Los Andes Copper Ltd. (TSXV: LA) ("Los Andes", or the "Company") is

pleased to announce that it has sold a net smelter return ("NSR")

royalty to Resource Capital Fund VI L.P ("RCF VI") for a total

price of US$14 million (the "Royalty"). The Royalty is calculated

over the sale of all locatable minerals produced from the Santa

Teresa 1/60, Santa Maria 1/60 and San Cayetano 1/20 exploitation

concessions (the "Concessions") that form part of the Company's

Vizcachitas Project in Chile (the Vizcachitas Project"). Under the

Royalty, RCF VI will receive a 2.00% NSR for open pit operations

and a 1.00% NSR for underground operations.

Highlights

- RCF VI to pay US$9 million for the Royalty in instalments and

an additional contingent payment of up to US$5 million by RCF (the

"Contingent Royalty Payment") if RCF VI were to sell the Royalty

prior to commencement of commercial production. Upon

commencement of commercial production, any unpaid balance of the

US$5 million Contingent Royalty Payment will be deducted from the

initial royalties payable.

- The financing will primarily be used to fund the purchase of an

existing royalty (the "Existing Royalty") previously granted on the

Vizcachitas Project by the Company's indirect, wholly owned

subsidiary, as described further below.

Fernando Porcile, Executive Chairman of Los

Andes, commented:

“I am delighted to announce the completion of

this NSR royalty agreement which highlights the continued support

from RCF VI for the Vizcachitas Project. It places the Company in a

strong position to continue successfully developing the Vizcachitas

Project.

"With a number of work streams currently

underway, or due to commence shortly, I look forward to keeping the

market updated with further progress."

Existing Royalty PurchaseThe

Company, through its indirect wholly-owned subsidiary, Gemma

Properties Group Ltd. (“Gemma”), has entered into a 30-month option

to purchase an existing royalty applied to the sale of all

locatable minerals produced from the Santa Teresa 1/60, Santa Maria

1/60, San Cayetano 1/20, Tigre 1/30 and Huemul 1/40 exploitation

concessions that form part of the Company's Vizcachitas Project

whereby a 2.00% NSR for open pit operations and 1.00% NSR for

underground operations is payable (the “Existing Royalty Purchase

Agreement”). The total purchase price under the Existing Purchase

Price Agreement varies between US$6.8 million and $7.6 million,

depending on the date of exercise of the option. Gemma has made an

initial option payment of US$1 million upon execution of the

Existing Royalty Purchase Agreement, with the following subsequent

option amounts payable as follows:

- an additional US$5.8 million on the date which falls 12 months

of the date of the Existing Royalty Purchase Agreement (in which

case the total option price would be US$6.8 million); or

- at the option of Gemma, an additional US$2.5 million on the

date which falls 12 months from the date of the Existing Royalty

Purchase Agreement along with an additional (a) US$3.6 million on

the date which falls 24 months from the date of the Existing

Royalty Purchase Agreement (in which case the total option price

would be US$7.1 million); or (b) US$2.3 million on the date which

falls 24 months from the date of the Existing Royalty Purchase

Agreement along with an additional US$1.8 million on the date which

falls 30 months from the date of the Existing Royalty Purchase

Agreement (in which case the total option price would be US$7.6

million).

For more information please contact:

| Fernando

Porcile, Executive Chairman |

Tel: +56 2

2954-0450 |

| |

|

| Antony J. Amberg, President & CEO |

Tel: +56 2 2954-0450 |

| |

|

| Blytheweigh, Financial PR |

Tel: +44 207 138 3203 |

| Megan Ray |

|

| Rachael Brooks |

|

E-Mail: info@losandescopper.com

or visit our website at:www.losandescopper.com

Follow us on twitter @LosAndesCopper

Follow us on LinkedIn Los Andes Copper Ltd

About Los Andes Copper Ltd.

Los Andes Copper Ltd. is an exploration and

development company with an 100% interest in the Vizcachitas

Project in Chile. The Company is focused on progressing the

Project, which is located along Chile’s most prolific copper belt,

into production.

The Project is a copper-molybdenum porphyry

deposit, located 120 km north of Santiago, in an area of very

good infrastructure. The Company’s Preliminary Economic Assessment

(the “PEA”), delivered in June 2019, highlights that the Project

has a post tax NPV of $1.8 billion and an IRR of 20.77%, based on a

$3 per pound copper price. It also has a Measured Resources of

254.4 million tonnes having a grade of 0.439% copper and Indicated

Resource of approximately 1.03 billion tonnes having a grade of

0.385% copper. Mineral resources that are not mineral reserves do

not have demonstrated economic viability. Please refer to the

technical report dated June 13, 2019, with an effective date of May

10, 2019 and titled "Preliminary Economic Assessment of the

Vizcachitas Project", prepared by Tetra Tech.

The PEA is preliminary in nature, it includes

inferred mineral resources that are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves, and

there is no certainty that the PEA will be realized.

Additionally, there is significant exploration

upside at Vizcachitas with potential to increase the resource base

beyond the initial 45-year mine life modeled in the PEA.

Los Andes Copper Ltd. is listed on the TSX-V

under the ticker: LA.

Qualified Person

Antony Amberg, the Company’s President and CEO

is the qualified person who has reviewed and approved the

scientific and technical information contained in this news

release.

Certain of the information and statements

contained herein that are not historical facts, constitute

“forward-looking information” within the meaning of the Securities

Act (British Columbia), Securities Act (Ontario) and the Securities

Act (Alberta) (“Forward-Looking Information”).

Forward-Looking Information is often, but not always, identified by

the use of words such as “seek”, “anticipate”, “believe”, “plan”,

“estimate”, “expect” and “intend”; statements that an event or

result is “due” on or “may”, “will”, “should”, “could”, or might”

occur or be achieved; and, other similar expressions. More

specifically, Forward-Looking Information involves known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company, or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

Forward-Looking Information; including, without limitation, the

achievement and maintenance of planned production rates, the

evolving legal and political policies of Chile, the volatility in

the Chilean economy, military unrest or terrorist actions, metal

and energy price fluctuations, favourable governmental relations,

the availability of financing for activities when required and on

acceptable terms, the estimation of mineral resources and reserves,

current and future environmental and regulatory requirements, the

availability and timely receipt of permits, approvals and licenses,

industrial or environmental accidents, equipment breakdowns,

availability of and competition for future acquisition

opportunities, availability and cost of insurance, labour disputes,

land claims, the inherent uncertainty of production and cost

estimates, currency fluctuations, expectations and beliefs of

management and other risks and uncertainties, including those

described in Management’s Discussion and Analysis in the Company’s

financial statements. Such Forward-Looking Information is

based upon the Company’s assumptions regarding global and Chilean

economic, political and market conditions and the price of metals

and energy, and the Company's production. Among the factors

that have a direct bearing on the Company’s future results of

operations and financial conditions are changes in project

parameters as plans continue to be refined, a change in government

policies, competition, currency fluctuations and restrictions and

technological changes, among other things. Should one or more

of any of the aforementioned risks and uncertainties materialize,

or should underlying assumptions prove incorrect, actual results

may vary materially from any conclusions, forecasts or projections

described in the Forward-Looking Information. Accordingly,

readers are advised not to place undue reliance on Forward-Looking

Information. Except as required under applicable securities

legislation, the Company undertakes no obligation to publicly

update or revise Forward-Looking Information, whether as a result

of new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

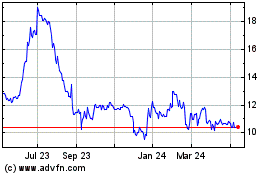

Los Andes Copper (TSXV:LA)

Historical Stock Chart

From Jan 2025 to Feb 2025

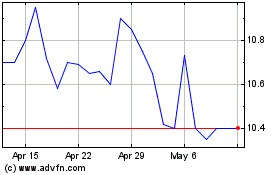

Los Andes Copper (TSXV:LA)

Historical Stock Chart

From Feb 2024 to Feb 2025