Trending: American Express 3Q Helped by Travel Demand

October 21 2022 - 1:28PM

Dow Jones News

13:58 ET -- American Express Co. is one of the most talked about

companies in the U.S. across all news items in the last 12 hours,

according to Factiva data. The company reported

better-than-expected third-quarter results, with earnings per share

rising to $2.47 from $2.27 a year earlier and revenue net of

interest expense up 24%, to $13.56 billion. American Express said

"demand for travel has exceeded our expectations throughout the

year." It reported favorable activity in card growth, including

millennials and Gen Z customers, and said credit metrics "remained

strong even as we steadily rebuild loan balances, with

delinquencies and write-offs continuing to be low." Consolidated

provisions for credit losses were $778 million, compared with a

benefit of $191 million a year ago, which reflected a $387 million

reserve build due to factors including loan growth and changes in

macroeconomic forecasts. Shares were recently down 3.5%, to

$137.40. Dow Jones & Co. owns Factiva.

(josh.beckerman@wsj.com)

(END) Dow Jones Newswires

October 21, 2022 14:13 ET (18:13 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

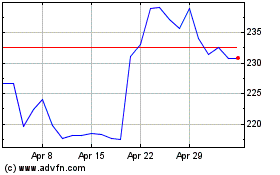

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

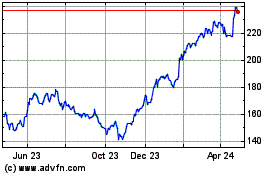

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024