Dundee Corporation Reports Third Quarter 2012 Financial Results

November 13 2012 - 4:35PM

Marketwired Canada

Dundee Corporation (TSX:DC.A)(TSX:DC.PR.A)(TSX:DC.PR.B) (the "Corporation") is

today reporting its financial results as at and for the three and nine months

ended September 30, 2012. The Corporation's unaudited condensed interim

consolidated financial statements, along with the accompanying management's

discussion and analysis, have been filed on the System for Electronic Document

Analysis and Retrieval ("SEDAR") and may be viewed under the Corporation's

profile at www.sedar.com or the Corporation's website at www.dundeecorp.com.

FINANCIAL HIGHLIGHTS

-- Fee Earning Assets under Management and Administration - Fee earning

assets under management and administration increased to $15.4 billion at

September 30, 2012, compared with $12.3 billion at each of September 30,

2011 and December 31, 2011.

-- Equity Accounted Investments - Earnings from equity accounted

investments were $3.3 million during the third quarter of 2012 compared

with $15.4 million earned during the same period of the prior year. At

September 30, 2012, the market value of equity accounted investments was

$697.6 million.

-- Market Value of Investments - The market value of the Corporation's

portfolio of investments, excluding equity accounted investments, was

$1.2 billion at September 30, 2012, and included $0.5 billion in shares

of The Bank of Nova Scotia, which were received by the Corporation on

its divestment of DundeeWealth Inc. in February 2011.

-- Net Earnings - Driven primarily from realized losses on dispositions of

certain investments, during the third quarter the Corporation incurred a

net loss of $8.1 million attributable to owners of the parent, compared

to net earnings of $88.6 million earned during the same period of the

prior year. Earnings in the third quarter of the prior year included a

pre-tax gain of $95.6 million from the Corporation's divestment of its

investment in Breakwater Resources Ltd.

-- Corporate Debt at September 30, 2012 was $376.5 million, all of which

was borrowed by our operating subsidiaries. At September 30, 2012, there

were no amounts borrowed pursuant to the credit facilities at the

corporate level.

At September 30, 2012, fee earning assets under management and administration

had increased to $15.4 billion, representing a 25% increase over $12.3 billion

in fee earning assets under management and administration at September 30, 2011,

and December 31, 2011. A significant part of this growth occurred in the real

estate asset management division, which benefited from a number of successful

new acquisitions of quality assets, including the acquisition in June 2012 of a

67% interest in the Scotia Plaza complex, a premier office complex located in

downtown Toronto.

Operating results from Dundee Realty's land and housing business were strong,

with revenue increasing 42% to $119.5 million from $84.3 million in the third

quarter of the prior year, and with a 50% increase in contribution margins from

$21.2 million in the third quarter of 2011 to $31.8 million in the current

quarter. Real estate results in the third quarter of 2012 benefited from higher

land under development sales, primarily in western Canada, compared to the same

period of the prior year. The real estate segment also benefited from first year

condominium sales in two of Dundee Realty's projects in the Toronto area.

Condominium sales are dependent upon the timing of completion of development

projects and may vary significantly from period to period.

Equity markets advanced during the third quarter of 2012, sustained in part by

stimulus provided by central banks, most notably in the United States and in the

European Union. This is reflected in the market value of the Corporation's

portfolio, which appreciated in value by approximately $25.2 million since June

30, 2012, and $16.2 million on a year-to-date basis.

Dundee Capital Markets incurred a loss before taxes of $2.4 million in the third

quarter of 2012, compared with a loss of $1.5 million in the same quarter of the

prior year. Capital markets investment banking revenue in the third quarter of

2012 increased 54% over the third quarter of the prior year, however this was

offset by higher general and administrative costs associated with certain

restructuring activities, including its expansion into the United Kingdom.

The Corporation continues to investigate numerous opportunities to expand its

agricultural portfolio. The focus of this effort is to spot good potential, in

advance of the general market. In agriculture, this means developing a thorough

understanding of how marketplace trends are likely to affect industry players;

ferreting out new "game changing" agricultural processes and technologies, as

well as high growth niche markets; and investing in companies that have a

sustainable competitive advantage.

ABOUT THE CORPORATION

Dundee Corporation is an independent publicly traded Canadian asset management

company. The Corporation's asset management activities are focused in the areas

of the Corporation's core competencies and include real estate and

infrastructure as well as energy, resources and agriculture. Asset management

activities are carried out by Goodman Investment Counsel Inc. (formerly Ned

Goodman Investment Counsel Limited), a registered portfolio manager and exempt

market dealer across Canada and an investment fund manager in the provinces of

Ontario, Quebec and Newfoundland; and by DREAM, the asset management division of

Dundee Realty Corporation, a 70% owned subsidiary of the Corporation. Asset

management activities are supported by the Corporation's ownership interest in

Dundee Capital Markets Inc. Dundee Capital Markets is also the asset manager of

the Corporation's flow-through limited partnership business carried out through

the "CMP", "CDR" and "Canada Dominion Resources" brands. Dundee Corporation also

owns and manages direct investments in these core focus areas, through ownership

of both publicly listed and private companies. Real estate operations are

carried out through the Corporation's investment in Dundee Realty Corporation,

an owner, developer and manager of residential and recreational properties in

North America. Energy and resource operations include the Corporation's

ownership in Dundee Energy Limited, an oil and natural gas company with a

mandate to create long-term value through the development of high impact energy

projects. The Corporation also holds other investments in the resource sector,

several of which are equity accounted. Agricultural activities are carried out

through Dundee Agricultural Corporation. Dundee Agricultural Corporation holds

an 84% interest in Blue Goose Capital Corporation, a privately owned Canadian

company with a leading position in the organic and natural beef production

market with operations in both British Columbia and Ontario.

FOR FURTHER INFORMATION PLEASE CONTACT:

Dundee Corporation

Ned Goodman

President and Chief Executive Officer

(416) 365-5665

Dundee Corporation

Lucie Presot

Vice President and Chief Financial Officer

(416) 365-5157

www.dundeecorp.com

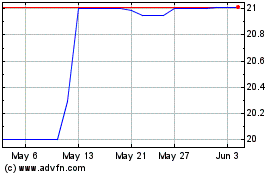

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Apr 2024 to May 2024

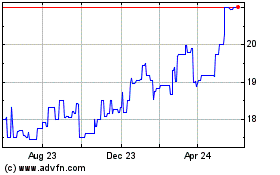

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From May 2023 to May 2024