Consolidated Lithium Metals Closes Final Tranche of Flow-Through Private Placement Financing

August 10 2023 - 5:30PM

Consolidated Lithium Metals Inc. (TSXV:

CLM | OTCQB:

JORFF | FRA:

Z36) (“

CLM” or the

“

Company“) is pleased to announce that it has

closed its third and final tranche of a previously announced

non-brokered private placement financing of common shares of the

Company issued on a flow-through basis (each, a

“

Flow-Through Share”) at a price of $0.08 per

Flow-Through Share (the “

Offering”) for proceeds

of $1,000,000 (the “

Final Tranche”). In total, an

aggregate of 21,250,000 Flow-Through Shares were issued by the

Company pursuant to the Offering for proceeds of $1.7 million. For

more information about the Offering and the first tranche and

second tranche closings (the “

Prior Tranches”),

please see the Company’s press releases dated May 24, 2023, June

12, 2023, and June 26, 2023, and July 20, 2023, which are available

under the Company’s SEDAR profile at www.sedar.com.

Pursuant to the Final Tranche, CLM issued

12,500,000 Flow-Through Shares at a price of $0.08 per share, each

of which are subject to a statutory four month hold period, which

expires on December 11, 2023. Completion of the Offering (including

the Prior Tranches) is subject to receipt of final approval of the

TSX Venture Exchange (“TSXV”).

In connection with the Final Tranche, CLM paid

finder’s fees of $80,000 in cash and issued 1,000,000

non-transferable finder’s warrants (“Finder’s

Warrants”) to Roche Securities Limited in accordance with

TSXV policies. Each Finder’s Warrant entitles the holder thereof to

acquire one common share of the Company at a price of $0.08 at any

time prior to August 10, 2025. The Company intends to use the

proceeds of the Offering to fund exploration expenses on its

Baillarge lithium mining property. The Company may also use

proceeds to fund exploration expenses at its other lithium mining

properties located in close proximity to the North American Lithium

mine, including its Preissac – La Corne and Vallée projects.

Option Grant

The Company also announces that it has granted

500,000 stock options to a director of the Company pursuant to the

Company’s omnibus incentive plan. The stock options vest in equal

quarterly installments over two years and may be exercised at a

price of $0.08 per option for a period of five years from the date

of grant. This grant of options is subject to the approval of the

TSXV.

About Consolidated Lithium Metals

Inc. Consolidated Lithium Metals Inc. (TSXV:

CLM | OTCQB: JORFF | FRA:

Z36) (formerly known as Jourdan Resources Inc.) is

a Canadian junior mining exploration with projects in Quebec. The

Company’s properties are in Quebec, Canada, primarily in the

spodumene-bearing pegmatites of the La Corne Batholith, around

North American Lithium’s Quebec lithium mine.

For more information:Rene

Bharti, Chief Executive Officer and PresidentEmail

| info@consolidatedlithium.comPhone | (416)

861-5800Website |www.consolidatedlithium.com

Cautionary StatementsThis press

release contains “forward-looking information” within the meaning

of applicable Canadian securities legislation. Forward-looking

information includes, but is not limited to, statements with

respect to the Prior Tranches, the Final Tranche, and the Offering,

including the Company’s intended use of proceeds, receipt of final

approval of the TSXV, and other matters related thereto. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved”.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of CLM to be

materially different from those expressed or implied by such

forward-looking information, including but not limited to: receipt

of necessary approvals; general business, economic, competitive,

political and social uncertainties; future mineral prices and

market demand; accidents, labour disputes and shortages and other

risks of the mining industry. Although CLM has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. CLM does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act") or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

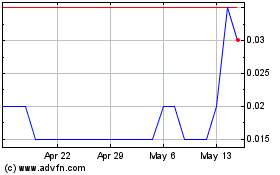

Consolidated Lithium Met... (TSXV:CLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

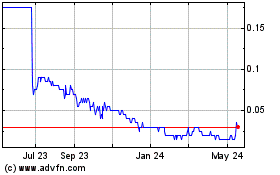

Consolidated Lithium Met... (TSXV:CLM)

Historical Stock Chart

From Apr 2023 to Apr 2024