By Rebecca Elliott

Tesla Inc. posted its first full-year profit, powered by record

vehicle deliveries amid a global pandemic and growing demand for

electric cars that is driving the company to pursue a sharp rise in

output this year.

The Silicon Valley car maker said Wednesday it expects to

increase production about 50% on average for the coming years --

and top that rate in 2021. The company delivered around half a

million vehicles to customers last year.

Chief Executive Elon Musk last year suggested a delivery target

of about 840,000 to one million vehicles in 2021. Wall Street's

projection is for about 796,000 vehicles.

For 2020, Tesla reported a profit of $721 million on about $31.5

billion in sales, supported by the increase in deliveries and

higher revenue from regulatory credits. That compares with an $862

million loss and sales of $24.6 billion in 2019. The company topped

Wall Street's revenue expectation of about $31.1 billion, according

to FactSet, though it missed profit estimates.

Tesla said its bottom line in the latest quarter was weighed

down by a range of factors, including supply-chain costs and

preparations for updated versions of its Model S luxury sedan and

Model X sport-utility vehicle. Costs linked to Mr. Musk's

stock-based compensation package also dented earnings. Mr. Musk,

who doesn't accept a salary from Tesla, became eligible for

multiple tranches of stock options last year.

Shares in the car maker slumped more than 3% in after-hours

trading.

Tesla delivered quarterly profits during the pandemic despite

the temporary shutdown of the company's U.S. car plant because of

the health crisis. To manage the impact, Mr. Musk battled with

local authorities to reopen the factory, temporarily reduced

salaries, furloughed workers and sought rent breaks. Later in the

year, he tested positive for Covid-19.

The 17-year-old company's performance, coupled with wider

investor enthusiasm about electric vehicles, sent the stock soaring

more than 700% last year and turned Tesla into the world's

most-valuable auto maker. The string of quarterly profits also

allowed it to secure a spot in the S&P 500 index.

Tesla is one of several American tech giants on a path to emerge

from the pandemic stronger than before. Apple Inc. on Wednesday

said profit in the most recent quarter rose 29% with sales in the

three months topping $111 billion for the first time, aided by

demand for laptops and iPad tablets in the work-from-home era.

Microsoft Corp. on Tuesday also reported record sales and issued an

upbeat outlook for the rest of its financial year. Social-media

giant Facebook Inc. Wednesday posted record quarterly revenue and

profit.

The car maker generated a profit of $270 million in the fourth

quarter, up from $105 million a year earlier. Sales rose about 46%

to roughly $10.7 billion.

Tesla's financial results have been buoyed by the sale of

regulatory credits to rival auto makers that need them to comply

with emissions-related rules. Such credits brought in roughly $1.6

billion last year, up from $594 million in 2019.

Tesla has benefited from growing electric-vehicle demand in

China, where it began delivering locally made vehicles in 2019. The

company has expanded production capacity at its Shanghai facility

and this month delivered its first made-in-China Model Y

sport-utility vehicles.

But Tesla also faces increased competition from incumbent auto

makers such as General Motors Co. and Ford Motor Co. and a fleet of

startups that are developing their own plug-in models, including in

China.

To support its growth, the company aims to open two new vehicle

factories this year, one near Austin, Texas, and the other near

Berlin, its first in Europe. The company reiterated those plans

Wednesday and said that it would deliver its first semitrailer

truck later this year. Mr. Musk said last year that the company

hoped to begin delivering its electric pickup truck to customers

toward the end of 2021.

To help sustain consumer appetite, the company said it is

preparing new batteries and other enhancements for the Model S --

which it began delivering almost a decade ago -- and for the more

than five-year-old Model X. Production is set to resume before

April, Tesla said. Deliveries of those higher-end models fell 3% in

the fourth quarter from the year-earlier period. Tesla said it has

capacity at its plant in Fremont, Calif., to make 100,000 of those

models, or 11% more than previously.

Tesla said it now has the capacity to produce more than one

million cars a year. It said its Shanghai plant could make 450,000

combined Model 3 and Model Y vehicles, or 200,000 more than it

reported in the prior quarter.

Tesla's ascendancy from plucky startup to the world's

most-valuable auto maker has been rocky at times. The company has

often struggled to introduce new vehicles, such as the Model 3

compact car, and grappled with production challenges that have

strained its finances.

Tesla also hasn't delivered on some of Mr. Musk's more grandiose

promises, such as launching a robot taxi service by the end of

2020.

Federal regulators this month asked Tesla to recall roughly

158,000 vehicles over touch-screen failures that can affect safety

functions, including backup cameras. Tesla hasn't responded to a

request for comment about whether it intends to follow through with

the recall, which would be one of its largest safety actions to

date.

Tesla has shored up its cash position recently by selling

billions in new stock. The company's cash holdings totaled around

$19.4 billion as of year-end, up from around $6.3 billion at the

end of 2019. Mr. Musk has said the company would use the funds to

pay down debt and amass what he described as a war chest.

Write to Rebecca Elliott at rebecca.elliott@wsj.com

(END) Dow Jones Newswires

January 27, 2021 18:17 ET (23:17 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

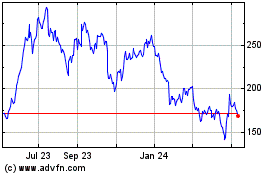

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

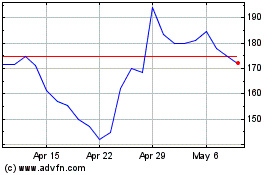

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024