Consolidated Uranium Inc. (“CUR”, the “Company”,

“Consolidated Uranium”) (TSXV: CUR) (OTCQB: CURUF) is

pleased to announce initial work programs (the

“

Program”) on its past producing US uranium

projects, Tony M, Daneros and Rim, acquired from Energy Fuels Inc.

(“

Energy Fuels”) in late 2021. The work programs

are being planned and implemented in conjunction with Energy Fuels,

as the operator of the projects, and include historic mineral

resource confirmation and expansion drilling as well as other

activities relating to advancing the projects toward a production

ready state. These mines are uniquely positioned in close proximity

to the White Mesa Mill (Figure 1) owned and operated by Energy

Fuels, with whom CUR has a Toll Milling Agreement.

Highlights:

Tony M Mine (Figure 2):

- Tony M is a large-scale, fully

developed and permitted underground mine that produced nearly one

million pounds of U3O8 during two different periods of operation

from 1979-1984 and from 2007-2008.

- A June 2012 Technical Report

authored by Roscoe Postle Associates Inc. detailed a mineral

resource estimate for the project as set out in the CUR news

release dated July 15, 2021. This mineral resource estimate is

considered to be a “historical estimate” for CUR as defined under

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”).

- A surface drill program at Tony M

using rotary and core drilling is expected to commence in Q2 2022,

to verify the historical exploration drill hole data and facilitate

the preparation of a current mineral resource estimate. The planned

drilling program will follow the recommendations from SLR

Consulting in the “Technical Report on the Tony M Project, Utah,

USA Report for NI 43-101”, which was prepared for Consolidated

Uranium, and dated October 15, 2021.

Daneros Uranium Mine (Figure 3):

- Daneros is a fully developed and

permitted underground mine that produced nearly one million pounds

of U3O8 during multiple periods of operation, most recently from

2010-2013.

- A March 2018 technical report,

authored by Peters Geosciences, detailed a mineral resource

estimate for the project as set out in the CUR news release dated

July 15, 2021. This mineral resource estimate is considered to be a

“historical estimate” for CUR as defined under NI 43-101.

- A surface drill program at Daneros

using rotary and core drilling is being planned and will commence

in Q2 2022. The proposed drilling program is designed to test

extensions of the historical mineral resource estimate in order to

aid in future mine planning.

- Concurrent with the surface drill

program, the Company will be upgrading and re-starting the mine

ventilation and monitoring system using state of the art equipment.

This will allow ready access for underground drilling and for the

future restart of mining at Daneros without delay.

- Additional permitting is underway

to take the current small mine permit to a large mine permit which

includes the expansion of the Daneros Mine footprint from less than

5 acres to approximately 45 acres.

Rim Uranium and Vanadium Mine (Figure 4):

- Rim includes a fully developed and

permitted underground mine that was most recently in production in

2009.

- A previous mineral resource

estimate prepared by Energy Fuels as described in the CUR news

release dated July 15, 2021. This mineral resource estimate is

considered to be a “historical estimate” for CUR as defined under

NI 43-101.

- A surface drill program at Rim

using core and rotary drilling is being planned and permitted, and

will commence in Q2 2022, to test continuations and extensions of

the historically defined mineral resources.

Philip Williams, CEO commented, “As discussed in

our year-end update, we expect 2022 to be characterized as much by

project-level advancement as by new M&A activity. Today’s

announcement presents the first meaningful project-level work

programs in the Company’s history as well as an important step in

advancing these key US projects back toward production. We look

forward to making similar announcements on other portfolio projects

where we see strong opportunities to expand known mineralization

and make other project level advancements. We believe the timing of

advancing our US and other projects this year will dovetail nicely

with the continued strength in the uranium market, which will

ultimately require new mine supply to meet growing demand.”

Marty Tunney, President and COO commented, “The

programs announced today strike the right balance between

aggressively exploring and advancing our past-producing uranium and

vanadium mines, while being measured and deliberate in our work

programs. We view these efforts as important steps toward upgrading

historic resources and advancing the projects with the goal of

restarting mining when market conditions are right. More

importantly, CUR is the only uranium company, other than Energy

Fuels, with guaranteed access to the White Mesa mill, the only

operating conventional uranium mill in the US. It has been a great

experience working with Energy Fuels on designing these programs

that could quickly supply feed to the mill, highlighting the

benefits of this important partnership for CUR.”

Graphics accompanying this announcement are available

athttps://www.globenewswire.com/NewsRoom/AttachmentNg/b8abcbf4-d116-4cbe-a8c1-77b184d31572

https://www.globenewswire.com/NewsRoom/AttachmentNg/b07ab258-99a4-4139-8929-77a74097b136

https://www.globenewswire.com/NewsRoom/AttachmentNg/2b153c71-4d7c-4eba-8282-73d834e7302c

https://www.globenewswire.com/NewsRoom/AttachmentNg/39c947f2-cc8d-4a45-aba7-e0db744e46ce

Matoush Uranium Project Acquisition Update

In addition, the Company announces that it will be

issuing 821,976 common shares of the Company (the “Shares”) at

a deemed price of $2.43 per Share, being the 20-day volume weighted

average price of the Shares on the TSX Venture Exchange (the

“TSXV”) up to and including February 16, 2022 and paying $1,500,000

in cash, as a deferred payment in connection with the completion of

the Company’s acquisition of the Matoush Uranium Project, as

previously announced on August 19, 2021. The securities issued as

deferred payment for the Matoush acquisition are subject to

approval of the TSXV and a hold period expiring four months and one

day from the date of issuance.

Qualified Person

The scientific and technical information contained in this news

release was reviewed and approved by Dean T. Wilton, CPG‐7659, who

is a “Qualified Person” (as defined in NI 43‐101).

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the Company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina,

and the United States each with significant past expenditures

and attractive characteristics for development. Most recently, the

Company completed a transformational strategic acquisition and

alliance with Energy Fuels Inc., a leading U.S.-based uranium

mining company, and acquired a portfolio of permitted,

past-producing conventional uranium and vanadium mines in Utah and

Colorado. These mines are currently on stand-by, ready for rapid

restart as market conditions permit, positioning CUR as a near-term

uranium producer.For More Information, Please

Contact:

Philip WilliamsChairman

& CEOpwilliams@consolidateduranium.com

Mars Investor Relations +1 647

557 6640 cur@marsinvestorrelations.com

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

“Forward-Looking” Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to activities, events or

developments that the Company expects or anticipates will or may

occur in the future including, but not limited to, the Company’s

ongoing business plan, exploration and work programs. Generally,

but not always, forward-looking information and statements can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes” or the negative connotation

thereof or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved” or the negative

connotation thereof. Such forward-looking information and

statements are based on numerous assumptions, including that

general business and economic conditions will not change in a

material adverse manner, that financing will be available if and

when needed and on reasonable terms, and that third party

contractors, equipment and supplies and governmental and other

approvals required to conduct the Company’s planned exploration

activities will be available on reasonable terms and in a timely

manner. Although the assumptions made by the Company in providing

forward-looking information or making forward-looking statements

are considered reasonable by management at the time, there can be

no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no known mineral reserves or resources, reliance on key

management and other personnel, potential downturns in economic

conditions, actual results of exploration activities being

different than anticipated, changes in exploration programs based

upon results, and risks generally associated with the mineral

exploration industry, environmental risks, changes in laws and

regulations, community relations and delays in obtaining

governmental or other approvals and the risk factors with respect

to Consolidated Uranium set out in CUR’s annual information form in

respect of the year ended December 31, 2020 filed with the Canadian

securities regulators and available under CUR’s profile on SEDAR at

www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

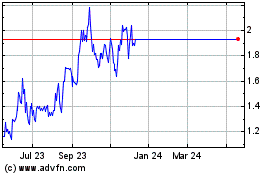

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2023 to Nov 2024