- Total revenue of $85.0 million in the fourth quarter, up 10%

year-over-year.

- Subscription revenue of $69.3 million in the fourth quarter, up

14% year-over-year.

- Subscription gross margin of 79% and non-GAAP subscription

gross margin of 81% in the fourth quarter, an improvement of more

than 270 basis points year-over-year.

- Operating cash flow of $24.0 million in the fourth quarter, up

73% year-over-year.

PROS Holdings, Inc. (NYSE: PRO), a leading provider of

AI-powered SaaS pricing and selling solutions, today announced

financial results for the fourth quarter and full year ended

December 31, 2024.

“I’m incredibly proud of our team for finishing the year strong

– in 2024, we achieved 14% subscription revenue growth, delivered a

400% improvement in adjusted EBITDA, won exceptional new customers,

and deepened our relationships across our expanding customer base,”

stated CEO Andres Reiner. “These results, combined with being

ranked a Leader in every key industry analyst evaluation specific

to our solutions, highlight our market momentum and position us for

continued growth in 2025 and beyond.”

Fourth Quarter and Full Year 2024 Financial

Highlights

Key financial results for the fourth quarter and full year 2024

are shown below. Throughout this press release all dollar figures

are in millions, except net earnings (loss) per share. Unless

otherwise noted, all results are on a reported basis and are

compared with the prior-year period.

GAAP

Non-GAAP

Q4 2024

Q4 2023

Change

Q4 2024

Q4 2023

Change

Revenue:

Total Revenue

$

85.0

$

77.5

10

%

n/a

n/a

n/a

Subscription Revenue

$

69.3

$

60.8

14

%

n/a

n/a

n/a

Subscription and Maintenance Revenue

$

72.4

$

65.2

11

%

n/a

n/a

n/a

Profitability:

Gross Profit

$

57.6

$

48.7

18

%

$

59.4

$

50.8

17

%

Operating (Loss) Income

$

(1.6

)

$

(10.6

)

$

9.0

$

9.9

$

1.5

580

%

Net (Loss) Income

$

(2.0

)

$

(10.2

)

$

8.2

$

7.5

$

1.1

608

%

Net (Loss) Earnings Per Share

$

(0.04

)

$

(0.22

)

$

0.18

$

0.16

$

0.02

$

0.14

Adjusted EBITDA

n/a

n/a

n/a

$

10.9

$

2.5

333

%

Cash:

Net Cash Provided by Operating

Activities

$

24.0

$

13.8

73

%

n/a

n/a

n/a

Free Cash Flow

n/a

n/a

n/a

$

23.5

$

13.6

73

%

GAAP

Non-GAAP

FY 2024

FY 2023

Change

FY 2024

FY 2023

Change

Revenue:

Total Revenue

$

330.4

$

303.7

9

%

n/a

n/a

n/a

Subscription Revenue

$

266.3

$

234.0

14

%

n/a

n/a

n/a

Subscription and Maintenance Revenue

$

279.8

$

254.0

10

%

n/a

n/a

n/a

Subscription Annual Recurring Revenue

("ARR")

n/a

n/a

n/a

$

281.5

$

259.0

9

%

Subscription ARR in constant currency

n/a

n/a

n/a

$

283.7

$

259.0

10

%

Profitability:

Gross Profit

$

217.0

$

188.4

15

%

$

224.9

$

197.7

14

%

Operating (Loss) Income

$

(19.0

)

$

(50.6

)

$

31.6

$

26.4

$

1.5

1,641

%

Net (Loss) Income

$

(20.5

)

$

(56.4

)

$

35.9

$

19.3

$

2.2

761

%

Net (Loss) Earnings Per Share

$

(0.43

)

$

(1.22

)

$

0.79

$

0.41

$

0.05

$

0.36

Adjusted EBITDA

n/a

n/a

n/a

$

30.0

$

6.0

400

%

Cash:

Net Cash Provided by Operating

Activities

$

27.4

$

9.9

177

%

n/a

n/a

n/a

Free Cash Flow

n/a

n/a

n/a

$

26.2

$

11.4

130

%

The attached table provides a summary of PROS results for the

period, including a reconciliation of GAAP to non-GAAP metrics.

Recent Business Highlights

- Welcomed many new customers who are adopting the PROS Platform

such as Arco, BradyPLUS, Cooper Machinery, Fastjet, HBK, Pipeline

Packaging, and Werner Electric, among others.

- Expanded adoption of the PROS Platform within existing

customers including Adobe, Air Canada, Averitt, BASF, Flydubai,

Henkel, Hertz, Holcim, Lufthansa Group, and Manitou, among

others.

- Earned recognition as a Leader in the 2025 Gartner® Magic

Quadrant™ for Configure, Price, and Quote (CPQ) Applications for

the third time, achieving PROS highest leadership ranking in the

evaluation to date, a testament to PROS leadership in innovation

and expanding market presence.

- Received the Leader designation in the IDC MarketScape:

Worldwide Configure Price Quote (CPQ) Applications for Commerce

2024-2025, in recognition of PROS AI-driven innovations including

our advanced pricing capabilities and seamless ecosystem

integrations.

- Received the IDC 2024 CX CPQ Customer Satisfaction Award,

ranking among the highest in a survey from 2,500 organizations

globally across approximately 40 customer satisfaction metrics,

with recognition for ease of implementation and user

experience.

- Released over 560 new features in the PROS Platform in 2024

that drove new customer acquisition and customer expansion

throughout the year, including new solutions such as Smart Rebate

Management and generative AI-powered Fare Finder Genie.

- Processed 4.4 trillion transactions in our platform in 2024, a

29% increase in volume year-over-year, underscoring the PROS

Platform's significant market value and increasing customer

adoption.

Financial Outlook

PROS currently anticipates the following based on an estimated

47.9 million diluted weighted average shares outstanding for the

first quarter of 2025 and a 22% non-GAAP estimated tax rate for the

first quarter and full year 2025.

Q1 2025 Guidance

v. Q1 2024 at

Mid-Point

Full Year 2025

Guidance

v. Prior Year at

Mid-Point

Total Revenue

$85.0 to $86.0

6%

$360.0 to $362.0

9%

Subscription Revenue

$70.25 to $70.75

10%

$294.0 to $296.0

11%

Subscription ARR

n/a

n/a

$308.0 to $311.0

10%

Non-GAAP Earnings Per Share

$0.10 to $0.12

$0.07

n/a

n/a

Adjusted EBITDA

$7.5 to $8.5

74%

$42.0 to $44.0

43%

Free Cash Flow

n/a

n/a

$40.0 to $44.0

61%

Conference Call

In conjunction with this announcement, PROS Holdings, Inc. will

host a conference call on Thursday, February 6, 2025, at 4:45 p.m.

ET to discuss the Company’s financial results and business outlook.

To access this call, dial 1-877-407-9039 (toll-free) or

1-201-689-8470. The live and archived webcasts of this call can be

accessed under the “Investor Relations” section of the Company’s

website at www.pros.com.

A telephone replay will be available until Thursday, February

13, 2025, 11:59 PM ET at 1-844-512-2921 (toll-free) or

1-412-317-6671 using the pass code 13750860.

About PROS

PROS Holdings, Inc. (NYSE: PRO) is a leading provider of

AI-powered SaaS pricing and selling solutions. Our vision is to

optimize every shopping and selling experience. With 40 years of

industry expertise and a proven track record of success, PROS helps

B2B and B2C companies across the globe, in a variety of industries,

including airlines, manufacturing, distribution, and services,

drive profitable growth. The PROS Platform leverages AI to provide

real-time predictive insights that enable businesses to drive

revenue and margin improvements. To learn more about PROS and our

innovative SaaS solutions, please visit our website at

www.pros.com.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements about our financial outlook;

expectations; ability to achieve future growth and profitability

goals; management's confidence and optimism; positioning; customer

successes; demand for our software solutions; pipeline; business

expansion; revenue; subscription revenue; subscription ARR;

non-GAAP earnings (loss) per share; adjusted EBITDA; free cash

flow; shares outstanding and effective tax rate. The

forward-looking statements contained in this press release are

based upon our historical performance and our current plans,

estimates and expectations and are not a representation that such

plans, estimates or expectations will be achieved. Factors that

could cause actual results to differ materially from those

described herein include, among others, risks related to: (a)

cyberattacks, data breaches and breaches of security measures

within our products, systems and infrastructure or products,

systems and infrastructure of third parties upon whom we rely, (b)

the macroeconomic environment and geopolitical uncertainty and

events, (c) increasing business from customers, maintaining

subscription renewal rates and capturing customer IT spend, (d)

managing our growth and profit objectives effectively, (e)

disruptions from our third party data center, software, data, and

other unrelated service providers, (f) implementing our solutions,

(g) cloud operations, (h) intellectual property and third-party

software, (i) acquiring and integrating businesses and/or

technologies, (j) catastrophic events, (k) operating globally,

including economic and commercial disruptions, (l) potential

downturns in sales and lengthy sales cycles, (m) software

innovation, (n) competition, (o) market acceptance of our software

innovations, (p) maintaining our corporate culture, (q) personnel

risks including loss of any key employees and competition for

talent, (r) expanding and training our direct and indirect sales

force, (s) evolving data privacy, cyber security, data localization

and AI laws, (t) the rapid adoption, evolution, and understanding

of AI, (u) our debt repayment obligations, (v) the timing of

revenue recognition and cash flow from operations, and (w)

returning to profitability. Additional information relating to the

risks and uncertainties affecting our business is contained in our

filings with the SEC. These forward-looking statements represent

our expectations as of the date hereof. Subsequent events may cause

these expectations to change, and PROS disclaims any obligations to

update or alter these forward-looking statements in the future,

whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Measures

PROS has provided in this release certain non-GAAP financial

measures, including non-GAAP gross profit and margin, non-GAAP

subscription margin, non-GAAP income (loss) from operations or

non-GAAP operating income (loss), subscription annual recurring

revenue, adjusted EBITDA, free cash flow, non-GAAP tax rate,

non-GAAP net income (loss), and non-GAAP earnings (loss) per share.

PROS uses these non-GAAP financial measures internally in analyzing

its financial results and believes they are useful to investors, as

a supplement to GAAP measures, in evaluating PROS ongoing

operational performance and cloud transition. Non-GAAP gross margin

can be compared to gross margin which can be calculated from the

condensed consolidated statements of income (loss) by dividing

gross profit by total revenue. Non-GAAP gross margin is similarly

calculated but first adds back to gross profit the portion of

certain of the non-GAAP adjustments described below attributable to

cost of revenue. Non-GAAP subscription margin can be compared to

subscription margin which can be calculated from the condensed

consolidated statements of income (loss) by dividing subscription

gross profit (subscription revenue minus subscription cost) by

subscription revenue. Non-GAAP subscription margin is similarly

calculated but first subtracts out from subscription cost the

portion of certain of the non-GAAP adjustments described below

attributable to cost of subscription. These items and amounts are

presented in the Supplemental Schedule of Non-GAAP Financial

Measures.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. Investors are encouraged to

review the reconciliation of these non-GAAP measures to their most

directly comparable GAAP financial measure as detailed above. A

reconciliation of GAAP financial measures to the non-GAAP financial

measures has been provided in the tables included as part of this

press release, and can be found, along with other financial

information, in the investor relations portion of our website. PROS

use of non-GAAP financial measures may not be consistent with the

presentations by similar companies in PROS industry. PROS has also

provided in this release certain forward-looking non-GAAP financial

measures, including non-GAAP income (loss) from operations,

subscription annual recurring revenue, non-GAAP earnings (loss) per

share, adjusted EBITDA, free cash flow, non-GAAP tax rates, and

calculated billings (collectively the "non-GAAP financial

measures") as follows:

Non-GAAP income (loss) from operations: Non-GAAP income

(loss) from operations excludes the impact of share-based

compensation, amortization of acquisition-related intangibles and

severance. Non-GAAP income (loss) from operations excludes the

following items from non-GAAP estimates:

- Share-Based Compensation: Although share-based

compensation is an important aspect of compensation for our

employees and executives, our share-based compensation expense can

vary because of changes in our stock price and market conditions at

the time of grant, varying valuation methodologies, and the variety

of award types. Since share-based compensation expense can vary for

reasons that are generally unrelated to our performance during any

particular period, we believe this could make it difficult for

investors to compare our current financial results to previous and

future periods. Therefore, we believe it is useful to exclude

share-based compensation in order to better understand our business

performance and allow investors to compare our operating results

with peer companies.

- Amortization of Acquisition-Related Intangibles: We view

amortization of acquisition-related intangible assets, such as the

amortization of the cost associated with an acquired company's

research and development efforts, trade names, customer lists and

customer relationships, as items arising from pre-acquisition

activities determined at the time of an acquisition. While these

intangible assets are continually evaluated for impairment,

amortization of the cost of purchased intangibles is a static

expense, one that is not typically affected by operations during

any particular period.

- Severance: Severance related to costs incurred as the

Company reprioritized its investments to focus on supporting key

growth areas of its business. As a result of this reprioritization,

the Company incurred severance, employee benefits, outplacement and

related costs. These amounts are unrelated to our core performance

during any particular period, and therefore, we believe it is

useful to exclude these amounts in order to better understand our

business performance and allow investors to compare our results

with peer companies.

Non-GAAP earnings (loss) per share: Non-GAAP net income

(loss) excludes the items listed above as excluded from non-GAAP

income (loss) from operations and also excludes amortization of

debt premium and issuance costs, (gain) loss on equity investments,

net, loss on derivatives, loss on debt extinguishment and the taxes

related to these items and the items excluded from non-GAAP income

(loss) from operations. Estimates of non-GAAP earnings (loss) per

share are calculated by dividing estimates for non-GAAP net income

(loss) by our estimate of weighted average shares outstanding for

the future period. In addition to the items listed above as

excluded from non-GAAP income (loss) from operations, non-GAAP net

income (loss) excludes the following items from non-GAAP

estimates:

- Amortization of Debt Premium and Issuance Costs:

Amortization of debt premium and issuance costs are related to our

convertible notes. These amounts are unrelated to our core

performance during any particular period, and therefore, we believe

it is useful to exclude these amounts in order to better understand

our business performance and allow investors to compare our results

with peer companies.

- (Gain) Loss on Equity Investments, net: (Gain) loss on

equity investments, net relate to observable price changes for

equity investments without a readily determinable fair value

identified during the quarter ended December 31, 2023, including

other-than temporary loss. These amounts are unrelated to our core

performance during any particular period, and therefore, we believe

it is useful to exclude these amounts in order to better understand

our business performance and allow investors to compare our results

with peer companies.

- Loss on Derivatives: Loss on derivatives relates to mark

to market features identified as part of the exchange of certain of

our convertible notes (the "Exchange") and related capped call,

non-recurring transactions, during the quarter ended September 30,

2023. These amounts are unrelated to our core performance during

any particular period, and therefore, we believe it is useful to

exclude these amounts in order to better understand our business

performance and allow investors to compare our results with peer

companies.

- Loss on Debt Extinguishment: Loss on debt extinguishment

relates to the Exchange, a non-recurring transaction, during the

quarter ended September 30, 2023. These amounts are unrelated to

our core performance during any particular period, and therefore,

we believe it is useful to exclude these amounts in order to better

understand our business performance and allow investors to compare

our results with peer companies.

- Taxes: We exclude the tax consequences associated with

non-GAAP items to provide investors with a useful comparison of our

operating results to prior periods and to our peer companies

because such amounts can vary significantly. In the fourth quarter

of 2014, we concluded that it is more likely than not that we will

be unable to fully realize our deferred tax assets and accordingly,

established a valuation allowance against those assets. The ongoing

impact of the valuation allowance on our non-GAAP effective tax

rate has been eliminated to allow investors to better understand

our business performance and compare our operating results with

peer companies.

Subscription Annual Recurring Revenue: Subscription

Annual Recurring Revenue ("subscription ARR") is used to assess the

trajectory of our cloud business. Subscription ARR means, as of a

specified date, the contracted subscription revenue, including

contracts with a future start date, together with annualized

overage fees incurred above contracted minimum transactions.

Subscription ARR should be viewed independently of revenue and any

other GAAP measure.

Non-GAAP Tax Rate: The estimated non-GAAP effective tax

rate adjusts the tax effect to quantify the impact of the excluded

non-GAAP items.

Adjusted EBITDA: Adjusted EBITDA is defined as GAAP net

income (loss) before interest expense, provision for income taxes,

depreciation and amortization, as adjusted to eliminate the effect

of stock-based compensation cost, severance, amortization of

acquisition-related intangibles, depreciation and amortization, and

capitalized internal-use software development costs. Adjusted

EBITDA should not be considered as an alternative to net income

(loss) as an indicator of our operating performance.

Free Cash Flow: Free cash flow is a non-GAAP financial

measure which is defined as net cash provided by (used in)

operating activities, excluding severance payments, less capital

expenditures and capitalized internal-use software development

costs.

Calculated Billings: Calculated billings is defined as

total subscription, maintenance and support revenue plus the change

in recurring deferred revenue in a given period.

These non-GAAP estimates are not measurements of financial

performance prepared in accordance with GAAP, and we are unable to

reconcile these forward-looking non-GAAP financial measures to

their directly comparable GAAP financial measures because the

information described above which is needed to complete a

reconciliation is unavailable at this time without unreasonable

effort.

PROS Holdings, Inc.

Condensed Consolidated Balance

Sheets

(In thousands, except share and

per share amounts)

(Unaudited)

December 31, 2024

December 31, 2023

Assets:

Current assets:

Cash and cash equivalents

$

161,983

$

168,747

Trade and other receivables, net of

allowance of $922 and $574, respectively

64,982

49,058

Deferred costs, current

4,634

4,856

Prepaid and other current assets

7,517

12,013

Total current assets

239,116

234,674

Restricted cash

10,000

10,000

Property and equipment, net

19,745

23,051

Operating lease right-of-use assets

16,066

14,801

Deferred costs, noncurrent

11,515

10,292

Intangibles, net

7,044

11,678

Goodwill

107,278

107,860

Other assets, noncurrent

9,138

9,477

Total assets

$

419,902

$

421,833

Liabilities and Stockholders’ (Deficit)

Equity:

Current liabilities:

Accounts payable and other liabilities

$

8,589

$

3,034

Accrued liabilities

14,085

13,257

Accrued payroll and other employee

benefits

27,117

32,762

Operating lease liabilities, current

6,227

5,655

Deferred revenue, current

130,977

120,955

Current portion of convertible debt,

net

—

21,668

Total current liabilities

186,995

197,331

Deferred revenue, noncurrent

5,438

3,669

Convertible debt, net, noncurrent

270,797

272,324

Operating lease liabilities,

noncurrent

23,870

25,118

Other liabilities, noncurrent

1,505

1,264

Total liabilities

488,605

499,706

Stockholders' (deficit) equity:

Preferred stock, $0.001 par value,

5,000,000 shares authorized; none issued

—

—

Common stock, $0.001 par value, 75,000,000

shares authorized; 52,083,732

and 51,184,584 shares issued,

respectively; 47,403,009 and 46,503,861 shares outstanding,

respectively

52

51

Additional paid-in capital

634,212

604,084

Treasury stock, 4,680,723 common shares,

at cost

(29,847

)

(29,847

)

Accumulated deficit

(667,727

)

(647,252

)

Accumulated other comprehensive loss

(5,393

)

(4,909

)

Total stockholders’ (deficit) equity

(68,703

)

(77,873

)

Total liabilities and stockholders’

(deficit) equity

$

419,902

$

421,833

PROS Holdings, Inc.

Condensed Consolidated

Statements of Loss

(In thousands, except per share

data)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenue:

Subscription

$

69,255

$

60,764

$

266,272

$

234,024

Maintenance and support

3,153

4,460

13,494

19,958

Total subscription, maintenance and

support

72,408

65,224

279,766

253,982

Services

12,561

12,260

50,606

49,726

Total revenue

84,969

77,484

330,372

303,708

Cost of revenue:

Subscription

14,229

14,550

57,882

57,212

Maintenance and support

1,716

1,776

7,027

7,703

Total cost of subscription, maintenance

and support

15,945

16,326

64,909

64,915

Services

11,434

12,410

48,420

50,398

Total cost of revenue

27,379

28,736

113,329

115,313

Gross profit

57,590

48,748

217,043

188,395

Operating expenses:

Selling and marketing

21,755

21,175

88,048

92,389

Research and development

22,445

23,018

89,725

89,361

General and administrative

14,957

15,164

58,292

57,247

Loss from operations

(1,567

)

(10,609

)

(19,022

)

(50,602

)

Convertible debt interest and

amortization

(1,125

)

(1,233

)

(4,596

)

(5,882

)

Other income, net

1,145

2,109

4,457

1,063

Loss before income tax provision

(1,547

)

(9,733

)

(19,161

)

(55,421

)

Income tax provision

420

462

1,314

933

Net loss

$

(1,967

)

$

(10,195

)

$

(20,475

)

$

(56,354

)

Net loss per share:

Basic and diluted

$

(0.04

)

$

(0.22

)

$

(0.43

)

$

(1.22

)

Weighted average number of shares:

Basic and diluted

47,349

46,370

47,116

46,155

PROS Holdings, Inc.

Condensed Consolidated

Statements of Cash Flows

(In thousands)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Operating activities:

Net loss

$

(1,967

)

$

(10,195

)

$

(20,475

)

$

(56,354

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

1,932

2,406

8,303

10,707

Amortization of debt premium and issuance

costs

(307

)

(233

)

(1,203

)

861

Share-based compensation

10,535

10,768

40,754

42,357

Deferred income tax, net

(11

)

(63

)

(11

)

(63

)

Provision for credit losses

247

(107

)

299

(19

)

Gain on lease modification

—

—

(697

)

—

Loss on disposal of assets

10

6

784

57

(Gain) loss on equity investments, net

—

(828

)

—

(828

)

Loss on derivatives

—

146

—

4,489

Loss on debt extinguishment

—

—

—

1,779

Changes in operating assets and

liabilities:

Trade and other receivables

(16,999

)

674

(16,211

)

(899

)

Deferred costs

(1,011

)

(1,055

)

(1,001

)

(351

)

Prepaid expenses and other assets

3,741

(1,378

)

4,899

(1,347

)

Operating lease right-of-use assets and

liabilities

(288

)

(1,100

)

(2,126

)

(2,786

)

Accounts payable and other liabilities

3,940

(1,664

)

6,131

(5,039

)

Accrued liabilities

711

(766

)

1,798

723

Accrued payroll and other employee

benefits

4,243

9,192

(5,663

)

8,950

Deferred revenue

19,237

8,041

11,802

7,640

Net cash provided by operating

activities

24,013

13,844

27,383

9,877

Investing activities:

Purchases of property and equipment

(497

)

(375

)

(1,166

)

(2,543

)

Capitalized internal-use software

development costs

—

(48

)

(58

)

(48

)

Investment in equity securities, net

118

—

5

(113

)

Net cash used in investing activities

(379

)

(423

)

(1,219

)

(2,704

)

Financing activities:

Proceeds from employee stock plans

—

—

2,079

2,170

Tax withholding related to net share

settlement of stock awards

(1,408

)

(2,468

)

(12,704

)

(9,299

)

Debt issuance costs related to convertible

debt

—

(2,198

)

—

(2,198

)

Purchase of Capped Call

—

578

—

(22,193

)

Repayment of convertible debt

—

—

(21,713

)

—

Debt issuance costs related to Credit

Agreement

—

—

—

(837

)

Net cash used in financing activities

(1,408

)

(4,088

)

(32,338

)

(32,357

)

Effect of foreign currency rates on

cash

(807

)

334

(590

)

304

Net change in cash, cash equivalents and

restricted cash

21,419

9,667

(6,764

)

(24,880

)

Cash, cash equivalents and restricted

cash:

Beginning of period

150,564

169,080

178,747

203,627

End of period

$

171,983

$

178,747

$

171,983

$

178,747

Reconciliation of cash, cash

equivalents and restricted cash to the condensed consolidated

balance sheets

Cash and cash equivalents

$

161,983

$

168,747

$

161,983

$

168,747

Restricted cash

10,000

10,000

10,000

10,000

Total cash, cash equivalents and

restricted cash

$

171,983

$

178,747

$

171,983

$

178,747

PROS Holdings, Inc. Reconciliation of

GAAP to Non-GAAP Financial Measures (In thousands, except per

share data) (Unaudited)

We use these non-GAAP financial measures to assist in the

management of the Company because we believe that this information

provides a more consistent and complete understanding of the

underlying results and trends of the ongoing business due to the

uniqueness of these charges.

See breakdown of the reconciling line items on

page 11.

Three Months Ended December

31,

Quarter over Quarter

Year Ended December

31,

Year over Year

2024

2023

% change

2024

2023

% change

GAAP gross profit

$

57,590

$

48,748

18

%

$

217,043

$

188,395

15

%

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles

629

953

3,273

4,632

Severance

—

—

—

749

Share-based compensation

1,180

1,073

4,576

3,923

Non-GAAP gross profit

$

59,399

$

50,774

17

%

$

224,892

$

197,699

14

%

Non-GAAP gross margin

69.9

%

65.5

%

68.1

%

65.1

%

GAAP loss from operations

$

(1,567

)

$

(10,609

)

(85

)%

$

(19,022

)

$

(50,602

)

(62

)%

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles

953

1,301

4,628

6,173

Severance

—

—

—

3,586

Share-based compensation

10,535

10,768

40,754

42,357

Total non-GAAP adjustments

11,488

12,069

45,382

52,116

Non-GAAP income from operations

$

9,921

$

1,460

580

%

$

26,360

$

1,514

1,641

%

Non-GAAP income from operations % of total

revenue

11.7

%

1.9

%

8.0

%

0.5

%

GAAP net loss

$

(1,967

)

$

(10,195

)

(81

)%

$

(20,475

)

$

(56,354

)

(64

)%

Non-GAAP adjustments:

Total non-GAAP adjustments affecting loss

from operations

11,488

12,069

45,382

52,116

Amortization of debt premium and issuance

costs

(377

)

(303

)

(1,482

)

737

(Gain) loss on equity investments, net

—

(828

)

—

(828

)

Loss on derivatives

—

146

—

4,489

Loss on debt extinguishment

—

—

—

1,779

Tax impact related to non-GAAP

adjustments

(1,685

)

164

(4,129

)

301

Non-GAAP net income

$

7,459

$

1,053

608

%

$

19,296

$

2,240

761

%

Non-GAAP earnings per share

$

0.16

$

0.02

$

0.41

$

0.05

Shares used in computing non-GAAP earnings

per share

47,534

47,786

47,579

47,139

PROS Holdings, Inc.

Supplemental Schedule of

Non-GAAP Financial Measures

Increase (Decrease) in GAAP

Amounts Reported

(In thousands)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Cost of Subscription

Items

Amortization of acquisition-related

intangibles

629

953

3,273

4,632

Severance

—

—

—

125

Share-based compensation

239

208

920

703

Total cost of subscription items

$

868

$

1,161

$

4,193

$

5,460

Cost of Maintenance Items

Severance

—

—

—

307

Share-based compensation

102

93

433

364

Total cost of maintenance items

$

102

$

93

$

433

$

671

Cost of Services Items

Severance

—

—

—

317

Share-based compensation

839

772

3,223

2,856

Total cost of services items

$

839

$

772

$

3,223

$

3,173

Sales and Marketing Items

Amortization of acquisition-related

intangibles

324

348

1,355

1,541

Severance

—

—

—

1,595

Share-based compensation

2,469

2,811

9,209

11,834

Total sales and marketing items

$

2,793

$

3,159

$

10,564

$

14,970

Research and Development Items

Severance

—

—

—

1,008

Share-based compensation

2,256

2,684

8,799

10,524

Total research and development items

$

2,256

$

2,684

$

8,799

$

11,532

General and Administrative

Items

Severance

—

—

—

234

Share-based compensation

4,630

4,200

18,170

16,076

Total general and administrative items

$

4,630

$

4,200

$

18,170

$

16,310

PROS Holdings, Inc.

Supplemental Reconciliation of

GAAP to Non-GAAP Financial Measures

(In thousands)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Adjusted EBITDA

GAAP Loss from Operations

$

(1,567

)

$

(10,609

)

$

(19,022

)

$

(50,602

)

Amortization of acquisition-related

intangibles

953

1,301

4,628

6,173

Severance

—

—

—

3,586

Share-based compensation

10,535

10,768

40,754

42,357

Depreciation and other amortization

979

1,105

3,675

4,534

Capitalized internal-use software

development costs

—

(48

)

(58

)

(48

)

Adjusted EBITDA

$

10,900

$

2,517

$

29,977

$

6,000

Net Cash Provided by Operating

Activities

$

24,013

$

13,844

$

27,383

$

9,877

Severance

—

211

—

4,081

Purchase of property and equipment

(497

)

(375

)

(1,166

)

(2,543

)

Capitalized internal-use software

development costs

—

(48

)

(58

)

(48

)

Free Cash Flow

$

23,516

$

13,632

$

26,159

$

11,367

Guidance

Q1 2025 Guidance

Full Year 2025

Guidance

Low

High

Low

High

Adjusted EBITDA

GAAP Loss from Operations

$

(5,400

)

$

(4,400

)

$

(13,300

)

$

(11,300

)

Amortization of acquisition-related

intangibles

1,000

1,000

3,700

3,700

Share-based compensation

11,000

11,000

48,000

48,000

Depreciation and other amortization

900

900

3,600

3,600

Adjusted EBITDA

$

7,500

$

8,500

$

42,000

$

44,000

PROS Holdings, Inc.

Supplemental Reconciliation of

GAAP to Non-GAAP Financial Measures (Continued)

(In thousands)

(Unaudited)

Three Months Ended December

31,

Quarter over Quarter

Year Ended December

31,

Year over Year

2024

2023

% change

2024

2023

% change

GAAP subscription gross profit

$

55,026

$

46,214

19

%

$

208,390

$

176,812

18

%

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles

629

953

3,273

4,632

Severance

—

—

—

125

Share-based compensation

239

208

920

703

Non-GAAP subscription gross profit

$

55,894

$

47,375

18

%

$

212,583

$

182,272

17

%

Non-GAAP subscription gross margin

80.7

%

78.0

%

79.8

%

77.9

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206040651/en/

Investor Contact: PROS Investor Relations Belinda

Overdeput 713-335-5879 ir@pros.com

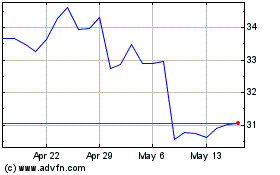

Pros (NYSE:PRO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pros (NYSE:PRO)

Historical Stock Chart

From Feb 2024 to Feb 2025