0000943452FALSE00009434522025-02-122025-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________

FORM 8-K

____________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): February 12, 2025 (February 12, 2025)

____________________________________

WESTINGHOUSE AIR BRAKE TECHNOLOGIES

CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________ | | | | | | | | | | | |

| Delaware |

(State or other jurisdiction

of incorporation or organization) |

| 033-90866 | 25-1615902 |

(Commission

File No.) | (I.R.S. Employer

Identification No.) |

| | | |

| 30 Isabella Street | 15212 |

Pittsburgh, PA | (Zip code) |

| (Address of principal executive offices) | |

412-825-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $.01 par value per share | WAB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On February 12, 2025, Westinghouse Air Brake Technologies Corporation (the “Company”) issued a press release reporting, among other things, the Company’s 2024 fourth quarter results. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 2.02 by reference. The Company is also furnishing an investor presentation relating to its fourth quarter of 2024 (the “Presentation”), which will be used by the management team for presentations to investors and others. A copy of the Presentation is attached hereto as Exhibit 99.2 and incorporated into this Item 2.02 by reference. The Presentation is also available on the Company’s web site at www.wabteccorp.com.

In accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to this Item 2.02 in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 7.01. | Regulation FD Disclosure |

On February 12, 2025, the Company issued a press release which, among other things, provided earnings guidance for fiscal year 2025. A copy of the press release is attached to this report as Exhibit 99.1 and the paragraph under the heading “2025 Financial Guidance” which discusses 2025 guidance is incorporated into this Item 7.01 by reference. The Company also furnished a Presentation relating to its fourth quarter of 2024, which is incorporated into this Item 7.01 by reference. A copy of the Presentation is attached to this report as Exhibit 99.2.

In accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to this Item 7.01 in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

The following exhibits are furnished with this report on Form 8-K: | | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Caution Concerning Forward-Looking Statements

This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. All statements, other than historical facts, including statements regarding Wabtec’s plans, objectives, expectations and intentions; Wabtec’s expectations about future sales, earnings and cash conversion; Wabtec’s projected expenses and cost savings associated with its Integration 2.0 and 3.0 initiatives and its portfolio optimization; Wabtec’s 5-year outlook; Wabtec’s expectations for evolving global industry, market and macro-economic conditions and their impact on Wabtec’s business; synergies and other expected benefits from Wabtec’s acquisitions; Wabtec’s expectations for production and demand conditions; and any assumptions underlying any of the foregoing, are forward looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) changes in general economic and/or industry specific conditions, including the impacts of tax and

tariff programs, inflation, supply chain disruptions, foreign currency exchange, and industry consolidation; (2) changes in the financial condition or operating strategies of Wabtec’s customers; (3) unexpected costs, charges or expenses resulting from acquisitions and potential failure to realize synergies and other anticipated benefits of acquisitions, including as a result of integrating acquired targets into Wabtec; (4) ability to retain and hire key personnel; (5) evolving legal, regulatory and tax regimes; (6) changes in the expected timing of projects; (7) a decrease in freight or passenger rail traffic; (8) an increase in manufacturing costs; (9) actions by third parties, including government agencies; (10) the impacts of epidemics, pandemics or similar public health crises on the global economy and, in particular, our customers, suppliers and end-markets, (11) potential disruptions, instability, and volatility in global markets as a result of global military action, acts of terrorism, or armed conflict, including Russia’s invasion of Ukraine; (12) cybersecurity and data protection risks; and (13) other risk factors as detailed from time to time in Wabtec’s reports filed with the SEC, including Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. Wabtec does not undertake any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION |

| |

| By: | /s/ JOHN A. OLIN |

| John A. Olin |

| Executive Vice President and

Chief Financial Officer |

| |

| |

| DATE: | February 12, 2025 |

Wabtec Delivers Strong Fourth Quarter 2024

Results; Announces 2025 Full-Year Guidance

| | | | | | | | | | | | | | |

| SALES | | GAAP DILUTED

EARNINGS PER SHARE | | ADJUSTED DILUTED

EARNINGS PER SHARE |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4Q’24 | | FY’24 | | 4Q’24 | | FY’24 | | 4Q’24 | | FY’24 |

| | | | | | | | | | | | | | | | | |

| $2.58B | $10.39B | $1.23 | $6.04 | $1.68 | $7.56 |

| +2.3% YOY | +7.3% YOY | +2.5% YOY | +33.3% YOY | +9.1% YOY | +27.7% YOY |

Q4 2024 HIGHLIGHTS

| | |

| “The Wabtec team delivered a strong 2024 as evidenced by higher orders, sales, margin expansion, increased earnings and robust cash flow,” said Rafael Santana, Wabtec’s President and CEO. |

| “We remain committed to our capital deployment strategy to maximize shareholder returns. We returned $1.2 billion to shareholders through share repurchases and dividends. And, based on our strong performance in 2024 and confidence in the future, our Board of Directors approved a 25% increase in our quarterly dividend, and in December, increased our share buyback authorization by $1.0 billion. |

| “I am encouraged by the underlying momentum of our business, and the team’s unrelenting focus on execution and delivering for our customers. And just as importantly, we continue to lay a solid foundation for us to build upon. Looking ahead, I believe Wabtec is well positioned to drive top quartile returns over time.” |

| Rafael Santana President and CEO |

•Announces 350+ bps of Adj. Operating Margin Expansion, Mid Single Digit Revenue Growth, and Double Digit Adj. EPS Growth CAGR with 5-Year Long-Term Guidance Update

•Announces 2025 Financial Guidance of Adjusted EPS Between $8.35 to $8.75; Up 13.1% at the Mid-Point

•20% Orders Growth Compared to Prior Year, Including Q4 Orders for Over $1 Billion of New Locos & Mods

•Strong Full Year Cash from Operations up 52.7% or 117% Cash Conversion

•Board of Directors Increases Quarterly Dividend by 25%, Increased Share Buyback Authorization by $1.0 Billion in December

PITTSBURGH, February 12, 2025 – Wabtec Corporation (NYSE: WAB) today reported fourth quarter 2024 GAAP earnings per diluted share of $1.23, up 2.5% versus the fourth quarter of 2023. Fourth quarter adjusted earnings per diluted share were $1.68, up 9.1% versus the same quarter a year ago. Fourth quarter sales were $2.58 billion and cash from operations was $723 million. Full year 2024 GAAP earnings per diluted share were $6.04, up 33.3% versus full year 2023. Full year adjusted earnings per diluted share were $7.56, up 27.7% versus full year 2023. Total 2024 sales were $10.39 billion and cash from operations was a record $1.83 billion.

2024 Fourth Quarter Consolidated Results

| | | | | | | | | | | |

| Wabtec Corporation Consolidated Financial Results |

| $ in millions except earnings per share and percentages; margin change in percentage points (pts) | Fourth Quarter |

| 2024 | 2023 | Change |

| Net Sales | $2,583 | $2,526 | 2.3 | % |

| | | |

| GAAP Gross Margin | 30.9 | % | 30.3 | % | 0.6 pts |

| Adjusted Gross Margin | 31.6 | % | 30.8 | % | 0.8 pts |

| GAAP Operating Margin | 12.9 | % | 12.2 | % | 0.7 pts |

| Adjusted Operating Margin | 16.9 | % | 17.0 | % | (0.1) pts |

| | | |

| GAAP Diluted EPS | $1.23 | $1.20 | 2.5 | % |

| Adjusted Diluted EPS | $1.68 | $1.54 | 9.1 | % |

| | | |

| Cash Flow from Operations | $723 | $686 | $37 |

| Operating Cash Flow Conversion | 212 | % | 182 | % | |

•Sales increased 2.3% compared to the year-ago quarter driven by increased sales in the Transit segment.

•GAAP operating margin was higher than the prior year at 12.9% and adjusted operating margin was down slightly versus the prior year at 16.9%. GAAP operating margins benefited from higher gross margin and lower operating expenses as a percent of revenue. Adjusted operating margins benefited from higher gross margin which was offset by higher SG&A expenses as a percent of revenue.

•GAAP EPS increased from the year-ago quarter primarily due to higher sales and margin expansion, partially offset by the absence of last year’s gain resulting from an increase in ownership interest of an assembly joint venture. Adjusted EPS increased from the year ago quarter primarily due to higher sales. Both benefited from share repurchases during the year.

2024 Fourth Quarter Freight Segment Results

| | | | | | | | | | | |

| Wabtec Corporation Freight Segment Financial Results |

| Net sales $ in millions; margin change in percentage points (pts) | Fourth Quarter |

| 2024 | 2023 | Change |

| Net Sales | $1,794 | $1,789 | 0.3 | % |

| GAAP Gross Margin | 31.0 | % | 31.0 | % | 0.0 pts |

| Adjusted Gross Margin | 31.4 | % | 31.3 | % | 0.1 pts |

| GAAP Operating Margin | 15.2 | % | 13.6 | % | 1.6 pts |

| Adjusted Operating Margin | 19.4 | % | 19.3 | % | 0.1 pts |

•Freight segment sales were up modestly in the quarter due to the rebalance of Freight segment production to the first half of the year. Full year sales were up 7.9%.

•GAAP operating margin benefited from lower operating expenses as a percent of revenue behind lower intangible amortization expenses. Adjusted operating margin benefited from modest gross margin improvement.

2024 Fourth Quarter Transit Segment Results

| | | | | | | | | | | |

| Wabtec Corporation Transit Segment Financial Results |

| Net sales $ in millions; margin change in percentage points (pts) | Fourth Quarter |

| 2024 | 2023 | Change |

| Net Sales | $789 | $737 | 7.1 | % |

| GAAP Gross Margin | 30.6 | % | 28.4 | % | 2.2 pts |

| Adjusted Gross Margin | 31.8 | % | 29.4 | % | 2.4 pts |

| GAAP Operating Margin | 13.0 | % | 11.9 | % | 1.1 pts |

| Adjusted Operating Margin | 16.4 | % | 14.9 | % | 1.5 pts |

•Transit segment sales for the fourth quarter were up 7.1% due to strong OE and aftermarket sales.

•GAAP and adjusted operating margins were up as a result of higher sales, savings related to Integration 2.0, and favorable product mix.

Backlog

| | | | | | | | | | | |

| Wabtec Corporation Consolidated Backlog Comparison |

| Backlog $ in millions | December 31, |

| 2024 | 2023 | Change |

| 12-Month Backlog | $7,681 | $7,457 | 3.0 | % |

| Total Backlog | $22,272 | $21,999 | 1.2 | % |

The Company’s 12-month and multi-year backlogs continue to provide strong visibility. At the end of the fourth quarter, the 12-month backlog was $224 million higher than the prior year. And at December 31, 2024, the multi-year backlog was $273 million higher than the same time a year ago. Excluding the impacts of foreign currency exchange, the 12-month backlog was up 5.5% and the multi-year backlog was up 3.6%.

Cash Flow and Liquidity Summary

•During the fourth quarter, the Company generated cash from operations of $723 million versus $686 million in the year ago period. Cash flow from operations benefited from increased customer deposits and receipt of a tax refund.

•At the end of the quarter, the Company had cash, cash equivalents and restricted cash of $715 million and total debt of $3.98 billion. At December 31, 2024 the Company’s total available liquidity was $2.21 billion, which includes cash and cash equivalents plus $1.50 billion available under current credit facilities.

•The Company repurchased $123 million of Wabtec shares in the fourth quarter, bringing the full year total to $1.10 billion.

•The Board of Directors increased the quarterly dividend by 25% and declared a regular quarterly common dividend of 25 cents per share, payable on March 7, 2025 to holders of record on February 21, 2025.

•In early December, the Board also increased our existing share repurchase authorization by $1 billion.

2025 Financial Guidance

•The Company has largely achieved its previous 5-year guidance over the past 3-year period. Consequently, the Company is replacing its previous long-term guidance with new 5-year guidance. The Company expects mid-single digit revenue growth CAGR, 350+ bps of adjusted operating margin expansion, and double digit EPS growth CAGR while delivering greater than 90% average cash conversion over the 5-year period through the end of 2029.

•Wabtec’s 2025 financial guidance expects sales to be in a range of $10.725 billion to $11.025 billion and adjusted earnings per diluted share to be in a range of $8.35 to $8.75. For full year 2025, Wabtec expects strong cash flow generation with operating cash flow conversion of greater than 90 percent.

2025 OUTLOOK

About Wabtec

Wabtec Corporation (NYSE: WAB) is revolutionizing the way the world moves for future generations. The Company is a leading global provider of equipment, systems, digital solutions and value-added services for the freight and transit rail industries, as well as the mining, marine and industrial markets. Wabtec has been a leader in the rail industry for over 150 years and has a vision to achieve a zero-emission rail system in the U.S. and worldwide. Visit Wabtec’s website at www.wabteccorp.com.

Forecasted GAAP Earnings Reconciliation

Wabtec is not presenting a quantitative reconciliation of our forecasted GAAP earnings per diluted share to forecasted adjusted earnings per diluted share in reliance on the unreasonable efforts exemption provided under Item 10(e)(1)(i)(B) of Regulation S-K. Wabtec is unable to predict with reasonable certainty and without unreasonable effort the impact and timing of restructuring-related and other charges, including acquisition-related expenses and the outcome of regulatory, legal and tax matters. The financial impact of these items is uncertain and is dependent on various factors, including timing, and could be material to our Consolidated Statements of Earnings.

Conference Call Information

Wabtec will host a call with analysts and investors at 8:30 a.m., ET, today. To listen via webcast, go to Wabtec’s website at www.WabtecCorp.com and click on “Events & Presentations” in the “Investor Relations” section. Also, an audio replay of the call will be available by calling 1-877-344-7529 or 1-412-317-0088 (access code: 3404117).

Information about non-GAAP Financial Information and Forward-Looking Statements

Wabtec’s earnings release and financial guidance mentions certain non-GAAP financial performance measures, including adjusted gross profit, adjusted operating expenses, adjusted operating margin, adjusted gross margin, EBITDA, adjusted EBITDA, adjusted income tax expense, adjusted income from operations, adjusted interest and other expense, adjusted net income, adjusted earnings per diluted share and operating cash flow conversion. Wabtec defines EBITDA as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is further adjusted for restructuring costs. Wabtec defines operating cash flow conversion as net cash provided by operating activities divided by net income plus depreciation and amortization including deferred debt cost amortization. While Wabtec believes these are useful supplemental measures for investors, they are not presented in accordance with GAAP. Investors should not consider non-GAAP measures in isolation or as a substitute for net income, cash flows from operations or any other items calculated in accordance with GAAP. In addition, the non-GAAP financial measures included in this release have inherent material limitations as performance measures because they add back certain expenses incurred by the Company to GAAP financial measures, resulting in those expenses not being taken into account in the applicable non-GAAP financial measure. Because not all companies use identical calculations, Wabtec’s presentation of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Included in this release are reconciliation tables that provide details about how adjusted results relate to GAAP results.

This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. All statements, other than historical facts, including statements regarding Wabtec’s plans, objectives, expectations and intentions; Wabtec’s expectations about future sales, earnings and cash conversion; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) changes in general economic and/or industry specific conditions, including the impacts of tax and tariff programs, inflation, supply chain disruptions, foreign currency exchange and industry consolidation; (2) changes in the financial condition or operating strategies of Wabtec’s customers; (3) unexpected costs, charges or expenses resulting from acquisitions and potential failure to realize synergies and other anticipated benefits of acquisitions, including as a result of integrating acquired targets into Wabtec; (4) ability to retain and hire key personnel; (5) evolving

legal, regulatory and tax regimes; (6) changes in the expected timing of projects; (7) a decrease in freight or passenger rail traffic; (8) an increase in manufacturing costs; (9) actions by third parties, including government agencies; (10) the impacts of epidemics, pandemics, or similar public health crises on the global economy and, in particular, our customers, suppliers and end-markets, (11) potential disruptions, instability, and volatility in global markets as a result of global military action, acts of terrorism or armed conflict, including Russia’s invasion of Ukraine; (12) cybersecurity and data protection risks and (13) other risk factors as detailed from time to time in Wabtec’s reports filed with the SEC, including Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. Wabtec does not undertake any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

Wabtec Investor Contact

Kyra Yates / Kyra.Yates@wabtec.com / 817-349-2735

Wabtec Media Contact

Tim Bader / Tim.Bader@wabtec.com / 682-319-7925

WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2024 AND 2023

(AMOUNTS IN MILLIONS EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | |

| December 31, | | December 31, | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | |

| Net sales | $ | 2,583 | | | $ | 2,526 | | | $ | 10,387 | | | $ | 9,677 | | | | | |

| Cost of sales | (1,786) | | | (1,762) | | | (7,021) | | | (6,733) | | | | | |

| Gross profit | 797 | | | 764 | | | 3,366 | | | 2,944 | | | | | |

| Gross profit as a % of Net sales | 30.9 | % | | 30.3 | % | | 32.4 | % | | 30.4 | % | | | | |

| | | | | | | | | | | |

| Selling, general and administrative expenses | (333) | | | (296) | | | (1,248) | | | (1,139) | | | | | |

| Engineering expenses | (51) | | | (61) | | | (206) | | | (218) | | | | | |

| Amortization expense | (79) | | | (99) | | | (303) | | | (321) | | | | | |

| Total operating expenses | (463) | | | (456) | | | (1,757) | | | (1,678) | | | | | |

| Operating expenses as a % of Net sales | 17.9 | % | | 18.1 | % | | 16.9 | % | | 17.3 | % | | | | |

| | | | | | | | | | | |

| Income from operations | 334 | | | 308 | | | 1,609 | | | 1,266 | | | | | |

| Income from operations as a % of Net sales | 12.9 | % | | 12.2 | % | | 15.5 | % | | 13.1 | % | | | | |

| | | | | | | | | | | |

| Interest expense, net | (53) | | | (55) | | | (201) | | | (218) | | | | | |

| Other income, net | 3 | | | 27 | | | 2 | | | 44 | | | | | |

| Income before income taxes | 284 | | | 280 | | | 1,410 | | | 1,092 | | | | | |

| | | | | | | | | | | |

| Income tax expense | (71) | | | (63) | | | (343) | | | (267) | | | | | |

| Effective tax rate | 25.1 | % | | 22.6 | % | | 24.3 | % | | 24.5 | % | | | | |

| | | | | | | | | | | |

| Net income | 213 | | | 217 | | | 1,067 | | | 825 | | | | | |

| | | | | | | | | | | |

| Less: Net income attributable to noncontrolling interest | (1) | | | (2) | | | (11) | | | (10) | | | | | |

| | | | | | | | | | | |

| Net income attributable to Wabtec shareholders | $ | 212 | | | $ | 215 | | | $ | 1,056 | | | $ | 815 | | | | | |

| | | | | | | | | | | |

| Earnings Per Common Share | | | | | | | | | | | |

| Basic | | | | | | | | | | | |

| Net income attributable to Wabtec shareholders | $ | 1.23 | | | $ | 1.20 | | | $ | 6.05 | | | $ | 4.54 | | | | | |

| Diluted | | | | | | | | | | | |

| Net income attributable to Wabtec shareholders | $ | 1.23 | | | $ | 1.20 | | | $ | 6.04 | | | $ | 4.53 | | | | | |

| | | | | | | | | | | |

| Weighted average shares outstanding | | | | | | | | | | | |

| Basic | 171.2 | | | 178.0 | | | 174.1 | | | 178.8 | | | | | |

| Diluted | 172.0 | | | 178.8 | | | 174.8 | | | 179.5 | | | | | |

| | | | | | | | | | | |

WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (CONTINUED)

FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2024 AND 2023

(AMOUNTS IN MILLIONS EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| |

| 2024 | | 2023 | | 2024 | | 2023 |

| Segment Information | | | | | | | |

| Freight Net sales | $ | 1,794 | | | $ | 1,789 | | | $ | 7,468 | | | $ | 6,923 | |

| Freight Income from operations | $ | 273 | | | $ | 245 | | | $ | 1,422 | | | $ | 1,065 | |

| Freight Operating margin | 15.2 | % | | 13.6 | % | | 19.0 | % | | 15.4 | % |

| | | | | | | |

| Transit Net sales | $ | 789 | | | $ | 737 | | | $ | 2,919 | | | $ | 2,754 | |

| Transit Income from operations | $ | 103 | | | $ | 87 | | | $ | 338 | | | $ | 295 | |

| Transit Operating margin | 13.0 | % | | 11.9 | % | | 11.6 | % | | 10.7 | % |

| | | | | | | |

| Backlog Information (Note: 12-month is a sub-set of total) | December 31, 2024 | | September 30, 2024 | | December 31, 2023 | | |

| Freight Total | $ | 17,986 | | | $ | 17,756 | | | $ | 17,785 | | | |

| Transit Total | 4,286 | | | 4,478 | | | 4,214 | | | |

| Wabtec Total | $ | 22,272 | | | $ | 22,234 | | | $ | 21,999 | | | |

| | | | | | | |

| Freight 12-month | $ | 5,577 | | | $ | 5,589 | | | $ | 5,420 | | | |

| Transit 12-month | 2,104 | | | 2,035 | | | 2,037 | | | |

| Wabtec 12-month | $ | 7,681 | | | $ | 7,624 | | | $ | 7,457 | | | |

WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| In millions | | | |

| Cash, cash equivalents and restricted cash | $ | 715 | | | $ | 620 | |

| Receivables, net | 1,702 | | | 1,684 | |

| Inventories, net | 2,314 | | | 2,284 | |

| Other current assets | 212 | | | 267 | |

| Total current assets | 4,943 | | | 4,855 | |

| Property, plant and equipment, net | 1,447 | | | 1,485 | |

| Goodwill | 8,710 | | | 8,780 | |

| Other intangible assets, net | 2,934 | | | 3,205 | |

| Other noncurrent assets | 668 | | | 663 | |

| Total Assets | $ | 18,702 | | | $ | 18,988 | |

| Current liabilities | $ | 3,792 | | | $ | 4,056 | |

| Long-term debt | 3,480 | | | 3,288 | |

| Other long-term liabilities | 1,297 | | | 1,120 | |

| Total Liabilities | 8,569 | | | 8,464 | |

| Shareholders' equity | 10,091 | | | 10,487 | |

| Noncontrolling interest | 42 | | | 37 | |

| Total Equity | 10,133 | | | 10,524 | |

| Total Liabilities and Equity | $ | 18,702 | | | $ | 18,988 | |

WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | |

| Twelve Months Ended December 31, |

| 2024 | | 2023 |

| In millions | | | |

| Operating activities | | | |

| Net income | $ | 1,067 | | | $ | 825 | |

| Non-cash expense | 580 | | | 473 | |

| Receivables | (34) | | | (195) | |

| Inventories | (117) | | | (58) | |

| Accounts payable | 70 | | | (58) | |

| Other assets and liabilities | 268 | | | 214 | |

| Net cash provided by operating activities | 1,834 | | | 1,201 | |

| | | |

| Net cash used for investing activities | (343) | | | (492) | |

| | | |

| Net cash used for financing activities | (1,371) | | | (633) | |

| | | |

| Effect of changes in currency exchange rates | (25) | | | 3 | |

| | | |

| Increase in cash | 95 | | | 79 | |

| | | |

| Cash, cash equivalents and restricted cash, beginning of period | 620 | | | 541 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 715 | | | $ | 620 | |

| | | |

Appendix D

Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec’s reported results prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Reported Results to Adjusted Results | | | | | | | | | | | | | | | | | |

| (in millions) | | Fourth Quarter 2024 Actual Results | |

| | Net | | Gross | | Operating | | Income from | | Interest & | | | | Net | | Noncontrolling | | Wabtec | | | |

| | Sales | | Profit | | Expenses | | Operations | | Other Exp | | Tax | | Income | | Interest | | Net Income | | EPS | |

| | | | | | | | | | | | | | | | | | | | | |

| Reported Results | $ | 2,583 | | | $ | 797 | | | $ | (463) | | | $ | 334 | | | $ | (50) | | | $ | (71) | | | $ | 213 | | | $ | (1) | | | $ | 212 | | | $ | 1.23 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Restructuring and Portfolio Optimization costs | — | | | 18 | | | 14 | | | 32 | | | — | | | (8) | | | 24 | | | — | | | 24 | | | $ | 0.14 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-cash Amortization expense | — | | | — | | | 72 | | | 72 | | | — | | | (17) | | | 55 | | | — | | | 55 | | | $ | 0.31 | | |

| | | | | | | | | | | | | | | | | | | | |

| Adjusted Results | $ | 2,583 | | | $ | 815 | | | $ | (377) | | | $ | 438 | | | $ | (50) | | | $ | (96) | | | $ | 292 | | | $ | (1) | | | $ | 291 | | | $ | 1.68 | | |

| | | | | | | | | | | | | | | | | | | | |

| Fully Diluted Shares Outstanding | | | | | | | | | | | | | | | | | | | 172.0 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Reported Results to Adjusted Results | | | | | | | | | | | | | | | | | |

| (in millions) | | Fourth Quarter Year-to-Date 2024 Actual Results | |

| | Net | | Gross | | Operating | | Income from | | Interest & | | | | Net | | Noncontrolling | | Wabtec | | | |

| | Sales | | Profit | | Expenses | | Operations | | Other Exp | | Tax | | Income | | Interest | | Net Income | | EPS | |

| | | | | | | | | | | | | | | | | | | | | |

| Reported Results | $ | 10,387 | | | $ | 3,366 | | | $ | (1,757) | | | $ | 1,609 | | | $ | (199) | | | $ | (343) | | | $ | 1,067 | | | $ | (11) | | | $ | 1,056 | | | $ | 6.04 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Restructuring and Portfolio Optimization costs | — | | | 37 | | | 33 | | | 70 | | | (4) | | | (16) | | | 50 | | | — | | | 50 | | | $ | 0.28 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-cash Amortization expense | — | | | — | | | 288 | | | 288 | | | — | | | (70) | | | 218 | | | — | | | 218 | | | $ | 1.24 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Adjusted Results | $ | 10,387 | | | $ | 3,403 | | | $ | (1,436) | | | $ | 1,967 | | | $ | (203) | | | $ | (429) | | | $ | 1,335 | | | $ | (11) | | | $ | 1,324 | | | $ | 7.56 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Fully Diluted Shares Outstanding | | | | | | | | | | | | | | | | | | | 174.8 | | |

| | | | | | | | | | | | | | | | | | | | | |

Appendix D

Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec’s reported results prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Reported Results to Adjusted Results | | | | | | | | | | | | | | | | | |

| (in millions) | | Fourth Quarter 2023 Actual Results | |

| | Net | | Gross | | Operating | | Income from | | Interest & | | | | Net | | Noncontrolling | | Wabtec | | | |

| | Sales | | Profit | | Expenses | | Operations | | Other Exp | | Tax | | Income | | Interest | | Net Income | | EPS | |

| | | | | | | | | | | | | | | | | | | | | |

| Reported Results | $ | 2,526 | | | $ | 764 | | | $ | (456) | | | $ | 308 | | | $ | (28) | | | $ | (63) | | | $ | 217 | | | $ | (2) | | | $ | 215 | | | $ | 1.20 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Restructuring and Portfolio Optimization costs | — | | | 13 | | | 34 | | | 47 | | | — | | | (9) | | | 38 | | | — | | | 38 | | | $ | 0.21 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Gain on LKZ investment | — | | | — | | | — | | | — | | | (35) | | | — | | | (35) | | | — | | | (35) | | | $ | (0.19) | | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-cash Amortization expense | — | | | — | | | 76 | | | 76 | | | — | | | (18) | | | 58 | | | — | | | 58 | | | $ | 0.32 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Adjusted Results | $ | 2,526 | | | $ | 777 | | | $ | (346) | | | $ | 431 | | | $ | (63) | | | $ | (90) | | | $ | 278 | | | $ | (2) | | | $ | 276 | | | $ | 1.54 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Fully Diluted Shares Outstanding | | | | | | | | | | | | | | | | | | | 178.8 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Reported Results to Adjusted Results | | | | | | | | | | | | | | | | | |

| (in millions) | | Fourth Quarter Year-to-Date 2023 Actual Results | |

| | Net | | Gross | | Operating | | Income from | | Interest & | | | | Net | | Noncontrolling | | Wabtec | | | |

| | Sales | | Profit | | Expenses | | Operations | | Other Exp | | Tax | | Income | | Interest | | Net Income | | EPS | |

| | | | | | | | | | | | | | | | | | | | | |

| Reported Results | $ | 9,677 | | | $ | 2,944 | | | $ | (1,678) | | | $ | 1,266 | | | $ | (174) | | | $ | (267) | | | $ | 825 | | | $ | (10) | | | $ | 815 | | | $ | 4.53 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Restructuring and Portfolio Optimization costs | — | | | 38 | | | 41 | | | 79 | | | — | | | (17) | | | 62 | | | — | | | 62 | | | $ | 0.34 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Gain on LKZ investment | — | | | — | | | — | | | — | | | (35) | | | — | | | (35) | | | — | | | (35) | | | $ | (0.19) | | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-cash Amortization expense | — | | | — | | | 298 | | | 298 | | | — | | | (74) | | | 224 | | | — | | | 224 | | | $ | 1.24 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Adjusted Results | $ | 9,677 | | | $ | 2,982 | | | $ | (1,339) | | | $ | 1,643 | | | $ | (209) | | | $ | (358) | | | $ | 1,076 | | | $ | (10) | | | $ | 1,066 | | | $ | 5.92 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Fully Diluted Shares Outstanding | | | | | | | | | | | | | | | | | | | 179.5 | | |

| | | | | | | | | | | | | | | | | | | | | |

Appendix E

Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec’s reported results prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | | | | | |

| Fourth Quarter 2024 EBITDA Reconciliation | | | | | | | | | |

| (in millions) | | | | | | | | | | | | | |

| | Reported Income | + | Other Income | + | Depreciation & | = | EBITDA | + | Restructuring | = | Adjusted | |

| | from Operations | (Expense) | Amortization | Costs | EBITDA | |

| | | | | | | | | | | | | |

| Consolidated Results | | $ | 334 | | | $ | 3 | | | $ | 127 | | | $ | 464 | | | $ | 22 | | | $ | 486 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | | | | | |

| Fourth Quarter 2024 YTD EBITDA Reconciliation | | | | | | | | | |

| (in millions) | | | | | | | | | | | | | |

| | Reported Income | + | Other Income | + | Depreciation & | = | EBITDA | + | Restructuring | = | Adjusted | |

| | from Operations | (Expense) | Amortization | Costs | EBITDA | |

| | | | | | | | | | | | | |

| Consolidated Results | | $ | 1,609 | | | $ | 2 | | | $ | 498 | | | $ | 2,109 | | | $ | 39 | | | $ | 2,148 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | | | | | |

| Fourth Quarter 2023 EBITDA Reconciliation | | | | | | | | | |

| (in millions) | | | | | | | | | | | | | |

| | Reported Income | + | Other Income | + | Depreciation & | = | EBITDA | + | Restructuring | = | Adjusted | |

| | from Operations | (Expense) | Amortization | Costs | EBITDA | |

| | | | | | | | | | | | | |

| Consolidated Results | | $ | 308 | | | $ | 27 | | | $ | 159 | | | $ | 494 | | | $ | (18) | | | $ | 476 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | | | | | |

| Fourth Quarter 2023 YTD EBITDA Reconciliation | | | | | | | | | |

| (in millions) | | | | | | | | | | | | | |

| | Reported Income | + | Other Income | + | Depreciation & | = | EBITDA | + | Restructuring | = | Adjusted | |

| | from Operations | (Expense) | Amortization | Costs | EBITDA | |

| | | | | | | | | | | | | |

| Consolidated Results | | $ | 1,266 | | | $ | 44 | | | $ | 526 | | | $ | 1,836 | | | $ | 6 | | | $ | 1,842 | | |

| | | | | | | | | | | | | |

Appendix F

WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION

SALES BY PRODUCT LINE

(UNAUDITED)

| | | | | | | | | | | |

| Three Months Ended December 31, |

| In millions | 2024 | | 2023 |

| Freight Segment | | | |

| Services | $ | 806 | | | $ | 958 | |

| Equipment | 499 | | | 352 | |

| Components | 282 | | | 269 | |

| Digital Intelligence | 207 | | | 210 | |

| Total Freight Segment | $ | 1,794 | | | $ | 1,789 | |

| | | |

| Transit Segment | | | |

| Original Equipment Manufacturer | $ | 339 | | | $ | 333 | |

| Aftermarket | 450 | | | 404 | |

| Total Transit Segment | $ | 789 | | | $ | 737 | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| Twelve Months Ended December 31, |

| In millions | 2024 | | 2023 |

| Freight Segment | | | |

| Services | $ | 3,381 | | | $ | 3,262 | |

| Equipment | 2,108 | | | 1,794 | |

| Components | 1,193 | | | 1,094 | |

| Digital Intelligence | 786 | | | 773 | |

| Total Freight Segment | $ | 7,468 | | | $ | 6,923 | |

| | | |

| Transit Segment | | | |

| Original Equipment Manufacturer | $ | 1,308 | | | $ | 1,264 | |

| Aftermarket | 1,611 | | | 1,490 | |

| Total Transit Segment | $ | 2,919 | | | $ | 2,754 | |

Appendix G

WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION

RECONCILIATION OF REPORTED RESULTS TO ADJUSTED RESULTS - BY SEGMENT

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| In millions | Gross Profit | | Income from Operations | | Gross Profit | | Income from Operations | | Gross Profit | | Income from Operations | | Gross Profit | | Income from Operations |

| | | | | | | | | | | | | | | |

| Freight Segment Reported Results | $ | 556 | | | $ | 273 | | | $ | 556 | | | $ | 245 | | | $ | 2,523 | | | $ | 1,422 | | | $ | 2,181 | | | $ | 1,065 | |

| Freight Segment Reported Margin | 31.0 | % | | 15.2 | % | | 31.0 | % | | 13.6 | % | | 33.8 | % | | 19.0 | % | | 31.5 | % | | 15.4 | % |

| | | | | | | | | | | | | | | |

| Restructuring and Portfolio Optimization costs | 8 | | | 9 | | | 5 | | | 30 | | | 18 | | | 27 | | | 13 | | | 41 | |

| Non-cash Amortization expense | — | | | 66 | | | — | | | 70 | | | — | | | 267 | | | — | | | 276 | |

| | | | | | | | | | | | | | | |

| Freight Segment Adjusted Results | $ | 564 | | | $ | 348 | | | $ | 561 | | | $ | 345 | | | $ | 2,541 | | | $ | 1,716 | | | $ | 2,194 | | | $ | 1,382 | |

| Freight Segment Adjusted Margin | 31.4 | % | | 19.4 | % | | 31.3 | % | | 19.3 | % | | 34.0 | % | | 23.0 | % | | 31.6 | % | | 19.9 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Transit Segment Reported Results | $ | 241 | | | $ | 103 | | | $ | 208 | | | $ | 87 | | | $ | 843 | | | $ | 338 | | | $ | 763 | | | $ | 295 | |

| Transit Segment Reported Margin | 30.6 | % | | 13.0 | % | | 28.4 | % | | 11.9 | % | | 28.9 | % | | 11.6 | % | | 27.7 | % | | 10.7 | % |

| | | | | | | | | | | | | | | |

| Restructuring and Portfolio Optimization costs | 10 | | | 21 | | | 8 | | | 17 | | | 19 | | | 41 | | | 25 | | | 38 | |

| Non-cash Amortization expense | — | | | 6 | | | — | | | 6 | | | — | | | 21 | | | — | | | 22 | |

| | | | | | | | | | | | | | | |

| Transit Segment Adjusted Results | $ | 251 | | | $ | 130 | | | $ | 216 | | | $ | 110 | | | $ | 862 | | | $ | 400 | | | $ | 788 | | | $ | 355 | |

| Transit Segment Adjusted Margin | 31.8 | % | | 16.4 | % | | 29.4 | % | | 14.9 | % | | 29.5 | % | | 13.7 | % | | 28.7 | % | | 12.8 | % |

| | | | | | | | | | | | | | | |

Appendix H

WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION

RECONCILIATION OF CHANGES IN NET SALES - BY SEGMENT

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | |

| In millions | Freight | | Transit | | Consolidated | |

| | | | | | |

| 2023 Net sales | $ | 1,789 | | | $ | 737 | | | $ | 2,526 | | |

| | | | | | |

| Acquisitions | 6 | | | 3 | | | 9 | | |

| Foreign Exchange | (14) | | | (3) | | | (17) | | |

| Organic | 13 | | | 52 | | | 65 | | |

| | | | | | |

| 2024 Net sales | $ | 1,794 | | | $ | 789 | | | $ | 2,583 | | |

| | | | | | |

| Change ($) | 5 | | | 52 | | | 57 | | |

| Change (%) | 0.3 | % | | 7.1 | % | | 2.3 | % | |

| | | | | | |

| | | | | | |

| Twelve Months Ended December 31, | |

| 2023 Net sales | $ | 6,923 | | | $ | 2,754 | | | $ | 9,677 | | |

| | | | | | |

| Acquisitions | 78 | | | 3 | | | 81 | | |

| Foreign Exchange | (32) | | | (1) | | | (33) | | |

| Organic | 499 | | | 163 | | | 662 | | |

| | | | | | |

| 2024 Net sales | $ | 7,468 | | | $ | 2,919 | | | $ | 10,387 | | |

| | | | | | |

| Change ($) | 545 | | | 165 | | | 710 | | |

| Change (%) | 7.9 | % | | 6.0 | % | | 7.3 | % | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Appendix I

Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wabtec Corporation | | | | | | | | | |

| 2024 Fourth Quarter Cash Conversion Calculation | | | | | | |

| (in millions) | | | | | | | | | |

| | Reported Cash from Operations | ÷ | (Net Income | + | Depreciation & Amortization) | = | Cash Conversion | |

| | | | | | | | | |

| Consolidated Results | | $723 | | $213 | | $128 | | 212% | |

| | | | | | | | | |

| | | | | | | | | |

| Wabtec Corporation | | | | | | | | | |

| 2024 Fourth Quarter YTD Cash Conversion Calculation | | | | | | |

| (in millions) | | | | | | | | | |

| | Reported Cash from Operations | ÷ | (Net Income | + | Depreciation & Amortization) | = | Cash Conversion | |

| | | | | | | | | |

| Consolidated Results | | $1,834 | | $1,067 | | $503 | | 117% | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Wabtec Corporation | | | | | | | | | |

| 2023 Fourth Quarter Cash Conversion Calculation | | | | | | |

| (in millions) | | | | | | | | | |

| | Reported Cash from Operations | ÷ | (Net Income | + | Depreciation & Amortization) | = | Cash Conversion | |

| | | | | | | | | |

| Consolidated Results | | $686 | | $217 | | $160 | | 182% | |

| | | | | | | | | |

| | | | | | | | | |

| Wabtec Corporation | | | | | | | | | |

| 2023 Fourth Quarter YTD Cash Conversion Calculation | | | | | | |

| (in millions) | | | | | | | | | |

| | Reported Cash from Operations | ÷ | (Net Income | + | Depreciation & Amortization) | = | Cash Conversion | |

| | | | | | | | | |

| Consolidated Results | | $1,201 | | $825 | | $531 | | 89% | |

| | | | | | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

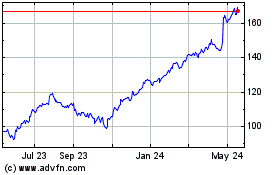

Wabtec (NYSE:WAB)

Historical Stock Chart

From Jan 2025 to Feb 2025

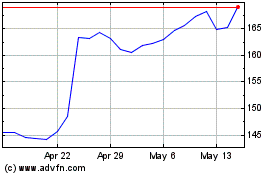

Wabtec (NYSE:WAB)

Historical Stock Chart

From Feb 2024 to Feb 2025