Operational Efficiency Improves: Operating

Expenses as a Percentage of Revenue Plunge by 35 Percentage Points

to 53%

Net Loss Improves by 31% Year-Over-Year

(All dollar amounts in this release are

unaudited and in U.S. dollars)

The Alkaline Water Company Inc. (NASDAQ: WTER) (the “Company”),

the country’s largest independent Alkaline water company, today

announced record-breaking financial results for the fiscal year

ending March 31, 2023. The Company reported historic high revenues

of $63.8 Million, representing year-over-year growth of 16%. The

Company also highlighted substantial progress on its Pathway to

Profitability. The corresponding Form 10-K will be filed with the

SEC on August 16, 2023, and can be accessed on the investor

relations section of the Company's website at

ir.theAlkalinewaterco.com.

The Company, the proud producer of Deliciously Smooth™

Alkaline88®, one of the nation’s best-selling alkaline water

brands, provided highlights and management commentary on the full

fiscal year.

Full-Year Fiscal 2023 Financial

Performance (all amounts in U.S. dollars):

- Revenue: Up 16% Year-over-Year (YoY) to $63.8MM.

- Gross Profit Margin: Improved by 111 basis points YoY to

18%.

- Total Operating Expenses (OpEx): Decreased $14.7 million

YoY.

- Total Operating Expenses as a Percentage of Revenue:

Improved from 88% to 53%, a 35 percentage point reduction YoY.

- Net Loss: Improved more than $12 million YoY from ($39.6

MM) to ($27.4 MM).

- Net Cash Used in Operating Activities: Improved 67% YoY,

from ($31.8MM) to ($10.4MM).

“Fiscal Year 2023 marked the highest revenue

in our company's history and 16% year-over-year growth, despite a

challenging economic environment,” stated Frank Chessman, President

and CEO of The Alkaline Water Company. “This achievement reflects

the strength of the Alkaline88® brand, the hard work of our team,

and the loyalty of our customers.”

Progress on the Pathway to Profitability—$22 Million in Cost

Savings and Margin Enhancement Now Identified:

In July of 2022, the Company announced its new Pathway to

Profitability, an initiative to increase margins, cut costs, and

improve overall operational efficiency.

The company's gross profit margin improved by 111 basis

points for the fiscal year. The improvement was a result of

more efficient production processes, better pricing on raw

materials, and strategic price increases to clients.

“Equally important to driving top-line

growth, we've emphasized cost control, margin enhancements, and

streamlining operations under our 'Pathway to Profitability'

initiative which we announced a year ago,” stated Mr. Chessman. “In

that time, we’ve seen an uptrend in our gross profit margin

which improved by over 100 basis points year over year.”

Amidst record revenue, another financial milestone stands

out—the substantial decrease in operating expenses relative to

our revenue. This fell sharply from 88% to 53%, a

year-over-year improvement of 35 percentage points.

The Alkaline Water Company has also managed to decrease net cash

used in operating activities by $21.4 million, down from ($31.8MM)

last year to ($10.4MM) this year. Furthermore, the company reported

that its net loss improved by 31%, and its loss per share (LPS)

improved by 50%.

Mr. Chessman added, “The Alkaline Water

Company is not only consistently driving top-line growth but also

ensuring that we extract maximum value out of every dollar of

revenue that we generate as we march on toward profitability. We

acknowledge there’s still a ways to go but we made progress in

fiscal year 2023 and trends continue in the right direction. We

have now identified approximately $22 Million in cost-savings and

margin enhancement compared to fiscal year 2022, once all the

changes are fully implemented. Our growth in topline sales and

these improvements in cost management and operational efficiency

all bring us closer to our goal of profitability.”

Key Business and Operational

Highlights

- Alkaline88 added over 11,000 new stores to its retail

footprint.

- Adding new clients in fiscal year 2023 was an important driver

to the Company’s continued growth. Alkaline88 found new shelf space

for the first time in stores across all channels including many

large and small regional convenience store chains, drug stores,

military exchanges, and whole divisions of large national grocery

banners like Whole Foods and Kroger.

- Alkaline88 expanded SKU offerings in over 33,000 existing

clients.

- Another important driver that helped the company maintain

double digit sales growth in fiscal year 2023 was the addition of

new SKUs in over 33,000 stores including some of the nation’s

largest drug store and grocery chains.

- The introduction of thousands of new distribution points and a

variety of size options in stores frequented by millions of

shoppers who are already familiar with the brand greatly increases

the likelihood of more Alkaline88 making its way into more shopping

carts across the country.

- Alkaline88 outpaced category growth in both dollar volume

and unit volume and continued its dominance as the leader in

bulk-sized Value-Added Water.

- For the 52-weeks ending 3/25/23 (6 days before the end of the

Company’s fiscal year), Nielsen xAOC+Conv. data shows that:

- Alkaline88 had over $93MM in retail sales, making it one of

only 12 brands across the nation with over $90MM in yearly sales

(excluding all private labels combined).

- Alkaline88 grew 19.5% year-over-year across all channels in

Dollar Volume, more than double the category’s growth, and

second-best amongst the 12 biggest brands.

- Alkaline88 also had the second-best Unit Volume growth amongst

the top-12 brands and was one of only five of these brands to

record growth in both Units and Dollars.

- The Alkaline88 1-Gallon was the 16th best-selling Value-Added

Water product by Dollar Volume in the entire country, regardless of

size. It outsold the next closest gallon product in the category by

more than 11x.

“The growth we've experienced this past fiscal year reaffirms

the strength of our brand, our strategy, and our team,” reiterated

Mr. Chessman. “We are optimistic about what the future holds for

The Alkaline Water Company as we continue to strive for

profitability, improve operational efficiencies, and create value

for our shareholders and customers."

Cash Flow and Operational

Runway

The Company reported limited cash resources at the end of the

fiscal year. As a result, the management team has remained focused

on securing the necessary funds to keep operations running

smoothly. The Company’s current credit facility, an asset-based

loan, has been extended into the fall as management pursues another

revolving financing agreement to continue pursuing the goal of

profitable operations.

Fiscal 2023 Complete Financial

Results

Complete results for the Company’s fiscal year 2023 will also be

filed on SEDAR under the Company’s profile on www.sedar.com and on

EDGAR at www.sec.gov.

Note on Reverse Split:

Effective April 5, 2023, The Company effected a one for fifteen

reverse stock split of its authorized, issued and outstanding

shares of common stock. As a result, the Company’s authorized

common stock has decreased from 200,000,000 shares of common stock,

with a par value of $0.001 per share, to 13,333,333 shares of

common stock, with a par value of $0.001 per share, and the number

of issued and outstanding shares of common stock has decreased from

approximately 152,149,661 to approximately 10,185,898. Any

fractional shares resulting from the reverse stock split were

rounded up to the next nearest whole number.

Accordingly, all share and per-share amounts referenced above

for the current period and prior periods have been adjusted to

reflect the reverse stock split.

About The Alkaline Water Company:

The Alkaline Water Company is the Clean Beverage® company making

a difference in the water you drink and the world we share.

Founded in 2012, The Alkaline Water Company (NASDAQ: WTER) is

headquartered in Scottsdale, Arizona. Its flagship product,

Alkaline88®, is a leading premier alkaline water brand available in

bulk and single-serve sizes along with eco-friendly aluminum

packaging options. With its innovative, state-of-the-art

proprietary electrolysis process, Alkaline88® delivers perfect 8.8

pH alkaline drinking water with trace minerals and electrolytes and

boasts our trademarked “Clean Beverage” label.

To purchase The Alkaline Water Company’s products online, visit

us at www.alkaline88.com.

To learn more about The Alkaline Water Company, please visit

www.thealkalinewaterco.com or connect with us on Facebook, Twitter,

Instagram, or LinkedIn.

Notice Regarding Forward-Looking Statements

This news release contains “forward-looking statements.”

Statements in this news release that are not purely historical are

forward-looking statements and include any statements regarding

beliefs, plans, expectations or intentions regarding the future.

Such forward-looking statements include, among other things, the

following: the statements relating to the Company’s pathway to

profitability, including the statement that the pathway to

profitability is an initiative to increase margins, cut costs and

improve overall operational efficiency; that the Company

acknowledges there’s still a ways to go on its pathway to

profitability but it has made progress in fiscal year 2023 and

trends continue in the right direction; that the Company has now

identified approximately $22 million in cost savings and margin

enhancement compared to fiscal year 2022 once all the changes are

fully implemented; that the Company’s growth in topline sales and

improvements in cost management and operational efficiency bring

the Company closer to its goal of profitability; and that the

Company is optimistic about what the future holds as it continues

to strive for profitability, improve operational efficiencies and

create value for its shareholders and customers.

The material assumptions supporting these forward-looking

statements include, among others, that the Company’s cost-saving

and margin enhancement measures will be fully implemented and, once

implemented, they will be effective to reduce the Company’s annual

expense and enhance the Company’s margin to the extent anticipated

by the Company; that the Company’s burn rate to reach the level

anticipated by the Company as a result of the Company’s proactive

reduction in its monthly burn rate; that the demand for the

Company’s products will continue to significantly grow; that the

past production capacity of the Company’s co-packing facilities can

be maintained or increased; that there will be increased production

capacity through implementation of new production facilities, new

co-packers and new technology; that there will be an increase in

number of products available for sale to retailers and consumers;

that there will be an expansion in geographical areas by national

retailers carrying the Company’s products; that there will be an

expansion into new national and regional grocery retailers; that

there will be an expansion into new e-commerce, home delivery,

convenience, and healthy food channels; that there will not be

interruptions on production of the Company’s products; that there

will not be a recall of products due to unintended contamination or

other adverse events relating to the Company’s products; and that

the Company will be able to obtain additional capital to meet the

Company’s growing demand and satisfy the capital expenditure

requirements needed to increase production and support sales

activity. Actual results could differ from those projected in any

forward-looking statements due to numerous factors. Such factors

include, among others, governmental regulations being implemented

regarding the production and sale of alkaline water; additional

competitors selling alkaline water and enhanced water products in

bulk containers reducing the Company’s sales; the fact that the

Company does not own or operate any of its production facilities

and that co-packers may not renew current agreements and/or not

satisfy increased production quotas; the fact that the Company has

a limited number of suppliers of its unique bulk bottles; the

potential for supply-chain interruption due to factors beyond the

Company’s control; the fact that there may be a recall of products

due to unintended contamination; the inherent uncertainties

associated with operating as an early stage company; changes in

customer demand and the fact that consumers may not embrace

enhanced water products as expected or at all; the extent to which

the Company is successful in gaining new long-term relationships

with new retailers and retaining existing relationships with

retailers; the Company’s ability to raise the additional funding

that it will need to continue to pursue its business, planned

capital expansion and sales activity; and competition in the

industry in which the Company operates and market conditions. These

forward-looking statements are made as of the date of this news

release, and the Company assumes no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those projected in the forward-looking

statements, except as required by applicable law, including the

securities laws of the United States and Canada. Although the

Company believes that any beliefs, plans, expectations and

intentions contained in this news release are reasonable, there can

be no assurance that any such beliefs, plans, expectations or

intentions will prove to be accurate. Readers should consult all of

the information set forth herein and should also refer to the risk

factors disclosure outlined in the reports and other documents the

Company files with the SEC, available at www.sec.gov, and on the

SEDAR, available at www.sedar.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230816095018/en/

The Alkaline Water Company Inc. Frank Chessman CEO

866-242-0240 investors@thealkalinewaterco.com

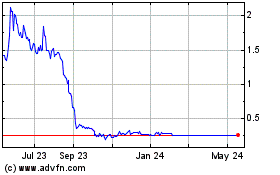

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Oct 2024 to Nov 2024

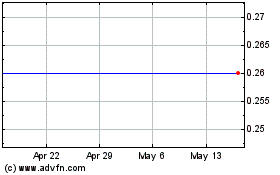

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Nov 2023 to Nov 2024