UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number 001-35297

Fortuna Silver Mines Inc.

(Translation of registrant’s name into English)

200 Burrard Street, Suite 650, Vancouver,

British Columbia, Canada V6C 3L6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fortuna Silver

Mines Inc. |

| |

(Registrant) |

| |

|

| Date: March 8, 2024 |

By: |

/s/

"Jorge Ganoza Durant" |

| |

|

Jorge Ganoza Durant |

| |

|

President and CEO |

Exhibits:

Exhibit 99.1

Fortuna Silver Mines

Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report

Effective Date:

December 31, 2023

| Prepared by |

Eric Chapman |

| |

Senior Vice President of Technical

Services - Fortuna Silver Mines Inc. |

| |

|

| |

Paul Weedon |

| |

Senior Vice President of Exploration

- Fortuna Silver Mines Inc. |

| |

|

| |

Raul Espinoza |

| |

Director of Technical Services

- Fortuna Silver Mines Inc. |

| |

|

| |

Mathieu Veillette |

| |

Director, Geotechnical, Tailings

and Water - Fortuna Silver Mines Inc. |

| |

|

| |

Patricia Gonzalez |

| |

Director of Operations - Compania

Minera Cuzcatlan S.A. de C.V. |

Suite 650, 200 Burrard Street,

Vancouver, BC, V6C 3L6 Tel: (604) 484 4085, Fax: (604) 484 4029

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

Contents

| |

1.1 |

Introduction |

15 |

| |

1.2 |

Property description, location and access |

15 |

| |

1.3 |

Mineral tenure, surface rights and royalties |

15 |

| |

1.4 |

History |

16 |

| |

1.5 |

Geology and mineralization |

16 |

| |

1.6 |

Drilling and sampling |

16 |

| |

1.7 |

Data verification |

19 |

| |

1.8 |

Mineral processing and metallurgical testing |

19 |

| |

1.9 |

Mineral Resources |

20 |

| |

1.10 |

Mineral Reserves |

21 |

| |

1.11 |

Mining methods |

23 |

| |

1.12 |

Recovery methods |

23 |

| |

1.13 |

Project infrastructure |

24 |

| |

1.14 |

Market studies and contracts |

24 |

| |

1.15 |

Environmental studies and permitting |

25 |

| |

1.16 |

Capital and operating costs |

26 |

| |

1.17 |

Economic analysis |

26 |

| |

1.18 |

Conclusions |

27 |

| |

1.19 |

Risks and opportunities |

27 |

| |

1.20 |

Recommendations |

28 |

| |

|

1.20.1 Exploration activities |

28 |

| |

|

1.20.2 Technical and operational studies |

29 |

| |

2.1 |

Report purpose |

30 |

| |

2.2 |

Qualified persons |

30 |

| |

2.3 |

Scope of personal inspection |

30 |

| |

2.4 |

Effective dates |

31 |

| |

2.5 |

Previous technical reports |

31 |

| |

2.6 |

Information sources and references |

32 |

| 3 |

Reliance on Other Experts |

34 |

| 4 |

Property Description and Location |

35 |

| |

4.1 |

Mineral tenure |

36 |

| |

|

4.1.1 Mining claims and concessions |

36 |

| |

4.2 |

Surface rights |

37 |

| |

4.3 |

Royalties |

39 |

| December 31, 2023 | Page 2 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

|

4.3.1 |

Mexico Mining Tax |

39 |

| |

4.4 |

Environmental aspects |

40 |

| |

|

4.4.1 |

Term extension of EA 1731-2009 |

40 |

| |

|

4.4.2 |

Mine closure |

40 |

| |

|

4.4.3 |

Other risks or liabilities |

41 |

| |

4.5 |

Permits |

41 |

| |

4.6 |

Comment on Section 4 |

41 |

| 5 |

Accessibility, Climate, Local

Resources, Infrastructure and Physiography |

42 |

| |

5.1 |

Access |

42 |

| |

5.2 |

Climate |

42 |

| |

5.3 |

Topography, elevation and vegetation |

42 |

| |

5.4 |

Infrastructure |

42 |

| |

5.5 |

Sufficiency of surface rights |

43 |

| |

5.6 |

Comment on Section 5 |

43 |

| |

6.1 |

Ownership history |

44 |

| |

6.2 |

Exploration history |

44 |

| |

6.3 |

Production history |

45 |

| |

|

6.3.1 |

Cuzcatlan |

45 |

| 7 |

Geological Setting and Mineralization |

45 |

| |

7.1 |

Regional geology |

46 |

| |

7.2 |

Local geology |

47 |

| |

7.3 |

Project geology |

48 |

| |

|

7.3.1 |

Stratigraphy |

49 |

| |

|

7.3.2 |

Structural geology |

50 |

| |

7.4 |

Description of mineralized zones |

51 |

| |

|

7.4.1 |

Trinidad deposit |

52 |

| |

|

7.4.2 |

Victoria mineralized zone |

55 |

| |

7.5 |

Comment on Section 7 |

57 |

| |

8.1 |

Mineral deposit type |

67 |

| |

8.2 |

Exploration model |

68 |

| |

8.3 |

Comment on Section 8 |

69 |

| |

9.1 |

Exploration conducted by Pan American

Silver |

70 |

| |

9.2 |

Exploration conducted by Continuum |

70 |

| |

9.3 |

Exploration conducted by Cuzcatlan |

70 |

| December 31, 2023 | Page 3 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

|

9.3.1 |

Geophysics |

70 |

| |

|

9.3.2 |

Fluid inclusion and petrographic studies |

71 |

| |

|

9.3.3 |

Terraspec analysis |

71 |

| |

|

9.3.4 |

Geological mapping |

71 |

| |

|

9.3.5 |

ASTER study |

74 |

| |

9.4 |

Exploration potential |

74 |

| |

9.5 |

Comment on Section 9 |

76 |

| |

10.1 |

Introduction |

77 |

| |

10.2 |

Drilling Campaigns |

79 |

| |

|

10.2.1 |

Pan American campaign (2001) |

79 |

| |

|

10.2.2 |

Continuum campaigns (2004 to 2006) |

80 |

| |

|

10.2.3 |

Cuzcatlan campaigns (2006 to 2023) |

80 |

| |

10.3 |

Drilling conducted post database cut-off

date |

82 |

| |

10.4 |

Geological and geotechnical logging procedures |

84 |

| |

10.5 |

Drill core recovery |

85 |

| |

10.6 |

Extent of drilling |

85 |

| |

10.7 |

Drill hole collar surveys |

86 |

| |

10.8 |

Downhole surveys |

86 |

| |

10.9 |

Drill sections |

86 |

| |

10.10 |

Sample length versus true thickness |

91 |

| |

10.11 |

Summary of drill intercepts |

91 |

| |

10.12 |

Comment on Section 10 |

92 |

| 11 |

Sample Preparation, Analyses,

and Security |

93 |

| |

11.1 |

Sample preparation prior to dispatch of

samples |

93 |

| |

|

11.1.1 |

Channel chip sampling |

93 |

| |

|

11.1.2 |

Core sampling |

94 |

| |

|

11.1.3 |

Bulk density determination |

94 |

| |

11.2 |

Dispatch of samples, sample preparation,

assaying and analytical procedures |

94 |

| |

|

11.2.1 |

Sample dispatch |

94 |

| |

|

11.2.2 |

Sample preparation |

95 |

| |

|

11.2.3 |

Sample analysis |

96 |

| |

11.3 |

Laboratory accreditation |

97 |

| |

11.4 |

Sample security and chain of custody |

98 |

| |

11.5 |

Quality control measures |

99 |

| |

|

11.5.1 |

Certified reference material |

99 |

| |

|

11.5.2 |

Blanks |

101 |

| |

|

11.5.3 |

Duplicates |

101 |

| |

|

11.5.4 |

Conclusions regarding quality control results |

104 |

| December 31, 2023 | Page 4 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

11.6 |

Comment on Section 11 |

104 |

| |

12.1 |

Introduction |

105 |

| |

|

12.1.1 |

Pan American and Continuum |

105 |

| |

|

12.1.2 |

Cuzcatlan |

105 |

| |

12.2 |

Database |

105 |

| |

12.3 |

Collars and downhole surveys |

106 |

| |

12.4 |

Geological logs and assays |

106 |

| |

12.5 |

Geotechnical and hydrogeology |

107 |

| |

12.6 |

Metallurgical recoveries |

107 |

| |

12.7 |

Mineral Resource estimation |

108 |

| |

12.8 |

Mineral Reserve estimation |

108 |

| |

12.9 |

Mine reconciliation |

109 |

| |

12.10 |

Site visits |

109 |

| |

12.11 |

Comment on Section 12 |

109 |

| 13 |

Mineral Processing and Metallurgical

Testing |

110 |

| |

13.1 |

Metallurgical tests |

111 |

| |

|

13.1.1 |

Whole rock analysis |

111 |

| |

|

13.1.2 |

Bond ball mill work index |

111 |

| |

|

13.1.3 |

Locked cycle flotation |

112 |

| |

|

13.1.4 |

Thickening and Filtering |

113 |

| |

13.2 |

Deleterious elements |

113 |

| |

13.3 |

Comment on Section 13 |

113 |

| 14 |

Mineral Resource Estimates |

114 |

| |

14.1 |

Introduction |

114 |

| |

14.2 |

Disclosure |

114 |

| |

|

14.2.1 |

Known issues that materially affect

Mineral Resources |

114 |

| |

14.3 |

Assumptions, methods and parameters |

115 |

| |

14.4 |

Supplied data, data transformations and

data validation |

115 |

| |

|

14.4.1 |

Data transformations |

115 |

| |

|

14.4.2 |

Software |

115 |

| |

|

14.4.3 |

Data preparation |

116 |

| |

|

14.4.4 |

Data validation |

116 |

| |

14.5 |

Geological interpretation and domaining |

116 |

| |

14.6 |

Exploratory data analysis |

118 |

| |

|

14.6.1 |

Compositing of assay intervals |

118 |

| |

|

14.6.2 |

Statistical analysis of composites |

119 |

| |

|

14.6.3 |

Sub-domaining |

120 |

| December 31, 2023 | Page 5 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

|

14.6.4 |

Extreme value treatment |

120 |

| |

|

14.6.5 |

Boundary conditions |

123 |

| |

|

14.6.6 |

Sample type comparison |

123 |

| |

|

14.6.7 |

Grade correlation |

123 |

| |

|

14.6.8 |

Continuity analysis |

124 |

| |

|

14.6.9 |

Variogram modeling |

124 |

| |

|

14.6.10 |

Opinion on the quality of the modeled variograms |

126 |

| |

|

14.6.11 |

Selective mining unit |

126 |

| |

14.7 |

Grade interpolation |

127 |

| |

14.8 |

Bulk density |

127 |

| |

14.9 |

Estimation validation |

128 |

| |

|

14.9.1 |

Global validation |

128 |

| |

|

14.9.2 |

Local validation |

129 |

| |

|

14.9.3 |

Visual validation |

130 |

| |

|

14.9.4 |

Mine reconciliation |

130 |

| |

|

14.10 |

Mineral Resource depletion |

131 |

| |

14.11 |

Mineral Resource classification |

131 |

| |

|

14.11.1 |

Geological continuity |

131 |

| |

|

14.11.2 |

Data density and orientation |

131 |

| |

|

14.11.3 |

Data accuracy and precision |

132 |

| |

|

14.11.4 |

Spatial grade continuity |

132 |

| |

|

14.11.5 |

Classification |

133 |

| |

14.12 |

Mineral Resource reporting |

134 |

| |

|

14.12.1 |

Reasonable prospects for eventual economic extraction |

134 |

| |

|

14.12.2 |

Mineral Resource statement |

134 |

| |

|

14.12.3 |

Mineral Resources by key geologic attributes |

135 |

| |

|

14.12.4 |

Comparison to previous estimates |

137 |

| |

14.13 |

Sequential Gaussian Simulation |

137 |

| |

14.14 |

Comment on Section 14 |

139 |

| 15 |

Mineral Reserve Estimates |

140 |

| |

15.1 |

Mineral Resources handover |

140 |

| |

15.2 |

Mineral Reserve methodology |

140 |

| |

15.3 |

Key Mining Parameters |

141 |

| |

|

15.3.1 |

Mining Recovery |

141 |

| |

|

15.3.2 |

Dilution |

141 |

| |

|

15.3.3 |

Metal prices, metallurgical recovery, and NSR values |

142 |

| |

15.4 |

Cut-off grade determination |

143 |

| |

15.5 |

Mineral Reserves |

144 |

| |

15.6 |

Comment on Section 15 |

145 |

| December 31, 2023 | Page 6 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

16.1 |

Introduction |

146 |

| |

16.2 |

Hydrogeology |

146 |

| |

16.3 |

Mine geotechnical |

146 |

| |

16.4 |

Mining method |

147 |

| |

16.5 |

Mine production schedule |

150 |

| |

|

16.5.1 |

Mineable stope optimization |

150 |

| |

16.6 |

Underground mine model |

152 |

| |

|

16.6.1 |

Mine layout |

152 |

| |

|

16.6.2 |

Lateral development |

152 |

| |

|

16.6.3 |

Raising requirements |

153 |

| |

16.7 |

Equipment, manpower, services, and infrastructure |

153 |

| |

|

16.7.1 |

Contractor development |

153 |

| |

|

16.7.2 |

Mining equipment |

153 |

| |

|

16.7.3 |

Mine manpower |

153 |

| |

|

16.7.4 |

Underground drilling |

153 |

| |

|

16.7.5 |

Ore and waste handling |

154 |

| |

|

16.7.6 |

Mine ventilation |

154 |

| |

|

16.7.7 |

Backfill method |

155 |

| |

|

16.7.8 |

Mine dewatering system |

155 |

| |

|

16.7.9 |

Maintenance facilities |

156 |

| |

|

16.7.10 |

Power distribution |

156 |

| |

|

16.7.11 |

Other services and infrastructure |

159 |

| |

16.8 |

Comment on Section 16 |

159 |

| |

17.1 |

Crushing and milling circuits |

160 |

| |

|

17.1.1 |

Crushing |

160 |

| |

|

17.1.2 |

Milling and classification |

160 |

| |

|

17.1.3 |

Flotation |

160 |

| |

|

17.1.4 |

Thickening, filtering, and shipping |

161 |

| |

17.2 |

Requirements for energy, water, and process

materials |

163 |

| |

17.3 |

Comment on Section 17 |

163 |

| 18 |

Project Infrastructure |

164 |

| |

18.1 |

Introduction |

164 |

| |

18.2 |

Roads |

164 |

| |

18.3 |

Tailing disposal facilities |

164 |

| |

|

18.3.1 |

Tailings dam |

166 |

| |

|

18.3.2 |

Dry stack |

166 |

| |

18.4 |

Mine waste stockpiles |

167 |

| December 31, 2023 | Page 7 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

18.5 |

Ore stockpiles |

167 |

| |

18.6 |

Concentrate transportation |

167 |

| |

18.7 |

Power generation |

167 |

| |

|

18.7.1 |

Principal substation |

168 |

| |

|

18.7.2 |

Distribution |

168 |

| |

|

18.7.3 |

Mine distribution |

168 |

| |

18.8 |

Communications systems |

169 |

| |

18.9 |

Comment on Section 18 |

170 |

| 19 |

Market Studies and Contracts |

171 |

| |

19.1 |

Market studies |

171 |

| |

19.2 |

Commodity price projections |

171 |

| |

19.3 |

Contracts |

171 |

| |

|

19.3.1 |

Silver–gold concentrate |

171 |

| |

|

19.3.2 |

Operations |

171 |

| |

19.4 |

Comment on Section 19 |

172 |

| 20 |

Environmental Studies, Permitting

and Social or Community Impact |

173 |

| |

20.1 |

Introduction |

173 |

| |

20.2 |

Regulation and permitting |

173 |

| |

|

20.2.1 |

Environmental legislation |

173 |

| |

|

20.2.2 |

Environmental obligations |

173 |

| |

|

20.2.3 |

Other obligations |

173 |

| |

|

20.2.4 |

Permitting |

173 |

| |

20.3 |

Environmental baseline |

174 |

| |

|

20.3.1 |

Climate |

174 |

| |

|

20.3.2 |

Air quality |

175 |

| |

|

20.3.3 |

Water quality |

175 |

| |

|

20.3.4 |

Hydrology |

175 |

| |

|

20.3.5 |

Soil |

175 |

| |

|

20.3.6 |

Fauna and flora |

175 |

| |

|

20.3.7 |

Ecosystem characterization |

175 |

| |

|

20.3.8 |

Protected areas and archaeology |

176 |

| |

|

20.3.9 |

Environmental risks and management plan |

176 |

| |

|

20.3.10 |

Environmental areas of focus |

176 |

| |

|

20.3.11 |

Operations and management |

176 |

| |

20.4 |

Community relations |

177 |

| |

|

20.4.1 |

Socioeconomic and cultural aspects |

177 |

| |

|

20.4.2 |

Stakeholder engagement |

178 |

| |

|

20.4.3 |

Community development |

178 |

| |

20.5 |

Mine closure |

180 |

| December 31, 2023 | Page 8 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

|

20.5.1 |

Legal requirements and other obligations |

180 |

| |

|

20.5.2 |

Mine closure management |

181 |

| |

|

20.5.3 |

Reclamation and closure of affected areas |

183 |

| |

|

20.5.4 |

Monitoring during closure |

183 |

| |

|

20.5.5 |

Monitoring post closure |

184 |

| |

|

20.5.6 |

Closure costs |

184 |

| |

20.6 |

Greenhouse gas (GHG) emissions |

184 |

| |

20.7 |

Comment on Section 20 |

184 |

| 21 |

Capital and Operating Costs |

185 |

| |

21.1 |

Sustaining capital costs |

185 |

| |

21.2 |

Operating costs |

185 |

| |

21.3 |

Comment on Section 21 |

186 |

| |

22.1 |

Economic analysis |

187 |

| |

22.2 |

Comments on Section 22 |

187 |

| 23 |

Adjacent Properties |

188 |

| 24 |

Other Relevant Data and Information |

189 |

| 25 |

Interpretation and Conclusions |

190 |

| |

25.1 |

Mineral tenure, surface rights, water rights,

royalties and agreements |

190 |

| |

25.2 |

Geology and mineralization |

190 |

| |

25.3 |

Exploration, drilling and analytical data

collection in support of Mineral Resource estimation |

191 |

| |

|

25.3.1 |

Data verification |

191 |

| |

25.4 |

Metallurgical testwork |

192 |

| |

25.5 |

Mineral Resource estimation |

193 |

| |

25.6 |

Mineral Reserve estimation |

194 |

| |

25.7 |

Mine plan |

195 |

| |

25.8 |

Recovery |

195 |

| |

25.9 |

Infrastructure |

195 |

| |

25.10 |

Markets and contracts |

196 |

| |

25.11 |

Environmental, permitting and social considerations |

196 |

| |

25.12 |

Capital and operating costs |

197 |

| |

25.13 |

Economic analysis |

197 |

| |

25.14 |

Risks and opportunities |

197 |

| |

26.1 |

Introduction |

199 |

| |

26.2 |

Exploration |

199 |

| December 31, 2023 | Page 9 of 208 |

| | |

| |

|

26.2.1 |

Trinidad deposit |

199 |

| |

|

26.2.2 |

Victoria mineralized zone |

199 |

| |

|

26.2.3 |

Taviche corridor |

199 |

| |

|

26.2.4 |

Maria vein |

199 |

| |

|

26.2.5 |

Other |

199 |

| |

26.3 |

Technical and Operational |

200 |

| |

|

26.3.1 |

Mineral Resources and Reserves |

200 |

| |

|

26.3.2 |

Mining and Processing |

200 |

| December 31, 2023 | Page 10 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

Table 1.1 Mineral Resources as of

December 31, 2023 |

21 |

| |

Table 1.2 Mineral Reserves as of December 31,

2023 |

22 |

| |

Table 1.3 Summary of projected operating costs in 2024 |

26 |

| |

Table 2.1 Acronyms |

33 |

| |

Table 4.1 Mineral concessions owned by Cuzcatlan |

36 |

| |

Table 4.2 Usufruct contracts registered by Cuzcatlan

for land usage at San Jose |

38 |

| |

Table 6.1 Production figures during Cuzcatlan management

of the San Jose Mine |

45 |

| |

Table 8.1 Trinidad deposit and Victoria mineralized

zone characteristics |

68 |

| |

Table 10.1 Drilling by company and period at the San

Jose Mine |

77 |

| |

Table 10.2 Drilling by core diameter size |

79 |

| |

Table 10.3 Drill intervals in the Trinidad deposit

and Victoria mineralized zone encountered post data cut-off date |

82 |

| |

Table 10.4 Example of typical drill results at the

Trinidad Deposit and Victoria mineralized zone |

91 |

| |

Table 11.1 Duplicate types used by Cuzcatlan |

101 |

| |

Table 13.1 Plant concentrate and recovery values since

2012 |

112 |

| |

Table 14.1 Data used in the 2023 Mineral Resource update

of the Trinidad deposit and Victoria mineralized zone |

116 |

| |

Table 14.2 Univariate statistics of undeclustered drill

hole and channel composites by vein |

119 |

| |

Table 14.3 Top cut thresholds by vein |

121 |

| |

Table 14.4 Correlation coefficients of gold and silver

grades by vein |

123 |

| |

Table 14.5 Variogram model normal score parameters |

125 |

| |

Table 14.6 Block model parameters |

126 |

| |

Table 14.7 Density statistics by vein |

127 |

| |

Table 14.8 Global estimation validation |

128 |

| |

Table 14.9 Mineral Resources exclusive of Mineral Reserves

reported as of December 31, 2023 |

135 |

| |

Table 14.10 Mineral Resources inclusive of Mineral

Reserves reported as of December 31, 2023 |

136 |

| |

Table 14.11 Mineral Resources inclusive of Mineral

Reserves by vein reported as of December 31, 2023 |

136 |

| |

Table 15.1 Parameters used for NSR determination |

143 |

| |

Table 15.2 Operating cost by area and mining method |

143 |

| |

Table 15.3 Mineral Reserves as of December 31,

2023 |

144 |

| |

Table 16.1 Geomechanical classification used at the

San Jose Mine |

147 |

| |

Table 16.2 San Jose Mine life-of-mine production plan

2024 |

150 |

| December 31, 2023 | Page 11 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

Table 16.3 Lateral development for

the San Jose in 2024 |

152 |

| |

Table 16.4 Vertical development for the San Jose in

2024 |

153 |

| |

Table 16.5 Mine air flow requirements |

154 |

| |

Table 16.6 Air flow in-out balance |

155 |

| |

Table 16.7 Transformer capacities |

157 |

| |

Table 17.1 Reagent consumption of the San Jose processing

plant |

163 |

| |

Table 18.1 Volumes and life of the dry stack tailings

facility |

167 |

| |

Table 20.1 Main stakeholder groups at the San Jose

Mine |

178 |

| |

Table 21.1 Summary of projected operating costs in

2024 |

185 |

| December 31, 2023 | Page 12 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

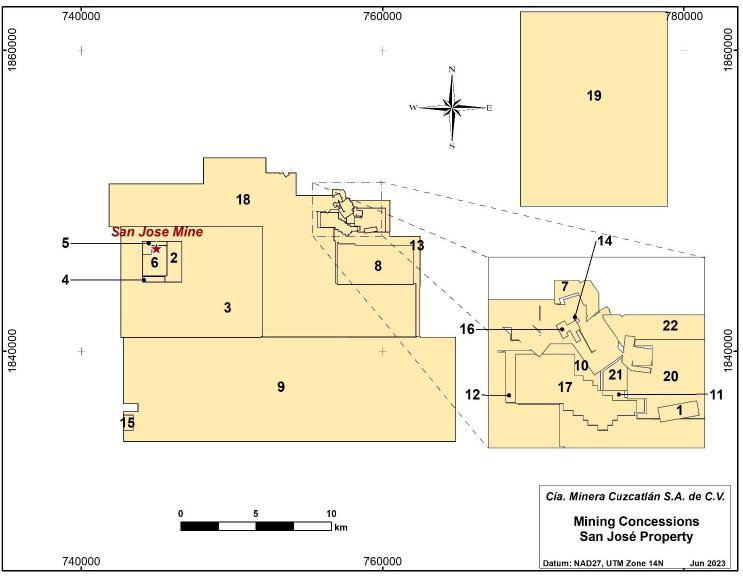

Figure 4.1 Map showing the location

of the San Jose Mine |

35 |

| |

Figure 4.2 Location of mining concessions at the San

Jose Property |

37 |

| |

Figure 7.1 Map of Oaxaca state showing approximate

distribution of Cenozoic volcanic rocks and underlying tectonostratigraphic terranes |

46 |

| |

Figure 7.2 Local geology of the San Jose Mine area |

47 |

| |

Figure 7.3 Geology of the San Jose Mine area |

48 |

| |

Figure 7.4 Stratigraphic column of the San Jose Mine

area |

49 |

| |

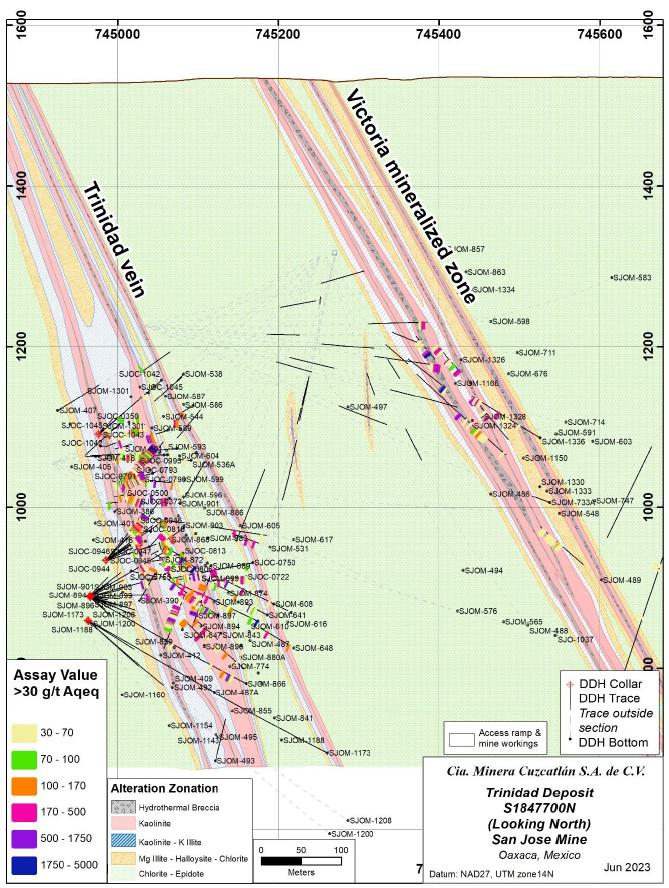

Figure 7.5 Trinidad and Victoria alteration assemblages

and zonation |

53 |

| |

Figure 7.6 Plan map showing location of resource drilling

and orientation of sections |

58 |

| |

Figure 7.7 Section displaying lithology along

1846925N |

59 |

| |

Figure 7.8 Section displaying lithology along

1846975N |

60 |

| |

Figure 7.9 Section displaying lithology along

1847500N |

61 |

| |

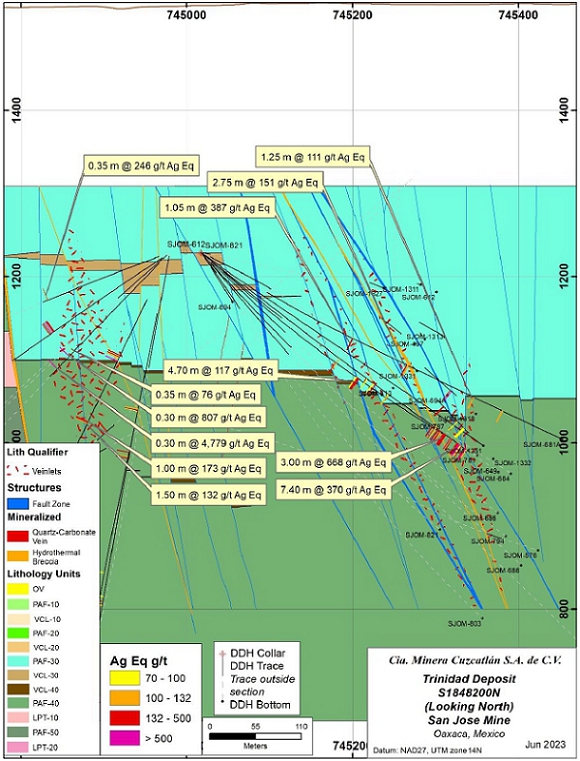

Figure 7.10 Section displaying lithology along

1848200N |

62 |

| |

Figure 7.11 Longitudinal section of Trinidad vein displaying

Ag Eq isogrades |

63 |

| |

Figure 7.12 Longitudinal section of Bonanza vein displaying

Ag Eq isogrades |

64 |

| |

Figure 7.13 Longitudinal section of Stockwork mineralization

Zones displaying Ag Eq isogrades |

65 |

| |

Figure 7.14 Longitudinal section of Victoria main structure

displaying Ag Eq isogrades |

66 |

| |

Figure 8.1 Classification of epithermal and base metal

deposits |

67 |

| |

Figure 8.2 Exploration model: extension-related pull-apart

basins |

69 |

| |

Figure 9.1 Map showing location of exploration programs

conducted by Cuzcatlan at the San Jose Mine |

72 |

| |

Figure 9.2 Map showing location of generative exploration

programs |

75 |

| |

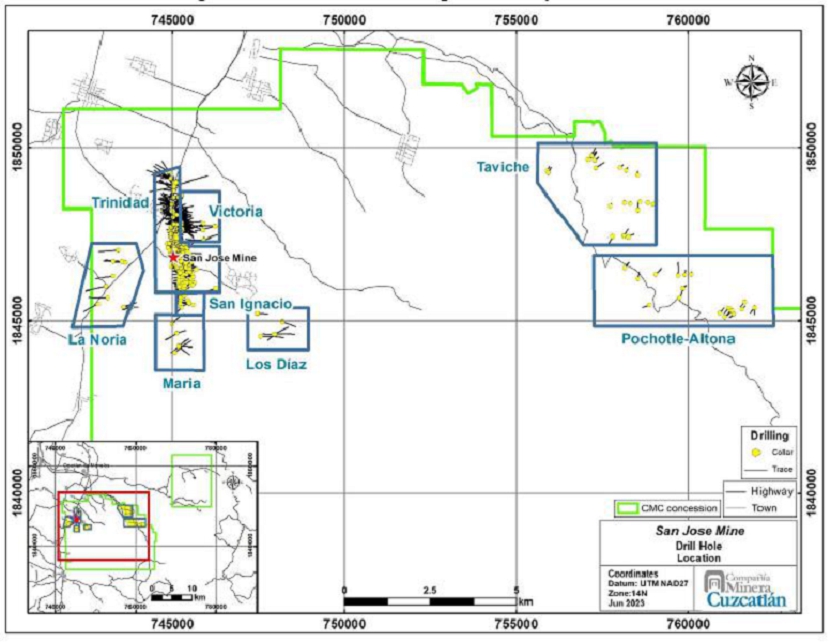

Figure 10.1 Drill hole location map for the San Jose

Mine |

78 |

| |

Figure 10.2 Graph of core recovery of Trinidad Deposit

and Victoria mineralized zone |

85 |

| |

Figure 10.3 Section displaying mineralization

along 1846925N |

87 |

| |

Figure 10.4 Section displaying mineralization

along 1846975N |

88 |

| |

Figure 10.5 Section displaying mineralization

along 1847500N |

89 |

| |

Figure 10.6 Section displaying mineralization

along 1848200N |

90 |

| |

Figure 14.1 3D perspective of Trinidad and Victoria

deposits showing vein wireframes |

117 |

| |

Figure 14.2 Length of samples assayed |

118 |

| |

Figure 14.3 Swath plot for gold grades in the Stockwork

vein |

129 |

| |

Figure 14.4 Visual validation of estimated block grades

versus composites – Stockwork vein |

130 |

| |

Figure 14.5 Long section of Stockwork

vein displaying Mineral Resource categorization criteria |

134 |

| December 31, 2023 | Page 13 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| |

Figure 15.1 Idealized diagram demonstrating

the methodology for determining operating dilution |

142 |

| |

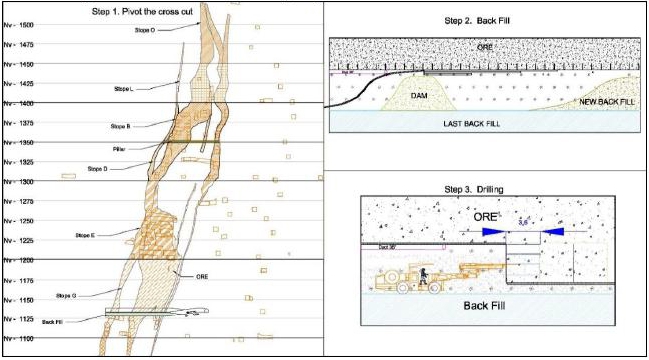

Figure 16.1 Mechanized mining sequence |

148 |

| |

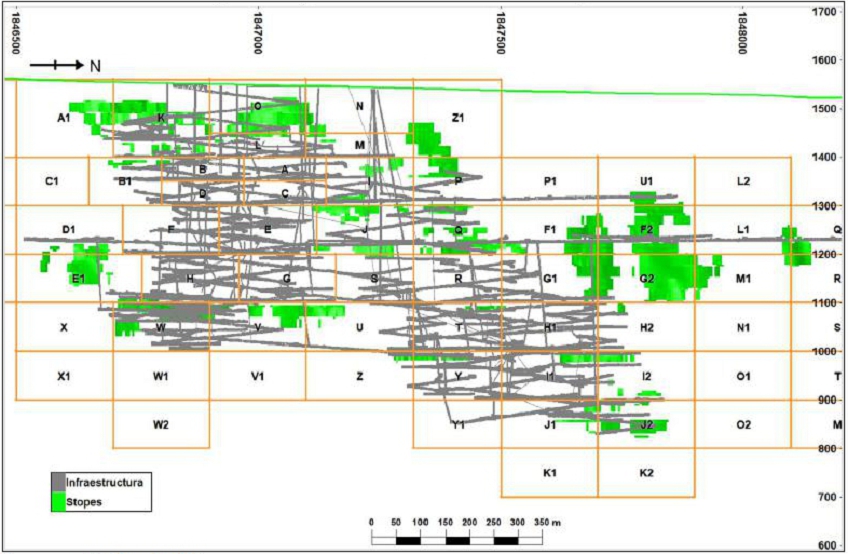

Figure 16.2 Optimized mineable areas for the San Jose

Mine |

151 |

| |

Figure 16.3 Mine layout |

152 |

| |

Figure 17.1 Crushing and milling circuits at the San

Jose processing plant |

162 |

| |

Figure 18.1 Plan view of mine and processing plant

area |

164 |

| |

Figure 18.2 Location map of tailings storage facilities |

165 |

| |

Figure 18.3 Schematic drawing showing phase 1, phase

2 and phase 3 tailings dam |

166 |

| December 31, 2023 | Page 14 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

Fortuna Silver Mines Inc. (Fortuna) has

compiled a Technical Report (the Report) on the San Jose Mine (the San Jose Project or the Project) located in Oaxaca, Mexico

The mineral rights of the San Jose Mine

are held by Compania Minera Cuzcatlan S.A. de C.V. (Cuzcatlan). Cuzcatlan is a Mexican subsidiary that is 100 % indirectly owned by Fortuna

and is responsible for running the underground silver-gold mine.

The Report discloses updated Mineral

Resource and Mineral Reserve estimates for the Project.

Costs are in US dollars (US$) unless

otherwise indicated.

| 1.2 | Property

description, location and access |

The mine is located in the central portion

of the state of Oaxaca, Mexico.

The San Jose Mine area is characterized

by gently sloping hills and adjoining colluvial-covered plains. Elevations above mean sea level range from approximately 1,540 m to 1,675 m.

The vegetation is grasslands and thornbush that are typical of dry savannah climates being temperate in nature with an average annual

temperature of 19.5ºC. Mining operations are conducted on a year-round basis.

The mine

site is 47 km by road south of the city of Oaxaca, which provides access to an international airport, and 0.8 km east of federal highway

175, the major highway between Oaxaca and Puerto Angel on the Pacific coast. The village of San Jose del Progreso is located 2

km to the southeast of the mine site.

| 1.3 | Mineral

tenure, surface rights and royalties |

The Project consists of mineral rights

for 22 mining concessions all located in the state of Oaxaca for a total surface area of approximately 47,844 hectares (ha). Tenure is

held in the name of Cuzcatlan with all mining concessions having an expiry date beyond the expected mine life.

Cuzcatlan has signed 45 usufruct contracts,

which have been registered before the National Agrarian Registry, with landowners to cover the surface area needed for the operation

and tailings facilities.

The San Jose Mine is not subject to any

back-in rights, liens, payments or encumbrances.

There are royalties attached to the mineral

concessions, however, the only royalties that affect the Mineral Reserves and have been considered in the economic analysis are:

| · | A

1.5 % royalty to Maverix on the Reduccion Taviche Oeste concession. |

| · | A

3 % royalty on the Progreso concession and a 1 % royalty the Reduccion Taviche Oeste concession

payable to SGM. |

| December 31, 2023 | Page 15 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

The Project has a long history of small

mining operations, dating from the 1850s.

Companies

with involvement in the Project prior to Fortuna’s interest include Pan American Silver, Minerales de Oaxaca S.A., and Continuum

Resources Ltd. (Continuum). Work completed included surface and underground mapping, chip-channel sampling of the surface and underground

workings, core drilling, and mining activities.

In November 2005, Fortuna reached

an agreement with Continuum to earn a 70 % interest in Continuum’s interests. Fortuna acquired a 100 % interest in the Project

in 2009.

Work completed

by Fortuna and Cuzcatlan since 2009 has included geological mapping, a remote-sensing-based geological study, airborne geophysical surveys

(airborne magnetometric and gamma-ray spectrometry), fluid inclusion and petrographic studies, core and RC drilling, metallurgical

testwork, mining studies, environmental baseline and supporting studies, social outreach, and underground mining activities.

Total production from the mine from September 2011

through December 31, 2023, is estimated as 66.8 Moz of silver and 457 koz of gold.

| 1.5 | Geology

and mineralization |

The silver-gold deposit at the San Jose

Mine is a typical low-sulfidation epithermal deposit.

The San Jose Mine area is underlain by

a thick sequence of sub-horizontal andesitic to dacitic volcanic and volcaniclastic rocks of presumed Paleogene age. These units have

been significantly displaced along major north and northwest-trending extensional fault systems with the precious metal mineralization

being hosted in hydrothermal breccias, crackle breccias, and sheeted stockwork-like zones of quartz/carbonate veins emplaced within zones

of high paleo permeability associated with the extensional structures.

The mineralized structural corridor extends

for more than 3 km in a north-south direction and has been subdivided into the Trinidad deposit, San Ignacio and Victoria areas. The

Mineral Resource and Mineral Reserve estimates discussed in this Report are located in the Trinidad deposit and Victoria areas.

The major mineralized structure in the

Trinidad deposit area consists of a sheeted and stockwork quartz–carbonate vein system referred to as the main Stockwork Zone located

between the primary Trinidad and Bonanza structures. In addition, several secondary vein systems are present locally in the hanging wall

and footwall of the Trinidad and Bonanza structures.

The Victoria mineralized zone is located

approximately 350 m east of the Trinidad vein and north of the current underground operations of the San Jose Mine. It is structurally

related to the same extensional behavior that dominates the Trinidad deposit with a similar style of mineralization, corresponding to

a low sulfidation epithermal deposit formed in a shallow crustal environment with a relatively low temperature resulting in the precipitation

of silver and gold mineralization.

As of June 30, 2023, the data cut-off

date for estimation of Mineral Resources, a total of 1,460 drill holes totaling 463,774.55 m have been completed at the San Jose Mine,

with the

| December 31, 2023 | Page 16 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

drilling being concentrated in the Trinidad deposit area and extensions to the south of the mineralized structural system.

Wide-spaced exploration drilling has

also been completed in the San Ignacio area along the southern extension of the structurally controlled mineralized corridor and to the

far north of the Trinidad deposit, as well as in the Victoria mineralized zone, Los Diaz, Maria and Taviche projects. All of the drilling

was conducted using core drilling methods with the exception of 1,476 m of reverse circulation (RC) pre-collars in six of the 1,460 diamond

drill holes.

A total of 1,110 core holes totaling

330,951.55 m have been drilled in the Trinidad deposit area and 205 holes totaling 75,229.25 m in the Victoria mineralized zone. In Trinidad,

the majority of the holes have been drilled from east to west to crosscut the steeply east-dipping mineralized zone at high angles, whereas

in the Victoria mineralized zone, the holes have been drilled from west to east from underground to intersect the subvertical Victoria

main structure. Of the 1,315 holes, 320 have been drilled from the surface and the remainder from underground.

The core drilling typically commences

with HQ-(63.5 mm diameter) core and continues to the maximum depth allowable based on the mechanical capabilities of the drill equipment.

Once this point is reached or poor ground conditions are encountered the hole is cased and further drilling undertaken with smaller diameter

drilling tools with the core diameter being reduced to NQ2 (50.6 mm) or NQ-size (47.6 mm) to completion of the hole. In the Trinidad

deposit, five of the drill holes were further reduced to BQ-size (36.5 mm) diameter to complete the drill holes to the target depths.

All the drilling completed in the project area has been carried out by contract drilling service companies. Ground conditions are generally

good with core recovery averaging 99 %.

Surface drill hole collars were surveyed

using differential global positioning system (GPS) and total station survey methods. Concrete monuments are constructed at each collar

location recording the drill hole name, azimuth, inclination and total depth. At locations where the drill hole collar is located in

a cultivated field, the collar monument is constructed approximately 50 cm below the actual surface.

Underground drill hole collars were surveyed

using total station survey methods. Concrete monuments similar to those used for surface collars are constructed to mark the location

with the drill hole name, azimuth, inclination and total depth recorded.

Down-hole surveys have been completed

for 1,443 of the 1,460 drill holes completed as of the data cut-off date. For the 17 holes where downhole surveys are not recorded, all

of which were drilled prior to 2007 with only three being drilled in the Trinidad deposit. The azimuth and dip orientation of these holes

was recorded at the collar to account for drilling direction. The absence of downhole surveys in three of the 1,315 holes drilled at

Trinidad and Victoria is not regarded as material to the Mineral Resource estimate.

Downhole surveys are typically completed

at 50 m intervals although recent drill holes include downhole surveys at 10 m intervals until reaching 50 m depth and then at 50 m intervals

thereafter. All downhole surveys have been carried out by the drilling contractor using Reflex electronic downhole survey tools.

As of the effective date of this Report,

drilling has been conducted at the Trinidad deposit over a strike length of approximately 2,500 m and to depths exceeding 1,000 m from

surface. Exploration drilling has generally increased in depth to the north. Drilling of the Victoria mineralized zone has been conducted

over a strike length of approximately 1,700

| December 31, 2023 | Page 17 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

m and covers a vertical extent of approximately 550 m, with upper holes intersecting the

structure approximately 250 m below the surface.

The relationship between the sample intercept

lengths and the true width of the mineralization varies in relation to the intersect angle between the steeply dipping zone of mineralized

veins and the inclined nature of the diamond core holes. Calculated estimated true widths are always reported together with actual sample

lengths by taking into account the angle of intersection between drill hole and the mineralized structure.

In 2018, all logging became digital,

being incorporated daily into the Maxwell Datashed database system. Data were initially recorded using Excel templates, and later with

the Maxwell LogChief application using essentially the same structure. Both input methods used picklists and data validation rules to

ensure consistency between loggers. Separate pages were designed to capture metadata, lithology, alteration, minerals (sulfides,

oxides, and limonite), structure (contacts, fractures, veins, and faults with attitudes to core axis). Intensity of alteration phases

was recorded using a numeric 1 to 4 scale (weak, moderate, strong, complete).

Geotechnical logging consists of the

collection of specified data fields including recovery percentage and rock quality designation (RQD) length. Joint filling and joint

weathering were described. A tablet-based data entry program was developed by Cuzcatlan using the Maxwell LogChief software. Data checks

are implemented into this program to prevent entry of erroneous data.

The sampling methodology, preparation,

and analyses differ depending on whether it is drill core or a channel sample. All samples are collected by Cuzcatlan geological staff

with sample preparation and analysis being conducted either at the onsite Cuzcatlan Laboratory or transported to the ALS Global preparation

facility in Guadalajara prior to being sent on for analysis at their laboratory in Vancouver.

The Cuzcatlan Laboratory used since 2012

for assaying channel samples was accredited as a testing laboratory with the requirements of ISO/IEC 17025:2005 for sample preparation

and assaying of silver and gold on March 2, 2018. Prior to this date, the laboratory was not certified. The Cuzcatlan Laboratory

is not independent of Fortuna/Cuzcatlan.

The ALS Global Laboratory is an independent,

privately-owned analytical laboratory group. The Vancouver laboratory holds ISO 17025 accreditation. The Mexican laboratory holds ISO

9001:2000 certification.

The SGS Laboratory used by Cuzcatlan

as an umpire laboratory is an independent privately-owned analytical laboratory located in Durango, Mexico and holds ISO/IEC 17025:2005

accreditation for sample preparation and assaying.

Channel chip samples are generally collected

from the face of newly exposed underground workings. The entire process is carried out under the mine geology department’s supervision.

Sampling is carried out at 3 m intervals within the drifts and stopes of all veins. The channel’s length and orientation are identified

using paint in the underground working and by painting the channel number on the footwall. The channel is typically approximately 20

cm wide and approximately 1 to 2 cm deep, with each individual sample preferably being no smaller than 0.4 m and no longer than 1.5 m.

Drill core is laid out for sampling and

logging at the core logging facility at the camp. Sample intervals are marked on the core and depths recorded on the appropriate box.

A geologist is responsible for determining and marking the drill core intervals to be sampled, selecting

| December 31, 2023 | Page 18 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

them based on geological and

structural logging. The sample length must not exceed 2 m or be less than 20 cm.

All samples collected by Cuzcatlan are

assayed by atomic absorption (AA) spectroscopy and by fire assay (FA) with gravimetric finish. For drill samples only, a full suite of

trace elements is analyzed using an aqua regia digestion followed by inductively-coupled plasma (ICP) analysis. Assay results and certificates

are reported electronically by e-mail. Since mid-2018, the onsite laboratory has also assayed channel samples and selected composites

for fluorine using a selective ion electrode technique.

Bulk density samples have been primarily

sourced from drill core with a limited number being sampled from underground workings. Bulk density measurements are performed at the

ALS Global Laboratory in Vancouver using an industry-standard wax coated water immersion technique.

Sample collection and transportation

of drill core and channel samples is the responsibility of and the Cuzcatlan mine geology and brownfields exploration departments and

must follow strict security and chain of custody requirements established by Fortuna. Samples are retained in accordance with the Fortuna

corporate quality assurance/quality control (QAQC) procedures.

Fortuna implemented a full QAQC program

to monitor the sampling, sample preparation and analytical process for all drilling campaigns in accordance with its companywide procedures.

The program involved the routine insertion of certified reference materials, blanks, and duplicates. Evaluation of the QAQC data indicates

that the data are sufficiently accurate and precise to support Mineral Resource estimation.

Data verification programs performed

by the QPs on the data collected by Cuzcatlan are adequate to support Mineral Resource and Mineral Reserve estimation.

| 1.8 | Mineral

processing and metallurgical testing |

Initial metallurgical test work was completed

in support of pre-feasibility studies with Cuzcatlan continuing to build on this original work with additional tests to support operational

requirements.

Work completed included whole rock analysis, Bond

ball mill work index, grind calibration. rougher flotation test work with three stages of cleaning, locked cycle flotation test work

and rougher kinetics flotation. Data was used to design the process plant, which has been in operation for 12 years, since 2011.

It is the opinion of the QP that the

San Jose Mine has an extensive body of metallurgical investigation comprising several phases of testwork as well as an extensive history

of treating ore at the operation since 2011. In the opinion of the QP, the San Jose metallurgical samples tested and the ore that is

presently treated in the plant is representative of the material included in the life-of-mine plan (LOMP) in respect to grade and metallurgical

response. In 2022, the geology department provided 25 samples from the Victoria mineralized zone for testing. The metallurgical recoveries

obtained for silver head grades in the range of 120-160 g/t were 87.7-90.1% for gold (Au) and 88.1-89.7% for silver (Ag). Therefore,

the samples exhibit a metallurgical recovery trend similar to the current operation within that range of Ag head grades. Additionally,

mineralogy did not detect any mineral types different from those currently being processed at the Trinidad deposit.

| December 31, 2023 | Page 19 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

Metallurgical recovery is estimated to

be constant for the LOMP at 90.54 % for silver and 89.82 % for gold. Differences between vein systems are minimal with regard to recovery.

There is no indication that the characteristics

of the material planned for mining will change and therefore the recovery assumptions applied for future mining are considered as reasonable

for the LOMP.

Deleterious elements detected in ore

in specific parts of the deposit have the potential to affect economics due to potential smelting penalties, including elevated levels

of fluorine (>1,000 ppm). These levels have been considered in the financial analysis.

Iron-oxide minerals (hematite) have been

identified in ore processed from mineralization associated with the highest levels of the mine. Elevated iron-oxide has been found to

lower metallurgical recovery in the plant by approximately 5 %. Testwork is ongoing to optimize the plant to maximize recovery from this

material that will potentially be processed in batches so as not to impact the recovery of sulfide ore.

Mineral Resource estimation involved

the usage of drill hole and channel samples in conjunction with underground mapping to construct three-dimensional wireframes to define

individual vein structures. Samples were selected inside these wireframes, coded, composited and top cuts applied if applicable. Boundaries

were treated as hard with statistical and geostatistical analysis conducted on composites identified in individual veins. Silver and

gold grades were estimated into a geological block model consisting of 4 m x 4 m x 4 m selective mining units (SMUs) representing

each vein. All veins were estimated by ordinary kriging (OK) with risk analysis conducted by sequential Gaussian simulation. Estimated

grades were validated globally, locally, visually, and (where possible) through production reconciliation prior to tabulation of Mineral

Resources.

Resource confidence classification considers

a number of aspects affecting confidence in the resource estimation including: geological continuity and complexity; data density and

orientation; data accuracy and precision; grade continuity; and simulated grade variability. Mineral Resources were classified as Measured, Indicated

and Inferred on a combination of the distance to the nearest sample, kriging efficiencies, and the slope of regression.

Mineral Resources are reported based

on underground mining within mineable stope shapes based on actual operational costs and mining equipment sizes using silver equivalent

grades in the block model calculated based on the projected long term metal prices and actual metallurgical recoveries experienced in

the plant using the following formula:

Ag Eq (g/t) = Ag (g/t)

+ (Au (g/t)*((1,880/23.90)*(91/90)).

Mineral Resources are reported above

a cut-off grade of 130 g/t Ag Eq based on operating costs of US$ 84.94/t comprised of US$ 38.31/t for mining, US$ 20.79/t for plant,

and US$ 25.92 for all other costs including general services and administration, distribution, community and social relations.

By

the application of a silver equivalent value taking into consideration the average metallurgical recovery and long-term metal prices

for each metal, and the determination of a reasonable cut-off grade using actual operating costs, as well as the exclusion of Mineral

Resources identified as being isolated or economically unviable using a floating stope optimizer, the Mineral Resources have ‘reasonable

prospects for eventual economic extraction’.

| December 31, 2023 | Page 20 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

Mineral Resources exclusive of Mineral

Reserves as of December 31, 2023, are reported in Table 1.1. Mineral Resources that are not Mineral Reserves do not have demonstrated

economic viability. Mineral Resources are reported insitu, using the 2014 CIM Definition Standards. Eric Chapman P. Geo, a Fortuna employee,

is the Qualified Person for the estimate.

Table 1.1 Mineral Resources as of

December 31, 2023

| Classification |

Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Contained Metal |

| Ag (Moz) |

Au (koz) |

| Measured |

45 |

141 |

1.09 |

0.2 |

2 |

| Indicated |

1,001 |

148 |

1.11 |

4.7 |

36 |

| Measured + Indicated |

1,046 |

147 |

1.11 |

5.0 |

37 |

| Inferred |

1,029 |

147 |

1.04 |

4.9 |

35 |

Notes:

| · | Mineral

Resources are reported insitu, using the 2014 CIM Definition Standards for Mineral Resources

and Mineral Reserves. |

| · | Mineral

Resources are exclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves,

do not have demonstrated economic viability. |

| · | Mineral

Resources are reported as of December 31, 2023. |

| · | Mr. Eric

Chapman, P. Geo., a Fortuna employee, is the Qualified Person for the estimate. |

| · | Mineral

Resources are reported based on underground mining within optimized stope designs using a

cut-off grade of 130 g/t Ag Eq based on assumed metal prices of US$ 23.90/oz Ag and

US$ 1,880/oz Au, estimated metallurgical recovery rates of 91 % for Ag and 90 % for

Au (Ag Eq (g/t) = Ag (g/t) + (Au (g/t)*((1,880/23.90)*(91/90)), and an average mining cost

of US$ 38.31/t, processing cost of US$ 20.79/t and other costs including general administrative &

services and distribution of US$ 25.92. |

| · | Mineral

Resource tonnes are rounded to the nearest thousand. |

| · | Totals

may not add due to rounding. |

Factors that may affect the estimates

include metal price and exchange rate assumptions; changes to the assumptions used to generate the cut-off grade; changes in local interpretations

of mineralization geometry and continuity of mineralized zones; changes to geological and mineralization shape and geological and grade

continuity assumptions; variations in density and domain assignments; geometallurgical assumptions; changes to geotechnical, mining,

dilution, and metallurgical recovery assumptions; changes to input and design parameter assumptions that pertain to the conceptual stope

designs constraining the estimates; and assumptions as to the continued ability to access the site, retain mineral and surface rights

titles, maintain environment and other regulatory permits, and maintain the social license to operate.

Mineral Reserves were converted from

Measured and Indicated Mineral Resources. Inferred Mineral Resources were set to waste.

Mineral

Reserves assume overhand cut and fill (OCF) or sublevel stoping (SLS) mining methods.

The overall mining recovery is approximately

92 % which takes into account the presence of pillars in wide veins and crown pillars for each main level of the mine.

Two sources

of dilution were considered, operational dilution and mucking dilution. Operational dilution for OCF averages 13.4 % if a zero

grade for the waste material is

| December 31, 2023 | Page 21 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

applied. In the case of SLS, the operation dilution averages 16.7 %. Mucking dilution was estimated as

1 % and applied to both mining methods.

Metal prices used for Mineral Reserve

estimation were determined as of June 2023 by the corporate financial department of Fortuna based on market consensus.

Metallurgical recoveries were based on

metallurgical testwork and operational results at the plant from July 2022 to June 2023.

Net smelter return (NSR) values were

dependent on various parameters including metal prices, metallurgical recovery, price deductions, refining charges and penalties.

A breakeven cut-off grade was determined

based on all variable and fixed costs applicable to the operation. These include exploitation and treatment costs, general expenses and

administrative and commercialization costs (including concentrate transportation). The cut-off grade determination does not include costs

associated with management fees, community support activities, institutional relations, capital expenditures, SG&A expenses, Brownfields

exploration or closure costs., with the expectation that these costs will be covered by the operations cash flow or by Fortuna. The breakeven

cut-off grade was determined to be 150 g/t Ag Eq for OCF and 132 g/t Ag Eq for SLS. For the Reduccion Taviche Oeste concession where

an additional 2.5 % royalty is payable, the cutoff was 153 g/t Ag Eq cut-off for OCF and 135 g/t Ag Eq for SLS. For the Progreso mineral

concession where a 3% royalty may be payable, the break-even cut-off grade would be increased to 154 g/t Ag Eq in OCF and 136 g/t Ag Eq

in SLS.

SLS mining will be used for 82 % of the

total Mineral Reserves with OCF mining representing the remainder.

Mineral

Reserves as of December 31, 2023, are reported in Table 1.2. Mineral Reserves are reported at the point of delivery to the process

plant, using the 2014 CIM Definition Standards. The Qualified Person for the estimate is Mr. Raul Espinoza, FAusIMM (CP),

a Fortuna employee.

Table 1.2 Mineral Reserves as of December 31,

2023

| Classification |

Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Contained Metal |

| Ag (Moz) |

Au (koz) |

| Proven |

37 |

172 |

1.23 |

0.2 |

1.5 |

| Probable |

695 |

155 |

0.97 |

3.5 |

21.7 |

| Proven + Probable |

733 |

156 |

0.98 |

3.7 |

23.1 |

Notes:

| · | Mineral

Reserves are reported at the point of delivery to the process plant using the 2014 CIM Definition

Standards. |

| · | Mineral

Reserves are reported as of December 31, 2023. |

| · | Mr. Raul

Espinoza, FAusIMM (CP), a Fortuna employee, is the Qualified Person for the estimate. |

| · | Mineral

Reserves are reported based on underground mining within optimized stope designs using an

NSR breakeven cut-off for cut and fill mining methods of US$ 96.54/t, equivalent to 150 g/t

Ag Eq and an NSR breakeven cut-off for sublevel stoping mining methods of US$ 85.02/t, equivalent

to 132 g/t Ag Eq. An additional 2.5 % royalty is applied to the cut-off for Mineral Reserves

mined from the Reduccion Taviche Oeste concession and a 3.0 % royalty is applied to the cut-off

for Mineral Reserves mined from the Progreso concession. |

| · | Metal

prices used in the NSR evaluation are US$ 23.90/oz for silver and US$ 1,880/oz for gold. |

| December 31, 2023 | Page 22 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

| · | Metallurgical

recovery values used in the NSR evaluation are 90.5 % for silver and 89.8 % for gold based

on actual plant recoveries. |

| · | NSR

values taking into account refining charges used in the estimation are US$ 20.08/oz for silver

and US$ 1,586.16/oz for gold with the exception of material located in the Reduccion Taviche

Oeste concession where NSR values are US$ 19.57/oz for silver and US$ 1,546.31/oz for gold

and Progreso concession where NSR values are US$ 19.47/oz for silver and US$ 1,538.34/oz

for gold. |

| · | Costs

used in NSR breakeven cut-off determination are US$ 49.83/t for cut and fill mining method;

US$ 38.31/t for sublevel stoping mining method; US$ 20.79/t for processing; and US$ 25.92/t

for other costs including distribution, general service and administration. |

| · | Mining

recovery is estimated to average 92 % and mining dilution is estimated at 17 %. |

| · | Mineral

Reserve tonnes are rounded to the nearest thousand. |

| · | Totals

may not add due to rounding. |

Mining uses conventional underground

methods, consisting of OCF and SLS.

Geotechnical recommendations used in

the mine design are based on a combination of rock mass rating and geotechnical strength index data.

Water inflows are currently managed using

five pumping stations installed at different levels of the mine. One future pumping station is planned for construction in 2024, in accordance

with the LOMP requirements.

Mineral Reserves are estimated at 0.7

million tonnes as of December 31, 2023, which is sufficient for a one-year LOMP consisting of 350 days at an average mill throughput

rate of 2,100 tonnes per day (tpd). Production in 2024 is estimated to be approximately 3.2 Moz of silver and 20 koz of gold based on

an average head grade of 156 g/t Ag and 0.98 g/t Au. Mine life will be complete by the end of 2024 unless additional Mineral Reserves

are discovered through exploration drilling or reduction in costs.

Access to the San Jose underground mine

is from surface through a main ramp. The San Jose Mine has been designed with a separation of 100 m between levels primarily to limit

blast vibration but also to assist with hanging wall and footwall stability.

Transportation of ore and waste is performed

via trucks with a 14 m3 and 7 m3 of capacity through the main and secondary ramps.

The ventilation requirements for the

mine to produce 2,100 tpd is 615,593 cfm. The ventilation system brings all the intake air through the main ramp and three main airway

networks. Exhaust air is forced to the surface from inside the mine by three principal fans, two operating at 250,000 cfm and one at

120,000 cfm.

The mine uses two kinds of backfill;

waste rock backfill generated during underground mining and paste fill.

The mobile equipment fleet is based on

the current mining operations, which is known to achieve the production targets set out in the LOMP.

Mine infrastructure and supporting facilities

are sufficient for the remaining LOMP.

The process design is based on metallurgical

testwork completed on samples from the deposit. The design and equipment are conventional.

| December 31, 2023 | Page 23 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

The process plant design is split into

four principal stages including: crushing; milling; flotation; and thickening, filtering and shipping. The plant has a 3,000 tpd throughput

rate.

Energy requirements at the operation

are provided by a State power line of 115 kV which supplies two power transformers of 7 to 8 MVA capacity.

The plant requires 2.7 m3

of water to process one tonne of ore, of which 92 % comes from the recirculation process, and the remaining 8 % from the waste-water

treatment plant in Ocotlan.

The plant uses conventional reagents,

including a frother, collectors, flocculant and a depressor.

| 1.13 | Project

infrastructure |

The mine

has a relatively small surface footprint with the property boundary split into two parts, a north area covering the operational

footprint, and a south area covering the area of the tailings storage facility.

Infrastructure consists primarily of

the concentration plant, electrical power station, water storage facilities, filtered dry stack tailings facility, tailings dam, stockpiles,

and workshop facilities, all connected by unsealed roads.

Additional facilities include offices,

dining hall, laboratory, core logging and core storage warehouses.

All process buildings and offices for

operating the mine have been constructed, with camp facilities not required due to the proximity of the site to urban areas.

The tailings

facility is located approximately 1,500 m to the southwest of the concentration plant. The current dry stack tailings facility

has a total capacity to 4,033,000 m3, which is sufficient for the LOMP.

The mine currently has one waste stockpile

used for storing waste material that could not be effectively disposed of underground. There is sufficient remaining capacity for LOMP

requirements.

The mine currently has two ore stockpiles

which store low-grade silver ore, or material pending evaluation (due to mixing of different ore types).

Tractor trailers that can transport two

25 t containers each are used to transport concentrate by road to the port of Veracruz in the State of Veracruz for subsequent shipping

to purchasers in 400 to 600 t lots.

Power is

provided to the mine from the main grid via a 115,000-volt circuit, as well as a secondary reserve power supply line, all managed

by Federal Electricity Commission (CFE).

| 1.14 | Market

studies and contracts |

Since the operation commenced commercial

production in September 2011, a corporate decision was made to sell the concentrate on the open market. In order to get the best

commercial terms for the concentrates, it is Fortuna’s policy to sign contracts for periods no longer than one year. In 2023 Cuzcatlan

agreed a short-term contract to sell concentrate to Trafigura PTE LTD (15,000 t) and Arrow Metals (15,000 t) for 12 months.

| December 31, 2023 | Page 24 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

All commercial terms entered between

the buyer and Cuzcatlan are regarded confidential but are considered to be within standard industry norms.

The QPs

have reviewed the key input information and consider that the data reflect a range of analyst predictions that are consistent with those

used by industry peers. Based on these sources, price projections are considered acceptable as consensus prices for use in mine

planning and financial analyses for the San Jose Mine in the context of this Report.

A price estimate of US$23.90/oz for silver

and US$1,880/oz for gold has been applied, based on mean consensus prices projected for 2024.

Cuzcatlan has used a Mexican peso exchange

rate of 19 pesos to the US dollar for financial analysis purposes, which conforms with general industry-consensus.

Cuzcatlan

has 14 major contracts for services relating to operations at the mine regarding: mining activities, ground support, raise boring, drilling,

transportation, electrical installations, plant and mine maintenance, explosives and civil works. The costs of such contracts are accounted

for in the capital and operating expenditure depending on work performed. Contracts are negotiated and renewed as needed. Contract

terms are typical of similar contracts in Mexico that Fortuna is familiar with.

The QP has reviewed the information provided

by Fortuna on marketing, contracts, metal price projections and exchange rate forecasts and notes that the information provided supports

the assumptions used in this Report and is consistent with the source documents, and that the information is consistent with what is

publicly available within industry norms.

| 1.15 | Environmental

studies and permitting |

Numerous baseline and supporting studies

were completed, covering areas including climate, air and water quality, hydrology, soil, flora, fauna, ecosystem characterization, identification

of protected areas and archaeology.

No significant environmental risks were

identified in the environmental baseline studies. During the operation stage, environmental risks and mitigation measures for the operation

stage are determined on an annual basis.

Cuzcatlan has an environmental management

and monitoring plan that includes follow-up on environmental programs for flora and fauna management, management of urban solid waste,

special waste, hazardous waste, and mining waste, as well as a surface and groundwater monitoring plans, environmental noise monitoring,

monitoring of the survival rate of flora included in reforestation programs, and a wildlife monitoring plan. Sustainability indicators

have also been defined and their performance monitored monthly.

The mining operation has been developed

in strict compliance with the Mexican regulations and permits required by the government agencies involved in the mining sector. In addition,

all work follows the international quality and safety standards set forth under standards ISO 14001 and OHSAS 18000.

To the extent known, all permits that

are required by Mexican law for the mining operation have been obtained. The tailings facility has sufficient storage capacity to support

the currently reported Mineral Reserves and LOMP.

Cuzcatlan continues developing sustainable

annual programs for the benefit of local communities, including educational, nutritional and economic programs. The social and environmental

responsibilities support a good relationship between the company and local

| December 31, 2023 | Page 25 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

communities. This will aid the development and continuity

of the mining operation and improve the standard of living and economies of local communities.

The mine plan anticipates closure of

the operation in late 2024. The Company has assigned a dedicated team to review and update a multiyear progressive mine closure and monitoring

plan with a current estimated budget of US$ 27 million, which will begin its implementation during 2024. Multiple considerations are

being included such as closure-related technical studies and designs, remediation of affected areas, decommissioning and removal of infrastructure,

landform reshaping, revegetation, and value-added activities for the communities associated with progressive closure, repurposing, and

where appropriate, long-term monitoring and maintenance, whilst adhering to strict compliance with mine closure governmental regulations

and high international standards.

| 1.16 | Capital

and operating costs |

As the mine has entered its last planned

year of operation, sustaining capital expenses such as mine development meters, infill drilling, mine equipment and other necessary expenses

have been considered as part of operating costs and covered by the projected cash flow generation in 2024.

The projected operating costs are based

on the LOMP mining and processing requirements for 2024, as well as historical information regarding performance, operational and administrative

support demands.

Operating costs include site costs and

operating expenses to maintain the operation. These operating costs are analyzed on a functional basis and the cost structure is not

similar to the operating costs reported by the financial statements published by Fortuna Silver Mines Inc.

Site costs relate to activities performed

on the property including mine, plant, indirect and distribution of the commercial products. Community relations and capital expenditure

costs are projected to be covered by Cuzcatlan’s cash flows in 2024. Brownfields explorations costs and closure costs sustained

after mining activities have ceased are planned to be paid by Fortuna’s cash flow from its four other operating mines.

Projected

operating costs for the LOMP are detailed in Table 1.3.

Table 1.3 Summary of projected operating

costs in 2024

| Area |

Units |

Q1 |

Q2 |

Q3 |

Q4 |

Total |

| Mine |

US$/t |

60 |

56 |

43 |

39 |

48 |

| Plant |

US$/t |

29 |

29 |

20 |

19 |

23 |

| Indirect |

US$/t |

31 |

31 |

21 |

19 |

24 |

| Distribution |

US$/t |

8 |

9 |

7 |

7 |

8 |

| Community Relations |

US$/t |

5 |

6 |

4 |

3 |

4 |

| Capital expenditure |

US$/t |

15 |

24 |

10 |

6 |

12 |

| Total |

US$/t |

148 |

155 |

104 |

93 |

120 |

Fortuna is using the provision for producing

issuers, whereby producing issuers may exclude the information required under Item 22 for technical reports on properties currently in

production and where no material production expansion is planned.

| December 31, 2023 | Page 26 of 208 |

| | |

|

|

Fortuna

Silver Mines Inc.: San Jose Mine, Oaxaca, Mexico

Technical Report |

The global after-tax financial results

exhibit a negative outcome when factoring in exploration costs and the total mine closure cost. However, the projected financial outcome

for 2024, considering only operational costs, shows a positive result. Fortuna expresses its commitment to covering Brownfields exploration

costs for 2024 and the subsequent expenses upon cessation of mining operations using funds derived from corporate profits. Given this,

the QP believes it is reasonable to continue mining operations throughout the planned operational period in 2024 to alleviate the negative

financial and social results of mine closure and support the current Mineral Reserve declaration under two assumptions:

| · | Fortuna

will cover the mines Brownfields exploration and closure costs at the corporate level. |

| · | Adequate

financial support is secured from Fortuna's other mining units, which, as per plans, will

be operational until 2035 and are expected to generate sufficient proceeds to cover closure

costs at San Jose. |

An economic analysis was performed in