MONTREAL, CANADA (TSX: ARA), a Canadian medical device company

and a leader in optical molecular imaging products for the

healthcare and pharmaceutical industries, today announces its

financial results for the fourth quarter and year ended December

31, 2007. Revenues for the fourth quarter of 2007 increased by 120%

to $1,384,014, compared to $628,907 for the same quarter of 2006.

Revenues for the year ended December 31, 2007 were $2,087,920,

compared to $3,081,776 for the year ended December 31, 2006. For

the 2007 fourth quarter, the loss before financial expenses, gain

on disposal of an investment and income taxes (operating loss)

decreased by $1,000,186, or 37%, to $1,706,286 from $2,706,472 for

the same period a year ago. As for the year 2007, the operating

loss decreased by $2,311,820, or 20%, to $9,272,503 from

$11,584,323 in 2006. The net loss for the three-month period ended

December 31, 2007 was $1,683,593 or $0.02 per share, compared to a

net income of $1,354,770 or $0.03 per share for the three-month

period ended December 31, 2006. The net loss for the year ended

December 31, 2007 was $8,623,447 or $0.13 per share, compared to

$8,754,767 or $0.18 per share for the year ended December 31, 2006.

All dollar amounts referenced herein are in U.S. dollars, unless

otherwise stated.

2007 Fourth Quarter Highlights

- As the worldwide installed base for the Optix� system expands,

sales reach the 50-unit level, confirming the interest of leading

pharmaceutical and academic research labs in the Company's ultra

sensitive molecular imaging technology and products.

- As a result of the new direct distribution strategy for the

commercialization of the Optix system, the sales force now in place

significantly increased fourth quarter revenues.

- ART expands partnerships, such as the one existing with the

National Research Council of Canada's Institute for Biological

Sciences, to leverage the Optix system's unique technical

advantages to drive new application development and new system

placements and upgrades.

- ART closes a public offering from treasury at a price of

C$0.16 per common share, resulting in total gross proceeds of C$5.0

million. Proceeds are to be used for the commercialization, sale

and distribution of the Company's products.

Post Quarter Events

- ART recruits two additional sales professionals, with strong

track records in selling imaging instrumentation and in supporting

a high technology user base, to represent the Optix product in

North America.

- ART secures a first breakthrough sale of SoftScan� breast

imaging device to Sunnybrook Health Sciences Centre in Toronto,

where the device is being used to measure treatment response for

breast cancer.

Revenues

For the three-month period ended December 31, 2007, sales

increased by 120% to $1,384,014, compared to $628,907 for the same

quarter a year ago. For the year ended December 31, 2007 revenues

were $2,087,920, compared to $3,081,776 for the year ended December

31, 2006. The decrease in sales in 2007 when compared to 2006 is

mainly due to the Company's transition to a direct distribution

model. In fact, while going through the transition, the Company

sold only one unit of its Optix system during the first half of

2007. During the third quarter, the Company completed the

implementation of its new marketing strategy, which provided

immediate results with the sale of four units during the fourth

quarter. During the year 2006, the Company had sold 11 units of the

Optix system. By selling directly to its customers, the Company now

generates a higher revenue per system since it does not have to

provide discounts to an exclusive distributor. During the year

ended December 31, 2007, the Company's sales from add-ons and

Fenestra products were equivalent to those in the year ended

December 31, 2006. The decrease in services and other revenues is

explained by the fact that the Company did not perform any upgrades

of single-wavelength systems to the new multiwavelength system in

2007. The nature of these revenues will change going forward as ART

now offers service and maintenance contracts. These contracts

typically offer terms of 12 to 24 months. For the year ended

December 31, 2007, the Company recognized services and other

revenues in the amount of $24,693, and $156,167 was accounted for

as deferred revenues.

Gross margin

The gross margin for the quarter ended December 31, 2007 was

$767,877 or 55% compared to $306,577 or 49% for the same quarter of

2006. For the year ended December 31, 2007, ART generated a gross

margin of $1,158,470 or 55%, and $1,301,760 or 42% the previous

year. The increase of the gross margin ratio in the year ended

December 31, 2007, compared to the year 2006, is primarily due to

the change in the Company's distribution channels. In 2007, the

Company sold 80% of its systems through direct sales channels,

which had a positive impact on the gross margin generated.

Operating expenses

The Company's research and development ("R&D") expenditures

for the three-month period ended December 31, 2007, net of

investment tax credits amounted to $734,287, compared to $1,517,747

for the same period a year ago. The R&D expenditures for the

year ended December 31, 2007, net of investment tax credits

amounted to $4,724,842, compared to $7,837,352 for the year ended

December 31, 2006. The decrease in both the 2007 fourth quarter and

year was primarily related to the medical sector given that the

SoftScan program reached important approval milestones at the end

of year 2006 and early 2007, more specifically following the Health

Canada approval in December 2006 and the CE marking received for

Europe in February 2007. Therefore the costs associated with the

achievement of these milestones did not have to be incurred again

in 2007.

Selling, general, and administrative ("SG&A") expenses for

the 2007 fourth quarter totaled $1,339,559, compared to $1,284,333

for the same quarter a year ago. SG&A expenses for the year

ended December 31, 2007, totaled $5,045,825, compared to $4,263,450

for the year ended December 31, 2006.

The increase of the SG&A expenses in both the 2007 fourth

quarter and year was mainly due to the recruitment of the direct

sales force, the commissions, and direct marketing expenses

incurred to support the commercialization of the Optix, SoftScan

and Fenestra products.

Therefore, the operating expenses for the 2007 fourth quarter

decreased by $538,886 or 18% to $2,474,163, from $3,013,049 for the

same quarter a year ago. For the 2007 year-end, the operating

expenses were $10,430,973 compared to $12,886,083 for the year

ended December 31, 2006.

As a result, the operating loss for the 2007 fourth quarter

decreased by $1,000,186 or 37%, to $1,706,286 from $2,706,472 for

the same period a year ago. As for the year 2007, the operating

loss decreased by $2,311,820, or 20%, to $9,272,503 from

$11,584,323 in 2006.

During the fourth quarter of 2007, the interest income and the

gain on foreign exchange exceeded the financial expenses which

resulted as income totaling $22,693, compared to financial expenses

of $1,002,506 for the same quarter a year ago. The financial

expenses for the year ended December 31, 2007 totaled $162,249

compared to $2,234,192 for the year ended December 31, 2006. The

financial expenses decreased during the year ended December 31,

2007, due to the fact that the convertible debentures were

repurchased in the fourth quarter of 2006. Consequently, no related

interest and amortization of financing fees were accounted for in

2007.

For the year December 31, 2006, a non-recurring gain in the

amount of $5,888,981 resulted from the disposal of an investment on

November 27, 2006. Therefore, no such gain has been recognized in

2007.

The current income taxes recovery for the quarter ended December

31, 2007 totaled $811,305 compared to a current income tax expense

of $825,233 during the same quarter a year ago. The current income

tax expense was primarily attributable to the tax impact resulting

from the gain on the disposal of an investment in the last quarter

of 2006 recovered following the utilization of the tax losses in

2007.

Net Loss

As a result, the net loss for the quarter ended December 31,

2007 was $1,683,593 or $0.02 per share, compared to a net income of

$1,354,770 or $0.03 per share for the three-month period ended

December 31, 2006. The net loss for the year ended December 31,

2007 was $8,623,447 or $0.13 per share, compared to $8,754,767 or

$0.18 per share for the year ended December 31, 2006.

As at December 31, 2007, the Company had a working capital of

$5.1 million, which includes inventories that could generate $2 to

3 million in revenues.

The financial statements, accompanying notes to the financial

statements, and Management's Discussion and Analysis for the

three-month period ended December 31, 2007, will be available

online at www.sedar.com, or at www.art.ca, in the "Investors"

section. Summary financial tables are provided below. A detailed

list of the risks and uncertainties affecting the Company can be

found in the Management's Discussion and Analysis for the year

ended December 31, 2007.

Conference Call

ART will host a conference call today at 5:00 PM (EDT). The

telephone number to access the conference call is (514) 861-1531

when dialing within the Montreal area, or (877) 667-7766 for the

rest of North America. Outside of North America, please dial (514)

861-1531. A replay of the call will be available until April 8,

2008. To listen to the replay from the Montreal area, please dial

(514) 861-2272, or, (800) 408-3053 for the rest of North America.

From outside of North America, please dial (514) 861-2272. The

access code for the replay is 3254231#.

A detailed list of the risks and uncertainties affecting the

Company can be found in the Company's Annual Information Form.

About ART

ART Advanced Research Technologies Inc. is a leader in molecular

imaging products for the healthcare and pharmaceutical industries.

ART has developed products in medical imaging, medical diagnostics,

disease research, and drug discovery with the goal of bringing new

and better treatments to patients faster. The Optix� optical

molecular imaging system, designed for monitoring physiological

changes in living systems at the preclinical study phases of new

drugs, is used by industry and academic leaders worldwide. The

SoftScan� optical medical imaging device is designed to improve the

diagnosis and treatment of breast cancer. ART is commercializing

these products in a global strategic alliance with GE Healthcare, a

world leader in mammography and imaging. Finally, the Fenestra�

line of molecular imaging contrast products provide image

enhancement for a wide range of preclinical Micro CT applications

allowing scientists to see greater detail in their imaging studies,

with potential extension into other major imaging modalities. ART's

shares are listed on the TSX under the ticker symbol ARA. For more

information on ART, visit our website at www.art.ca .

This press release may contain forward-looking statements

subject to risks and uncertainties that would cause actual events

to differ materially from expectations. These risks and

uncertainties are described in the most recent Annual Information

Form and the financial statements for the year ended December 31,

2007, available on SEDAR (www.sedar.com).

Financial Statements (in U.S. dollars)

ART Advanced Research Technologies Inc.

Balance Sheets

(In U.S. dollars)

(unaudited)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

December 31, December 31,

2007 2006

--------------------------------------------------------------------------

ASSETS

Current assets

Cash $561,325 $6,546,936

Term deposits, 4.05%, maturing in

January 2008 3,026,329 -

Accounts receivable 1,768,146 625,189

Investment tax credits receivable 1,558,709 353,583

Inventories 1,510,499 1,715,592

Prepaid expenses 260,199 331,782

--------------------------------------------------------------------------

8,685,207 9,573,082

Property and equipment 551,210 504,426

Patents 2,135,855 1,962,038

Deferred development costs 1,268,438 459,488

--------------------------------------------------------------------------

$12,640,710 $12,499,034

--------------------------------------------------------------------------

--------------------------------------------------------------------------

LIABILITIES

Current liabilities

Bank loan $605,266 $-

Accounts payable and

accrued liabilities 2,652,219 3,256,756

Deferred revenues 156,167 -

Deferred grant 152,305 129,552

Income taxes payable - 806,751

--------------------------------------------------------------------------

3,565,957 4,193,059

SHAREHOLDERS' EQUITY

Share capital and share purchase

warrants 32,217,942 24,126,432

Contributed surplus 4,537,336 3,586,059

Deficit (31,007,264) (21,247,643)

Accumulated other comprehensive income 3,326,739 1,841,127

--------------------------------------------------------------------------

9,074,753 8,305,975

--------------------------------------------------------------------------

$12,640,710 $12,499,034

--------------------------------------------------------------------------

--------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Operations

(In U.S. dollars)

(unaudited)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three-month Twelve-month

periods ended periods ended

December 31 December 31

2007 2006 2007 2006

--------------------------------------------------------------------------

Sales

Products $1,359,321 $628,907 $2,063,227 $2,917,159

Services and

other revenues 24,693 - 24,693 164,617

--------------------------------------------------------------------------

1,384,014 628,907 2,087,920 3,081,776

--------------------------------------------------------------------------

Cost of sales

Products 602,034 322,330 915,347 1,642,181

Services and

other revenues 14,103 - 14,103 137,835

--------------------------------------------------------------------------

616,137 322,330 929,450 1,780,016

--------------------------------------------------------------------------

Gross margin 767,877 306,577 1,158,470 1,301,760

--------------------------------------------------------------------------

Operating expenses

Research and

development, net

of investment

tax credits 734,287 1,517,747 4,724,842 7,837,352

Selling, general

and administrative 1,339,559 1,284,333 5,045,825 4,263,450

Severance and

related costs - - - 361,118

Amortization 400,317 210,969 660,306 424,163

--------------------------------------------------------------------------

2,474,163 3,013,049 10,430,973 12,886,083

--------------------------------------------------------------------------

Operating loss 1,706,286 2,706,472 9,272,503 11,584,323

Financial expenses

(revenues) (22,693) 1,002,506 162,249 2,234,192

Gain on disposal

of an investment - (5,888,981) - (5,888,981)

--------------------------------------------------------------------------

Loss (income) from

operations before

income taxes 1,683,593 (2,180,003) 9,434,752 7,929,534

Current income

taxes (Recovery) - 825,233 (811,305) 825,233

--------------------------------------------------------------------------

Net loss (income) $1,683,593 $(1,354,770) $8,623,447 $8,754,767

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic and diluted

net loss (income)

per share $0.02 $(0.03) $0.13 $0.18

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic and diluted

weighted average

number of

common shares

outstanding 75,179,179 52,248,981 63,967,183 48,775,554

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Number of common

shares outstanding,

end of period 94,540,592 52,411,350 94,540,592 52,411,350

--------------------------------------------------------------------------

--------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Cash Flows

(In U.S. dollars)

(Unaudited)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three-month Twelve-month

periods ended periods ended

December 31 December 31

2007 2006 2007 2006

--------------------------------------------------------------------------

OPERATING ACTIVITIES

Net loss $(1,683,593) $1,354,770 $(8,623,447) $(8,754,767)

Items not

affecting cash

Amortization 400,317 210,969 660,306 424,163

Amortization of

deferred financing

costs - 118,826 - 118,826

Stock-based

compensation 42,834 57,452 172,242 268,206

Interest on

convertible

debentures - 16,143 - 942,375

Gain on disposal

of an investment - (5,888,981) - (5,888,981)

Convertible

debentures

settlement - 793,930 - 793,930

Net changes in working

capital items

Accounts receivable (860,155) 149,863 (1,010,929) 463,129

Investment tax

credits receivable (640,106) (13,139) (1,101,184) 350,802

Inventories 488,399 (570,008) 508,265 (551,082)

Prepaid expenses 56,094 97,443 126,797 82,610

Accounts payable and

accrued liabilities 240,002 1,576,570 (935,991) 1,192,822

Deferred revenues 157,678 - 157,678 -

Deferred grant - - - 40,190

Income taxes payable - 806,751 (811,304) 806,751

--------------------------------------------------------------------------

Cash flows from

operating activities (1,798,530) (1,289,411) (10,857,567) (9,711,026)

--------------------------------------------------------------------------

INVESTING ACTIVITIES

Business acquisition - 118,700 - (333,755)

Short-term investments 1,118,039 1,001,464 - 4,272,571

Property and equipment (12,323) (7,093) (125,104) (7,825)

Patents (192,320) (18,939) (192,320) (18,939)

Deferred development

costs (332,234) 6,994 (825,869) (50,034)

--------------------------------------------------------------------------

Cash flows from

investing activities 581,162 1,101,126 (1,143,293) 3,862,018

--------------------------------------------------------------------------

FINANCING ACTIVITIES

Credit facility - - 546,398 -

Repayment of senior

convertible debentures - (625,000) - (2,500,000)

Convertible debenture

settlement - (2,928,866) - (2,928,866)

Disposal of an investment - 5,888,981 - 5,888,981

Issue of convertible

preferred shares - (24,317) - 2,007,043

Common shares and share

purchase warrants 4,982,561 - 8,870,545 6,283,708

Equity issue expenses (940,771) (43,484) (1,136,174) (953,440)

--------------------------------------------------------------------------

Cash flows from

financing activities 4,041,790 2,267,314 8,280,769 7,797,426

Effect of foreign

currency translation

adjustments 68,626 (288,286) 760,809 (260,624)

--------------------------------------------------------------------------

4,110,416 1,979,028 9,041,578 7,536,802

--------------------------------------------------------------------------

Net decrease in cash

and cash equivalents 2,893,048 1,790,743 (2,959,282) 1,687,794

Cash and cash

equivalents,

beginning of period 694,606 4,756,193 6,546,936 4,859,142

--------------------------------------------------------------------------

Cash and cash

equivalents, end

of period $3,587,654 $6,546,936 $3,587,654 $6,546,936

--------------------------------------------------------------------------

--------------------------------------------------------------------------

CASH AND CASH

EQUIVALENTS

Cash $561,325 $6,546,936 $561,325 $6,546,936

Term deposit 3,026,329 - 3,026,329 -

--------------------------------------------------------------------------

$3,587,654 $6,546,936 $3,587,654 $6,546,936

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Supplemental

Disclosure of cash

flow information

Interest received $36,160 $(38,623) $57,512 $(340,646)

Interest paid 13,320 14,103 129,504 156,953

Transfer of finished

goods inventory to

property and equipment - 180,001 - 180,001

Contacts: ART Advanced Research Technologies Inc. Jacques Bedard

Chief Financial Officer 514-832-0777 jbedard@art.ca www.art.ca

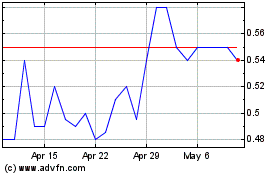

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Jun 2024 to Jul 2024

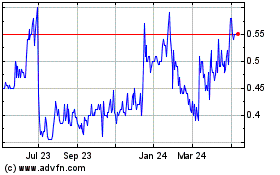

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Jul 2023 to Jul 2024