Partners Value Investments Announces Initial Preferred Distributions and Dividend Rate on Preferred Shares

December 13 2023 - 7:00AM

Partners Value Investments L.P. (TSXV: PVF.UN, PVF.PR.U)

(“

PVI LP”) and Partners Value Investments Inc.

(TSXV: PVF.WT, PVF.PR.V) (“

PVII”) today jointly

announce the following expected initial distributions on the Class

A preferred units, Series 1, 2, 3 and 4 of PVI LP and Class A

preferred shares, Series 1 of PVII.

|

Class A preferred units, Series 1 of PVI LP |

US$0.2096 |

|

Class A preferred units, Series 2 of PVI LP |

US$0.1863 |

|

Class A preferred units, Series 3 of PVI LP |

US$0.1863 |

|

Class A preferred units, Series 4 of PVI LP |

US$0.1863 |

|

Class A preferred shares, Series 1 of PVII |

US$0.0038 |

|

|

|

Unitholders of PVI LP and shareholders of PVII

of record at December 29, 2023 will receive the distributions on

January 31, 2024.

PVII also announces a correction to its articles

of amendment dated November 27, 2023. The dividend rate for the

Class A preferred shares, Series 1 of PVII (the “Preferred

Shares”) is 4% per annum equal to$0.01 per Preferred Share

each quarter, rather than $0.04 per Preferred Share each quarter.

Holders of Preferred Shares are entitled to receive an annual

dividend of $0.04 per Preferred Share payable quarterly. PVII

intends to correct its articles of amendment, which will be filed

on PVII’s profile on www.sedarplus.ca. PVII expects trading in the

Preferred Shares to resume by December 15, 2023.

For additional information, please contact Investor Relations at

ir@pvii.ca or 416-643-7621.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of applicable Canadian securities regulations.

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future events or conditions, or

include words such as “expects”, “anticipates”, “plans”,

“believes”, “estimates”, “intends”, “targets”, “projects”,

“forecasts”, “seeks”, “likely” or negative versions thereof and

other similar expressions, or future or conditional verbs such as

“may”, “will”, “should”, “would” and “could”. Forward-looking

statements in this news release include statements relating to

and regarding the corrected articles of amendment and

commencement of trading in the Preferred Shares. Forward-looking

statements are provided for the purpose of presenting information

about current expectations and plans of management of PVII and

readers are cautioned that such statements may not be appropriate

for other purposes. Although management believes that these

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond the control of PVII.

Factors that could cause actual results to

differ materially from those contemplated or implied by forward-

looking statements and information include but are not limited to

risks and factors detailed from time to time in PVII’s and PVI LP’s

documents filed with the securities regulators in Canada.

PVII cautions that the foregoing list of

important factors that may affect future results is not exhaustive.

When relying on PVII’s forward-looking statements and information,

investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. Except as

required by law, PVII undertakes no obligation to publicly update

or revise any forward-looking statements and information, whether

written or oral, that may be as a result of new information, future

events or otherwise.

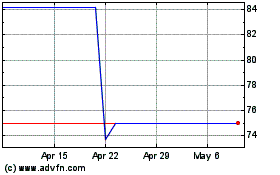

Partners Value Investments (TSXV:PVF.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

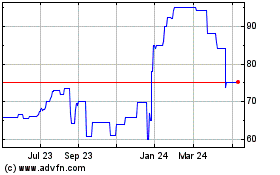

Partners Value Investments (TSXV:PVF.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024