false

0000717588

0000717588

2024-03-08

2024-03-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 OR

15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest

event reported): March 8, 2024

CHINA SOLAR & CLEAN ENERGY SOLUTIONS, INC.

(Exact name of registrant as

specified in its charter)

| Nevada |

|

000-12561 |

|

95-3819300 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

2 Valley View Drive |

|

|

| |

|

Avon, New York 14414 |

|

|

| |

|

(Address of principal offices) |

|

|

| |

|

|

|

|

| |

|

+1-315-451-7515 |

|

|

| |

|

(Registrant’s Telephone Number) |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

(Former name or former address, if changed since last report) |

|

|

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| n/a |

CSOL |

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

SECTION 1 – REGISTRANT’S

BUSINESS AND OPERATION

Item 1.01 Entry

into a Material Definitive Agreement

Asset Purchase Agreement

On March 5, 2024, China Solar & Clean Energy

Solutions, Inc (the “Company) entered into an asset purchase agreement (the “Asset Purchase Agreement”) with Easy Modular

Manufacturing, Inc (“Easy Modular Manufacturing”) for the purchase of the asset Easy Nano-Void Injection System Modular (the

“Product”). The Company consummated the acquisition and acquired the assets on March 1, 2024 (the “Closing Date”)

for cash consideration and contingent consideration.

The Asset Purchase Agreement contains customary

representations and warranties and covenants by each party. The foregoing description of the Asset Purchase Agreement does not purport

to be complete and is qualified in its entirety by reference to the full text of the Asset Purchase Agreement, a copy of which is attached

hereto as Exhibit 2.01 and is incorporated herein by reference.

China Solar & Clean Energy Solutions, Inc

has updated their Company Business Plan which is attached hereto as Exhibit 2.02

SECTION 9 – FINANCIAL STATEMENTS

AND EXHIBITS

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1933, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| Dated:

March 8, 2024 |

|

China Solar & Clean Energy Solutions, Inc. |

| |

|

|

| |

|

By:

/s/SHELLI FIELDS

|

| |

|

Name: Shelli Fields |

| |

|

Title: President / CEO |

| |

|

|

| 1. |  THE PARTIES THE PARTIES |

| 2. |  DESCRIPTION

OF THE ASSET(S) DESCRIPTION

OF THE ASSET(S) |

| 3. |  SALE

AND PURCHASE SALE

AND PURCHASE |

| 4. |  PURCHASE

PRICE AND PAYMENT PURCHASE

PRICE AND PAYMENT |

The purchase

price to be paid to the Seller

by the Buyer for the Asset(s) shall

be Two Hundred Thousand and 00/100 (US $200,000.00)

Unites States Dollars (the “Purchase Price”),

payable on or before seven days

from the date of execution (the “Closing

Date”).

| 5. |  INSPECTION PERIOD INSPECTION PERIOD |

| 6. |  CONDITIONS

FOR THE

CLOSING CONDITIONS

FOR THE

CLOSING |

| 8. |  NOTICES NOTICES |

| 9. |  BINDING

AGREEMENT BINDING

AGREEMENT |

| 10. |  SEVERABILITY SEVERABILITY |

| 11. |  BINDING

ARBITRATION BINDING

ARBITRATION |

In

the event of any dispute, claim, question, or disagreement

arising from or relating to this Agreement

or the breach thereof, the Parties hereto shall

use their best efforts to settle the dispute,

claim question, or disagreement. To this effect,

they shall consult and negotiate with each

other in good faith and, recognizing their mutual

interests, attempt to reach a just and equitable

solution satisfactory to both Parties. If

they do not reach such a solution within

a period of sixty (60) days, then, upon notice

by either Party to the other,

all disputes, claims, questions, or disagreements

shall be settled by arbitration

administered by the American Arbitration

Association in accordance with its Commercial Arbitration

Rules including the Optional Rules for Emergency Measures of

Protection, and judgment on any award

rendered by the arbitrator(s) may be entered

in any court having jurisdiction

thereof.

| 12. |  GOVERNING LAW GOVERNING LAW |

| 13. |  MULTIPLE

COUNTERPARTS MULTIPLE

COUNTERPARTS |

| 14. |  ENTIRE

AGREEMENT ENTIRE

AGREEMENT |

This Agreement,

including and together with any related

exhibits, schedules, attachments, and appendices, constitutes the sole and

entire agreement of the Parties with respect

to the subject matter contained herein and supersedes

all prior and contemporaneous understandings, agreements, representations, and warranties,

both written and oral, regarding such subject matter.

In Witness Whereof,

the Parties hereto have executed this Agreement as

of the last date written below.

BILL OF SALE

THIS BILL

OF SALE is made as of the 5th

day of March,

2024, by EASY MODULAR MANUFACTURING, INC.,

a Minnesota Corporation having a business

address of 40 Good Counsel Dr., Suite

200, Mankato, MN 56001 (“Seller”),

in favor of CHINA SOLAR AND CLEAN ENERGY

SOLUTIONS, INC., a Nevada corporation having a business address

at 2 Valley View Dr., Avon, NY 14414 (“Buyer”).

This Bill of Sale is being executed pursuant

to the terms of that certain Asset Purchase

Agreement (“Asset Purchase Agreement”), dated March 1, 2024, by and

between Seller and Buyer.

| 1. | Seller does hereby transfer,

grant, convey, assign, and relinquish exclusively to Buyer all of Seller’s

right, title, and interest in the property described on Schedule

1 of the Asset Purchase Agreement, which schedule

is also attached hereto and incorporated herein

(the “Assets”). |

| 2. | Seller represents and warrants

that Buyer shall receive, complete and

exclusive right, title, and interest in and

to all of the Assets free and clear of all

claims, liens and encumbrances as of the date hereof. |

The undersigned,

being duly authorized, has executed this Bill

of Sale as of the date first above written.

EASY MODULAR MANUFACTURING,

INC.

By:

Mark Gaalswyk, CEO Date: March 1, 2024

China Solar

Business Plan

Created on March 5, 2024

China Solar

Product

China Solar provides

pond, lake and lagoon water

clean-up services to agricultural entities,

municipalities, government entities, HOA’s

and private and municipal golf courses. China

Solar utilizes Easy Modular Manufacturing, Inc.’s (EMM) “Easy Nano Void”

systems to accomplish our water clean-up goals. EMM offers varying sizes of nano void generation systems; China Solar initially purchased

one of these systems for $200,000.

Key partnerships

China Solar will work

closely with Easy Modular Manufacturing, Inc.

to accommodate its customers’ needs. China

Solar will be purchasing all necessary nano void generation

systems from EMM and working

closely with them as their equipment support

arm. China Solar may partner with existing turf

management and municipal services companies to accomplish

our goals.

China Solar’s

Strategic Partner, Easy

Modular Manufacturing’s Easy Nano

Void System:

Key

activities and resources

China Solar will be competitive

in the water clean-up space due to the

cutting edge patented nanobubble technology

being utilized by Easy Modular

Manufacturing, inc. China Solar will work directly with customers

in the golf and waterway sectors,

while pulling experience and support from EMMs

network of municipal, recreational, private

turf, and agriculture companies across the United

States of America to immediately begin impacting

waterways for the better.

Additionally, EMM offers

a patented microbial fertilizer

product, Terreplenish, which will go

hand in hand with the water clean-up efforts

of China Solar.

Value proposition

China Solar offers

a unique solution to dead zones and low-quality

bodies of water by utilizing patented

nanobubble technology; creating a healthier environment

for all local inhabitants, human or otherwise.

Customer relationships

A goal

of China Solar’s is to create a closer

community which understands and values

clean waterways, this will be accomplished in

many ways. Customers will interact

with China Solar through multiple media. China Solar will interact

directly with customers at local golf course management

trade shows as well as accepting phone

calls and internet leads.

Customers

will engage China Solar for their water

clean-up needs; paying a per hour operating

fee (initially $18 per hour or $420 per

24-hour day) based on the necessary equipment.

China Solar will operate this equipment on their

site for the allotted time period, paying

EMM a 20% portion of the received per hour operating

revenue as an ongoing licensing and remote

management fee as all of the

nanobubble systems offered

by EMM will have remote

monitoring and optimization capabilities to log hours

of operation and allow remote “tuning”

of system to optimize water

clean-up. The system can

be disabled remotely if payments are not made timely.

The system’s location is GPS monitored

to prevent theft.

Customer segments

China Solar will serve

golf courses, HOA’s, and government entities

and municipalities across North America, engaging local

natural resource experts to identify areas of need.

Channels

China Solar will communicate

with customers in various ways

including but not limited to: email outreach, exhibiting

at trade shows, and through the network of their equipment

partner Easy Modular Manufacturing, Inc.

Cost

structure

China Solar will focus

on maximizing the value of their equipment. Each

“Easy Nano Void” system which is deployed

will generate recurring revenue. The nanobubble

technology can be paired with EMM’s

Terreplenish product to allow a “one

stop shop” for maximizing the health

of water bodies. Nanobubbles have many applications

and China Solar may rent or lease an existing

system to a third party to

realize

value

in another market segment during periods of downtime

or seasonality in the golf course

and municipal waterway markets.

Revenue streams

China Solar will generate

revenue by operating equipment on-site for customers.

China Solar may additionally generate revenue

from the renting or leasing of their owned systems to

other operators across multiple industries such

as agricultural lagoons and irrigation. On the

next page you will find a pro forma

financial projection for China Solar if we

were to operate 1 Easy

Nano void system over

a 1-year period. This spreadsheet shows the

initial purchase of the equipment as well

as labor and any licensing fees

to Easy Modular Manufacturing,

inc. or Easy Energy Systems,

Inc.

In our 5-year projections

China Solar will realize an IRR of 350%.

(Tables on following

pages)

Extended

5 Year Pro Forma

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

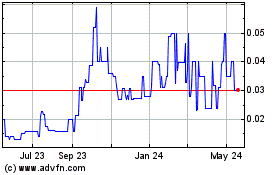

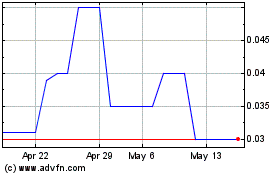

China Solar and Clean En... (PK) (USOTC:CSOL)

Historical Stock Chart

From Nov 2024 to Dec 2024

China Solar and Clean En... (PK) (USOTC:CSOL)

Historical Stock Chart

From Dec 2023 to Dec 2024