Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

November 20 2024 - 1:59PM

Edgar (US Regulatory)

|

Auto-Callable Contingent Coupon Barrier Notes

Linked to the Common Stock of Eli Lilly and Company

Due November 27, 2026

|

| · | Contingent Coupons — If the Notes have not been automatically called, investors will receive a Contingent Coupon on a

quarterly Coupon Payment Date if the closing value of the Underlier is greater than or equal to the Coupon Threshold on the immediately

preceding Coupon Observation Date. You may not receive any Contingent Coupons during the term of the Notes. |

| · | Call Feature — If, on any quarterly Call Observation Date beginning approximately six months following the Trade Date,

the closing value of the Underlier is greater than or equal to the Call Value, the Notes will be automatically called for 100% of their

principal amount plus the Contingent Coupon otherwise due. No further payments will be made on the Notes. |

| · | Contingent Return of Principal at Maturity — If the Notes are not automatically called and the Final Underlier Value

is greater than or equal to the Barrier Value, at maturity, investors will receive the principal amount of their Notes plus the Contingent

Coupon otherwise due. If the Notes are not automatically called and the Final Underlier Value is less than the Barrier Value, at maturity,

investors will receive shares of the Underlier that will likely be worth significantly less than the principal amount of their Notes and

could be worth nothing. |

| KEY TERMS |

| Issuer: |

Royal Bank of Canada (“RBC”) |

| CUSIP: |

78015QPF2 |

| Underlier: |

The common stock of Eli Lilly and Company (Bloomberg symbol “LLY UN”) |

| Trade Date: |

November 22, 2024 |

| Issue Date: |

November 27, 2024 |

| Valuation Date: |

November 23, 2026 |

| Maturity Date: |

November 27, 2026 |

| Payment of Contingent Coupons: |

If the Notes have not been automatically called, investors

will receive a Contingent Coupon on a Coupon Payment Date if the closing value of the Underlier is greater than or equal to

the Coupon Threshold on the immediately preceding Coupon Observation Date.

No Contingent Coupon will be payable on a Coupon

Payment Date if the closing value of the Underlier is less than the Coupon Threshold on the immediately preceding Coupon Observation Date. |

| Contingent Coupon: |

If payable, $141.25 per $5,000 principal amount of Notes (corresponding to a rate of 2.825% per quarter or 11.30% per annum) |

| Coupon Observation Dates: |

Quarterly |

| Coupon Payment Dates: |

Quarterly |

| Call Feature: |

If, on any Call Observation Date, the closing value of the Underlier is greater than or equal to the Call Value, the Notes will be automatically called. Under these circumstances, investors will receive on the Call Settlement Date per $5,000 principal amount of Notes an amount equal to $5,000 plus the Contingent Coupon otherwise due. No further payments will be made on the Notes. |

| KEY TERMS (continued) |

| Call Value: |

100% of the Initial Underlier Value |

| Call Observation Dates: |

Quarterly, beginning approximately six months following the Trade Date |

| Call Settlement Date: |

If the Notes are automatically called on any Call Observation Date, the Coupon Payment Date immediately following that Call Observation Date |

| Payment at Maturity: |

If the Notes are not automatically called, investors

will receive on the Maturity Date per $5,000 principal amount of Notes, in addition to any Contingent Coupon otherwise due:

·

If

the Final Underlier Value is greater than or equal to the Barrier Value: $5,000

·

If

the Final Underlier Value is less than the Barrier Value, a number of shares of the Underlier equal to the Physical Delivery

Amount. Fractional shares will be paid in cash with a value equal to the number of fractional shares times the Final Underlier

Value.

If the Notes are not automatically called and the

Final Underlier Value is less than the Barrier Value, you will receive shares of the Underlier that will likely be worth significantly

less than the principal amount of your Notes and could be worth nothing at maturity. |

| Physical Delivery Amount: |

A number of shares of the Underlier equal to $5,000 divided by the Initial Underlier Value (rounded to two decimal places) |

| Coupon Threshold and Barrier Value: |

70% of the Initial Underlier Value |

| Initial Underlier Value: |

The closing value of the Underlier on the Trade Date |

| Final Underlier Value: |

The closing value of the Underlier on the Valuation Date |

This document provides a summary of the terms of the

Notes. Investors should carefully review the accompanying preliminary pricing supplement, product supplement, prospectus supplement and

prospectus, as well as “Selected Risk Considerations” below, before making a decision to invest in the Notes:

https://www.sec.gov/Archives/edgar/data/1000275/000095010324016564/dp220966_424b2-us1899lly.htm

The initial estimated value of the Notes determined

by us as of the Trade Date, which we refer to as the initial estimated value, is expected to be between $4,600.00 and $4,850.00 per $5,000

principal amount of Notes and will be less than the public offering price of the Notes. We describe the determination of the initial estimated

value in more detail in the accompanying preliminary pricing supplement.

|

|

Selected

Risk Considerations

An investment in the Notes involves significant risks.

We urge you to consult your investment, legal, tax, accounting and other advisers before you invest in the Notes. Some of the risks that

apply to an investment in the Notes are summarized below, but we urge you to read also the “Selected Risk Considerations”

section of the accompanying preliminary pricing supplement and the “Risk Factors” sections of the accompanying prospectus,

prospectus supplement and product supplement. You should not purchase the Notes unless you understand and can bear the risks of investing

in the Notes.

| · | You May Lose a Portion or All of the Principal Amount at Maturity. |

| · | You May Not Receive Any Contingent Coupons. |

| · | You Will Not Participate in Any Appreciation of the Underlier, and Any Potential Return on the Notes Is Limited. |

| · | The Notes Are Subject to an Automatic Call. |

| · | Payments on the Notes Are Subject to Our Credit Risk, and Market Perceptions about Our Creditworthiness May Adversely Affect the Market

Value of the Notes. |

| · | Any Payment on the Notes Will Be Determined Based on the Closing Values of the Underlier on the Dates Specified. |

| · | The U.S. Federal Income Tax Consequences of an Investment in the Notes Are Uncertain. |

| · | There May Not Be an Active Trading Market for the Notes; Sales in the Secondary Market May Result in Significant Losses. |

| · | The Initial Estimated Value of the Notes Will Be Less Than the Public Offering Price. |

| · | The Initial Estimated Value of the Notes Is Only an Estimate, Calculated as of the Trade Date. |

| · | Our and Our Affiliates’ Business and Trading Activities May Create Conflicts of Interest. |

| · | RBCCM’s Role as Calculation Agent May Create Conflicts of Interest. |

| · | You Will Not Have Any Rights to the Underlier. |

| · | Any Payment on the Notes May Be Postponed and Adversely Affected by the Occurrence of a Market Disruption Event. |

| · | Anti-dilution Protection Is Limited, and the Calculation Agent Has Discretion to Make Anti-dilution Adjustments. |

| · | Reorganization or Other Events Could Adversely Affect the Value of the Notes or Result in the Notes Being Accelerated. |

Royal Bank of Canada has filed a registration statement

(including a product supplement, prospectus supplement and prospectus) with the SEC for the offering to which this document relates. Before

you invest, you should read those documents and the other documents that we have filed with the SEC for more complete information about

us and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, we, any

agent or any dealer participating in this offering will arrange to send you those documents if you so request by calling toll-free at

1-877-688-2301.

As used in this document, “Royal Bank of Canada,”

“we,” “our” and “us” mean only Royal Bank of Canada. Capitalized terms used in this document without

definition are as defined in the accompanying preliminary pricing supplement.

Registration Statement No. 333-275898; filed pursuant

to Rule 433

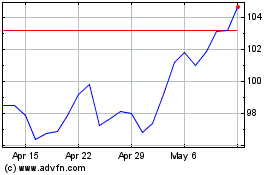

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Nov 2024 to Dec 2024

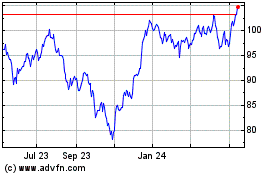

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Dec 2023 to Dec 2024