Voya WealthPath provides Voya Financial Advisors with broader

in- and out-of-plan solution set to support clients’ wealth

management needs more efficiently

Voya Financial, Inc. (NYSE: VOYA) announced today that it is

collaborating with Orion, a premier provider of transformative

wealthtech solutions for financial professionals, to launch a new

and enhanced technology platform for its Voya Financial Advisors

(VFA) business. Voya WealthPath will provide VFA’s financial

professionals with an integrated experience of holistic in-plan and

retail and advisory solutions, including financial planning and

client relationship management tools. The new platform offers a

more efficient, streamlined experience for the firm’s network of

financial professionals to help them better manage their business,

service and retain clients, and grow their practices.

Voya WealthPath comes at a time when Voya is focused on

investing in its financial professional platform and accompanying

retail presence. The new solution builds on Voya’s continued

enhancements in technology and value-added services that support

financial professionals and their clients.

“Over the past several years, Voya has delivered on our mission

and vision of serving our clients, and the financial professionals

we work with while continuing to meet the evolving health, wealth

and investment needs of our customers and their participants,” said

Jonathan Reilly, president, Voya Financial Advisors. “Our

commitment and relentless focus on customer satisfaction has been

supported through the products and services we offer today, along

with the technology we provide to financial professionals. The

enhancements we are offering through this new platform expand what

VFA offers to the marketplace and reinforce Voya’s commitment to

building a foundation for competitive growth across our broad scope

of advisory solutions.”

Through the Orion end-to-end platform, Voya WealthPath offers a

new set of integrated technology solutions, product offerings, and

resources to help VFA financial professionals further connect the

workplace and retail needs of individuals — both in and out of

one’s retirement plan. This includes an enhanced digital and

service experience for financial professionals and clients,

including:

- New retail brokerage and advisory account opening

processes;

- Seamless integration of data; and

- Easier tracking of client interaction.

The new solution will also provide financial professionals with

access to enhanced financial planning tools, providing clients with

a more comprehensive view of their full financial picture to

deliver holistic advice, connect progress toward goals, and

collaborate on goals-based planning — all on one easy-to-use

platform.

“At Voya, we are committed to investing in our advisory business

to deliver a differentiated experience for our customers,” added

Reilly. “Our goal is to empower advisors and other financial

professionals with the support they need to thrive in a rapidly

evolving landscape, and working together with Orion, a provider who

is focused on innovation, does just that. As we continue to invest

in the technology utilized by Voya Financial Advisors, we remain

well-positioned for growth within the Retail Wealth Management

space while being able to offer distinctive value to financial

professionals and their clients.”

“We are excited to work together with Voya Financial Advisors to

elevate the advisor technology landscape,” said Todd Bertucci,

Orion’s EVP of Technology Sales. “The new platform, designed to

offer a best-in-class, unified experience, integrates Orion’s

pioneering technology seamlessly with Voya’s systems, enriching

every aspect of the advisory process from financial planning to

compliance and portfolio accounting. Working with Voya underscores

our commitment to supporting financial professionals’ unique

business goals by providing highly flexible technology solutions

that help drive growth and efficiency. Through this collaboration,

we are empowering VFA’s financial professionals to thrive in a

rapidly evolving marketplace with the tools they need to enhance

their client experiences and expand their practices

efficiently.”

The launch of Voya WealthPath further complements and builds on

Voya’s comprehensive suite of in-plan and retail advice and

guidance solutions designed to help individuals work toward their

financial goals. Most recently, Voya introduced a new dual

Qualified Default Investment Alternative, providing plan

participants with more-personalized retirement investments and

broader sophistication for asset allocation. Voya’s growing support

solutions also include its advisory services program through Voya

Retirement Advisors, advisor managed accounts advisory program and

myVoyage personalized financial-guidance, and connected

workplace-benefits digital platform.

Voya plans to continue investing in its broader retail wealth

management presence throughout 2025 and beyond by providing new

solutions to support its financial professionals. Today, Voya’s

Retail Wealth Management business, which serves the needs of both

in-plan and out-of-plan customers, supports $31 billion in Retail

Client Assets.1

As an industry leader focused on the delivery of benefits,

savings, and investment solutions to and through the workplace,

Voya is committed to delivering on its mission to make a secure

financial future possible for all — one person, one family, one

institution at a time.

1. Voya Financial internal data as of Sept. 30, 2024.

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA) is a leading health, wealth

and investment company with approximately 9,000 employees who are

focused on achieving Voya’s aspirational vision: “Clearing your

path to financial confidence and a more fulfilling life.” Through

products, solutions and technologies, Voya helps its 15.2 million

individual, workplace and institutional clients become well

planned, well invested and well protected. Benefitfocus, a Voya

company and a leading benefits administration provider, extends the

reach of Voya’s workplace benefits and savings offerings by

engaging directly with more than 12 million employees in the U.S.

Certified as a “Great Place to Work” by the Great Place to Work®

Institute, Voya is purpose-driven and committed to conducting

business in a way that is economically, ethically, socially and

environmentally responsible. Voya has earned recognition as one of

the World’s Most Ethical Companies® by Ethisphere; a member of the

Bloomberg Gender-Equality Index; and a “Best Place to Work for

Disability Inclusion” on the Disability Equality Index. For more

information, visit voya.com. Follow Voya Financial on Facebook,

LinkedIn and Instagram.

About Orion

Orion is a premier provider of the tech-enabled fiduciary

process that transforms the advisor-client relationship by enabling

financial advisors to Prospect, Plan, Invest, and Achieve within a

single, connected, technology-driven experience. Combined, our

brand entities, Orion Advisor Tech, Orion Portfolio Solutions,

Brinker Capital Investments, Redtail Technology, and Orion OCIO

create a complete offering that empowers firms to attract new

clients seamlessly, connect goals more meaningfully to investment

strategies and outcomes, and ultimately track progress toward each

investor’s unique definition of financial success. Orion services

$4.7 trillion in assets under administration and $72.5 billion of

wealth management platform assets (as of September 30, 2024) and

supports over six million technology accounts and thousands of

independent advisory firms. Today, 17 out of the Top 20 Barron’s

RIA firms* rely on Orion’s technology to power their businesses and

win for investors. Learn more at Orion.com.

*“2024 Top 100 RIA Firms,” Barron's, 2024.

VOYA-RET

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203739577/en/

Media: Kris Kagel Voya Financial (201) 221-6534

Kristopher.Kagel@voya.com

On Orion’s behalf: Natalie O’Dell StreetCred PR

Orion@streetcredpr.com (717) 818-2116

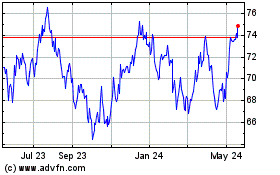

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Jan 2025 to Feb 2025

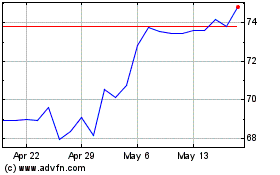

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Feb 2024 to Feb 2025