Brookfield Asset Management (NYSE: BAM, TSX: BAM) and its listed

affiliate Brookfield Business Partners (NYSE: BBU; TSX: BBU.UN)

today announced the completion of the sale of Westinghouse Electric

Company (“Westinghouse” or “the Company”).

Westinghouse is a global leading provider of

mission-critical technologies, products, and services to the

nuclear power industry. The sale follows a five-year repositioning

of Westinghouse to refocus the business, strengthen its

organizational structure and reinvest for future growth.

“We are pleased to complete the sale of

Westinghouse and crystallize significant value for our investors,”

said Cyrus Madon, CEO of Brookfield Business Partners. “Over the

last five years, we have worked alongside the Westinghouse team to

strengthen the business’ global leadership position and

meaningfully enhance its profitability and cash flows by leveraging

our established approach to operational value creation.

Westinghouse is led by a world-class management team and is

exceptionally well-positioned for future growth under its new

ownership.”

Brookfield Business Partners will generate

approximately $1.4 billion in proceeds from the sale of its 44%

interest in the business. The proceeds will be used to redeem $750

million of preferred equity securities held by Brookfield

Corporation and reduce revolving credit facilities. The annual

dividend is 7% on the remaining $725 million of preferred equity

securities held by Brookfield Corporation and the securities are

redeemable at par, at the option of Brookfield Corporation, to the

extent Brookfield Business Partners completes asset sales or equity

issuances.

Brookfield Asset Management

(NYSE: BAM, TSX: BAM) is a leading global alternative asset manager

with over $850 billion of assets under management. We invest client

capital for the long-term with a focus on real assets and essential

service businesses that form the backbone of the global economy. We

offer a range of alternative investment products to investors

around the world — including public and private pension plans,

endowments and foundations, sovereign wealth funds, financial

institutions, insurance companies and private wealth investors.

Brookfield Business Partners is

the flagship listed vehicle of Brookfield’s private equity group.

It is a global business services and industrials company focused on

owning and operating high-quality businesses that provide essential

products and services and benefit from a strong competitive

position.

Investors have flexibility to invest in

Brookfield Business Partners either through Brookfield Business

Corporation (NYSE, TSX: BBUC), a corporation, or Brookfield

Business Partners L.P. (NYSE: BBU; TSX: BBU.UN), a limited

partnership. For more information, please visit

https://bbu.brookfield.com.

For more information, please

contact:

|

Media:Marie FullerTel: +44 207 408 8375Email:

marie.fuller@brookfield.com |

Investors:Alan FlemingTel: +1 (416) 645-2736Email:

alan.fleming@brookfield.com |

Cautionary Statement Regarding

Forward-Looking Statements and Information

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of applicable Canadian and U.S. securities laws,

including the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or

conditions, include statements regarding the operations, business,

financial condition, expected financial results, performance,

prospects, opportunities, priorities, targets, goals, ongoing

objectives, strategies and outlook of Brookfield Business Partners,

as well as regarding recently completed and proposed acquisitions,

dispositions, and other transactions, and the outlook for North

American and international economies for the current fiscal year

and subsequent periods, and include words such as “expects”,

“anticipates”, “plans”, “believes”, “estimates”, “seeks”,

“intends”, “targets,” “projects”, “forecasts”, “views”,

“potential”, “likely” or negative versions thereof and other

similar expressions, or future or conditional verbs such as “may,”

“will,” “should,” “would” and “could”.

Although we believe that our anticipated future

results, performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, investors and other

readers should not place undue reliance on forward-looking

statements and information because they involve known and unknown

risks, uncertainties and other factors, many of which are beyond

our control, which may cause the actual results, performance or

achievements of Brookfield Business Partners to differ materially

from anticipated future results, performance or achievements

expressed or implied by such forward-looking statements and

information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: general

economic conditions and risks relating to the economic, including

unfavorable changes in interest rates, foreign exchange rates,

inflation and volatility in the financial markets; global equity

and capital markets and the availability of equity and debt

financing and refinancing within these markets; strategic actions

including our ability to complete dispositions and achieve the

anticipated benefits therefrom; the ability to complete and

effectively integrate acquisitions into existing operations and the

ability to attain expected benefits; changes in accounting policies

and methods used to report financial condition (including

uncertainties associated with critical accounting assumptions and

estimates); the ability to appropriately manage human capital; the

effect of applying future accounting changes; business competition;

operational and reputational risks; technological change; changes

in government regulation and legislation within the countries in

which we operate; governmental investigations; litigation; changes

in tax laws; ability to collect amounts owed; catastrophic events,

such as earthquakes, hurricanes and pandemics/epidemics including

COVID-19; the possible impact of international conflicts, wars and

related developments including Russia’s invasion of Ukraine,

terrorist acts and cyber terrorism; and other risks and factors

detailed from time to time in our documents filed with the

securities regulators in Canada and the United States including in

the “Risk Factors” section in our most recently filed Form

20-F.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive. When

relying on our forward-looking statements and information,

investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. Except as

required by law, we undertake no obligation to publicly update or

revise any forward-looking statements or information, whether

written or oral, that may be as a result of new information, future

events or otherwise.

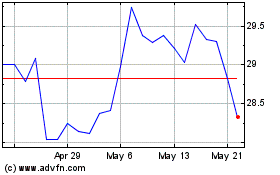

Brookfield Business (TSX:BBUC)

Historical Stock Chart

From Oct 2024 to Nov 2024

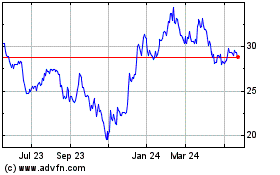

Brookfield Business (TSX:BBUC)

Historical Stock Chart

From Nov 2023 to Nov 2024