McEwen Mining: 2024 Production Within Guidance; 2025 Guidance: Stable Production and Cost/Oz

January 28 2025 - 7:29PM

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to report full-year 2024 consolidated production of

135,900 gold equivalent ounces (“GEOs”)(1), within

our guidance range for the year (press release dated Feb 12, 2024).

During 2024, Gold Bar and San Jose produced

44,600 and 60,100 GEOs, respectively, slightly exceeding the top

end of our guidance ranges for those operations. At the Fox

Complex, we produced 30,150 GEOs, which was below annual guidance

due to a stope failure in early 2024 impacting production.

|

Table 1: Consolidated 2024 Production and 2025 Guidance

Summary |

|

|

|

|

|

|

|

Full

Year2024(3)(4) |

2024Guidance(4) |

2025 Guidance |

|

Consolidated Production |

|

|

|

GEOs(1) |

135,900 |

130,000 - 145,000 |

120,000 - 140,000 |

|

Cash Costs/GEO |

|

|

$1,550 - $1,750 |

|

AISC/GEO |

|

|

$1,800 - $2,000 |

|

Gold Bar Mine, Nevada |

|

|

|

GEOs |

44,600 |

40,000 - 43,000 |

40,000 - 45,000 |

|

Cash Costs/GEO |

|

|

$1,500 - $1,700 |

|

AISC/GEO |

|

|

$1,700 - $1,900 |

|

Fox Complex, Canada |

|

|

|

GEOs |

30,150 |

40,000 - 42,000 |

30,000 - 35,000 |

|

Cash Costs/GEO |

|

|

$1,600 - $1,800 |

|

AISC/GEO |

|

|

$1,700 - $1,900 |

|

San José Mine, Argentina (49%)(2) |

|

|

|

GEOs |

60,100 |

50,000 - 60,000 |

50,000 - 60,000 |

|

Cash Costs/GEO |

|

|

$1,600 - $1,800 |

|

AISC/GEO |

|

|

$1,900 - $2,100 |

|

|

|

|

|

2025 Production and Cost Guidance

For 2025, we expect consolidated production to

be between 120,000 and 140,000 GEOs attributable

to MUX from all operations. The lower end of the 2025 range is

driven by the planned transition of production at the Fox Complex

from the Froome mine to the Stock mine in late 2025.

At Fox in 2025, due to permitting delays, the

development of the ramp access to the Stock project is expected to

continue through the majority of the year, with commercial

production from Stock now expected in early 2026. Operations at the

Froome mine will wind down in late 2025. The capital investment

required for ramp development in 2025 has been partially funded by

the US$22.0 million flow-through financing completed in June

2024.

At Gold Bar in 2025, the first half of the year

is expected to deliver lower production relative to the second

half, due to a scheduled continuation of high waste stripping in

the Pick pit to be completed during 2025. The investment in waste

stripping at the Pick pit is expected to improve ore availability

during the second half of 2025 and through 2026, increasing future

annual gold production.

| Notes: |

|

(1) |

'Gold Equivalent Ounces' are calculated based on a gold-to-silver

price ratio of 89:1 for Q1 2024, 81:1 for Q2 2024, 85:1 for Q3

2024, and 85:1 for Q4 2024. 2025 production guidance is calculated

based on an 86:1 gold-to-silver price ratio. |

|

(2) |

The San José Mine is 49% owned by McEwen Mining Inc. and 51% owned

and operated by Hochschild Mining plc. Production is shown on a 49%

basis. |

|

(3) |

El Gallo Mine (on care and maintenance) sold 1,052 ounces in

FY2024 from plant and pond cleanout. |

|

(4) |

Full Year 2024 costs and their comparison against 2024

Guidance will be published in a future press release on our 2024

audited annual results. |

|

(5) |

Cash costs and AISC per GEO sold are presented in U.S.

Dollars for all operations. |

| |

|

Technical Information

The technical content of this news release

related to financial results, mining and development projects has

been reviewed and approved by William (Bill) Shaver, P.Eng., COO of

McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and

the Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

Reliability of

Information Regarding San JoséMinera Santa Cruz S.A., the

owner of the San José Mine, is responsible for and has supplied the

Company with all reported results from the San José Mine. McEwen

Mining’s joint venture partner, a subsidiary of Hochschild Mining

plc, and its affiliates other than MSC do not accept responsibility

for the use of project data or the adequacy or accuracy of this

release.

CAUTION

CONCERNING FORWARD-LOOKING STATEMENTSThis news release

contains certain forward-looking statements and information,

including "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. The

forward-looking statements and information expressed, as at the

date of this news release, McEwen Mining Inc.'s (the "Company")

estimates, forecasts, projections, expectations or beliefs as to

future events and results. Forward-looking statements and

information are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management, are

inherently subject to significant business, economic and

competitive uncertainties, risks and contingencies, and there can

be no assurance that such statements and information will prove to

be accurate. Therefore, actual results and future events could

differ materially from those anticipated in such statements and

information. Risks and uncertainties that could cause results or

future events to differ materially from current expectations

expressed or implied by the forward-looking statements and

information include, but are not limited to, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the Company to receive or receive in a

timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, foreign exchange

volatility, foreign exchange controls, foreign currency risk, and

other risks. Readers should not place undue reliance on

forward-looking statements or information included herein, which

speak only as of the date hereof. The Company undertakes no

obligation to reissue or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. See McEwen Mining's Annual

Report on Form 10-K for the fiscal year ended December 31, 2023,

Quarterly Report on Form 10-Q for the three months ended March 31,

2024, June 30, 2024, and September 30, 2024, and other filings with

the Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have

not reviewed and do not accept responsibility for the adequacy or

accuracy of the contents of this news release, which has been

prepared by management of McEwen Mining Inc.

ABOUT MCEWEN

MINING

McEwen Mining is a

gold and silver producer with operations in Nevada, Canada, Mexico

and Argentina. In addition, it owns 46.4% of McEwen Copper which

owns the large, advanced stage Los Azules copper project in

Argentina. The Company’s objective is to improve the productivity

and life of its assets with the goal of increasing its share price

and providing an investor yield. Rob McEwen, Chairman and Chief

Owner, has a personal investment in the companies of $225 million.

His annual salary is $1.

McEwen Mining's shares

are publicly traded on the New York Stock Exchange (NYSE) and the

Toronto Stock Exchange (TSX) under the symbol "MUX".

|

WEB SITEwww.mcewenmining.com |

SOCIAL MEDIA |

|

| |

|

|

| CONTACT

INFORMATION150 King Street West Suite 2800, PO Box

24 Toronto, ON, Canada M5H 1J9 |

Facebook:LinkedIn:Twitter:Instagram: |

McEwen Miningfacebook.com/mcewenmininglinkedin.com/company/mcewen-mining-inc- twitter.com/mcewenmininginstagram.com/mcewenmining |

| |

|

|

| Relationship with

Investors: (866)-441-0690 Toll

free (647)-258-0395 |

Facebook:LinkedIn:Twitter:Instagram: |

McEwen Copperfacebook.com/

mcewencopperlinkedin.com/company/mcewencoppertwitter.com/mcewencopperinstagram.com/mcewencopper |

| Mihaela

Iancu ext. 320 info@mcewenmining.com |

|

|

| |

Facebook:LinkedIn:Twitter: |

Rob

McEwenfacebook.com/mcewenrob linkedin.com/in/robert-mcewen-646ab24twitter.com/robmcewenmux |

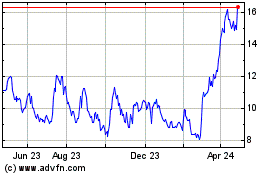

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Feb 2025 to Mar 2025

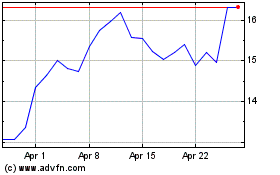

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Mar 2024 to Mar 2025