false

0001650729

0001650729

2025-02-05

2025-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): February 5, 2025

SiteOne Landscape Supply, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-37760 |

|

46-4056061 |

|

(State or

other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

300

Colonial Center Parkway, Suite

600 Roswell,

Georgia |

|

30076 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(470) 277-7000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

SITE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Performance Unit Awards

Effective February 5, 2025, the Human Resources

and Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of SiteOne Landscape Supply,

Inc. (the “Company”) granted performance stock units (“PSUs”) under the SiteOne Landscape Supply, Inc. 2020 Omnibus

Equity Incentive Plan (the “Plan”) to certain of the Company’s officers, including certain named executive officers.

The PSUs will be earned based upon the Company’s performance over a three-year period, commencing December 30, 2024 and ending January

2, 2028. Seventy percent (70%) of the award will be measured by the Company’s pre-tax income plus amortization expense for intangible

assets (“EBTA”) growth relative to a select peer group (excluding non-recurring items). Thirty percent (30%) of the award

will be measured by the Company’s return on invested capital (“ROIC”). Vesting of PSUs is contingent upon each named

executive’s continued employment, subject to certain exceptions as set forth in the PSU award agreement.

The table below sets forth the performance criteria for the PSUs:

Performance

Level |

|

Relative

EBTA

Growth |

|

%

Target

Award (for 70% of

Target Award) |

|

Absolute

Avg.

ROIC |

|

%

Target Award (for 30%

of Target Award) |

|

| Maximum |

|

>=75th percentile |

|

200% |

|

>=20% |

|

200% |

|

| Target |

|

50th percentile |

|

100% |

|

16% |

|

100% |

|

| Threshold |

|

25th percentile |

|

50% |

|

12% |

|

50% |

|

| <Threshold |

|

<25th percentile |

|

0% |

|

<12% |

|

0% |

|

| · | Payout on relative EBTA growth performance capped at 100% of target if Company’s absolute EBTA growth is negative. |

| | | |

| · | Payout for performance between levels noted above shall be determined using straight-line interpolation between threshold and target and

between target and maximum for each metric, as applicable. |

The table below sets forth the number of PSUs awarded to the Company’s

named executive officers by the Committee:

| Executive / Title | |

Number of PSUs

Awarded | |

| Doug Black, Chief Executive Officer | |

| 15,460 | |

| Briley Brisendine, Executive Vice President, General Counsel and Secretary | |

| 3,036 | |

| John Guthrie, Executive Vice President, Chief Financial Officer and Assistant Secretary | |

| 3,036 | |

| Scott Salmon, Executive Vice President, Strategy and Development | |

| 2,668 | |

| Joseph Ketter, Executive Vice President, Human Resources | |

| 2,576 | |

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| SITEONE LANDSCAPE SUPPLY, INC. |

|

| |

|

| By: |

/s/ Briley Brisendine |

|

| |

Briley

Brisendine |

|

| |

Executive Vice President, General Counsel and Secretary |

|

Date: February 10, 2025

EXHIBIT

INDEX TO CURRENT REPORT ON FORM 8-K

Dated February 10, 2025

Exhibit 10.1

SiteOne Landscape

Supply, Inc.

ELT Performance Stock

Unit Agreement

This Performance Stock Unit

Agreement (this "Agreement") is made and entered into as of February 5, 2025 (the "Grant Date")

by and between SiteOne Landscape Supply, Inc., a Delaware corporation (the "Company") and _____________________________

(the "Participant").

1. Grant

of Performance Share Units. Effective as of the Grant Date, the Company hereby grants to Participant an Award of Performance

Stock Units (“PSUs”) in the amount of ______________________________PSUs (the “Target Award”), each

of which represents the right to receive one share of Company Common Stock (the “Share”) upon vesting of such PSU,

subject to and in accordance with the terms, conditions and restrictions set forth in the SiteOne Landscape Supply, Inc. 2020 Omnibus

Equity Incentive Plan (as it may be amended from time to time, the “Plan”) and this Agreement. The number of PSUs that

Participant may earn hereunder shall range between zero to 200% of the Target Award and shall be determined based on the level of achievement

of the performance conditions set forth in Exhibit A attached hereto (the “Performance Goals”) over the

Performance Cycle (as defined in Section 2). In consideration of the receipt of this Award, Participant agrees to be bound by the

covenants set forth in Exhibit B governing Competitive Activity. Capitalized terms not otherwise defined herein shall have

the same meanings as in the Plan.

2. Performance

Cycle. For purposes of this Agreement, the term "Performance Cycle" shall mean the period commencing on December 30,

2024 and ending January 2, 2028.

3. Performance

Goals.

3.1 The

number of PSUs earned by Participant for the Performance Cycle shall be determined at the end of the Performance Cycle based on the level

of achievement of the Performance Goals in accordance with Exhibit A. All determinations of whether Performance Goals have

been achieved, the number of PSUs earned by Participant, and all other matters related to this Section 3.1 shall be made by the Administrator

in its sole discretion.

3.2 As

soon as practicable following completion of the Performance Cycle, but no later than May 31, 2028 the Administrator shall review

and certify in writing (a) whether, and to what extent, the Performance Goals for the Performance Cycle have been achieved, and (b) the

number of PSUs earned by Participant, if any, subject to satisfaction of the requirements of Section 4 (the “Determination

Date”). Such certification shall be final, conclusive and binding on Participant, and on all other persons, to the maximum extent

permitted by law.

4. Vesting

of PSUs.

4.1 Vesting.

The PSUs are subject to forfeiture until they vest. Except as otherwise provided in Sections 5 and 6, the PSUs shall vest and become nonforfeitable

on the last day of the Performance Cycle, subject to (a) the achievement of the minimum threshold Performance Goal for payout set

forth in Exhibit A, and (b) Participant's continuous employment (“Continuous Service”) from the Grant

Date through the last day of the Performance Cycle (the “Vesting Date”). The number of PSUs that vest and become payable

under this Agreement shall be determined by the Administrator based on the level of achievement of the Performance Goals set forth in

Exhibit A and shall be rounded down to the nearest whole PSU.

4.2 Discretionary

Acceleration. Notwithstanding anything contained in this Agreement to the contrary, the Administrator, in its sole discretion, may

accelerate the vesting with respect to any PSUs under this Agreement, at such times and upon such terms and conditions as the Administrator

shall determine; provided, that the acceleration of vesting of PSUs that are subject to Section 409A of the Code shall not

accelerate the Settlement Date thereof unless permitted by Section 409A of the Code.

4.3 No

Other Accelerated Vesting. The vesting provisions set forth in this Section 4 or in Section 6 shall be the exclusive vesting

and exercisability provisions applicable to the PSUs and shall supersede any other provisions relating to vesting, unless such other such

provision expressly refers to the Plan by name and this Agreement by name and date.

5. Termination

of Continuous Service.

5.1 Except

as otherwise provided in Sections 5.2, 5.3, 5.4 and 6, if Participant's Continuous Service terminates for any reason at any time before

the Vesting Date, Participant's unvested PSUs shall be automatically forfeited upon such termination of Continuous Service and neither

the Company nor any Affiliate shall have any further obligations to Participant under this Agreement.

5.2 If

Participant’s Continuous Service is terminated by the Company without Cause or by Participant for Good Reason (provided Participant

has not engaged in any Competitive Activity), Participant shall vest in the number of PSUs that would otherwise have vested (if any) based

on actual performance level at the end of the Performance Cycle, determined by multiplying such number of PSUs by a fraction, the numerator

of which equals the number of completed months that Participant was employed with the Company during the Performance Cycle and the denominator

of which equals 36 months, provided, however, that the payout of such PSUs shall remain subject to all other terms and conditions

of this Agreement, including the payment date described in Section 7 and the opportunity to earn a greater or lesser number of PSUs

(subject to pro-ration as provided in this Section) as provided in Exhibit A.

5.3 If

Participant's Continuous Service terminates during the Performance Cycle as a result of Participant's death or Disability, Participant

shall vest on such date in a portion of the Target Award (based on target level performance), determined by multiplying the Target Award

by a fraction, the numerator of which equals the number of completed months that Participant was employed with the Company during the

Performance Cycle and the denominator of which equals 36 months, provided, however, the payout of such prorated Target Award

shall remain subject to all other terms and conditions of this Agreement, including the payment dates described in Section 7.

5.4 In

the event Participant’s Continuous Service terminates due to Retirement and Participant has not violated any of the terms set forth

in Exhibit B, Participant shall vest in a pro-rated number of PSUs that would otherwise have vested (if any) based on actual

performance level at the end of the Performance Cycle determined based on the following schedule:

| Retirement Occurs During | |

Pro-Ration Factor | |

| Year 1 of Performance Cycle | |

| 33 | % |

| Year 2 of Performance Cycle | |

| 67 | % |

| Year 3 of Performance Cycle | |

| 100 | % |

provided, however, that such PSUs

shall remain subject to all other terms and conditions of this Agreement, including the payment date described in Section 7 and the

opportunity to earn a greater or lesser number of PSUs (subject to pro-ration as provided in this Section) as provided in Exhibit A.

As used in this Agreement:

“Retirement” means Participant’s voluntary resignation (a) where the sum of the Participant’s age

and years of service equals or exceeds 65, with a minimum age of 55 and after providing a minimum of at least 5 years of service to the

Company as an Employee (or, if approved by the Administrator, as a Consultant or Director), and (b) after providing Continuous Service

for 6 or more months as an Employee (or, if approved by the Administrator, as a Consultant or Director) from the Grant Date.

6. Effect

of a Change in Control. In the event of a Change in Control during the Performance Cycle, the PSUs subject to this Agreement

shall convert into one Restricted Stock Unit (the “Conversion Ratio”) and vest at the end of the Performance Cycle

as follows: (a) if the Change in Control occurs prior to the completion of 2-years of the Performance Cycle, the Conversion Ratio

shall be based on PSUs at target level performance, or (b) if the Change in Control occurs after completion of 2-years of the Performance

Cycle, the Conversion Ratio shall be based on PSUs at performance-to-date level if reasonably measurable or target performance level if

performance-to-date level shall not be reasonably measurable, as determined in the sole discretion of the Administrator. Provided,

however, such Restricted Stock Units shall vest immediately if the (x) the continuing entity fails to provide an Alternative

Award at the time of the Change in Control, or (y) the Company terminates Participant’s employment without Cause or Participant

terminates Participant’s employment for Good Reason within the 12-month period following the Change in Control; provided,

further, that the payout of such Restricted Stock Units shall remain subject to all other terms and conditions of this Agreement,

including the payment date described in Section 7.

7. Payment

of PSUs. Payment in respect of the PSUs earned for the Performance Cycle shall be made in Shares and shall be issued to Participant

as soon as practicable following the end of the Performance Cycle, but no later than May 31, 2028 provided, however,

payment in respect of any PSUs vested as a result of Participant’s death or Disability pursuant to Section 5.3 or in connection

with a Change in Control pursuant to Section 6(x) and (y) shall be made as soon as practical, but no later than 30 days

following the applicable vesting event. The Company shall (a) issue and deliver to Participant the number of Shares equal to the

number of vested PSUs, and (b) enter Participant's name on the books of the Company as the shareholder of record with respect to

the Shares delivered to Participant. Notwithstanding anything herein to the contrary, PSUs subject to Section 409A that are to be

made upon a “separation from service” to Participant pursuant to Section 5.2, 5.3, 5.4 and 6 on any date when Participant

is a “specified employee” as defined under Section 409A shall not be paid before the date that is 6 months following

Participant’s “separation from service” or, if earlier, Participant’s death.

8. Transferability.

Subject to any exceptions set forth in this Agreement or the Plan, the PSUs or the rights relating thereto may not be assigned, alienated,

pledged, attached, sold or otherwise transferred or encumbered by Participant, except by will or the laws of descent and distribution,

and upon any such transfer by will or the laws of descent and distribution, the transferee shall hold such PSUs subject to all of the

terms and conditions that were applicable to Participant immediately prior to such transfer.

9. Rights

as Shareholder; Dividend Equivalents.

9.1 Participant

shall not have any rights of a shareholder with respect to the Shares underlying the PSUs, except for dividend equivalents provided under

Section 9.2.

9.2 In

the event that the Company declares and pays any ordinary cash or stock dividend in respect of its outstanding Shares and, on the record

date of such dividend, Participant holds PSUs granted pursuant to this Agreement that have not been settled, the Company shall provide,

at the time any PSUs are settled in accordance with Section 7, a cash and/ or stock dividend payment equal to the dividends Participant

would have received if Participant was the holder of record, as of such record date, of a number of Shares equal to the number of PSUs

which are settled in accordance with Section 7 (the “Dividend Equivalents”). If the PSUs (or any portion thereof)

are forfeited by Participant pursuant to the terms of this Agreement, then Participant shall also forfeit the Dividend Equivalents, if

any, with respect to such forfeited PSUs. No interest will accrue on the Dividend Equivalents between the declaration and payment of the

applicable dividends and the settlement of the Dividend Equivalents.

9.3 Upon

and following the vesting of the PSUs and the issuance of Shares, Participant shall be the record owner of such Shares unless and until

such Shares are sold or otherwise disposed of, and as record owner shall be entitled to all rights of a shareholder of the Company (including

voting and dividend rights).

10. No

Right to Continued Service. Neither the Plan nor this Agreement shall confer upon Participant any right to be retained in any

position, as a Service Provider. Further, nothing in the Plan or this Agreement shall be construed to limit the discretion of the Company

to terminate Participant's Continuous Service at any time, with or without Cause.

11. Adjustments.

If any change is made to the outstanding Common Stock or the capital structure of the Company, if required, this Award shall be adjusted

or terminated in any manner as contemplated by Section 4.3 of the Plan.

12. Tax

Liability and Withholding.

12.1 Participant

shall be required to pay to the Company, and the Company shall have the right to deduct from any compensation paid to Participant pursuant

to the Plan, the amount of any required withholding taxes in respect of the PSUs and to take all such other action as the Administrator

deems necessary to satisfy all obligations for the payment of such withholding taxes. Notwithstanding the preceding sentence, unless previously

satisfied, the Company shall retain a number of Shares issued in respect of the vested PSU that have an aggregate Fair Market Value as

of the Settlement Date equal to the amount of such taxes required to be withheld; provided that the number of such Shares retained

shall not be in excess of the maximum amount required to satisfy the statutory withholding tax obligations. The number of Shares to be

issued in respect of PSUs shall thereupon be reduced by the number of Shares so retained. The method of withholding set forth in the immediately

preceding sentence shall not be available if withholding in this manner would violate any financing instrument of the Company or any of

the Subsidiaries or result in material adverse accounting treatment for the Company as determined by the Administrator in its sole discretion.

12.2 Notwithstanding

any action the Company takes with respect to any or all income tax, social insurance, payroll tax, or other tax-related withholding ("Tax-Related

Items"), the ultimate liability for all Tax-Related Items is and remains Participant's sole responsibility and the Company (a) makes

no representation or undertakings regarding the treatment of any Tax-Related Items in connection with this Award, vesting or settlement

of the PSUs or the subsequent sale of any Shares, and (b) does not commit to structure the PSUs to reduce or eliminate Participant's

liability for Tax-Related Items.

13. Compliance

with Law. The issuance and transfer of Shares in connection with the PSUs shall be subject to compliance by the Company and

Participant with all applicable requirements of federal and state securities laws and with all applicable requirements of any stock exchange

on which the Shares may be listed. No Shares of Common Stock shall be issued or transferred unless and until any then applicable requirements

of state and federal laws and regulatory agencies have been fully complied with to the satisfaction of the Company and its counsel.

14. Authorization

to Share Personal Data. Participant authorizes the Company or any Affiliate of the Company that has or lawfully obtains personal data

relating to Participant to divulge or transfer such personal data to the Company or to a third party, in each case in any jurisdiction,

if and to the extent reasonably appropriate in connection with this Agreement or the administration of the Plan.

15. PSUs

Subject to Plan. This Agreement is subject to the Plan. The terms and provisions of the Plan as it may be amended from time

to time are hereby incorporated herein by reference. In the event of a conflict between any term or provision contained herein and a term

or provision of the Plan, the applicable terms and provisions of the Plan will govern and prevail.

16. Successors

and Assigns. The Company may assign any of its rights under this Agreement. This Agreement will be binding upon and inure to

the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth herein, this Agreement will

be binding upon Participant and Participant's beneficiaries, executors, administrators and the person(s) to whom the PSUs may be

transferred by will or the laws of descent or distribution.

17. Severability.

The invalidity or unenforceability of any provision of the Plan or this Agreement shall not affect the validity or enforceability of any

other provision of the Plan or this Agreement, and each provision of the Plan and this Agreement shall be severable and enforceable to

the extent permitted by law.

18. Discretionary

Nature of Plan. The Plan is discretionary and may be amended, cancelled or terminated by the Company at any time, in its discretion.

The grant of the PSUs in this Agreement does not create any contractual right or other right to receive any PSUs or other Awards in the

future. Future Awards, if any, will be at the sole discretion of the Company. Any amendment, modification, or termination of the Plan

shall not constitute a change or impairment of the terms and conditions of Participant's employment with the Company.

19. Amendment.

The Administrator has the right to amend, alter, suspend, discontinue or cancel the PSUs, prospectively or retroactively; provided,

however, that, no such amendment shall adversely affect Participant's material rights under this Agreement without Participant's

consent.

20. Section 409A.

This Agreement is intended to comply with Section 409A of the Code or an exemption thereunder and shall be construed and interpreted

in a manner that is consistent with the requirements for avoiding additional taxes or penalties under Section 409A of the Code. Notwithstanding

the foregoing, the Company makes no representations that the payments and benefits provided under this Agreement comply with Section 409A

of the Code and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that

may be incurred by Participant on account of non-compliance with Section 409A of the Code.

21. No

Impact on Other Benefits. The value of Participant's PSUs is not part of Participant’s normal or expected compensation

for purposes of calculating any severance, retirement, welfare, insurance or similar employee benefit.

22. Acknowledgments.

Participant hereby acknowledges receipt of a copy of the Plan and this Agreement. Participant has read and understands the terms and provisions

thereof and accepts this Award subject to all of the terms and conditions of the Plan and this Agreement, including, but not limited to,

the covenants set forth in Exhibit B governing Competitive Activity. Participant acknowledges that there may be adverse tax

consequences upon the vesting or settlement of the PSUs or disposition of the underlying Shares and that Participant has been advised

to consult a tax advisor prior to such vesting, settlement or disposition.

23. Interpretation.

The Administrator shall have full power and discretion to construe and interpret the Plan (and any rules and regulations issued thereunder)

and this Award. Any determination or interpretation by the Administrator under or pursuant to the Plan or this Award shall be final and

binding and conclusive on all persons affected hereby.

24. Waiver

of Jury Trial. The Company and Participant each hereby waives, to the fullest extent permitted by applicable law, any right the Company

or Participant may have to a trial by jury in respect of any suit, action or proceeding arising out of this Agreement or any transaction

contemplated hereby. The Company and Participant each (a) certifies that no representative, agent or attorney of any other party

has represented, expressly or otherwise, that such other party would not, in the event of litigation, seek to enforce the foregoing waiver

and (b) acknowledges that each party has been induced to enter into the Agreement by, among other things, the mutual waivers and

certifications in this section.

25. Forfeiture.

Except as otherwise set forth in Exhibit B, the PSUs granted hereunder (and any Shares received, and gains earned or accrued

in connection therewith) shall be subject to potential cancellation, recoupment, rescission, payback or other action in accordance with

the terms of the Company’s clawback policy, as it may be amended from time to time (the “Policy”). The Participant

hereby appoints the Company as the Participant’s attorney-in-fact to take such actions as may be necessary or appropriate to effectuate

the Policy.

26. Acceptance

of Agreement. Participant has indicated Participant’s consent and acknowledgement of the terms of this Agreement pursuant to

the instructions provided to Participant by or on behalf of the Company. Participant acknowledges receipt of the Plan, represents to the

Company that Participant has read and understood this Agreement and the Plan, and, as an express condition to the grant of the PSUs under

this Agreement, agrees to be bound by the terms of both this Agreement (including, but not limited to, the covenants set forth in Exhibit B

governing Competitive Activity) and the Plan. Participant and the Company each agrees and acknowledges that the use of electronic media

(including, without limitation, a clickthrough button or checkbox on a website of the Company or a third-party administrator) to indicate

Participant’s confirmation, consent, signature, agreement and delivery of this Agreement and the PSUs is legally valid and has the

same legal force and effect as if Participant and the Company signed and executed this Agreement in paper form. The same use of electronic

media may be used for any amendment or waiver of any provision of this Agreement.

* * *

SiteOne Landscape Supply, Inc.

ELT Performance Stock Unit Agreement

exhibit

a

PERFORMANCE

GOALS

PSUs shall be earned based on 3-year relative

EBTA growth and absolute ROIC. Seventy percent (70%) of the Target Award shall be subject to performance goals set forth herein related

to Relative EBTA Growth, and thirty percent (30%) of the Target Award shall be subject to performance goals set forth herein related to

ROIC. The Company’s EBTA shall be measured relative to the Peers plus the BICs. Relative performance shall be measured using

the 12 most recent quarters reported as of the end of the Performance Cycle (as reported after all Form 10-K Annual Reports have

been filed by the Peers reporting their results for such period). Absolute ROIC performance shall be measured over the Performance Cycle.

Actual PSUs earned, if any, shall range from 0% to 200% of the Target Award based upon performance relative the Performance Goals.

For purposes of this Award, the following terms

shall have the following meanings:

“BICs” shall mean the four

best-in-class distributors set forth in Schedule 1 to this Exhibit.

“EBTA” shall mean the generally

accepted accounting principles (GAAP) pre-tax income, adjusted to exclude unusual and infrequent non-operating items, including, but not

limited to, merger and related restructuring charges, goodwill impairments, gain/loss on sale of assets, gain/loss on sale of investments,

insurance settlements and legal settlements, as reported in the financial statements, plus amortization expense for intangible assets.

In determining the magnitude and appropriateness of such adjustments, the Administrator may utilize data sourced from a third-party financial

data vendor for both the Company’s performance and the performance of the Peers and BICs.

“Peers” shall mean the 16 benchmarking

peers set forth in Schedule 1 to this Exhibit.

“ROIC” shall mean the annual

percentage return on invested capital calculated as follows:

ROIC = (Annual EBITA) / (Average Net Assets

for the year)

EBITA = earnings before interest, taxes

and amortization

Net Assets = Shareholder Equity + Net

Debt (Net Debt = Debt + Capital Leases – Cash)

Average is the average for the 4-reporting

quarter that fiscal year.

| · | Annual ROIC shall be independently calculated for each of the three years during the Performance Cycle. |

| · | Three annual ROIC values shall then be averaged to calculate average ROIC over the Performance Cycle to

determine the % of target award earned. |

“Performance

goals” shall mean:

Perf.

Level |

|

Relative EBTA

Growth |

|

% Target

Award (for

70% of

Target

Award) |

|

Absolute

Avg.

ROIC |

|

% Target

Award (for

30% of Target

Award) |

|

| Maximum |

|

>=75th percentile |

|

200% |

|

>=20% |

|

200% |

|

| Target |

|

50th percentile |

|

100% |

|

16% |

|

100% |

|

| Threshold |

|

25th percentile |

|

50% |

|

12% |

|

50% |

|

| <Threshold |

|

<25th percentile |

|

0% |

|

<12% |

|

0% |

|

| · | Payout on relative EBTA growth performance capped at 100% of target if Company’s absolute EBTA growth

is negative. |

| · | Payout for performance between levels noted above shall be determined using straight-line interpolation

between threshold and target and between target and maximum, for each metric, as applicable. |

Footnotes (for EBTA calculations):

| 1. | Source: Standard & Poor's Capital IQ or other third-party financial database |

| 2. | Growth rates calculated as a 3-year cumulative compound annual growth rate (CAGR) such that growing the

base year by the CAGR for each of the three years results in the sum of 3-year cumulative performance (i.e., all three years are included,

not just the base and ending year) |

| 3. | Cumulative negative actual performance off of a positive base year shown as -100% |

| 4. | Any Peer or BIC company that (a) does not have 4-years of data or growth is not calculable due to

a negative base year, shall be excluded from the percentile calculations, (b) is acquired by another company, including through a

management buy-out or going-private transaction, will no longer be considered a Peer or BIC company for the Performance Cycle, (c) files

a petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code or liquidation under Chapter 7 of the U.S. Bankruptcy Code

will remain a Peer or BIC company but EBTA for such company will be deemed to be -100% growth, and (d) does not file its Form 10-K

or 10-Q, as applicable, within three months of the Company’s fiscal year end will no longer be considered a Peer or BIC company

for the Performance Cycle. |

* * *

SiteOne Landscape Supply, Inc.

ELT Performance Stock Unit Agreement

EXHIBIT A

PERFORMANCE GOALS

SCHEDULE 1

PEERS AND BIC

Advanced Drainage Systems, Inc.

Applied Industrial Technologies, Inc.

Beacon Roofing Supply, Inc.

Builders FirstSource Inc.*

Central Garden & Pet Company

Core & Main, Inc.

Eagle Materials Inc.

Fastenal Company

Ferguson Enterprises Inc.*

GMS Inc.

Installed Building Products, Inc.

MRC Global Inc.

MSC Industrial Direct Co., Inc.

Pool Corporation

Summit Materials, Inc.

The Scotts Miracle-Gro Company

TopBuild Corp.

W.W. Grainger, Inc.*

Watsco, Inc.

WESCO International, Inc.*

*BICs.

SiteOne Landscape Supply, Inc.

ELT Performance Stock Unit Agreement

exhibit

B

RESTRICTIVE

COVENANTS

All section references in

this Exhibit B shall refer to the designated section(s) of this Exhibit B.

Section 1

Confidential Information. Except as otherwise provided in Section 5, Participant agrees not to disclose, divulge, publish,

communicate, publicize, disseminate or otherwise reveal, either directly or indirectly, any Confidential Information to any person, natural

or legal, except as required in the performance of Participant’s authorized employment duties to the Company. For the avoidance

of doubt, Participant’s duty to hold the Confidential Information in confidence as set forth in this Section 1 shall remain

in effect until the Confidential Information no longer qualifies as Confidential Information or until the Company provides written notice

to Participant releasing Participant from such duty, whichever occurs first. The term “Confidential Information” means

all information not generally known to the public in any form relating to the past, present or future business affairs of the Company

or any of its Subsidiaries, including without limitation: all business plans and marketing strategies; information concerning existing

and prospective markets, suppliers and customers; financial information; information concerning the development of new products and services;

and technical and non-technical data related to software programs, design, specifications, compilations, inventions, improvements, patent

applications, studies, research, methods, devices, prototypes, processes, procedures and techniques. Such Confidential Information includes

all such information of the Company or a person not a party to this Agreement whose information the Company has in its possession under

obligations of confidentiality, which is disclosed by the Company to Participant or which is produced or developed while Participant is

an employee or director of the Company. “Confidential Information” shall also include trade secrets (as defined under applicable

law) as well as information that does not rise to the level of a trade secret and includes information that has been entrusted to the

Company by a third party under an obligation of confidentiality. The term “Confidential Information” shall not include any

information of the Company which (i) becomes publicly known through no wrongful act of Participant, (ii) is received from a

person not a party to this Agreement who is free to disclose it to Participant, or (iii) is lawfully required to be disclosed to

any governmental agency or is otherwise required to be disclosed by law, subpoena or court order but only to the extent of such requirement,

provided that before making such disclosure Participant shall give the Company an adequate opportunity to interpose an objection or take

action to assure confidential handling of such information.

Section 2

Return of Company Property. Participant acknowledges that all tangible items containing any Confidential Information or

any other proprietary information of the Company or any of its Subsidiaries, including without limitation memoranda, photographs, records,

reports, manuals, drawings, blueprints, prototypes, notes, documents, drawings, specifications, software, media and other materials, including

any copies thereof (including electronically recorded copies), are the exclusive property of the Company and its Subsidiaries, and Participant

shall deliver to the Company all such material in Participant’s possession or control upon the Company’s request and in any

event upon the termination of Participant’s employment with the Company. Participant shall also return any keys, equipment, identification

or credit cards, or other property belonging to the Company or its Subsidiaries upon termination of Participant’s employment or

the Company’s request.

Section 3

Non-competition and Non-solicitation.

3.1 Participant

agrees that during Participant’s employment with the Company, Participant will not, directly or indirectly: (i) as an employee,

consultant, owner, officer, director, manager, operator, or controlling person (including indirectly through a debt or equity investment),

provide to a Competing Business services of the same or similar type provided by Participant to the Company during Participant’s

employment with the Company; (ii) solicit, recruit, aid or induce any employee of the Company or its Subsidiaries to leave his or

her employment with the Company or its Subsidiary in order to accept employment with or render services to another person or entity unaffiliated

with the Company or its Subsidiaries; (iii) solicit, aid, or induce any customer of the Company or its Subsidiaries to purchase goods

or services then sold by the Company or its Subsidiaries from another person or entity, or assist or aid any other person or entity in

identifying or soliciting any such customer, or (iv) otherwise interfere with the relationship of the Company or any of its Subsidiaries

with any of its employees, customers, agents, representatives or suppliers.

3.2 Participant

agrees that during the 18-month period following the date on which Participant’s employment with the Company terminates for any

reason (the “Non-compete Period”), Participant will not directly or indirectly, as an employee, consultant, owner,

officer, director, manager, operator, or controlling person (including indirectly through a debt or equity investment), provide a Competing

Business anywhere in the Territory services of the same or similar type provided by Participant to the Company within 2 years of the termination

of Participant’s employment with the Company. Notwithstanding anything to the contrary in the preceding sentence, (i) if Participant’s

employment terminates for any reason within the 1-year period following a Change in Control, the Non-compete Period shall be a 12-month

period, and (ii) this Section 3.2 shall not apply if Participant’s employment is terminated by the Company without Cause.

The term “Competing Business” means the sale or distribution of landscaping or irrigation products or supplies. The

term “Territory” means those states, cities, and other regions of the United States, Canada, and any other country

within which Participant had substantial responsibilities while employed by the Company. For the avoidance of doubt, if Participant is

a senior officer of the Company, the restriction contained herein shall relate to all of the businesses of the Company and its Subsidiaries.

3.3 Participant

agrees that during the 18-month period following the date on which Participant’s employment with the Company terminates for any

reason, Participant will not, directly or indirectly, on Participant’s own behalf or on behalf of another, or in assistance or aid

of another: (i) solicit, recruit, aid or induce any employee of the Company or its Subsidiaries to leave his or her employment with

the Company or its Subsidiaries in order to accept employment with or render services to another person or entity unaffiliated with the

Company or its Subsidiaries, (ii) solicit, aid, or induce any customer of the Company or its Subsidiaries, with whom Participant

had material contact during the 2-year period prior to the date of termination of Participant’s employment with the Company, to

purchase goods or services then sold by the Company or its Subsidiaries from another person or entity, or assist or aid any other person

or entity in identifying or soliciting any such customer, or (iii) otherwise interfere with the relationship of the Company or any

of its Subsidiaries with any of its employees, customers, agents, representatives or suppliers with whom Participant had material contact

during the 2-year period prior to the date of termination of Participant’s employment with the Company.

3.4 For

the avoidance of doubt, Participant’s agreement to the covenants set forth in Sections 3.2 and 3.3 of this Exhibit B

are not a condition of continued employment with the Company; rather, agreement to these covenants is a condition of Participant’s

participation in the Plan. Sections 3.2 and 3.3 do not apply to employment, competition, or recruitment in California. For the avoidance

of doubt, with respect to any Participant who primarily resides or works in California at the time of his or her execution of this Agreement

or at the time of his or her termination of employment from the Company, the provisions of Sections 3.2 and 3.3 of this Exhibit B

will not apply.

Section 4

Remedies.

4.1 The

Company and Participant agree that the provisions of this Exhibit B do not impose an undue hardship on Participant and are

not injurious to the public; that these provisions are necessary to protect the business of the Company and its Subsidiaries; that the

nature of Participant’s responsibilities with the Company provide and/or will provide Participant with access to Confidential Information

that is valuable to the Company and its Subsidiaries; that the Company would not grant this Award to Participant if Participant did not

agree to the provisions of this Exhibit B; that the provisions of this Exhibit B are reasonable in terms of length

of time and scope; and that adequate consideration supports the provisions of this Exhibit B. In the event that a court determines

that any provision of this Exhibit B is unreasonably broad or extensive, Participant agrees that such court should narrow

such provision to the extent necessary to make it reasonable and enforce the provisions as narrowed. The Company reserves all rights to

seek any and all remedies and damages permitted under law, including, but not limited to, injunctive relief, equitable relief and compensatory

damages for any breach of Participant’s obligations under this Exhibit B.

4.2 Without

limiting the generality of the remedies available to the Company pursuant to Section 4.1, if Participant, except with the prior written

consent of the Company, materially breaches the restrictive covenants contained in this Exhibit B, Participant shall forfeit

any PSU’s that vested during the 12-month period prior to the date of termination of Participant’s employment with the Company,

and any Shares acquired on settlement of such PSU’s (including the proceeds from the sale of any such Shares) shall be subject to

clawback or recoupment by the Company. These rights of forfeiture and recoupment are in addition to any other remedies the Company may

have against Participant for Participant’s breach of the restrictive covenants contained in this Exhibit B. Participant’s

obligations under this Exhibit B shall be cumulative (but not operate to extend the length of any such obligations) of any

similar obligations Participant has under the Plan, the Agreement or any other agreement with the Company or any Affiliate.

Section 5

Protected Rights

5.1 Notwithstanding

any other provision of this Agreement, nothing contained in this Agreement limits Participant’s ability to file a charge or complaint

with the Equal Employment Opportunity Commission, the National Labor Relations Board, the Occupational Safety and Health Administration,

the Securities and Exchange Commission or any other federal, state or local governmental agency or commission (collectively, “Government

Agencies”), or prevents Participant from providing truthful information in response to a lawfully issued subpoena or court order.

Further, this Agreement does not limit Participant’s ability to communicate with any Government Agencies or otherwise participate

in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other information,

without notice to the Company.

5.2 Participant

is hereby notified that under the Defend Trade Secrets Act: (i) no individual will be held criminally or civilly liable under federal

or state trade secret law for disclosure of a trade secret (as defined in the Economic Espionage Act) that is: (A) made in confidence

to a federal, state, or local government official, either directly or indirectly, or to an attorney, and made solely for the purpose of

reporting or investigating a suspected violation of law; or (B) made in a complaint or other document filed in a lawsuit or other

proceeding, if such filing is made under seal so that it is not made public; and (ii) an individual who pursues a lawsuit for retaliation

by an employer for reporting a suspected violation of the law may disclose the trade secret to the attorney of the individual and use

the trade secret information in the court proceeding, if the individual files any document containing the trade secret under seal, and

does not disclose the trade secret, except as permitted by court order.

* * *

v3.25.0.1

Cover

|

Feb. 05, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 05, 2025

|

| Entity File Number |

001-37760

|

| Entity Registrant Name |

SiteOne Landscape Supply, Inc.

|

| Entity Central Index Key |

0001650729

|

| Entity Tax Identification Number |

46-4056061

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

300

Colonial Center Parkway

|

| Entity Address, Address Line Two |

Suite

600

|

| Entity Address, City or Town |

Roswell

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30076

|

| City Area Code |

470

|

| Local Phone Number |

277-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

SITE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

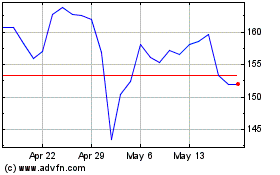

SiteOne Landscape Supply (NYSE:SITE)

Historical Stock Chart

From Jan 2025 to Feb 2025

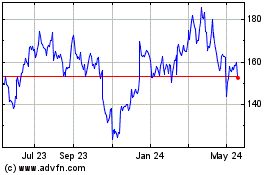

SiteOne Landscape Supply (NYSE:SITE)

Historical Stock Chart

From Feb 2024 to Feb 2025