UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 2)*

Savara Inc.

(Name

of Issuer)

Common Stock, $0.001 par value

(Title

of Class of Securities)

805111101

(CUSIP

Number)

Stephanie Brecher

New

Enterprise Associates

1954

Greenspring Drive, Suite 600, Timonium, MD 21093

(410)

842-4000

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

August

12, 2024

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this

Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect

to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP

No. 805111101

|

13D |

Page

2 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Growth Equity Opportunities 17, LLC

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

WC

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

OO

|

|

|

CUSIP

No. 805111101

|

13D |

Page

3 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

New Enterprise Associates 17, L.P.

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

WC

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

PN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

4 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

NEA Partners 17, L.P.

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

PN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

5 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

NEA 17 GP, LLC

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

OO

|

|

|

CUSIP

No. 805111101

|

13D |

Page

6 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Forest Baskett

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

7 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Ali Behbahani

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

8 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Carmen Chang

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

9 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Anthony A. Florence, Jr.

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

10 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Mohamad H. Makhzoumi

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

11 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Edward T. Mathers

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

12 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Scott D. Sandell

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

13 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Paul Walker

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

14 of 22 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS.

Rick Yang

|

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐ |

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

|

|

|

|

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

0

Shares

|

| |

8. |

|

SHARED

VOTING POWER

24,471,264 Shares

|

| |

9. |

|

SOLE

DISPOSITIVE POWER

0

Shares

|

| |

10. |

|

SHARED

DISPOSITIVE POWER

24,471,264 Shares

|

|

|

|

|

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,471,264 Shares

|

|

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

☐ |

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.9%

|

|

|

14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

CUSIP

No. 805111101

|

13D |

Page

15 of 22 Pages |

| Item 1. | Security

and Issuer. |

This

Amendment No. 2 (“Amendment No. 2”) to Schedule 13D amends and supplements the Schedule 13D originally filed on March 25,

2021, and Amendment No. 1 filed on July 26, 2023, and relates to the common stock, $0.001 par value (the “Common Stock”),

of Savara Inc. (the “Issuer”), having its principal executive office at 1717 Langhorne Newtown Road, Suite 300, Langhorne,

PA 19047.

Certain

terms used but not defined in this Amendment No. 2 have the meanings assigned thereto in the Schedule 13D (and Amendment No. 1 thereto).

Except as specifically provided herein, this Amendment No. 2 does not modify any of the information previously reported on the Schedule

13D (and Amendment No. 1 thereto).

This

Amendment No. 2 is being filed to report that the beneficial ownership of Common Stock by the Reporting Persons (as defined below) has

decreased by more than 1% as a result of an increase in the number of Common Stock outstanding.

| Item 2. | Identity

and Background. |

This

statement is being filed by:

(a)

Growth Equity Opportunities 17, LLC (“GEO”);

(b)

New Enterprise Associates 17, L.P. (“NEA 17”), which is the sole member of GEO; NEA Partners 17, L.P. (“NEA Partners

17”), which is the sole general partner of NEA 17; and NEA 17 GP, LLC (“NEA 17 LLC” and, together with NEA Partners

17, the “Control Entities”), which is the sole general partner of NEA Partners 17; and

(c)

Forest Baskett (“Baskett”), Ali Behbahani (“Behbahani”), Carmen Chang (“Chang”), Anthony A. Florence,

Jr. (“Florence”), Mohamad H. Makhzoumi (“Makhzoumi”), Edward T. Mathers (“Mathers”), Scott D. Sandell

(“Sandell”), Paul Walker (“Walker”) and Rick Yang (“Yang”) (together, the “Managers”).

The Managers are the managers of NEA 17 LLC.

The

persons named in this Item 2 are referred to individually herein as a “Reporting Person” and collectively as the “Reporting

Persons.”

The

address of the principal business office of GEO, NEA 17, each Control Entity and Sandell is New Enterprise Associates, 1954 Greenspring

Drive, Suite 600, Timonium, MD 21093. The address of the principal business office of Baskett, Behbahani, Chang, Makhzoumi, Walker and

Yang is New Enterprise Associates, 2855 Sand Hill Road, Menlo Park, CA 94025. The address of the principal business office of Florence

and Mathers is New Enterprise Associates, 104 5th Avenue, 19th Floor, New York, NY 10011.

The

principal business of GEO and NEA 17 is to invest in and assist growth-oriented businesses located principally in the United States.

The principal business of NEA Partners 17 is to act as the sole general partner of NEA 17. The principal business of NEA 17 LLC is to

act as the sole general partner of NEA Partners 17. The principal business of each of the Managers is to manage the Control Entities,

GEO and a number of affiliated partnerships with similar businesses.

During

the five years prior to the date hereof, none of the Reporting Persons has been convicted in a criminal proceeding or has been a party

to a civil proceeding ending in a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violation with respect to such laws.

GEO

and NEA 17 LLC are limited liability companies organized under the laws of the State of Delaware. NEA 17 and NEA Partners 17 are limited

partnerships organized under the laws of the State of Delaware. Each of the Managers is a United States citizen.

CUSIP

No. 805111101

|

13D |

Page

16 of 22 Pages |

| Item 3. | Source

and Amount of Funds or Other Consideration. |

Not

applicable.

| Item 4. | Purpose

of Transaction. |

Not

applicable.

| Item 5. | Interest

in Securities of the Issuer. |

| (a) | GEO

is the record owner of the GEO Shares. As the sole member of GEO, NEA 17 may be deemed to

own beneficially the GEO Shares. As the general partner of NEA 17, NEA Partners 17 may be

deemed to own beneficially the GEO Shares. As the sole general partner of NEA Partners 17,

NEA 17 LLC may be deemed to own beneficially the GEO Shares. As members of NEA 17 LLC, each

of the Managers may be deemed to own beneficially the GEO Shares. |

Each Reporting

Person disclaims beneficial ownership of the GEO Shares other than those shares which such person owns of record.

The percentage

of outstanding Common Stock of the Issuer which may be deemed to be beneficially owned by each Reporting Person is set forth on Line

13 of such Reporting Person’s cover sheet. Such percentage was calculated based on 164,600,603 shares of Common Stock reported

by the Issuer to be outstanding as of August 12, 2024 on the Issuer’s Form 10-Q filed with the Securities and Exchange Commission

on August 12, 2024.

| (b) | Regarding

the number of shares as to which such person has: |

| (i) | sole

power to vote or to direct the vote: See line 7 of cover sheets |

| (ii) | shared

power to vote or to direct the vote: See line 8 of cover sheets |

| (iii) | sole

power to dispose or to direct the disposition: See line 9 of cover sheets |

| (iv) | shared

power to dispose or to direct the disposition: See line 10 of cover sheets |

| (c) | None of the Reporting Persons has effected any transaction in the Common

Stock during the last 60 days. |

| (d) | No other person is known to have the right to receive or the power to direct

the receipt of dividends from, or any proceeds from the sale of, Common Stock beneficially owned by any of the Reporting Persons. |

| Item

6. | Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Not applicable.

| Item

7. | Material

to be Filed as Exhibits. |

Exhibit 1 – Agreement regarding filing of joint Schedule 13D.

Exhibit 2 – Power of Attorney regarding filings under the Securities Exchange Act of 1934, as amended.

CUSIP

No. 805111101

|

13D |

Page

17 of 22 Pages |

SIGNATURE

After

reasonable inquiry and to the best of its knowledge and belief, each of the undersigned certifies that the information set forth

in this statement is true, complete and correct.

EXECUTED

this 14th day of August, 2024.

GROWTH

EQUITY OPPORTUNITIES 17, LLC

| By: | NEW

ENTERPRISE ASSOCIATES 17, L.P.

Sole Member |

General Partner

General Partner

| By: | | * |

| | | Anthony A. Florence, Jr.

Managing Partner and Co-Chief Executive Officer |

| By: | | * |

| | | Mohamad

Makhzoumi

Managing Partner and Co-Chief Executive

Officer |

NEW

ENTERPRISE ASSOCIATES 17, L.P.

| By: | NEA

PARTNERS 17, L.P.

General Partner |

| By: | NEA

17 GP, LLC

General Partner |

| By: | * |

| | | Anthony

A. Florence, Jr.

Managing Partner and Co-Chief Executive Officer |

| By: | * |

| | | Mohamad

Makhzoumi

Managing Partner and Co-Chief Executive

Officer |

NEA

PARTNERS 17, L.P.

| By: | NEA

17 GP, LLC

General Partner |

| By: | | * |

| | | Anthony A. Florence, Jr.

Managing Partner and Co-Chief Executive Officer |

| By: | | * |

| | | Mohamad Makhzoumi

Managing Partner and Co-Chief Executive Officer

|

NEA

17 GP, LLC

| By: | * |

| | Anthony

A. Florence, Jr.

Managing Partner and Co-Chief Executive Officer |

| By: | * |

| | Mohamad

Makhzoumi

Managing Partner and Co-Chief Executive

Officer |

CUSIP

No. 805111101

|

13D |

Page

18 of 22 Pages |

*

Forest

Baskett

*

Ali

Behbahani

*

Carmen

Chang

*

Anthony

A. Florence, Jr.

*

Mohamad

H. Makhzoumi

*

Edward

T. Mathers

*

Scott

D. Sandell

*

Paul

Walker

*

Rick

Yang

*/s/

Zachary Bambach

Zachary Bambach

As

attorney-in-fact

This Amendment No. 2 to Schedule 13D was executed by Zachary Bambach

on behalf of the individuals listed above pursuant to a Power of Attorney a copy of which is attached as Exhibit 2.

CUSIP

No. 805111101

|

13D |

Page

19 of 22 Pages |

EXHIBIT

1

AGREEMENT

Pursuant to Rule 13d-1(k)(1) under the Securities Exchange

Act of 1934, the undersigned hereby agree that only one statement containing the information required by Schedule 13D need

be filed with respect to the ownership by each of the undersigned of shares of stock of Savara, Inc.

EXECUTED

this 14th day of August, 2024.

GROWTH

EQUITY OPPORTUNITIES 17, LLC

| By: | NEW

ENTERPRISE ASSOCIATES 17, L.P.

Sole Member |

General Partner

General Partner

| By: | | * |

| | | Anthony A. Florence, Jr.

Managing Partner and Co-Chief Executive Officer |

| By: | | * |

| | | Mohamad

Makhzoumi

Managing Partner and Co-Chief Executive

Officer |

NEW

ENTERPRISE ASSOCIATES 17, L.P.

| By: | NEA

PARTNERS 17, L.P.

General Partner |

| By: | NEA

17 GP, LLC

General Partner |

| By: | * |

| | | Anthony

A. Florence, Jr.

Managing Partner and Co-Chief Executive Officer |

| By: | * |

| | | Mohamad

Makhzoumi

Managing Partner and Co-Chief Executive

Officer |

NEA

PARTNERS 17, L.P.

| By: | NEA

17 GP, LLC

General Partner |

| By: | | * |

| | | Anthony A. Florence, Jr.

Managing Partner and Co-Chief Executive Officer |

| By: | | * |

| | | Mohamad Makhzoumi

Managing Partner and Co-Chief Executive Officer

|

NEA

17 GP, LLC

| By: | * |

| | Anthony

A. Florence, Jr.

Managing Partner and Co-Chief Executive Officer |

| By: | * |

| | Mohamad

Makhzoumi

Managing Partner and Co-Chief Executive

Officer |

CUSIP

No. 805111101

|

13D |

Page

20 of 22 Pages |

*

Forest

Baskett

*

Ali

Behbahani

*

Carmen

Chang

*

Anthony

A. Florence, Jr.

*

Mohamad

H. Makhzoumi

*

Edward

T. Mathers

*

Scott

D. Sandell

*

Paul

Walker

*

Rick

Yang

*/s/

Zachary Bambach

Zachary Bambach

As

attorney-in-fact

This Agreement relating to Schedule 13D was executed by Zachary Bambach

on behalf of the individuals listed above pursuant to a Power of Attorney a copy of which is attached hereto as Exhibit 2.

CUSIP

No. 805111101

|

13D |

Page

21 of 22 Pages |

EXHIBIT

2

POWER

OF ATTORNEY

KNOW ALL MEN BY THESE

PRESENTS, that the undersigned hereby constitutes and appoints Zachary Bambach, Nicole Hatcher and Stephanie Brecher, and each of them,

with full power to act without the others, his or her true and lawful attorney-in-fact, with full power of substitution, to sign any

and all instruments, certificates and documents that may be necessary, desirable or appropriate to be executed on behalf of himself as

an individual or in his or her capacity as a direct or indirect general partner, director, officer or manager of any partnership, corporation

or limited liability company, pursuant to section 13 or 16 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and any and all regulations promulgated thereunder, including, without limitation, Forms 3, 4 and 5 and Schedules 13D and

13G (and any amendments thereto), and to file the same, with all exhibits thereto, and any other documents in connection therewith, with

the Securities and Exchange Commission (the “SEC”), including, but not limited to, signing a Form ID for and on behalf of

the undersigned and filing such Form ID with the SEC, and with any other entity when and if such is mandated by the Exchange Act or by

the Financial Industry Regulatory Authority, granting unto said attorney-in-fact full power and authority to do and perform each and

every act and thing necessary, desirable or appropriate, fully to all intents and purposes as he or she might or could do in person,

thereby ratifying and confirming all that said attorney-in-fact, or his or her substitutes, may lawfully do or cause to be done by virtue

hereof. This power of attorney is perpetual, unless revoked by the undersigned in a signed writing delivered to each of the foregoing

attorneys-in-fact.

IN WITNESS WHEREOF,

this Power of Attorney has been signed as of the 29th day of February, 2024.

| /s/

Peter J. Barris |

|

| Peter

J. Barris |

|

| |

|

| /s/

Forest Baskett |

|

| Forest

Baskett |

|

| |

|

| /s/

Ali Behbahani |

|

| Ali

Behbahani |

|

| |

|

| /s/

Ronald D. Bernal |

|

| Ronald

D. Bernal |

|

| |

|

| /s/

Ann Bordetsky |

|

| Ann

Bordetsky |

|

| |

|

| /s/

Carmen Chang |

|

| Carmen

Chang |

|

| |

|

| /s/

Philip Chopin |

|

| Philip

Chopin |

|

| |

|

| /s/

Anthony A. Florence, Jr. |

|

| Anthony

A. Florence, Jr. |

|

| |

|

| /s/

Jonathan Golden |

|

| Jonathan

Golden |

|

| |

|

| /s/

Scott Gottlieb |

|

| Scott

Gottlieb |

|

CUSIP

No. 805111101

|

13D |

Page

22 of 22 Pages |

| /s/

Mark Hawkins |

|

| Mark

Hawkins |

|

| |

|

| /s/

Jeffrey R. Immelt |

|

| Jeffrey

R. Immelt |

|

| |

|

| /s/

Aaron Jacobson |

|

| Aaron

Jacobson |

|

| |

|

| /s/

Patrick J. Kerins |

|

| Patrick

J. Kerins |

|

| |

|

| /s/

Hilarie Koplow-McAdams |

|

| Hilarie

Koplow-McAdams |

|

| |

|

| /s/

Vanessa Larco |

|

| Vanessa

Larco |

|

| |

|

| /s/

Julio C. Lopez |

|

| Julio

C. Lopez |

|

| |

|

| /s/

Tiffany Le |

|

| Tiffany

Le |

|

| |

|

| /s/

Mohamad H. Makhzoumi |

|

| Mohamad

H. Makhzoumi |

|

| |

|

| /s/

Edward T. Mathers |

|

| Edward

T. Mathers |

|

| |

|

| /s/

Gregory Papadopoulos |

|

| Gregory

Papadopoulos |

|

| |

|

| /s/

Kavita Patel |

|

| Kavita

Patel |

|

| |

|

| /s/

Scott D. Sandell |

|

| Scott

D. Sandell |

|

| |

|

| /s/

A. Brooke Seawell |

|

| A.

Brooke Seawell |

|

| |

|

| /s/

Peter Sonsini |

|

Peter

Sonsini |

|

| |

|

| /s/

Melissa Taunton |

|

| Melissa

Taunton |

|

| |

|

| /s/

Paul E. Walker |

|

| Paul

E. Walker |

|

| |

|

| /s/

Rick Yang |

|

| Rick

Yang |

|

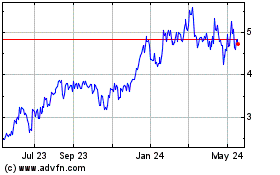

Savara (NASDAQ:SVRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Savara (NASDAQ:SVRA)

Historical Stock Chart

From Jan 2024 to Jan 2025