UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE

SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant |

☒ |

| Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

| ☐ | Preliminary

Proxy Statement. |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| ☒ | Definitive

Proxy Statement. |

| ☐ | Definitive

Additional Materials. |

| ☐ | Soliciting

Material Pursuant to §240.14a-12. |

SCWORX CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other

Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee

paid previously with preliminary materials. |

| ☐ | Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

SCWORX CORP.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On October 6, 2023

You are hereby notified that the annual meeting

of stockholders of SCWorx Corp. (“Annual Meeting”) (the “Company”), will be held at the Regus conference room

at 35 Village Rd, Suite 100, Middleton, MA 01949 on October 6, 2023, for the following purposes:

| 1. | To

elect three directors to serve until the next annual meeting of stockholders and until their respective successors shall have been duly

elected and qualified; |

| 2. | To

consider and act upon a proposed amendment of the Company’s certificate of incorporation to effect a 1:__[TBD] reverse stock split

of the Company’s Common Stock; |

| 3. | To

consider and vote, on a non-binding, advisory basis, upon the compensation of those of our executive officers listed in the Summary Compensation

Table appearing elsewhere in this proxy statement, or our named executive officers, as disclosed in this proxy statement pursuant to

Item 402 of Regulation S-K; |

| 4. | To

ratify the selection of BF Borgers CPA PC as independent registered public accounting firm of the Company for the fiscal year ending

December 31, 2023; and |

| 5. | To

consider and act upon such other business as may properly come before the meeting or any adjournment or postponement thereof. |

All stockholders are cordially invited to attend

the annual meeting. If your shares are registered in your name, please bring the admission ticket attached to your proxy card. If your

shares are registered in the name of a broker, trust, bank or other nominee, you will need to bring a proxy or a letter from that broker,

trust, bank or other nominee or your most recent brokerage account statement, that confirms that you are the beneficial owner of those

shares. If you do not have either an admission ticket or proof that you own shares of the Company, you will not be admitted to the meeting.

We intend to mail this proxy statement and the accompanying proxy card on or about August 25, 2023 to all stockholders of record that

are entitled to vote.

The Board of Directors has fixed the close of

business on August 6, 2023 as the record date for the meeting. Only stockholders on the record date are entitled to notice of and to vote

at the meeting and at any adjournment or postponement thereof.

Your vote is important regardless of the number

of shares you own. The Company requests that you complete, sign, date and return the enclosed proxy card without delay in the enclosed

postage-paid return envelope, even if you now plan to attend the annual meeting. You may revoke your proxy at any time prior to its exercise

by delivering written notice or another duly executed proxy bearing a later date to the Secretary of the Company, or by attending the

annual meeting and voting in person.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on October 6, 2023:

The proxy statement, proxy card and Annual Report to stockholders for the year ended December 31, 2022 (the “Annual Report”) are also available at https://ir.scworx.com/

Stockholders may also obtain additional paper or e-mail copies of these materials at no cost by writing to SCWorx Corp., 590 Madison Avenue, 21st Floor, New York, NY 10022, attention: CEO. |

IMPORTANT: If your shares are held in the

name of a brokerage firm, bank, nominee or other institution, you should provide instructions to your broker, bank, nominee or other institution

on how to vote your shares. Please contact the person responsible for your account and give instructions for a proxy to be completed for

your shares.

By order of the Board of Directors,

| /s/ Timothy A. Hannibal |

|

| Timothy A. Hannibal |

|

| Chief Executive Officer |

|

August 18, 2023

IMPORTANT: In order to secure a quorum and

to avoid the expense of additional proxy solicitation, please either vote by internet or sign, date and return your proxy promptly in

the enclosed envelope even if you plan to attend the meeting personally. Your cooperation is greatly appreciated.

SCWORX CORP.

590 Madison Avenue, 21st Floor.

New York, NY 10022

PROXY STATEMENT

INTRODUCTION

This proxy statement and the accompanying proxy

are made available by SCWorx Corp. (the “Company”), to the holders of record of the Company’s outstanding shares of

Common Stock, $0.001 par value per share, (the “Common Stock”), on or about August 6, 2023. The accompanying proxy is being

solicited by the Board of Directors of the Company (the “Board”), for use at the annual meeting of stockholders of the Company

(the “Meeting”), to be held on October 6, 2023, at the Regus conference room at 35 Village Rd, Suite 100, Middleton, MA 01949

and at any adjournment or postponement thereof. The cost of solicitation of proxies will be borne by the Company. Directors, officers

and employees of the Company may also assist in the solicitation of proxies by mail, telephone, telefax, in person or otherwise, without

additional compensation. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting materials to the owners of

stock held in their names and the Company will reimburse them for their reasonable out-of-pocket expenses incurred in connection with

the distribution of such proxy materials.

The Board has fixed August 4, 2023 as the record

date for the Meeting (the “Record Date”). Only stockholders of record on the Record Date are entitled to notice of and to

vote at the Meeting or any adjournment or postponement thereof. On August 4, 2023, there were 16,696,766 shares of Common Stock and 39,810

shares of Series A Preferred Stock (convertible into 222,402 shares of Common Stock) issued and outstanding. Each share of Common Stock

and each share of Series A Preferred Stock (on an as converted basis) is entitled to one vote per share.

The Company’s amended and restated bylaws

provide that a quorum shall consist of the holders of at least one third of the shares of each class, and series of each class, to the

extent applicable (unless more than one class and or series votes as a class, in which case a majority of the shares voting as a

class) of the stock issued and outstanding and entitled to vote thereat, present in person or represented by proxy at the Meeting. If

such quorum shall not be present or represented at any meeting of the stockholders, the stockholders, entitled to vote thereat, present

in person or represented by proxy, shall have the power to adjourn the meeting from time to time without notice (other than the announcement

at the meeting) until a date and time that a quorum shall be present. At such adjourned meeting at which a quorum shall be present or

represented any business may be transacted which might have been transacted at the meeting as originally notified. If the adjournment

is for more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned

meeting shall be given to each stockholder of record entitled to vote at the meeting.

The Company’s amended and restated bylaws

provide that directors are to be elected by a majority of the votes of the shares present in person or represented by proxy at the Meeting

and entitled to vote on the election of directors. This means that the three candidates receiving the highest number of affirmative votes

at the Meeting will be elected as directors. Only shares that are voted in favor of a particular nominee will be counted toward that nominee’s

achievement of a majority. Shares present at the Meeting that are not voted for a particular nominee or shares present by proxy where

the stockholder properly withheld authority to vote for such nominee will not be counted toward that nominee’s achievement of a

majority. The proposed amendment to the Company’s certificate of incorporation to effect a reverse stock split requires the vote

of holders of a majority of the issued and outstanding voting shares.

In other matters, the affirmative vote by the

holders of a majority of the shares voted on any matter shall be sufficient for the approval of the proposals in this proxy statement

and any other business which may properly be brought before the Meeting or any adjournment or postponement thereof.

All shares of Common Stock represented in person

or by valid proxies received by the Company prior to the date of, or at, the Meeting, and not revoked, will be voted as specified in the

proxies or voting instructions. Votes that are left blank will be voted as recommended by the Board. With regard to other matters that

may properly come before the Meeting, votes will be cast at the discretion of the proxies.

Broker non-votes occur when a beneficial owner

of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on

matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled

to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions,

the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with

respect to “non-routine” matters.

In the event that a broker, bank, or other agent

indicates on a proxy that it does not have discretionary authority to vote certain shares on a non-routine proposal, then those shares

will be treated as broker non-votes. We believe that Proposal No. 1 relating to the election of directors and Proposal No. 2 relating

to the reverse split of our common stock are non-routine proposals and Proposal No. 3, with respect to the advisory vote on the compensation

of our executive officers and Proposal No. 4 with respect to the ratification of the selection of the independent registered public accounting

firm, is a routine matter; therefore, your broker, bank or other agent will not be entitled to vote on Proposals No. 1 or 2 at the

Meeting without your instructions. Broker non-votes will be counted towards the quorum requirement. Other than for the purpose of establishing

a quorum, as discussed above, broker non-votes will not be counted as entitled to be voted and will therefore not affect the outcome of

the matters to be voted thereon.

Any stockholder who has submitted a proxy may

revoke it at any time before it is voted, by written notice addressed to and received by our Chief Executive Officer, by submitting a

duly executed proxy bearing a later date or by electing to vote in person at the Meeting. The mere presence at the Meeting of the person

appointing a proxy does not, however, revoke the appointment.

IMPORTANT: If your shares are held in the

name of a brokerage firm, bank, nominee or other institution, you should provide instructions to your broker, bank, nominee or other institution

on how to vote your shares. Please contact the person responsible for your account and give instructions for a proxy to be completed for

your shares.

Our website address is included several times

in this proxy statement as a textual reference only and the information in our website is not incorporated by reference into this proxy

statement.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

At the Meeting, three directors are to be elected,

which number shall constitute our entire Board, to hold office until the next annual meeting of stockholders and until their successors

shall have been duly elected and qualified. Pursuant to our bylaws, as amended, directors are to be elected by a majority of the votes

of the shares present in person or represented by proxy at the Meeting and entitled to vote on the election of directors. This means that

the three candidates receiving the highest number of affirmative votes at the Meeting will be elected as directors. Only shares that are

voted in favor of a particular nominee will be counted toward that nominee’s achievement of a majority. Proxies cannot be voted

for a greater number of persons than the number of nominees named or for persons other than the named nominees.

Unless otherwise specified in the proxy, it is

the intention of the persons named in the enclosed form of proxy to vote the stock represented thereby for the election as directors,

of each of the nominees whose names and biographies appear below. All of the nominees whose names and biographies appear below are presently

our directors. In the event any of the nominees should become unavailable or unable to serve as a director, it is intended that votes

will be cast for a substitute nominee designated by the Board. The Board has no reason to believe that the nominees named will be unable

to serve if elected. Each nominee has consented to being named in this proxy statement and to serve if elected.

Principal Employment and Experience of Director Nominees

The following information is furnished with respect

to the persons nominated for election as directors. All of these nominees are current members of our Board:

| Name |

|

Age |

|

Present Principal Employer and Prior Business Experience |

| |

|

|

|

|

| Tim Hannibal |

|

54 |

|

Mr. Hannibal is a seasoned technology executive and entrepreneur, with

nearly 30 years’ experience in SaaS and cloud technology, driving revenue, go-to-market strategies, business development and

mergers and acquisitions. Mr. Hannibal joined the Company in January 2019 and currently serves as its Chief Executive Officer. Prior

to joining the Company, Mr. Hannibal was an employee at Primrose Solutions (the predecessor to SCWorx) which he joined in September

of 2016. At Primrose, Mr. Hannibal was responsible for overseeing marketing, sales and operations, including executing the Company’s

business plan. Mr. Hannibal has a successful track record of growth and management at both startup and national companies.

Prior to joining Primrose, Mr. Hannibal was the President and CEO of

VaultLogix for thirteen years, a company he founded. VaultLogix was a private equity sponsored leading SaaS company in the cloud backup

industry before being acquired by J2 Global, a publicly traded technology company ($3.5b market cap) focused on cloud services and digital

media. |

| Name |

|

Age |

|

Present Principal Employer and Prior Business Experience |

| |

|

|

|

|

| *Steven Horowitz |

|

52 |

|

Mr. Horowitz was appointed to the Board of

Directors in August 2021. Mr. Horowitz is currently the Chief Executive Officer of CareCentrix, a multi-billion dollar health care services

company, after previously serving as its Chief Financial Officer since 2012.

Prior to joining CareCentrix, Steve was the

Vice President of business planning for Medco Health Solutions, a Fortune 50 pharmacy benefit manager. In this role, Steve was the CFO

for three key U.S.-based divisions as well as all international markets, which together generated over $2 billion in annual revenue. Previously,

Steve held the position of controller at National Medical Health Card Systems, a pharmacy benefit manager, and at The Fantastic Corporation,

a global broadband multimedia corporation. Earlier, Steve was CFO at the Mount Vernon Neighborhood Health Center.

Steve received his MBA from Adelphi University

and earned his BS in business management from Cornell University. He is a licensed CPA and Chartered Global Management Accountant (CGMA).

Steve is a member of the American Institute of Certified Public Accountants (AICPA). |

| |

|

|

|

|

| *Alton Irby |

|

82 |

|

Mr. Irby was appointed to the Board of Directors on March 10, 2021. Alton Irby is a co-founder of London Bay Capital and has been Chairman of the firm. Since 2006. London Bay Capital makes investments in private companies, and also provides business advisory services. Mr. Irby is a seasoned executive with a highly successful track record in the financial services and investment banking industries in both the UK and the US from 1982 to the present. Mr. Irby has served on the boards on several public and private companies including 17 years as a director of The McKesson Corporation chairing both the Compensation and Finance Committees. |

| * | The

Board has determined that this director or nominee is “independent” as defined by the rules of the Securities and Exchange

Commission, or SEC, and Nasdaq Stock Market, or Nasdaq, rules and regulations. None of the independent directors has any relationship

with us besides serving on our Board. |

Required Vote

Our Certificate of Incorporation, as amended,

does not authorize cumulative voting. Our bylaws, as amended, provide that directors are to be elected by a majority of the votes of the

shares present in person or represented by proxy at the Meeting and entitled to vote on the election of directors. This means that the

three candidates receiving the highest number of affirmative votes at the Meeting will be elected as directors. Only shares that are voted

in favor of a particular nominee will be counted toward that nominee’s achievement of a majority. Shares present at the Meeting

that are not voted for a particular nominee or shares present by proxy where the stockholder properly withheld authority to vote for such

nominee will not be counted toward that nominee’s achievement of a majority. Broker non-votes will not impact the outcome of the

vote on this proposal but will be counted for purposes of determining whether there is a quorum.

| The Board recommends a vote FOR the election of each of the director nominees named above. |

PROPOSAL NO. 2 – APPROVE AMENDMENT TO

THE CERTIFICATE OF INCORPORATION OF

SCWORX CORP. TO EFFECT REVERSE STOCK SPLIT

At the Annual Meeting, shareholders will be asked

to approve and adopt an amendment to the certificate of incorporation of SCWorx Corp. effecting a reverse stock split of the issued shares

of the Company’s common stock, in the ratio sufficient in the judgment of the Board of Directors to result in a minimum bid price

of the Company’s common stock of at least $1.00 per share (the reverse stock split ratio is anticipated to be in the range of between

1/10 and 1/12) where the numerator is the number of new shares being issued (“Stock Split Proposal”) and the denominator is

the number of shares outstanding for which such number of new shares is being issued. By way of illustration, if the reverse split ratio

is 1/10, then 1 new share will be issued in replacement for every 10 shares outstanding, so that if there were 15 million shares outstanding

pre-split, there would be 1.5 million shares outstanding post-split.

Although the Board of Directors anticipates that

the reverse stock split ratio will be in the range of between 1/10 and 1/12, the actual reverse stock split ratio will be determined by

the Board of Directors and may be significantly higher or lower than such anticipated range.

Because the Board of Directors cannot predict

with any certainty how the Company’s stock price will react to the reverse stock split, the Board anticipates setting the reverse

split ratio at a level mathematically calculated to result in a stock price sufficiently above the minimum requirement of $1.00 per share.

For example, if the Company’s stock price were $0.20 per share, to achieve a $1.00 post-split price, the theoretical reverse split

ratio would be 1/5 ($1.00/$0.20). In this example, for the reasons described herein, the Board of Directors might set the reverse stock

split ratio at 1/10 or some other ratio based on the considerations described herein.

Stockholder approval of the Stock Split Proposal

is required by the Delaware General Corporation Law. Upon the effectiveness of the amendment to the certificate of incorporation of the

Company effecting the reverse stock split, the issued shares of the Company’s common stock immediately prior to the split effective

time will be reclassified into a smaller number of shares such that a Company shareholder will own that number of shares equal to the

quotient of the number of shares of issued common stock held by that shareholder immediately prior to the split effective time, divided

by the denominator of the reverse split ratio.

The Company’s board of directors approved

the proposed amendment to the certificate of incorporation of the Company effecting the reverse stock split for the following reason:

| |

● |

the board of directors believes effecting the reverse stock split should be an effective means to increase the per share price of the Company’s common stock to a minimum of at least $1.00 per share, thereby avoiding a delisting of the Company’s common stock from the Nasdaq Capital Market |

If the reverse stock split successfully increases

the per share price of the Company’s common stock, the Company’s board of directors believes this increase may increase trading

volume in its common stock and facilitate future financings.

The Company’s board of directors’

decision regarding the exact reverse split ratio will be based on a number of factors, including market conditions, existing and expected

trading prices for the Company’s common stock and the listing requirements of the Nasdaq Capital Market.

The reverse stock split will affect all of the

Company’s shareholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except

to the extent that the reverse stock split results in any of the Company’s shareholders owning a fractional share. Common stock

issued pursuant to the reverse stock split will remain fully paid and nonassessable. The reverse stock split will not affect the Company

continuing to be subject to the periodic reporting requirements of the Exchange Act.

SCWorx’s authorized capital stock currently

consists of 45,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per

share. The reverse stock split will not change the number of authorized shares of the Company’s common stock or preferred stock,

or the par value of the Company’s common stock or preferred stock. As of August 4, 2023, there were 16,696,766 shares of the Company’s

common stock issued and outstanding, which would equate to approximately 1,669,677 and 1,391,397 shares of common stock after giving effect

to a 1/10 and 1/12 reverse stock split, respectively.

The Company has no current plans, arrangements

or understandings to issue shares that will be available and unreserved after the completion of the reverse stock split, other than to

satisfy obligations under the Company’s warrants, Preferred Stock, stock options and other equity awards from time to time as such

warrants, Preferred Stock, stock options and other awards are exercised. In addition, the Company may from time to time seek to finance

future cash needs through financings that may take the form of a public or private equity offering. Any such equity financing could occur

at any time, including as soon as concurrently with or soon after completion of the reverse stock split.

Nasdaq Requirements for Listing on the Nasdaq Capital Market

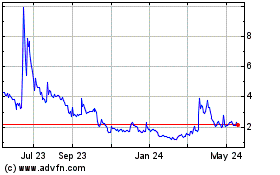

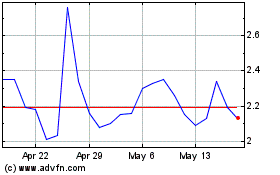

SCWorx Corp. common stock is quoted on the Nasdaq

Capital Market under the symbol “WORX.” One of the requirements for continued listing on the Nasdaq Capital Market pursuant

to Nasdaq Listing Rule 5550(a)(2) is maintenance of a minimum closing bid price of $1.00. On August 6, 2023, the closing market

price per share of the Company’s common stock was $0.265, as reported by the Nasdaq Capital Market.

On June 9, 2022, the Company received a written

notification from the Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it had failed to comply with the minimum

bid price requirement because the bid price for its common stock over a period of 30 consecutive business days prior to such date had

closed below the minimum $1.00 per share requirement. The letter stated that the Company had 180 days, or until December 5, 2022, to demonstrate

compliance by maintaining a minimum closing bid price of at least $1.00 for a minimum of 10 consecutive trading days. On December 6, 2022,

the Company received a determination letter from the Staff advising the Company that the Staff had determined that the Company had not

regained compliance with the Rule and that the Company was eligible for an additional 180-day period, or until June 5, 2023, to regain

compliance with the Rule.

On June 6, 2023, the Company received a determination

letter from the Staff stating that the Company has not regained compliance with Listing Rule 5550(a)(2). Accordingly, its securities were

to be delisted from the Capital Market. In that regard, had the Company failed to request an appeal of this determination, trading of

the Company’s common stock would have been suspended at the opening of business on June 15, 2023, and a Form 25-NSE would have been

filed with the Securities and Exchange Commission (the “SEC”), which would have removed the Company’s securities from

listing and registration on The Nasdaq Stock Market.

On June 12, 2023, however, the Company requested

a hearing to appeal the Nasdaq’s delisting determination. On July 20, 2023, as part of the appeal process, the Company presented

to Nasdaq the Company’s plan for meeting the Nasdaq’s continued listing qualifications.

On July 27, 2023, Nasdaq notified the Company

that the Nasdaq Hearings Panel (the “Panel”) granted the Company’s request for continued listing on The Nasdaq Capital

Market, subject to the Company’s satisfaction of certain conditions.

In accordance with Nasdaq’s decisions, subject

to the filing of this Proxy Statement, the Company has until October 20, 2023 to demonstrate that the Company satisfies the requirements

for continued listing on The Nasdaq Capital Market.

The Company expects that, after giving effect

to the reverse stock split contemplated hereby, it should be able to meet the Nasdaq’s requirements for continued listing.

If the Company fails to achieve compliance with

the applicable Nasdaq listing rules, shares of the Company’s common stock would likely trade in the over-the-counter market. If

the Company’s shares were to trade on the over-the-counter market, selling the Company’s common stock could be more difficult

because smaller quantities of shares would likely be bought and sold, and transactions could be delayed. In addition, in the event the

Company’s common stock is delisted, broker-dealers have certain regulatory burdens imposed upon them, which may discourage broker-dealers

from effecting transactions in the Company’s common shares, further limiting the liquidity of the Company’s common shares.

These factors could result in lower prices and larger spreads in the bid and ask prices for common shares.

The Company cannot predict whether the reverse

stock split will increase the market price for the Company’s common stock. The history of similar stock split combinations for companies

in like circumstances is varied. There is no assurance that:

| |

● |

the market price per share of the Company’s common stock after the reverse stock split will rise in proportion to the reduction in the number of shares of the Company’s common stock outstanding before the reverse stock split; |

| |

● |

the reverse stock split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks; |

| |

● |

the market price per share will remain in excess of the $1.00 minimum bid price as required by Nasdaq for continued listing. |

The market price of the Company’s common

stock will also be based on performance of the Company and other factors, some of which are unrelated to the number of shares outstanding.

If the reverse stock split is effected and the market price of the Company’s common stock declines, the percentage decline as an

absolute number and as a percentage of the overall market capitalization of the Company may be greater than would occur in the absence

of a reverse stock split. Furthermore, the liquidity of the Company’s common stock could be adversely affected by the reduced number

of shares that would be outstanding after the reverse stock split.

Procedure for Effecting Reverse Stock Split and Exchange of Stock

Certificates

If the Company’s shareholders approve the

amendment to the certificate of incorporation of the Company effecting the reverse stock split, and if the Company’s board of directors

still believes that a reverse stock split is in the best interests of the Company and its stockholders, the Company will file the certificate

of amendment to the certificate of incorporation with the Secretary of State of the State of Delaware. Beginning at the split effective

time, each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

As soon as practicable after the split effective

time, stockholders will be notified that the reverse stock split has been effected. The Company expects that the Company’s transfer

agent will act as exchange agent for purposes of implementing any exchange of stock certificates. Holders of pre-split shares will be

asked to surrender to the exchange agent certificates representing pre-split shares in exchange for certificates representing post-split

shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by the Company’s transfer agent.

No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s)

together with the properly completed and executed letter of transmittal to the exchange agent. Any pre-split shares submitted for transfer,

whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split shares. Stockholders

should not destroy any stock certificate(s) and should not submit any certificate(s) unless and until requested to do so.

Fractional Shares

No fractional shares of the Company’s common

stock will be issued in connection with the reverse stock split. Stockholders of record who otherwise would be entitled to receive fractional

shares because they hold a number of pre-split shares not evenly divisible by the number of pre-split shares for which each post-split

share is to be reclassified, will be entitled, upon surrender to the exchange agent of certificates representing such shares, to one additional

share of the Company’s common stock for each fractional share.

Effect of Approving the Stock Split Proposal

By approving an amendment to the Company’s

amended and restated certificate of incorporation effecting the reverse stock split, stockholders will be approving the combination of

that number of shares of the Company’s common stock into one share of the Company’s common stock, sufficient in the judgment

of the Board of Directors to cause the Company’s stock price to be a minimum of at least $1.00 per share (it is estimated that between

10 and 12 shares will be combined into one share by virtue of the reverse split). Although the Board of Directors anticipates that the

reverse stock split ratio will be in the range of between 1/10 and 1/12, the actual reverse stock split ratio will be determined by the

Board of Directors and may be significantly higher or lower than such anticipated range.

Because the Board of Directors cannot predict

with any certainty how the Company’s stock price will react to the reverse stock split, the Board anticipates setting the reverse

split ratio at a level mathematically calculated to result in a stock price above the minimum requirement of $1.00 per share. For example,

if the Company’s stock price were $0.20 per share, to achieve a $1.00 post-split price, the theoretical reverse split ratio would

be 1/5 ($1.00/$0.20). In this example, for the reasons described herein, the Board of Directors might set the reverse stock split ratio

at 1/10 or some other ratio based on the considerations described herein.

Required Vote

Approval of the Reverse Stock Split requires the

affirmative vote of the holders of a majority of the issued and outstanding shares of the Company’s common stock present and entitled

to vote thereon as of the record date at the Annual Meeting of the Company’s shareholders.

| The Board recommends a vote FOR the amendment to effect a reverse stock split. |

PROPOSAL NO. 3 — ADVISORY VOTE ON

THE COMPENSATION OF

OUR NAMED EXECUTIVE OFFICERS

In accordance with the requirements of Section 14A

of the Securities Exchange Act of 1934, as amended, or the Exchange Act (which was added by the Dodd-Frank Wall Street Reform and Consumer

Protection Act of 2010) and related rules of the SEC, we are including a separate proposal subject to stockholder vote to approve, on

a non-binding, advisory basis, the compensation of those of our executive officers listed in the Summary Compensation Table appearing

elsewhere in this proxy statement, or our named executive officers, as disclosed in this proxy statement pursuant to Item 402 of

Regulation S-K.

The vote on this proposal is not intended to address

any specific element of compensation; rather, the vote relates to the compensation of our named executive officers, as described in this

proxy statement in accordance with the compensation disclosure rules of the SEC. To the extent there is any significant vote against our

named executive officer compensation as disclosed in this proxy statement, the compensation committee of our Board, or the Compensation

Committee, will evaluate whether any actions are necessary to address the concerns of stockholders.

Based on the above, we request that you indicate

your support for our executive compensation philosophy and practices, by voting in favor of the following resolution:

“RESOLVED, that the Company’s stockholders approve,

on a non-binding, advisory basis, the compensation of the Company’s named executive officers as described in this proxy statement,

including the “Compensation Discussion and Analysis” section, the compensation tables and the other narrative compensation

disclosures.”

The affirmative vote of the holders of a majority

of the stock having voting power present in person or represented by proxy shall be sufficient to approve this Proposal 3. The opportunity

to vote on this Proposal 3 is required pursuant to Section 14A of the Exchange Act. However, as an advisory vote, the vote on Proposal

3 is not binding upon us and serves only as a recommendation to our Board. Nonetheless, the Compensation Committee, which is responsible

for designing and administering our executive compensation program, and the Board value the opinions expressed by stockholders, and will

consider the outcome of the vote when making future compensation decisions for our named executive officers.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL

OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS,

AS DISCLOSED IN THIS PROXY STATEMENT. |

PROPOSAL NO. 4 — RATIFICATION OF THE SELECTION

OF BFBORGERS CPA PC AS

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL

YEAR ENDING DECEMBER 31, 2023.

Our audit committee of our Board (the “Audit

Committee”) has selected BF Borgers CPA PC as our independent registered public accounting firm (the “Independent Auditors”)

for the current fiscal year, subject to ratification by our stockholders at the Meeting. We do not expect to have a representative of

the Independent Auditors attending the Meeting.

Neither our by-laws, our other governing documents,

nor applicable law requires stockholder ratification of the selection of the Independent Auditors as our independent registered public

accounting firm. However, the Audit Committee is submitting the selection of the Independent Auditors to the stockholders for ratification

as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether

or not to retain the Independent Auditors. Even if the selection is ratified, the Audit Committee in its discretion may decide to appoint

a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change

would be in the best interests of the Company and its stockholders.

Required Vote

The affirmative vote of the holders of a majority

of the votes cast at the Meeting is required for the ratification of the selection of the independent registered public accounting firm.

Broker non-votes will not impact the outcome of the vote on this proposal but will be counted for purposes of determining whether there

is a quorum.

The Board recommends a vote “FOR” the ratification of the selection of BF Borgers CPA PC as

independent registered public accounting firm of

the Company for the fiscal year ending December 31, 2023. |

CORPORATE GOVERNANCE

Committees and Meetings of Our Board of Directors

The Board held sixteen meetings and took action

by consent three times during our fiscal year ended December 31, 2022 (“Fiscal 2022”). Throughout this period, each member

of our Board who was a director in Fiscal 2022 attended or participated in all of the total number of meetings of our Board held during

the period for which such person has served as a director, and the total number of meetings held by all committees of our Board on which

each the director served during the periods such director served. Our Board has three standing committees: The Compensation Committee,

the Audit Committee and the Nominating and Corporate Governance Committee.

Compensation Committee. The current members

of our Compensation Committee are Mr. Irby, Mr. Horowitz and Mr. Ferrara. Mr. Irby is the current Chairman of the Compensation Committee

and our board of directors has determined that all of the members of the Compensation Committee are “independent” as defined

by the rules of the SEC and Nasdaq rules and regulations. The Compensation Committee operates under a written charter that is posted on

our website at www.scworx.com.

The primary responsibilities of our Compensation

Committee include:

| |

● |

Reviewing and recommending to our Board of the annual base compensation, the annual incentive bonus, equity compensation, employment agreements and any other benefits of our executive officers; |

| |

● |

Administering our equity-based plans and exercising all rights authority and functions of the Board under all of the Company’s equity compensation plans, including without limitation, the authority to interpret the terms thereof, to grant options thereunder and to make stock awards thereunder; and |

| |

● |

Annually reviewing and making recommendations to our Board with respect to the compensation policy for such other officers as directed by our Board. |

The Compensation Committee meets, as often as

it deems necessary, without the presence of any executive officer whose compensation it is then approving.

Our Compensation Committee held one meeting during

2022.

Audit Committee. The current members of

our Audit Committee are Mr. Ferrara, Mr. Horowitz and Mr. Irby. Mr. Horowitz is the Chairman of the Audit Committee, and our

board of directors has determined that Mr. Horowitz is an “Audit Committee financial expert” and that all members of

the Audit Committee are “independent” as defined by the rules of the SEC and the Nasdaq rules and regulations. The Audit Committee

operates under a written charter that is posted on our website at www.scworx.com.

The primary responsibilities of our Audit Committee

include:

| |

● |

Appointing, compensating and retaining our registered independent public accounting firm; |

| |

● |

Overseeing the work performed by any outside accounting firm; |

| |

● |

Assisting the Board in fulfilling its responsibilities by reviewing: (i) the financial reports provided by us to the SEC, our stockholders or to the general public, and (ii) our internal financial and accounting controls; and |

| |

● |

Recommending, establishing and monitoring procedures designed to improve the quality and reliability of the disclosure of our financial condition and results of operations. |

Our Audit Committee held four meetings during

2022.

Nominating and Corporate Governance Committee.

The current members of our Nominating and Corporate Governance Committee are Mr. Horowitz, Mr. Ferrara, and Mr. Irby. Mr. Ferrara is the

Chairman of the Nominating and Corporate Governance Committee. Our board of directors has determined that all of the members of the Nominating

and Corporate Governance Committee are “independent” as defined by Nasdaq rules and regulations. The Nominating and Corporate

Governance Committee operates under a written charter that is posted on our website at www.scworx.com. The primary responsibilities

of our Nominating and Corporate Governance Committee include:

| |

● |

Assisting the Board in, among other things, effecting Board organization, membership and function including identifying qualified Board nominees; effecting the organization, membership and function of Board committees including composition and recommendation of qualified candidates; establishment of and subsequent periodic evaluation of successor planning for the chief executive officer and other executive officers; development and evaluation of criteria for Board membership such as overall qualifications, term limits, age limits and independence; and oversight of compliance with applicable corporate governance guidelines; and |

| |

● |

Identifying and evaluating the qualifications of all candidates for nomination for election as directors. |

Our Nominating and Corporate Governance Committee

held one meeting and did not take action by consent during 2022.

Potential nominees will be identified by the Board

based on the criteria, skills and qualifications determined by the Nominating and Corporate Governance Committee. In considering whether

to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, our Nominating and Corporate

Governance Committee will apply criteria including the candidate’s integrity, business acumen, knowledge of our business and industry,

age, experience, diligence, conflicts of interest and the ability to act in the interests of all stockholders. No particular criteria

will be a prerequisite or will be assigned a specific weight, nor do we have a diversity policy. We believe that the backgrounds and qualifications

of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will result in a well-rounded

board of directors and allow the Board to fulfill its responsibilities.

The Company has never received from stockholders

proposed nominees for director. Pursuant to the Bylaws, any nominations for director made by stockholders must be received no later than

120 calendar days in advance of the first anniversary after the mailing of this proxy statement. In 2022, we did not pay a fee to any

third party to identify or evaluate, or assist in identifying or evaluating, potential nominees for our Board. All of the nominees for

election at the Meeting are current members of our Board, while one current member is stepping off the board.

Leadership Structure. In his position as

Chairman of the Board, Mr. Irby is responsible for setting the agenda and priorities of the Board. As President and CEO, Mr. Timothy Hannibal

leads our day-to-day business operations and is accountable directly to the full Board. Mr. Christopher Kohler, our CFO, reports to Mr.

Hannibal and is responsible for overseeing the financial operations of the Company. We believe that this structure provides an efficient

and effective leadership model for the Company.

Risk Oversight. The Board, including the

Audit Committee, Compensation Committee and Nominating/Governance Committee, periodically reviews and assesses the significant risks to

the Company. Our management is responsible for the Company’s risk management process and the day-to-day supervision and mitigation

of risks. These risks include strategic, operational, competitive, financial, legal and regulatory risks. Our Board leadership structure,

together with the frequent interaction between our directors and management, assists in this effort. Communication between our Board and

management regarding long-term strategic planning and short-term operational practices include matters of material risk inherent in our

business.

The Board plays an active role, as a whole and

at the committee level, in overseeing management of the Company’s risks. Each of our Board committees is focused on specific risks

within their areas of responsibility, but the Board believes that the overall enterprise risk management process is more properly overseen

by all of the members of the Board. The Audit Committee is responsible for overseeing the management of financial and accounting risks.

The Compensation Committee is responsible for overseeing the management of risks relating to executive compensation plans and arrangements.

The Nominating and Governance Committee is responsible for setting standards for and recommending director nominees to the Board and advising

the Board about corporate governance matters. While each committee is responsible for the evaluation and management of such risks, the

entire Board is regularly informed through committee reports. The Board incorporates the insight provided by these reports into its overall

risk management analysis.

The Board administers its risk oversight responsibilities

through the Chief Executive Officer and the Chief Financial Officer, who, together with management representatives of the relevant functional

areas review and assess the operations of the Company as well as operating management’s identification, assessment and mitigation

of the material risks affecting our operations.

The Board has not adopted any policies involving

the ability of employees (including officers) or directors to pursue financial instruments or otherwise engage in transactions that hedge

or offset (or are designed to hedge or offset) any decrease in the market value of the Company’s Common Stock.

Board Diversity Matrix. The following chart

summarizes certain self-identified characteristics of the directors of the Company utilizing the categories and terms set forth in applicable

Nasdaq Rules and related guidance:

| Board Diversity Matrix (As of August 6, 2022) |

| Board Size: |

|

| Total Number of Directors |

4 |

| |

|

Female |

|

Male |

|

Non-

Binary |

|

Did not

Disclose Gender |

| Gender: |

| Directors |

|

- |

|

4 |

|

- |

|

- |

| Number of Directors who identify in Any of the Categories Below: |

| African American or Black |

|

- |

|

- |

|

- |

|

- |

| Alaskan Native or Native American |

|

- |

|

- |

|

- |

|

- |

| Asian (other than South Asian) |

|

- |

|

- |

|

- |

|

- |

| South Asian |

|

- |

|

- |

|

- |

|

- |

| Hispanic or Latinx |

|

- |

|

- |

|

- |

|

- |

| Native Hawaiian or Pacific Islander |

|

- |

|

- |

|

- |

|

- |

| White |

|

- |

|

4 |

|

- |

|

- |

| Two or More Races or Ethnicities |

|

- |

|

- |

|

- |

|

- |

| LGBTQ+ |

|

- |

| Persons with Disabilities |

|

- |

The Company has not actively solicited directors

to be added to the Board who would broaden the diversity on the Board or otherwise due to the size of the Company and its current directorship

needs.

COMMUNICATING WITH OUR BOARD OF DIRECTORS

Our Board will give appropriate attention to written

communications that are submitted by stockholders and will respond if and as appropriate. Timothy Hannibal, our Chief Executive Officer

and a director, with the assistance of our outside counsel, has been primarily responsible for monitoring communications from our stockholders

and for providing copies or summaries to the other directors as he considers appropriate. Communications are forwarded to all directors

if they relate to substantive matters and include suggestions or comments that Mr. Hannibal considers to be important for the directors

to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded

than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or

duplicative communications.

Stockholders who wish to send communications on

any topic to our Board should address such communications to: SCWorx Corp., c/o Timothy A. Hannibal, Chief Executive Officer, at

the address on the first page of this proxy statement.

ATTENDANCE AT STOCKHOLDER MEETINGS

We encourage our directors to attend our stockholders’

meetings.

EXECUTIVE COMPENSATION

The following summary compensation table sets

forth information concerning compensation for services rendered in all capacities during 2022 and 2021 awarded to, earned by or paid to

our executive officers. The value attributable to any option awards and stock awards reflects the grant date fair values of stock awards

calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718.

| | |

| | |

| | |

| | |

| | |

| | |

Non-Equity | | |

| | |

| |

| | |

| | |

| | |

| | |

Stock | | |

Option | | |

Incentive Plan | | |

All Other | | |

| |

| | |

Fiscal | | |

Salary | | |

Bonus | | |

Awards | | |

Awards | | |

Compensation | | |

Compensation | | |

Total | |

| Name and Principal Position | |

Year | | |

$ | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | |

| Timothy Hannibal (1) | |

| 2022 | | |

| 250,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 44,996 | | |

| 294,996 | |

| President, Chief Executive Officer and Director | |

| 2021 | | |

| 225,000 | | |

| - | | |

| 319,350 | | |

| - | | |

| - | | |

| 6,663 | | |

| 551,013 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Chris Kohler (2) | |

| 2022 | | |

| 90,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 90,000 | |

| Chief Financial Officer | |

| 2021 | | |

| 90,000 | | |

| - | | |

| 185,828 | | |

| - | | |

| - | | |

| - | | |

| 275,828 | |

| (1) |

Mr. Hannibal was hired as Chief Revenue Officer on February 1, 2019 and was appointed Interim Chief Financial Officer on June 10, 2020. On August 10, 2020, Mr. Hannibal was appointed President and Chief Operating Officer. On May 28, 2021, Mr. Hannibal was appointed President and Chief Executive Officer. |

| (2) |

Mr. Kohler was hired as Chief Financial Officer on November 1, 2020. |

Employee Grants of Plan Based Awards and Outstanding Equity

Awards at Fiscal Year-End

Prior to the completion of our initial public

offering, our Board of Directors adopted the SCWorx Corp. (formerly, Alliance MMA) 2016 Equity Incentive Plan (the “2016 Plan”)

pursuant to which the Company may grant shares of our common stock to the Company’s directors, officers, employees or consultants.

Our stockholders approved the 2016 Plan at our annual meeting of stockholders held September 1, 2017, and on January 30, 2019

approved the addition of 3,000,000 shares to be added to the 2016 Plan. On May 24, 2021, our stockholders approved the addition of another

2,000,000 shares to be added to the 2016 Plan. Unless earlier terminated by the Board of Directors, the 2016 plan will terminate, and

no further awards may be granted, after July 30, 2026.

As of December 31, 2022, there were no outstanding

stock option awards to officers of the Company.

Employment Agreements

Tim Hannibal, currently the Chief Executive Officer

of the Company has an employment agreement which was entered into in January 2021.

COMPENSATION OF DIRECTORS

Directors’ Compensation

The following summary compensation table sets forth

information concerning compensation for services rendered in all capacities during 2022 and 2021 awarded to, earned by or paid to our

directors. The value attributable to any stock option awards reflects the grant date fair values of stock awards calculated in accordance

with ASC Topic 718.

| | |

| | |

Fees | | |

| | |

| | |

| | |

Non-Equity | | |

| | |

| |

| | |

| | |

Earned or | | |

| | |

| | |

| | |

Incentive | | |

| | |

| |

| | |

| | |

Paid in | | |

| | |

Stock | | |

Option | | |

Plan | | |

All Other | | |

| |

| | |

Fiscal | | |

Cash | | |

Bonus | | |

Awards | | |

Awards | | |

Compensation | | |

Compensation | | |

Total | |

| Name and Principal Position | |

Year | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | |

| Alton Irby (1) | |

| 2022 | | |

| - | | |

| - | | |

| 138,000 | | |

| - | | |

| - | | |

| - | | |

| 138,000 | |

| Chairman and Director | |

| 2021 | | |

| - | | |

| - | | |

| 157,000 | | |

| - | | |

| - | | |

| - | | |

| 157,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| John Ferrara (2) | |

| 2022 | | |

| - | | |

| - | | |

| 124,200 | | |

| - | | |

| - | | |

| - | | |

| 124,200 | |

| Director | |

| 2021 | | |

| - | | |

| - | | |

| 124,584 | | |

| - | | |

| - | | |

| - | | |

| 124,584 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Steven Horowitz (3) | |

| 2022 | | |

| - | | |

| - | | |

| 124,200 | | |

| - | | |

| - | | |

| - | | |

| 124,200 | |

| Director | |

| 2021 | | |

| - | | |

| - | | |

| 124,584 | | |

| - | | |

| - | | |

| - | | |

| 124,584 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Steven Wallitt (4) | |

| 2022 | | |

| - | | |

| - | | |

| 110,400 | | |

| - | | |

| - | | |

| - | | |

| 110,400 | |

| Former Director | |

| 2021 | | |

| - | | |

| - | | |

| 157,000 | | |

| - | | |

| - | | |

| - | | |

| 157,000 | |

| (1) |

Alton Irby was appointed as a Director on March 16, 2021. |

| (2) |

John Ferrara was appointed as a Director on August 11, 2021. |

| (3) |

Steven Horowitz was appointed as a Director on August 11, 2021. |

| (4) |

Steven Wallitt was appointed as a Director on October 4, 2019. Mr Wallitt’s service was not continued effective the approval of the Company’s proxy statement nominations at our shareholder meeting held December 22, 2022. |

We do not have a formal plan for compensating

our directors for their service in their capacity as directors. However, during 2022, our directors each received the following:

| |

● |

70,000 Restricted Stock Units for Independent Directors serving on our Board |

| |

● |

10,000 Restricted Stock Units for Independent Directors serving on a committee |

| |

● |

10,000 Restricted Stock Units for Independent Directors chairing a committee |

| |

● |

10,000 Restricted Stock Units for Independent Directors serving as Chairman |

Currently, Directors are entitled to reimbursement

for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of our board of directors. The

board of directors may award special remuneration to any director undertaking any special services on our behalf other than services ordinarily

required of a director. Other than indicated above, no director received and/or accrued any compensation for his or her services as a

director, including committee participation and/or special assignments during 2022 or 2021.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

The following sets forth the

stock option awards to our officers and directors as of December 31, 2022.

| | |

Stock Awards | |

| Name | |

Number of

shares

or units of

stock

that have

not

vested | | |

Market

value of

shares or

units of

stock that

have not

vested | | |

Equity

incentive

plan

awards:

Number of

unearned

shares,

units or

other

rights that

have not

vested | | |

Equity

incentive

plan

awards:

Market or

payout

value of

unearned

shares,

units or

other

rights that

have not

vested | |

| Current Officers | |

| | | |

| | | |

| | | |

| | |

| Chris Kohler | |

| - | | |

$ | - | | |

| 12,500 | | |

$ | 19,125 | |

Directors, Executive Officers and Corporate Governance

The current members of our Board and our executive

officers, together with their respective ages and certain biographical information are set forth below. Directors hold office until the

next annual meeting of our stockholders and until their successors have been duly elected and qualified. Our executive officers are elected

by and serve at the designation and appointment of the board of directors.

| Name |

|

Age |

|

Position |

| Alton Irby(1)(2)(3) |

|

82 |

|

Chairman of the Board of Directors |

| Timothy A Hannibal |

|

54 |

|

Chief Executive Officer and Director |

| John Ferrara(1)(2)(3) |

|

71 |

|

Director |

| Steven Horowitz(1)(2)(3) |

|

52 |

|

Director |

| Chris Kohler |

|

43 |

|

Chief Financial Officer |

| (1) |

A member of the Audit Committee. |

| (2) |

A member of the Compensation Committee. |

| (3) |

A member of the Nominating and Corporate Governance Committee. |

The following is a summary of the business experience

of each of our executive officers.

Timothy A. Hannibal. Mr. Hannibal, 54, is a seasoned

technology executive and entrepreneur, with nearly 30 years’ experience in SaaS and cloud technology, driving revenue, go-to-market

strategies, business development and mergers and acquisitions. Mr. Hannibal joined the Company in January 2019 and currently serves

as its Chief Executive Officer. Prior to joining the Company, Mr. Hannibal was an employee at Primrose Solutions (the predecessor to SCWorx) which

he joined in September of 2016. At Primrose, Mr. Hannibal was responsible for overseeing marketing, sales and operations, including executing

the Company’s business plan. Mr. Hannibal has a successful track record of growth and management at both startup and national companies.

Mr. Kohler, 42, has over 15 years of experience

serving in a wide variety of roles in the finance and accounting sectors. Mr. Kohler is the founder and CEO of Kohler Consulting, Inc.,

which he founded in 2012. The firm, through Mr. Kohler, provides outsourced CFO and advisory services to private and public companies,

with a focus on small cap and start-up businesses.

There are no family relationships between any

of the director nominees or executive officers named in this proxy statement.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires

our executive officers and directors and persons who beneficially own more than 10% of a registered class of our equity securities to

file with the SEC initial statements of beneficial ownership, statements of changes in beneficial ownership and annual statements of changes

in beneficial ownership with respect to their ownership of the Company’s securities, on Forms 3, 4 and 5 respectively. Executive

officers, directors and greater than 10% shareholders are required by SEC regulations to furnish us with copies of all Section 16(a)

reports they file.

Based solely on our review of the copies of such

reports filed with the SEC, and on written representations by our officers and directors regarding their compliance with the applicable

reporting requirements under Section 16(a) of the Exchange Act, and without conducting an independent investigation of our own, we

believe that with respect to the fiscal year ended December 31, 2022, our officers and directors, and all of the persons known to

us to beneficially own more than 10% of our common stock filed all required reports on a timely basis.

REPORT OF THE AUDIT COMMITTEE

In the course of our oversight of the Company’s

financial reporting process, we have: (1) reviewed and discussed with management the audited financial statements the year ended

December 31, 2022; (2) discussed with the Independent Auditors the matters required to be discussed by the applicable requirements

of the Public Accounting Oversight Board and the SEC; and (3) received the written disclosures and the letter from the independent

registered public accounting firm required by applicable requirements of the standards of the Public Company Accounting Oversight Board

regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with the

independent accountant the independent accountant’s independence.

Based on the foregoing review and discussions,

the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022, for filing with the SEC.

By the Audit Committee of the Board of

Directors of SCWorx Corp.

Alton Irby

John Ferrara

Steven Horowitz

INFORMATION CONCERNING OUR INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors

has selected BF Borgers CPA PC, an independent registered public accounting firm, to audit our financial statements for the year ending

December 31, 2022. BF Borgers CPA PC has served as our independent registered public accounting firm since April 2021. Prior to April

2021, the Company’s independent registered public accounting firm was Sadler Gibb & Associates, LLC, and for the year ending

December 31, 2019, Withum served as the Company’s independent registered public accounting firm. The Company does not anticipate

a representative from either firm to attend the annual meeting.

On October 14, 2020, Withum Smith + Brown (“Withum”),

SCWorx Corp.’s independent registered public accounting firm, notified SCWorx Corp. (the “Company” or “Registrant”)

that it would no longer be able to provide audit and review services to the Company, effective October 14, 2020. The audit and review

services were discontinued for reasons unrelated to the reviews or audited financials of the Company. Withum had audited the Company’s

financial statements since 2019.

Withum’s report on the Company’s financial

statements for the fiscal year ended December 31, 2019 did not contain an adverse opinion or disclaimer of opinion, nor was such report

qualified or modified as to uncertainty, audit scope or accounting principle, except for an explanatory paragraph relating to a substantial

doubt regarding the Company’s ability to continue as a going concern. During the fiscal year ended December 31, 2019, and through

October 14, 2020, there were no disagreements with Withum on any matter of accounting principles or practices, financial statement disclosure,

or auditing scope or procedure which, if not resolved to Withum’s satisfaction, would have caused Withum to make reference to the

subject matter of the disagreement in connection with its report.

During the fiscal year ended December 31, 2019,

and through October 14, 2020, there were no “reportable events” as defined under Item 304(a)(1)(v) of Regulation S-K, except

for material weaknesses in internal control over financial reporting.

On October 20, 2020, the Company appointed Sadler

Gibb & Associates, LLC (“SG”) as its new independent registered public accounting firm, effective immediately, for the

fiscal year ending December 31, 2020. This appointment was authorized and approved by the Audit Committee of the Company’s Board

of Directors.

During the fiscal years ended December 31, 2019

and 2018 and through October 20, 2020, the Company did not consult with SG on the application of accounting principles to a specified

transaction, either completed or proposed, or consult with SG for the type of audit opinion that might be rendered on the Company’s

consolidated financial statements, where a written report or oral advice was provided that SG concluded was an important factor considered

by the Company in reaching a decision as to the accounting, auditing or financial reporting issue. In addition, the Company did not consult

with SG on the subject of any disagreement, as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions or on any

“reportable events” as identified under Item 304(a)(1)(v) of Regulation S-K.

As previously disclosed in the Company’s

Current Report on Form 8-K filed April 21, 2021, on April 15, 2021, Sadler Gibb & Associates, LLC notified the Company that it was

(i) terminating its engagement to provide audit and review services to the Company, effective April 14, 2021, and (ii) withdrawing its

consent and association with the Completed Interim Review of the consolidated financial statements performed by SG for the period ended

September 30, 2020. SG’s Letter stated that, in reaching this conclusion, it believed that it cannot rely on the representations

of management and that there are disagreements between the Company and SG on matters of accounting principles or practices, financial

statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of SG, would have caused

SG to make reference to the subject matter of the disagreement in their reports on the Company’s consolidated financial statements.

The Company disagreed with SG’s belief regarding the representations of management and requested the opportunity to explain its

position to SG, but SG declined such request. The Company and SG also disagreed about the number of reporting units the Company has for

financial reporting purposes. The Company’s CFO discussed with SG the number of reporting units. In addition, the Company engaged

an independent technical accounting expert who also discussed the Company’s position with SG.

On April 19, 2021, the Company appointed BF Borgers

CPA PC (“BFB”) as its new independent registered public accounting firm, effective immediately, for the fiscal year ended

December 31, 2020. This appointment was authorized and approved by the Audit Committee of the Company’s Board of Directors.

During 2022 and 2021, fees for services provided

by BF Borgers CPA PC were as follows:

| | |

For the year ended

December 31, | |

| | |

2022 | | |

2021 | |

| Audit Fees | |

$ | 179,400 | | |

$ | 164,800 | |

| Audit-Related Fees | |

| - | | |

| - | |

| Tax Fees | |

| - | | |

| - | |

| All Other Fees | |

| - | | |

| - | |

| Total | |

$ | 179,400 | | |

$ | 164,800 | |

During 2022 and 2021, fees for services provided

by Sadler Gibb were as follows:

| | |

For the year ended

December 31, | |

| | |

2022 | | |

2021 | |

| Audit Fees | |

$ | - | | |

$ | 40,000 | |

| Audit-Related Fees | |

| - | | |

| - | |

| Tax Fees | |

| - | | |

| - | |

| All Other Fees | |

| - | | |

| - | |

| Total | |

$ | - | | |

$ | 40,000 | |

During 2022 and 2021, fees for services provided

by Withum were as follows:

| | |

For the year ended

December 31, | |

| | |

2022 | | |

2021 | |

| Audit Fees | |

$ | - | | |

$ | - | |

| Audit-Related Fees | |

| - | | |

| - | |

| Tax Fees | |

| - | | |

| - | |

| All Other Fees | |

| - | | |

| 7,650 | |

| Total | |

$ | - | | |

$ | 7,650 | |

Audit Fees

Audit fees for 2022 and 2021 include amounts related

to the audit of our annual consolidated financial statements and quarterly review of the consolidated financial statements included in

our Quarterly Reports on Form 10-Q.

Audit Related Fees

Audit Related Fees include amounts related to

accounting consultations and services.

Tax Fees

Tax Fees include fees billed for tax compliance,

tax advice and tax planning services.

All Other Fees

Other Fees include fees billed for consents to

file prior period reports as part of our 2021 Form 10-K

Audit Committee Pre-Approval Policies and Procedures

Currently, the audit committee acts with respect

to audit policy, choice of auditors, and approval of out of the ordinary financial transactions. The audit committee pre-approves all

services provided by our independent registered public accounting firm. All of the above services and fees were reviewed and approved

by the audit committee before the services were rendered.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our policy is to enter into transactions with

related parties on terms that are on the whole no less favorable to us than those that would be available from unaffiliated parties at

arm’s length. Based on our experience in the business sectors in which we operate and the terms of our transactions with unaffiliated

third parties, we believe that all of the transactions described below met this policy standard at the time they occurred.

At December 31, 2022, 2021 and 2020, the Company

had amounts due to officers in the amount of $153,838.

During September 2021, the Company’s former

CEO (also a significant shareholder) advanced $100,000 in cash to the Company for short term capital requirements. This amount is non-interest

bearing and payable upon demand and included in Shareholder advance on the Company’s consolidated balance sheet as of December 31,

2022

STOCKHOLDER PROPOSALS

We intend to mail this proxy statement, the accompanying

proxy card and the 2022 annual report on or about August 25, 2023 to all stockholders of record that are entitled to vote. Stockholders

who wish to submit proposals for inclusion in our proxy statement and form of proxy relating to our next annual meeting of stockholders

must advise our Secretary of such proposals in writing by April 26, 2024, or 120 days prior to the one year anniversary of the mailing

of this proxy statement.

Stockholders who wish to present a proposal at

our next annual meeting of stockholders without inclusion of such proposal in our proxy materials must advise our Secretary of such proposals

in writing by April 26, 2024.

If we do not receive notice of a stockholder proposal

within this timeframe, our management will use its discretionary authority to vote the shares they represent, as the Board may recommend.

We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply

with these requirements.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information,

as of August 4, 2023, with respect to the beneficial ownership of the outstanding Common Stock held by (1) each person known by us

to be the beneficial owner of more than 5% of our Common Stock; (2) our current directors; (3) each of our named executive officers;

and (4) our executive officers and current directors as a group. Unless otherwise indicated, the persons named in the table below

have sole voting and investment power with respect to the number of shares indicated as beneficially owned by them. Unless otherwise indicated,

the address for each of the below persons is c/o SCWorx Corp., 590 Madison Avenue, 21st Floor, New York, NY 10022.

| Named Executive

Officers and Directors | |

Common

Stock | | |

Preferred

Stock | | |

Options/

Warrants | | |

Total | | |

Percentage

Ownership | |

| Current (as of August 4, 2023) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Timothy Hannibal | |

| 821,807 | | |

| — | | |

| — | | |

| 821,807 | | |

| 4.5 | % |

| Chris Kohler | |

| 104,750 | | |

| — | | |

| — | | |

| 104,750 | | |

| * | |

| Alton Irby | |

| 290,000 | | |

| — | | |

| — | | |

| 290,000 | | |

| 1.6 | % |

| John Ferrara | |

| 214,167 | | |

| — | | |

| — | | |

| 214,167 | | |

| 1.2 | % |

| Steven Horowitz | |

| 214,167 | | |

| — | | |

| — | | |

| 214,167 | | |

| 1.2 | % |

| Directors and Executive Officers as a Group (5 persons) | |

| 1,644,891 | | |

| — | | |

| — | | |

| 1,644,891 | | |

| 9.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Former | |

| | | |

| | | |