HEICO CORPORATION (NYSE:HEI.A) (NYSE:HEI) today reported that net

income increased 31% to $40.9 million, or 59 cents per diluted

share, in the first quarter of fiscal 2017, up from $31.3 million,

or 46 cents per diluted share, in the first quarter of fiscal

2016.

Operating income increased 23% to $64.6 million in the first

quarter of fiscal 2017, up from $52.6 million in the first quarter

of fiscal 2016. The Company's consolidated operating margin

increased to 18.8% in the first quarter of fiscal 2017, up from

17.2% in the first quarter of fiscal 2016.

Net sales increased 12% to $343.4 million in the first quarter

of fiscal 2017, up from $306.2 million in the first quarter of

fiscal 2016.

Consolidated Results

Laurans A. Mendelson, HEICO’s Chairman and CEO, commented on the

Company's first quarter results stating, "We are pleased to report

exceptional first quarter year-over-year increases in net sales and

operating income within both our Flight Support Group and

Electronic Technologies Group. These results principally

reflect strong organic growth of 8% within both of our operating

segments as well as the excellent performance of our well managed

and profitable fiscal 2016 acquisitions.

Cash flow provided by operating activities was strong,

increasing 24% to $56.0 million in the first quarter of fiscal

2017, representing 137% of net income, as compared to $45.2 million

in the first quarter of fiscal 2016.

Our total debt to shareholders' equity ratio was 38.3% as of

January 31, 2017. Our net debt to shareholders’ equity ratio

was 34.1% as of January 31, 2017, with net debt (total debt less

cash and cash equivalents) of $371.4 million principally incurred

to fund acquisitions in fiscal 2016 and 2015. We have no

significant debt maturities until fiscal 2019 and plan to utilize

our financial flexibility to aggressively pursue high quality

acquisition opportunities to accelerate growth and maximize

shareholder returns.

Given the strength in HEICO’s share prices and the Company’s

history of stock splits and dividends, the Board of Directors

intends to consider a stock split or stock dividend at its next

regular meeting on March 17, 2017. Historically, we have

declared 14 stock splits or stock dividends since 1995.

As we look ahead to the remainder of fiscal 2017, we anticipate

net sales growth within the Flight Support Group and Electronic

Technologies Group resulting from increased demand across the

majority of our product lines. During the remainder of fiscal

2017, we will continue our commitments to developing new products

and services, further market penetration, and an aggressive

acquisition strategy while maintaining our financial strength and

flexibility.

Based on our current economic visibility, we are increasing our

estimated consolidated fiscal 2017 year-over-year growth in net

sales to 6% - 8% and net income to 9% - 11%, up from prior growth

estimates in net sales of 5% - 7% and in net income of 7% -

10%. Additionally, we anticipate our operating margin to

approximate 19% - 20%, depreciation and amortization expense of

approximately $63 million, capital expenditures to approximate $38

million and cash flow from operations to approximate $260

million. These estimates exclude additional acquired

businesses, if any."

Flight Support Group

Eric A. Mendelson, HEICO's Co-President and President of HEICO's

Flight Support Group, commented on the Flight Support Group's first

quarter results stating, "Our year-over-year increase in net sales

and operating income in the first quarter of fiscal 2017 was driven

by strong organic growth within the majority of our product

lines.

The Flight Support Group's net sales increased 8% to $220.9

million in the first quarter of fiscal 2017, up from $204.6 million

in the first quarter of fiscal 2016. The increase reflects

organic growth of 8% principally attributed to increased demand and

new product offerings within our aftermarket replacement parts and

repair and overhaul parts and services product lines.

The Flight Support Group's operating income increased 17% to

$41.4 million in the first quarter of fiscal 2017, up from $35.5

million in the first quarter of fiscal 2016. The increase

principally reflects the previously mentioned net sales growth.

The Flight Support Group's operating margin improved to 18.7% in

the first quarter of fiscal 2017, up from 17.3% in the first

quarter of fiscal 2016. The increase principally reflects the

benefit of the previously mentioned higher net sales volumes and

the positive impact of higher net sales on the fixed portion of

SG&A expenses.

With respect to the remainder of fiscal 2017, we continue to

estimate mid-single digit growth in the Flight Support Group's net

sales over fiscal 2016 levels and the full year Flight Support

Group operating margin to approximate 19.0% - 19.5%. These

estimates exclude additional acquired businesses, if any.”

Electronic Technologies Group

Victor H. Mendelson, HEICO's Co-President and President of

HEICO’s Electronic Technologies Group, commented on the Electronic

Technologies Group's first quarter results stating, "The Electronic

Technologies Group reported another solid quarter, with

year-over-year increases in net sales and operating income

principally reflecting increased demand for the majority of our

products and the impact from our profitable fiscal 2016

acquisitions.

The Electronic Technologies Group's net sales increased 21% to

$126.2 million in the first quarter of fiscal 2017, up from $104.2

million in the first quarter of fiscal 2016. The increase

reflects the net sales contributed by our fiscal 2016 acquisitions

and organic growth of 8% mainly attributed to higher net sales of

certain other electronics, aerospace and medical products.

The Electronic Technologies Group's operating income increased

31% to $29.1 million in the first quarter of fiscal 2017, up from

$22.3 million in the first quarter of fiscal 2016. The

Electronic Technologies Group’s operating margin improved to 23.1%

in the first quarter of fiscal 2017, up from 21.4% in the first

quarter of fiscal 2016. The increase in operating income and

operating margin is principally attributed to the previously

mentioned net sales growth and $3.1 million in acquisition costs

associated with a fiscal 2016 acquisition that were recognized in

the first quarter of fiscal 2016, partially offset by a less

favorable product mix for certain space products and an increase in

research and development expenses.

With respect to the remainder of fiscal 2017, we are continuing

to estimate mid to high-single digit growth in the Electronic

Technologies Group's net sales over fiscal 2016 levels, and the

full year Electronic Technologies Group's operating margin to

approximate 24%. These estimates exclude additional acquired

businesses, if any.”

(NOTE: HEICO has two classes of common stock

traded on the NYSE. Both classes, the Class A Common Stock

(HEI.A) and the Common Stock (HEI), are virtually identical in all

economic respects. The only difference between the share

classes is the voting rights. The Class A Common Stock

(HEI.A) has 1/10 vote per share and the Common Stock (HEI) has one

vote per share.)

There are currently approximately 40.4 million shares of HEICO's

Class A Common Stock (HEI.A) outstanding and 27.0 million shares of

HEICO's Common Stock (HEI) outstanding. The stock symbols for

HEICO’s two classes of common stock on most websites are HEI.A and

HEI. However, some websites change HEICO's Class A Common

Stock trading symbol (HEI.A) to HEI/A or HEIa.

As previously announced, HEICO will hold a conference call on

Wednesday, March 1, 2017 at 9:00 a.m. Eastern Standard Time to

discuss its first quarter results. Individuals wishing to

participate in the conference call should dial: U.S. and

Canada (877) 586-4323, International (706) 679-0934, wait for the

conference operator and provide the operator with the Conference ID

68558772. A digital replay will be available two hours after

the completion of the conference for 14 days. To access,

dial: (404) 537-3406, and enter the Conference ID

68558772.

HEICO Corporation is engaged primarily in the design,

production, servicing and distribution of products and services to

certain niche segments of the aviation, defense, space, medical,

telecommunications and electronics industries through its

Hollywood, Florida-based Flight Support Group and its Miami,

Florida-based Electronic Technologies Group. HEICO's

customers include a majority of the world's airlines and overhaul

shops, as well as numerous defense and space contractors and

military agencies worldwide, in addition to medical,

telecommunications and electronics equipment manufacturers.

For more information about HEICO, please visit our website at

http://www.heico.com.

Certain statements in this press release constitute

forward-looking statements, which are subject to risks,

uncertainties and contingencies. HEICO's actual results may

differ materially from those expressed in or implied by those

forward-looking statements as a result of factors including: lower

demand for commercial air travel or airline fleet changes or

airline purchasing decisions, which could cause lower demand for

our goods and services; product specification costs and

requirements, which could cause an increase to our costs to

complete contracts; governmental and regulatory demands, export

policies and restrictions, reductions in defense, space or homeland

security spending by U.S. and/or foreign customers or competition

from existing and new competitors, which could reduce our sales;

our ability to introduce new products and services at profitable

pricing levels, which could reduce our sales or sales growth;

product development or manufacturing difficulties, which could

increase our product development costs and delay sales; our ability

to make acquisitions and achieve operating synergies from acquired

businesses; customer credit risk; interest, foreign currency

exchange and income tax rates; economic conditions within and

outside of the aviation, defense, space, medical,

telecommunications and electronics industries, which could

negatively impact our costs and revenues; and defense budget cuts,

which could reduce our defense-related revenue. There can be

no assurance that a stock split or stock dividend will be

declared. Parties receiving this material are encouraged to

review all of HEICO's filings with the Securities and Exchange

Commission, including, but not limited to filings on Form 10-K,

Form 10-Q and Form 8-K. We undertake no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise, except to

the extent required by applicable law.

HEICO CORPORATIONCondensed Consolidated

Statements of Operations (Unaudited)(in thousands, except

per share data)

| |

| |

Three Months Ended January 31, |

|

| |

2017 |

|

2016 |

|

| Net sales |

$ |

343,432 |

|

|

$ |

306,227 |

|

|

| Cost of sales |

|

218,015 |

|

|

|

194,031 |

|

|

| Selling, general and

administrative expenses |

|

60,867 |

|

|

|

59,575 |

|

|

| Operating income |

|

64,550 |

|

|

|

52,621 |

|

(b) |

| Interest expense |

|

(1,969 |

) |

|

|

(1,567 |

) |

|

| Other income

(expense) |

|

484 |

|

|

|

(430 |

) |

|

| Income before income

taxes and noncontrolling interests |

|

63,065 |

|

|

|

50,624 |

|

|

| Income tax expense |

|

16,800 |

|

(a) |

|

14,700 |

|

(c) |

| Net income from

consolidated operations |

|

46,265 |

|

|

|

35,924 |

|

|

| Less: Net income

attributable to noncontrolling interests |

|

5,338 |

|

|

|

4,653 |

|

|

| Net income attributable

to HEICO |

$ |

40,927 |

|

(a) |

$ |

31,271 |

|

(b)(c) |

| |

|

|

|

|

| Net income per share

attributable to HEICO shareholders: |

|

|

|

|

|

Basic |

$ |

.61 |

|

(a) |

$ |

.47 |

|

(b)(c) |

|

Diluted |

$ |

.59 |

|

(a) |

$ |

.46 |

|

(b)(c) |

| |

|

|

|

|

| Weighted average number

of common shares outstanding: |

|

|

|

|

|

Basic |

|

67,314 |

|

|

|

66,875 |

|

|

|

Diluted |

|

69,123 |

|

|

|

67,940 |

|

|

| |

|

|

|

|

| |

Three Months Ended January 31, |

|

| |

2017 |

|

2016 |

|

| Operating segment

information: |

|

|

|

|

| Net

sales: |

|

|

|

|

| Flight

Support Group |

$ |

220,901 |

|

|

$ |

204,576 |

|

|

|

Electronic Technologies Group |

|

126,165 |

|

|

|

104,152 |

|

|

|

Intersegment sales |

|

(3,634 |

) |

|

|

(2,501 |

) |

|

|

|

$ |

343,432 |

|

|

$ |

306,227 |

|

|

|

|

|

|

|

|

| Operating

income: |

|

|

|

|

| Flight

Support Group |

$ |

41,363 |

|

|

$ |

35,480 |

|

|

|

Electronic Technologies Group |

|

29,084 |

|

|

|

22,269 |

|

|

| Other,

primarily corporate |

|

(5,897 |

) |

|

|

(5,128 |

) |

|

| |

$ |

64,550 |

|

|

$ |

52,621 |

|

|

| |

|

|

|

|

|

|

|

|

HEICO

CORPORATIONFootnotes to Condensed Consolidated

Statements of Operations

(Unaudited)

(a) During the first quarter of fiscal 2017, the Company adopted

Accounting Standards Update ("ASU") 2016-09, "Improvements to

Employee Share-Based Payment Accounting," resulting in the

recognition of a $3.1 million discrete income tax benefit and a

543,000 increase in the Company's weighted average number of

diluted common shares outstanding, which, net of noncontrolling

interests, increased net income attributable to HEICO by $2.6

million, or $.04 per basic and $.03 per diluted share.

(b) During the first quarter of fiscal 2016, the Company

incurred $3.1 million of acquisition costs in connection with a

fiscal 2016 acquisition. These are one-time nonrecurring

costs. These expenses, net of tax, decreased net income

attributable to HEICO by $2.0 million, or $.03 per basic and

diluted share.

(c) During the first quarter of fiscal 2016, the Company

recognized additional income tax credits for qualified R&D

activities related to the last ten months of fiscal 2015 upon the

retroactive and permanent extension of the U.S. federal R&D tax

credit in December 2015. The tax credits, net of expenses,

increased net income attributable to HEICO by $1.7 million, or $.03

per basic and $.02 per diluted share.

HEICO CORPORATIONCondensed Consolidated

Balance Sheets (Unaudited)(in thousands)

| |

| |

January 31, 2017 |

|

October 31, 2016 |

| Cash and cash

equivalents |

$ |

45,905 |

|

|

$ |

42,955 |

|

| Accounts receivable,

net |

|

176,029 |

|

|

|

202,227 |

|

| Inventories, net |

|

301,120 |

|

|

|

286,302 |

|

| Prepaid expenses and

other current assets |

|

52,151 |

|

|

|

52,737 |

|

| Total

current assets |

|

575,205 |

|

|

|

584,221 |

|

| Property, plant and

equipment, net |

|

121,881 |

|

|

|

121,611 |

|

| Goodwill |

|

864,658 |

|

|

|

865,717 |

|

| Intangible assets,

net |

|

357,123 |

|

|

|

366,863 |

|

| Other assets |

|

112,555 |

|

|

|

101,063 |

|

| Total

assets |

$ |

2,031,422 |

|

|

$ |

2,039,475 |

|

| |

|

|

|

| Current maturities of

long-term debt |

$ |

397 |

|

|

$ |

411 |

|

| Other current

liabilities |

|

196,323 |

|

|

|

214,010 |

|

| Total

current liabilities |

|

196,720 |

|

|

|

214,421 |

|

| Long-term debt, net of

current maturities |

|

416,932 |

|

|

|

457,814 |

|

| Deferred income

taxes |

|

103,233 |

|

|

|

105,962 |

|

| Other long-term

liabilities |

|

127,043 |

|

|

|

114,061 |

|

| Total

liabilities |

|

843,928 |

|

|

|

892,258 |

|

| Redeemable

noncontrolling interests |

|

98,902 |

|

|

|

99,512 |

|

| Shareholders’

equity |

|

1,088,592 |

|

|

|

1,047,705 |

|

| Total

liabilities and equity |

$ |

2,031,422 |

|

|

$ |

2,039,475 |

|

|

|

|

|

|

|

|

|

|

HEICO CORPORATIONCondensed Consolidated

Statements of Cash Flows (Unaudited)(in thousands)

| |

|

|

Fiscal Year Ended January

31, |

|

|

2017 |

|

2016 |

| Operating

Activities: |

|

|

|

| Net

income from consolidated operations |

$ |

46,265 |

|

|

$ |

35,924 |

|

|

Depreciation and amortization |

|

15,248 |

|

|

|

13,921 |

|

| Employer

contributions to HEICO Savings and Investment Plan |

|

1,714 |

|

|

|

1,417 |

|

|

Share-based compensation expense |

|

1,451 |

|

|

|

1,680 |

|

| Increase

in accrued contingent consideration |

|

537 |

|

|

|

847 |

|

| Deferred

income tax (benefit) provision |

|

(346 |

) |

|

|

2,276 |

|

| Foreign

currency transaction adjustments, net |

|

(956 |

) |

|

|

(839 |

) |

| Tax

benefit from stock option exercises |

|

— |

|

|

|

871 |

|

| Excess

tax benefit from stock option exercises |

|

— |

|

|

|

(871 |

) |

| Decrease

in accounts receivable |

|

25,998 |

|

|

|

12,348 |

|

| Increase

in inventories |

|

(14,989 |

) |

|

|

(2,326 |

) |

| Decrease

in current liabilities |

|

(18,000 |

) |

|

|

(16,632 |

) |

|

Other |

|

(947 |

) |

|

|

(3,449 |

) |

| Net cash

provided by operating activities |

|

55,975 |

|

|

|

45,167 |

|

|

|

|

|

|

| Investing

Activities: |

|

|

|

|

Acquisitions, net of cash acquired |

|

— |

|

|

|

(264,324 |

) |

| Capital

expenditures |

|

(6,422 |

) |

|

|

(5,690 |

) |

|

Other |

|

419 |

|

|

|

474 |

|

| Net cash

used in investing activities |

|

(6,003 |

) |

|

|

(269,540 |

) |

|

|

|

|

|

| Financing

Activities: |

|

|

|

|

(Payments) borrowings on revolving credit facility, net |

|

(40,000 |

) |

|

|

228,000 |

|

| Cash

dividends paid |

|

(6,059 |

) |

|

|

(5,350 |

) |

|

Distributions to noncontrolling interests |

|

(1,986 |

) |

|

|

(2,696 |

) |

| Proceeds

from stock option exercises |

|

1,230 |

|

|

|

94 |

|

| Excess

tax benefit from stock option exercises |

|

— |

|

|

|

871 |

|

|

Other |

|

(108 |

) |

|

|

(86 |

) |

| Net cash

(used in) provided by financing activities |

|

(46,923 |

) |

|

|

220,833 |

|

|

|

|

|

|

| Effect of exchange rate

changes on cash |

|

(99 |

) |

|

|

(177 |

) |

|

|

|

|

|

| Net increase (decrease)

in cash and cash equivalents |

|

2,950 |

|

|

|

(3,717 |

) |

| Cash and cash

equivalents at beginning of year |

|

42,955 |

|

|

|

33,603 |

|

| Cash and cash

equivalents at end of period |

$ |

45,905 |

|

|

$ |

29,886 |

|

Victor H. Mendelson (305) 374-1745 ext. 7590

Carlos L. Macau, Jr. (954) 987-4000 ext. 7570

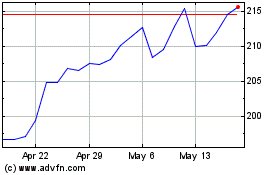

HEICO (NYSE:HEI)

Historical Stock Chart

From Jun 2024 to Jul 2024

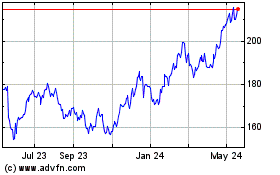

HEICO (NYSE:HEI)

Historical Stock Chart

From Jul 2023 to Jul 2024