1st Colonial National Bank Becomes 1st Colonial Community Bank

November 01 2012 - 2:47PM

Business Wire

Effective as of the opening of business on November 1, 2012 and

following receipt of required regulatory approvals, 1st Colonial

National Bank, the wholly owned subsidiary of 1st Colonial Bancorp,

Inc. (OTCBB:FCOB), converted from a national bank to a New Jersey

state-chartered bank, as authorized by the National Bank Act and

New Jersey law. As a result of the conversion, the bank opened on

November 1, 2012 as an FDIC-insured New Jersey bank operating under

the name, “1st Colonial Community Bank.”

“We believe that the charter conversion will allow greater

ability to execute our strategy as a New Jersey-based community

bank and remain competitive in the markets we serve,” said Gerry

Banmiller, the Bank’s President and Chief Executive Officer.

As a state-chartered bank, 1st Colonial will be regulated

primarily by the New Jersey Department of Banking and Insurance and

the Federal Deposit Insurance Corporation (FDIC). The conversion to

a state charter will not have any significant financial or

regulatory impact or affect 1st Colonial’s current activities or

customers.

1st Colonial Community Bank provides a range of business and

consumer financial services, placing emphasis on customer service

and access to decision makers. Headquartered in Collingswood, New

Jersey, the Bank also has branches in the New Jersey communities of

Westville and Cinnaminson. To learn more, call (856) 858-8402 or

visit www.1stcolonial.com.

This Release contains forward-looking statements that are not

historical facts and include statements about management’s

strategies and expectations about our business. There are risks and

uncertainties that may cause our actual results and performance to

be materially different from results indicated by these

forward-looking statements. Factors that might cause a difference

include economic conditions; unanticipated loan losses, lack of

liquidity; varying and unanticipated costs of collection with

respect to nonperforming loans; changes in interest rates, changes

in FDIC assessments, deposit flows, loan demand, and real estate

values; changes in relationships with major customers; operational

risks, including the risk of fraud by employees or outsiders;

competition; changes in accounting principles, policies or

guidelines; changes in laws or regulations and in the manner in

which the regulators enforce same; new technology and other factors

affecting our operations, pricing, products and services.

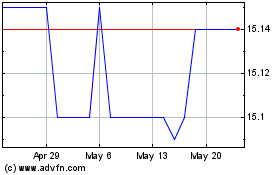

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Oct 2024 to Nov 2024

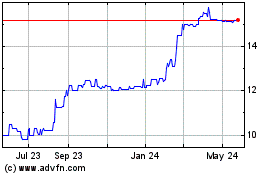

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about 1st Colonial Bancorp Inc (PK) (OTCMarkets): 0 recent articles

More 1st Colonial Bancorp, Inc. News Articles