UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant’s name into English)

Republic of Chile

(Jurisdiction of incorporation or organization)

Vitacura 2670, 23

rd

floor, Santiago, Chile

(Address of principal executive offices)

_________________________________________

Securities registered or to be registered pursuant to section 12(b) of the Act.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X

Form 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No

X

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

(UNITED BREWERIES COMPANY, INC)

Open Stock Corporation Securities Reg. N° 0007

INFORMATION ON PROPOSALS

TO BE SUBMITTED TO VOTE

AT THE

115

TH

ORDINARY SHAREHOLDERS

’

MEETING

To be held on April 11, 2018

Regarding the proposals that will be submitted to vote in the next Ordinary Shareholder

s’

Meeting

(the “Meeting”) of

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

(“

CCU

” or the “

Company

”), and in

compliance with article 59 of the Chilean Corporations Act, Law N° 18,046, shareholders are informed of the following:

1.

Approval of the Annual Report, Financial Statements and

External Auditors’ Report

corresponding to the fiscal year ended on December 31, 2017.

The Consolidated Financial Statements of the Company as of December 31, 2017, including the Report of External Auditors and their notes, are available to the public at the Company's offices and have been published on February 28, 2018, in accordance with article 76 of the Chilean Corporations Act (Law N° 18,046), on the webpage of the Company www.ccu.cl, section Investor Relations, subsection Financial Reports.

In accordance with article 75 of the Chilean Corporations Act, Law N° 18,046, the Company has made available to the shareholders the Annual Report for the period ended on December 31, 2017, on the webpage of the Company www.ccu.cl, section Investor Relations, subsection Annual Reports. In any case, there are sufficient printed copies of the Annual Report for consultations of shareholders, at the Company's offices located in Avenida Vitacura N°2,670, piso 23, comuna de Las Condes, Santiago.

2.

Distribution of net profits and dividends for year 2017.

The Board of Directors, at their meeting held on March 7, 2018, resolved to propose to the Shareholders´ Meeting the distribution of final dividend N°255, charged to the net profits of period 2017 (net income attributable to equity holders of the parent). This dividend amounts to $40,234,550,662, which represents 31.04% of the distributable net profits of the period

ended on December 31, 2017, that is, $108.88833 per share, which together with the interim dividend paid on January, 2018 of $70 per share, amounting to $25,865,201,040, implies the distribution of the aggregate amount of $66,099,751,702, which represents 51% of the distributable net profits of this period being $129,607,352,650.

Therefore, the amount of $38,882,207,101 of the net profits corresponds to the mandatory minimum dividend of 30%, this is $105.22843 per share; and the amount of $27,217,544,601 corresponds to the additional dividend equivalent to 21% of such profits, that is, $73.65990 per share.

The proposed final dividend N°255 will be paid as of April 26, 2018, in accordance with the procedure described below. Finally, it will be proposed to the Shareholders´ Meeting that the remainder of the net profits to be distributed shall be added to retained earnings.

The procedure to be used for payment of future dividends and the security measures that

will be observed:

(i) Within the first ninety days as of the date of the beginning of the dividend payment, the dividend will be paid through bank drafts (

“

vale vista bancario

”

) issued on the name of the shareholder who shall personally request such document at the bank´s offices agreed to with the administration of Company´s Shareholder Registry, DCV Registros S.A. which will be indicated on the announcement that will be published to that end, and the payment will be made in any branch office of the mentioned bank during their opening hours, from 9:00 to 14:00 hrs. For dividend N° 255 the bank will be

Banco de Crédito e Inversiones

(BCI).

(ii) Those shareholders that have so requested will receive payment of their dividends through any of the following means he or she has explicitly opted for: bank deposit on a saving or current account of which they are the entitled owner in Chile; or sending of nominative checks or bank drafts (

“

vale vista bancario

”

)

, by certified post. This request shall be made in writing and be in the possession of the Company´s Shareholder Registry office on time.

(iii) The selected method of payment by each shareholder will be used by the Shares Registry for all the payments of dividends, as long as the shareholder does not express in writing his intention of changing the method and registers a new option.

(iv) The shareholders that have not chosen a payment method, will be paid through bank

drafts (

“

vale vista bancario”

)

, in accordance with method described in point (i).

(v) After ninety days as of the date of the beginning of the dividend payment, the shareholders or their attorneys shall collect the dividend at the Company´s Shareholder Registry office, located at Huérfanos N° 770, piso 22, Santiago, from Monday through Thursday from 9:00 to 17:00 and Friday from 9:00 to 16:00. At the moment of such request, they shall identify themselves with their identity card, exhibit the power of attorney if applicable, sign the receipts, voucher and registers that the Company requires to that end. Payment in these cases will always be though nominative checks.

(vi) In case of checks returned by post to DCV Registros S.A., these will remain in their custody

until they are collected or requested by the shareholders.

(vii) In case of deposits in current bank accounts, shareholders can request, for security reasons, the verification of these accounts by the pertinent banks. If the shareholders´ accounts are rejected, because of a previous procedure of verification or due to any other reason, the dividend will be paid through the method indicated in point (i), or as indicated in point (v), as applicable.

(viii) The dividend payment will be communicated through an announcement in the newspaper where the notices to shareholders

’

meetings have to be done, that is, El Mercurio newspaper.

3.

Determination of the Board of Directors members´ remuneration for fiscal year 2018.

The Board of Directors agreed to propose the same compensation that was approved by the last Ordinary

Shareholder’s

Meeting, consisting of a monthly gross remuneration for their attendance to meetings, as of May, of UF 100 per director and UF 200 for the Chairman, independent of the number of meetings held in each period, plus an equivalent of 3% of the distributed dividends with charge to the Company´s profits, for the whole board, calculated over a maximum of 50% of the distributable net profits, at a rate of one-ninth for each director and in proportion to the time each one served as such during the year 2018, which will be paid at the same time as the dividend or dividends are made available to the

shareholders. If the distributed dividends exceed 50% of the distributed net profits, the Board

D

irectors’ variable remuneration shall be calculated over a maximum 50% of such profits.

4.

Determination of the Committee of Directors remuneration for its members for fiscal year 2018.

The Board of Directors agreed to propose to the Shareholders´ Meeting the same remuneration approved by the last Ordinary Shareholders´ Meeting for each director member of the Directors Committee, consisting of a gross fee of UF 34 for each meeting they attend, plus the amount that, as the percentage of the dividends, as explained in the previous item regarding Board member´s remuneration, is required to complete the additional one-third prescribed in article 50 bis of the Chilean Corporations Act (Law N° 18,046), and the Circular Letter N° 1,956 of the Commission for the Financial Market. In any case, the amount required to complete the additional one-third will be settled and paid at the end of the period, once the total payment regarding compensation of the Board of Directors is known.

Regarding the annual budget for operating costs of the Directors Committee and their advisors, it was agreed to propose that this budget is fixed at an amount equal of the sum of the annual compensation of its members, in accordance with the article 50 bis section 12, of the Chilean Corporations Act, Law N° 18,046.

5.

Determination of the Audit Committee budget and remuneration for its members for fiscal year 2018.

The Board of Directors agreed to propose to maintain what was agreed in the last Shareholders´ Meeting, for year 2018 and until the next Ordinary Shareholders´ Meeting, which is a monthly gross remuneration of UF 25 for each director member of the Audit Committee and for each director that is designated as observers of the Committee; and a total and annual budget for operating costs and advisors of UF 2,000.

6.

Appointment of External Auditors Firm for the 2018 fiscal year.

The Board of Directors of CCU, at the meeting held on March 7, 2018, agreed to propose to the Shareholders´ Meeting, the appointment of Pricewaterhouse Coopers Consultores y Auditores Limitada

(“PWC”)

as External Auditors of the Company and, as second option, Deloitte Auditors Consultores Limitada

(“DELOITTE”)

.

Thus, the Board of Directors took into consideration the proposal of the Directors Committee of CCU which, in accordance with the article 50 bis of the Chilean Corporation Act (Law N° 18,046) and Circular Letter N° 718 of February 10, 2012, clarified and complemented by the Circular Letter N° 764 of December 21, 2012, both from the Commission for the Financial Market, proposed to the Board of Directors of the Company to submit to the next Ordinary Shareholders

’

Meeting the appointment of PWC as the External Audit company for year 2018 as the first preferred option and DELOITTE as the second preferred option. The above is based on the reasons stated in the following paragraphs and contained in the offers presented by PWC and DELOITTE for the period 2016 to 2018.

The Audit Committee of CCU, formed pursuant to Sarbanes Oxley Act of the United States of America, submitted to the Board of Directors a proposal on the same terms as the Directors Committee.

The following are the reasons that support the above mentioned proposal of the Board of

Directors to the Shareholders´ Meeting:

(i)

PWC:

(1) The experience of PWC in auditing companies with similar size and complexity as CCU and its subsidiaries; (2) Adequate structure and experience to assist companies that trade on the New York Stock Exchange (ADRs); (3) Profound knowledge of CCU and its subsidiaries; (4) Competence of the team that will perform the audit function ; (5) Company that fulfills the parameters of suitability and independence, guaranteed by the partners rotation policy and other guidelines that PWC applies on an international level, together with the policy on this subject adopted by the Board of Directors of CCU that consists of requiring the external audit company to rotate the assigned partner every five years; (6) Satisfaction of the Board of Directors and management regarding the quality of the services provided since April 30, 1982; (7) Convenient cost of the offered services, considering the number of hours committed, the level of the activities involved and the proposed price.

(ii)

DELOITTE:

(1) It is considered an audit company with sufficient prestige in Chile and on an international level, which has the size, capacity and support of a global network in order to audit companies with similar size and complexity as CCU and its subsidiaries; (2) Adequate

structure and experience to assist companies that trade at the New York Stock Exchange

(ADRs); (3) Competence of the team that will perform the audit function.

The most relevant factors that have motivated the prioritization amongst the options that

have been considered are the ones mentioned on point (1) to (6) of paragraph (i).

7.

Appointment of Risk Rating agencies for the 2018 fiscal year.

The Directors Committee of CCU, in accordance with paragraph 8° number 2 of article 50 bis of the Chilean Corporations Act (Law N° 18,046 ), agreed to propose to the Board of Directors of CCU to be considered in the next Shareholders´ Meeting, to maintain Fitch Chile Clasificadores de Riesgo Ltda. and International Credit Rating (ICR) Compañía Clasificadora de Riesgo Ltda., as risk rating agency for 2018, due to the Company´s satisfaction regarding the services rendered to date and having presented the most favorable economic conditions. The proposal of the Directors Committee was confirmed by the Company´s Board of Directors at its meeting held on March 7, 2018.

Santiago, March 26, 2018.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Compañía Cervecerías Unidas S.A.

(United Breweries Company, Inc.)

|

|

|

|

|

/s/ Felipe Dubernet

|

|

|

Chief Financial Officer

|

|

|

|

Date: March 26, 2018

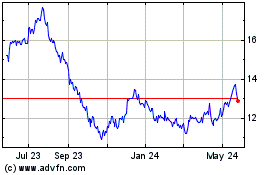

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From Jun 2024 to Jul 2024

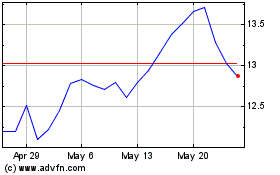

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From Jul 2023 to Jul 2024