SFL – Third-Quarter 2023 Financial Information

October 19 2023 - 12:43PM

Business Wire

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231019027084/en/

#cloud.paris (Paris 2) - SFL © Clément

Guillaume

SFL (Paris:FLY):

Robust business performance

“SFL’s high-quality portfolio, 99% of which is located within

Paris including 77% in the CBD, is a guarantee of resilience in a

tight and highly selective market driven by demand, among companies

and their employees, for centrally located, modern buildings

meeting the highest environmental standards. The growth in our

rental income and our robust operating ratios are proof of

this.” Dimitri Boulte, Chief Executive Officer of

SFL

Rental income up by a sharp 13.1% to

€171.6 million

Consolidated revenue by

business segment (€000’s)

Rental income:

2023 (9 months)

2022 (9 months)

Change

Paris CBD

129,235

116,743

+10.7%

Paris Other

40,056

32,825

+22.0%

Western Crescent

2,335

2,163

+7.9%

Total rental income

171,626

151,731

+13.1%

Consolidated rental income for the first nine months of 2023

totalled €171.6 million, up by a strong €19.9 million (up 13.1%)

versus the year-earlier period:

- On a like-for-like basis (excluding all changes in the

portfolio affecting period-on-period comparisons), rental income

was €10.8 million higher (up 8.3%), reflecting:

- application of rent escalation clauses (€6.4 million

impact);

- the gradual recovery in occupancy of the hotel located in the

Edouard VII complex following the end of Covid-19 restrictions in

February 2022 (€1.2 million impact);

- the improved occupancy rate for the Group’s revenue-generating

units, thanks to the signature of new leases in 2022 and 2023 (with

long-standing tenants or new clients such as Promontoria, Atalante

and Fabrique de Styles);

- the effective rent uplifts negotiated for new leases, addenda

or protocols on occupied space.

In particular, a significant increase in rental income was

observed from the Edouard VII, #cloud.paris, Louvre Saint-Honoré,

Washington Plaza and 103 Grenelle buildings.

- Rental income from spaces being redeveloped rose by a net €4.3

million versus the first nine months of 2022, reflecting:

• An increase of €13.3 million, due in particular to:

- the contribution over the entire nine-month period of revenues

from the Biome building (delivered in July 2022 following its

complete restructuring and fully let to La Banque Postale and

SFIL);

- the delivery in July 2023 of the retail area of the Louvre

Saint-Honoré complex redeveloped for the Cartier Foundation, whose

lease took effect immediately;

- new leases signed on several floors renovated in 2022 and/or

2023, mainly in the Cézanne Saint-Honoré building (Wendel, Lacourte

Raquin Tatar, Lincoln International and Jouin Manku).

• A decrease of €9.1 million, mainly due to:

- part of the retail space in the Galerie des Champs-Elysées

building (former H&M store) becoming vacant in 2022; following

restructuring and delivery in August 2023, this space is now set to

become the Paris flagship for its new tenant, Adidas;

- the Scope building (formerly Rives de Seine) previously let to

Natixis being vacated at the end of September 2022 in preparation

for its redevelopment.

- The acquisition of the Pasteur building in April 2022 generated

a significant increase in rental income, partly offset by the

impact of Pretty Simple’s October 2022 departure from the 6 Hanovre

building, which was sold in April 2023. Together, these movements

had a positive net impact on rental income of €4.1 million.

- Lastly, rental income for the first nine months was boosted by

€0.7 million in penalties received from tenants for breaking their

leases.

Sustained business volumes in an

uncertain environment

In the first nine months of 2023, the Group signed leases on

over 30,000 sq.m. of mainly office space.

The average nominal rent for the new office leases was

significantly higher, at €845 per sq.m., corresponding to an

effective rent of €695 per sq.m., for an average non-cancellable

period of 8.5 years. These lease terms attest to the resilience of

the Paris office property market and the attractiveness of the

Group’s properties.

The physical occupancy rate for revenue-generating properties at

30 September 2023 was a record 99.7% (compared with 99.5% at 31

December 2022). The EPRA vacancy rate was 0.3% (versus 0.6% at 31

December 2022).

On 11 April 2023, SFL sold the 6 rue de Hanovre building in

Paris (2nd arrondissement) to the GCI/Eternam joint venture for a

net selling price of €58.3 million. The building’s tenant moved out

in October 2022 and the 4,600 sq.m. complex was sold untenanted in

its condition on the transaction date.

No properties were purchased during the first nine months of

2023.

Financing: increased liquidity and

sound debt ratios

SFL’s consolidated net debt at 30 September 2023 amounted to

€2,570 million, compared with €2,438 million at 31 December 2022,

representing a loan-to-value ratio of 30.4% based on the

portfolio’s appraisal value (including transfer costs) at 30 June

2023. The average cost of debt after hedging was 2.0% and the

average maturity was 3.8 years. At end-September 2023, the interest

coverage ratio stood at 3.7x.

The Company’s liquidity position at 30 September 2023 was

excellent, with €1,600 million in undrawn confirmed lines of

credit

About SFL

Leader in the prime segment of the Parisian

commercial real estate market, Société Foncière Lyonnaise stands

out for the quality of its property portfolio, which is valued at

€7.9 billion and is focused on the Central Business District of

Paris (#cloud.paris, Edouard VII, Washington Plaza, etc.), and for

the quality of its client portfolio, which is composed of

prestigious companies. As France’s oldest property company, SFL

demonstrates year after year an unwavering commitment to its

strategy focused on creating a high value in use for users and,

ultimately, substantial appraisal values for its properties. With

its sights firmly set on the future, SFL is committed to

sustainable real estate with the aim of building the city of

tomorrow and helping to reduce carbon emissions in its sector.

Stock market: Euronext Paris Compartment A – Euronext Paris ISIN

FR0000033409 – Bloomberg: FLY FP – Reuters: FLYP PA S&P rating:

BBB+ stable outlook

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231019027084/en/

SFL – Thomas Fareng – T +33 (0)1 42 97 27 00 –

t.fareng@fonciere-lyonnaise.com www.fonciere-lyonnaise.com

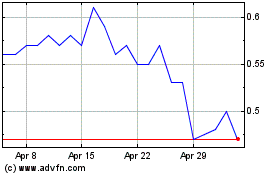

Flyht Aerospace Solutions (TSXV:FLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

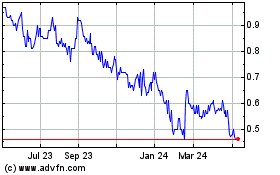

Flyht Aerospace Solutions (TSXV:FLY)

Historical Stock Chart

From Apr 2023 to Apr 2024