Shopify Inc. (NYSE:SHOP) (TSX:SHOP) (“Shopify”) today announced

the pricing of its previously announced public offering of

1,100,000 Class A subordinate voting shares (the “Offered Shares”)

at a price to the public of US$900 per share (such offering, the

“Equity Offering”) and its previously announced public offering of

US$800,000,000 aggregate principal amount of convertible senior

notes due 2025 (the “Notes”) (such offering, the “Note Offering”,

and together with the Equity Offering, the “Offerings”). The gross

proceeds from the Equity Offering, before underwriting discounts

and offering costs, are expected to be US$990,000,000, and the

gross proceeds from the Note Offering, before underwriting

discounts and offering costs, are expected to be US$800,000,000.

The Equity Offering and the Note Offering are not conditional upon

one another.

Shopify has granted the Equity Underwriters (as defined below)

an over-allotment option to purchase up to an additional 165,000

Class A subordinate voting shares to be sold pursuant to the Equity

Offering (the “Equity Over-Allotment Option”). The Equity

Over-Allotment Option is exercisable for a period of 30 days from

the date of the final prospectus supplement relating to the Equity

Offering. Shopify has also granted the Note Underwriters (as

defined below) an over-allotment option to purchase up to an

additional US$120,000,000 aggregate principal amount of Notes (the

“Note Over-Allotment Option”). The Note Over-Allotment Option is

exercisable for a period of 30 days from the date of the final

prospectus supplement relating to the Note Offering.

Shopify expects to use the net proceeds of the Offerings to

strengthen its balance sheet, providing flexibility to fund its

growth strategies.

The closings of the Equity Offering and the Note Offering are

subject to a number of closing conditions, including the listing of

the Offered Shares and approval to list the Class A subordinate

voting shares underlying the Notes on the NYSE and the TSX, and any

required approvals of each exchange, and are expected to occur on

or about September 18, 2020. The Equity Offering is being led by

Citigroup, Goldman Sachs & Co. LLC and Credit Suisse, with RBC

Capital Markets acting as Co-Manager (the “Equity Underwriters”),

and the Note Offering is being led by Goldman Sachs & Co. LLC,

Citigroup and Credit Suisse, with RBC Capital Markets acting as

Co-Manager (the “Note Underwriters”).

The Notes will be senior, unsecured obligations of Shopify, and

interest will be payable semi-annually in cash at a rate of 0.125%

per annum on May 1 and November 1 of each year, beginning on May 1,

2021. The Notes will mature on November 1, 2025 unless redeemed,

repurchased, or converted prior to such date. Prior to August 1,

2025, the Notes will be convertible at the option of the holders

during certain periods, upon satisfaction of certain conditions.

Thereafter, the Notes will be convertible at any time until the

close of business on the second scheduled trading day immediately

preceding the maturity date. Upon conversion, the Notes may be

settled, at Shopify's election, in Shopify’s Class A subordinate

voting shares, cash or a combination thereof.

The Notes will have an initial conversion rate of 0.6944 Class A

subordinate voting shares per US$1,000 principal amount of Notes.

This represents an initial conversion price of approximately

US$1,440 per Class A subordinate voting share. The initial

conversion price of the Notes represents a premium of approximately

60% to the price per Offered Share in the Equity Offering.

No securities regulatory authority has either approved or

disapproved the contents of this news release. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy, nor shall there be any sale of these securities in

any province, state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such province, state

or jurisdiction.

Shopify has filed preliminary prospectus supplements for the

Offerings, and will file final prospectus supplements, to its short

form base shelf prospectus dated August 6, 2020 (the “Base Shelf

Prospectus”) with the securities regulatory authorities in each of

the provinces and territories of Canada except Québec. The

preliminary prospectus supplements have also been filed, and the

final prospectus supplements will be filed, with the U.S.

Securities and Exchange Commission (the “SEC”) as supplements to

Shopify’s registration statement on Form F-10 (the “Registration

Statement”) under the U.S./Canada Multijurisdictional Disclosure

System. The prospectus supplements, the Base Shelf Prospectus and

the Registration Statement contain important detailed information

about the Offerings. Copies of the Canadian prospectus supplements

and the Base Shelf Prospectus can be found on SEDAR at

www.sedar.com, and copies of the U.S. prospectus supplements and

the Registration Statement can be found on EDGAR at www.sec.gov.

Copies of these documents may also be obtained from Citigroup, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, Telephone: 1-800-831-9146; or Goldman Sachs & Co.

LLC, Attn: Prospectus Department, 200 West Street, New York, NY

10282, telephone: 866-471-2526, facsimile: 212-902-9316 or email:

prospectus-ny@ny.email.gs.com. Prospective investors should read

the prospectus supplements, the Base Shelf Prospectus and the

Registration Statement before making an investment decision.

About Shopify

Shopify is a leading global commerce company, providing trusted

tools to start, grow, market, and manage a retail business of any

size. Shopify makes commerce better for everyone with a platform

and services that are engineered for reliability, while delivering

a better shopping experience for consumers everywhere.

Headquartered in Ottawa, Canada, Shopify powers over one million

businesses in more than 175 countries and is trusted by brands such

as Allbirds, Gymshark, Heinz, Staples and many more.

Forward-looking Statements

This press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities laws (“forward-looking statements”) including statements

regarding the proposed Offerings, the terms of the Offerings and

the proposed use of proceeds. Words such as “expects”, “continue”,

“will”, “plans”, “anticipates” and “intends” or similar expressions

are intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current

expectations about future events and financial trends that

management believes might affect its financial condition, results

of operations, business strategy and financial needs, and on

certain assumptions and analysis made by Shopify in light of the

experience and perception of historical trends, current conditions

and expected future developments and other factors management

believes are appropriate. These projections, expectations,

assumptions and analyses are subject to known and unknown risks,

uncertainties, assumptions and other factors that could cause

actual results, performance, events and achievements to differ

materially from those anticipated in these forward-looking

statements. Although Shopify believes that the assumptions

underlying these forward-looking statements are reasonable, they

may prove to be incorrect, and readers cannot be assured that

either or both the Offerings discussed above will be completed on

the terms described above. Completion of the proposed Offerings are

subject to numerous factors, many of which are beyond Shopify’s

control, including but not limited to, the failure of customary

closing conditions and other important factors disclosed previously

and from time to time in Shopify’s filings with the SEC and the

securities commissions or similar securities regulatory authorities

in each of the provinces or territories of Canada. The

forward-looking statements contained in this news release represent

Shopify’s expectations as of the date of this news release, or as

of the date they are otherwise stated to be made, and subsequent

events may cause these expectations to change. Shopify undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200915006377/en/

INVESTORS: Katie Keita Senior Director, Investor Relations

613-241-2828 x 1024 IR@shopify.com

MEDIA: Rebecca Feigelsohn Communications Lead 416-238-6705 x 302

press@shopify.com

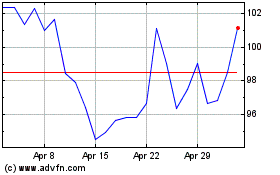

Shopify (TSX:SHOP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Shopify (TSX:SHOP)

Historical Stock Chart

From Nov 2023 to Nov 2024