0001360901false00013609012025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2025

| | |

|

| EVERCORE INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 001-32975 | 20-4748747 |

(State or Other Jurisdiction of

Incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 55 East 52nd Street | | |

| New York, | New York | | 10055 |

| (Address of principal executive offices) | | (Zip Code) |

(212) 857-3100

(Registrant's telephone number, including area code)

| | |

| NOT APPLICABLE |

| (Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

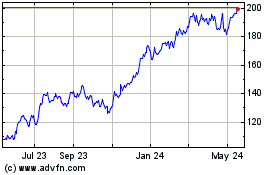

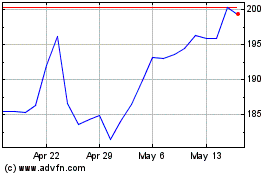

| Class A Common Stock, par value $0.01 per share | EVR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On February 5, 2025, Evercore Inc. issued a press release announcing financial results for its fourth quarter ended December 31, 2024.

A copy of the press release is attached hereto as Exhibit 99.1. All information in the press release is furnished but not filed.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | | | | |

| | |

| 99.1 | | |

| | |

| 101 | | The cover page information is formatted in Inline XBRL |

| | |

| 104 | | Cover Page Interactive Data is formatted in Inline XBRL (and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | EVERCORE INC. |

| | |

| Date: February 5, 2025 | | | | /s/ Tim LaLonde |

| | | | By: | | Tim LaLonde |

| | | | Title: | | Chief Financial Officer |

E V E R C O R E

EVERCORE REPORTS FOURTH QUARTER AND FULL YEAR 2024 RESULTS;

QUARTERLY DIVIDEND OF $0.80 PER SHARE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter Results | | Full Year Results | | | | |

| U.S. GAAP | | Adjusted | | U.S. GAAP | | Adjusted | | | | |

| Q4 2024 | Q4 2023 | | Q4 2024 | Q4 2023 | | 2024 | 2023 | | 2024 | 2023 | | | | |

| Net Revenues ($ mm) | $ | 975.3 | | $ | 784.2 | | | $ | 980.5 | | $ | 790.3 | | | $ | 2,979.6 | | $ | 2,425.9 | | | $ | 3,002.6 | | $ | 2,449.3 | | | | | |

| Operating Income ($ mm) | $ | 212.6 | | $ | 117.7 | | | $ | 217.7 | | $ | 123.9 | | | $ | 526.9 | | $ | 359.1 | | | $ | 557.3 | | $ | 385.4 | | | | | |

| Net Income Attributable to Evercore Inc. ($ mm) | $ | 140.4 | | $ | 82.7 | | | $ | 153.2 | | $ | 87.8 | | | $ | 378.3 | | $ | 255.5 | | | $ | 415.8 | | $ | 276.9 | | | | | |

| Diluted Earnings Per Share | $ | 3.30 | | $ | 2.03 | | | $ | 3.41 | | $ | 2.02 | | | $ | 9.08 | | $ | 6.37 | | | $ | 9.42 | | $ | 6.46 | | | | | |

| Compensation Ratio | 65.6 | % | 71.4 | % | | 65.2 | % | 70.8 | % | | 66.3 | % | 68.3 | % | | 65.7 | % | 67.6 | % | | | | |

| Operating Margin | 21.8 | % | 15.0 | % | | 22.2 | % | 15.7 | % | | 17.7 | % | 14.8 | % | | 18.6 | % | 15.7 | % | | | | |

| | | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | |

Business and Financial

Highlights | g | Fourth Quarter and Full Year Net Revenues were $975.3 million and $3.0 billion, respectively, on a U.S. GAAP basis and $980.5 million and $3.0 billion, respectively, on an Adjusted basis, representing the second best Quarter and Full Year by both measures. Fourth Quarter and Full Year 2024 Net Revenues increased 24% and 23%, respectively, on both a U.S. GAAP basis and an Adjusted basis versus 2023 | |

| | | | |

| g | Fourth Quarter Operating Income of $212.6 million and $217.7 million on a U.S. GAAP and an Adjusted basis, respectively, increased 81% and 76%, respectively versus 2023; Fourth Quarter Operating Margins of 21.8% and 22.2% on a U.S. GAAP basis and an Adjusted basis, respectively, increased 679 and 653 basis points, respectively, versus 2023 | |

| | | | |

| g | In Strategic Advisory, Evercore advised on three of the top seven globally announced transactions in 2024. In the fourth quarter, we advised on some notable and complex transactions, including: | |

| | |

| g | Summit Materials on its sale to Quikrete for $11.5 billion | |

| | | | |

| g | Warner Bros. Discovery on its new corporate structure | |

| g | Vivendi on the partial demergers of Canal+ (€3.5 billion) and Louis Hachette Group (€1.2 billion) and the spin-off of Havas (€1.8 billion) | |

| | |

| | |

| g | In the early weeks of 2025, we continue to see strong momentum and we were lead financial advisor to Calpine on its sale to Constellation Energy for $29.1 billion, which is currently the largest announced transaction year-to-date | |

| | | | |

| g | Our Private Capital Advisory and Private Funds Group each had their best year on record, highlighting the strength of our market-leading franchises | |

| | | | |

| g | In 2024, Evercore was a bookrunner on two of the top 10 U.S. Equity and Equity-Linked offerings, including lead-left bookrunner on Diamondback Energy Inc.’s $2.6 billion follow-on |

| | | | |

| g | Evercore was lead-left bookrunner on six transactions in the year, of which five were follow-ons and one convertible | |

| | | | |

| g | Our Equities business had its strongest full year revenue since 2016, demonstrating the strength of our client franchise | |

| | | | |

| | |

| | | | |

| g | Evercore ISI was recognized by Extel (formerly Institutional Investor) as the #1 Firm on a weighted basis in U.S. Equity Research for the third consecutive year, and for having the most #1 ranked analysts among Wall Street firms for the second consecutive year | |

| | | | |

| | |

| | |

| | |

| | | | | |

| | | | | |

| Talent | g | Three Investment Banking Senior Managing Directors (SMDs) joined Evercore in the fourth quarter; Katrina Niehaus in the Structured Capital Solutions Group as well as Eric Neveux and Graham Nix, in the Financial Institutions Group | |

| | |

| g | Since our last earnings call, one Investment Banking SMD has committed to join Evercore in our Healthcare group | |

| | | | |

| | | | |

| | | | | |

| | | | | |

| | | |

| | | | | |

| | | |

| Capital Return | g | Quarterly dividend of $0.80 per share | |

| | | | |

| g | Returned $590.6 million to shareholders during 2024 through dividends and repurchases of 2.3 million shares at an average price of $193.40 | |

| | | | | |

| | | | | |

| | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| |

NEW YORK, February 5, 2025 – Evercore Inc. (NYSE: EVR) today announced its results for the fourth quarter and full year ended December 31, 2024.

LEADERSHIP COMMENTARY

John S. Weinberg, Chairman and Chief Executive Officer, "We are pleased with our performance in 2024, as we continue to intensively cover our clients and broaden our coverage. We begin 2025 with strong momentum and we expect the market to continue to gradually improve throughout the year."

Roger C. Altman, Founder and Senior Chairman, "Evercore just had its second strongest year in terms of revenue and has considerable momentum going into 2025. The breadth and competitiveness of the Firm, at least in my view, has never been stronger."

Evercore's quarterly results may fluctuate significantly due to the timing and amount of transaction fees earned, as well as other factors. Accordingly, financial results in any particular quarter may not be representative of future results over a longer period of time.

Business Segments:

Evercore's business results are categorized into two segments: Investment Banking & Equities and Investment Management. Investment Banking & Equities includes providing advice to clients on mergers, acquisitions, divestitures and other strategic corporate transactions, as well as services related to securities underwriting, private placement services and commissions for agency-based equity trading services and equity research. Investment Management includes Wealth Management and interests in private equity funds which are not managed by the Company, as well as advising third-party investors through affiliates. See pages A-2 to A-8 for further information and reconciliations of these segment results to our U.S. GAAP consolidated results.

Non-GAAP Measures:

Throughout this release certain information is presented on an adjusted basis, which is a non-GAAP measure. Adjusted results begin with information prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"), and then those results are adjusted to exclude certain items and reflect the conversion of certain Evercore LP Units into Class A shares. Evercore believes that the disclosed adjusted measures and any adjustments thereto, when presented in conjunction with comparable U.S. GAAP measures, are useful to investors to compare Evercore's results across several periods and facilitate an understanding of Evercore's operating results. Evercore uses these measures to evaluate its operating performance, as well as the performance of individual employees. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP.

In the third quarter of 2024, the Company sold its remaining ownership interest in ABS. The gain on the sale has been excluded from Adjusted Net Revenues.

In the third quarter of 2024, the Company agreed to the redemption of its interest in Luminis, such that it no longer has an equity interest in Luminis following the redemption. The Company received no consideration in respect of the redemption. As a result, the Company incurred a loss in the third quarter of 2024 associated with the write-off of the remaining carrying value of its investment, included within Special Charges, Including Business Realignment Costs, as well as the release of cumulative foreign exchange losses, included within Other Revenue, net. These charges in 2024 have been excluded from Adjusted Net Income Attributable to Evercore Inc.

Evercore's Adjusted Diluted Shares Outstanding for the three and twelve months ended December 31, 2024 were higher than U.S. GAAP as a result of the inclusion of certain Evercore LP Units and Unvested Restricted Stock Units.

Further details of these adjustments, as well as an explanation of similar amounts for the three and twelve months ended December 31, 2023 are included in pages A-2 to A-8.

Selected Financial Data – U.S. GAAP Results

The following is a discussion of Evercore's consolidated results on a U.S. GAAP basis. See pages A-5 to A-7 for our business segment results.

Net Revenues

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP |

| Three Months Ended | | Twelve Months Ended |

| December 31, 2024 | | December 31, 2023 | | %

Change | | December 31, 2024 | | December 31, 2023 | | %

Change |

| (dollars in thousands) |

| Investment Banking & Equities: | | | | | | | | | | | |

| Advisory Fees | $ | 849,556 | | | $ | 659,338 | | | 29 | % | | $ | 2,440,605 | | | $ | 1,963,857 | | | 24 | % |

| Underwriting Fees | 26,401 | | | 19,119 | | | 38 | % | | 157,067 | | | 111,016 | | | 41 | % |

| Commissions and Related Revenue | 58,049 | | | 55,979 | | | 4 | % | | 214,045 | | | 202,789 | | | 6 | % |

| Investment Management: | | | | | | | | | | | |

| Asset Management and Administration Fees | 21,096 | | | 17,204 | | | 23 | % | | 79,550 | | | 67,041 | | | 19 | % |

| Other Revenue, net | 20,230 | | | 32,527 | | | (38 | %) | | 88,326 | | | 81,246 | | | 9 | % |

| Net Revenues | $ | 975,332 | | | $ | 784,167 | | | 24 | % | | $ | 2,979,593 | | | $ | 2,425,949 | | | 23 | % |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Three Months Ended | | Twelve Months Ended |

| December 31, 2024 | | December 31, 2023 | | %

Change | | December 31, 2024 | | December 31, 2023 | | %

Change |

| |

| | | | | | | | | | | |

Total Number of Fees from Advisory and Underwriting Client Transactions(1) | 322 | | | 310 | | | 4 | % | | 748 | | | 666 | | | 12 | % |

Total Number of Fees of at Least $1 million from Advisory and Underwriting Client Transactions(1) | 159 | | | 137 | | | 16 | % | | 457 | | | 378 | | | 21 | % |

| | | | | | | | | | | |

Total Number of Underwriting Transactions(1) | 12 | | | 7 | | | 71 | % | | 65 | | | 47 | | | 38 | % |

Total Number of Underwriting Transactions as a Bookrunner(1) | 10 | | | 7 | | | 43 | % | | 55 | | | 43 | | | 28 | % |

| | | | | | | | | | | |

| 1. Includes Equity and Debt Underwriting Transactions. |

| | | | | | | | | | | | | | | | | |

| As of December 31, |

| 2024 | | 2023 | | %

Change |

Assets Under Management ($ mm)(1) | $ | 13,898 | | | $ | 12,272 | | | 13 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

|

| | | | | |

| 1. Assets Under Management reflect end of period amounts from our consolidated Wealth Management business. |

|

Advisory Fees – Fourth quarter Advisory Fees increased $190.2 million, or 29%, year-over-year, and full year Advisory Fees increased $476.7 million, or 24%, year-over-year, reflecting an increase in revenue earned from large transactions and an increase in the number of advisory fees earned during 2024.

Underwriting Fees – Fourth quarter Underwriting Fees increased $7.3 million, or 38%, year-over-year, and full year Underwriting Fees increased $46.1 million, or 41%, year-over-year, reflecting an increase in the number of transactions we participated in during 2024.

Commissions and Related Revenue – Fourth quarter Commissions and Related Revenue increased $2.1 million, or 4%, year-over-year, and full year Commissions and Related Revenue increased $11.3 million, or 6%, year-over-year, primarily reflecting higher trading commissions and subscription fees.

Asset Management and Administration Fees – Fourth quarter Asset Management and Administration Fees increased $3.9 million, or 23%, year-over-year, and full year Asset Management and Administration

Fees increased $12.5 million, or 19%, year-over-year, driven by an increase in fees from Wealth Management clients, as associated AUM increased 13%, primarily from market appreciation.

Other Revenue – Fourth quarter Other Revenue, net, decreased $12.3 million, or 38%, year-over-year, primarily reflecting lower gains on our investment funds portfolio. Full year Other Revenue, net, increased $7.1 million, or 9%, year-over-year, primarily reflecting higher interest income, as well as higher performance of our investment funds portfolio. The investment funds portfolio is used as an economic hedge against our deferred cash compensation program.

Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP |

| Three Months Ended | | Twelve Months Ended |

| December 31, 2024 | | December 31, 2023 | | %

Change | | December 31, 2024 | | December 31, 2023 | | %

Change |

| (dollars in thousands) |

| Employee Compensation and Benefits | $ | 639,386 | | | $ | 559,899 | | | 14 | % | | $ | 1,974,036 | | | $ | 1,656,875 | | | 19 | % |

| Compensation Ratio | 65.6 | % | | 71.4 | % | | | | 66.3 | % | | 68.3 | % | | |

| Non-Compensation Costs | $ | 123,388 | | | $ | 106,579 | | | 16 | % | | $ | 471,338 | | | $ | 407,018 | | | 16 | % |

| Non-Compensation Ratio | 12.7 | % | | 13.6 | % | | | | 15.8 | % | | 16.8 | % | | |

| Special Charges, Including Business Realignment Costs | $ | — | | | $ | — | | | NM | | $ | 7,305 | | | $ | 2,921 | | | 150 | % |

Employee Compensation and Benefits – Fourth quarter Employee Compensation and Benefits increased $79.5 million, or 14%, year-over-year, reflecting a compensation ratio of 65.6% for the fourth quarter of 2024 versus 71.4% for the prior year period. The increase in Employee Compensation and Benefits compared to the prior year period principally reflects a higher accrual for incentive compensation, higher base salaries and higher compensation expense related to senior new hires. The Compensation Ratio was also impacted by higher net revenues, as described above, during the current year period compared to the prior year period. Full year Employee Compensation and Benefits increased $317.2 million, or 19%, year-over-year, reflecting a full year compensation ratio of 66.3% versus 68.3% for the prior year period. The increase in Employee Compensation and Benefits compared to the prior year period principally reflects a higher accrual for incentive compensation, higher base salaries and higher compensation expense related to senior new hires. The Compensation Ratio was also impacted by higher net revenues, as described above, during the current year period compared to the prior year period. See "Deferred Compensation" for more information.

Non-Compensation Costs – Fourth quarter Non-Compensation Costs increased $16.8 million, or 16%, year-over-year, primarily driven by an increase in professional fees and occupancy and equipment rental expense, primarily related to an increase in office space, as well as an increase in travel and related expenses, largely due to higher levels of business activity and increased headcount. The fourth quarter Non-Compensation ratio of 12.7% decreased from 13.6% for the prior year period. The Non-Compensation Ratio was also impacted by higher net revenues, as described above, during the current year period compared to the prior year period. Full year Non-Compensation Costs increased $64.3 million, or 16%, year-over-year, primarily driven by an increase in professional fees and travel and related expenses, largely due to higher levels of business activity and increased headcount, as well as an increase in communications and information services, principally reflecting higher expenses associated with license fees and research services in 2024. The full year Non-Compensation ratio of 15.8% decreased from 16.8% for the prior year period. The Non-Compensation Ratio was also impacted by higher net revenues, as described above, during the current year period compared to the prior year period.

Special Charges, Including Business Realignment Costs – Full year 2024 Special Charges, Including Business Realignment Costs, relate to the write-off of the remaining carrying value of the Company's investment in Luminis in connection with the redemption of the Company's interest. See page 3 for further information.

Full year 2023 Special Charges, Including Business Realignment Costs, relate to the write-off of non-recoverable assets in connection with the wind-down of the Company's operations in Mexico.

Effective Tax Rate

The fourth quarter effective tax rate was 27.5% versus 23.1% for the prior year period. The full year effective tax rate was 21.6% versus 22.0% for the prior year period. The effective tax rate is principally impacted by an increase in non-deductible expenses, state and local apportionment adjustments and the deduction associated with the appreciation in the Firm's share price upon vesting of employee share-based awards above the original grant price. The full year provision for income taxes for 2024 reflects an additional tax benefit of $35.1 million versus $13.7 million for the prior year period, due to the net impact associated with the appreciation in our share price upon vesting of employee share-based awards above the original grant price.

Selected Financial Data – Adjusted Results

The following is a discussion of Evercore's consolidated results on an Adjusted basis. See pages 3 and A-2 to A-8 for further information and reconciliations of these metrics to our U.S. GAAP results. See pages A-5 to A-7 for our business segment results.

Adjusted Net Revenues

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted |

| Three Months Ended | | Twelve Months Ended |

| December 31, 2024 | | December 31, 2023 | | %

Change | | December 31, 2024 | | December 31, 2023 | | %

Change |

| (dollars in thousands) |

| | | | | | | | | | | |

| Investment Banking & Equities: | | | | | | | | | | | |

Advisory Fees(1) | $ | 849,587 | | | $ | 659,564 | | | 29 | % | | $ | 2,441,678 | | | $ | 1,964,477 | | | 24 | % |

| Underwriting Fees | 26,401 | | | 19,119 | | | 38 | % | | 157,067 | | | 111,016 | | | 41 | % |

| Commissions and Related Revenue | 58,049 | | | 55,979 | | | 4 | % | | 214,045 | | | 202,789 | | | 6 | % |

| Investment Management: | | | | | | | | | | | |

Asset Management and Administration Fees(2) | 22,042 | | | 18,959 | | | 16 | % | | 84,708 | | | 73,076 | | | 16 | % |

| Other Revenue, net | 24,423 | | | 36,708 | | | (33 | %) | | 105,137 | | | 97,963 | | | 7 | % |

| Net Revenues | $ | 980,502 | | | $ | 790,329 | | | 24 | % | | $ | 3,002,635 | | | $ | 2,449,321 | | | 23 | % |

| | | | | | | | | | | |

| 1. Advisory Fees on an Adjusted basis reflect the reclassification of earnings related to our equity method investments in Luminis (through September 2024) and Seneca Evercore of $0.03 million and $1.1 million for the three and twelve months ended December 31, 2024, respectively, and $0.2 million and $0.6 million for the three and twelve months ended December 31, 2023, respectively. |

| 2. Asset Management and Administration Fees on an Adjusted basis reflect the reclassification of earnings related to our equity method investments in Atalanta Sosnoff and ABS (through July 2024) of $0.9 million and $5.2 million for the three and twelve months ended December 31, 2024, respectively, and $1.8 million and $6.0 million for the three and twelve months ended December 31, 2023, respectively. |

|

See page 4 for additional business metrics.

Advisory Fees – Fourth quarter adjusted Advisory Fees increased $190.0 million, or 29%, year-over-year, and full year adjusted Advisory Fees increased $477.2 million, or 24%, year-over-year, reflecting an increase in revenue earned from large transactions and an increase in the number of advisory fees earned during 2024.

Underwriting Fees – Fourth quarter Underwriting Fees increased $7.3 million, or 38%, year-over-year, and full year Underwriting Fees increased $46.1 million, or 41%, year-over-year, reflecting an increase in the number of transactions we participated in during 2024.

Commissions and Related Revenue – Fourth quarter Commissions and Related Revenue increased $2.1 million, or 4%, year-over-year, and full year Commissions and Related Revenue increased $11.3 million, or 6%, year-over-year, primarily reflecting higher trading commissions and subscription fees.

Asset Management and Administration Fees – Fourth quarter adjusted Asset Management and Administration Fees increased $3.1 million, or 16%, year-over-year, driven by an increase in fees from Wealth Management clients, as associated AUM increased 13%, primarily from market appreciation. The increase was partially offset by a 46% decrease in equity in earnings of affiliates, reflecting the sale of the remaining portion of our interest in ABS during the third quarter of 2024. Full year adjusted Asset Management and Administration Fees increased $11.6 million, or 16%, year-over-year, driven by an increase in fees from Wealth Management clients, as associated AUM increased 13%, primarily from market appreciation. The increase was partially offset by a 15% decrease in equity in earnings of affiliates, reflecting the sale of the remaining portion of our interest in ABS during the third quarter of 2024.

Other Revenue – Fourth quarter adjusted Other Revenue, net, decreased $12.3 million, or 33%, year-over-year, primarily reflecting lower gains on our investment funds portfolio. Full year adjusted Other Revenue, net, increased $7.2 million, or 7%, year-over-year, primarily reflecting higher interest income, as well as higher performance of our investment funds portfolio. The investment funds portfolio is used as an economic hedge against our deferred cash compensation program.

Adjusted Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted |

| Three Months Ended | | Twelve Months Ended |

| December 31, 2024 | | December 31, 2023 | | %

Change | | December 31, 2024 | | December 31, 2023 | | %

Change |

| (dollars in thousands) |

| | | | | | | | | | | |

| Employee Compensation and Benefits | $ | 639,386 | | | $ | 559,899 | | | 14 | % | | $ | 1,974,036 | | | $ | 1,656,875 | | | 19 | % |

| Compensation Ratio | 65.2 | % | | 70.8 | % | | | | 65.7 | % | | 67.6 | % | | |

| Non-Compensation Costs | $ | 123,388 | | | $ | 106,579 | | | 16 | % | | $ | 471,338 | | | $ | 407,018 | | | 16 | % |

| Non-Compensation Ratio | 12.6 | % | | 13.5 | % | | | | 15.7 | % | | 16.6 | % | | |

| | | | | | | | | | | |

Employee Compensation and Benefits – Fourth quarter adjusted Employee Compensation and Benefits increased $79.5 million, or 14%, year-over-year, reflecting an adjusted compensation ratio of 65.2% for the fourth quarter of 2024 versus 70.8% for the prior year period. The increase in adjusted Employee Compensation and Benefits compared to the prior year period principally reflects a higher accrual for incentive compensation, higher base salaries and higher compensation expense related to senior new hires. The adjusted Compensation Ratio was also impacted by higher net revenues, as described above, during the current year period compared to the prior year period. Full year adjusted Employee Compensation and Benefits increased $317.2 million, or 19%, year-over-year, reflecting a full year adjusted compensation ratio of 65.7% versus 67.6% for the prior year period. The increase in adjusted Employee Compensation and Benefits compared to the prior year period principally reflects a higher accrual for incentive compensation, higher base salaries and higher compensation expense related to senior new hires. The adjusted Compensation Ratio was also impacted by higher net revenues, as described above, during the current year period compared to the prior year period. See "Deferred Compensation" for more information.

Non-Compensation Costs – Fourth quarter adjusted Non-Compensation Costs increased $16.8 million, or 16%, year-over-year, primarily driven by an increase in professional fees and occupancy and equipment rental expense, primarily related to an increase in office space, as well as an increase in travel and related expenses, largely due to higher levels of business activity and increased headcount. The fourth quarter adjusted Non-Compensation ratio of 12.6% decreased from 13.5% for the prior year period. The adjusted Non-Compensation Ratio was also impacted by higher net revenues, as described above, during the current year period compared to the prior year period. Full year adjusted Non-Compensation Costs increased $64.3 million, or 16%, year-over-year, primarily driven by an increase in professional fees and travel and related expenses, largely due to higher levels of business activity and increased headcount, as well as an increase in communications and information services, principally reflecting higher expenses associated with license fees and research services in 2024. The full year adjusted Non-Compensation ratio of 15.7% decreased from 16.6% for the prior year period. The adjusted Non-Compensation Ratio was also impacted by higher net revenues, as described above, during the current year period compared to the prior year period.

Adjusted Effective Tax Rate

The fourth quarter adjusted effective tax rate was 27.3% versus 25.3% for the prior year period. The full year adjusted effective tax rate was 21.8% versus 23.4% for the prior year period. The adjusted effective

tax rate is principally impacted by an increase in non-deductible expenses, state and local apportionment adjustments and the deduction associated with the appreciation in the Firm's share price upon vesting of employee share-based awards above the original grant price. The full year adjusted provision for income taxes for 2024 reflects an additional tax benefit of $36.6 million versus $14.8 million for the prior year period, due to the net impact associated with the appreciation in our share price upon vesting of employee share-based awards above the original grant price.

Liquidity

The Company continues to maintain a strong balance sheet. As of December 31, 2024, cash and cash equivalents were $873.0 million, investment securities and certificates of deposit were $1.5 billion and current assets exceeded current liabilities by $1.8 billion. Amounts due related to the Notes Payable were $373.9 million at December 31, 2024.

Headcount

As of December 31, 2024 and 2023, the Company employed approximately 2,380 and 2,195 people, respectively, worldwide.

As of December 31, 2024 and 2023, the Company employed 184(1) and 174(2) total Investment Banking & Equities Senior Managing Directors, respectively, of which 144(1) and 136(2), respectively, were Investment Banking Senior Managing Directors.

(1) Senior Managing Director headcount as of December 31, 2024, adjusted to include two additional Investment Banking Senior Managing Directors committed to join in 2025 and to exclude for a known departure of one Investment Banking Senior Managing Director.

(2) Senior Managing Director headcount as of December 31, 2023, adjusted to include one additional Investment Banking Senior Managing Director that joined in January 2024.

Deferred Compensation

During 2024, the Company granted to certain employees 1.8 million unvested restricted stock units ("RSUs") (which were primarily granted in conjunction with the 2023 bonus awards) with a grant date fair value of $336.2 million.

In addition, during 2024, the Company granted $143.2 million of deferred cash awards to certain employees, related to our deferred cash compensation program, principally pursuant to 2023 bonus awards.

The Company recognized compensation expense related to RSUs and our deferred cash compensation program of $114.0 million and $476.2 million for the three and twelve months ended December 31, 2024, respectively, and $103.6 million and $439.1 million for the three and twelve months ended December 31, 2023, respectively.

As of December 31, 2024, the Company had 5.1 million unvested RSUs with an aggregate grant date fair value of $758.3 million. RSUs are expensed over the service period of the award, subject to retirement eligibility, and generally vest over four years.

As of December 31, 2024, the Company expects to pay an aggregate of $394.9 million related to our deferred cash compensation program at various dates through 2028, subject to certain vesting events. Amounts due pursuant to this program are expensed over the service period of the award, subject to

retirement eligibility, and are reflected in Accrued Compensation and Benefits, a component of current liabilities.

In addition, from time to time, the Company also grants cash and equity-based performance awards to certain employees, the settlement of which is dependent on the performance criteria being achieved.

Capital Return Transactions

On February 4, 2025, the Board of Directors of Evercore declared a quarterly dividend of $0.80 per share to be paid on March 14, 2025 to common stockholders of record on February 28, 2025.

During the fourth quarter, the Company repurchased 14 thousand shares from employees for the net settlement of stock-based compensation awards at an average price per share of $297.41, and 0.1 million shares at an average price per share of $264.91 in open market transactions pursuant to the Company's share repurchase program. The aggregate 0.1 million shares were acquired at an average price per share of $269.06. During 2024, the Company repurchased 1.0 million shares from employees for the net settlement of stock-based compensation awards at an average price per share of $179.67, and 1.3 million shares at an average price per share of $203.84 in open market transactions pursuant to the Company's share repurchase program. The aggregate 2.3 million shares were acquired at an average price per share of $193.40.

Conference Call

Evercore will host a related conference call beginning at 8:00 a.m. Eastern Time, Wednesday, February 5, 2025, accessible via telephone and webcast. Investors and analysts may participate in the live conference call by dialing (800) 445-7795 (toll-free domestic) or (785) 424-1699 (international); passcode: EVRQ424. Please register at least 10 minutes before the conference call begins.

A live audio webcast of the conference call will be available on the Investor Relations section of Evercore’s website at www.evercore.com. The webcast will be archived on Evercore’s website for 30 days.

About Evercore

Evercore (NYSE: EVR) is a premier global independent investment banking advisory firm. We are dedicated to helping our clients achieve superior results through trusted independent and innovative advice on matters of strategic significance to boards of directors, management teams and shareholders, including mergers and acquisitions, strategic shareholder advisory, restructurings, and capital structure. Evercore also assists clients in raising public and private capital and delivers equity research and equity sales and agency trading execution, in addition to providing wealth and investment management services to high net worth and institutional investors. Founded in 1995, the Firm is headquartered in New York and maintains offices and affiliate offices in major financial centers in the Americas, Europe, the Middle East and Asia. For more information, please visit www.evercore.com.

| | | | | |

| Investor Contact: | Katy Haber |

| Head of Investor Relations & ESG |

| InvestorRelations@Evercore.com |

| |

| Media Contacts: | Jamie Easton |

| Head of Communications & External Affairs |

| Communications@Evercore.com |

| |

| Shree Dhond / Zach Kouwe |

| Dukas Linden Public Relations |

| Evercore@DLPR.com |

| (646) 722-6531 |

Basis of Alternative Financial Statement Presentation

Our Adjusted results are a non-GAAP measure. As discussed further under "Non-GAAP Measures", Evercore believes that the disclosed Adjusted measures and any adjustments thereto, when presented in conjunction with comparable U.S. GAAP measures, are useful to investors to compare Evercore's results across several periods and better reflects how management views its operating results. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of our U.S. GAAP results to Adjusted results is presented in the tables included in the following pages.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect our current views with respect to, among other things, Evercore's operations and financial performance. In some cases, you can identify these forward-looking statements by the use of words such as "outlook," "backlog," "believes," "expects," "potential," "probable," "continues," "may," "will," "should," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. All statements, other than statements of historical fact, included in this release are forward-looking statements and are based on various underlying assumptions and expectations and are subject to known and unknown risks, uncertainties and assumptions, and may include projections of our future financial performance based on our growth strategies and anticipated trends in Evercore's business. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Evercore believes these factors include, but are not limited to, those described under "Risk Factors" discussed in Evercore's Annual Report on Form 10-K for the year ended December 31, 2023, subsequent quarterly reports on Form 10-Q, current reports on Form 8-K and Registration Statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release. In addition, new risks and uncertainties emerge from time to time, and it is not possible for Evercore to predict all risks and uncertainties, nor can Evercore assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and Evercore does not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. Evercore undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EVERCORE INC. | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | | | | | | | | |

| THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2024 AND 2023 | | | | | | | | |

| (dollars in thousands, except per share data) | | | | | | | | |

| (UNAUDITED) | | | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, | | | | | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | | | | | |

| | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | |

| Investment Banking & Equities: | | | | | | | | | | | | | | | |

| Advisory Fees | $ | 849,556 | | | $ | 659,338 | | | $ | 2,440,605 | | | $ | 1,963,857 | | | | | | | | | |

| Underwriting Fees | 26,401 | | | 19,119 | | | 157,067 | | | 111,016 | | | | | | | | | |

| Commissions and Related Revenue | 58,049 | | | 55,979 | | | 214,045 | | | 202,789 | | | | | | | | | |

| Asset Management and Administration Fees | 21,096 | | | 17,204 | | | 79,550 | | | 67,041 | | | | | | | | | |

| Other Revenue, Including Interest and Investments | 24,423 | | | 36,708 | | | 105,094 | | | 97,963 | | | | | | | | | |

| Total Revenues | 979,525 | | | 788,348 | | | 2,996,361 | | | 2,442,666 | | | | | | | | | |

Interest Expense(1) | 4,193 | | | 4,181 | | | 16,768 | | | 16,717 | | | | | | | | | |

| Net Revenues | 975,332 | | | 784,167 | | | 2,979,593 | | | 2,425,949 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | | |

| Employee Compensation and Benefits | 639,386 | | | 559,899 | | | 1,974,036 | | | 1,656,875 | | | | | | | | | |

| Occupancy and Equipment Rental | 24,121 | | | 20,335 | | | 90,953 | | | 84,329 | | | | | | | | | |

| Professional Fees | 37,906 | | | 28,809 | | | 135,726 | | | 108,801 | | | | | | | | | |

| Travel and Related Expenses | 20,562 | | | 18,437 | | | 79,446 | | | 64,527 | | | | | | | | | |

| Communications and Information Services | 21,479 | | | 19,597 | | | 81,474 | | | 71,603 | | | | | | | | | |

| Depreciation and Amortization | 5,840 | | | 5,975 | | | 24,468 | | | 24,348 | | | | | | | | | |

| Execution, Clearing and Custody Fees | 3,473 | | | 3,430 | | | 13,211 | | | 12,275 | | | | | | | | | |

| Special Charges, Including Business Realignment Costs | — | | | — | | | 7,305 | | | 2,921 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other Operating Expenses | 10,007 | | | 9,996 | | | 46,060 | | | 41,135 | | | | | | | | | |

| Total Expenses | 762,774 | | | 666,478 | | | 2,452,679 | | | 2,066,814 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Income Before Income from Equity Method Investments and Income Taxes | 212,558 | | | 117,689 | | | 526,914 | | | 359,135 | | | | | | | | | |

| Income from Equity Method Investments | 977 | | | 1,981 | | | 6,231 | | | 6,655 | | | | | | | | | |

| Income Before Income Taxes | 213,535 | | | 119,670 | | | 533,145 | | | 365,790 | | | | | | | | | |

| Provision for Income Taxes | 58,749 | | | 27,622 | | | 115,408 | | | 80,567 | | | | | | | | | |

| Net Income | 154,786 | | | 92,048 | | | 417,737 | | | 285,223 | | | | | | | | | |

| Net Income Attributable to Noncontrolling Interest | 14,351 | | | 9,300 | | | 39,458 | | | 29,744 | | | | | | | | | |

| Net Income Attributable to Evercore Inc. | $ | 140,435 | | | $ | 82,748 | | | $ | 378,279 | | | $ | 255,479 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net Income Attributable to Evercore Inc. Common Shareholders | $ | 140,435 | | | $ | 82,748 | | | $ | 378,279 | | | $ | 255,479 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Weighted Average Shares of Class A Common Stock Outstanding: | | | | | | | | | | | | | | | |

| Basic | 38,228 | | | 37,871 | | | 38,365 | | | 38,101 | | | | | | | | | |

| Diluted | 42,611 | | | 40,679 | | | 41,646 | | | 40,099 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net Income Per Share Attributable to Evercore Inc. Common Shareholders: | | | | | | | | | | | | | | | |

| Basic | $ | 3.67 | | | $ | 2.18 | | | $ | 9.86 | | | $ | 6.71 | | | | | | | | | |

| Diluted | $ | 3.30 | | | $ | 2.03 | | | $ | 9.08 | | | $ | 6.37 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Includes interest expense on long-term debt. | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

Adjusted Results

Throughout the discussion of Evercore's business and elsewhere in this release, information is presented on an Adjusted basis, which is a non-generally accepted accounting principles ("non-GAAP") measure. Adjusted results begin with information prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"), adjusted to exclude certain items and reflect the conversion of certain Evercore LP Units and Unvested Restricted Stock Units into Class A shares. Evercore believes that the disclosed Adjusted measures and any adjustments thereto, when presented in conjunction with comparable U.S. GAAP measures, are useful to investors to compare Evercore's results across several periods and facilitate an understanding of Evercore's operating results. The Company uses these measures to evaluate its operating performance, as well as the performance of individual employees. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP. These Adjusted amounts are allocated to the Company's two business segments: Investment Banking & Equities and Investment Management. The differences between the Adjusted and U.S. GAAP results are as follows:

1.Assumed Exchange of Evercore LP Units into Class A Shares. The Adjusted results assume substantially all Evercore LP Units have been exchanged for Class A shares. Accordingly, the noncontrolling interest related to these units is converted to a controlling interest. The Company's management believes that it is useful to provide the per-share effect associated with the assumed conversion of substantially all of these previously granted equity interests and IPO related restricted stock units, and thus the Adjusted results reflect their exchange into Class A shares.

2.Adjustments Associated with Business Combinations and Divestitures. The following charges resulting from business combinations and divestitures have been excluded from the Adjusted results because the Company's Management believes that operating performance is more comparable across periods excluding the effects of these acquisition-related charges:

a.Foreign Exchange Gains / (Losses). The release of cumulative foreign exchange losses in the third quarter of 2024 resulting from the redemption of the Company's interest in Luminis is excluded from the Adjusted presentation.

b.Gain on Sale of Interests in ABS. The gain on the sale of the remaining portion of the Company's interest in ABS in the third quarter of 2024 is excluded from the Adjusted presentation.

3.Special Charges, Including Business Realignment Costs. Expenses during 2024 that are excluded from the Adjusted presentation relate to the write-off of the remaining carrying value of the Company's investment in Luminis in connection with the redemption of the Company's interest. Expenses during 2023 that are excluded from the Adjusted presentation relate to the write-off of non-recoverable assets in connection with the wind-down of the Company's operations in Mexico.

4.Income Taxes. Evercore is organized as a series of Limited Liability Companies, Partnerships, C-Corporations and a Public Corporation in the U.S. as the ultimate parent. Certain of the subsidiaries, particularly Evercore LP, have noncontrolling interests held by management or former members of management. As a result, not all of the Company’s income is subject to corporate level taxes and certain other state and local taxes are levied. The assumption in the Adjusted earnings presentation is that substantially all of the noncontrolling interest is eliminated through the exchange of Evercore LP units into Class A common stock of the ultimate parent. As a result, the Adjusted earnings presentation assumes that the allocation of earnings to Evercore LP’s noncontrolling interest holders is substantially eliminated and is therefore subject to statutory tax rates of a C-Corporation under a conventional tax structure in the U.S. and that certain state and local taxes are reduced accordingly.

5.Presentation of Interest Expense. The Adjusted results present Adjusted Investment Banking & Equities Operating Income before interest expense on debt, which is included in interest expense on a U.S. GAAP basis.

6.Presentation of Income from Equity Method Investments. The Adjusted results present Income from Equity Method Investments within Revenue as the Company's Management believes it is a useful presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EVERCORE INC. | | | | | | | |

| U.S. GAAP RECONCILIATION TO ADJUSTED RESULTS | | | | | | | |

| (dollars in thousands, except per share data) | | | | | | | |

| (UNAUDITED) | | | | | | | |

| | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | | | | | | |

| December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 | | | | | | | |

| Net Revenues - U.S. GAAP | $ | 975,332 | | | $ | 784,167 | | | $ | 2,979,593 | | | $ | 2,425,949 | | | | | | | | |

| | | | | | | | | | | | | | |

| Income from Equity Method Investments (1) | 977 | | | 1,981 | | | 6,231 | | | 6,655 | | | | | | | | |

| Interest Expense on Debt (2) | 4,193 | | | 4,181 | | | 16,768 | | | 16,717 | | | | | | | | |

| Release of Foreign Exchange Losses from Luminis Redemption (3) | — | | | — | | | 658 | | | — | | | | | | | | |

| Gain on Sale of Interests in ABS (4) | — | | | — | | | (615) | | | — | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Revenues - Adjusted | $ | 980,502 | | | $ | 790,329 | | | $ | 3,002,635 | | | $ | 2,449,321 | | | | | | | | |

| | | | | | | | | | | | | | |

| Other Revenue, net - U.S. GAAP | $ | 20,230 | | | $ | 32,527 | | | $ | 88,326 | | | $ | 81,246 | | | | | | | | |

| Interest Expense on Debt (2) | 4,193 | | | 4,181 | | | 16,768 | | | 16,717 | | | | | | | | |

| Release of Foreign Exchange Losses from Luminis Redemption (3) | — | | | — | | | 658 | | | — | | | | | | | | |

| Gain on Sale of Interests in ABS (4) | — | | | — | | | (615) | | | — | | | | | | | | |

| | | | | | | | | | | | | | |

| Other Revenue, net - Adjusted | $ | 24,423 | | | $ | 36,708 | | | $ | 105,137 | | | $ | 97,963 | | | | | | | | |

| | | | | | | | | | | | | | |

| Operating Income - U.S. GAAP | $ | 212,558 | | | $ | 117,689 | | | $ | 526,914 | | | $ | 359,135 | | | | | | | | |

| Income from Equity Method Investments (1) | 977 | | | 1,981 | | | 6,231 | | | 6,655 | | | | | | | | |

| Pre-Tax Income - U.S. GAAP | 213,535 | | | 119,670 | | | 533,145 | | | 365,790 | | | | | | | | |

| Release of Foreign Exchange Losses from Luminis Redemption (3) | — | | | — | | | 658 | | | — | | | | | | | | |

| Gain on Sale of Interests in ABS (4) | — | | | — | | | (615) | | | — | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Special Charges, Including Business Realignment Costs (5) | — | | | — | | | 7,305 | | | 2,921 | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Pre-Tax Income - Adjusted | 213,535 | | | 119,670 | | | 540,493 | | | 368,711 | | | | | | | | |

| Interest Expense on Debt (2) | 4,193 | | | 4,181 | | | 16,768 | | | 16,717 | | | | | | | | |

| Operating Income - Adjusted | $ | 217,728 | | | $ | 123,851 | | | $ | 557,261 | | | $ | 385,428 | | | | | | | | |

| | | | | | | | | | | | | | |

| Provision for Income Taxes - U.S. GAAP | $ | 58,749 | | | $ | 27,622 | | | $ | 115,408 | | | $ | 80,567 | | | | | | | | |

| Income Taxes (6) | (390) | | | 2,624 | | | 2,312 | | | 5,739 | | | | | | | | |

| Provision for Income Taxes - Adjusted | $ | 58,359 | | | $ | 30,246 | | | $ | 117,720 | | | $ | 86,306 | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Income Attributable to Evercore Inc. - U.S. GAAP | $ | 140,435 | | | $ | 82,748 | | | $ | 378,279 | | | $ | 255,479 | | | | | | | | |

| Release of Foreign Exchange Losses from Luminis Redemption (3) | — | | | — | | | 658 | | | — | | | | | | | | |

| Gain on Sale of Interests in ABS (4) | — | | | — | | | (615) | | | — | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Special Charges, Including Business Realignment Costs (5) | — | | | — | | | 7,305 | | | 2,921 | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Income Taxes (6) | 390 | | | (2,624) | | | (2,312) | | | (5,739) | | | | | | | | |

| Noncontrolling Interest (7) | 12,411 | | | 7,700 | | | 32,446 | | | 24,263 | | | | | | | | |

| Net Income Attributable to Evercore Inc. - Adjusted | $ | 153,236 | | | $ | 87,824 | | | $ | 415,761 | | | $ | 276,924 | | | | | | | | |

| | | | | | | | | | | | | | |

| Diluted Shares Outstanding - U.S. GAAP | 42,611 | | | 40,679 | | | 41,646 | | | 40,099 | | | | | | | | |

| LP Units (8) | 2,359 | | | 2,715 | | | 2,499 | | | 2,769 | | | | | | | | |

| Unvested Restricted Stock Units - Event Based (8) | 12 | | | 12 | | | 12 | | | 12 | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Diluted Shares Outstanding - Adjusted | 44,982 | | | 43,406 | | | 44,157 | | | 42,880 | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| Key Metrics: (a) | | | | | | | | | | | | | | |

| Diluted Earnings Per Share - U.S. GAAP | $ | 3.30 | | | $ | 2.03 | | | $ | 9.08 | | | $ | 6.37 | | | | | | | | |

| Diluted Earnings Per Share - Adjusted | $ | 3.41 | | | $ | 2.02 | | | $ | 9.42 | | | $ | 6.46 | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Operating Margin - U.S. GAAP | 21.8 | % | | 15.0 | % | | 17.7 | % | | 14.8 | % | | | | | | | |

| Operating Margin - Adjusted | 22.2 | % | | 15.7 | % | | 18.6 | % | | 15.7 | % | | | | | | | |

| | | | | | | | | | | | | | |

| Effective Tax Rate - U.S. GAAP | 27.5 | % | | 23.1 | % | | 21.6 | % | | 22.0 | % | | | | | | | |

| Effective Tax Rate - Adjusted | 27.3 | % | | 25.3 | % | | 21.8 | % | | 23.4 | % | | | | | | | |

| | | | | | | | | | | | | | |

| (a) Reconciliations of the key metrics from U.S. GAAP to Adjusted results are a derivative of the reconciliations of their components above. | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EVERCORE INC. |

| U.S. GAAP SEGMENT RECONCILIATION TO ADJUSTED RESULTS |

| FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2024 |

| (dollars in thousands) |

| (UNAUDITED) |

| | | | | | | | | | | |

| Investment Banking & Equities Segment |

| Three Months Ended December 31, 2024 | | Twelve Months Ended December 31, 2024 |

| U.S. GAAP Basis | | Adjustments | | Non-GAAP Adjusted Basis | | U.S. GAAP Basis | | Adjustments | | Non-GAAP Adjusted Basis |

| Net Revenues: | | | | | | | | | | | |

| Investment Banking & Equities: | | | | | | | | | | | |

| Advisory Fees | $ | 849,556 | | | $ | 31 | | (1) | $ | 849,587 | | | $ | 2,440,605 | | | $ | 1,073 | | (1) | $ | 2,441,678 | |

| Underwriting Fees | 26,401 | | | — | | | 26,401 | | | 157,067 | | | — | | | 157,067 | |

| Commissions and Related Revenue | 58,049 | | | — | | | 58,049 | | | 214,045 | | | — | | | 214,045 | |

| Other Revenue, net | 19,970 | | | 4,193 | | (2) | 24,163 | | | 86,772 | | | 17,426 | | (2)(3) | 104,198 | |

| Net Revenues | 953,976 | | | 4,224 | | | 958,200 | | | 2,898,489 | | | 18,499 | | | 2,916,988 | |

| | | | | | | | | | | |

| Expenses: | | | | | | | | | | | |

| Employee Compensation and Benefits | 626,587 | | | — | | | 626,587 | | | 1,927,928 | | | — | | | 1,927,928 | |

| Non-Compensation Costs | 119,309 | | | — | | | 119,309 | | | 456,257 | | | — | | | 456,257 | |

| Special Charges, Including Business Realignment Costs | — | | | — | | | — | | | 7,305 | | | (7,305) | | (5) | — | |

| Total Expenses | 745,896 | | | — | | | 745,896 | | | 2,391,490 | | | (7,305) | | | 2,384,185 | |

| | | | | | | | | | | |

| Operating Income (a) | $ | 208,080 | | | $ | 4,224 | | | $ | 212,304 | | | $ | 506,999 | | | $ | 25,804 | | | $ | 532,803 | |

| | | | | | | | | | | |

| Compensation Ratio (b) | 65.7 | % | | | | 65.4 | % | | 66.5 | % | | | | 66.1 | % |

| Operating Margin (b) | 21.8 | % | | | | 22.2 | % | | 17.5 | % | | | | 18.3 | % |

| | | | | | | | | | | |

| Investment Management Segment |

| Three Months Ended December 31, 2024 | | Twelve Months Ended December 31, 2024 |

| U.S. GAAP Basis | | Adjustments | | Non-GAAP Adjusted Basis | | U.S. GAAP Basis | | Adjustments | | Non-GAAP Adjusted Basis |

| Net Revenues: | | | | | | | | | | | |

| Asset Management and Administration Fees | $ | 21,096 | | | $ | 946 | | (1) | $ | 22,042 | | | $ | 79,550 | | | $ | 5,158 | | (1) | $ | 84,708 | |

| Other Revenue, net | 260 | | | — | | | 260 | | | 1,554 | | | (615) | | (4) | 939 | |

| Net Revenues | 21,356 | | | 946 | | | 22,302 | | | 81,104 | | | 4,543 | | | 85,647 | |

| | | | | | | | | | | |

| Expenses: | | | | | | | | | | | |

| Employee Compensation and Benefits | 12,799 | | | — | | | 12,799 | | | 46,108 | | | — | | | 46,108 | |

| Non-Compensation Costs | 4,079 | | | — | | | 4,079 | | | 15,081 | | | — | | | 15,081 | |

| | | | | | | | | | | |

| Total Expenses | 16,878 | | | — | | | 16,878 | | | 61,189 | | | — | | | 61,189 | |

| | | | | | | | | | | |

| Operating Income (a) | $ | 4,478 | | | $ | 946 | | | $ | 5,424 | | | $ | 19,915 | | | $ | 4,543 | | | $ | 24,458 | |

| | | | | | | | | | | |

| Compensation Ratio (b) | 59.9 | % | | | | 57.4 | % | | 56.9 | % | | | | 53.8 | % |

| Operating Margin (b) | 21.0 | % | | | | 24.3 | % | | 24.6 | % | | | | 28.6 | % |

| | | | | | | | | | | |

| (a) Operating Income for U.S. GAAP excludes Income (Loss) from Equity Method Investments. |

| (b) Reconciliations of the key metrics from U.S. GAAP to Adjusted results are a derivative of the reconciliations of their components above. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EVERCORE INC. |

| U.S. GAAP SEGMENT RECONCILIATION TO ADJUSTED RESULTS |

| FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2023 |

| (dollars in thousands) |

| (UNAUDITED) |

| | | | | | | | | | | |

| Investment Banking & Equities Segment |

| Three Months Ended December 31, 2023 | | Twelve Months Ended December 31, 2023 |

| U.S. GAAP Basis | | Adjustments | | Non-GAAP Adjusted Basis | | U.S. GAAP Basis | | Adjustments | | Non-GAAP Adjusted Basis |

| Net Revenues: | | | | | | | | | | | |

| Investment Banking & Equities: | | | | | | | | | | | |

| Advisory Fees | $ | 659,338 | | | $ | 226 | | (1) | $ | 659,564 | | | $ | 1,963,857 | | | $ | 620 | | (1) | $ | 1,964,477 | |

| Underwriting Fees | 19,119 | | | — | | | 19,119 | | | 111,016 | | | — | | | 111,016 | |

| Commissions and Related Revenue | 55,979 | | | — | | | 55,979 | | | 202,789 | | | — | | | 202,789 | |

| Other Revenue, net | 31,809 | | | 4,181 | | (2) | 35,990 | | | 78,281 | | | 16,717 | | (2) | 94,998 | |

| Net Revenues | 766,245 | | | 4,407 | | | 770,652 | | | 2,355,943 | | | 17,337 | | | 2,373,280 | |

| | | | | | | | | | | |

| Expenses: | | | | | | | | | | | |

| Employee Compensation and Benefits | 550,763 | | | — | | | 550,763 | | | 1,617,449 | | | — | | | 1,617,449 | |

| Non-Compensation Costs | 103,141 | | | — | | | 103,141 | | | 393,308 | | | — | | | 393,308 | |

| Special Charges, Including Business Realignment Costs | — | | | — | | | — | | | 2,921 | | | (2,921) | | (5) | — | |

| Total Expenses | 653,904 | | | — | | | 653,904 | | | 2,013,678 | | | (2,921) | | | 2,010,757 | |

| | | | | | | | | | | |

| Operating Income (a) | $ | 112,341 | | | $ | 4,407 | | | $ | 116,748 | | | $ | 342,265 | | | $ | 20,258 | | | $ | 362,523 | |

| | | | | | | | | | | |

| Compensation Ratio (b) | 71.9 | % | | | | 71.5 | % | | 68.7 | % | | | | 68.2 | % |

| Operating Margin (b) | 14.7 | % | | | | 15.1 | % | | 14.5 | % | | | | 15.3 | % |

| | | | | | | | | | | |

| Investment Management Segment |

| Three Months Ended December 31, 2023 | | Twelve Months Ended December 31, 2023 |

| U.S. GAAP Basis | | Adjustments | | Non-GAAP Adjusted Basis | | U.S. GAAP Basis | | Adjustments | | Non-GAAP Adjusted Basis |

| Net Revenues: | | | | | | | | | | | |

| Asset Management and Administration Fees | $ | 17,204 | | | $ | 1,755 | | (1) | $ | 18,959 | | | $ | 67,041 | | | $ | 6,035 | | (1) | $ | 73,076 | |

| Other Revenue, net | 718 | | | — | | | 718 | | | 2,965 | | | — | | | 2,965 | |

| Net Revenues | 17,922 | | | 1,755 | | | 19,677 | | | 70,006 | | | 6,035 | | | 76,041 | |

| | | | | | | | | | | |

| Expenses: | | | | | | | | | | | |

| Employee Compensation and Benefits | 9,136 | | | — | | | 9,136 | | | 39,426 | | | — | | | 39,426 | |

| Non-Compensation Costs | 3,438 | | | — | | | 3,438 | | | 13,710 | | | — | | | 13,710 | |

| | | | | | | | | | | |

| Total Expenses | 12,574 | | | — | | | 12,574 | | | 53,136 | | | — | | | 53,136 | |

| | | | | | | | | | | |

| Operating Income (a) | $ | 5,348 | | | $ | 1,755 | | | $ | 7,103 | | | $ | 16,870 | | | $ | 6,035 | | | $ | 22,905 | |

| | | | | | | | | | | |

| Compensation Ratio (b) | 51.0 | % | | | | 46.4 | % | | 56.3 | % | | | | 51.8 | % |

| Operating Margin (b) | 29.8 | % | | | | 36.1 | % | | 24.1 | % | | | | 30.1 | % |

| | | | | | | | | | | |

| (a) Operating Income for U.S. GAAP excludes Income (Loss) from Equity Method Investments. |

| (b) Reconciliations of the key metrics from U.S. GAAP to Adjusted results are a derivative of the reconciliations of their components above. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EVERCORE INC. | | | | | | |

| U.S. GAAP SEGMENT AND CONSOLIDATED RESULTS | | | | | | |

| (dollars in thousands) | | | | | | |

| (UNAUDITED) | | | | | | |

| | | | | | | | | | | | | |

| U.S. GAAP | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, | | | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | | | |

| Investment Banking & Equities | | | | | | | | | | | | | |

| Net Revenues: | | | | | | | | | | | | | |

| Investment Banking & Equities: | | | | | | | | | | | | | |

| Advisory Fees | $ | 849,556 | | | $ | 659,338 | | | $ | 2,440,605 | | | $ | 1,963,857 | | | | | | | |

| Underwriting Fees | 26,401 | | | 19,119 | | | 157,067 | | | 111,016 | | | | | | | |

| Commissions and Related Revenue | 58,049 | | | 55,979 | | | 214,045 | | | 202,789 | | | | | | | |

| Other Revenue, net | 19,970 | | | 31,809 | | | 86,772 | | | 78,281 | | | | | | | |

| Net Revenues | 953,976 | | | 766,245 | | | 2,898,489 | | | 2,355,943 | | | | | | | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | |

| Employee Compensation and Benefits | 626,587 | | | 550,763 | | | 1,927,928 | | | 1,617,449 | | | | | | | |

| Non-Compensation Costs | 119,309 | | | 103,141 | | | 456,257 | | | 393,308 | | | | | | | |

| Special Charges, Including Business Realignment Costs | — | | | — | | | 7,305 | | | 2,921 | | | | | | | |

| Total Expenses | 745,896 | | | 653,904 | | | 2,391,490 | | | 2,013,678 | | | | | | | |

| | | | | | | | | | | | | |

| Operating Income (a) | $ | 208,080 | | | $ | 112,341 | | | $ | 506,999 | | | $ | 342,265 | | | | | | | |

| | | | | | | | | | | | | |

| Investment Management | | | | | | | | | | | | | |

| Net Revenues: | | | | | | | | | | | | | |

| Asset Management and Administration Fees | $ | 21,096 | | | $ | 17,204 | | | $ | 79,550 | | | $ | 67,041 | | | | | | | |

| Other Revenue, net | 260 | | | 718 | | | 1,554 | | | 2,965 | | | | | | | |

| Net Revenues | 21,356 | | | 17,922 | | | 81,104 | | | 70,006 | | | | | | | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | |

| Employee Compensation and Benefits | 12,799 | | | 9,136 | | | 46,108 | | | 39,426 | | | | | | | |

| Non-Compensation Costs | 4,079 | | | 3,438 | | | 15,081 | | | 13,710 | | | | | | | |

| | | | | | | | | | | | | |

| Total Expenses | 16,878 | | | 12,574 | | | 61,189 | | | 53,136 | | | | | | | |

| | | | | | | | | | | | | |

| Operating Income (a) | $ | 4,478 | | | $ | 5,348 | | | $ | 19,915 | | | $ | 16,870 | | | | | | | |

| | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | |

| Net Revenues: | | | | | | | | | | | | | |

| Investment Banking & Equities: | | | | | | | | | | | | | |

| Advisory Fees | $ | 849,556 | | | $ | 659,338 | | | $ | 2,440,605 | | | $ | 1,963,857 | | | | | | | |

| Underwriting Fees | 26,401 | | | 19,119 | | | 157,067 | | | 111,016 | | | | | | | |

| Commissions and Related Revenue | 58,049 | | | 55,979 | | | 214,045 | | | 202,789 | | | | | | | |

| Asset Management and Administration Fees | 21,096 | | | 17,204 | | | 79,550 | | | 67,041 | | | | | | | |

| Other Revenue, net | 20,230 | | | 32,527 | | | 88,326 | | | 81,246 | | | | | | | |

| Net Revenues | 975,332 | | | 784,167 | | | 2,979,593 | | | 2,425,949 | | | | | | | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | |

| Employee Compensation and Benefits | 639,386 | | | 559,899 | | | 1,974,036 | | | 1,656,875 | | | | | | | |

| Non-Compensation Costs | 123,388 | | | 106,579 | | | 471,338 | | | 407,018 | | | | | | | |

| Special Charges, Including Business Realignment Costs | — | | | — | | | 7,305 | | | 2,921 | | | | | | | |

| Total Expenses | 762,774 | | | 666,478 | | | 2,452,679 | | | 2,066,814 | | | | | | | |

| | | | | | | | | | | | | |

| Operating Income (a) | $ | 212,558 | | | $ | 117,689 | | | $ | 526,914 | | | $ | 359,135 | | | | | | | |

| | | | | | | | | | | | | |

| (a) Operating Income excludes Income (Loss) from Equity Method Investments. | | | | | | |

Notes to Unaudited Condensed Consolidated Adjusted Financial Data

For further information on these adjustments, see page A-2.

(1)Income (Loss) from Equity Method Investments has been reclassified to Revenue in the Adjusted presentation.

(2)Interest Expense on Debt is excluded from Net Revenues and presented below Operating Income in the Adjusted results and is included in Interest Expense on a U.S. GAAP basis.

(3)The release of cumulative foreign exchange losses in the third quarter of 2024 resulting from the redemption of the Company's interest in Luminis is excluded from the Adjusted presentation.

(4)The gain on the sale of the remaining portion of the Company's interest in ABS in the third quarter of 2024 is excluded from the Adjusted presentation.

(5)Expenses during 2024 that are excluded from the Adjusted presentation relate to the write-off of the remaining carrying value of the Company's investment in Luminis in connection with the redemption of the Company's interest. Expenses during 2023 that are excluded from the Adjusted presentation relate to the write-off of non-recoverable assets in connection with the wind-down of the Company's operations in Mexico.

(6)Evercore is organized as a series of Limited Liability Companies, Partnerships, C-Corporations and a Public Corporation in the U.S. as the ultimate parent. Certain of the subsidiaries, particularly Evercore LP, have noncontrolling interests held by management or former members of management. As a result, not all of the Company’s income is subject to corporate level taxes and certain other state and local taxes are levied. The assumption in the Adjusted earnings presentation is that substantially all of the noncontrolling interest is eliminated through the exchange of Evercore LP units into Class A common stock of the ultimate parent. As a result, the Adjusted earnings presentation assumes that the allocation of earnings to Evercore LP’s noncontrolling interest holders is substantially eliminated and is therefore subject to statutory tax rates of a C-Corporation under a conventional tax structure in the U.S. and that certain state and local taxes are reduced accordingly.

(7)Reflects an adjustment to eliminate noncontrolling interest related to substantially all Evercore LP partnership units which are assumed to be converted to Class A common stock in the Adjusted presentation.

(8)Assumes the exchange into Class A shares of substantially all Evercore LP Units and IPO related restricted stock unit awards in the Adjusted presentation. In the computation of outstanding common stock equivalents for U.S. GAAP net income per share, the Evercore LP Units are anti-dilutive.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |