Klondike Silver Corp. (the "Company") (TSX VENTURE: KS) and

Kootenay Gold Inc. (TSX VENTURE: KTN) ("Kootenay") are pleased to

announce the phase one diamond drill program has commenced on the

Espiritu Gold - Copper porphyry system in Sonora, Mexico.

"We are excited to be moving forward with a much anticipated

drill program on the Espiritu project and look forward to testing

the potential large scale porphyry gold-copper system," comments

Company President, Richard Hughes. "A significant amount of work

has been completed by joint venture partner, Kootenay Gold, to

advance the property to this point including sampling of the

leach-cap zone which has produced copper values consistent with

those taken above other porphyry deposits in northwest Mexico and

the southwest USA. Initial drilling on the property will focus on

determining the thickness and mineralization grade of the enriched

Supergene layer."

Drilling will consist of a minimum 1000 meters of HQ core and

comprise of 4 to 6 holes in 4 drill sites 100 to 500 meters apart.

It is anticipated it will take 3 to 4 weeks to complete the

program.

The Espiritu project is owned 100% by Kootenay Gold Inc. and is

under option to Klondike Silver Corp. who have the right to earn a

50% interest in the project by making certain payments and

exploration expenditures (March 31, 2008).

Geology

The Espiritu project is host to an extensive area of

polymetallic vein, stockwork, breccia and gold-copper porphyry

mineralization. The evidence of Silver-Gold enriched veins

occurring within and adjacent to the gold-copper porphyry style

mineralization significantly enhances the economic value of the

project due to the potential existence of a strong precious metal

component.

Mineralization and alterations are hosted along a 5 km east

northeast trending structure that measures between one and two km

in width. Two zones of mineralization have been recognized; the

northeast zone dominated by a porphyry setting is separated by a

major fault from the southwest zone dominated by veins and

stockworks of precious and base metal mineralization. The two zones

appear to be genetically related with the polymetallic

vein/stockwork systems representing mineralization that would be

expected to overlie the porphyry setting.

Northeast Zone

The northeast Espiritu porphyry prospect is a 2.2 x 1.4 km

sub-circular area defined by a concentric pattern of zonation

diagnostic of copper gold porphyry deposits. The different zones

are strong propylite, argillic, sericitic and potassic alteration

hosted in a biotite, feldspar quartz porphyry.

Mineralization and alteration covers a 1.5 km x 1 km zone. In

the biotite zone of alteration, 19 grab samples from the

disseminated and fracture mineralization showed good values of

copper (average 0.24%) and gold (average 0.239 gpt). In the

argillic/sericitic zone of alteration or leach-cap zone, extensive

leaching of the fracture and dissemintated mineralization has taken

place, and the average copper content shows values of 0.034%,

consistent with the general average copper values within the

leach-cap zones that sit on top of known porphyry deposits of the

southwest USA and northwest Mexico. The polymetallic veins show

anomalous values in gold (to a high of 3.60 gpt) and silver (to a

high of 462gpt). All samples are grab samples.

Southwest Zone

The southwestern part of the system is represented by veins,

breccias and stockworks anomalous in gold, silver, copper, lead and

zinc.

At present, the main mineralization in the southwest is defined

by several zones spread out along a 2 km length. These are named

the west, central and east polymetallic zones. Anomalous

mineralization has been recognized in two other separate zones: the

PS-1 zone about 2 km to the northwest and the PS-2 zone about 500

metres to the east.

Two stages of mineralization are noted; one stage marked by

mainly quartz veins low in all metal values and a second stage

marked by veins, breccias and stockworks of polymetallic gold,

silver, copper, lead and zinc mineralization.

Fifty-eight grab samples were collected within the west, central

and eastern parts of the southwest polymetallic zone. The

polymetallic veins averaged 226 gpt silver, 1.58% lead and 1.57%

zinc associated with 0.18 gpt gold and 0.15% copper. From the 35

samples collected from the polymetallic system, 18/35 were greater

than 0.100 gpt gold and 29/35 were greater than 30 gpt silver.

The PS-1 area gave values of 0.84, 0.50 and 0.46 gpt gold and

277 and 217 gpt silver associated with anomalous lead (to 6%) and

zinc(to 1.5%). The PS-2 zone gave silver values of 686, 644 and 487

gpt and anomalous copper, lead and zinc from thirteen samples has

been noted. Anomalous values of molybdenum (to 0-0.129%) were noted

from this area.

QA/QC

All samples were placed and sealed with tape into a plactic rock

sample bag. Each sample was labeled and catalogued and delivered to

ALS Chemex's preparation laboratory in Hermosillo, Sonora Mexico

where pulps are made of each sample which were then sent to the ALS

Chemex laboratory in North Vancouver, B.C. Canada. Each sample was

analyzed with a multi acid digestion ICP AES (Plasma Emission

Spectroscopy). Samples with precious exceeding the upper detection

limit of the ICP AES are analyzed again using fire assay methods

with either atomic absorption, emission spectroscopy or gravimetric

finishes for gold and silver. Base metals exceeding upper limits

are reanalyzed using a four acid ore grade analysis. All samples

referred to herein are grab samples. ALS Chemex is an

internationally recognized independent laboratory operating to ISO

17025 quality assurance standards. The drill contractor is

Globexplore located in Hermosillo, Sonora Mexico.

The foregoing geological disclosure has been reviewed and

verified by Kootenay's CEO, James McDonald, P.Geo (a qualified

person for the purpose of National Instrument 43-101, Standards of

Disclosure for Mineral Projects). Mr. McDonald is a director of the

Company.

The Company would also like to announce it has received approval

from the TSX Venture Exchange to extend the term and reduce the

exercise price of 5,178,301 warrants issued by the Company which

expired on December 4, 2009 (the "Warrants"). The expiration date

of the Warrants has been extended to December 3, 2012, and the

exercise price reduced to $0.10.

The Company has also completed the private placement announced

on October 27, 2009. The private placement consisted of 2,500,000

flow through units at a price of $0.065 per unit. Each unit

consisted of one flow-through common share and one non flow through

common share purchase warrant. Each common share purchase warrant

will entitle the holder to purchase one common share at $0.10 per

share until November 10, 2011, and $0.15 per share until November

10, 2014. Union Securities Ltd. was paid a cash commissions

totaling $2,925. Shares issued are subject to a hold period

expiring on March 12, 2010. Proceeds from the private placement

will be used for exploration on the Company's British Columbia

properties.

About Kootenay Gold

Kootenay is an emerging exploration Company actively developing

mineral projects in the Sierra Madre Region of Mexico and in

British Columbia, Canada. The Company is currently drill testing

four separate projects. Kootenay's top priority remains the ongoing

development of its Promontorio Silver project in Sonora State,

Northwest Mexico, which encompasses the former producing

Promontorio Silver Mine.

About Klondike Silver:

Klondike Silver is a member of the Hughes Exploration Group of

Companies and is led by a team with a stellar track record of

discovery and development in Canada.

Klondike Silver Corp. has assembled a quality portfolio of

silver properties in historic mineral districts in North America,

and is applying advanced exploration technologies to add value to

these core assets. Klondike Silver is reviving the Gowganda and Elk

Lake silver camps in Ontario, and the world-famous Klondike

district of Yukon Territory. The Company owns a 100 TPD fully

operational flotation mill in Sandon, BC, which is currently

processing material from local mines in the historic Slocan Silver

Camp. As well, Klondike Silver entered into a joint venture with

Kootenay Gold Inc. to explore a copper-porphyry property in the

state of Sonoro in northern Mexico.

Visit Klondike Silver's web-site: www.klondikesilver.com to see

Smartstox interviews with Company President, Richard Hughes.

Cautionary Note to US Investors: This news release may contain

information about adjacent properties on which we have no right to

explore or mine. We advise U.S. investors that the SEC's mining

guidelines strictly prohibit information of this type in documents

filed with the SEC. U.S. investors are cautioned that mineral

deposits on adjacent properties are not indicative of mineral

deposits on our properties. This news release may contain

forward-looking statements including but not limited to comments

regarding the timing and content of upcoming work programs,

geological interpretations, receipt of property titles, potential

mineral recovery processes, etc. Forward-looking statements address

future events and conditions and therefore involve inherent risks

and uncertainties. Actual results may differ materially from those

currently anticipated in such statements.

The statements made in this news release may contain

forward-looking statements that may involve a number of risks and

uncertainties. Actual events or results could differ materially

from the Company's expectations and projections.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy or contents of this news release.

Contacts: Corporate Inquiries: Klondike Silver Corp. Kevin Hull

or Alan Campbell (604)-685-2222 info@klondikesilver.com

www.klondikesilver.com AGORACOM Investor Relations KS@agoracom.com

www.agoracom.com/ir/KlondikeSilver

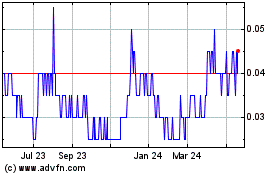

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jun 2024 to Jul 2024

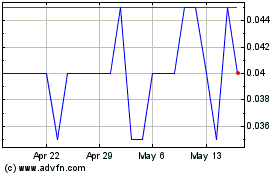

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jul 2023 to Jul 2024