0001836833FALSE00018368332023-12-072023-12-070001836833us-gaap:CommonStockMember2023-12-072023-12-070001836833us-gaap:WarrantMember2023-12-072023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 7, 2023

Planet Labs PBC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-40166 | | 85-4299396 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

645 Harrison Street, Floor 4 San Francisco, California | | 94107 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (415) 829-3313

N/A

(Former Name or Former Address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

Class A common stock, $0.0001 par value per share | | PL | | New York Stock Exchange |

Warrants, each warrant exercisable for one share of common stock, each at an exercise price of $11.50 per share | | PLWS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition.

On December 7, 2023, Planet Labs PBC (the “Company”) issued a press release announcing its financial results for its third fiscal quarter ended October 31, 2023. The Company announced that it will hold a conference call and webcast to discuss these results at 5:00 p.m. eastern time on December 7, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information in this Item 2.02, including the information contained in Exhibit 99.1, of this Current Report on Form 8-K is furnished herewith and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Exhibit Description |

| |

| 99.1 | | |

104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | Planet Labs PBC |

| | | |

Date: December 7, 2023 | By: | | /s/ Ashley Johnson |

| | | Ashley Johnson Chief Financial and Operating Officer |

Planet Reports Financial Results for Third Quarter of Fiscal 2024

Delivers Record Quarterly Revenue of $55.4 Million

Launched 36 SuperDove Satellites and First Pelican Tech Demo Satellite

Released Groundbreaking Global Forest Carbon Product

San Francisco, CA – December 7, 2023 – Planet Labs PBC (NYSE: PL) (“Planet” or the “Company”), a leading provider of daily data and insights about Earth, today announced financial results for the period ended October 31, 2023, that demonstrated continued growth and momentum of its unique data subscription business.

“Growth in the third quarter was driven by strength in the Civil Government and Defense & Intelligence markets,” said Will Marshall, Planet’s Co-Founder, Chief Executive Officer and Chairperson. “We focused on sharpening our go-to-market execution and we recently achieved multiple important product milestones, including successfully launching 37 satellites, enabling low touch sales of Planet data on our Sentinel Hub platform and releasing the new Forest Carbon product to market.”

Ashley Johnson, Planet’s Chief Financial and Operating Officer, added, “We’re also pleased with the cost discipline and focus on operational efficiency that we’re seeing across the business, which support our path to profitability. Our balance sheet remains strong with $315 million of cash, cash equivalents, and short-term investments as of the end of the quarter and we continue to have no debt.”

Fiscal Third Quarter 2024 Financial and Key Metric Highlights:

•Third quarter revenue increased 11% year-over-year to $55.4 million.

•Percent of Recurring Annual Contract Value (ACV) for the third quarter was 94%.

•End of Period (EoP) Customer Count increased 13% year-over-year to 976 customers.

•Third quarter gross margin was 47%, compared to 50% in the third quarter of fiscal year 2023.

•Third quarter Non-GAAP Gross Margin(1) was 52%, compared to 54% in the third quarter of fiscal year 2023.

•Ended the quarter with $315 million in cash, cash equivalents and short-term investments.

(1) Please see “Planet’s Use of Non-GAAP Financial Measures” below for a discussion on how Planet calculates the non-GAAP financial measures presented herein. In addition, reconciliations to the most directly comparable U.S. GAAP financial measures are provided in the tables at the end of this release.

Recent Business Highlights:

Growing Customer and Partner Relationships

•BASF Expansion: Planet recently expanded its seven-figure contract with BASF Digital Farming GmbH, a subsidiary of BASF, the large European-based multinational company and large chemical producer. BASF Digital Farming offers precision digital farming products through its Xarvio Digital Farming Solutions platform. Xarvio FIELD MANAGER, its crop optimization platform, uses PlanetScope and Planetary Variables solutions for broad area management to deliver targeted and timely agronomic advice that supports more efficient, profitable, and sustainable agricultural practices.

•Instituto Geográfico Agustín Codazzi (IGAC): Planet recently closed a seven-figure ACV contract with the Cartographic Agency for Colombia, IGAC. This entity regulates, produces, and articulates high-quality geographic, cadastral, and agronomical information of the country, contributing to its development for decision-making and definition of public policies in Colombia. They’re using PlanetScope and SkySat data to support geographic studies, professional training, and education in GIS technology and improve land-use planning and risk management across Colombia.

•USDA Foreign Agricultural Service: Planet recently added the USDA Foreign Agricultural Service as a new customer. The USDA FAS links U.S. agriculture to the world to enhance export

opportunities and global food security. The USDA FAS is using PlanetScope’s broad area management to support the production of crop type maps and area estimates in areas overseas.

•BeZero Carbon: Planet recently added BeZero Carbon, a global carbon ratings agency, as a new partner. BeZero is using Planet’s Forest Carbon product to help market participants continue to make more informed carbon credit investments. Planet’s 30 meter global time series of forest height, tree cover, and carbon is seen as an invaluable addition to BeZero’s cutting-edge geospatial analysis and methodologies.

•SI Analytics: Planet closed a new contract with South Korea-based AI company, SI Analytics, to provide imagery data for anomaly analysis of North Korea. SI Analytics is a provider for satellite image analytics based on deep learning technology and GEO-information solutions. SI Analytics is using PlanetScope to run analytics for defense and intelligence customers.

•NGIS: Planet expanded its contract with Australian-based partner, NGIS who provides critical geospatial services using Planet data to Australian civil governments, supporting resource management and natural disaster response for wildfires and floods.

•on-X Maps: Planet recently added on-X Maps as a new customer. on-X’s Recent Imagery product uses Planet’s bi-weekly Basemaps to provide outdoor enthusiasts with up-to-date imagery of outdoor recreation sites. on-X was recently recognized on the TIME’s Best Innovations list of 2023.

New Technologies and Products

•Pelican Tech Demo and 36 SuperDoves Launch: On November 11, 2023, Planet successfully launched its first Pelican technology demonstration, Pelican-1, and 36 SuperDoves to orbit on SpaceX’s Transporter-9 mission. The Planet Team quickly established contact with all 37 satellites and began commissioning the new satellites to join its fleet of roughly 200 currently on-orbit. This launch marks a momentous milestone for the Company, especially for Planet’s next-generation high-resolution mission. Over time, the Pelican constellation is expected to offer a more capable and cost-effective upgrade to the Company’s current high-resolution satellites, the SkySats.

•Planet Data Available on Sentinel Hub: During Q3, Planet data and services were launched on the Sentinel Hub platform with transparent pricing and APIs, enabling low touch or self-service sales for small customers and giving partners what they need to more rapidly and flexibly build solutions on top of our data.

•Global Forest Carbon Product Release: Planet released its Forest Carbon product, a global, 30 meter historical time series of forest carbon, tree height, and cover. This groundbreaking data product aims to provide unprecedented insights into forest change and carbon stocks and is already being used by customers to inform their carbon credit investments. The 10-year archive of global forest carbon is highly accurate, affordable, and scalable, helping to solve long-standing challenges associated with measuring forest carbon stocks.

Global Sustainability and Impact

•First PBC Report: Planet published its first Public Benefit Corporation (“PBC”) Report, which can be found at planet.com/esg. As a PBC, Planet is required under Delaware law to publish this report once every two years, highlighting the objectives, standards and metrics used by the Company’s Board of Directors to determine that the Company continues to perform in accordance with its PBC mission.

Financial Outlook

For the fourth quarter of fiscal year 2024, ending January 31, 2023, Planet expects revenue to be in the range of approximately $56 million to $59 million, representing approximately 9% year-over-year growth at the midpoint. Non-GAAP Gross Margin is expected to be in the range of approximately 52% to 56%. Adjusted EBITDA loss is expected to be in the range of approximately ($12) million and ($9) million. Capital Expenditures as a Percentage of Revenue is expected to be in the range of approximately 25% to 27% for the quarter.

For fiscal year 2024, ending January 31, 2024, Planet expects revenue to be in the range of approximately $218 million to $221 million, representing approximately 15% year-over-year growth at the midpoint. Non-GAAP Gross Margin is expected to be in the range of approximately 53% to 54%. Adjusted EBITDA loss is expected to be in the range of approximately ($58) million and ($55) million. Capital Expenditures as a Percentage of Revenue is expected to be in the range of approximately 21% to 22% for the full fiscal year 2024.

Planet has not reconciled its Non-GAAP financial outlook to the most directly comparable GAAP measures because certain reconciling items, such as stock-based compensation expenses and depreciation and amortization are uncertain or out of Planet’s control and cannot be reasonably predicted. The actual amount of these expenses during the fourth quarter of fiscal year 2024 and fiscal year 2024 will have a significant impact on Planet’s future GAAP financial results. Accordingly, a reconciliation of Planet’s Non-GAAP outlook to the most comparable GAAP measures is not available without unreasonable efforts.

The foregoing forward-looking statements reflect Planet’s expectations as of today's date. Given the number of risk factors, uncertainties and assumptions discussed below, actual results may differ materially.

Webcast and Conference Call Information

Planet will host a conference call at 5:00 p.m. ET / 2:00 p.m. PT today, December 7, 2023. The webcast can be accessed at www.planet.com/investors/. A replay will be available approximately 2 hours following the event. If you would prefer to register for the conference call, please go to the following link: https://www.netroadshow.com/events/login?show=b06cfb3b&confId=57995. You will then receive your access details via email.

Additionally, a supplemental presentation has been made available on Planet’s investor relations page.

About Planet Labs PBC

Planet is a leading provider of global, daily satellite imagery and geospatial solutions. Planet is driven by a mission to image the world every day, and make change visible, accessible and actionable. Founded in 2010 by three NASA scientists, Planet designs, builds, and operates the largest Earth observation fleet of imaging satellites. Planet provides mission-critical data, advanced insights, and software solutions to over 950 customers, comprising the world’s leading agriculture, forestry, intelligence, education and finance companies and government agencies, enabling users to simply and effectively derive unique value from satellite imagery. Planet is a public benefit corporation listed on the New York Stock Exchange as PL. To learn more visit www.planet.com and follow us on Twitter.

Planet’s Use of Non-GAAP Financial Measures

This press release includes Non-GAAP Gross Profit, Non-GAAP Gross Margin, certain Non-GAAP Expenses described further below, Non-GAAP Loss from Operations, Non-GAAP Net Loss, Non-GAAP Net Loss per Diluted Share and Adjusted EBITDA which are non-GAAP performance measures that the Company uses to supplement its results presented in accordance with U.S. GAAP. The Company believes these non-GAAP financial measures are useful in evaluating its operating performance, as they are similar to measures reported by the Company’s public competitors and are regularly used by analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. Further, the Company believes such non-GAAP measures are helpful in highlighting trends in the Company’s operating results because they exclude certain items that are not indicative of the Company’s core operating performance. In addition, the Company includes these non-GAAP financial measures

because they are used by management to evaluate the Company’s core operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments.

Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, as a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP. The non-GAAP financial measures presented are not based on any standardized methodology prescribed by U.S. GAAP and are not necessarily comparable to similarly-titled measures presented by other companies, which may have different definitions from the Company. Further, the non-GAAP financial measures presented exclude stock-based compensation expenses, which has recently been, and will continue to be for the foreseeable future, a significant recurring expense for the Company’s business and an important part of its compensation strategy.

Planet calculates these non-GAAP financial measures as follows:

Non-GAAP Gross Profit and Non-GAAP Gross Margin: The Company defines and calculates Non-GAAP Gross Profit as gross profit adjusted for stock-based compensation, amortization of acquired intangible assets classified as cost of revenue, restructuring costs, employee transaction bonuses in connection with the Sinergise business combination, and other expenses that are considered unrelated to our underlying business performance. The Company defines Non-GAAP Gross Margin as Non-GAAP Gross Profit divided by revenue.

Non-GAAP Expenses: The Company defines and calculates Non-GAAP cost of revenue, Non-GAAP research and development expenses, Non-GAAP sales and marketing expenses, and Non-GAAP general and administrative expenses as, in each case, the corresponding U.S. GAAP financial measure (cost of revenue, research and development expenses, sales and marketing expenses, and general and administrative expenses) adjusted for stock-based compensation, amortization of acquired intangible assets, restructuring costs, employee transaction bonuses in connection with the Sinergise business combination, and other expenses that are considered unrelated to our underlying business performance, that are classified within each of the corresponding U.S. GAAP financial measures.

Non-GAAP Loss from Operations: The Company defines and calculates Non-GAAP Loss from Operations as loss from operations adjusted for stock-based compensation, amortization of acquired intangible assets, restructuring costs, employee transaction bonuses in connection with the Sinergise business combination, and other expenses that are considered unrelated to our underlying business performance.

Non-GAAP Net Loss and Non-GAAP Net Loss per Diluted Share: The Company defines and calculates Non-GAAP Net Loss as net loss adjusted for stock-based compensation, amortization of acquired intangible assets, restructuring costs, employee transaction bonuses in connection with the Sinergise business combination, and other expenses that are considered unrelated to our underlying business performance and the tax effects of the adjustments. The Company defines and calculates Non-GAAP Net Loss per Diluted Share as Non-GAAP Net Loss divided by diluted weighted-average common shares outstanding.

Adjusted EBITDA: The Company defines and calculates Adjusted EBITDA as net income (loss) before the impact of interest income and expense, income tax expense and depreciation and amortization, and further adjusted for the following items: stock-based compensation, change in fair value of warrant liabilities, gain or loss on the extinguishment of debt and non-operating income, expenses such as foreign currency exchange gain or loss, restructuring costs, employee transaction bonuses in connection with the Sinergise business combination, and other expenses that are considered unrelated to our underlying business performance.

Other Key Metrics

ACV and EoP ACV Book of Business: In connection with the calculation of several of the key operational and business metrics we utilize, the Company calculates Annual Contract Value (“ACV”) for contracts of one year or greater as the total amount of value that a customer has contracted to pay for the most recent 12 month period for the contract, excluding customers that are exclusively Sentinel Hub self-service paying users. For short-term contracts (contracts less than 12 months), ACV is equal to total contract value.

The Company also calculates EoP ACV Book of Business in connection with the calculation of several of the key operational and business metrics we utilize. The Company defines EoP ACV Book of Business as the sum of the ACV of all contracts that are active on the last day of the period pursuant to the effective dates and end dates of such contracts, excluding customers that are exclusively Sentinel Hub self-service paying users. Active contracts exclude any contract that has been canceled, expired prior to the last day of the period without renewing, or for any other reason is not expected to generate revenue in the subsequent period. For contracts ending on the last day of the period, the ACV is either updated to reflect the ACV of the renewed contract or, if the contract has not yet renewed or extended, the ACV is excluded from the EoP ACV Book of Business. The Company does not annualize short-term contracts in calculating EoP ACV Book of Business. The Company calculates the ACV of usage-based contracts based on the committed contracted revenue or the revenue achieved on the usage-based contract in the prior 12-month period.

Percent of Recurring ACV: Percent of Recurring ACV is the portion of the total EoP ACV Book of Business that is recurring in nature. The Company defines ACV Book of Business as the sum of the ACV of all contracts that are active on the last day of the period pursuant to the effective dates and end dates of such contracts, excluding customers that are exclusively Sentinel Hub self-service paying users. We define Percent of Recurring ACV as the dollar value of all data subscription contracts and the committed portion of usage-based contracts (excluding customers that are exclusively Sentinel Hub self-service paying users) divided by the total dollar value of all contracts in our ACV Book of Business at a specific point in time. We believe Percent of Recurring ACV is useful to investors to better understand how much of our revenue is from customers that have the potential to renew their contracts over multiple years rather than being one-time in nature. We track Percent of Recurring ACV to inform estimates for the future revenue growth potential of our business and improve the predictability of our financial results. There are no significant estimates underlying management’s calculation of Percent of Recurring ACV, but management applies judgment as to which customers have an active contract at a period end for the purpose of determining ACV Book of Business, which is used as part of the calculation of Percent of Recurring ACV.

EoP Customer Count: The Company defines EoP Customer Count as the total count of all existing customers at the end of the period excluding customers that are exclusively Sentinel Hub self-service paying users. For EoP Customer Count, the Company defines existing customers as customers with an active contract with the Company at the end of the reported period. For the purpose of this metric, the Company defines a customer as a distinct entity that uses the Company’s data or services. The Company sells directly to customers, as well as indirectly through its partner network. If a partner does not provide the end customer’s name, then the partner is reported as the customer. Each customer, regardless of the number of active opportunities with the Company, is counted only once. For example, if a customer utilizes multiple products of Planet, the Company only counts that customer once for purposes of EoP Customer Count. A customer with multiple divisions, segments, or subsidiaries are also counted as a single unique customer based on the parent organization or parent account. For EoP Customer Count, the Company does not include users that only utilize the Company’s self-service Sentinel Hub web based ordering system, which the Company acquired in August 2023, and which offers standard starter packages on a monthly or annual basis. The Company believes excluding these users from EoP Customer Count creates a more useful metric, as the Company views the Sentinel Hub starter packages as entry points for smaller accounts, leading to broader awareness of the Company’s solutions throughout their networks and organizations. The Company believes EoP Customer Count is a useful metric for investors and management to track as it is an important indicator of the broader adoption of the

Company’s platform and is a measure of the Company’s success in growing its market presence and penetration. Management applies judgment as to which customers are deemed to have an active contract in a period, as well as whether a customer is a distinct entity that uses the Company’s data or services.

Capital Expenditures as a Percentage of Revenue: The Company defines capital expenditures as purchases of property and equipment plus capitalized internally developed software development costs, which are included in our statements of cash flows from investing activities. The Company defines Capital Expenditures as a Percentage of Revenue as the total amount of capital expenditures divided by total revenue in the reported period. Capital Expenditures as a Percentage of Revenue is a performance measure that we use to evaluate the appropriate level of capital expenditures needed to support demand for the Company’s data services and related revenue, and to provide a comparable view of the Company’s performance relative to other earth observation companies, which may invest significantly greater amounts in their satellites to deliver their data to customers. The Company uses an agile space systems strategy, which means we invest in a larger number of significantly lower cost satellites and software infrastructure to automate the management of the satellites and to deliver the Company’s data to clients. As a result of the Company’s strategy and business model, the Company’s capital expenditures may be more similar to software companies with large data center infrastructure costs. Therefore, the Company believes it is important to look at the level of capital expenditure investments relative to revenue when evaluating the Company’s performance relative to other earth observation companies or to other software and data companies with significant data center infrastructure investment requirements. The Company believes Capital Expenditures as a Percentage of Revenue is a useful metric for investors because it provides visibility to the level of capital expenditures required to operate the Company and the Company’s relative capital efficiency.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or Planet's future financial or operating performance. In some cases, you can identify forward looking statements because they contain words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “target,” “anticipate,” “intend,” “develop,” “evolve,” “plan,” “seek,” “may,” “will,” “could,” “can,” “should,” “would,” “believes,” “predicts,” “potential,” “strategy,” “opportunity,” “aim,” “conviction,” “continue,” “positioned” or the negative of these words or other similar terms or expressions that concern Planet's expectations, strategy, priorities, plans or intentions. Forward-looking statements in this release include, but are not limited to, statements regarding Planet’s financial guidance and outlook, Planet’s path to profitability, Planet’s expectations regarding future product development and performance, and Planet’s expectations regarding its strategies with respect to its markets and customers. Planet’s expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including risks related to the macroeconomic environment and risks regarding our ability to forecast our performance due to our limited operating history. The forward-looking statements contained in this release are also subject to other risks and uncertainties, including those more fully described in Planet's filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K and any subsequent filings with the SEC the Company may make. All forward-looking statements reflect the Company’s beliefs and assumptions only as of the date of this press release. The Company undertakes no obligation to update forward-looking statements to reflect future events or circumstances, except as may be required by law. The Company’s results for the quarter ended October 31, 2023 are not necessarily indicative of its operating results for any future periods.

PLANET

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

| | | | | | | | | | | |

| (In thousands) | October 31, 2023 | | January 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 101,547 | | | $ | 181,892 | |

| Restricted cash and cash equivalents, current | 7,880 | | 527 |

| Short-term investments | 213,347 | | 226,868 |

| Accounts receivable, net | 45,145 | | 38,952 |

| Prepaid expenses and other current assets | 19,616 | | 27,416 |

| Total current assets | 387,535 | | 475,655 |

| Property and equipment, net | 114,058 | | 108,091 |

| Capitalized internal-use software, net | 14,050 | | 11,417 |

| Goodwill | 135,701 | | 112,748 |

| Intangible assets, net | 27,427 | | 14,831 |

| Restricted cash and cash equivalents, non-current | 10,321 | | 5,657 |

| Operating lease right-of-use assets | 22,091 | | 20,403 |

| Other non-current assets | 2,337 | | 3,921 |

| Total assets | $ | 713,520 | | | $ | 752,723 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 4,589 | | | $ | 6,900 | |

| Accrued and other current liabilities | 41,961 | | 46,022 |

| Deferred revenue | 67,228 | | 51,900 |

| Liability from early exercise of stock options | 9,860 | | 12,550 |

| Operating lease liabilities, current | 7,500 | | 4,885 |

| Total current liabilities | 131,138 | | 122,257 |

| Deferred revenue | 7,763 | | 2,882 |

| Deferred hosting costs | 8,353 | | 8,679 |

| Public and private placement warrant liabilities | 2,666 | | 16,670 |

| Operating lease liabilities, non-current | 17,321 | | 17,145 |

| Contingent consideration | 5,588 | | 7,499 |

| Other non-current liabilities | 7,093 | | 1,487 |

| Total liabilities | 179,922 | | 176,619 |

| Commitments and contingencies | | | |

| Stockholders’ equity | | | |

| Common stock | 28 | | 27 |

| Additional paid-in capital | 1,583,531 | | 1,513,102 |

Accumulated other comprehensive income (loss) | (242) | | 2,271 |

| Accumulated deficit | (1,049,719) | | (939,296) |

| Total stockholders’ equity | 533,598 | | 576,104 |

| Total liabilities and stockholders’ equity | $ | 713,520 | | | $ | 752,723 | |

PLANET

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 31, | | Nine Months Ended October 31, |

| (In thousands, except share and per share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 55,380 | | | $ | 49,704 | | | $ | 161,844 | | | $ | 138,281 | |

| Cost of revenue | 29,350 | | | 24,728 | | | 81,375 | | | 73,333 | |

| Gross profit | 26,030 | | | 24,976 | | | 80,469 | | | 64,948 | |

| Operating expenses | | | | | | | |

| Research and development | 33,002 | | | 27,598 | | | 87,929 | | | 79,085 | |

| Sales and marketing | 20,774 | | | 19,383 | | | 66,209 | | | 57,721 | |

| General and administrative | 20,112 | | | 20,627 | | | 62,161 | | | 61,128 | |

| Total operating expenses | 73,888 | | | 67,608 | | | 216,299 | | 197,934 | |

| Loss from operations | (47,858) | | | (42,632) | | | (135,830) | | | (132,986) | |

| Interest income | 3,445 | | | 2,853 | | | 11,753 | | | 4,276 | |

| Change in fair value of warrant liabilities | 6,833 | | | (19) | | | 14,004 | | | 5,369 | |

| Other income (expense), net | (69) | | | 1 | | | 894 | | | 123 | |

| Total other income (expense), net | 10,209 | | | 2,835 | | | 26,651 | | | 9,768 | |

| Loss before provision for income taxes | (37,649) | | | (39,797) | | | (109,179) | | | (123,218) | |

| Provision for income taxes | 355 | | | 439 | | | 1,244 | | | 907 | |

| Net loss | $ | (38,004) | | | $ | (40,236) | | | $ | (110,423) | | | $ | (124,125) | |

| Basic and diluted net loss per share attributable to common stockholders | $ | (0.13) | | | $ | (0.15) | | | $ | (0.40) | | | $ | (0.47) | |

| Basic and diluted weighted-average common shares outstanding used in computing net loss per share attributable to common stockholders | 284,197,733 | | 267,947,661 | | 277,252,951 | | 266,104,962 |

PLANET

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 31, | | Nine Months Ended October 31, |

| (In thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | $ | (38,004) | | | $ | (40,236) | | | $ | (110,423) | | | $ | (124,125) | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Foreign currency translation adjustment | (1,667) | | | (235) | | | (1,543) | | | 82 | |

| Change in fair value of available-for-sale securities | 89 | | | (1,538) | | | (970) | | | (1,235) | |

| Other comprehensive income (loss), net of tax | (1,578) | | | (1,773) | | | (2,513) | | | (1,153) | |

| Comprehensive loss | $ | (39,582) | | | $ | (42,009) | | | $ | (112,936) | | | $ | (125,278) | |

PLANET

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

| | | | | | | | | | | |

| Nine Months Ended October 31, |

| (In thousands) | 2023 | | 2022 |

| Operating activities | | | |

| Net loss | $ | (110,423) | | | $ | (124,125) | |

| Adjustments to reconcile net loss to net cash used in operating activities | | | |

| Depreciation and amortization | 36,033 | | | 33,997 | |

| Stock-based compensation, net of capitalized cost | 44,611 | | | 59,841 | |

| Change in fair value of warrant liabilities | (14,004) | | | (5,369) | |

| Change in fair value of contingent consideration | (923) | | | — | |

| Other | (3,538) | | | 555 | |

| Changes in operating assets and liabilities | | | |

| Accounts receivable | (3,872) | | | 15,237 | |

| Prepaid expenses and other assets | 9,483 | | | (9,472) | |

| Accounts payable, accrued and other liabilities | (20,706) | | | (8,649) | |

| Deferred revenue | 19,557 | | | (19,382) | |

| Deferred hosting costs | (92) | | | (1,751) | |

| Net cash used in operating activities | (43,874) | | | (59,118) | |

| Investing activities | | | |

| Purchases of property and equipment | (29,086) | | | (9,008) | |

| Capitalized internal-use software | (3,266) | | | (1,737) | |

| Business acquisition | (7,542) | | | — | |

| Maturities of available-for-sale securities | 142,903 | | | 13,000 | |

| Sales of available-for-sale securities | 40,072 | | | — | |

| Purchases of available-for-sale securities | (166,169) | | | (239,321) | |

| Other | (944) | | | (412) | |

| Net cash used in investing activities | (24,032) | | | (237,478) | |

| Financing activities | | | |

| Proceeds from the exercise of common stock options | 6,770 | | | 10,909 | |

| Class A common stock withheld to satisfy employee tax withholding obligations | (7,112) | | | (4,328) | |

Payment of transaction costs related to the Business Combination | — | | | (326) | |

| Other | (15) | | | 122 | |

| Net cash provided by (used in) financing activities | (357) | | | 6,377 | |

| Effect of exchange rate changes on cash and cash equivalents, and restricted cash and cash equivalents | (65) | | | (1,781) | |

| Net decrease in cash and cash equivalents, and restricted cash and cash equivalents | (68,328) | | | (292,000) | |

| Cash and cash equivalents, and restricted cash and cash equivalents at the beginning of the period | 188,076 | | | 496,814 | |

| Cash and cash equivalents, and restricted cash and cash equivalents at the end of the period | $ | 119,748 | | | $ | 204,814 | |

PLANET

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, | | Nine Months Ended October 31, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | | $ | (38,004) | | | $ | (40,236) | | | $ | (110,423) | | | $ | (124,125) | |

| Interest income | | (3,445) | | (2,853) | | (11,753) | | (4,276) |

| Income tax provision | | 355 | | 439 | | 1,244 | | 907 |

| Depreciation and amortization | | 13,625 | | 10,785 | | 36,033 | | 33,997 |

| Change in fair value of warrant liabilities | | (6,833) | | 19 | | (14,004) | | (5,369) |

| Stock-based compensation | | 12,598 | | 19,438 | | 44,611 | | 59,841 |

Restructuring costs(1) | | 7,341 | | — | | 7,341 | | — |

Employee transaction bonuses in connection with the Sinergise business combination(2) | | 2,317 | | — | | 2,317 | | — |

| Other (income) expense, net | | 69 | | (1) | | (894) | | (123) |

| Adjusted EBITDA | | $ | (11,977) | | | $ | (12,409) | | | $ | (45,528) | | | $ | (39,148) | |

| | | | | | | | |

(1) As part of the headcount reduction plan announced in August 2023, we recognized $7.3 million of severance and other employee costs for the three and nine months ended October 31, 2023. For the three and nine months ended October 31, 2023, the restructuring related stock-based compensation benefit of $1.5 million is included on its respective line item. |

(2) Certain employees of Sinergise, which became employees of Planet, were paid cash transaction bonuses in connection with the closing of the Sinergise acquisition. The cost of the transaction bonuses was allocated from the purchase consideration we paid for the acquisition. |

PLANET

RECONCILIATION OF U.S. GAAP TO NON-GAAP FINANCIAL MEASURES (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 31, | | Nine Months Ended October 31, |

| (In thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of cost of revenue: | | | | | | | |

| GAAP cost of revenue | $ | 29,350 | | | $ | 24,728 | | | $ | 81,375 | | | $ | 73,333 | |

| Less: Stock-based compensation | 888 | | | 1,317 | | | 2,855 | | | 3,992 | |

| Less: Amortization of acquired intangible assets | 796 | | | 366 | | | 1,674 | | | 1,163 | |

| Less: Restructuring costs | 563 | | | — | | | 563 | | | — | |

| Less: Employee transaction bonuses in connection with the Sinergise business combination | 267 | | | — | | | 267 | | | — | |

| Non-GAAP cost of revenue | $ | 26,836 | | | $ | 23,045 | | | $ | 76,016 | | | $ | 68,178 | |

| | | | | | | |

| Reconciliation of gross profit: | | | | | | | |

| GAAP gross profit | $ | 26,030 | | | $ | 24,976 | | | $ | 80,469 | | | $ | 64,948 | |

| Add: Stock-based compensation | 888 | | 1,317 | | 2,855 | | 3,992 |

| Add: Amortization of acquired intangible assets | 796 | | | 366 | | | 1,674 | | | 1,163 | |

| Add: Restructuring costs | 563 | | | — | | | 563 | | | — | |

| Add: Employee transaction bonuses in connection with the Sinergise business combination | 267 | | | — | | | 267 | | | — | |

| Non-GAAP gross profit | $ | 28,544 | | | $ | 26,659 | | | $ | 85,828 | | | $ | 70,103 | |

| GAAP gross margin | 47 | % | | 50 | % | | 50 | % | | 47 | % |

| Non-GAAP gross margin | 52 | % | | 54 | % | | 53 | % | | 51 | % |

PLANET

RECONCILIATION OF U.S. GAAP TO NON-GAAP FINANCIAL MEASURES (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 31, | | Nine Months Ended October 31, |

| (In thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of operating expenses: | | | | | | | |

| GAAP research and development | $ | 33,002 | | | $ | 27,598 | | | $ | 87,929 | | | $ | 79,085 | |

| Less: Stock-based compensation | 5,655 | | 7,910 | | 18,555 | | 24,642 |

| Less: Amortization of acquired intangible assets | — | | | — | | | — | | | — | |

| Less: Restructuring costs | 3,297 | | | — | | | 3,297 | | | — | |

| Less: Employee transaction bonuses in connection with the Sinergise business combination | 1,891 | | | — | | | 1,891 | | | — | |

| Non-GAAP research and development | $ | 22,159 | | | $ | 19,688 | | | $ | 64,186 | | | $ | 54,443 | |

| GAAP sales and marketing | $ | 20,774 | | | $ | 19,383 | | | $ | 66,209 | | | $ | 57,721 | |

| Less: Stock-based compensation | 1,626 | | 3,221 | | 7,827 | | 10,615 |

| Less: Amortization of acquired intangible assets | 261 | | | 153 | | | 665 | | | 458 | |

| Less: Restructuring costs | 1,943 | | | — | | | 1,943 | | | — | |

| Less: Employee transaction bonuses in connection with the Sinergise business combination | 41 | | | — | | | 41 | | | — | |

| Non-GAAP sales and marketing | $ | 16,903 | | | $ | 16,009 | | | $ | 55,733 | | | $ | 46,648 | |

| GAAP general and administrative | $ | 20,112 | | | $ | 20,627 | | | $ | 62,161 | | | $ | 61,128 | |

| Less: Stock-based compensation | 4,429 | | 6,990 | | 15,374 | | 20,592 |

| Less: Amortization of acquired intangible assets | 93 | | | 80 | | | 254 | | | 240 | |

| Less: Restructuring costs | 1,538 | | | — | | | 1,538 | | | — | |

| Less: Employee transaction bonuses in connection with the Sinergise business combination | 118 | | | — | | | 118 | | | — | |

| Non-GAAP general and administrative | $ | 13,934 | | | $ | 13,557 | | | $ | 44,877 | | | $ | 40,296 | |

| | | | | | | |

| Reconciliation of loss from operations | | | | | | | |

| GAAP loss from operations | $ | (47,858) | | | $ | (42,632) | | | $ | (135,830) | | | $ | (132,986) | |

| Add: Stock-based compensation | 12,598 | | 19,438 | | 44,611 | | 59,841 |

| Add: Amortization of acquired intangible assets | 1,150 | | 599 | | 2,593 | | 1,861 |

| Add: Restructuring costs | 7,341 | | — | | 7,341 | | — |

| Add: Employee transaction bonuses in connection with the Sinergise business combination | 2,317 | | — | | 2,317 | | — |

| Non-GAAP loss from operations | $ | (24,452) | | | $ | (22,595) | | | $ | (78,968) | | | $ | (71,284) | |

PLANET

RECONCILIATION OF U.S. GAAP TO NON-GAAP FINANCIAL MEASURES (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 31, | | Nine Months Ended October 31, |

| (In thousands, except share and per share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of net loss | | | | | | | |

| GAAP net loss | $ | (38,004) | | | $ | (40,236) | | | $ | (110,423) | | | $ | (124,125) | |

| Add: Stock-based compensation | 12,598 | | 19,438 | | 44,611 | | 59,841 |

| Add: Amortization of acquired intangible assets | 1,150 | | 599 | | 2,593 | | 1,861 |

| Add: Restructuring costs | 7,341 | | — | | 7,341 | | — |

| Add: Employee transaction bonuses in connection with the Sinergise business combination | 2,317 | | — | | 2,317 | | — |

| Income tax effect of non-GAAP adjustments | — | | — | | — | | — |

| Non-GAAP net loss | $ | (14,598) | | | $ | (20,199) | | | $ | (53,561) | | | $ | (62,423) | |

| | | | | | | |

| Reconciliation of net loss per share, diluted | | | | | | | |

| GAAP net loss | $ | (38,004) | | | $ | (40,236) | | | $ | (110,423) | | | $ | (124,125) | |

| Non-GAAP net loss | $ | (14,598) | | | $ | (20,199) | | | $ | (53,561) | | | $ | (62,423) | |

| | | | | | | |

GAAP net loss per share, basic and diluted (1) | $ | (0.13) | | | $ | (0.15) | | | $ | (0.40) | | | $ | (0.47) | |

| Add: Stock-based compensation | 0.04 | | | 0.07 | | | 0.16 | | | 0.22 | |

| Add: Amortization of acquired intangible assets | — | | | — | | | 0.01 | | | 0.01 | |

| Add: Restructuring costs | 0.03 | | | — | | | 0.03 | | | — | |

| Add: Employee transaction bonuses in connection with the Sinergise business combination | 0.01 | | | — | | | 0.01 | | | — | |

| Income tax effect of non-GAAP adjustments | — | | | — | | | — | | | — | |

Non-GAAP net loss per share, diluted (2) (3) | $ | (0.05) | | | $ | (0.08) | | | $ | (0.19) | | | $ | (0.23) | |

| | | | | | | |

Weighted-average shares used in computing GAAP net loss per share, basic and diluted (1) | 284,197,733 | | 267,947,661 | | 277,252,951 | | 266,104,962 |

Weighted-average shares used in computing Non-GAAP net loss per share, diluted (1) | 284,197,733 | | 267,947,661 | | 277,252,951 | | 266,104,962 |

| | | | | | | |

| (1) Basic and diluted GAAP net loss per share was the same for each period presented as the inclusion of all potential Class A common stock and Class B common stock outstanding would have been anti-dilutive. |

| (2) Non-GAAP net loss per share, diluted is calculated using weighted-average shares, adjusted for dilutive potential shares assumed outstanding during the period. No adjustment was made to weighted-average shares for each period presented as the inclusion of all potential Class A common stock and Class B common stock outstanding would have been anti-dilutive. |

| (3) Totals may not sum due to rounding. Figures are calculated based upon the respective underlying non-rounded data. |

Investor Contact

Chris Genualdi / Cleo Palmer-Poroner

Planet Labs PBC

ir@planet.com

Press Contact

Claire Bentley Dale

Planet Labs PBC

comms@planet.com

v3.23.3

Cover

|

Dec. 07, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 07, 2023

|

| Entity Registrant Name |

Planet Labs PBC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40166

|

| Entity Tax Identification Number |

85-4299396

|

| Entity Address, Address Line One |

645 Harrison Street

|

| Entity Address, Address Line Two |

Floor 4

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94107

|

| City Area Code |

415

|

| Local Phone Number |

829-3313

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001836833

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

PL

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

PLWS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

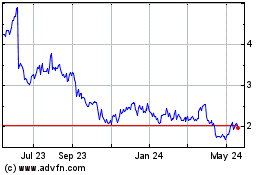

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Apr 2024 to May 2024

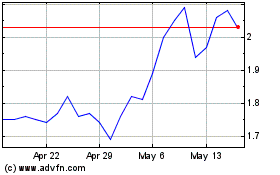

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From May 2023 to May 2024