Partners Value Investments LP Announces Expiry of Substantial Issuer Bid

December 13 2021 - 5:50AM

Partners Value Investments LP (the “Partnership” or “PVI LP”, TSXV:

PVF.UN TSXV: PVF.PR.U) announced the expiry of its substantial

issuer bid (the "Offer'') to exchange up to 8,000,000 of its Equity

Limited Partnership Units (the “Equity LP Units”) for either, per

Equity LP Unit, (A) US$43.75 cash and 1.05 newly issued Preferred

Limited Partnership Units (the “PVI LP Consideration Units”) in the

capital of PVI LP with a redemption price of US$26.25 (subject to a

maximum of 5,800,000 Equity LP Units) (“Option A”) or, as an

alternative, (B) 2.80 newly issued PVI LP Consideration Units with

a redemption price of US$70 or, in the case of holders of Equity LP

Units that are eligible Canadian corporations, 2.70 newly issued

Preferred Limited Partnership Units (the “SIB LP Consideration

Units”) in the capital of an indirect wholly-owned subsidiary of

the Partnership with a redemption price of US$67.50 (subject to a

maximum of 2,200,000 Equity LP Units) (“Option B”).

In accordance with the terms of the Offer, the

Partnership took up an aggregate of 7,052,230 Equity LP Units.

6,159,204 Equity LP Units were tendered under Option A. Since the

Option A maximum was surpassed, the Equity Units taken up under

Option A, other than for odd lot holders, were subject to a

proration factor of 0.94167599753717. 1,252,230 Equity LP Units

were tendered under Option B. All the Equity Units tendered

pursuant to Option B were taken up without any proration. As a

result of the Equity LP Units tendered under Option A, the

Partnership will pay an aggregate of US$253,750,000 and issue

6,095,619 PVI LP Consideration Units (“Option A Consideration”). As

a result of the Equity LP Units tendered under Option B, the

Partnership will issue an aggregate of 3,375,000 SIB LP

Consideration Units (“Option B Consideration”, together with Option

A Consideration, the “Bid Consideration”). The Bid Consideration

will be paid on or about December 14, 2021. After completion of the

Offer, there will be 66,212,461 Equity LP Units issued and

outstanding.

For further information, contact Investor

Relations at ir@pvii.ca or 416-956-5142.

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of applicable Canadian securities regulations or

applicable U.S. securities regulations. Expressions which are

predictions of or indicate future events, trends or prospects and

which do not relate to historical matters identify forward-looking

information and forward-looking Statements.

Although the Partnership believes that its

anticipated future results, performance or achievements expressed

or implied by the forward-looking statements and information are

based upon reasonable assumptions and expectations, the reader

should not place undue reliance on forward-looking statements and

information because they involve known and unknown risks,

uncertainties and other factors, many of which are beyond its

control, which may cause the actual results, performance or

achievements of the Partnership to differ materially from

anticipated future results, performance or achievement expressed or

implied by such forward-looking statements and information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements and information include, but are not

limited to: the financial performance of Brookfield Asset

Management Inc., the impact or unanticipated impact of general

economic, political and market factors; the behavior of financial

markets, including fluctuations in interest and foreign exchanges

rates; global equity and capital markets and the availability of

equity and debt financing and refinancing within these markets;

strategic actions including dispositions; changes in accounting

policies and methods used to report financial condition (including

uncertainties associated with critical accounting assumptions and

estimates); the effect of applying future accounting changes;

business competition; operational and reputational risks;

technological change; changes in government regulation and

legislation; changes in tax laws, catastrophic events, such as

earthquakes and hurricanes; the possible impact of international

conflicts and other developments including terrorist acts; and

other risks and factors detailed from time to time in the

Partnership’s documents filed with the securities regulators in

Canada.

The Partnership cautions that the foregoing list

of important factors that may affect future results is not

exhaustive. When relying on the Partnership’s forward-looking

statements and information, investors and others should carefully

consider the foregoing factors and other uncertainties and

potential events. Except as required by law, the Partnership

undertakes no obligation to publicly update or revise any

forward-looking statements and information, whether written or

oral, that may be as a result of new information, future events or

otherwise.

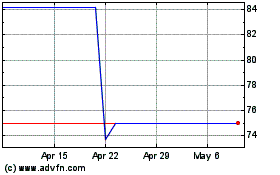

Partners Value Investments (TSXV:PVF.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

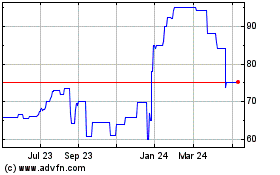

Partners Value Investments (TSXV:PVF.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024