Certain Closed-end Funds Advised by Franklin Templeton Fund Adviser, LLC Announce Appointment of New Chair and Directors

November 15 2024 - 7:00AM

Business Wire

BrandywineGLOBAL – Global Income

Opportunities Fund Inc. (“BWG”)

Clarion Partners Real Estate Income Fund

Inc. (“CPREIF”)

ClearBridge Energy Midstream Opportunity

Fund Inc. (“EMO”)

LMP Capital and Income Fund Inc.

(“SCD”)

Western Asset Diversified Income Fund

(“WDI”)

Western Asset Emerging Markets Debt Fund

Inc. (“EMD”)

Western Asset Global Corporate Opportunity

Fund Inc. (“GDO”)

Western Asset Global High Income Fund Inc.

(“EHI”)

Western Asset High Income Fund II Inc.

(“HIX”)

Western Asset High Income Opportunity Fund

Inc. (“HIO”)

Western Asset High Yield Defined Opportunity

Fund Inc. (“HYI”)

Western Asset Intermediate Muni Fund Inc.

(“SBI”)

Western Asset Investment Grade Opportunity

Trust Inc. (“IGI”)

Western Asset Managed Municipals Fund Inc.

(“MMU”)

Western Asset Mortgage Opportunity Fund Inc.

(“DMO”)

Western Asset Municipal High Income Fund

Inc. (“MHF”)

(collectively, the “Funds”)

The Board of each Fund announced today the elevation of

independent Director Eileen A. Kamerick to Chair of Board,

effective November 15, 2024. Ms. Kamerick replaces Jane Trust, the

former Chair of the Board of the Funds. Ms. Trust will continue to

serve as an interested Director of the Funds. The Boards also

announced the appointments of Anthony Grillo, Peter Mason and

Hillary Sale as Directors of the Funds, effective November 15,

2024.

Ms. Kamerick has served as an independent Director of the Funds

since 2013. Ms. Kamerick is an adjunct professor at leading law

schools and consults on corporate governance and financial strategy

matters. Ms. Kamerick is also a National Association of Corporate

Directors Board Leadership Fellow, with Director Certification and

NACD 2022 Directorship 100 honoree. Ms. Kamerick has also served as

Chief Financial Officer at several leading companies, including

Houlihan Lokey, Heidrick & Struggles International, Inc. Leo

Burnett, and BP Amoco Americas. She also serves an independent

director of Associated Banc Corp., ACV Auctions Inc. and VALIC

Company I.

Mr. Grillo was one of the founders of the American Securities

Opportunity Funds established in 2005. Mr. Grillo served as

Managing Director of the American Securities Opportunity Funds

until his retirement in 2018. Prior to his experience at American

Securities Opportunity Funds, he held senior management positions

at various private equity and private credit firms. Currently, Mr.

Grillo is a Director of Littelfuse, Inc. since 1991. Mr. Grillo

served on the board of directors of Oaktree Acquisition Corp. II

(NYSE:OACB) from September 2020 until its merger with Alvotech

Holdings S.A. in June 2022. He previously served on the board of

directors of Oaktree Acquisition Corp. (NYSE: OAC) from June 2019

until its merger with Hims & Hers Health, Inc. in January

2021.

Mr. Mason has been an international commercial arbitrator and

mediator since 2021. Prior to establishing his arbitration and

mediation practice, Mr. Mason served as global General Counsel of

UNICEF from 1998 through 2021. At UNICEF, he chaired the Investment

Committee for a retiree benefits fund and was a member of the

Global Finance Committee. He served on the UNICEF Audit Committee

for eight years.

Ms. Sale has been the Agnes Williams Sesquicentennial Professor

of Leadership and Corporate Governance at the Georgetown University

Law Center and Professor of Management at the McDonough School of

Business at Georgetown University since 2018, and was Associate

Dean for Strategy at the Georgetown University Law Center from 2020

to 2023. Ms. Sale has been a Board Faculty Member of the National

Association of Corporate Directors since 2021, and a Director of

CBOE Regulatory Boards since 2022. Ms. Sale was a Member of the

Board of Governors of FINRA from 2016 to 2022.

For more information about the Funds, please call 1-888-777-0102

or consult the Funds’ website at

www.franklintempleton.com/investments/options/closed-end-funds.

Hard copies of the Funds’ complete audited financial statements are

available free of charge upon request.

Data and commentary provided in this press release are for

informational purposes only. Franklin Resources and its affiliates

do not engage in selling shares of the Funds traded on the New York

Stock Exchange.

Certain Fund shares are traded on the New York Stock Exchange.

Similar to stocks, such Fund share prices will fluctuate with

market conditions and, at the time of sale, may be worth more or

less than the original investment. Shares of closed-end funds often

trade at a discount to their net asset value, and can increase an

investor’s risk of loss. All investments are subject to risk,

including the risk of loss.

INVESTMENT PRODUCTS: NOT FDIC INSURED | NO BANK GUARANTEE | MAY

LOSE VALUE

About Franklin Templeton

Franklin Resources, Inc. is a global investment management

organization with subsidiaries operating as Franklin Templeton and

serving clients in over 150 countries. Franklin Templeton’s mission

is to help clients achieve better outcomes through investment

management expertise, wealth management and technology solutions.

Through its specialist investment managers, the company offers

specialization on a global scale, bringing extensive capabilities

in fixed income, equity, alternatives and multi-asset solutions.

With more than 1,500 investment professionals, and offices in major

financial markets around the world, the California-based company

has over 75 years of investment experience and over $1.6 trillion

in assets under management as of October 31, 2024. For more

information, please visit franklintempleton.com and follow us on

LinkedIn, X and Facebook.

Category: Fund Announcement

Source: Franklin Resources, Inc.

Source: Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241115156581/en/

Media Contact: Lisa Tibbitts +1 (904) 942-4451

Lisa.Tibbitts@franklintempleton.com

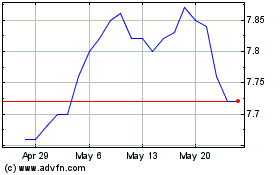

Western Asset Intermedia... (NYSE:SBI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Western Asset Intermedia... (NYSE:SBI)

Historical Stock Chart

From Dec 2023 to Dec 2024