | |

| 275,749 | | |

| (584,760 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | | |

| | |

| Accounts receivable | |

| (2,075,274 | ) | |

| (13,294,924 | ) | |

| 573,418 | |

| Advance to suppliers, net | |

| (39,859,386 | ) | |

| (9,213,279 | ) | |

| - | |

| Prepaid expenses and other current assets | |

| (4,734,501 | ) | |

| (3,464,939 | ) | |

| 16,009 | |

| Receivables from supply chain solutions | |

| 11,372,841 | | |

| (48,202,128 | ) | |

| (10,741,981 | ) |

| Inventories | |

| (25,530,993 | ) | |

| (3,931,400 | ) | |

| - | |

| Accounts payable | |

| 7,693,011 | | |

| 33,620,611 | | |

| 1,014,227 | |

| Advance from customers | |

| 19,085,377 | | |

| 3,375,769 | | |

| (17,977 | ) |

| Taxes payable | |

| (5,574,048 | ) | |

| 5,575,502 | | |

| 1,609,498 | |

| Other payables | |

| - | | |

| 2,576,570 | | |

| (2,112,886 | ) |

| Payable to supply chain solutions | |

| (15,198,883 | ) | |

| 25,608,622 | | |

| - | |

| Operating lease liabilities | |

| (855,242 | ) | |

| (952,495 | ) | |

| (580,628 | ) |

| Accrued expenses and other current liabilities | |

| 1,501,078 | | |

| (1,049,489 | ) | |

| 502,100 | |

| Net cash (used in) provided by operating activities from continuing operations | |

| (28,952,923 | ) | |

| 23,857,102 | | |

| 2,250,373 | |

| Net cash (used in) provided by operating activities from discontinued operations | |

| - | | |

| - | | |

| 436,389 | |

| NET CASH (USED IN) PROVIDED BY OPERATING ACTIVITIES | |

| (28,952,923 | ) | |

| 23,857,102 | | |

| 2,686,762 | |

| | |

| | | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | | |

| | |

| Acquisition of property and equipment | |

| (652,585 | ) | |

| (186,705 | ) | |

| (204,904 | ) |

| Purchase of intangible assets | |

| (74,710 | ) | |

| (18,281 | ) | |

| (94,400 | ) |

| Proceeds from disposal of equipment | |

| - | | |

| - | | |

| 41,688 | |

| Cash (paid) received in connection with Nami acquisition | |

| - | | |

| (7,007,905 | ) | |

| 4,990,754 | |

| Cash paid in connection with acquisition, net of cash received | |

| (530,322 | ) | |

| - | | |

| - | |

| Investment in limited partnership | |

| - | | |

| - | | |

| (15,589,966 | ) |

| Cash received on disposal of discontinued operations | |

| - | | |

| 14,950,730 | | |

| - | |

| Proceeds from sale of short-term investments | |

| 78,595,280 | | |

| 4,894,270 | | |

| - | |

| Purchase of short-term investments | |

| (51,567,746 | ) | |

| (39,526,099 | ) | |

| (3,065,134 | ) |

| Purchase of Long-term investments | |

| (7,430,511 | ) | |

| - | | |

| - | |

| Collection of loans to third parties | |

| - | | |

| 1,643,203 | | |

| 11,019,545 | |

| Loans to third parties | |

| (501,905 | ) | |

| - | | |

| (1,810,495 | ) |

| Net cash provided by (used in) investing activities from continuing operations | |

| 17,837,501 | | |

| (25,250,787 | ) | |

| (4,712,912 | ) |

| Net cash (used in) investing activities from discontinued operations | |

| - | | |

| - | | |

| (6,713 | ) |

| NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES | |

| 17,837,501 | | |

| (25,250,787 | ) | |

| (4,719,625 | ) |

| | |

| | | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | | |

| | |

| Proceeds from short-term bank loans | |

| 445,831 | | |

| 784,609 | | |

| - | |

| Proceeds from issuance of common shares and pre-funded warrants | |

| - | | |

| 70,794,465 | | |

| - | |

| Proceeds from private placement | |

| - | | |

| - | | |

| 6,503,378 | |

| Proceeds from third-party loans | |

| 36,770,626 | | |

| - | | |

| - | |

| Repayment of short-term bank loans | |

| (1,239,983 | ) | |

| - | | |

| - | |

| Repayment of third-party loans | |

| (41,491,973 | ) | |

| - | | |

| - | |

| Repayment to related parties | |

| (10,097 | ) | |

| (1,803,374 | ) | |

| (6,803,115 | ) |

| Advances from related parties | |

| - | | |

| - | | |

| 1,303,556 | |

| Loan from related parties | |

| - | | |

| - | | |

| 10,528,965 | |

| Repayment of loan from related parties | |

| (2,500,000 | ) | |

| - | | |

| - | |

| Purchase of treasury shares | |

| (355,844 | ) | |

| - | | |

| - | |

| Capital contribution from non-controlling interest | |

| 37,116 | | |

| 751,841 | | |

| 3,065,134 | |

| Capital contribution by shareholder | |

| - | | |

| - | | |

| 4,550,000 | |

| Net

cash (used in) provided by financing activities from continuing operations | |

| (8,344,324 | ) | |

| 70,527,541 | | |

| 19,147,918 | |

| Net cash (used in) financing activities from discontinued operations | |

| - | | |

| - | | |

| (788,599 | ) |

| NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES | |

| (8,344,324 | ) | |

| 70,527,541 | | |

| 18,359,319 | ) |

| | |

| | | |

| | | |

| | |

| EFFECT OF EXCHANGE RATE CHANGE ON CASH AND CASH EQUIVALENTS | |

| (4,848,722 | ) | |

| 294,928 | | |

| 2,806,981 | |

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | |

| (24,308,468 | ) | |

| 69,428,784 | | |

| 19,133,437 | |

| Less: (decrease) in cash and cash equivalents from discontinued operations | |

| | | |

| - | | |

| (283,314 | ) |

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS FROM CONTINUING OPERATIONS | |

| (24,308,468 | ) | |

| 69,428,784 | | |

| 19,416,751 | |

| | |

| | | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH FROM CONTINUING OPERATIONS-BEGINNING | |

| 91,627,041 | | |

| 22,198,257 | | |

| 2,781,506 | |

| | |

| | | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH FROM CONTINUING OPERATIONS-ENDING | |

$ | 67,318,573 | | |

$ | 91,627,041 | | |

$ | 22,198,257 | |

| | |

| | | |

| | | |

| | |

| SUPPLEMENTAL CASH FLOW DISCLOSURES: | |

| | | |

| | | |

| | |

| Cash paid for income taxes | |

$ | 10,385,495 | | |

$ | 5,546,082 | | |

$ | 552,783 | |

| Cash paid for interest | |

$ | 496,932 | | |

$ | 370,356 | | |

$ | 124,778 | |

| | |

| | | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH ACTIVITIES: | |

| | | |

| | | |

| | |

| Amount payable to related parties for business acquisition | |

$ | - | | |

$ | - | | |

$ | 7,007,905 | |

| Issuance of shares for business acquisition | |

$ | - | | |

$ | - | | |

$ | 18,330,776 | |

| Receivable from disposal of subsidiary | |

$ | 289,973 | | |

$ | - | | |

$ | 14,950,730 | |

| Issuance of shares for share-based compensation | |

$ | - | | |

$ | 71,175 | | |

$ | 1,721,870 | |

| | |

| | | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS FROM CONTINUING OPERATIONS ARE COMPRISED OF THE FOLLOWING: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 63,901,329 | | |

$ | 91,447,620 | | |

$ | 22,135,310 | |

| Restricted cash | |

| 3,417,244 | | |

| 179,421 | | |

| 62,947 | |

| Total cash, cash equivalents and restricted cash | |

$ | 67,318,573 | | |

$ | 91,627,041 | | |

$ | 22,198,257 | |

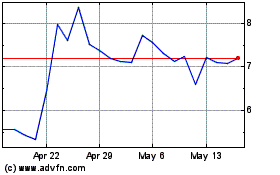

NiSun International Ente... (NASDAQ:NISN)

Historical Stock Chart

From Nov 2024 to Dec 2024

NiSun International Ente... (NASDAQ:NISN)

Historical Stock Chart

From Dec 2023 to Dec 2024