Gaming and Leisure Properties Closes on $250 Million Land Acquisition, the Site for Bally’s Future Chicago Flagship Casino

September 11 2024 - 3:50PM

Gaming and Leisure Properties, Inc. (NASDAQ:GLPI) (“GLPI” or “the

Company”), announced today that it completed its previously

announced $250 million acquisition, from Blue Owl Capital, of the

land on which Bally’s Corporation (NYSE: BALY) (“Bally’s”)

permanent Chicago Casino will be constructed. The land purchase was

one component of GLPI’s broader agreement with Bally’s, announced

in July.

With the completion of GLPI’s purchase of the

Chicago land, the current lease in place with Blue Owl Capital will

be assumed by an affiliate of GLPI and amended to reflect the

negotiated annual rent of $20 million, representing an initial cash

yield of 8.0%. GLPI will own substantially all of the real estate

and improvements related to the Chicago casino and hotel for a

total investment of $1.19 billion resulting in a blended initial

cash investment yield of 8.4%. Stabilized rent coverage for the

lease is expected to be in the range of 2.0x – 2.4x.

Peter Carlino, Chairman and CEO of GLPI

commented, “The completion of the Chicago land purchase is a

significant milestone toward the development of Bally’s Chicago,

which promises to be a must-visit destination casino resort

property in the heart of Chicago. Our transactions with Bally’s

related to Chicago and our real estate acquisitions at Bally’s

Kansas City Casino and Bally’s Shreveport Casino & Hotel will

be accretive to our financial results, resulting in an 8.3% blended

initial cash yield and conservative rent coverage. We are pleased

to be working with the Bally’s team, the host community and various

stakeholders in Chicago to deliver a world-class entertainment

center in the nation’s third largest metropolitan area.”

About Gaming and Leisure Properties,

Inc.GLPI is engaged in the business of acquiring,

financing, and owning real estate property to be leased to gaming

operators in triple-net lease arrangements, pursuant to which the

tenant is responsible for all facility maintenance, insurance

required in connection with the leased properties and the business

conducted on the leased properties, taxes levied on or with respect

to the leased properties and all utilities and other services

necessary or appropriate for the leased properties and the business

conducted on the leased properties.

Forward-Looking StatementsThis

press release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

including our expectations regarding the benefits of the

transaction to our shareholders. Forward-looking statements can be

identified by the use of forward-looking terminology such as

“expects,” “believes,” “estimates,” “intends,” “may,” “will,”

“should” or “anticipates” or the negative or other variation of

these or similar words, or by discussions of future events,

strategies or risks and uncertainties. Such forward-looking

statements are inherently subject to risks, uncertainties and

assumptions about GLPI and its subsidiaries, including risks

related to the following: GLPI’s ability to successfully consummate

the announced transactions with Bally’s, including the ability of

the parties to satisfy the various conditions to advancing loan

proceeds, including receipt of all required regulatory approvals

and other approvals and consents, or other delays or impediments to

completing the proposed transactions; the potential negative impact

of recent high levels of inflation (which have been exacerbated by

the armed conflict between Russia and Ukraine) on our tenants'

operations; GLPI's ability to maintain its status as a REIT; our

ability to access capital through debt and equity markets in

amounts and at rates and costs acceptable to GLPI; the impact of

our substantial indebtedness on our future operations; changes in

the U.S. tax law and other state, federal or local laws, whether or

not specific to REITs or to the gaming or lodging industries; and

other factors described in GLPI’s Annual Report on Form 10-K for

the year ended December 31, 2023, Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K, each as filed with the Securities

and Exchange Commission. All subsequent written and oral

forward-looking statements attributable to GLPI or persons acting

on GLPI’s behalf are expressly qualified in their entirety by the

cautionary statements included in this press release. GLPI

undertakes no obligation to publicly update or revise any

forward-looking statements contained or incorporated by reference

herein, whether as a result of new information, future events or

otherwise, except as required by law. In light of these risks,

uncertainties and assumptions, the forward-looking events discussed

in this press release may not occur as presented or at all.

|

Contact: |

|

| Gaming and Leisure Properties, Inc. |

Investor Relations |

| Matthew Demchyk, Chief Investment Office |

Joseph Jaffoni, Richard Land, James Leahy at JCIR |

| 610/401-2900 |

212/835-8500 |

| investorinquiries@glpropinc.com |

glpi@jcir.com |

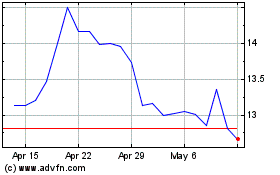

Ballys (NYSE:BALY)

Historical Stock Chart

From Jan 2025 to Feb 2025

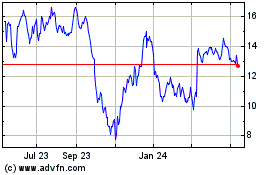

Ballys (NYSE:BALY)

Historical Stock Chart

From Feb 2024 to Feb 2025