Destra Multi-Alternative Fund Declares September 2022 Distribution

September 09 2022 - 8:00AM

Business Wire

On September 9, 2022, Destra Multi-Alternative Fund (the “Fund”

or “DMA”), a closed-end fund traded on the New York Stock Exchange

under the symbol DMA, today declared a distribution of $0.0563 per

share for the month of September 2022. The record date for the

distribution is September 20, 2022, and the payable date is

September 30, 2022. The Fund will trade ex-distribution on

September 19, 2022.

Based on the Fund’s current share price of $7.31 (as of its

close on September 7, 2022), the distribution represents an

annualized distribution rate of approximately 9.24% (calculated by

annualizing the distribution amount and dividing it by the current

market price). Information regarding the distribution rate is

included for informational purposes only and is not necessarily

indicative of future results, the achievement of which cannot be

assured. The distribution rate should not be considered the yield

or total return on an investment in the Fund.

Pursuant to the Fund’s Dividend Reinvestment Plan (“DRP”),

unless the registered owner of the Fund’s Common Shares elects

otherwise by contacting the Fund’s plan agent, American Stock

Transfer & Trust Company, LLC (“AST”), all dividends declared

on the Common Shares will be automatically reinvested in additional

Common Shares by AST. Common Shareholders who elect not to

participate in the DRP will receive all dividends and other

distributions in cash paid by check mailed directly to the

shareholder of record. Shareholders may obtain more information on

the shareholder services offered to the Fund by calling AST at the

Fund's dedicated toll free number 800-591-8238.

A portion of each distribution may be treated as paid from

sources other than net investment income, including but not limited

to short-term capital gain, long-term capital gain, or return of

capital. As required by Section 19(a) of the Investment Company Act

of 1940, a notice will be distributed to shareholders in the event

that a portion of a monthly distribution is derived from sources

other than undistributed net investment income. The final

determination of the source and tax characteristics of these

distributions will depend upon the Fund’s investment experience

during its fiscal year and will be made after the Fund’s year end.

The Fund will send to investors a Form 1099-DIV for the calendar

year that will define how to report these distributions for federal

income tax purposes. For further information regarding the Fund’s

distributions, please visit www.destracapital.com.

Destra Multi-Alternative Fund (NYSE: DMA) is a core alternative

solution that seeks to achieve long-term performance non-correlated

to the broad stock and bond markets. It invests primarily in

alternative strategies and asset classes including real estate,

direct private equity, alternative credit, commodities, and hedge

strategies.

Destra Capital Advisors LLC, based in Bozeman, MT, serves as

Investment Adviser and Secondary Market Servicing agent to the

Fund. Validus Growth Investors serves as the Investment Sub-Adviser

to the Fund.

Shares of the Fund can be purchased on the New York Stock

Exchange through any securities broker.

Information regarding the Fund and Destra Capital Advisors can

be found at

www.destracapital.com/strategies/destra-multi-alternative-fund.

Please contact Destra Capital Advisors LLC, the Fund’s

marketing, and investor support services agent, at

DMA@destracapital.com or call (877) 855-3434 if you have any

questions regarding DMA.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220909005031/en/

Destra Capital Advisors LLC DMA@destracapital.com (877)

855-3434

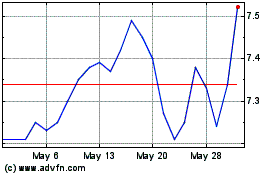

Destra Multi Alternative (NYSE:DMA)

Historical Stock Chart

From Oct 2024 to Oct 2024

Destra Multi Alternative (NYSE:DMA)

Historical Stock Chart

From Oct 2023 to Oct 2024