UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

|

|

|

|

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

|

For

the quarterly period ended December 31, 2008

|

|

|

|

OR

|

|

|

|

|

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period from ___________________ to _______________

CHINA

DASHENG BIOTECHNOLOGY COMPANY

(Exact

name of registrant as specified in its charter)

|

Nevada

|

333-141327

|

26-0162321

|

|

(State

or other jurisdiction

of

incorporation or organization)

|

Commission

File Number

|

(I.R.S.

Employer

Identification

No.)

|

Building

B 17th Floor

Century

Plaza

Qingyang

Road

Lanzhou,

Gansu

People's

Republic of China

Telephone

number:

(

86

)

931

8441248

(Address

and telephone number of principal executive offices)

P.O Box

520767

Flushing,

11352, NY

Telephone

number: (

646)

306-1366

(Address

and telephone number of United States agent offices)

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

þ

No

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large

accelerated filer

o

|

|

|

Accelerated

filer

o

|

|

|

|

|

|

|

Non-accelerated

filer

o

|

(Do

not check if a smaller reporting company)

|

|

Smaller

reporting company

þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes

o

No

þ

As of

February 5, 2009, 30,000,000 shares of common stock, par value $.001

per share, were outstanding.

|

TABLE OF CONTENTS

|

|

|

|

|

|

PART I. FINANCIAL INFORMATION

|

|

|

|

|

|

Item 1. Financial Statements Consolidated Balance Sheets as of

June 30, 2008

(Unaudited) and December 31, 2008

|

3

|

|

|

|

|

Consolidated Statements of Operations for three months and

six months ended December 31, 2008 and 2007 (Unaudited)

|

4

|

|

|

|

|

Consolidated Statements of Cash Flows for

the six months ended December 31, 2008 and 2007 (Unaudited)

|

5

|

|

|

|

|

Notes to Consolidated Financial Statements

|

6 - 9

|

|

|

|

|

Item 2. Management's Discussion and Analysis of Financial

Condition and Results of Operations

|

10

|

|

|

|

|

Item 3. Quantitative and Qualitative Disclosures About

Market Risk

|

|

|

|

|

|

Item 4. Controls and Procedures

|

12

|

|

|

|

|

PART II. OTHER INFORMATION

|

|

|

|

|

|

Item 1. Legal Proceedings

|

13

|

|

|

|

|

Item 2. Unregistered Sales of Equity Securities and Use of

Proceeds

|

13

|

|

|

|

|

Item 3. Defaults Upon Senior Securities

|

13

|

|

|

|

|

Item 4. Submission of Matters to a Vote of Security Holders

|

13

|

|

|

|

|

Item 5. Other Information

|

13

|

|

|

|

|

Item 6. Exhibitions

|

13

|

|

|

|

|

Signatures

|

14

|

CHINA DASHENG BIOTECHNOLOGY COMPANY

(FORMERLY NAMED

AS MAX NUTRITION INC.)

CONSOLIDATED BALANCE SHEETS

AS OF

DECEMBER 31, 2008 and JUNE 30, 2008

(in US DOLLARS)

|

|

|

31-Dec-08

|

|

|

30-Jun-08

|

|

|

|

|

(UNAUDITED)

|

|

|

|

|

|

ASSETS

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash & cash

equivalents

|

$

|

7,820,979

|

|

$

|

1,561,403

|

|

|

Accounts receivable, net of allowance

for doubtful accounts of $22,831 and $16,303, respectively

|

|

3,306,404

|

|

|

3,244,476

|

|

|

Inventory

|

|

463,356

|

|

|

561,883

|

|

|

Advances to suppliers

|

|

88,090

|

|

|

1,486,379

|

|

|

Due from related parties

|

|

94,247

|

|

|

1,580,820

|

|

|

Prepayments and other

current assets

|

|

22,048

|

|

|

35,675

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

11,795,124

|

|

|

8,470,636

|

|

|

|

|

|

|

|

|

|

|

Investment in Real Estate Ventures

|

|

6,518,218

|

|

|

6,483,437

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net of

accumulated depreciation

|

|

1,457,819

|

|

|

1,618,829

|

|

|

|

|

|

|

|

|

|

|

Other Assets

|

|

|

|

|

|

|

|

Land use right, net of accumulated

amortization

|

|

1,484,856

|

|

|

1,531,555

|

|

|

Notes receivable

|

|

1,046,745

|

|

|

998,502

|

|

|

Long-term prepayments

|

|

1,264,562

|

|

|

1,150,082

|

|

|

|

|

|

|

|

|

|

|

Total other

assets

|

|

3,796,163

|

|

|

3,680,139

|

|

|

|

|

|

|

|

|

|

|

Total

Assets

|

$

|

23,567,324

|

|

$

|

20,253,041

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND

STOCKHOLDERS' EQUITY

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Accounts payable

|

$

|

287,287

|

|

$

|

725,680

|

|

|

Accrued expenses and other

payables

|

|

747,279

|

|

|

809,463

|

|

|

Payable to

related parties

|

|

18,143

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

1,052,709

|

|

|

1,535,143

|

|

|

|

|

|

|

|

|

|

|

Long-term payable - land use right

|

|

1,466,963

|

|

|

1,459,137

|

|

|

|

|

|

|

|

|

|

|

Minority Interest

|

|

3,159,318

|

|

|

2,282,109

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity:

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par

value, 1,000,000 shares authorized,

|

|

|

|

|

|

|

|

- 0 -

shares issued and outstanding at December 31, 2008 and June 30, 2008

|

|

-

|

|

|

-

|

|

|

Common stock, $0.001 par value,

74,000,000 and 74,000,000 shares

|

|

|

|

|

|

|

|

authorized, 30,000,000 and 30,000,000 shares issued and outstanding

at

|

|

|

|

|

|

|

|

December 31, 2008 and June 30,

2008, respectively

|

|

30,000

|

|

|

30,000

|

|

|

Additional

paid-in-capital

|

|

3,846,035

|

|

|

3,846,035

|

|

|

Statutory surplus reserve and

common welfare fund

|

|

2,771,281

|

|

|

1,837,187

|

|

|

Retained

earnings

|

|

10,135,534

|

|

|

8,009,800

|

|

|

Accumulated other comprehensive

income

|

|

1,105,484

|

|

|

1,253,630

|

|

|

|

|

|

|

|

|

|

|

Total

stockholders' equity

|

|

17,888,334

|

|

|

14,976,652

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity

|

$

|

23,567,324

|

|

$

|

20,253,041

|

|

See accompanying notes to the Unaudited Consolidated Financial

Statements

3

CHINA

DASHENG

BIOTECHNOLOGY

COMPANY

(FORMERLY

NAMED

AS MAX

NUTRITION

INC.)

CONSOLIDATED

STATEMENTS

OF

OPERATIONS

FOR THE SIX AND

THREE

MONTHS

ENDED

DECEMBER

31, 2008

AND 2007

(in US

DOLLARS)

|

|

For the six

months ended December 31,

|

For

the three months ended December 31

,

|

|

|

|

2008

|

|

2007

|

|

2008

|

|

2007

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales

|

$

|

10,768,309

|

$

|

7,715,124

|

$

|

5,660,793

|

$

|

4,708,687

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales

|

|

(5,604,860)

|

|

(4,189,838)

|

|

(2,938,255)

|

|

(2,378,083)

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

5,163,449

|

|

3,525,286

|

|

2,722,538

|

|

2,330,604

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

649,909

|

|

400,803

|

|

298,982

|

|

250,726

|

|

General and administration expense

|

|

825,167

|

|

483,939

|

|

370,252

|

|

284,269

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

1,475,076

|

|

884,742

|

|

669,234

|

|

534,995

|

|

|

|

|

|

|

|

|

|

|

|

Income from

Operations

|

|

3,688,373

|

|

2,640,544

|

|

2,053,304

|

|

1,795,609

|

|

|

|

|

|

|

|

|

|

|

|

Other Income

and Expenses:

|

|

|

|

|

|

|

|

|

|

Interest income (expenses)

|

|

53,592

|

|

(35,031)

|

|

27,355

|

|

(12,648)

|

|

Other income

|

|

2,925

|

|

-

|

|

(0)

|

|

-

|

|

Other expenses

|

|

(5,099)

|

|

(59,787)

|

|

(175)

|

|

(64,333)

|

|

|

|

|

|

|

|

|

|

|

|

Total other income and

(expense)

|

|

51,418

|

|

(94,818)

|

|

27,180

|

|

(76,981)

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes and

minority interest

|

|

3,739,791

|

|

2,545,726

|

|

2,080,484

|

|

1,718,628

|

|

|

|

|

|

|

|

|

|

|

|

Minority Interest

|

|

(679,966)

|

|

(391,474)

|

|

(348,929)

|

|

(220,231)

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

$

|

3,059,825

|

$

|

2,154,252

|

$

|

1,731,555

|

$

|

1,498,397

|

|

|

|

|

|

|

|

|

|

|

|

Other Comprehensive Income:

|

|

|

|

|

|

|

|

|

|

Foreign currency

translation adjustment

|

|

(148,147)

|

|

528,136

|

|

(245,382)

|

|

352,752

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive

income

|

$

|

2,911,678

|

$

|

2,682,388

|

$

|

1,486,173

|

$

|

1,851,149

|

|

|

|

|

|

|

|

|

|

|

|

Basic and

Diluted Income per common share

|

|

|

|

|

|

|

|

|

|

Basic

|

$

|

0.10

|

$

|

0.07

|

$

|

0.06

|

$

|

0.05

|

|

Diluted

|

$

|

0.10

|

$

|

0.07

|

$

|

0.06

|

$

|

0.05

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average common share outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

30,000,000

|

|

30,000,000

|

|

30,000,000

|

|

30,000,000

|

|

Diluted

|

|

30,000,000

|

|

30,000,000

|

|

30,000,000

|

|

30,000,000

|

See accompanying notes to the Unaudited Consolidated Financial

Statements

4

CHINA DASHENG BIOTECHNOLOGY COMPANY

(FORMERLY NAMED

AS MAX NUTRITION INC.)

CONSOLIDATED STATEMENTS OF CASH

FLOWS

FOR THE SIX MONTHS ENDED DECEMBER 31, 2008 AND 2007

(

in US DOLLARS)

|

|

|

For the six months ended December 31,

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Cash Flows From Operating

Activities:

|

|

|

|

|

|

|

|

Net income

|

$

|

3,059,825

|

|

$

|

2,154,252

|

|

|

Adjustments

to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

Minority interest in net income of consolidated

subsidiaries

|

|

679,966

|

|

|

391,474

|

|

|

Interest income from real estate project

|

|

-

|

|

|

-

|

|

|

Bad debt expense

|

|

6,528

|

|

|

-

|

|

|

Depreciation expense

|

|

158,023

|

|

|

167,042

|

|

|

Amortization expense

|

|

46,699

|

|

|

74,500

|

|

|

Loss on sale of

fixed asset

|

|

4,923

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Changes

in operating assets and liabilities:

|

|

|

|

|

|

|

|

Accounts receivable

|

|

(68,455

|

)

|

|

(730,476

|

)

|

|

Inventory

|

|

(71,612

|

)

|

|

379,534

|

|

|

Advance to suppliers

|

|

1,398,289

|

|

|

888,430

|

|

|

Prepayments and other current assets

|

|

(100,852

|

)

|

|

|

|

|

Accounts payable

|

|

(268,254

|

)

|

|

(172,232

|

)

|

|

Accrued expenses and other current liabilities

|

|

(62,186

|

)

|

|

(1,635,086

|

)

|

|

|

|

|

|

|

|

|

|

Cash provided (used) by

operating activities

|

|

4,782,894

|

|

|

1,517,438

|

|

|

|

|

|

|

|

|

|

|

Cash Flows From Investing

Activities:

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment

|

|

1,935

|

|

|

(22,431

|

)

|

|

|

|

|

|

|

|

|

|

Cash used in investing activities

|

|

1,935

|

|

|

(22,431

|

)

|

|

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities:

|

|

|

|

|

|

|

|

Repayment of long-term debt

|

|

-

|

|

|

(1,151,537

|

)

|

|

Amounts received from (paid to) related parties

|

|

-

|

|

|

823,740

|

|

|

Collection from related parties

|

|

1,513,196

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

Cash provided by

financing activities

|

|

1,513,196

|

|

|

(327,797

|

)

|

|

|

|

|

|

|

|

|

|

Effect of currency exchange rate on cash

and cash equivalents

|

|

(38,449

|

)

|

|

124,710

|

|

|

|

|

|

|

|

|

|

|

Increase in cash and cash

equivalents

|

|

6,259,576

|

|

|

1,291,920

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents - Beginning of

the year

|

|

1,561,403

|

|

|

1,316,569

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents - Ending of

the year

|

$

|

7,820,979

|

|

$

|

2,608,489

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information:

|

|

|

|

|

|

|

|

Interest paid

|

$

|

41,760

|

|

$

|

-

|

|

|

Income Taxes paid

|

|

-

|

|

|

-

|

|

See accompanying notes to the Unaudited Consolidated Financial

Statements

5

CHINA DASHENG BIOTECHNOLOGY COMPANY

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

China Dasheng Biotechnology Company (“Dasheng” or the

“Company”) was incorporated in the state of Nevada on January 12, 2007, under

the original name of Max Nutrition Inc, as a holding vehicle for selling the

nutritional supplements.

On January 29, 2008, Pursuant to an Agreement and Plan of

Reorganization, American Spring Pharmaceutical, Inc., a Delaware corporation

(“ASPI”) purchased an aggregate of 7,700,000 shares of the 10,000,000 issued and

outstanding shares of Max Nutrition common stock for $183,000 and ASPI's

transfer of 100% of the issued and outstanding shares of Gansu Dasheng Biology

Science and Technology Stock Co., Ltd. (“Dasheng”) to Max Nutrition in exchange

for 20,000,000 shares of the common stock of Max Nutrition. Upon completion of

the transaction, ASPI distributed 27,700,000 shares of Max Nutrition common

stock it received from Max Nutrition and the Max Nutrition' previous principal

stockholder to Dasheng's shareholders, pro rata. At the effective time of the

merger, the total number of shares of Max Nutrition acquired and number of

shares of Max Nutrition Common Stock issued to the shareholders of Dasheng

pursuant to the agreement, represented approximately 92.33% of the outstanding

shares of Max Nutrition's common stock after giving effect to Max Nutrition's

acquisition of Dasheng. As a result of the ownership interests of the former

shareholders of Dasheng, for financial statement reporting purposes, the merger

between the Company and Dasheng has been treated as a reverse acquisition with

Dasheng deemed as the accounting acquirer and the Max Nutrition deemed the

accounting acquire in accordance with Statement of Financial Accounting

Standards No. 141 “Business Combinations” (“SFAS No. 141”). The reverse merger

is deemed as a recapitalization of Dasheng and the net assets of Dasheng (the

accounting acquirer) are carried forward to the Company (the legal acquirer and

the reporting entity) at their historical carrying value before the combination.

The assets and liabilities of Dasheng are recorded at historical cost.

Gansu Dasheng Biology Science and Technology Stock Co., Ltd.

was incorporated on October 16, 2002, in the City of Lanzhou, Gansu Province,

People's Republic of China (“PRC”). Dasheng operates within the biological

products and agents market. This space includes organic fertilizers,

non-chemical agents, and biological agents based additives.

On March 6, 2008, the Company changed its name to China Dasheng

Biotechnology Company.

The Company derived its revenues from the sale of products in

the biological products and agents market. All revenues generated are from sales

to customers in China. The Company has two majority-owned subsidiaries in China.

It has 80% interest in Hainan Lüshen Biology Technology Co., Ltd. (“Lüshen”)

located in HaiKou, Hainan Province, China. Lüshen engages in developing,

manufacturing and marketing artificial microorganisms (“AM”), high-efficiency

microorganism (“HM”) based biological bacterium blends, and biological

preservatives. The Company also has a 60% interest in Yangling Elemiss Foods Co., Ltd. (“Elemiss”) located in City of

Yangling, Shaanxi Province, China. Elemiss engages in developing, manufacturing

and marketing artificial microorganism (“AM”) based biological bacterium blends,

and Bulgarian lactobacillus live stock feed additives.

6

CHINA DASHENG BIOTECHNOLOGY COMPANY

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Interim financial statements

The accompanying unaudited interim financial statements of

China DaSheng Biotechnology Company have been prepared in accordance with

accounting principles generally accepted in the United States of America and the

rules of the Securities and Exchange Commission, and should be read in

conjunction with the audited consolidated financial statements and notes thereto

contained in the Company's Amendment No. 1 to Annual Report filed with the SEC

on Form 10-K/A. In the opinion of management, all adjustments, consisting of

normal recurring adjustments, necessary for a fair presentation of financial

position and the results of operations for the interim periods presented have

been reflected herein. The results of operations for the interim periods are not

necessarily indicative of the results to be expected for the full year. Notes to

the consolidated financial statements which would substantially duplicate the

disclosure contained in the audited consolidated financial statements for 2008

as reported in the 10-K/A have been omitted.

Basis of presentation and consolidation

The consolidated financial statements include the financial

statements of DaSheng, and its wholly owned subsidiary, and its majority-owned

subsidiaries, Lüshen and Elemiss. All significant inter-company transactions and

balances among the Company and its subsidiary are eliminated upon consolidation.

Reclassifications

Certain previously reported amounts have been reclassified to

conform to classifications adopted in the period ended December 31, 2008.

NOTE 3 – INVENTORY

The inventory consists of the following as of December 31, 2008

and June 30, 2008:

7

CHINA DASHENG BIOTECHNOLOGY COMPANY

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

|

|

|

Balance as of

|

|

|

|

|

December 31, 2008

|

|

|

June

30, 2008

|

|

|

Raw materials

|

$

|

23,089

|

|

$

|

218,985

|

|

|

Packing materials

|

|

41,480

|

|

|

14,461

|

|

|

Work-in-process

|

|

314,629

|

|

|

246,695

|

|

|

Finished goods

|

|

84,158

|

|

|

81,742

|

|

|

|

|

|

|

|

|

|

|

Total

|

$

|

463,356

|

|

$

|

561,883

|

|

No allowance for inventory was made as of December 31, 2008 and

June 30, 2008.

NOTE 4 – RELATED PARTY TRANSACTIONS

The detail of related party transactions is as follows:

(i) Office space

On December 1, 2006, Lüshen entered into a non-cancellable

operating lease for its manufacturing facility in Hainan Province from Dasheng

Industries Co., Ltd., an affiliate of the Company, expiring November 30, 2026.

Lüshen prepaid the total lease obligation of RMB3.0 million (equivalent to

$439,722 and $437,375 at December 31, 2008 and June 30, 2008 respectively) upon

signing the lease, which approximates the present fair market value of the

lease.

(ii)

Due from (+) and to

(-) related parties

|

|

|

Balance as of

|

|

|

|

|

December 31, 2008

|

|

|

June

30, 2008

|

|

|

Receivables from shareholders/officers

|

$

|

94,247

|

|

$

|

1,580,820

|

|

|

Payable to shareholder

|

|

(18,143

|

)

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Total

|

$

|

76,104

|

|

$

|

1,580,820

|

|

The advances to shareholders/officers bear no interest and have

no formal repayment terms.

NOTE 5 – INCOME TAXES

The Company is governed by the Income Tax Law of the People's

Republic of China concerning foreign invested companies, which, until January

2008, generally subject to tax at a statutory rate of 33% (30% state income tax plus 3%

local income tax) on income reported in the statutory financial statements after

appropriate tax adjustments.

8

CHINA DASHENG BIOTECHNOLOGY COMPANY

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

Substantially all of the Company's taxable income and related

tax expense are from PRC sources. Dasheng, Lüshen and Elemiss file separate

income tax returns under the Income Tax Law of the People's Republic of China

concerning Foreign Investment Enterprises and Foreign Enterprises and local

income tax laws (the “PRC Income Tax Law”). In accordance with the relevant

income tax laws, the profits of the Company derived from agribusiness are fully

exempted from income taxes and the profits of the Company derived from real

estate investment are subject to income taxes. As of September 30, 2008 and

2007, the Company derived all of its revenues and profits from its agriculture

business.

On March 16, 2007, the National People's Congress of China

approved the Corporate Income Tax Law of the People's Republic of China (the

“New CIT Law”), which is effective from January 1, 2008. Under the new law, the

corporate income tax rate applicable to all Companies, including both domestic

and foreign-invested companies, will be 25%, replacing the current applicable

tax rate of 33%. However, tax concession granted to eligible companies prior to

the new CIT laws will be grand fathered in.

The Company has been formally approved by the local tax bureau

for the favorable tax benefit enjoyed by the foreign invested company, which

allows two-year tax exemption from income tax from January 1, 2007 through

December 31, 2008, and three-year 50% tax reduction from January 1, 2009 to

December 31, 2011. As a result of this tax reduction benefit, the Company is

still subject to income tax exemption for the three months ended December 31,

2008.

9

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking”

statements as such term is defined in the Private Securities Litigation Reform

Act of 1995 and information relating to the Company that is based on the beliefs

of the Company's management as well as assumptions made by and information

currently available to the Company's management. When used in this report, the

words “anticipate,” “believe,” “estimate,” “expect” and “intend” and words or

phrases of similar import, as they relate to the Company or Company management,

are intended to identify forward-looking statements. Such statements reflect the

current risks, uncertainties and assumptions related to certain factors

including, without limitations, competitive factors, general economic

conditions, customer relations, relationships with vendors, the interest rate

environment, governmental regulation and supervision, seasonality, distribution

networks, product introductions and acceptance, technological change, changes in

industry practices, onetime events and other factors described herein and in

other filings made by the company with the Securities and Exchange Commission.

Based upon changing conditions, should any one or more of these risks or

uncertainties materialize, or should any underlying assumptions prove incorrect,

actual results may vary materially from those described herein as anticipated,

believed, estimated, expected or intended. The Company does not intend to update

these forward-looking statements.

Management's Discussion and Analysis of Financial Condition and

Results of Operations

RESULTS OF OPERATIONS – Second Quarter of Fiscal 2008

compared to Second Quarter of Fiscal 2009

RESULTS OF OPERATIONS – Three months ended December

31

st

, 2008 compared to three months ended December 31

st

,

2007.

Revenues for the three months

ended December 31

st

, 2008 were $5,660,793. Compared to $4,708,687 for

the same period of year 2007, there was $952,106 or 20.2% increase in revenues.

This increase is due to the continuous sales growth of AM/HM Crop additives and

FGW Preservatives. Compared to the data in the same period of year 2007, revenue

from AM/HM Crop additives was increased 36.5% in 2008 and revenue from FGW

Preservatives was increased 70.2% . The revenue from AM/HM Livestock feed

additives were slightly down by 7.6%, which might suggest an increased

competition in the livestock feed additive market. Overall, we are still able to

see the healthy operation and potential market growth for our product line.

The following is a breakdown of revenue by products as a

percentage of total revenue:

|

|

Percentage of Q2 2008

|

Percentage of Q2 2009

|

|

Product line

|

|

AM/HM Crop additives

|

$2,552,579.2

|

54.21%

|

$3,483,085.9

|

61.53%

|

|

AM/HM Livestock additives

|

$1,915,964.7

|

40.69%

|

$1,768,997.8

|

31.25%

|

|

FGW Preservatives

|

$ 240,143.1

|

5.1%

|

$ 408,709.3

|

7.22%

|

|

Total

|

$4,708,687

|

100%

|

$5,660,793

|

100%

|

10

Most of the revenues were

realized in South region and from Hainan Lushen Subsidiary due to winter season.

Gross profit for the three months

ended December 31

st

, 2008 was $2,722,538, an increase of $391,934 or

16.8% compared to the same period in year 2007. This increase in gross profit is

due to the revenue growth showed above.

Operating expenses for the three

months ended December 31

st

, 2008 were $669,324. Compared to $534,995

in the same period on year 2007, the operating expenses was increased by

$134,329 or 25.1% overall. Within it, we can see the selling expense was

increased by $48,256 or 19.2% and general administration expense by $85,983 or

30.2%. The big jump for the general administration expense was due to the

increased spending on sales promotion, advertising and professional fees. This

also reflects the increased competition in the industry.

Even facing the increased

competition, the net income for the three months ended December 31

st

,

2008 was $1,731,555, and increase of $233,158 or 15.6% compared to the same

period in year 2007. The increase in net income is due to our sales growth and

we can see we are able to keep healthy profit margin.

RESULTS OF OPERATIONS – First Two quarters of 2009 Compared

to First Two Quarters of 2008

The Company has one reportable segment that is engaged in

manufacturing and marketing certain products that are primarily fertilizer and

livestock feed.

Net Sales increased from

$7,715,124 in the first two quarters of fiscal 2008 to $10,768,309 in the

first two quarters of fiscal 2009, an increase of $3,053,185 or 39.6%. This

is due to an increase in our unit sales. Gross Profit increased from

$3,525,286 in the first two quarters of fiscal 2008 to $5,163,449 in the

first two quarters of fiscal 2009 an increase of $1,638,163 or 46.5%. The

higher revenues and gross profits reflect a greater acceptance of the

Company's products. The increase for the general administration expense was

due to the increased spending on sales promotion, advertising and

professional fees. Net Income increased from $2,154,252 in the first two

quarters of Fiscal 2008 to $3,059,825 in the first two quarters of fiscal

2009, an increase of $905,573 or 42.0%.

11

LIQUIDITY AND CAPITAL RESOURCES

We continued to strengthen our

balance sheet in the second quarter of year 2009. Total assets and

stockholders' equity have both increased. Currently, we utilized short-term

bank financing to provide operating liquidity needs for our operation and

growth. For the long-term, we plans to seek additional equity or debt to

increase our plant capacity and company head counts to support the increased

operation activities.

Cash flow from operating

activities increased by $3,265,456 compared the six months ended December

31, 2009 to the six months ended December 31, 2008. The increase is due to

increase in net income and less advance payment to suppliers.

Cash flow from financing

activities increased by $1,840,993 compared the six months ended December

31, 2009 to the six months ended December 31, 2008. The increase is due to

the collection of notes receivables from related parties.

CRITICAL ACCOUNTING POLICIES AND USE OF ESTIMATES

The discussion and analysis of our financial condition and

results of operations are based on our unaudited financial statements, which

have been prepared according to U.S. generally accepted accounting principles.

In preparing these financial statements, we are required to make estimates and

judgments that affect the reported amounts of assets, liabilities, revenues and

expenses and related disclosures of contingent assets and liabilities. We

evaluate these estimates on an ongoing basis. We base these estimates on

historical experience and on various other assumptions that we believe are

reasonable under the circumstances, the results of which form the basis for

making judgments about the carrying values of assets and liabilities. Actual

results may differ from these estimates under different assumptions or

conditions.

ITEM 4. CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are

designed to ensure that information required to be disclosed in our Securities

Exchange Act reports is recorded, processed, summarized and reported within the

time periods specified in the SEC's rules and forms, and that such information

is accumulated and communicated to our management, including our Principal

Executive Officer and Principal Financial Officer, as appropriate, to allow

timely decisions regarding required disclosure. In designing and evaluating the

disclosure controls and procedures, management recognized that any controls and

procedures, no matter how well designed and operated, can provide only

reasonable assurance of achieving the desired control objectives, as ours are

designed to do, and management necessarily was required to apply its judgment in

evaluating the cost-benefit relationship of possible controls and procedures.

As of December 31, 2008, we carried out an evaluation, under

the supervision and with the participation of our management, including our

Principal Executive Officer and Principal Financial Officer, of the

effectiveness of the design and operation of our disclosure controls and

procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities

Exchange Act of 1934. Based upon that evaluation, our Principal Executive

Officer and Principal Financial Officer concluded that our disclosure controls

and procedures are effective in enabling us to record, process, summarize and

report information required to be included in our periodic SEC

filings within the required time period.

12

(b) Changes in Internal Controls

There have been no changes in our internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial

reporting.

PART II

OTHER INFORMATION

Item 1. Legal Proceedings

The company is not party to any material legal proceeding.

Item 2. Changes in Securities

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Submission of Matters to a Vote of Security Holders

None.

Item 5. Other Information

None.

Item 6. Exhibits and Reports on Form 8-K

13

a) EXHIBITS

b) REPORTS ON FORM 8-K

On November 20, 2008, the Company filed a report on Form 8-K,

dated November 17, 2008, responding to Item 5.02 Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers which reflected the resignation of

its CEO and appointment of new officers and a new director

On October 28, 2008, the Company filed a report on Form 8-K,

dated October 23, 2008, responding to ITEM 7.01. Regulation FD Disclosure which

included information shown to attendees at a conference.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned, thereunto duly authorized.

China Dasheng Biotechnology Company

By:

/s/ Sidong Zhang

Sidong Zhang

Chief Executive Officer and President

(Principal Executive

Officer)

Date: February __, 2009

/s/ Hongsheng Wang

Hongsheng Wang

Chief

Financial Officer

(Principal Financial and Accounting Officer)

14

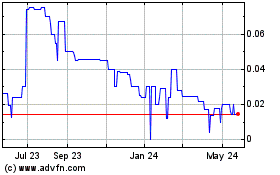

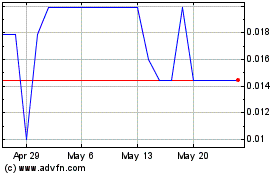

China Dasheng Biotechnol... (PK) (USOTC:CDBT)

Historical Stock Chart

From Jan 2025 to Feb 2025

China Dasheng Biotechnol... (PK) (USOTC:CDBT)

Historical Stock Chart

From Feb 2024 to Feb 2025