Comfort Systems USA, Inc. (NYSE: FIX) (the “Company”)

today reported results for the quarter ended September 30,

2024.

For the quarter ended September 30, 2024, net income was $146.2

million, or $4.09 per diluted share, as compared to $105.1 million,

or $2.93 per diluted share, for the quarter ended September 30,

2023. Revenue for the third quarter of 2024 was $1.81 billion

compared to $1.38 billion in 2023. The Company reported operating

cash flow of $302.2 million in the current quarter compared to

$214.2 million in 2023.

Brian Lane, Comfort Systems USA’s President and Chief Executive

Officer, said, “We are happy to report record earnings and cash

flow this quarter, as our employees continue to achieve unmatched

execution for our customers. Recently acquired companies exceeded

our high expectations, and each of our operating segments excelled

in every respect. Quarterly per share earnings were 40% ahead of

the same quarter last year, and through nine months our per share

earnings were 60% higher than in the same period last year. Cash

flow surpassed any previous quarter, and that extraordinary cash

flow is both a great base for continued investment and a definite

signal of strong underlying trends in our execution, customer

relationships, and prospects.”

Backlog as of September 30, 2024 was $5.68 billion as compared

to $5.77 billion as of June 30, 2024 and $4.29 billion as of

September 30, 2023. On a same-store basis, backlog increased from

$4.29 billion as of September 30, 2023 to $5.17 billion as of

September 30, 2024.

Mr. Lane continued, “Backlog continues far above the levels of

the prior year and bookings were remarkable even as we are burning

through work at a record pace, with same-store revenue higher by

18% on a quarterly basis, and by 23% year-to-date, compared to the

prior year. Entering the fourth quarter, same-store backlog is 21%

higher than it was at this time last year, and we are experiencing

unprecedented strength in our pipelines. Considering these

advantages and given the confidence we have in our unmatched

workforce, we expect continued strong results in the fourth quarter

and in 2025.”

The Company reported net income of $376.6 million, or $10.52 per

diluted share, for the nine months ended September 30, 2024, as

compared to $231.8 million, or $6.46 per diluted share in 2023. The

Company also reported revenue of $5.16 billion for the nine months

ended September 30, 2024, as compared to $3.85 billion in 2023.

Operating cash flow for the nine months ended September 30, 2024

was $638.6 million, as compared to $466.6 million in 2023.

The Company will host a webcast and conference call to discuss

its financial results and position on Friday, October 25, 2024 at

10:00 a.m. Central Time. To register for the call, please visit

https://register.vevent.com/register/BI51e8bc7e6c5c46f18a83b04a20b07efa.

Upon registering, participants will receive dial-in information and

a unique PIN to join the call. The call and the slide presentation

to accompany the remarks can be accessed on the Company’s website

at www.comfortsystemsusa.com under the “Investor” tab. A replay of

the entire call will be available on the Company’s website on the

next business day following the call.

Comfort Systems USA® is a leading provider of commercial,

industrial and institutional heating, ventilation, air conditioning

and electrical contracting services, with 178 locations in 137

cities across the nation. For more information, visit the Company’s

website at www.comfortsystemsusa.com.

Certain statements and information in this press release may

constitute forward-looking statements regarding our future business

expectations, which are subject to applicable securities laws and

regulations. The words “believe,” “expect,” “anticipate,” “plan,”

“intend,” “foresee,” “should,” “would,” “could,” or other similar

expressions are intended to identify forward-looking statements,

which are generally not historic in nature. These forward-looking

statements are based on the current expectations and beliefs of

Comfort Systems USA, Inc. and its subsidiaries (collectively, the

“Company”) concerning future developments and their effect on the

Company. While the Company’s management believes that these

forward-looking statements are reasonable as and when made, there

can be no assurance that future developments affecting the Company

will be those that it anticipates, and the Company’s actual results

of operations, financial condition and liquidity, and the

development of the industry in which the Company operates, may

differ materially from those made in or suggested by the

forward-looking statements contained in this press release. In

addition, even if our results of operations, financial condition

and liquidity, and the development of the industry in which we

operate, are consistent with the forward-looking statements

contained in this press release, those results or developments may

not be indicative of our results or developments in subsequent

periods. All comments concerning the Company’s expectations for

future revenue and operating results are based on the Company’s

forecasts for its existing operations and do not include the

potential impact of any future acquisitions. The Company’s

forward-looking statements involve significant risks and

uncertainties (some of which are beyond the Company’s control) and

assumptions that could cause actual future results to differ

materially from the Company’s historical experience and its present

expectations or projections. Important factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to: the use

of incorrect estimates for bidding a fixed-price contract;

undertaking contractual commitments that exceed the Company’s labor

resources; failing to perform contractual obligations efficiently

enough to maintain profitability; national or regional weakness in

construction activity and economic conditions; rising inflation and

fluctuations in interest rates; shortages of labor and specialty

building materials or material increases to the cost thereof; the

Company’s business being negatively affected by health crises or

outbreaks of disease, such as epidemics or pandemics (and related

impacts, such as supply chain disruptions); financial difficulties

affecting projects, vendors, customers, or subcontractors; the

Company’s backlog failing to translate into actual revenue or

profits; failure of third party subcontractors and suppliers to

complete work as anticipated; difficulty in obtaining, or increased

costs associated with, bonding and insurance; impairment to

goodwill; errors in the Company’s cost-to-cost input method of

accounting; the result of competition in the Company’s markets; the

Company’s decentralized management structure; material failure to

comply with varying state and local laws, regulations or

requirements; debarment from bidding on or performing government

contracts; retention of key management; seasonal fluctuations in

the demand for mechanical and electrical systems; the imposition of

past and future liability from environmental, safety, and health

regulations including the inherent risk associated with

self-insurance; adverse litigation results; an increase in our

effective tax rate; a material information technology failure or a

material cyber security breach; risks associated with acquisitions,

such as challenges to our ability to integrate those companies into

our internal control environment; our ability to manage growth and

geographically-dispersed operations; our ability to obtain

financing on acceptable terms; extreme weather conditions (such as

storms, droughts, extreme heat or cold, wildfires and floods),

including as a result of climate change, and any resulting

regulations or restrictions related thereto; and other risks

detailed in our reports filed with the Securities and Exchange

Commission (the “SEC”).

For additional information regarding known material factors that

could cause the Company’s results to differ from its projected

results, please see its filings with the SEC, including its Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K.

Readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date hereof.

The Company undertakes no obligation to publicly update or revise

any forward-looking statements after the date they are made,

whether because of new information, future events, or

otherwise.

— Financial tables follow —

Comfort Systems USA, Inc.

Consolidated Statements of

Operations

(In Thousands, Except per Share

Amounts)

Three Months Ended

Nine Months Ended

September 30,

September 30,

(Unaudited)

(Unaudited)

2024

%

2023

%

2024

%

2023

%

Revenue

$

1,812,366

100.0

%

$

1,378,124

100.0

%

$

5,159,672

100.0

%

$

3,849,194

100.0

%

Cost of services

1,430,652

78.9

%

1,100,625

79.9

%

4,116,999

79.8

%

3,138,370

81.5

%

Gross profit

381,714

21.1

%

277,499

20.1

%

1,042,673

20.2

%

710,824

18.5

%

SG&A

180,177

9.9

%

142,935

10.4

%

522,437

10.1

%

414,397

10.8

%

Gain on sale of assets

(1,347

)

(0.1

)

%

(579

)

—

(2,778

)

(0.1

)

%

(1,683

)

—

Operating income

202,884

11.2

%

135,143

9.8

%

523,014

10.1

%

298,110

7.7

%

Interest income (expense), net

2,095

0.1

%

(934

)

(0.1

)

%

1,620

—

(7,439

)

(0.2

)

%

Changes in the fair value of contingent

earn-out obligations

(17,254

)

(1.0

)

%

(8,727

)

(0.6

)

%

(44,434

)

(0.9

)

%

(14,207

)

(0.4

)

%

Other income (expense), net

87

—

(44

)

—

323

—

1

—

Income before income taxes

187,812

10.4

%

125,438

9.1

%

480,523

9.3

%

276,465

7.2

%

Provision for income taxes

41,577

20,313

103,960

44,648

Net income

$

146,235

8.1

%

$

105,125

7.6

%

$

376,563

7.3

%

$

231,817

6.0

%

Income per share

Basic

$

4.10

$

2.93

$

10.54

$

6.47

Diluted

$

4.09

$

2.93

$

10.52

$

6.46

Shares used in computing income per

share:

Basic

35,669

35,820

35,718

35,819

Diluted

35,755

35,917

35,804

35,910

Dividends per share

$

0.300

$

0.225

$

0.850

$

0.600

Supplemental Non-GAAP Information —

(Unaudited) (In Thousands, Except per Share Amounts)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Net income

$

146,235

$

105,125

$

376,563

$

231,817

Tax gains related to prior years

—

(7,393

)

—

(10,761

)

Tax-related SG&A costs, net of tax

—

730

—

1,063

Net income excluding tax gains

$

146,235

$

98,462

$

376,563

$

222,119

Diluted income per share

$

4.09

$

2.93

$

10.52

$

6.46

Tax gains related to prior years

—

(0.21

)

—

(0.30

)

Tax-related SG&A costs, net of tax

—

0.02

—

0.03

Diluted income per share excluding tax

gains

$

4.09

$

2.74

$

10.52

$

6.19

Note: Net income excluding tax gains and diluted income per

share excluding tax gains are presented because the Company

believes they reflect the results of the core ongoing operations of

the Company, and we believe they are responsive to frequent

questions we receive from third parties. These amounts, however,

are not considered primary measures of an entity’s financial

results under generally accepted accounting principles, and

accordingly, they should not be considered an alternative to

operating results as determined under generally accepted accounting

principles and as reported by the Company.

Supplemental Non-GAAP Information —

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization (“Adjusted EBITDA”) — (Unaudited) (In Thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

%

2023

%

2024

%

2023

%

Net income

$

146,235

$

105,125

$

376,563

$

231,817

Provision for income taxes

41,577

20,313

103,960

44,648

Other expense (income), net

(87

)

44

(323

)

(1

)

Changes in the fair value of contingent

earn-out obligations

17,254

8,727

44,434

14,207

Interest expense (income), net

(2,095

)

934

(1,620

)

7,439

Gain on sale of assets

(1,347

)

(579

)

(2,778

)

(1,683

)

Tax-related SG&A costs

—

924

—

1,345

Amortization

24,421

10,929

75,224

32,273

Depreciation

12,333

9,457

35,377

27,717

Adjusted EBITDA

$

238,291

13.1

%

$

155,874

11.3

%

$

630,837

12.2

%

$

357,762

9.3

%

Note: The Company defines adjusted earnings before interest,

taxes, depreciation, and amortization (“Adjusted EBITDA”) as net

income, provision for income taxes, other expense (income), net,

changes in the fair value of contingent earn-out obligations,

interest expense (income), net, gain on sale of assets, goodwill

impairment, other one-time expenses or gains and depreciation and

amortization. Other companies may define Adjusted EBITDA

differently. Adjusted EBITDA is presented because it is a financial

measure that is frequently requested by third parties. However,

Adjusted EBITDA is not considered under generally accepted

accounting principles as a primary measure of an entity’s financial

results, and accordingly, Adjusted EBITDA should not be considered

an alternative to operating income, net income, or cash flows as

determined under generally accepted accounting principles and as

reported by the Company.

Comfort Systems USA, Inc.

Condensed Consolidated Balance

Sheets

(In Thousands)

September 30,

December 31,

2024

2023

(Unaudited)

Cash and cash equivalents

$

415,583

$

205,150

Billed accounts receivable, net

1,730,960

1,318,926

Unbilled accounts receivable, net

89,332

72,774

Costs and estimated earnings in excess of

billings, net

73,934

28,084

Other current assets, net

227,090

286,166

Total current assets

2,536,899

1,911,100

Property and equipment, net

250,150

208,568

Goodwill

875,193

666,834

Identifiable intangible assets, net

456,459

280,397

Other noncurrent assets

294,064

238,680

Total assets

$

4,412,765

$

3,305,579

Current maturities of long-term debt

$

6,046

$

4,867

Accounts payable

603,546

419,962

Billings in excess of costs and estimated

earnings and deferred revenue

1,197,532

909,538

Other current liabilities

622,019

386,838

Total current liabilities

2,429,143

1,721,205

Long-term debt

62,315

39,345

Other long-term liabilities

333,585

267,200

Total liabilities

2,825,043

2,027,750

Total stockholders’ equity

1,587,722

1,277,829

Total liabilities and stockholders’

equity

$

4,412,765

$

3,305,579

Selected Cash Flow Data (Unaudited) (In

Thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Cash provided by (used in):

Operating activities

$

302,179

$

214,241

$

638,594

$

466,560

Investing activities

$

(21,586

)

$

(25,497

)

$

(304,020

)

$

(119,125

)

Financing activities

$

(64,429

)

$

(111,128

)

$

(124,141

)

$

(267,026

)

Free cash flow:

Cash from operating activities

$

302,179

$

214,241

$

638,594

$

466,560

Purchases of property and equipment

(22,059

)

(28,444

)

(70,395

)

(69,574

)

Proceeds from sales of property and

equipment

1,782

3,007

3,611

5,093

Free cash flow

$

281,902

$

188,804

$

571,810

$

402,079

Note: Free cash flow is defined as cash flow from operating

activities less customary capital expenditures, plus the proceeds

from asset sales. Other companies may define free cash flow

differently. Free cash flow is presented because it is a financial

measure that is frequently requested by third parties. However,

free cash flow is not considered under generally accepted

accounting principles as a primary measure of an entity’s financial

results, and accordingly, free cash flow should not be considered

an alternative to operating income, net income, or cash flows as

determined under generally accepted accounting principles and as

reported by the Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024838786/en/

Julie Shaeff, Chief Accounting Officer ir@comfortsystemsusa.com;

713-830-9687

675 Bering Drive, Suite 400 Houston, Texas 77057

713-830-9600

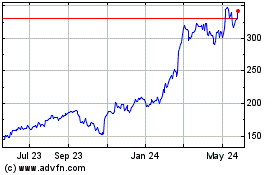

Comfort Systems USA (NYSE:FIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

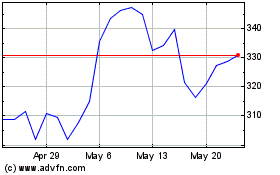

Comfort Systems USA (NYSE:FIX)

Historical Stock Chart

From Nov 2023 to Nov 2024