false

0001747079

0001747079

2024-08-27

2024-08-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 27, 2024

BALLY’S CORPORATION

(Exact name of Registrant as Specified in its

Charter)

| Delaware |

|

001-38850 |

|

20-0904604 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

100 Westminster Street

Providence, RI |

|

02903 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 475-8474

Registrant’s telephone number, including

area code

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a.12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, $0.01 par value |

|

BALY |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement

On August 27, 2024, Bally’s Corporation,

a Delaware corporation (the “Company”), entered into Amendment No. 1 (the “Merger Agreement Amendment”)

to the Agreement and Plan of Merger, dated as of July 25, 2024 (the “Merger Agreement”), by and among the Company,

SG Parent LLC, a Delaware limited liability company (“Parent”), The Queen Casino & Entertainment Inc., a Delaware

corporation and affiliate of Parent (“Queen”), Epsilon Sub I, Inc., a Delaware corporation and wholly owned subsidiary

of the Company (“Merger Sub I”), Epsilon Sub II, Inc., a Delaware corporation and wholly owned subsidiary of the Company

(“Merger Sub II”, and together with the Company and Merger Sub I, the “Company Parties”), and,

solely for purposes of specified provisions of the Merger Agreement, SG CQ Gaming LLC, a Delaware limited liability company (“SG

Gaming” and together with Parent and Queen, the “Buyer Parties”). Each of the Buyer Parties and the Company

Parties is a party to the Merger Agreement Amendment. Capitalized terms used herein but not otherwise

defined have the meaning set forth in the Merger Agreement, a copy of which was filed as Exhibit 2.1 to the Current Report on Form 8-K

filed by the Company with the Securities and Exchange Commission (the “SEC”)

on July 25, 2024, which is incorporated herein by reference.

Parent and

SG Gaming are owned and controlled by Standard General L.P., a Delaware limited partnership (“Standard

General”). Soohyung Kim is the Managing

Partner and Chief Investment Officer of Standard General and is the Chairman of the Company’s Board of Directors (the “Board”). According

to a Schedule 13D amendment filed by Standard General with the SEC on July 26, 2024, Standard General and Mr. Kim beneficially owned 10,589,849

shares of Company Common Stock, or 26.1 % of the Company Common Stock as calculated in accordance with SEC Rule 13d-3. Standard

General and Mr. Kim each disclaim beneficial ownership of such shares except to the extent of its or his pecuniary interest in such shares.

The Merger Agreement Amendment was entered into

in order to amend the Rolling Share Election mechanism set forth in the Merger Agreement to provide for the issuance of a new class of

capital stock, Class A Common Stock, par value $0.01 per share, of the Company (the “Class A Common Stock”),

to be authorized by an amendment to the Fifth Amended and Restated Certificate of Incorporation of the Company (the “Certificate

of Amendment”) which, if approved by the Company Stockholders at the Company Stockholder Meeting, would have rights, preferences,

privileges, limitations and restrictions substantially identical to those of Company Common Stock (except for its conversion feature).

It is expected that any Class A Common Stock that is held by persons who are not Company “affiliates” and who do not otherwise

hold restricted shares of Company Common Stock generally would be tradable from the time of issuance until immediately prior to the Company

Effective Time.

Pursuant to the Merger Agreement Amendment,

if the Company Stockholders approve the Certificate of Amendment, the Company will issue the Class A Common Stock after the

Election Deadline and receipt of the Requisite Stockholder Approval and will use commercially reasonable efforts to effect such

issuance within two business days following the Election Deadline. The Merger Agreement Amendment provides that, in making any

Rolling Share Election, each record holder making such Rolling Share Election will be deemed to have elected to exchange each

Rolling Company Share to which such election pertains for a share of Class A Common Stock. Each share of issued Class A

Common Stock will be deemed to be and will be treated as a Rolling Company Share for all purposes under the Merger Agreement, as

amended by the Merger Agreement Amendment (the “Amended Merger Agreement”). The Company will use commercially

reasonable efforts to list any issued shares of Class A Common Stock on the NYSE. Shares of Class A Common Stock

that are issued will remain outstanding until the earliest to occur of a time immediately prior to the Company Effective Time (for

the avoidance of doubt, in which case such shares shall be deemed to be and shall continue to be treated as Rolling Company Shares)

and the time of termination of the Amended Merger Agreement in accordance with its terms, upon which event each share of

Class A Common Stock that is issued and outstanding will, by its terms, automatically convert into a share of Company Common

Stock.

If the Company Stockholders do not approve the

Certificate of Amendment that authorizes the Class A Common Stock, then each Rolling Company Share will remain outstanding as Company

Common Stock prior to the Company Effective Time, and the provisions in the Amended Merger Agreement regarding the issuance of Class A

Common Stock will not take effect. Further, if the Requisite Stockholder Approval is obtained for the Merger Proposal but the Company

Stockholders have not approved the Certificate of Amendment, then subject to compliance with applicable law (including, to the extent

applicable SEC Rules 13e-3 and 13e-4), Parent and the Company (subject to prior approval by the Special Committee) will, promptly following

the Company Stockholder Meeting, cause an additional period for Rolling Share Elections (and revocations by the applicable stockholders

of existing Rolling Share Elections) to be made prior to the Company Effective Time subject to such deadlines and procedures as they determine

to be necessary or appropriate.

The Merger

Agreement Amendment was approved by the Board and a special committee of independent directors of the Board (the “Special Committee”).

In addition, the Board, acting upon the unanimous recommendation of the Special Committee, has recommended that the Company Stockholders

vote to adopt the Amended Merger Agreement at the Company Stockholder Meeting. Neither the Special Committee nor the

Board has made any recommendation with regard to whether any stockholders of the Company should take the Rolling Share Election or retain

and hold the Rolling Company Shares, has considered the terms and conditions of the Rolling Share Election or the Rolling Company Shares,

or has made any recommendation with regard to or the merits of retaining an investment in the Company.

The foregoing description of the Merger Agreement

Amendment is not complete and is subject to and qualified in its entirety by reference to the Merger Agreement Amendment, a copy of which

is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Merger Agreement Amendment and the above description

of the Merger Agreement Amendment have been included to provide investors with information regarding the terms of the Merger Agreement

Amendment and the transaction contemplated thereby and by the Amended Merger Agreement. The Merger Agreement Amendment and the above description

of the Merger Agreement Amendment are not intended to provide any other factual information about the Company Parties, Buyer Parties or

their respective subsidiaries or affiliates.

Cautionary Statement

Concerning Forward-Looking Statements

Certain of the matters

discussed in this communication constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking

statements in this communication include, but are not limited to, statements regarding the proposed transaction, the ability of the Company

to complete the proposed transaction and the expected timing thereof and statements regarding the future prospects of the Company following

the completion of the proposed transaction. By their nature, forward-looking statements involve risks and uncertainties because they relate

to events and depend on circumstances that may or may not occur in the future. As a result, these statements are not guarantees of future

performance and actual events may differ materially from those expressed in or suggested by the forward-looking statements. Any forward-looking

statement made by the Company in this report filed with the SEC and other public statements made from time-to-time speak only as of the

date made. New risks and uncertainties come up from time to time, and it is impossible for the Company to predict or identify all such

events or how they may affect it. The Company has no obligation, and does not intend, to update any forward-looking statements after the

date hereof, except as required by federal securities laws. Factors that could cause these differences include, but are not limited to

those included in Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed by the Company

with the SEC. These statements constitute the Company’s cautionary statements under the Private Securities Litigation Reform Act

of 1995.

There are a number

of factors that could have material adverse effects on our future results, performance or achievements and cause our actual results

to differ materially from the forward-looking statements. These factors include, but are not limited to, (1) the timing, receipt and

terms and conditions of any required governmental or regulatory approvals of the Mergers, (2) the ability of the parties to satisfy

the conditions precedent and consummate the proposed Mergers, (3) the timing of consummation of the proposed Mergers, (4) the

ability of the parties to secure any required stockholder approval in a timely manner or on the terms desired or anticipated, (5)

failure of the parties to obtain the financing required to consummate the Company Merger, (6) the ability to achieve anticipated

benefits and savings expected from the proposed Mergers, (7) risks related to the potential disruption of management’s

attention from the ongoing business operations of the Company due to the pending Mergers, (8) the Company’s operating results

and businesses generally, (9) the outcome of any legal proceedings related to the proposed Mergers and (10) the general risks

associated with the respective businesses of the Company and Queen, including the general volatility of the capital markets, terms

and employment of capital, the volatility of the Company’s share price, interest rates or general economy, potential adverse

effects or changes to the relationships with the parties’ customers, competitors, suppliers or employees or other parties

resulting from the announcement, pendency or completion of the proposed Mergers, unpredictability and severity of catastrophic

events, including but not limited to the risks related to the effects of pandemics and global outbreaks of contagious diseases (such

as the COVID-19 pandemic) and domestic or geopolitical crises, such as terrorism, military conflict (including the outbreak of

hostilities between Russia and Ukraine and Israel and Hamas), war or the perception that hostilities may be imminent, political

instability or civil unrest, or other conflict.

Additional Information and Where to Find It

This communication is being made in respect of

the proposed transaction involving the Company, Standard General, and Queen. In connection with the proposed transaction, (i) the Company

filed with the SEC a preliminary proxy statement on Schedule 14A on August 28, 2024 and (ii) certain participants in the transaction,

including the Company, Standard General and Queen, jointly filed with the SEC a Schedule 13E-3 Transaction Statement on August 28, 2024,

which will contain important information on the Company, Standard General, Queen and the transaction, including the terms and conditions

of the transaction. Promptly after filing its definitive proxy statement with the SEC, the Company will mail the definitive proxy statement,

the Schedule 13E-3 and a proxy card to each stockholder of the Company entitled to vote at the Company Stockholders Meeting. Prior to

the closing, the Company will distribute election forms to its stockholders for use by stockholders to consider making a rollover election

with respect to all or a portion of their stock in the Company. This communication is not a substitute for the proxy statement, the Schedule

13E-3 Transaction Statement, the election form or any other document that the Company may file with the SEC or send to its stockholders

in connection with the proposed transaction. The materials to be filed by the Company will be made available to the Company’s investors

and stockholders at no expense to them and copies may be obtained free of charge on the Company’s website at www.ballys.com. In

addition, all of those materials will be available at no charge on the SEC’s website at www.sec.gov. Investors and stockholders

of the Company are urged to read the proxy statement, the Schedule 13E-3 Transaction Statement, the election form and the other relevant

materials when they become available before making any voting or investment decision with respect to the proposed transaction because

they contain important information about the Company, Standard General, Queen and the proposed transaction. This communication does not

constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval.

Participants in the Proxy Solicitation:

The Company and its directors, executive officers,

other members of its management and employees, and Standard General, Queen and their respective directors, executive officers and other

members of their respective management and employees, may be deemed to be participants in the solicitation of proxies of the Company Stockholders

in connection with the proposed transaction under SEC rules. Investors and stockholders may obtain more detailed information regarding

the names, affiliations and interests of the Company’s executive officers and directors in the solicitation by reading the Company’s

proxy statement on Schedule 14A filed with the SEC on April 5, 2024, in connection with its 2024 annual meeting of stockholders. Investors

and stockholders may obtain more detailed information regarding the names, affiliations and interests of the other participants in the

solicitation by reading the proxy statement, the Schedule 13E-3 Transaction Statement, the election form and other relevant materials

that have been or will be filed with the SEC in connection with the proposed transaction when they become available. Information concerning

the interests of the Company’s participants in the solicitation, which may, in some cases, be different than those of the Company

Stockholders generally, will be set forth in such proxy statement relating to the proposed transaction, a preliminary copy of which was

filed with the SEC on August 28, 2024, and the Schedule 13E-3 Transaction Statement which was filed with the SEC on August 28, 2024.

STOCKHOLDERS OF THE COMPANY ARE URGED TO READ

ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, THE SCHEDULE 13E-3 TRANSACTION STATEMENT, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TRANSACTION.

Item 9.01 Financial Statements and Exhibits.

Exhibit

Number |

|

Description |

| 2.1* |

|

Amendment No. 1 to the Agreement and Plan of Merger, dated as of August 27, 2024, by and among the Company, Parent, Queen, Merger Sub I, Merger Sub II, and, solely for purposes of specified provisions of the Merger Agreement, SG Gaming. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| * | Schedules (or similar

attachments) have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The registrant will furnish copies of any such schedules

or similar attachments to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BALLY’S CORPORATION. |

| |

|

| Date: August 28, 2024 |

By: |

/s/ Kim M. Barker |

| |

|

Kim M. Barker |

| |

|

Chief Legal Officer |

4

Exhibit 2.1

AMENDMENT

NO. 1

TO

AGREEMENT

AND PLAN OF MERGER

This AMENDMENT NO. 1 (this

“Amendment”), dated as of August 27, 2024 to the Agreement and Plan of Merger dated as of July 25, 2024 (as the same

may be amended, modified or supplemented in accordance with its terms, the “Merger Agreement”) is entered into by and

among Bally’s Corporation, a Delaware corporation (the “Company”), SG Parent LLC, a Delaware limited liability

company (“Parent”), The Queen Casino & Entertainment, Inc., a Delaware corporation and affiliate of Parent (“Queen”),

Epsilon Sub I, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Merger Sub I”), Epsilon Sub

II, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Merger Sub II”, and together with

the Company and Merger Sub I, the “Company Parties”), and, solely for purposes of specified provisions of the Merger

Agreement, SG CQ Gaming LLC, a Delaware limited liability company (“SG Gaming” and together with Parent and Queen,

the “Buyer Parties”). Each of the Buyer Parties and the Company Parties is sometimes referred to as a “Party”

and collectively as the “Parties.”

WHEREAS,

the Parties entered into the Merger Agreement as of July 25, 2024 (the “Original Execution Date”);

WHEREAS,

Section 11.13 of the Merger Agreement permits the Parties to amend the Merger Agreement prior to the Closing by an instrument in writing

signed by the Parties; and

WHEREAS,

the Parties desire to amend certain terms of the Merger Agreement to the extent provided herein.

NOW,

THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties, intending to

be legally bound hereby, agree as follows:

Section

1. Defined Terms; References. Unless otherwise specifically defined herein, each capitalized

term used herein that is defined in the Merger Agreement has the meaning assigned to such term in the Merger Agreement.

Section

2. Amendments to the Merger Agreement.

Section

1.1 of the Merger Agreement is hereby amended to add the following definition in the appropriate alphabetical order:

“Class

A Common Stock” means Class A common stock, par value $0.01 per share, of the Company to be authorized by the proposed amendment

to the Company Charter having the rights, privileges, preferences, restrictions and limitations substantially in the form set forth on

Annex A hereto.

Section

1.2 is amended to change all references to Section 2.8 and any paragraph thereof to simply Section 2.8.

(a) Sections

2.8(a), (b), (c) and (d) of the Merger Agreement are amended to read as follows:

(a) Elections.

Each Person (other than the Company and its Subsidiaries) who is a record holder of shares of Company Common Stock on the Election Form

Record Date, or who becomes a record holder of shares of Company Common Stock during the period between the Election Form Record Date

and the Election Deadline and has received the Election Form and related materials pursuant to Section 2.8(c), may submit

an Election Form specifying the number of shares of Company Common Stock held by such Person that such Person elects to have remain issued

and outstanding in the Company Merger (each such share of Company Common Stock for which such election is validly made and not revoked

in accordance herewith, a “Rolling Company Share,” and each such election, a “Rolling Share Election”).

In making any Rolling Share Election, each such record holder making such election shall be deemed to have elected to exchange each Rolling

Company Share to which such election pertains for a share of Class A Common Stock of the Company; provided, that if the Company Stockholders

do not approve the proposed amendment to the Company Charter authorizing the Class A Common Stock, then each Rolling Company Share shall

remain outstanding prior to the Company Effective Time in the form of Company Common Stock and the provisions of this Section 2.8

that relate to the issuance of the Class A Common Stock shall not take effect. Each such share of Class A Common Stock shall be deemed

to be and shall be treated as a Rolling Company Share. The Company will use commercially reasonable efforts to list any issued Class

A Common Stock on the NYSE. Each share of issued Class A Common Stock shall, by its terms, automatically convert into a share of Company

Common Stock, without any action by the relevant holder of such Class A Common Stock or the Company, upon the earlier to occur of (i) the

time that is immediately prior to the Company Effective Time (for the avoidance of doubt, in which case such shares of Company Common

Stock shall be deemed to be and shall be treated as a Rolling Company Share) and (ii) the termination of this Agreement. Any such

record holder who fails to properly submit an Election Form on or before the Election Deadline in accordance with the procedures set

forth in this Section 2.8(a) with respect to all or any portion of such holder’s shares of Company Common Stock shall

be deemed to have not made a Rolling Share Election with respect to such shares. Holders of record of shares of Company Common Stock

who hold such shares of Company Common Stock as nominees, trustees or in other representative capacities may submit a separate Election

Form on or before the Election Deadline with respect to each beneficial owner for whom such nominee, trustee or representative holds

shares of Company Common Stock. Each of Parent and the Company shall have the authority to reject all or any part of a Rolling Share

Election at any time prior to the Company Effective Time if it determines in good faith that such election is reasonably likely to delay

or prevent receipt of any of the Requisite Gaming Approvals or the holding of shares of Company Common Stock after Closing by the holder

who made such election is reasonably likely to adversely affect the conduct of Gaming Activities by the Surviving Corporation or any

of its Subsidiaries after the Closing. If all or any part of a Rolling Share Election is rejected (i) prior the issuance of Class

A Common Stock in exchange for any shares of Company Common Stock to which such rejected Rolling Share Election relates, such shares

of Company Common Stock shall be returned to the Company Stockholder that submitted the same to the Payment Agent and shares represented

by such Certificates and Book-Entry Shares in respect of which an Election Form was previously submitted shall thereupon become transferable

on the stock transfer books and ledger of the Company or (ii) following the issuance of Class A Common Stock in exchange for any

shares of Company Common Stock to which such rejected Rolling Share Election relates, such shares of Class A Common Stock shall be exchanged

for an equal number of shares of Company Common Stock. The Parties agree to treat each Rolling Share Election as a non-realization event

for U.S. federal income tax purposes.

(b) Appointment

of Payment Agent. Prior to the mailing of the Proxy Statement by the Company to the Company Stockholders: (i) Parent and the Company

shall mutually agree on the appointment of a bank or trust company to act as payment and exchange agent (the “Payment Agent”)

in respect of the Rolling Share Election, Class A Common Stock issuance and conversion, Company Merger and payment of the Per Share Price;

and (ii) the Company will enter into a paying agent agreement, in form and substance reasonably acceptable to Parent and the Company,

with such Payment Agent, to which Parent shall be a third-party beneficiary.

(c) Mailing

of Election Form; Election Deadline. Parent shall prepare, and the Company shall direct the Payment Agent to mail, a form of election,

which form shall be subject to the reasonable approval of the Company (the “Election Form”), at least twenty (20)

Business Days prior to the Company Stockholder Meeting, as reasonably determined by Parent and the Company, to the record holders of

Company Common Stock on the record date for the Company Stockholder Meeting (the “Election Form Record Date”), which

Election Form shall permit each record holder of shares of Company Common Stock (other than the Company and its Subsidiaries) who wishes

to make a Rolling Share Election to specify the number of shares of Company Common Stock with respect to which each such holder elects

the Rolling Share Election; provided that the Company shall use commercially reasonable efforts to mail or otherwise make available (by

posting on the Company’s website or otherwise) the Election Form and related materials to all Persons who become record holders

of Company Common Stock during the period between the Election Form Record Date and the Election Deadline for use by such holders who

desire to make a Rolling Share Election. Any such holder’s Rolling Share Election shall have been properly made only if the Payment

Agent shall have received at its designated office, by 5:00 p.m. Eastern time on the date of the Company Stockholder Meeting or such

later date mutually agreed by Parent and the Company (the “Election Deadline”), an Election Form properly completed

and signed and, if the shares of Company Common Stock in respect of which such election is sought to be made are represented by a certificate

or certificates (the “Certificates”), such Election Form shall be accompanied by such Certificate or Certificates

(or by an appropriate guarantee of delivery of such Certificate or Certificates as set forth in the Election Form from a member in good

standing of the Securities Transfer Agents Medallion Program or any other “eligible guarantor institution,” as such term

is defined in Rule 17Ad-15 of the Exchange Act, provided that such Certificate or Certificates are in fact delivered to the Payment Agent

within five (5) Business Days after receipt by the Payment Agent of such guarantee of delivery (or as promptly as practicable thereafter))

together with a letter of transmittal in form reasonably acceptable to the Company. The Election Form may provide that the stockholders

making a Rolling Share Election agree not to effect any sales or other transfers of the Company Common Stock relating thereto from the

time of submission of the related Election Form unless and until the shares of Class A Common Stock are issued in respect thereof. The

Company shall issue the Class A Common Stock after the Election Deadline and receipt of the Requisite Stockholder Approval, and shall

use commercially reasonable efforts to effect such issuance within two (2) Business Days following the Election Deadline. Such shares

of Class A Common Stock shall be issued to the stockholder that submitted the applicable Election Form (or otherwise in accordance with

the Election Form) in the same form (i.e., certificated or book entry) as the shares of Common Stock subject to the Election Form.

(d) Ability

to Revoke Election Forms. Any Election Form may be revoked by the record holders of Company Common Stock submitting it to the Payment

Agent only by written notice received by the Payment Agent prior to the Election Deadline. All Election Forms shall automatically be

revoked if the Payment Agent is notified in writing by Parent and the Company that the Company Merger has been abandoned and this Agreement

has been terminated. If an Election Form is properly revoked by the record holder of Company Common Stock prior to the Election Deadline

or is automatically revoked pursuant to the immediately preceding sentence, any Certificates (or guarantees of delivery, as appropriate)

for the shares of Company Common Stock to which such Election Form relates shall be returned to the stockholder that submitted the same

to the Payment Agent and shares represented by such Certificates and Book-Entry Shares in respect of which an Election Form was previously

submitted shall thereupon become transferable on the stock transfer books and ledger of the Company.

(b) Sections

2.8(f) and (g) of the Merger Agreement is hereby amended to read as follows:

(f) Notification

of Rolling Company Shares. The Company shall provide, or cause to be provided, prompt notice (but in any event within two (2) Business

Days following the Requisite Stockholder Approval) to each Company Stockholder who submits a Rolling Share Election of the number of

shares of Company Common Stock held by such Company Stockholder that will be Rolling Company Shares; provided that none of Parent,

Merger Sub I or the Company shall be under any obligation to notify any Person of any defect in an Election Form.

(g) Certificates;

Book-Entry Shares. Any Certificate or Certificates that immediately prior to the Company Effective Time represented outstanding shares

of Class A Common Stock and any book-entry shares that immediately prior to the Company Effective Time represented outstanding shares

of Class A Common Stock shall, by their terms, be converted into an equal number of shares of Company Common Stock immediately prior

to the Company Effective Time and shall remain issued and outstanding as shares of Company Common Stock from and after the Company Effective

Time. Shares of Company Common Stock into which shares of Class A Common Stock are converted shall be issued to the stockholder in the

same form (i.e., certificated or book entry) as the shares of Class A Common Stock that was converted.

(c) Section

2.8 of the Merger Agreement is hereby amended by adding the following as Sections 2.8(h) and (i):

(h)

Reopening of Rolling Share Elections. After receipt of the Requisite Stockholder Approval and subject to compliance with applicable

law (including, to the extent applicable SEC Rules 13e-3 and 13e-4), notwithstanding the foregoing provisions of this Section 2.8,

Parent and the Company (subject to the prior approval by the Special Committee) may elect to cause one or more periods for Rolling Share

Elections to be made prior to the Company Effective Time subject to such deadlines and procedures as they determine to be necessary or

appropriate. If the Requisite Stockholder Approval is obtained and the Company Stockholders have not approved the proposed amendment

to the Company Charter authorizing the Class A Common Stock, subject to compliance with applicable law (including, to the extent applicable

SEC Rules 13e-3 and 13e-4), notwithstanding the foregoing provisions of this Section 2.8, Parent and the Company (subject to prior

approval by the Special Committee) shall, promptly following the Company Stockholder Meeting, cause an additional period for Rolling

Share Elections (and revocations by the applicable stockholders of existing Rolling Share Elections) to be made prior to the Company

Effective Time subject to such deadlines and procedures as they determine to be necessary or appropriate. The Company shall notify

Company Stockholders of each such period and the related deadlines and procedures by the filing with the SEC of a Form 8-K or such other

report or schedule as may be appropriate.

(i)

Treatment of Class A Common Stock Converted into Common Stock. For the avoidance of

doubt, all Company Common Stock into which Class A Common Stock is converted immediately prior to the Company Effective Time shall be

treated as Rolling Company Shares in connection with the Company Merger unless and to the extent that Parent or the Company rejects all

or any part of a Rolling Share Election with respect to such shares of Class A Common Stock prior to the Company Effective Time.

(d)

Section 8.9 of the Merger Agreement is hereby amended by adding the following immediately after the words “the Queen Merger”:

“or any exchange of shares of Company Common Stock for shares of Class A Common Stock or exchange of conversion of shares of Class

A Common Stock to shares of Common Stock”.

Section

3. Company Disclosure Letter. The Company Disclosure Letter is amended as set forth on Annex B to this Amendment. Each part

of the Company Disclosure Letter corresponds to the numbered and lettered sections and subsections of the Merger Agreement, it being

understood that any matter disclosed in any section or subsection of the Company Disclosure Letter will be deemed to be disclosed with

respect to each other section or subsection of the Agreement to the extent that it is reasonably apparent on the face of such disclosure

that it is applicable to such other section or subsection of the Merger Agreement.

Section

4. Effect of Amendment. From and after the date hereof, each reference in the Merger Agreement (or in any and all instruments or

documents provided for in the Merger Agreement or delivered or to be delivered thereunder or in connection therewith) to “this

Agreement”, “hereunder”, “hereof”, “herein”, or words of like import shall, except where the

context otherwise requires, be deemed a reference to the Merger Agreement as amended hereby. No reference to this Amendment need be made

in any instrument or document at any time referring to the Merger Agreement, and a reference to the Merger Agreement in any of such instruments

or documents will be deemed to be a reference to the Merger Agreement as amended hereby. The parties hereto agree that all references

in the Merger Agreement to “the date hereof” or “the date of this Agreement” shall refer to the Original Execution

Date. The Merger Agreement shall not be modified by this Amendment in any respect except as expressly set forth herein.

Section

5. Other Provisions. This Amendment hereby incorporates the provisions of Section 1.3 and Article XI (General Provisions) of

the Merger Agreement as if fully set forth herein, mutatis mutandis.

[Signature

Pages Follow]

IN

WITNESS WHEREOF, the Parties have caused this Agreement to be executed and delivered by their respective duly authorized officers as

of the date first written above.

| |

SG PARENT

LLC |

| |

|

| |

By |

/s/

Soohyung Kim |

| |

Name: |

Soohyung Kim |

| |

Title: |

Chief Executive Officer |

| |

|

| |

THE QUEEN

CASINO & ENTERTAINMENT, INC. |

| |

|

| |

By |

/s/

Vladimira Mircheva |

| |

Name: |

Vladimira Mircheva |

| |

Title: |

Chief Financial Officer |

| |

|

| |

SG CQ GAMING

LLC |

| |

|

| |

By |

/s/

Soohyung Kim |

| |

Name: |

Soohyung Kim |

| |

Title: |

Manager |

| |

|

| |

BALLY’S

CORPORATION |

| |

|

| |

By |

/s/

Marcus Glover |

| |

Name: |

Marcus Glover |

| |

Title: |

Chief Financial Officer |

| |

|

|

| |

EPSILON SUB I, INC. |

| |

|

|

| |

By |

/s/ Marcus Glover |

| |

Name: |

Marcus Glover |

| |

Title: |

Director and Chief Financial Officer |

| |

|

|

| |

EPSILON SUB II, INC. |

| |

|

|

| |

By |

/s/ Marcus Glover |

| |

Name: |

Marcus Glover |

| |

Title: |

Director and Chief Financial Officer |

[Signature

Page to Amendment No. 1 to the Agreement and Plan of Merger]

Annex

A

Certificate

of Amendment

to

the

Fifth

Amended and Restated Certificate of Incorporation

of

Bally’s Corporation

Bally’s

Corporation, a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby

certifies as follows:

1.

The Corporation filed its original Certificate of Incorporation with the Delaware Secretary of State on March 23, 2004 (the “Original

Certificate”). The Original Certificate was amended and restated by the Amended and Restated Certificate of Incorporation filed

with the Delaware Secretary of State on March 26, 2004 (the “First Amended and Restated Certificate”). The First Amended

and Restated Certificate was further amended and restated by the Amended and Restated Certificate of Incorporation filed on November

5, 2010 (the “Second Amended and Restated Certificate”). The Second Amended and Restated Certificate was further amended

on February 14, 2011 and May 9, 2013, in each case, by filing a Certificate of Amendment with the Delaware Secretary of State,

effective as of such dates. The Second Amended and Restated Certificate was amended and restated by the Amended and Restated Certificate

of Incorporation filed with the Delaware Secretary of State on July 25, 2013 (the “Third Amended and Restated Certificate”).

The Third Amended and Restated Certificate was amended and restated by the Amended and Restated Certificate of Incorporation filed with

the Delaware Secretary of State on July 8, 2014 (the “Fourth Amended and Restated Certificate”). The Fourth Amended

and Restated Certificate was further amended by filing a Certificate of Amendment with the Delaware Secretary of State, effective as

of November 9, 2020. The Fourth Amended and Restated Certificate was amended and restated by Fifth Amended and Restated Certificate of

Incorporation filed with the Delaware Secretary of State on May __, 2021(the “Fifth Amended and Restated Certificate”).

2.

The Board of Directors of the Corporation (the “Board”) adopted a resolution filed with the minutes of the Board proposing

and declaring advisable that the Fifth Amended and Restated Certificate be amended.

3.

This Certificate of Amendment to the Fifth Amended and Restated Certificate of Incorporation of the Corporation (the “Certificate

of Amendment”) has been duly executed and acknowledged by an officer of the Corporation in accordance with the provisions of

Section 242 of the Delaware General Corporation Law.

4.

That pursuant to a resolution of the Board, this Certificate of Amendment was duly adopted by the stockholders in a manner and by the

vote prescribed in Sections 222 and 242 of the DGCL.

5.

The Fifth Amended and Restated Certificate is hereby amended and restated in its entirety as follows:

| (a) | Section

4.01 of the Fifth Amended and Restated Certificate is hereby amended to read as follows: |

Section 4.01. Authorized

Stock. The Corporation is authorized to issue two classes of registered capital stock, designated common stock and preferred

stock. The aggregate number of registered shares that the Corporation is authorized to issue is 270,000,000, consisting of

200,000,000 shares of common stock, par value $0.01 per share (“Common Stock”), 60,000,000 shares of Class A

common stock, par value, $0.01 per shares (“Class A Common Stock”), and 10,000,000 shares of preferred stock, par

value $0.01 per share (“Preferred Stock”).

| (b) | Article

IV of the Fifth Amended and Restated Certificate is hereby amended by adding as a new Section

4.03A between Section 4.03 and Section 4.04 thereof that reads as follows: |

Section

4.03A. Class A Common Stock. The Class A Common Stock shall have the following powers, preferences, privileges, restrictions

and limitations:

| |

(A) |

Ranking and Characteristics. Except as expressly set forth herein (including without limitation Section 4.03A(B) hereof), with respect to dividends, the distribution of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, and voting, all shares of the Class A Common Stock will be on parity with, and shall be identical in all respects to, the Common Stock of the Corporation. Except as required by applicable law, the Class A Common Stock will vote on all matters as a single class with the Common Stock. The Class A Common Stock shall be subject to all other provisions of this Amended and Restated Certificate of the Corporation, as amended, including without limitation, Sections 4.08 through Section 4.10 hereof. |

| (B) | Automatic Conversion. Upon the occurrence of a Conversion

Event (as defined below) with respect to an outstanding share of Class A Common Stock, such share of Class A Common Stock shall automatically

convert into one share of Common Stock of the Corporation without any action by the relevant holder of such shares or the Corporation.

As promptly as possible following such Conversion Event, the Corporation shall send each holder of Class A Common Stock with respect

to which a Conversion Event has occurred written notice of the Conversion Event. All shares of Common Stock issued hereunder by the Corporation

in connection with any such conversion of the Class A Common Stock shall be duly and validly issued, fully paid and nonassessable. All

shares of Class A Common Stock converted as provided in this Section 4.03A(B) shall no longer be deemed outstanding as of the

effective time of the conversion and all rights with respect to such shares shall immediately cease and terminate as of such time other

than the right of the holder thereof to receive shares of Common Stock in exchange therefor. Upon the occurrence of a Conversion Event,

Class A Common Stock shall no longer be issuable by the Corporation. |

| (C) | Definitions.

As used herein, the following terms shall have the meanings set forth below: |

| 1. | “Conversion

Event” means the earliest to occur of: (i) a time immediately prior to the Company

Effective Time (as defined in the Merger Agreement); and (ii) the termination of the Merger

Agreement in accordance with its terms; and |

| 2. | “Merger Agreement” means the Agreement and Plan of Merger dated as of July 25, 2024

(as the same has been and may be amended, modified or supplemented in accordance with its terms) among the Corporation, SG Parent LLC,

a Delaware limited liability company (“Parent”), The Queen Casino & Entertainment, Inc., a Delaware corporation

and affiliate of Parent, Epsilon Sub I, Inc., a Delaware corporation and wholly owned subsidiary of the Corporation, Epsilon Sub II, Inc.,

a Delaware corporation and wholly owned subsidiary of the Corporation, and, solely for purposes of specified provisions of the Merger

Agreement, SG CQ Gaming LLC, a Delaware limited liability company. |

| (c) | No

Reissuance; Cancellation. Any shares of Class A Common Stock converted or otherwise acquired

by the Corporation or any subsidiary of the Corporation shall be cancelled and retired and no such shares shall thereafter be reissued,

sold, or transferred. Upon the occurrence of a Conversion Event, all authorized and unissued shares of Class A Common Stock shall be

cancelled and retired. |

IN WITNESS WHEREOF,

the Corporation has caused this Amended and Restated Certificate to be signed by its duly authorized officer on this [●] day of

[●], [2024].

| BALLY'S

CORPORATION |

| a

Delaware corporation |

| |

|

|

| By: |

|

|

| |

Name: |

|

| |

Title: |

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

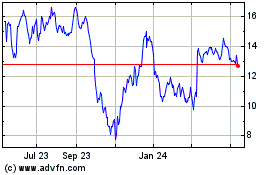

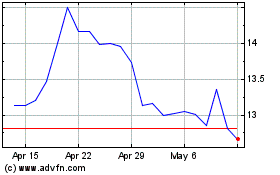

Ballys (NYSE:BALY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ballys (NYSE:BALY)

Historical Stock Chart

From Feb 2024 to Feb 2025