Urban Select Announces Letter of Intent With ARNEVUT Resources

November 08 2011 - 1:21AM

Marketwired Canada

Urban Select Capital Corporation (the "Company") (TSX VENTURE:CH) is pleased to

announce that it has entered into a letter of intent ("LOI") with ARNEVUT

Resources Inc. ("ARNEVUT"), a Colorado incorporated private company dedicated to

the identification and active exploration of mineral properties. Pursuant to the

terms of the LOI, the Company and ARNEVUT have agreed to establish a new company

focused on precious metals exploration and development in the Western United

States, especially in Nevada. The new company is expected to be called ARNEVUT

Exploration Corp. ("ARNEVUT Exploration").

Pursuant to the LOI, the Company has agreed to: (i) incorporate ARNEVUT

Exploration as a wholly-owned subsidiary of the Company; (ii) transfer cash to

ARNEVUT Exploration in consideration for common shares of ARNEVUT Exploration

and distribute these common shares to the Company's shareholders pursuant to a

plan of arrangement under the Business Corporations Act (British Columbia) (the

"Plan of Arrangement"); and (iii) assist ARNEVUT Exploration with completion of

an anticipated $1,500,000 non-brokered private placement financing (the

"Financing") to be completed following the entering into of the Definitive

Agreement (as defined herein). The Company will seek approval of the Plan of

Arrangement at an annual and special general meeting of its shareholders to be

held on December 19, 2011 (the "Meeting"). Further information regarding the LOI

and the Plan of Arrangement will be set forth in the notice of meeting and

information circular to be prepared in connection with the Meeting. Should the

Plan of Arrangement receive approval at the Meeting, it is anticipated that the

Plan of Arrangement will become effective shortly thereafter. Upon completion of

the Plan of Arrangement, ARNEVUT Exploration will become a reporting issuer in

British Columbia and Alberta. Completion of the Plan of Arrangement is subject

to the approval of the Supreme Court of British Columbia and the TSX Venture

Exchange.

Subject to completion of the Plan of Arrangement, ARNEVUT and ARNEVUT

Exploration anticipate entering into a definitive agreement (the "Definitive

Agreement") whereby ARNEVUT Exploration will acquire, in consideration for the

issuance of 18,997,767 common shares of ARNEVUT Exploration, 100% of ARNEVUT's

option interests in the Island Mountain Gold Property, Nevada, USA (the

"Acquisition") and East Canyon Property, Nevada and Utah, USA (collectively the

"Properties"). Should ARNEVUT and ARNEVUT Exploration enter into the Definitive

Agreement, the Acquisition will be subject to a number of conditions, including:

completion of the Financing; delivery by ARNEVUT of a National Instrument 43-101

compliant technical report in respect of one of the Properties; and satisfactory

due diligence. Should the Plan of Arrangement be implemented, the Definitive

Agreement will be entered into and the Acquisition will be completed, it is

expected that shareholders of the Company will:

-- retain their current interest in the Company;

-- obtain an approximate 3.4% interest in ARNEVUT Exploration; and

-- through their interest in the Company, receive the benefit of the

Company's approximate 3.8% interest in ARNEVUT Exploration.

Should the Plan of Arrangement be completed, it is anticipated that the

Definitive Agreement will be entered into on or before January 31, 2012 with the

Acquisition to be completed shortly thereafter. The Company and ARNEVUT are at

arm's length.

ABOUT ARNEVUT RESOURCES

ARNEVUT Resources is a private, pre-IPO stage company transitioning to a full

junior gold mining company. ARNEVUT holds an option on the Island Mountain

gold-silver property, Nevada, USA. ARNEVUT also holds an exclusive contract on

the East Canyon Claims, a gold-silver-copper-lead-zinc property on the border

between Nevada and Utah, USA.

Island Mountain

The Island Mountain property is located near the northeast end of the Jerritt

Canyon Trend (greater than 9 million oz Au produced), 70 miles north of Elko,

Nevada, with similarities to other known deposits in that Trend. The property

has had gold intercepts in drill holes (up to 11 m at 0.119 opt); intercepts are

variable, scattered laterally and vertically in clusters, and mineralization

limits have not yet been defined.

The Island Mountain Property currently consists of approximately 1,480 acres of

Federal land, managed by the Forest Service, as 78 unpatented claims and 320

acres of leased private land (16 patented claims). ARNEVUT's option agreement

with Victoria Gold Corp. requires expenditures of $2,500,000 to earn a 51%

ownership in the Property by November 2013. ARNEVUT's expenditures to date are

approximately $740,000. ARNEVUT can achieve a total ownership of 75% through

further expenditure of $2,500,000 and completion of a full feasibility analysis.

ARNEVUT has completed a NI 43-101 Technical Report on Island Mountain, dated

2008, but is in the process of updating this report to include more recent

resource estimation modeling by a QP and cover changes to the land package and

technical activities since 2008. The resource modeling has shown that the Island

Mountain Property has a historical Inferred resource of 515,000 ounces of gold

at a 0.20 g/tonne cutoff grade (P.J. Hollenbeck, pers. Communication, 2011),

which is a most likely cutoff for a heap leach operating scenario. NI 43-101

compliant resources are 38,000 ounces Measured and Indicated resources and

43,000 ounces Inferred resources. The known gold deposits occur in clusters,

partially due to the clustered nature of past drilling activity, along multiple

apparent northeast-southwest and west-northwest-east-southeast trends. All known

resources are in the oxide zone, and any sulfide resource potential remains

untested. All clusters are unconstrained laterally and vertically based on past

drilling.

East Canyon

This property consists of 10 unpatented claims (approx. 180 acres) on Federal

lands and one 634 acre Utah State Section encompassing a highly prospective Long

Canyon-type gold target that is mostly within Utah but straddles the Nevada-Utah

state line, roughly 40 miles north of Wendover, Utah. The property also has

silver, copper, lead, and zinc mineralization.

East Canyon is located in the northern Pilot Range and is within the Long Canyon

Trend in northeastern Nevada and northwestern Utah. The Long Canyon Trend was

recently identified as a result of gold discoveries in the northern Pequop Range

of Nevada, the T.U.G. and KB deposits about 10 miles north of East Canyon, and

the Viper deposit about 15 miles north of East Canyon, the latter three deposits

are all near the Utah-Nevada border.

ABOUT URBAN SELECT

Urban Select Capital Corporation is global investment management, financial

advisory and private equity firm focused on investing growth capital into

private and public companies in a broad range of sectors including renewable

energy, natural resources, chemicals, agriculture and consumer retail services.

Caution Regarding Forward-Looking Statements - This news release contains

certain forward-looking statements, including statements regarding the business

and anticipated financial performance of the Company, including with respect to

completion of the Plan of Arrangement, the entering into of a Definitive

Agreement, completion of the Financing, completion of the Acquisition and the

anticipated results thereof. These statements are subject to a number of risks

and uncertainties. Actual results may differ materially from results

contemplated by the forward-looking statements. There is no guarantee that any

of the Plan of Arrangement, the entering into of the Definitive Agreement, the

Acquisition or the Financing will be completed as proposed or at all. The Plan

of Arrangement remains subject to approval of the Company's shareholders, the

Supreme Court of British Columbia and the TSX Venture Exchange. The Acquisition

is subject to completion of the Plan of Arrangement, execution of a Definitive

Agreement and completion of the Financing, among other things. When relying on

forward-looking statements to make decisions, investors and others should

carefully consider the foregoing factors and other uncertainties and should not

place undue reliance on such forward-looking statements. The Company does not

undertake to update any forward looking statements, oral or written, made by

itself or on its behalf except as required by law.

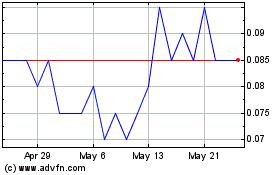

Charbone Hydrogen (TSXV:CH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Charbone Hydrogen (TSXV:CH)

Historical Stock Chart

From Jul 2023 to Jul 2024