Sherritt and Partners Sign Definitive Agreement to Restructure Ambatovy Joint Venture

November 10 2017 - 6:00AM

Business Wire

Sherritt International Corporation (“Sherritt”) (TSX:S):

NOT FOR DISTRIBUTION TO UNITED STATES

NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Sherritt International Corporation (“Sherritt”) (TSX:S) today

announced the signing of a definitive agreement to restructure its

Ambatovy Joint Venture with Sumitomo Corporation and Korea

Resources Corporation that will result in the transfer by Sherritt

of a 28% interest in the Joint Venture and the elimination of

related debt from Sherritt’s balance sheet consistent with the

previously announced agreement in principle.

“The signing of a definitive agreement to restructure our

Ambatovy joint venture partnership represents a significant

milestone,” said David Pathe, President and CEO of Sherritt. “This

agreement addresses our ’40 for 12’ issue and eliminates the

uncertainty caused by the Ambatovy non-recourse debt, while

ensuring that we retain an ownership stake in the world’s largest

finished nickel laterite mine. Closing of the transaction will

represent the culmination of numerous discussions with our

partners, bondholders, and other lenders over the past three years

to preserve liquidity, de-lever our balance sheet, extend the

maturities of our outstanding public debt, and defer Ambatovy debt

repayment.”

Terms of the definitive agreement are consistent with the

agreement in principle that Sherritt and its joint venture partners

announced in May 2017, and will result in, amongst other things,

amendments to several agreements governing the Ambatovy Joint

Venture and related partner loans, as well as the Operating

Agreement.

Highlights of the Definitive

Agreement:

- Sherritt will transfer 28% and retain a

12% ownership interest in the Ambatovy Joint Venture.

- Sherritt will eliminate $1.3 billion

(at September 30, 2017) in Ambatovy Joint Venture additional

partner loans from its balance sheet.

- Sherritt will resume funding for its

12% interest retroactively to the end of 2015 and expects to pay

approximately US$35 million to fulfill non-funding to date,

including accrued interest.

- Sherritt’s outstanding partner loans of

US$101 million due 2023 (at September 30, 2017) will continue to be

secured by Sherritt’s 12% interest.

- The outstanding partner loans can be

repaid in cash at any time through maturity in August 2023.

Alternatively, at maturity Sherritt can: (i) elect to repay the

loans in shares or a combination of cash and shares at 105% of the

amount then due, or ( ii) elect to repay in 10 equal semi-annual

principal installments (plus interest) commencing in December 2024,

at an interest rate of LIBOR +5% applied from the original August

2023 maturity date.

- Sherritt expects to make an additional

payment of approximately US$13 million that will be placed into an

escrow account to cover potential future funding requirements of

the Ambatovy Joint Venture. Any amounts remaining in escrow in

August 2023 will be used to repay the outstanding partner loans, if

any.

- Sherritt will remain as Operator until

at least 2024.

- Sherritt will regain voting rights and

certain other rights that were suspended when it ceased

funding.

- Sherritt will cover transaction and

other closing costs, including financial and legal advisory fees,

applicable taxes and corporate restructuring costs.

Closing of the transaction remains subject to various conditions

and third party consents. Sherritt expects final closing of the

transaction to occur before year-end 2017.

About Sherritt

Sherritt, which is celebrating its 90th anniversary in 2017, is

the world leader in the mining and refining of nickel from

lateritic ores with projects and operations in Canada, Cuba and

Madagascar. The Corporation is the largest independent energy

producer in Cuba, with extensive oil and power operations across

the island. Sherritt licenses its proprietary technologies and

provides metallurgical services to mining and refining operations

worldwide. The Corporation’s common shares are listed on the

Toronto Stock Exchange under the symbol “S”.

Forward-Looking Statements

This press release contains certain forward-looking statements.

Forward-looking statements can generally be identified by the use

of statements that include such words as “believe”, “expect”,

“anticipate”, “intend”, “plan”, “forecast”, “likely”, “may”,

“will”, “could”, “should”, “suspect”, “outlook”, “projected”,

“continue” or other similar words or phrases. Specifically,

forward-looking statements in this document include, but are not

limited to, statements set out in this press release relating to

estimated costs and future funding requirements.

Forward-looking statements are not based on historic facts, but

rather on current expectations, assumptions and projections about

future events, including matters relating to the transaction

disclosed herein; availability of governmental, regulatory and

third party approvals; and the ability to achieve corporate

objectives, goals and plans for 2017. By their nature,

forward-looking statements require the Corporation to make

assumptions and are subject to inherent risks and uncertainties.

There is significant risk that predictions, forecasts, conclusions

or projections will not prove to be accurate, that those

assumptions may not be correct and that actual results may differ

materially from such predictions, forecasts, conclusions or

projections.

The Corporation cautions readers of this press release not to

place undue reliance on any forward-looking statement as a number

of factors could cause actual future results, conditions, actions

or events to differ materially from the targets, expectations,

estimates or intentions expressed in the forward-looking

statements. These risks, uncertainties and other factors include,

but are not limited to the risks and uncertainties set out in the

Management’s Discussion & Analysis of the Corporation for the

period ending March 31, 2017 and the Corporation’s Annual

Information Form dated March 28, 2017, each of which are available

on SEDAR at www.sedar.com. Readers are cautioned that the foregoing

list of factors is not exhaustive and should be considered in

conjunction with the risk factors described in this press release

and in the Corporation’s other documents filed with the Canadian

securities authorities.

The Corporation may, from time to time, make oral

forward-looking statements. The Corporation advises that the above

paragraph and the risk factors described in this press release and

in the Corporation’s other documents filed with the Canadian

securities authorities should be read for a description of certain

factors that could cause the actual results of the Corporation to

differ materially from those in the oral forward-looking

statements. The forward-looking information and statements

contained in this press release are made as of the date hereof and

the Corporation undertakes no obligation to update publicly or

revise any oral or written forward-looking information or

statements, whether as a result of new information, future events

or otherwise, except as required by applicable securities laws. The

forward-looking information and statements contained herein are

expressly qualified in their entirety by this cautionary

statement.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171110005279/en/

Sherritt International CorporationJoe Racanelli,

416-935-2451Director of Investor RelationsToll-Free:

1-800-704-6698investor@sherritt.comwww.sherritt.com

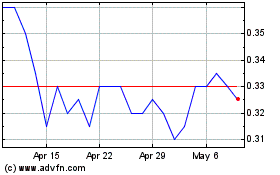

Sherritt (TSX:S)

Historical Stock Chart

From Oct 2024 to Nov 2024

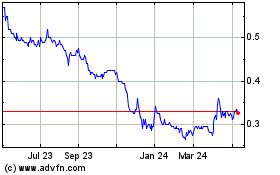

Sherritt (TSX:S)

Historical Stock Chart

From Nov 2023 to Nov 2024