KKR Income Opportunities Fund Q2 2023 Investor Call Now Available

September 13 2023 - 8:15AM

Business Wire

KKR Income Opportunities Fund (the “Fund”) (NYSE: KIO) announced

today that the Q2 2023 investor call is now available on the Fund’s

website. Tom Hobby and Richard Schoenfeld hosted the call and

provided market color and portfolio updates for the second quarter

of 2023. Richard Schoenfeld is a Director and a senior investment

professional on the KKR U.S. Leveraged Credit Team and Tom Hobby is

a Principal and member of KKR’s Client and Partner Group.

https://www.kkrfunds.com/kio

The Fund is a diversified, closed-end fund. Investors should

consider the Fund’s investment objectives, risks, charges and

expenses carefully before investing. Please see below for

additional important information and disclaimers.

About KKR Income Opportunities Fund

KKR Income Opportunities Fund is a diversified, closed-end

management investment company managed by KKR Credit Advisors (US)

LLC (“KKR Credit”), an indirect subsidiary of KKR & Co. Inc.

(“KKR”). The Fund’s primary investment objective is to seek a high

level of current income with a secondary objective of capital

appreciation. The Fund will seek to achieve its investment

objective by investing primarily in first- and second-lien secured

loans, unsecured loans and high yield corporate debt instruments.

It expects to employ a dynamic strategy of investing in a targeted

portfolio of loans and fixed-income instruments of U.S. and

non-U.S. issuers and implementing hedging strategies in order to

achieve attractive risk-adjusted returns. Please visit

www.kkrfunds.com/kio for additional information.

About KKR Credit

Launched by KKR in 2004, KKR Credit invests on behalf of its

managed funds, clients and accounts across the corporate credit

spectrum, including secured credit, bank loans and high yield

securities and alternative assets such as mezzanine financing,

strategic investments and structured finance. With over 440

employees, including approximately 160 investment professionals,

KKR Credit’s investment teams are closely aligned with KKR’s wealth

of private equity investment and industry resources.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com and

on Twitter @KKR_Co.

Forward Looking Statements

This press release contains certain statements that may include

"forward-looking statements" within the meaning of the federal

securities laws. All statements, other than statements of

historical fact, included herein are "forward-looking statements."

The forward-looking statements are based on the Fund’s and KKR's

beliefs, assumptions and expectations of its future performance,

taking into account all information currently available to them.

These beliefs, assumptions and expectations can change as a result

of many possible events or factors, not all of which are known to

the Fund or KKR or are within their control. The Fund and KKR do

not undertake any obligation to update any forward-looking

statements to reflect circumstances or events that occur after the

date on which such statements were made except as required by

law.

Fund Disclaimer

This press release is not an offer to sell securities and is not

soliciting an offer to buy securities in any jurisdiction where the

offer or sale is not permitted. Investors should consider the

Fund’s investment objectives, risks, charges and expenses carefully

before investing. The prospectus, which contains this and other

important information about the Fund, should be read carefully

before investing. A copy of the prospectus can be obtained on the

Fund’s website. An investment in the Fund should not constitute a

complete investment program.

The investment return, price, distribution rate, market value

and net asset value (“NAV”) of a fund's shares will fluctuate with

market conditions. Closed-end funds frequently trade at a discount

to their NAV, which may increase an investor’s risk of loss. There

is no assurance that the Fund will meet its investment objective.

The Fund’s distribution rate may be affected by numerous factors,

including changes in realized and projected market returns, Fund

performance, and other factors. There can be no assurance that a

change in market conditions or other factors will not result in a

change in a Fund distribution rate at a future time.

An investment in the Fund is not appropriate for all investors

and is not intended to be a complete investment program. An

investment in the Fund involves risks, including the risk that you

may receive little or no return on your investment or that you may

lose part or even all of your investment. Therefore, prospective

investors should consider carefully the Fund’s investment

objectives, risks, charges and expenses and should consult with a

tax, legal or financial advisor before making any investment

decision. The market price and the NAV of the Fund’s shares will

fluctuate, and it is possible to lose money by investing in the

Fund. Past performance is not a guarantee of future results.

The Fund will invest in loans and other types of fixed‐income

instruments and securities. Such investments may be secured,

partially secured or unsecured and may be unrated, and whether or

not rated, may have speculative characteristics. The market price

of the Fund’s investments will change in response to changes in

interest rates and other factors. Generally, when interest rates

rise, the values of fixed‐ income instruments fall, and vice

versa.

Use of leverage creates an opportunity for increased income and

return for Common Shareholders but, at the same time, creates

risks, including the likelihood of greater volatility in the NAV

and market price of, and distributions on, the Common Shares. In

particular, leverage may magnify interest rate risk, which is the

risk that the prices of portfolio securities will fall (or rise) if

market interest rates for those types of securities rise (or fall).

As a result, leverage may cause greater changes in the Fund’s NAV,

which will be borne entirely by the Fund’s Common Shareholders.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230913804650/en/

Investor Relations: (855) 330-3927 KIOIR@KKR.com

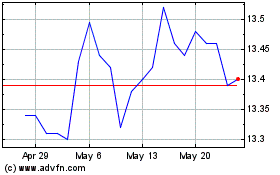

KKR Income Opportunities (NYSE:KIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

KKR Income Opportunities (NYSE:KIO)

Historical Stock Chart

From Nov 2023 to Nov 2024