UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-38237

Sea Limited

1 Fusionopolis Place, #17-10, Galaxis

Singapore 138522

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

Exhibit 99.1 — Press Release

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| SEA LIMITED |

|

|

| By: |

|

/s/ Forrest Xiaodong Li |

| Name: |

|

Forrest Xiaodong Li |

| Title: |

|

Chairman and Chief Executive Officer |

Date: May 14, 2024

Exhibit 99.1

Sea Limited Reports First Quarter 2024 Results

Singapore, May 14, 2024 – Sea Limited (NYSE: SE) (“Sea” or the “Company”) today

announced its financial results for the first quarter ended March 31, 2024.

“I am pleased to share that we are kicking off 2024 with

a strong quarter. All our three businesses have delivered strong growth with an improved profit profile,” said Forrest Li, Sea’s Chairman and Chief Executive Officer. Referring to the macro environment challenges in the past few years, he

said, “Going through this period has made us leaner, fitter, and savvier. We are now much more confident of our ability to weather headwinds well, and adapt quickly to changing environments.”

On the e-commerce front, Mr Li said, “Shopee delivered strong growth this quarter, achieving its highest ever quarterly orders, GMV, and

revenue.” He pointed to Shopee’s integrated logistics capability as a key differentiating factor of service quality, saying SPX Express had become “one of the fastest and most extensive logistics operators in our markets today,

greatly enhancing our customer experience.”

On digital financial services, Mr Li said, “SeaMoney has continued its strong

growth momentum and profitability into 2024 while maintaining prudent risk management.” Commenting on future growth, Mr Li said, “We anticipate further growth for our digital financial services business throughout the year. As we healthily

grow our user base, we will be able to offer a broader set of financial services to meet our users’ needs in the future.”

On

digital entertainment, Mr Li said, “We are pleased to share that Garena is back to positive growth, led by Free Fire’s strong performance across markets.” Specifically on Free Fire, Mr Li commented, “In its 7th year, Free Fire is

still one of the largest mobile games in the world by user scale, and remains highly effective in attracting new users. We are confident of building Free Fire into an evergreen franchise.”

In conclusion, Mr Li said, “We have a clear roadmap for profitable growth. Our results in the first quarter have given us a strong start

to 2024, and we are well on-track to deliver our full-year guidance.”

First Quarter 2024 Highlights

|

|

|

|

|

|

|

○ |

|

Total GAAP revenue was US$3.7 billion, up 22.8% year-on-year. |

|

|

|

|

|

|

|

○ |

|

Total gross profit was US$1.6 billion, up 9.7% year-on-year. |

|

|

|

|

|

|

|

○ |

|

Total net loss was US$23.0 million, as compared to total net income of US$87.3 million for the first quarter of

2023. |

|

|

|

|

|

|

|

○ |

|

Total adjusted EBITDA1 was US$401.1 million, as compared to US$507.2

million for the first quarter of 2023. |

|

|

|

|

|

|

|

○ |

|

As of March 31, 2024, cash, cash equivalents, short-term investments, and other treasury investments2 were US$8.6 billion, representing a net change of US$(12.3) million from December 31, 2023. This included US$143.9 million of cash consideration used to repurchase US$171.9 million aggregate

principal amount of the 0.25% convertible senior notes due 2026 during the first quarter. |

1

|

|

|

|

|

|

|

○ |

|

Gross orders totaled 2.6 billion for the quarter, increasing by 56.8% year-on-year. |

|

|

|

|

|

|

|

○ |

|

GMV was US$23.6 billion for the quarter, increasing by 36.3% year-on-year. |

|

|

|

|

|

|

|

○ |

|

GAAP revenue was US$2.7 billion, up 32.9% year-on-year. |

|

|

|

|

|

|

|

○ |

|

GAAP revenue included US$2.4 billion of GAAP marketplace revenue, which consists of core marketplace revenue and

value-added services revenue and increased by 32.7% year-on-year. |

|

|

|

|

|

|

|

● |

|

Core marketplace revenue, mainly consisting of transaction-based fees and advertising revenues, was up 47.0% year-on-year

to US$1.7 billion. |

|

|

|

|

|

|

|

● |

|

Value-added services revenue, mainly consisting of revenues related to logistics services, was up 7.9% year-on-year to

US$722.5 million. |

|

|

|

|

|

|

|

○ |

|

Adjusted EBITDA1 was US$(21.7) million, as compared to US$207.7

million for the first quarter of 2023. |

|

|

|

|

|

|

|

● |

|

Asia markets recorded adjusted EBITDA of US$11.5 million, as compared to US$275.8 million for the first quarter of

2023. |

|

|

|

|

|

|

|

● |

|

Other markets recorded adjusted EBITDA of US$(33.2) million, as compared to US$(68.1) million for the first quarter of

2023. |

|

|

|

|

|

|

|

● |

|

In Brazil, unit economics continued to improve, with contribution

margin3 loss per order improving 87.9% year-on-year to US$(0.04) for the quarter. |

|

|

|

|

|

|

|

◾ |

|

Digital Financial Services |

|

|

|

|

|

|

|

○ |

|

GAAP revenue was US$499.4 million, up 21.0% year-on-year. |

|

|

|

|

|

|

|

○ |

|

Adjusted EBITDA1 was US$148.7 million, up 50.3%

year-on-year. |

|

|

|

|

|

|

|

○ |

|

Digital financial services revenue and operating income are primarily attributed to the consumer and SME credit business.

As of March 31, 2024, consumer and SME loans principal outstanding was US$3.3 billion, up 28.7% year-on-year. This consists of US$2.7 billion on-book and US$0.6 billion off-book loans principal outstanding4. |

|

|

|

|

|

|

|

○ |

|

Non-performing loans past due by more than 90 days as a percentage of consumer and SME loans principal outstanding,

which includes both on-book and off-book loans principal outstanding4, was 1.4%, as compared to 1.4% in the fourth quarter of 2023, stable quarter-on-quarter. |

|

|

|

|

|

|

|

○ |

|

Bookings5 were US$512.1 million, up 10.8% year-on-year. |

|

|

|

|

|

|

|

○ |

|

GAAP revenue was US$458.1 million, as compared to US$539.7 million for the first quarter of 2023. |

|

|

|

|

|

|

|

○ |

|

Adjusted EBITDA1 was US$292.2 million, up 27.0%

year-on-year. |

|

|

|

|

|

|

|

○ |

|

Adjusted EBITDA represented 57.1% of bookings for the first quarter of 2024, as compared to 49.8% for the first quarter of

2023. |

|

|

|

|

|

|

|

○ |

|

Quarterly active users were 594.7 million, up 21.0% year-on-year. |

|

|

|

|

|

|

|

○ |

|

Quarterly paying users were 48.9 million, up 29.8% year-on-year. Paying user ratio was 8.2%, as compared to 7.7% for the

first quarter of 2023. |

|

|

|

|

|

|

|

○ |

|

Average bookings per user were US$0.86, as compared to US$0.94 for the first quarter of 2023. |

2

1 For a discussion of the use of non-GAAP financial measures, see “Non-GAAP Financial

Measures”.

2 Other treasury investments currently consist of group treasury

related investments, such as available-for-sale sovereign bonds and corporate bonds, classified as part of long-term investments and securities purchased under agreements to resell relating to our banking operations.

3 Contribution margin refers to adjusted EBITDA before allocation of HQ costs.

4 Off-book loans principal outstanding mainly refers to channeling arrangements, which is

lending by other financial institutions on our platform.

5 GAAP revenue for the

digital entertainment segment plus change in digital entertainment deferred revenue. This operating metric is used as an approximation of cash spent by our users in the applicable period that is attributable to our digital entertainment segment.

3

Unaudited Summary of Financial Results

(Amounts are expressed in thousands of US dollars “$” except for per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

ended March

31, |

|

|

|

|

| |

|

2023 |

|

|

2024 |

|

|

YOY% |

|

| |

|

$ |

|

|

$ |

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Service revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Digital Entertainment |

|

|

539,686 |

|

|

|

458,119 |

|

|

|

(15.1 |

)% |

| E-commerce and other services |

|

|

2,259,577 |

|

|

|

2,950,020 |

|

|

|

30.6 |

% |

| Sales of goods |

|

|

241,841 |

|

|

|

326,190 |

|

|

|

34.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,041,104 |

|

|

|

3,734,329 |

|

|

|

22.8 |

% |

| Cost of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of service |

|

|

|

|

|

|

|

|

|

|

|

|

| Digital Entertainment |

|

|

(173,366 |

) |

|

|

(155,977 |

) |

|

|

(10.0 |

)% |

| E-commerce and other services |

|

|

(1,241,328 |

) |

|

|

(1,715,054 |

) |

|

|

38.2 |

% |

| Cost of goods sold |

|

|

(209,720 |

) |

|

|

(309,548 |

) |

|

|

47.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,624,414 |

) |

|

|

(2,180,579 |

) |

|

|

34.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

1,416,690 |

|

|

|

1,553,750 |

|

|

|

9.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other operating income |

|

|

57,880 |

|

|

|

43,977 |

|

|

|

(24.0 |

)% |

| Sales and marketing expenses |

|

|

(400,143 |

) |

|

|

(769,635 |

) |

|

|

92.3 |

% |

| General and administrative expenses |

|

|

(333,377 |

) |

|

|

(290,854 |

) |

|

|

(12.8 |

)% |

| Provision for credit losses |

|

|

(177,439 |

) |

|

|

(161,767 |

) |

|

|

(8.8 |

)% |

| Research and development expenses |

|

|

(320,512 |

) |

|

|

(304,379 |

) |

|

|

(5.0 |

)% |

| Impairment of goodwill |

|

|

(117,875 |

) |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

(1,291,466 |

) |

|

|

(1,482,658 |

) |

|

|

14.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

125,224 |

|

|

|

71,092 |

|

|

|

(43.2 |

)% |

| Non-operating income (loss), net |

|

|

22,522 |

|

|

|

(17,541 |

) |

|

|

(177.9 |

)% |

| Income tax expense |

|

|

(61,898 |

) |

|

|

(78,760 |

) |

|

|

27.2 |

% |

| Share of results of equity investees |

|

|

1,444 |

|

|

|

2,209 |

|

|

|

53.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

87,292 |

|

|

|

(23,000 |

) |

|

|

(126.3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (Loss) per share attributable to Sea Limited’s ordinary shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

0.16 |

|

|

|

(0.04 |

) |

|

|

(125.0 |

)% |

| Diluted |

|

|

0.15 |

|

|

|

(0.04 |

) |

|

|

(126.7 |

)% |

| Change in deferred revenue of Digital Entertainment |

|

|

(77,431 |

) |

|

|

54,029 |

|

|

|

(169.8 |

)% |

| Adjusted EBITDA for Digital Entertainment

(1) |

|

|

230,055 |

|

|

|

292,208 |

|

|

|

27.0 |

% |

| Adjusted EBITDA for E-commerce (1) |

|

|

207,714 |

|

|

|

(21,700 |

) |

|

|

(110.4 |

)% |

| Adjusted EBITDA for Digital Financial Services

(1) |

|

|

98,938 |

|

|

|

148,658 |

|

|

|

50.3 |

% |

| Adjusted EBITDA for Other Services

(1) |

|

|

(21,941 |

) |

|

|

(10,671 |

) |

|

|

(51.4 |

)% |

| Unallocated expenses (2) |

|

|

(7,594 |

) |

|

|

(7,346 |

) |

|

|

(3.3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjusted EBITDA

(1) |

|

|

507,172 |

|

|

|

401,149 |

|

|

|

(20.9 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) For a discussion of the use of non-GAAP financial

measures, see “Non-GAAP Financial Measures”.

(2) Unallocated expenses

within total adjusted EBITDA are mainly related to general and corporate administrative costs such as professional fees and other miscellaneous items that are not allocated to segments. These expenses are excluded from segment results as they are

not reviewed by the Chief Operating Decision Maker (“CODM”) as part of segment performance.

4

Three Months Ended March 31, 2024 Compared

to Three Months Ended March 31, 2023

Revenue

Our total GAAP revenue increased by 22.8% to US$3.7 billion in the first quarter of 2024 from US$3.0 billion in the first quarter of 2023.

|

|

|

|

|

|

|

● |

|

Digital Entertainment: GAAP revenue was US$458.1 million in the first quarter of 2024 compared to US$539.7 million

in the first quarter of 2023. Despite the increase in bookings during the first quarter of 2024, the decrease in GAAP revenue was primarily due to lower recognition of accumulated deferred revenue due to lower bookings in previous

quarters. |

|

|

|

|

|

|

|

● |

|

E-commerce and other services: GAAP revenue increased by 30.6% to US$3.0 billion in the first quarter of 2024 from

US$2.3 billion in the first quarter of 2023, primarily driven by the GMV growth of our e-commerce business and the growth of our credit business. |

|

|

|

|

|

|

|

● |

|

Sales of goods: GAAP revenue increased by 34.9% to US$326.2 million in the first quarter of 2024 from

US$241.8 million in the first quarter of 2023. |

Cost of Revenue

Our total cost of revenue was US$2.2 billion in the first quarter of 2024, as compared to US$1.6 billion in the first quarter of 2023.

|

|

|

|

|

|

|

● |

|

Digital Entertainment: Cost of revenue decreased by 10.0% to US$156.0 million in the first quarter of 2024 from

US$173.4 million in the first quarter of 2023. |

|

|

|

|

|

|

|

● |

|

E-commerce and other services: Cost of revenue for our e-commerce and other services segment combined was US$1.7

billion in the first quarter of 2024, as compared to US$1.2 billion in the first quarter of 2023, primarily driven by an increase in logistics costs as orders volume grew. |

|

|

|

|

|

|

|

● |

|

Cost of goods sold: Cost of goods sold increased by 47.6% to US$309.5 million in the first quarter of 2024 from

US$209.7 million in the first quarter of 2023. |

Other Operating Income

Our other operating income was US$44.0 million and US$57.9 million in the first quarter of 2024 and 2023, respectively. Other operating income

mainly consists of rebates from e-commerce related logistics services providers.

5

Sales and Marketing Expenses

Our total sales and marketing expenses increased by 92.3% to US$769.6 million in the first quarter of 2024 from US$400.1 million in the first

quarter of 2023. The table below sets forth breakdown of the sales and marketing expenses of our major reporting segments. Amounts are expressed in thousands of US dollars (“$”).

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

ended March 31, |

|

|

|

|

| |

|

2023 |

|

|

2024 |

|

|

YOY% |

|

| |

|

$ |

|

|

$ |

|

|

|

|

| Sales and Marketing Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| E-commerce |

|

|

338,189 |

|

|

|

675,881 |

|

|

|

99.9 |

% |

| Digital Financial Services |

|

|

20,159 |

|

|

|

56,768 |

|

|

|

181.6 |

% |

| Digital Entertainment |

|

|

23,447 |

|

|

|

19,376 |

|

|

|

(17.4 |

)% |

General and Administrative Expenses

Our general and administrative expenses decreased by 12.8% to US$290.9 million in the first quarter of 2024 from US$333.4 million in the first

quarter of 2023.

Provision for Credit Losses

Our provision for credit losses decreased by 8.8% to US$161.8 million in the first quarter of 2024 from US$177.4 million in the first quarter

of 2023.

Research and Development Expenses

Our research and development expenses decreased by 5.0% to US$304.4 million in the first quarter of 2024 from US$320.5 million in the first

quarter of 2023.

Impairment of Goodwill

We recorded nil impairment of goodwill in the first quarter of 2024, compared to US$117.9 million in the first quarter of 2023.

Non-operating Income or Losses, Net

Non-operating income or losses mainly consist of interest income, interest expense, investment gain (loss), foreign exchange gain (loss) and

gain (loss) on debt extinguishment. We recorded a net non-operating loss of US$(17.5) million in the first quarter of 2024, as compared to a net non-operating income of US$22.5 million in the first quarter of 2023. The non-operating loss in the

first quarter of 2024 was primarily due to investment losses of US$111.2 million recognized, partially offset by interest income of US$87.1 million and a US$27.1 million net gain from debt extinguishment.

We recognized a gain on debt extinguishment of US$27.1 million in the first quarter of 2024 as the Company repurchased US$171.9 million

aggregate principal amount of the 0.25% convertible senior notes due 2026 (the “2026 CB”), for a cash consideration of US$143.9 million. As of March 31, 2024, approximately US$1.6 billion aggregate principal amount of the 2026 CB remained

outstanding.

6

Income Tax Expense

We had a net income tax expense of US$78.8 million and US$61.9 million in the first quarter of 2024 and 2023, respectively.

Net Loss or Income

As a result of the foregoing, we had net loss of US$(23.0) million in the first quarter of 2024, as compared to net income of US$87.3 million

in the first quarter of 2023.

Basic and Diluted Loss or Earnings Per Share Attributable to Sea Limited’s Ordinary Shareholders

Basic loss per share attributable to Sea Limited’s ordinary shareholders was US$(0.04) in the first quarter of 2024,

compared to basic earnings per share attributable to Sea Limited’s ordinary shareholders of US$0.16 in the first quarter of 2023.

Diluted loss per share attributable to Sea Limited’s ordinary shareholders was US$(0.04) in the first quarter of 2024, compared to basic

earnings per share attributable to Sea Limited’s ordinary shareholders of US$0.15 in the first quarter of 2023.

7

Webcast and Conference Call Information

The Company’s management will host a conference call today to review Sea’s business and financial performance.

Details of the conference call and webcast are as follows:

|

|

|

| Date and time: |

|

7:30 AM U.S. Eastern Time on May 14, 2024

7:30 PM Singapore / Hong Kong Time on May 14, 2024 |

|

|

| Webcast link: |

|

https://events.q4inc.com/attendee/321830000 |

A replay of the conference call will be available at the Company’s investor relations website

(www.sea.com/investor/home). An archived webcast will be available at the same link above.

For enquiries, please contact:

Investors / analysts: ir@sea.com

Media: media@sea.com

About Sea Limited

Sea

Limited (NYSE: SE) is a leading global consumer internet company founded in Singapore in 2009. Its mission is to better the lives of consumers and small businesses with technology. Sea operates three core businesses across digital entertainment,

e-commerce, as well as digital financial services, known as Garena, Shopee and SeaMoney, respectively. Garena is a leading global online games developer and publisher. Shopee is the largest pan-regional e-commerce platform in Southeast Asia and

Taiwan and has a significant presence in Latin America. SeaMoney is a leading digital financial services provider in Southeast Asia and is growing its presence in Brazil.

8

Forward-Looking Statements

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “may,” “could,” “will,” “expect,” “anticipate,” “aim,”

“future,” “intend,” “plan,” “believe,” “estimate,” “likely to,” “potential,” “confident,” “guidance,” and similar statements. Among other things, statements

that are not historical facts, including statements about Sea’s beliefs and expectations, the business, financial and market outlook, and projections from its management in this announcement, as well as Sea’s strategic and operational

plans, contain forward-looking statements. Sea may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press

releases, and other written materials, and in oral statements made by its officers, directors, or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking statement, including but not limited to the following: Sea’s goals and strategies; its future business development, financial condition, financial results, and results of operations;

the expected growth in, and market size of, the digital entertainment, e-commerce and digital financial services industries in the markets where it operates, including segments within those industries; expected changes or guidance in its revenue,

costs or expenditures; its ability to continue to source, develop and offer new and attractive online games and to offer other engaging digital entertainment content; the expected growth of its digital entertainment, e-commerce and digital financial

services businesses; its expectations regarding growth in its user base, level of engagement, and monetization; its ability to continue to develop new technologies and/or upgrade its existing technologies; growth and trends of its markets and

competition in its industries; government policies and regulations relating to its industries, including the effects of any government orders or actions on its businesses; general economic, political, social and business conditions in its markets;

and the impact of widespread health developments. Further information regarding these and other risks is included in Sea’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this

press release, and Sea undertakes no obligation to update any forward-looking statement, except as required under applicable law.

9

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with U.S. GAAP, we use the following

non-GAAP financial measures to help evaluate our operating performance:

| ● |

“Adjusted EBITDA” for our digital entertainment segment represents operating income (loss) plus

(a) depreciation and amortization expenses, and (b) the net effect of changes in deferred revenue and its related cost for our digital entertainment segment. We believe that the segment adjusted EBITDA helps to identify underlying trends in our

operating results, enhancing their understanding of the past performance and future prospects. |

| ● |

“Adjusted EBITDA” for our e-commerce segment, digital financial services segment and other

services segment represents operating income (loss) before share-based compensation and impairment of goodwill plus depreciation and amortization expenses. We believe that the segment adjusted EBITDA helps to identify underlying trends in our

operating results, enhancing their understanding of the past performance and future prospects. |

| ● |

“Total adjusted EBITDA” represents the sum of adjusted EBITDA of all our segments combined, plus

unallocated expenses. We believe that the total adjusted EBITDA helps to identify underlying trends in our operating results, enhancing their understanding of the past performance and future prospects. |

These non-GAAP financial measures have limitations as analytical tools. None of the above financial measures should be considered in isolation

or construed as an alternative to revenue, net loss/income, or any other measure of performance or as an indicator of our operating performance. These non-GAAP financial measures presented here may not be comparable to similarly titled measures

presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to Sea’s data. We compensate for these limitations by reconciling the non-GAAP financial

measures to their nearest U.S. GAAP financial measures, all of which should be considered when evaluating our performance. We encourage you to review our financial information in its entirety and not rely on any single financial measure.

10

The tables below present selected financial information of our reporting segments, the non-GAAP

financial measures that are most directly comparable to GAAP financial measures, and the related reconciliations between the financial measures. Amounts are expressed in thousands of US dollars (“$”) except for number of shares & per

share data.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months ended March 31, 2024 |

|

| |

|

E-commerce |

|

|

Digital

Financial

Services |

|

|

Digital

Entertainment |

|

|

Other

Services(1) |

|

|

Unallocated

expenses(2) |

|

|

Consolidated |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Operating (loss) income |

|

|

(97,335 |

) |

|

|

134,443 |

|

|

|

236,198 |

|

|

|

(13,787 |

) |

|

|

(188,427 |

) |

|

|

71,092 |

|

| Net effect of changes in deferred revenue and its related cost |

|

|

- |

|

|

|

- |

|

|

|

46,701 |

|

|

|

- |

|

|

|

- |

|

|

|

46,701 |

|

| Depreciation and Amortization |

|

|

75,635 |

|

|

|

14,215 |

|

|

|

9,309 |

|

|

|

3,116 |

|

|

|

- |

|

|

|

102,275 |

|

| Share-based compensation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

181,081 |

|

|

|

181,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

(21,700 |

) |

|

|

148,658 |

|

|

|

292,208 |

|

|

|

(10,671 |

) |

|

|

(7,346 |

) |

|

|

401,149 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

For the Three Months ended March 31, 2023 |

|

| |

|

E-commerce |

|

|

Digital

Financial

Services |

|

|

Digital

Entertainment |

|

|

Other

Services(1) |

|

|

Unallocated

expenses(2) |

|

|

Consolidated |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Operating income (loss) |

|

|

115,844 |

|

|

|

84,568 |

|

|

|

274,594 |

|

|

|

(25,432 |

) |

|

|

(324,350 |

) |

|

|

125,224 |

|

| Net effect of changes in deferred revenue and its related cost |

|

|

- |

|

|

|

- |

|

|

|

(55,003 |

) |

|

|

- |

|

|

|

- |

|

|

|

(55,003 |

) |

| Depreciation and Amortization |

|

|

91,870 |

|

|

|

14,370 |

|

|

|

10,464 |

|

|

|

3,491 |

|

|

|

- |

|

|

|

120,195 |

|

| Share-based compensation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

198,881 |

|

|

|

198,881 |

|

| Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

117,875 |

|

|

|

117,875 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

207,714 |

|

|

|

98,938 |

|

|

|

230,055 |

|

|

|

(21,941 |

) |

|

|

(7,594 |

) |

|

|

507,172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) A combination of multiple business activities that

does not meet the quantitative thresholds to qualify as reportable segments are grouped together as “Other Services”.

(2) Unallocated expenses are mainly related to share-based compensation, impairment of goodwill of prior acquisition that are not under our reportable segments, and general and corporate administrative

costs such as professional fees and other miscellaneous items that are not allocated to segments. These expenses are excluded from segment results as they are not reviewed by the CODM as part of segment performance.

11

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

Amounts expressed in thousands of US dollars (“$”) except for number of shares & per share data

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

ended

March 31, |

|

| |

|

2023 |

|

|

2024 |

|

| |

|

$ |

|

|

$ |

|

| Revenue |

|

|

|

|

|

|

|

|

| Service revenue |

|

|

|

|

|

|

|

|

| Digital Entertainment |

|

|

539,686 |

|

|

|

458,119 |

|

| E-commerce and other services |

|

|

2,259,577 |

|

|

|

2,950,020 |

|

| Sales of goods |

|

|

241,841 |

|

|

|

326,190 |

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

3,041,104 |

|

|

|

3,734,329 |

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

|

|

|

|

|

|

| Cost of service |

|

|

|

|

|

|

|

|

| Digital Entertainment |

|

|

(173,366 |

) |

|

|

(155,977 |

) |

| E-commerce and other services |

|

|

(1,241,328 |

) |

|

|

(1,715,054 |

) |

| Cost of goods sold |

|

|

(209,720 |

) |

|

|

(309,548 |

) |

|

|

|

|

|

|

|

|

|

| Total cost of revenue |

|

|

(1,624,414 |

) |

|

|

(2,180,579 |

) |

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

1,416,690 |

|

|

|

1,553,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (expenses): |

|

|

|

|

|

|

|

|

| Other operating income |

|

|

57,880 |

|

|

|

43,977 |

|

| Sales and marketing expenses |

|

|

(400,143 |

) |

|

|

(769,635 |

) |

| General and administrative expenses |

|

|

(333,377 |

) |

|

|

(290,854 |

) |

| Provision for credit losses |

|

|

(177,439 |

) |

|

|

(161,767 |

) |

| Research and development expenses |

|

|

(320,512 |

) |

|

|

(304,379 |

) |

| Impairment of goodwill |

|

|

(117,875 |

) |

|

|

– |

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

(1,291,466 |

) |

|

|

(1,482,658 |

) |

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

125,224 |

|

|

|

71,092 |

|

| Interest income |

|

|

68,798 |

|

|

|

87,115 |

|

| Interest expense |

|

|

(10,389 |

) |

|

|

(9,718 |

) |

| Investment loss, net |

|

|

(27,743 |

) |

|

|

(111,244 |

) |

| Net gain on debt extinguishment |

|

|

– |

|

|

|

27,112 |

|

| Foreign exchange loss |

|

|

(8,144 |

) |

|

|

(10,806 |

) |

|

|

|

|

|

|

|

|

|

| Income before income tax and share of results of equity investees |

|

|

147,746 |

|

|

|

53,551 |

|

| Income tax expense |

|

|

(61,898 |

) |

|

|

(78,760 |

) |

| Share of results of equity investees |

|

|

1,444 |

|

|

|

2,209 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

87,292 |

|

|

|

(23,000 |

) |

| Net loss (income) attributable to non-controlling interests |

|

|

783 |

|

|

|

(663 |

) |

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to Sea Limited’s ordinary

shareholders |

|

|

88,075 |

|

|

|

(23,663 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (Loss) per share: |

|

|

|

|

|

|

|

|

| Basic |

|

|

0.16 |

|

|

|

(0.04 |

) |

| Diluted |

|

|

0.15 |

|

|

|

(0.04 |

) |

|

|

|

|

|

|

|

|

|

| Weighted average shares used in earnings (loss) per share computation: |

|

|

|

|

|

|

|

|

| Basic |

|

|

563,558,642 |

|

|

|

570,937,761 |

|

| Diluted |

|

|

598,691,484 |

|

|

|

570,937,761 |

|

12

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US dollars (“$”)

|

|

|

|

|

|

|

|

|

| |

|

As of

December 31, |

|

|

As of

March 31, |

|

| |

|

2023 |

|

|

2024 |

|

| |

|

$ |

|

|

$ |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

2,811,056 |

|

|

|

2,460,831 |

|

| Restricted cash |

|

|

1,410,365 |

|

|

|

1,479,871 |

|

| Accounts receivable, net of allowance for credit losses of $9,351 and $6,753, as of

December 31, 2023 and March 31, 2024 respectively |

|

|

262,716 |

|

|

|

236,608 |

|

| Prepaid expenses and other assets |

|

|

1,861,842 |

|

|

|

2,076,799 |

|

| Loans receivable, net of allowance for credit losses of $319,463 and $331,336, as of

December 31, 2023 and March 31, 2024 respectively |

|

|

2,464,662 |

|

|

|

2,609,291 |

|

| Inventories, net |

|

|

125,395 |

|

|

|

142,284 |

|

| Short-term investments |

|

|

2,547,644 |

|

|

|

2,940,964 |

|

| Amounts due from related parties |

|

|

290,254 |

|

|

|

434,623 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

11,773,934 |

|

|

|

12,381,271 |

|

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

1,207,698 |

|

|

|

1,107,072 |

|

| Operating lease right-of-use assets, net |

|

|

1,015,982 |

|

|

|

951,402 |

|

| Intangible assets, net |

|

|

50,821 |

|

|

|

42,883 |

|

| Long-term investments |

|

|

4,262,562 |

|

|

|

4,024,615 |

|

| Prepaid expenses and other assets |

|

|

87,705 |

|

|

|

98,569 |

|

| Loans receivable, net of allowance for credit losses of $2,105 and $2,221, as of December 31,

2023 and March 31, 2024 respectively |

|

|

20,551 |

|

|

|

19,995 |

|

| Restricted cash |

|

|

22,236 |

|

|

|

28,675 |

|

| Deferred tax assets |

|

|

328,961 |

|

|

|

330,509 |

|

| Goodwill |

|

|

112,782 |

|

|

|

110,049 |

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

7,109,298 |

|

|

|

6,713,769 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

18,883,232 |

|

|

|

19,095,040 |

|

|

|

|

|

|

|

|

|

|

13

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US dollars (“$”)

|

|

|

|

|

|

|

|

|

| |

|

As of

December 31, |

|

|

As of

March 31, |

|

| |

|

2023 |

|

|

2024 |

|

| |

|

$ |

|

|

$ |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

342,547 |

|

|

|

280,005 |

|

| Accrued expenses and other payables |

|

|

1,834,807 |

|

|

|

1,815,919 |

|

| Deposits payable |

|

|

1,706,299 |

|

|

|

1,948,148 |

|

| Escrow payables and advances from customers |

|

|

2,199,464 |

|

|

|

2,405,751 |

|

| Amounts due to related parties |

|

|

64,081 |

|

|

|

186,068 |

|

| Borrowings |

|

|

146,661 |

|

|

|

105,058 |

|

| Operating lease liabilities |

|

|

290,788 |

|

|

|

272,801 |

|

| Convertible notes |

|

|

151,764 |

|

|

|

151,841 |

|

| Deferred revenue |

|

|

1,208,892 |

|

|

|

1,199,621 |

|

| Income tax payable |

|

|

223,638 |

|

|

|

121,993 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

8,168,941 |

|

|

|

8,487,205 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

| Accrued expenses and other payables |

|

|

79,257 |

|

|

|

78,250 |

|

| Borrowings |

|

|

119,323 |

|

|

|

117,273 |

|

| Operating lease liabilities |

|

|

789,514 |

|

|

|

731,952 |

|

| Deferred revenue |

|

|

72,587 |

|

|

|

121,997 |

|

| Convertible notes |

|

|

2,949,785 |

|

|

|

2,780,047 |

|

| Deferred tax liabilities |

|

|

133 |

|

|

|

307 |

|

| Unrecognized tax benefits |

|

|

6,107 |

|

|

|

9,107 |

|

|

|

|

|

|

|

|

|

|

| Total non-current liabilities |

|

|

4,016,706 |

|

|

|

3,838,933 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

12,185,647 |

|

|

|

12,326,138 |

|

|

|

|

|

|

|

|

|

|

14

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US dollars (“$”)

|

|

|

|

|

|

|

|

|

| |

|

As of

December 31, |

|

|

As of

March 31, |

|

| |

|

2023 |

|

|

2024 |

|

| |

|

$ |

|

|

$ |

|

| Shareholders’ equity |

|

|

|

|

|

|

|

|

| Class A Ordinary shares |

|

|

262 |

|

|

|

263 |

|

| Class B Ordinary shares |

|

|

23 |

|

|

|

23 |

|

| Additional paid-in capital |

|

|

15,283,870 |

|

|

|

15,466,092 |

|

| Accumulated other comprehensive loss |

|

|

(108,000 |

) |

|

|

(193,312 |

) |

| Statutory reserves |

|

|

16,981 |

|

|

|

16,981 |

|

| Accumulated deficit |

|

|

(8,599,306 |

) |

|

|

(8,622,969 |

) |

|

|

|

|

|

|

|

|

|

| Total Sea Limited shareholders’ equity |

|

|

6,593,830 |

|

|

|

6,667,078 |

|

| Non-controlling interests |

|

|

103,755 |

|

|

|

101,824 |

|

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

|

|

6,697,585 |

|

|

|

6,768,902 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

|

18,883,232 |

|

|

|

19,095,040 |

|

|

|

|

|

|

|

|

|

|

15

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Amounts expressed in thousands of US dollars (“$”)

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

ended March 31, |

|

| |

|

2023 |

|

|

2024 |

|

| |

|

$ |

|

|

$ |

|

| Net cash generated from operating activities |

|

|

605,536 |

|

|

|

468,494 |

|

| Net cash used in investing activities |

|

|

(673,772 |

) |

|

|

(853,786 |

) |

| Net cash generated from financing activities |

|

|

59,214 |

|

|

|

183,831 |

|

| Effect of foreign exchange rate changes on cash, cash equivalents and restricted cash |

|

|

49,508 |

|

|

|

(72,819 |

) |

| Net increase (decrease) in cash, cash equivalents and restricted cash |

|

|

40,486 |

|

|

|

(274,280 |

) |

| Cash, cash equivalents and restricted cash at beginning of the period |

|

|

7,610,384 |

|

|

|

4,243,657 |

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash at end of the period |

|

|

7,650,870 |

|

|

|

3,969,377 |

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities amounted to US$854 million for the three months ended March 31, 2024.

This was primarily attributable to net placement of US$423 million in securities purchased under agreements to resell, time deposits and liquid investment products, for better cash yield management, increase in loans receivable of our credit

business of US$377 million and purchase of property and equipment of US$27 million to support the existing operations. Net cash generated from financing activities amounted to US$184 million for the three months ended March 31, 2024. This was

primarily attributable to an increase in bank customer deposits of US$363 million, offset by the cash used in repurchase of convertible notes of US$144 million as well as net repayment from other funding sources related to the credit business of

US$36 million.

16

UNAUDITED SEGMENT INFORMATION

The Company has three reportable segments, namely e-commerce, digital financial services and digital entertainment. The Chief Operating

Decision Maker (“CODM”) reviews the performance of each segment based on revenue and certain key operating metrics of the operations and uses these results for the purposes of allocating resources to and evaluating the financial

performance of each segment. Amounts are expressed in thousands of US dollars (“$”).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months ended March 31, 2024 |

|

| |

|

E-commerce |

|

|

Digital

Financial

Services |

|

|

Digital

Entertainment |

|

|

Other

Services(1) |

|

|

Unallocated

expenses(2) |

|

|

Consolidated |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Revenue |

|

|

2,747,768 |

|

|

|

499,364 |

|

|

|

458,119 |

|

|

|

29,078 |

|

|

|

- |

|

|

|

3,734,329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (loss) income |

|

|

(97,335 |

) |

|

|

134,443 |

|

|

|

236,198 |

|

|

|

(13,787 |

) |

|

|

(188,427 |

) |

|

|

71,092 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-operating loss, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(17,541 |

) |

| Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(78,760 |

) |

| Share of results of equity investees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(23,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

For the Three Months ended March 31, 2023 |

|

| |

|

E-commerce |

|

|

Digital

Financial

Services |

|

|

Digital

Entertainment |

|

|

Other

Services(1) |

|

|

Unallocated

expenses(2) |

|

|

Consolidated |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Revenue |

|

|

2,067,071 |

|

|

|

412,844 |

|

|

|

539,686 |

|

|

|

21,503 |

|

|

|

- |

|

|

|

3,041,104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

115,844 |

|

|

|

84,568 |

|

|

|

274,594 |

|

|

|

(25,432 |

) |

|

|

(324,350 |

) |

|

|

125,224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-operating income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,522 |

|

| Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(61,898 |

) |

| Share of results of equity investees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

87,292 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) A combination of multiple business activities that do

not meet the quantitative thresholds to qualify as reportable segments are grouped together as “Other Services”.

(2) Unallocated expenses are mainly related to share-based compensation, impairment of goodwill of prior acquisition that are not under our reportable segments, and general and corporate administrative

costs such as professional fees and other miscellaneous items that are not allocated to segments. These expenses are excluded from segment results as they are not reviewed by the CODM as part of segment performance.

17

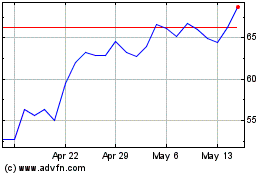

Sea (NYSE:SE)

Historical Stock Chart

From Apr 2024 to May 2024

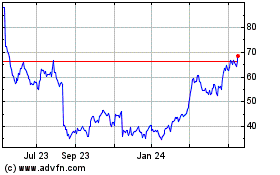

Sea (NYSE:SE)

Historical Stock Chart

From May 2023 to May 2024