Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

November 20 2024 - 3:22PM

Edgar (US Regulatory)

|

|

Auto-Callable Contingent Coupon Barrier Notes

Linked to the Least Performing of Three Underliers

Due November 30, 2028

|

| · | Contingent Coupons — If the Notes have not been automatically called, investors will receive a Contingent Coupon on a

quarterly Coupon Payment Date if the closing value of each Underlier is greater than or equal to its Coupon Threshold on the immediately

preceding Coupon Observation Date. You may not receive any Contingent Coupons during the term of the Notes. |

| · | Call Feature — If, on any quarterly Call Observation Date beginning approximately one year following the Trade Date,

the closing value of each Underlier is greater than or equal to its Call Value, the Notes will be automatically called for 100% of their

principal amount plus the Contingent Coupon otherwise due. No further payments will be made on the Notes. |

| · | Contingent Return of Principal at Maturity — If the Notes are not automatically called and the Final Underlier Value

of the Least Performing Underlier is greater than or equal to its Barrier Value, at maturity, investors will receive the principal amount

of their Notes plus the Contingent Coupon otherwise due. If the Notes are not automatically called and the Final Underlier Value of the

Least Performing Underlier is less than its Barrier Value, at maturity, investors will lose 1% of the principal amount of their Notes

for each 1% that the Final Underlier Value of the Least Performing Underlier is less than its Initial Underlier Value. |

| KEY TERMS |

| Issuer: |

Royal Bank of Canada (“RBC”) |

| CUSIP: |

78017GYU9 |

| Underliers: |

The Russell 2000® Index (Bloomberg symbol “RTY”), the S&P 500® Index (Bloomberg symbol “SPX”) and the EURO STOXX 50® Index (Bloomberg symbol “SX5E”) |

| Trade Date: |

November 26, 2024 |

| Issue Date: |

November 29, 2024 |

| Valuation Date: |

November 27, 2028 |

| Maturity Date: |

November 30, 2028 |

| Payment of Contingent Coupons: |

If the Notes have not been automatically called, investors

will receive a Contingent Coupon on a Coupon Payment Date if the closing value of each Underlier is greater than or equal to

its Coupon Threshold on the immediately preceding Coupon Observation Date.

No Contingent Coupon will be payable on a Coupon

Payment Date if the closing value of any Underlier is less than its Coupon Threshold on the immediately preceding Coupon Observation Date.

|

| Contingent Coupon: |

If payable, $20.00 per $1,000 principal amount of Notes (corresponding to a rate of 2.00% per quarter or 8.00% per annum) |

| Coupon Observation Dates: |

Quarterly |

| Coupon Payment Dates: |

Quarterly |

| Call Feature: |

If, on any Call Observation Date, the closing value of each Underlier is greater than or equal to its Call Value, the Notes will be automatically called. Under these circumstances, investors will receive on the Call Settlement Date per $1,000 principal amount of Notes an amount equal to $1,000 plus the Contingent Coupon otherwise due. No further payments will be made on the Notes. |

| KEY TERMS (continued) |

| Call Value: |

With respect to each Underlier, 100% of its Initial Underlier Value |

| Call Observation Dates: |

Quarterly, beginning approximately one year following the Trade Date |

| Call Settlement Date: |

If the Notes are automatically called on any Call Observation Date, the Coupon Payment Date immediately following that Call Observation Date |

| Payment at Maturity: |

If the Notes are not automatically called, investors

will receive on the Maturity Date per $1,000 principal amount of Notes, in addition to any Contingent Coupon otherwise due:

· If

the Final Underlier Value of the Least Performing Underlier is greater than or equal to its Barrier Value: $1,000

· If

the Final Underlier Value of the Least Performing Underlier is less than its Barrier Value, an amount equal to:

$1,000 + ($1,000 ×

Underlier Return of the Least Performing Underlier)

If the Notes are not automatically called and the

Final Underlier Value of the Least Performing Underlier is less than its Barrier Value, you will lose a substantial portion or all of

your principal amount at maturity.

|

| Coupon Threshold and Barrier Value: |

With respect to each Underlier, 70% of its Initial Underlier Value |

| Underlier Return: |

With respect to each Underlier:

Final Underlier Value –

Initial Underlier Value

Initial Underlier Value |

| Initial Underlier Value: |

With respect to each Underlier, the closing value of that Underlier on the Trade Date |

| Final Underlier Value: |

With respect to each Underlier, the closing value of that Underlier on the Valuation Date |

| Least Performing Underlier: |

The Underlier with the lowest Underlier Return |

This document provides a summary of the terms of the

Notes. Investors should carefully review the accompanying preliminary pricing supplement, product supplement, underlying supplement, prospectus

supplement and prospectus, as well as “Selected Risk Considerations” below, before making a decision to invest in the Notes:

https://www.sec.gov/Archives/edgar/data/1000275/000095010324016566/dp220968_424b2-us1888mul.htm

The initial estimated value of the Notes determined

by us as of the Trade Date, which we refer to as the initial estimated value, is expected to be between $900.00 and $950.00 per $1,000

principal amount of Notes and will be less than the public offering price of the Notes. We describe the determination of the initial estimated

value in more detail in the accompanying preliminary pricing supplement.

|

|

|

Selected

Risk Considerations

An investment in the Notes involves significant risks.

We urge you to consult your investment, legal, tax, accounting and other advisers before you invest in the Notes. Some of the risks that

apply to an investment in the Notes are summarized below, but we urge you to read also the “Selected Risk Considerations”

section of the accompanying preliminary pricing supplement and the “Risk Factors” sections of the accompanying prospectus,

prospectus supplement and product supplement. You should not purchase the Notes unless you understand and can bear the risks of investing

in the Notes.

| · | You May Lose a Portion or All of the Principal Amount at Maturity. |

| · | You May Not Receive Any Contingent Coupons. |

| · | Any Payment on the Notes Will Be Determined Solely by the Performance of the Underlier with the Worst Performance Even If the Other

Underliers Perform Better. |

| · | You Will Not Participate in Any Appreciation of Any Underlier, and Any Potential Return on the Notes Is Limited. |

| · | The Notes Are Subject to an Automatic Call. |

| · | Payments on the Notes Are Subject to Our Credit Risk, and Market Perceptions about Our Creditworthiness May Adversely Affect the Market

Value of the Notes. |

| · | Any Payment on the Notes Will Be Determined Based on the Closing Values of the Underliers on the Dates Specified. |

| · | The U.S. Federal Income Tax Consequences of an Investment in the Notes Are Uncertain. |

| · | There May Not Be an Active Trading Market for the Notes; Sales in the Secondary Market May Result in Significant Losses. |

| · | The Initial Estimated Value of the Notes Will Be Less Than the Public Offering Price. |

| · | The Initial Estimated Value of the Notes Is Only an Estimate, Calculated as of the Trade Date. |

| · | Our and Our Affiliates’ Business and Trading Activities May Create Conflicts of Interest. |

| · | RBCCM’s Role as Calculation Agent May Create Conflicts of Interest. |

| · | You Will Not Have Any Rights to the Securities Included in Any Underlier. |

| · | The Notes Are Subject to Small-Capitalization Companies Risk with Respect to the RTY Index. |

| · | The Notes Are Subject to Risks Relating to Non-U.S. Securities Markets with Respect to the SX5E Index. |

| · | The Notes Do Not Provide Direct Exposure to Fluctuations in Exchange Rates between the U.S. Dollar and the Euro with Respect to the

SX5E Index. |

| · | We May Accelerate the Notes If a Change-in-Law Event Occurs. |

| · | Any Payment on the Notes May Be Postponed and Adversely Affected by the Occurrence of a Market Disruption Event. |

| · | Adjustments to an Underlier Could Adversely Affect Any Payments on the Notes. |

Royal Bank of Canada has filed a registration statement

(including a product supplement, underlying supplement, prospectus supplement and prospectus) with the SEC for the offering to which this

document relates. Before you invest, you should read those documents and the other documents that we have filed with the SEC for more

complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

Alternatively, we, any agent or any dealer participating in this offering will arrange to send you those documents if you so request by

calling toll-free at 1-877-688-2301.

As used in this document, “Royal Bank of Canada,”

“we,” “our” and “us” mean only Royal Bank of Canada. Capitalized terms used in this document without

definition are as defined in the accompanying preliminary pricing supplement.

Registration Statement No. 333-275898; filed pursuant

to Rule 433

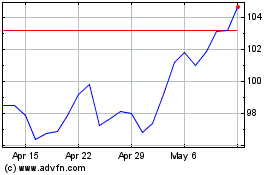

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Oct 2024 to Nov 2024

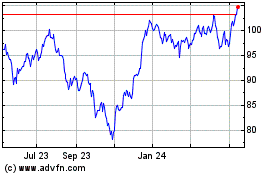

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Nov 2023 to Nov 2024