Growth in both revenue and EBITDA

Advertising revenue up 3.7% (€199.0

million)Profit from recurring operations (EBITA) up 15.4%

(€45.8 million)

Regulatory News:

M6 Group (Paris:MMT):

1st Quarter

(€ millions) 1

2016 2015 change

Group advertising revenues

199.0

191.9

+3.7%

- of which FTA channels' advertising

revenue

186.1

181.0

+2.8%

- of which cab-sat channels and other

media advertising revenue

12.8

10.9

+18.0%

Non advertising revenue

112.9

115.5

-2.3%

Consolidated

revenues

311.8

307.4

+1.4%

Over the first three months of the 2016 financial year, M6

Group posted consolidated revenue of €311.8 million, an

increase of 1.4% in comparison with the first quarter of 2015.The

Group’s first quarter advertising revenues (free-to-air and pay

channels, Internet) grew 3.7%, reflecting the strength of TV and

Internet audience figures.Conversely, non-advertising revenue

dipped 2.3%, primarily as a result of a less dynamic home shopping

business.

During the first quarter of the financial year, consolidated

profit from recurring operations (EBITA) reached €45.8 million, an

increase of 15.4% in relation to the €39.7 million achieved in the

first quarter of 2015.

(€ millions)

1st Quarter

2016 2015 change

Consolidated Revenue

201.0

196.1

+2.5%

o.w. FTA channels' advertising

revenues

186.1

181.0

+2.8%

The average individual television viewing time over the

first quarter of 2015 was stable and, for individuals aged

four and over, reached 3 hours 52 minutes.

Within an ever more fragmented environment marked by audience

share gains for DTT channels, M6 Group confirmed its growth

across all audiences, with an average audience share of 13.6%

for its free-to-air channels (an increase of 0.2 percentage

points vs. the first quarter of 2015, source - Médiamétrie),

and was the only traditional audiovisual group to achieve

year-on-year growth on the commercial target with an average

audience share of 21.8% (up 1.2 percentage points vs.

the first quarter of 2015):

- The M6 channel was the sole traditional

channel to achieve year-on-year growth for both the entire

viewing public (up 0.1 percentage points) and for women under 50

responsible for purchases (up 0.8 percentage points), thanks to the

success of its access primetime schedule (Les Reines du Shopping,

Chasseurs d’appart, Le 19’45 and Scènes de ménages) and to the

relevance of its evening programming, which combines well

established brands (Top Chef, Capital, etc.) and new shows (Garde à

vous, X-Files, etc.);

- W9 retained its position as the second

placed DTT channel on the commercial target, thanks to the

strength of its range of blockbuster films, sporting events and

original magazines;

- 6ter was the top ranked of the new DTT

channels on the commercial target, thereby achieving the

highest growth of the new DTT channels on this target in a year (up

0.4 percentage points).

M6 Group was able to capitalise on its solid 2015 and early

2016 audience figures to post an increase in advertising

revenue for its free-to-air channels, which grew 2.8% in what

remained a cautious market.

- PRODUCTION

& AUDIOVISUAL RIGHTS

(€ millions)

1st Quarter

2016 2015 change

Consolidated revenue

30.5

27.0

+12.9%

At 31 March 2016, revenue from Production and Audiovisual

Rights activities increased €3.5 million (up 12.9%) thanks to a

busier cinema release schedule than during the first quarter of

2015 (5.0 million admissions compared with 2.9 million).The first

quarter of 2016 was marked by the success of Hateful Eight (1.8

million admissions) and The Divergent Series: Allegiant (1.7

million), both distributed at the box office by SND.

M6 Films also coproduced two films that were released in

cinemas over the first quarter, Chocolat (1.9 million admissions),

and Amis publics (0.8 million).

(€ millions)

1st Quarter

2016 2015 change

Consolidated revenue

80.2

84.3

-4.8%

Diversification revenues posted a fall of 4.8% over the first

quarter of the financial year, as a result of the contraction in

the activity of Ventadis, which saw its revenues fall by

€4.7 million (10.6%) due to the gradual renewal of the range of

home shopping products.

This decline was partly offset by the €0.6 million (4.4%) growth

in F.C.G.B’s revenues, related to the increase in

partnership/sponsorship revenues resulting from the new

stadium.

In addition, M6 Web’s revenue was stable at €24.9

million despite the decline in M6 Mobile’s contribution; M6 is

positioned as the leading French TV Group online with 14

million unique monthly visitors (source - Médiamétrie-Nielsen

Netratings, February 2016), and a new audience record for

6play in March with almost 120 million videos viewed across all

screens, a year-on-year increase of 46%.

At 31 March 2016, Group equity totalled €614.2 million (€583.9

million at 31 December 2015) with a net cash position of €201.1

million.

For the first quarter of the financial year, consolidated

profit from recurring operations (EBITA)2 reached

€45.8 million, compared with €39.7 million at 31 March 2015.

This €6.1 million growth was due to the increase in the

contribution of TV activities, related to the growth in advertising

revenues, as well as a profit on Girondins de Bordeaux players

during the winter transfer window.

- DIVIDEND AND

ANNUAL GENERAL MEETING

The Combined General Meeting convened today will be asked to

approve the payment3 of a dividend of €0.85 per share in

respect of the 2015 financial year, unchanged from the previous

year and corresponding to a yield of 5.4% based on the 2015 closing

price.

At the same General Meeting, the renewal of the terms of office

of five members of the Supervisory Board will be proposed:

- Delphine Arnault, Deputy CEO of Louis

Vuitton Malletier;- Mouna Sepehri, Executive Vice-President, Office

of the CEO, Renault;- Guillaume de Posch, co-CEO of RTL Group;-

Philippe Delusinne, Chief Executive Officer of RTL Belgium;- Elmar

Heggen, Chief Financial Officer, Head of the Corporate Center of

RTL Group.

Next release: Half-year financial information

on 26 July 2016 after close of tradingM6 Métropole Télévision is

listed on Euronext Paris, Compartment A.Ticker: MMT, ISIN code:

FR0000053225

1 The information provided is intended to highlight the

breakdown of consolidated revenue between advertising and

non-advertising revenue. Group advertising revenue include the

revenues of the free-to-air channels M6, W9 and 6ter, the

advertising portion of revenues from pay channels and the

advertising portion of revenues generated by diversification

activities (mainly Internet).2 Profit from recurring operations

(EBITA) is defined as operating profit (EBIT) before amortisation

and impairment of intangible assets (excluding audiovisual rights)

related to acquisitions and capital gains and losses on the

disposal of financial assets and subsidiaries.3 Last trading day

with dividend rights: 17 May 2016 - Ex-dividend date: 18 May 2016 -

Payment date: 20 May 2016

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160425006227/en/

M6 METROPOLE TELEVISIONINVESTOR RELATIONSEric

Ghestemme, +33 (0)1 41 92 59

53eric.ghestemme@m6.frorPRESSYann de Kersauson, +33 (0)1 41

92 73 50ydekersauson@m6.fr

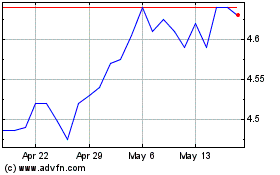

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Jun 2024 to Jul 2024

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Jul 2023 to Jul 2024